Key Insights

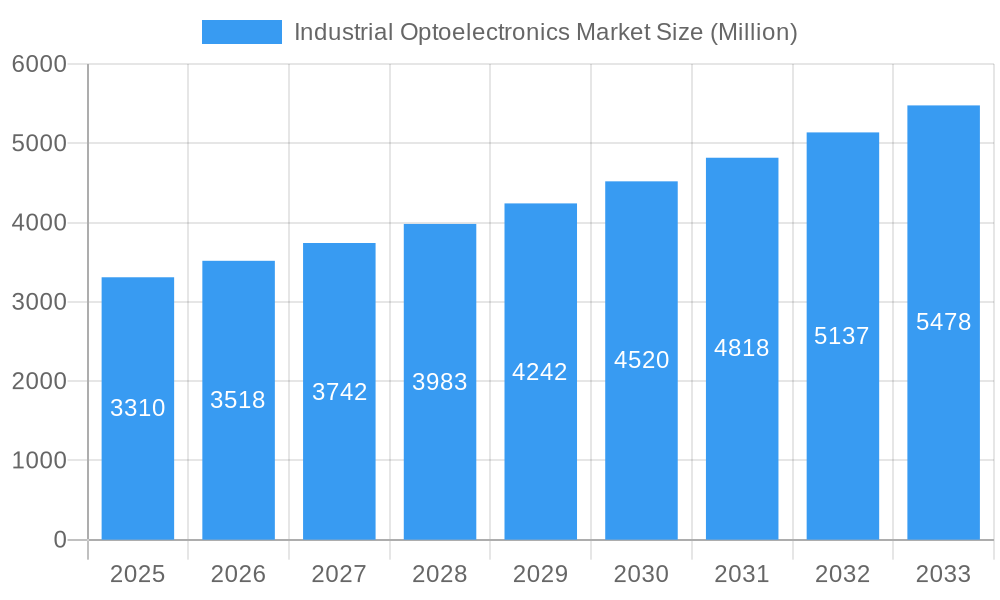

The industrial optoelectronics market, valued at $3.31 billion in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This robust growth is driven by several key factors. The increasing automation across various industries, particularly manufacturing, automotive, and logistics, fuels the demand for advanced sensing and control technologies. Optoelectronics, with its capabilities in precise measurement, high-speed communication, and robust performance in harsh environments, is a crucial component of these automated systems. Furthermore, the rising adoption of Industry 4.0 principles, emphasizing data-driven decision-making and smart factories, further strengthens market demand. Technological advancements, such as the development of miniaturized sensors, improved spectral sensitivity, and enhanced processing power, also contribute to market expansion. Key players like SK Hynix, Samsung Electronics, and Sony are actively involved in research and development, pushing the boundaries of optoelectronic technology and driving innovation within the sector.

Industrial Optoelectronics Market Market Size (In Billion)

However, certain restraints could potentially impede market growth. The high initial investment costs associated with implementing optoelectronic systems in existing industrial infrastructure may present a barrier for some businesses, particularly smaller enterprises. Additionally, the market is susceptible to fluctuations in the prices of raw materials and components, influencing overall production costs. Nonetheless, the long-term benefits of enhanced efficiency, improved safety standards, and increased productivity are expected to outweigh these challenges, driving consistent market growth throughout the forecast period. The segmentation within the market, while not explicitly provided, is likely based on technology type (photodiodes, phototransistors, lasers, etc.), application (automation, sensing, imaging), and end-user industry. Future growth is expected to be heavily influenced by the adoption of next-generation technologies, such as LiDAR and 3D sensing, creating new opportunities within diverse industrial segments.

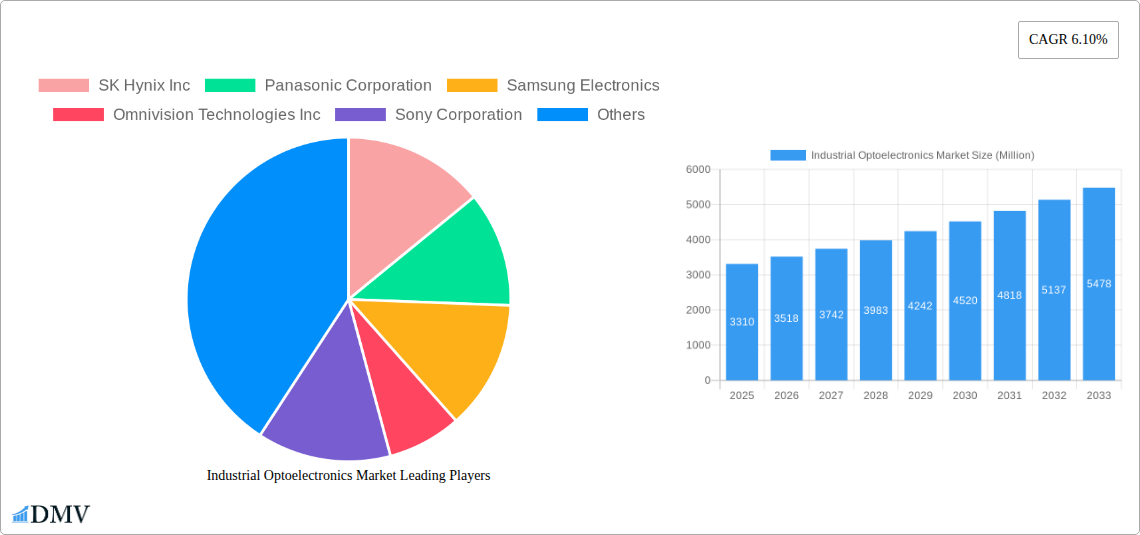

Industrial Optoelectronics Market Company Market Share

Industrial Optoelectronics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Industrial Optoelectronics Market, offering a comprehensive overview of market trends, leading players, technological advancements, and future growth prospects. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast period, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is expected to reach xx Million by 2033.

Industrial Optoelectronics Market Market Composition & Trends

This section delves into the competitive landscape of the industrial optoelectronics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution among key players, revealing the dominance of certain entities and highlighting emerging competitors. The impact of regulatory changes on market dynamics is assessed, along with the influence of substitute technologies. Finally, a detailed analysis of recent M&A activities, including deal values (where available), provides insights into strategic market positioning and future growth trajectories. The analysis includes an in-depth examination of end-user segments, identifying key applications and growth potential within each sector. The total market value was xx Million in 2024.

- Market Concentration: High, with top 5 players holding approximately xx% market share.

- Innovation Catalysts: Increasing demand for automation, advancements in sensor technology, and the rise of Industry 4.0.

- Regulatory Landscape: Varying regulations across regions impacting product certifications and adoption.

- Substitute Products: Limited, with specific niche applications utilizing alternative technologies.

- End-User Profiles: Predominantly automotive, industrial automation, healthcare, and consumer electronics.

- M&A Activities: Significant consolidation observed in recent years, with deal values exceeding xx Million in 2024.

Industrial Optoelectronics Market Industry Evolution

This section provides a comprehensive analysis of the Industrial Optoelectronics Market's evolution, examining growth trajectories, technological advancements, and evolving consumer demands. It explores historical growth rates (2019-2024) and projects future growth rates (2025-2033), considering factors such as technological breakthroughs, market penetration rates of new technologies, and shifting industry preferences. We delve into the adoption of new technologies, analyzing the speed of integration and impact on market expansion. Detailed data points on growth rates and adoption metrics for key segments are included.

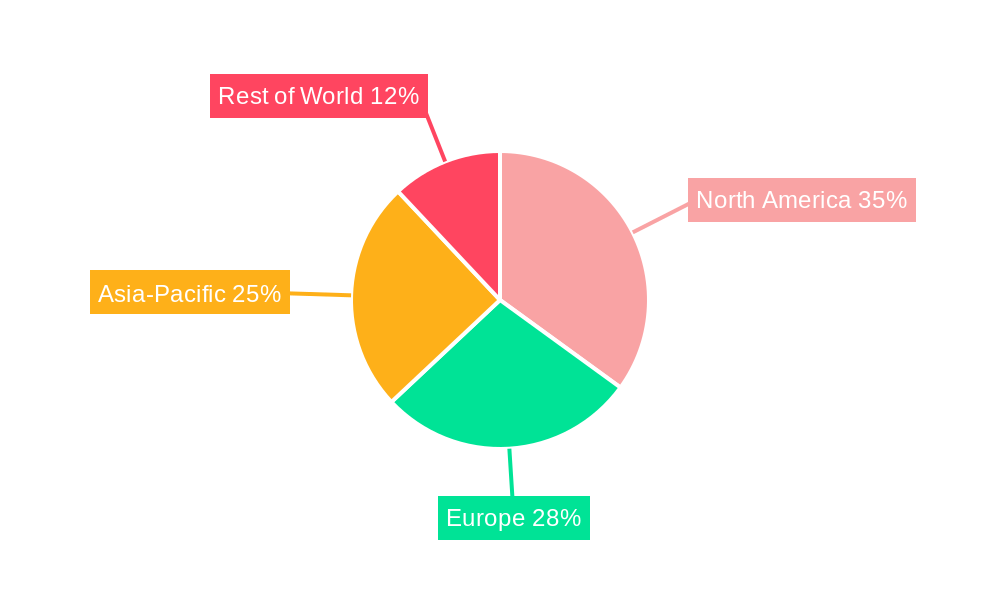

Leading Regions, Countries, or Segments in Industrial Optoelectronics Market

This section identifies the dominant regions, countries, and segments within the industrial optoelectronics market. A detailed analysis of the factors driving dominance in the leading region(s) is presented, focusing on investment trends, government support, and infrastructural developments. Key drivers for each dominant segment are outlined, providing a nuanced understanding of market dynamics and opportunities.

- Dominant Region: [Region Name], driven by [Reasons: e.g., strong government support, large manufacturing base, robust investments in automation].

- Key Drivers for Dominance:

- High investment in R&D and infrastructure development.

- Favorable government policies and regulations promoting technological adoption.

- Growing demand from key end-user industries (e.g., automotive, manufacturing).

- Established supply chain and manufacturing capabilities.

Industrial Optoelectronics Market Product Innovations

Recent years have witnessed significant product innovations in the industrial optoelectronics market. The introduction of high-speed optocouplers, such as Vishay Intertechnology's VOIH72A, offering unprecedented speed and integration capabilities, exemplifies this trend. The emergence of large-format CMOS global shutter sensors, as showcased by OmniVision's OG09A10, caters to the increasing demand for high-quality image capture in applications like factory automation and intelligent transportation systems. These innovations are characterized by enhanced performance metrics such as increased speed, improved sensitivity, and reduced power consumption, driving further market growth.

Propelling Factors for Industrial Optoelectronics Market Growth

Several factors are driving the growth of the industrial optoelectronics market. Technological advancements, particularly in sensor technology and LED lighting, are creating new applications and improving existing ones. The increasing demand for automation across various industries, driven by rising labor costs and efficiency targets, significantly boosts market growth. Furthermore, supportive government regulations and incentives for technology adoption in key regions are fostering expansion.

Obstacles in the Industrial Optoelectronics Market Market

Despite the significant growth potential, several challenges hinder the industrial optoelectronics market. Stringent regulatory compliance requirements for certain applications increase development costs and slow down product launches. Supply chain disruptions, particularly regarding crucial semiconductor components, impact manufacturing output and pricing. Furthermore, intense competition among established players and emerging entrants creates pricing pressure and necessitates continuous innovation.

Future Opportunities in Industrial Optoelectronics Market

The industrial optoelectronics market presents significant future opportunities. The expansion of new applications, such as advanced driver-assistance systems (ADAS) and industrial robotics, offers considerable growth potential. The emergence of novel technologies, like LiDAR and 3D sensing, unlocks further market expansion. Moreover, growing consumer demand for energy-efficient solutions and environmentally friendly manufacturing practices creates new opportunities for innovative products.

Major Players in the Industrial Optoelectronics Market Ecosystem

Key Developments in Industrial Optoelectronics Market Industry

- May 2024: Vishay Intertechnology Inc. launched the VOIH72A high-speed optocoupler (25 MBd), featuring a CMOS logic interface, 6 ns pulse width distortion, 2 mA supply current, and operation up to +110 °C. This significantly enhances speed and integration in digital industrial systems.

- April 2024: OmniVision introduced the OG09A10 CMOS global shutter sensor, its first large-format GS sensor. Designed for factory automation and ITS, its 3.45 µm BSI stacked global shutter provides superior image quality with minimal readout noise and high QE, ideal for high-speed machine vision.

Strategic Industrial Optoelectronics Market Market Forecast

The Industrial Optoelectronics Market is poised for robust growth driven by continuous technological advancements, increasing automation demands across diverse sectors, and supportive regulatory landscapes. The emergence of innovative products, such as high-speed optocouplers and large-format global shutter sensors, along with the expansion into new applications, indicates significant market potential. The market is projected to experience substantial expansion throughout the forecast period, driven by these key factors and the continuous integration of optoelectronic solutions into modern industrial processes.

Industrial Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Device Types

Industrial Optoelectronics Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Industrial Optoelectronics Market Regional Market Share

Geographic Coverage of Industrial Optoelectronics Market

Industrial Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technology Advancements

- 3.2.2 and AI Developments will Drive the Growth; The Continued Rise of Smart Factories

- 3.3. Market Restrains

- 3.3.1 Technology Advancements

- 3.3.2 and AI Developments will Drive the Growth; The Continued Rise of Smart Factories

- 3.4. Market Trends

- 3.4.1. Image Sensors are Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. LED

- 6.1.2. Laser Diode

- 6.1.3. Image Sensors

- 6.1.4. Optocouplers

- 6.1.5. Photovoltaic cells

- 6.1.6. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. LED

- 7.1.2. Laser Diode

- 7.1.3. Image Sensors

- 7.1.4. Optocouplers

- 7.1.5. Photovoltaic cells

- 7.1.6. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. LED

- 8.1.2. Laser Diode

- 8.1.3. Image Sensors

- 8.1.4. Optocouplers

- 8.1.5. Photovoltaic cells

- 8.1.6. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. LED

- 9.1.2. Laser Diode

- 9.1.3. Image Sensors

- 9.1.4. Optocouplers

- 9.1.5. Photovoltaic cells

- 9.1.6. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South Korea Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. LED

- 10.1.2. Laser Diode

- 10.1.3. Image Sensors

- 10.1.4. Optocouplers

- 10.1.5. Photovoltaic cells

- 10.1.6. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Industrial Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. LED

- 11.1.2. Laser Diode

- 11.1.3. Image Sensors

- 11.1.4. Optocouplers

- 11.1.5. Photovoltaic cells

- 11.1.6. Other Device Types

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SK Hynix Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omnivision Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sony Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ams Osram AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Signify Holding

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vishay Intertechnology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LITE-ON Technology Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Rohm Company Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Mitsubishi Electric Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Broadcom Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sharp Corporatio

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 SK Hynix Inc

List of Figures

- Figure 1: Global Industrial Optoelectronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Optoelectronics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: United States Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 5: United States Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: United States Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: United States Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 13: Europe Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Japan Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 21: Japan Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Japan Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Japan Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: China Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 29: China Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: China Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: China Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 36: South Korea Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 37: South Korea Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: South Korea Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: South Korea Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Industrial Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 44: Taiwan Industrial Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 45: Taiwan Industrial Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Taiwan Industrial Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 47: Taiwan Industrial Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Industrial Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Industrial Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Industrial Optoelectronics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 3: Global Industrial Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Optoelectronics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 7: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 11: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 15: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 19: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 22: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 23: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Industrial Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Global Industrial Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 27: Global Industrial Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Industrial Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Optoelectronics Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Industrial Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Ams Osram AG, Signify Holding, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Company Limited, Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the Industrial Optoelectronics Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Technology Advancements. and AI Developments will Drive the Growth; The Continued Rise of Smart Factories.

6. What are the notable trends driving market growth?

Image Sensors are Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Technology Advancements. and AI Developments will Drive the Growth; The Continued Rise of Smart Factories.

8. Can you provide examples of recent developments in the market?

May 2024: Vishay Intertechnology Inc. unveiled the VOIH72A, a high-speed optocoupler boasting a 25 MBd speed. Tailored for industrial settings, this optocoupler stands out with a CMOS logic digital input and output interface, ensuring seamless integration into digital systems. Noteworthy features include a remarkably low 6 ns maximum pulse width distortion, a modest 2 mA supply current, and a broad operational voltage range from 2.7 V to 5.5 V, extending up to +110 °C.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Industrial Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence