Key Insights

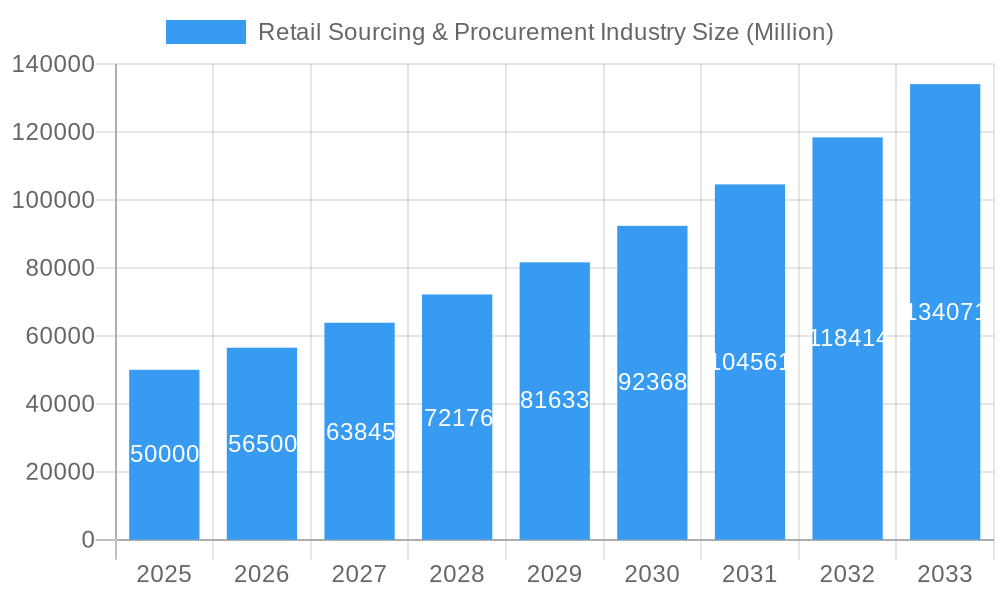

The retail sourcing and procurement market is projected for significant expansion, driven by the imperative for enhanced supply chain efficiency, widespread adoption of digital solutions, and the relentless pursuit of cost optimization within a highly competitive sector. The market is forecasted to experience a Compound Annual Growth Rate (CAGR) of 14.2%. Based on a 2025 market size of $6.37 billion, this indicates substantial future growth. Key catalysts include the accelerating growth of e-commerce, which necessitates more agile and responsive procurement strategies. The integration of advanced analytics and AI-powered solutions is actively streamlining operations, boosting supply chain visibility, and fostering stronger supplier relationships. Moreover, a heightened emphasis on sustainability and ethical sourcing is increasingly shaping procurement decisions, driving demand for solutions that support these crucial initiatives.

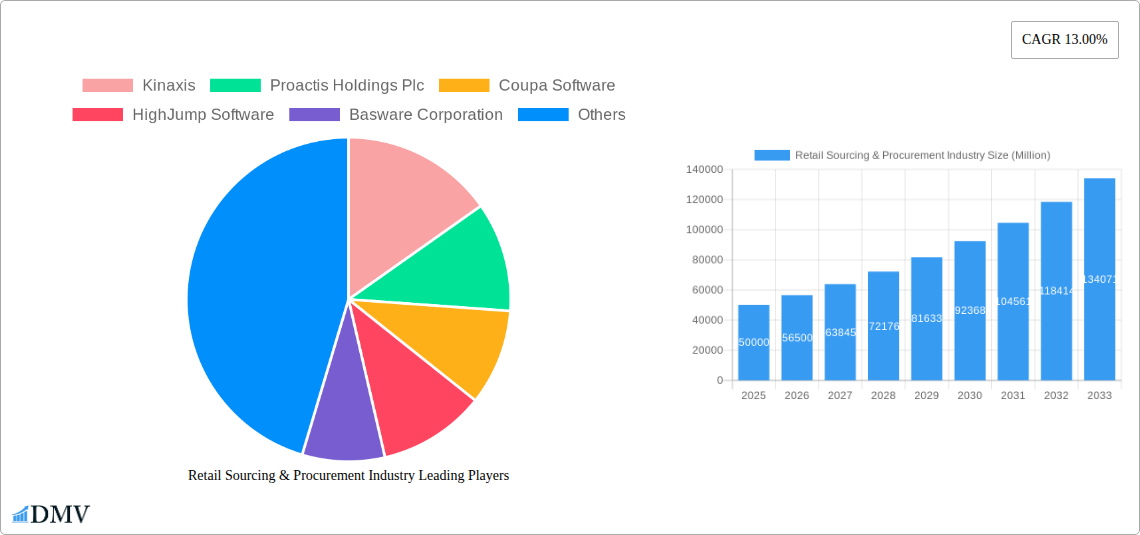

Retail Sourcing & Procurement Industry Market Size (In Billion)

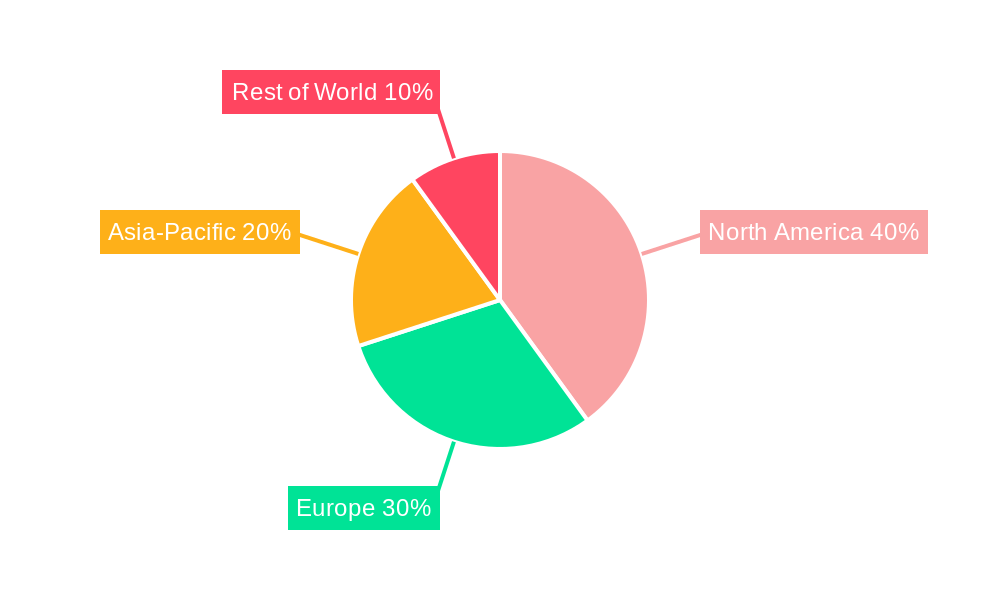

Market segmentation spans solution types, including procurement software and sourcing platforms; deployment modes, such as cloud-based and on-premise; and enterprise size. Leading industry players, including Kinaxis, Coupa Software, and SAP, are actively competing for market share through continuous innovation and strategic alliances. Nevertheless, challenges persist, notably the complexity of integrating disparate systems and the demand for skilled professionals to effectively manage sophisticated solutions. Regional dynamics play a significant role, with North America and Europe anticipated to command the largest market share, attributed to their advanced technology adoption rates and robust e-commerce infrastructure. Future market trajectory will be further shaped by geopolitical stability, prevailing economic conditions, and advancements in technologies like blockchain, which promise to enhance supply chain transparency and security.

Retail Sourcing & Procurement Industry Company Market Share

Retail Sourcing & Procurement Industry: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Retail Sourcing & Procurement industry, projecting a market value exceeding $XX Million by 2033. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. It offers crucial insights for stakeholders, investors, and industry professionals seeking to navigate the dynamic landscape of retail supply chain management. The report meticulously examines market trends, competitive dynamics, technological advancements, and future growth opportunities, providing a robust foundation for informed decision-making.

Retail Sourcing & Procurement Industry Market Composition & Trends

This section delves into the intricate composition of the retail sourcing and procurement market, analyzing its concentration, innovation drivers, regulatory environment, substitute products, and end-user profiles. We examine the impact of mergers and acquisitions (M&A) activity, providing quantitative data on market share distribution and M&A deal values. The analysis considers the historical period (2019-2024) and projects future trends based on current market dynamics.

- Market Concentration: The market exhibits a [Describe concentration level, e.g., moderately concentrated] structure with the top 5 players holding an estimated [XX]% market share in 2025.

- Innovation Catalysts: Key drivers include the adoption of AI-powered procurement platforms, blockchain technology for enhanced transparency, and the growing emphasis on sustainable sourcing practices.

- Regulatory Landscape: Regulations concerning data privacy, ethical sourcing, and trade compliance significantly influence market operations, creating both opportunities and challenges.

- Substitute Products: The emergence of alternative sourcing models and procurement technologies represents a potential threat, necessitating adaptive strategies.

- End-User Profiles: The report profiles key end-users, including large retail chains, online marketplaces, and smaller independent retailers, highlighting their specific needs and procurement practices.

- M&A Activity: The industry witnessed [XX] billion in M&A transactions during the historical period (2019-2024), with a projected increase to [XX] billion during the forecast period. This consolidation trend reflects the industry's maturity and the pursuit of scale and efficiency.

Retail Sourcing & Procurement Industry Industry Evolution

This section traces the evolution of the retail sourcing and procurement industry, examining market growth trajectories, technological advancements, and the impact of shifting consumer demands. We provide specific data points, including growth rates and adoption metrics, to illuminate the industry's transformation.

The global retail sourcing and procurement market experienced a [XX]% CAGR between 2019 and 2024, driven primarily by the increasing adoption of e-commerce, growing consumer expectations for faster delivery, and the need for enhanced supply chain resilience. Technological advancements, particularly in areas like AI, machine learning, and blockchain, are fundamentally reshaping procurement processes, leading to increased efficiency, cost optimization, and improved risk management. The shift towards omnichannel retailing further fuels demand for sophisticated sourcing and procurement solutions capable of managing complex, multi-channel supply chains. Adoption rates for cloud-based procurement platforms are projected to reach [XX]% by 2033, driven by the need for scalability, accessibility, and data-driven insights.

Leading Regions, Countries, or Segments in Retail Sourcing & Procurement Industry

This section pinpoints the dominant regions, countries, or segments within the retail sourcing and procurement market. A detailed analysis of the factors driving market leadership is provided, including investment trends and regulatory support.

- Dominant Region: North America currently holds the largest market share, driven by factors such as high technological adoption, the presence of major retail players, and robust infrastructure.

- Key Drivers for North American Dominance:

- Significant investments in technology and digital transformation initiatives within the retail sector.

- A strong regulatory framework supporting fair competition and ethical sourcing practices.

- The presence of a large pool of skilled professionals and technology providers.

- High consumer spending and a well-established e-commerce ecosystem.

- Other Key Regions: Europe and Asia Pacific are also significant markets, exhibiting considerable growth potential.

Further analysis explores the factors contributing to the dominance of specific countries within these regions and examines the unique characteristics of each segment.

Retail Sourcing & Procurement Industry Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the retail sourcing and procurement space. We showcase unique selling propositions and technological advancements driving market growth.

Recent innovations focus on AI-powered platforms that automate tasks like supplier selection, contract negotiation, and invoice processing. These platforms also leverage machine learning to predict market trends, optimize inventory levels, and mitigate supply chain risks. The integration of blockchain technology enhances transparency and traceability throughout the supply chain, fostering trust and accountability. These innovations deliver significant improvements in efficiency, cost savings, and risk mitigation, boosting the adoption rate among retailers.

Propelling Factors for Retail Sourcing & Procurement Industry Growth

Several key factors are driving the growth of the retail sourcing and procurement market.

Technological advancements, such as AI and machine learning, are automating processes, improving efficiency, and reducing costs. The growth of e-commerce and omnichannel retail strategies is creating demand for sophisticated supply chain management solutions. Furthermore, increasing focus on ethical sourcing, sustainability, and supply chain resilience enhances demand for robust procurement technologies. Stringent regulatory compliance requirements also drive the adoption of advanced procurement systems.

Obstacles in the Retail Sourcing & Procurement Industry Market

The retail sourcing and procurement industry faces various challenges that may hinder growth.

Supply chain disruptions, exacerbated by geopolitical instability and natural disasters, pose a significant risk. Regulatory complexities and compliance requirements across different jurisdictions add to operational costs and complexity. Furthermore, intense competition among technology providers and the need for continuous adaptation to evolving consumer demands present ongoing challenges.

Future Opportunities in Retail Sourcing & Procurement Industry

The retail sourcing and procurement industry presents significant growth opportunities in several areas.

The expansion into emerging markets with growing retail sectors offers significant potential. Advancements in areas like AI, blockchain, and IoT promise to further revolutionize procurement processes. Growing consumer demand for personalized experiences and sustainable products creates opportunities for businesses to leverage innovative sourcing strategies.

Major Players in the Retail Sourcing & Procurement Industry Ecosystem

- Kinaxis

- Proactis Holdings Plc

- Coupa Software

- HighJump Software

- Basware Corporation

- SAP SE

- Oracle Corporation

- IBM Corporation

- Epicor Software Corporation

- JDA Software Group Inc

- JAGGAER Inc

- Infor Nexus

- Zycus Inc

*List Not Exhaustive

Key Developments in Retail Sourcing & Procurement Industry Industry

- [Month, Year]: [Company Name] launched a new AI-powered procurement platform, significantly enhancing efficiency and cost savings. Impact: Increased market competition and adoption of AI-driven solutions.

- [Month, Year]: [Company A] and [Company B] merged, creating a larger player with increased market share and expanded capabilities. Impact: Industry consolidation and intensified competition.

- [Month, Year]: New regulations regarding data privacy in the retail sector were implemented. Impact: Increased focus on data security and compliance among procurement solutions.

- [Month, Year]: A major supply chain disruption impacted the availability of key raw materials, highlighting the need for greater resilience in supply chains. Impact: Increased demand for advanced risk management and supply chain visibility solutions.

Strategic Retail Sourcing & Procurement Industry Market Forecast

The retail sourcing and procurement market is poised for continued growth, driven by sustained technological advancements, the expansion of e-commerce, and the need for improved supply chain resilience. The growing adoption of AI, blockchain, and other innovative technologies will further optimize procurement processes and enhance efficiency. Opportunities exist in emerging markets and the development of specialized solutions addressing specific industry needs. The market is projected to reach a value exceeding $XX Million by 2033, representing a significant growth trajectory.

Retail Sourcing & Procurement Industry Segmentation

-

1. Deployment Type

- 1.1. On-Premise

- 1.2. Cloud

-

2. Solution Type

- 2.1. Strategic Sourcing

- 2.2. Supplier Management

- 2.3. Contract Management

- 2.4. Procure-to-pay

- 2.5. Spend Analysis

Retail Sourcing & Procurement Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Retail Sourcing & Procurement Industry Regional Market Share

Geographic Coverage of Retail Sourcing & Procurement Industry

Retail Sourcing & Procurement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth

- 3.4. Market Trends

- 3.4.1. Contract Management to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Solution Type

- 5.2.1. Strategic Sourcing

- 5.2.2. Supplier Management

- 5.2.3. Contract Management

- 5.2.4. Procure-to-pay

- 5.2.5. Spend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-Premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Solution Type

- 6.2.1. Strategic Sourcing

- 6.2.2. Supplier Management

- 6.2.3. Contract Management

- 6.2.4. Procure-to-pay

- 6.2.5. Spend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-Premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Solution Type

- 7.2.1. Strategic Sourcing

- 7.2.2. Supplier Management

- 7.2.3. Contract Management

- 7.2.4. Procure-to-pay

- 7.2.5. Spend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-Premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Solution Type

- 8.2.1. Strategic Sourcing

- 8.2.2. Supplier Management

- 8.2.3. Contract Management

- 8.2.4. Procure-to-pay

- 8.2.5. Spend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-Premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Solution Type

- 9.2.1. Strategic Sourcing

- 9.2.2. Supplier Management

- 9.2.3. Contract Management

- 9.2.4. Procure-to-pay

- 9.2.5. Spend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-Premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Solution Type

- 10.2.1. Strategic Sourcing

- 10.2.2. Supplier Management

- 10.2.3. Contract Management

- 10.2.4. Procure-to-pay

- 10.2.5. Spend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kinaxis

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Proactis Holdings Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coupa Software

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HighJump Software

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Basware Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SAP SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IBM Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Epicor Software Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JDA Software Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JAGGAER Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Infor Nexus

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zycus Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Kinaxis

List of Figures

- Figure 1: Global Retail Sourcing & Procurement Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 3: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 5: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 6: North America Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 9: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 10: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 11: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 12: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 15: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 16: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 17: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 18: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 21: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 22: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 23: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 24: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 27: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 29: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 30: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 3: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 5: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 6: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 8: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 9: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 11: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 12: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 15: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 17: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 18: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Sourcing & Procurement Industry?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the Retail Sourcing & Procurement Industry?

Key companies in the market include Kinaxis, Proactis Holdings Plc, Coupa Software, HighJump Software, Basware Corporation, SAP SE, Oracle Corporation, IBM Corporation, Epicor Software Corporation, JDA Software Group Inc, JAGGAER Inc, Infor Nexus, Zycus Inc *List Not Exhaustive.

3. What are the main segments of the Retail Sourcing & Procurement Industry?

The market segments include Deployment Type, Solution Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.37 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth.

6. What are the notable trends driving market growth?

Contract Management to Dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Sourcing & Procurement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Sourcing & Procurement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Sourcing & Procurement Industry?

To stay informed about further developments, trends, and reports in the Retail Sourcing & Procurement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence