Key Insights

The Aerospace & Defense Semiconductor Device Market is poised for substantial expansion, propelled by the escalating demand for cutting-edge technologies in military and commercial aviation, autonomous systems (UAVs), and satellite infrastructure. With a projected Compound Annual Growth Rate (CAGR) of 7.36%, the market is estimated to reach 14.74 billion by 2025. Key growth drivers include the integration of advanced electronics for enhanced aircraft performance and safety, the proliferation of AI-driven defense applications and autonomous platforms requiring high-performance semiconductors, and continuous innovation in semiconductor miniaturization and power efficiency. Significant R&D investments within the sector further bolster this growth. The increasing adoption of sophisticated semiconductor devices, such as microprocessors, microcontrollers, and sensors, is crucial for advancing navigation, communication, and situational awareness systems.

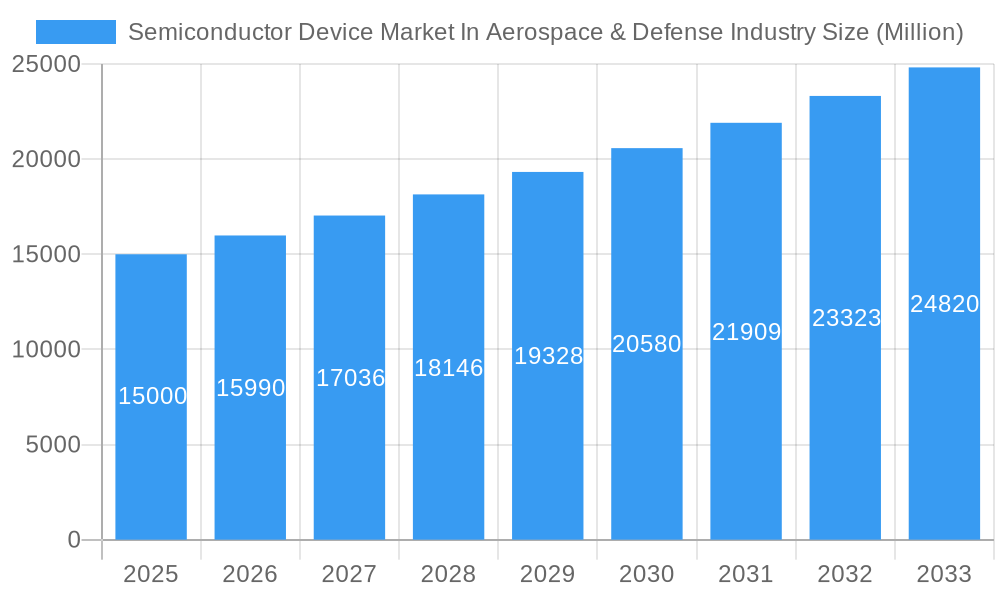

Semiconductor Device Market In Aerospace & Defense Industry Market Size (In Billion)

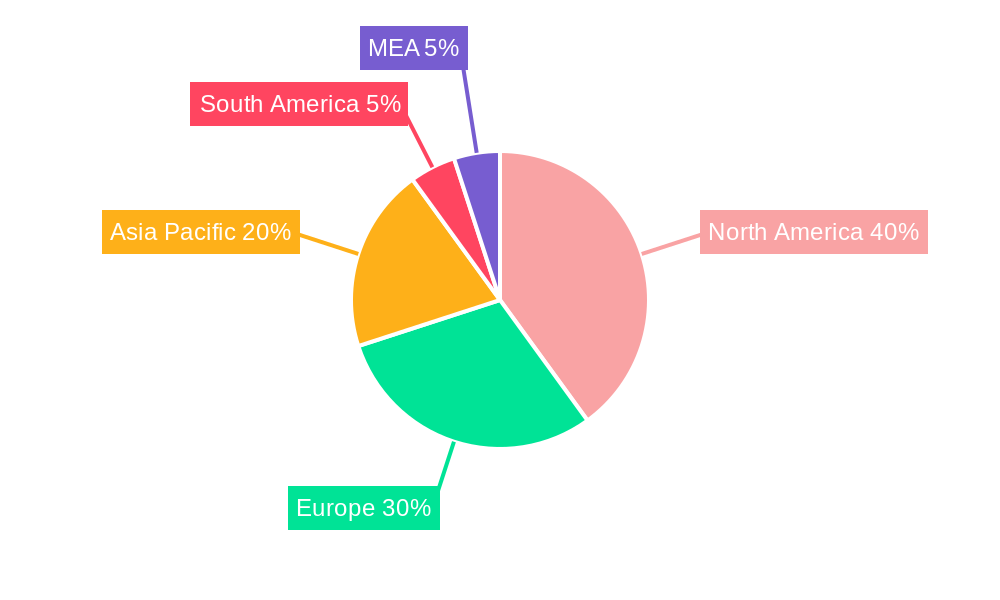

Market segmentation highlights robust growth across diverse semiconductor types. Integrated circuits, particularly radiation-hardened and high-reliability variants essential for complex aerospace and defense systems, command a significant market share. Optoelectronics and sensors are also critical enablers of advancements in imaging, guidance, and target acquisition technologies. Geographically, North America and Europe lead the market due to their advanced technological ecosystems and established defense industries. However, the Asia-Pacific region is anticipated to experience rapid growth, driven by increasing defense expenditure and technological advancements in key nations. Despite challenges such as supply chain dynamics and stringent regulations, the long-term outlook for the Aerospace & Defense Semiconductor Device Market remains highly optimistic, underpinned by sustained technological innovation and rising global defense budgets.

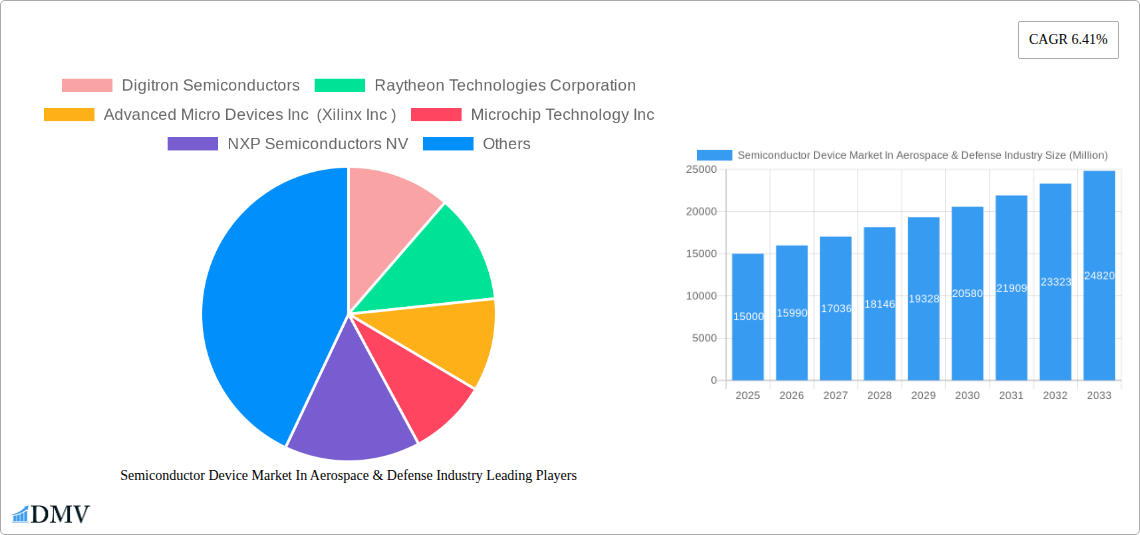

Semiconductor Device Market In Aerospace & Defense Industry Company Market Share

Semiconductor Device Market in Aerospace & Defense Industry: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Semiconductor Device Market in the Aerospace & Defense industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to navigate this dynamic market. The market value in 2025 is estimated to be xx Million, projected to reach xx Million by 2033.

Semiconductor Device Market In Aerospace & Defense Industry Market Composition & Trends

This section delves into the competitive landscape of the aerospace and defense semiconductor market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution among key players like Digitectron Semiconductors, Raytheon Technologies Corporation, Advanced Micro Devices Inc (Xilinx Inc), Microchip Technology Inc, NXP Semiconductors NV, AMS Technologies AG, STMicroelectronics, ON Semiconductor Corporation, Texas Instruments Incorporated, Analog Devices Inc, and Teledyne Technologies Inc. The report quantifies M&A deal values and their impact on market dynamics, revealing the strategic shifts and consolidation within the sector. We explore the influence of regulatory bodies and standards on market growth, examining the role of substitute technologies and emerging end-user demands. The analysis incorporates a thorough assessment of market concentration, revealing the dominance of specific players and the overall competitive intensity.

- Market Share Distribution: Analysis of market share among top 10 companies (detailed breakdown within the report).

- M&A Activity: Review of significant M&A deals (e.g., deal value, strategic rationale) in the 2019-2024 period.

- Regulatory Landscape: Detailed examination of key regulations impacting market growth.

- Substitute Products: Analysis of alternative technologies and their market penetration.

Semiconductor Device Market In Aerospace & Defense Industry Industry Evolution

This section provides a detailed analysis of the semiconductor device market's evolutionary trajectory within the aerospace and defense sector. We examine market growth trajectories, technological advancements, and the evolving needs of consumers. Specific data points, such as growth rates and adoption metrics for various semiconductor devices (Discrete Semiconductors, Optoelectronics, Sensors, Integrated Circuits, Microprocessors, and Microcontrollers), are provided, illustrating the market's dynamism. The analysis includes an in-depth exploration of technological leaps, emphasizing their impact on market expansion. We assess shifting consumer demands, linking them to market adjustments and product innovations. The interplay between technological progress, consumer expectations, and market growth is meticulously examined, providing a complete picture of the industry’s evolution. This includes an assessment of factors driving the increased adoption of advanced semiconductor technologies in aerospace and defense applications.

Leading Regions, Countries, or Segments in Semiconductor Device Market In Aerospace & Defense Industry

This section pinpoints the dominant regions, countries, and segments within the aerospace and defense semiconductor market. We provide an in-depth examination of the factors contributing to the leading segment's prominence. This analysis encompasses Device Type (Discrete Semiconductors, Optoelectronics, Sensors, Integrated Circuits) and Micro (Microprocessor, Microcontroller) segments. Key drivers, such as investment trends, government support, and technological advancements, are detailed using bullet points for clarity.

- Dominant Region/Country: (Detailed analysis within the report, identifying specific countries and regions).

- Key Drivers for Dominant Segment:

- Government investment in defense technologies.

- Stringent regulatory requirements driving adoption of high-reliability components.

- Technological advancements enhancing performance and miniaturization.

- Growing demand from specific applications (e.g., guided missiles, satellite communication).

Semiconductor Device Market In Aerospace & Defense Industry Product Innovations

This section highlights recent product innovations, their applications, and performance metrics. We showcase unique selling propositions (USPs) and technological advancements, emphasizing the impact on the aerospace and defense sectors. The focus is on how these innovations are improving the performance, reliability, and efficiency of aerospace and defense systems.

Propelling Factors for Semiconductor Device Market In Aerospace & Defense Industry Growth

This section identifies key growth drivers, encompassing technological advancements, economic factors, and regulatory influences. Examples include increased government spending on defense, the rising adoption of advanced technologies like GaN and SiC, and the growing demand for high-performance computing in defense systems.

Obstacles in the Semiconductor Device Market In Aerospace & Defense Industry Market

This section discusses barriers and restraints impacting market growth, including regulatory challenges, supply chain vulnerabilities, and intense competition. We quantify the impact of these challenges on market expansion.

Future Opportunities in Semiconductor Device Market In Aerospace & Defense Industry

This section highlights emerging opportunities, focusing on new market segments, technological advancements, and changing consumer preferences.

Major Players in the Semiconductor Device Market In Aerospace & Defense Industry Ecosystem

- Digitectron Semiconductors

- Raytheon Technologies Corporation

- Advanced Micro Devices Inc (Xilinx Inc)

- Microchip Technology Inc

- NXP Semiconductors NV

- AMS Technologies AG

- STMicroelectronics

- ON Semiconductor Corporation

- Texas Instruments Incorporated

- Analog Devices Inc

- Teledyne Technologies Inc

Key Developments in Semiconductor Device Market In Aerospace & Defense Industry Industry

- April 2023: National Instruments (NI) acquired SET GmbH, accelerating the convergence of semiconductor and transportation supply chains and leveraging power electronics like silicon carbide and gallium nitride.

- September 2022: Collins Aerospace secured a multimillion-pound contract to develop a navigation-grade IMU using MEMS technology for UK weapon platforms.

Strategic Semiconductor Device Market In Aerospace & Defense Industry Market Forecast

This section summarizes growth catalysts and future market potential, emphasizing opportunities arising from technological advancements, increased defense spending, and the growing need for reliable and high-performance semiconductor devices in aerospace and defense applications. The forecast underscores the significant growth expected in the coming years, highlighting the key factors driving this expansion.

Semiconductor Device Market In Aerospace & Defense Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessor

- 1.4.4.2. Microcontroller

Semiconductor Device Market In Aerospace & Defense Industry Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. Korea

- 6. Taiwan

Semiconductor Device Market In Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Semiconductor Device Market In Aerospace & Defense Industry

Semiconductor Device Market In Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aircraft Modernization and Upgrade Programs; Growing Investments by Governments and Space Agencies

- 3.3. Market Restrains

- 3.3.1. The Shortage of Semiconductors would Limit Market Expansion

- 3.4. Market Trends

- 3.4.1. Sensors Segment to Grow Significantly in Aerospace & Defense Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessor

- 5.1.4.4.2. Microcontroller

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessor

- 6.1.4.4.2. Microcontroller

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessor

- 7.1.4.4.2. Microcontroller

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessor

- 8.1.4.4.2. Microcontroller

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessor

- 9.1.4.4.2. Microcontroller

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Korea Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Discrete Semiconductors

- 10.1.2. Optoelectronics

- 10.1.3. Sensors

- 10.1.4. Integrated Circuits

- 10.1.4.1. Analog

- 10.1.4.2. Logic

- 10.1.4.3. Memory

- 10.1.4.4. Micro

- 10.1.4.4.1. Microprocessor

- 10.1.4.4.2. Microcontroller

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Semiconductor Device Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. Discrete Semiconductors

- 11.1.2. Optoelectronics

- 11.1.3. Sensors

- 11.1.4. Integrated Circuits

- 11.1.4.1. Analog

- 11.1.4.2. Logic

- 11.1.4.3. Memory

- 11.1.4.4. Micro

- 11.1.4.4.1. Microprocessor

- 11.1.4.4.2. Microcontroller

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Digitron Semiconductors

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Raytheon Technologies Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Advanced Micro Devices Inc (Xilinx Inc )

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microchip Technology Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 NXP Semiconductors NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AMS Technologies AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 STMicroelectronics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ON Semiconductor Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Incorporated

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Analog Devices Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Teledyne Technologies Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Digitron Semiconductors

List of Figures

- Figure 1: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Device Market In Aerospace & Defense Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: United States Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 4: United States Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 5: United States Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: United States Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 7: United States Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: United States Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: United States Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 12: Europe Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 13: Europe Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 20: Japan Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 21: Japan Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Japan Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Japan Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Japan Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Japan Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: China Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 28: China Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 29: China Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: China Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 31: China Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: China Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: China Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Korea Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 36: Korea Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 37: Korea Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: Korea Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 39: Korea Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 40: Korea Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Korea Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Korea Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Device Type 2025 & 2033

- Figure 44: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Device Type 2025 & 2033

- Figure 45: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Device Type 2025 & 2033

- Figure 47: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Semiconductor Device Market In Aerospace & Defense Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 7: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 10: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 11: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 14: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 15: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 18: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 19: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 22: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 23: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 26: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 27: Global Semiconductor Device Market In Aerospace & Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Semiconductor Device Market In Aerospace & Defense Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Device Market In Aerospace & Defense Industry?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Semiconductor Device Market In Aerospace & Defense Industry?

Key companies in the market include Digitron Semiconductors, Raytheon Technologies Corporation, Advanced Micro Devices Inc (Xilinx Inc ), Microchip Technology Inc, NXP Semiconductors NV, AMS Technologies AG, STMicroelectronics, ON Semiconductor Corporation, Texas Instruments Incorporated, Analog Devices Inc, Teledyne Technologies Inc.

3. What are the main segments of the Semiconductor Device Market In Aerospace & Defense Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aircraft Modernization and Upgrade Programs; Growing Investments by Governments and Space Agencies.

6. What are the notable trends driving market growth?

Sensors Segment to Grow Significantly in Aerospace & Defense Sector.

7. Are there any restraints impacting market growth?

The Shortage of Semiconductors would Limit Market Expansion.

8. Can you provide examples of recent developments in the market?

April 2023: National Instruments (NI) completed the acquisition of SET GmbH (SET), a prominent player in the development of test systems for the aerospace and defense industries and a leading expert in reliability testing for power semiconductors. This strategic move aims to expedite the convergence of semiconductor and transportation supply chains. The collaboration between NI and SET is poised to harness power electronics components like silicon carbide and gallium nitride, facilitating the swift introduction of essential and highly innovative products to the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Device Market In Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Device Market In Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Device Market In Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Device Market In Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence