Key Insights

The Computer and Peripherals Standard Logic IC Market is projected for substantial growth, anticipated to reach $198.285 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7% through 2033. This expansion is driven by escalating demand for advanced computing, smart peripherals, and innovation in consumer electronics and telecommunications. The increasing complexity of modern devices necessitates sophisticated logic ICs for efficient operation. Key growth catalysts include the burgeoning adoption of industrial automation and the rapid evolution of the automotive sector's electronic systems. The market is characterized by the critical development of Programmable Logic Devices (PLDs) and Application-Specific Integrated Circuits (ASICs) to meet tailored performance requirements.

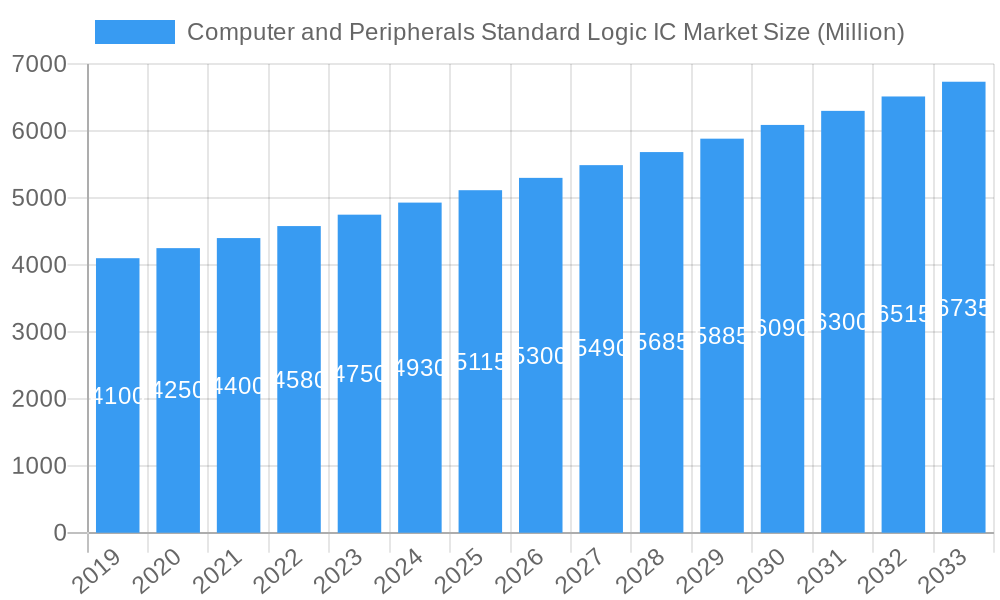

Computer and Peripherals Standard Logic IC Market Market Size (In Billion)

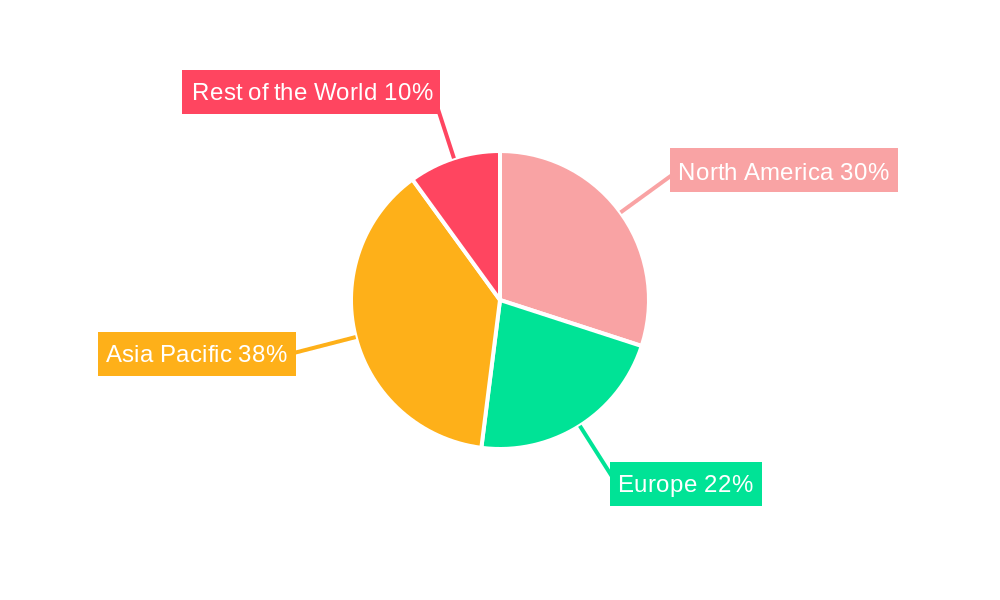

Leading segments include Combinational Logic ICs and Sequential Logic ICs, vital for core processing and memory functions. The application landscape is dominated by Computers, Peripheral Devices, and Networking Equipment, highlighting the foundational role of standard logic ICs in digital infrastructure. Consumer Electronics and Industrial Automation represent significant growth areas, reflecting broad industry integration. Geographically, Asia Pacific is expected to lead market expansion due to its strong manufacturing base and consumer market, followed by North America, driven by technological innovation. Restraints like escalating raw material costs and intense price competition are present. However, the persistent drive for miniaturization, enhanced power efficiency, and increased processing power in Information Technology and Telecommunications will continue to create market opportunities.

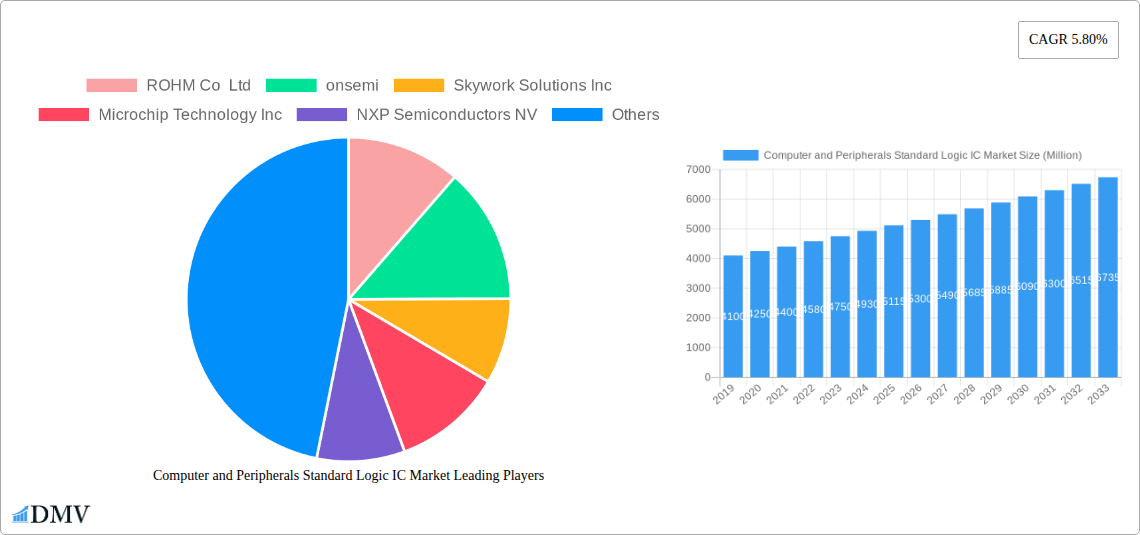

Computer and Peripherals Standard Logic IC Market Company Market Share

This report offers a comprehensive overview of the Computer and Peripherals Standard Logic IC Market, providing critical intelligence for stakeholders. The study analyzes market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. With a Study Period of 2019–2033, Base Year of 2025, and Forecast Period of 2025–2033, this report delivers actionable insights for strategic decision-making in the evolving logic integrated circuits sector.

Computer and Peripherals Standard Logic IC Market Market Composition & Trends

The Computer and Peripherals Standard Logic IC Market exhibits a moderate level of market concentration, with key players like Texas Instruments Inc., NXP Semiconductors NV, and STMicroelectronics NV holding significant market share distributions, estimated to be around XX% collectively. Innovation catalysts are primarily driven by the relentless demand for higher processing speeds and increased power efficiency in computing and peripheral devices. The regulatory landscape, while generally stable, influences product design and manufacturing standards, impacting development cycles. Substitute products, such as more advanced system-on-chip (SoC) solutions, pose a gradual threat, prompting manufacturers to focus on specialized standard logic ICs for cost-effectiveness and specific functionalities. End-user profiles range from individual consumers seeking enhanced device performance to large-scale enterprises demanding robust and reliable computing infrastructure. Merger and acquisition (M&A) activities have been strategic, with deal values often ranging from tens of millions to hundreds of millions, aimed at consolidating market positions, acquiring advanced technologies, or expanding product portfolios. Notable M&A activities in the historical period (2019-2024) are estimated to have contributed significantly to market restructuring, with a total estimated deal value of approximately XXX Million.

Computer and Peripherals Standard Logic IC Market Industry Evolution

The Computer and Peripherals Standard Logic IC Market has undergone a significant evolution, marked by consistent growth trajectories and transformative technological advancements. Over the Historical Period: 2019–2024, the market witnessed a Compound Annual Growth Rate (CAGR) of approximately X.XX%, fueled by the burgeoning demand for personal computers, sophisticated peripheral devices, and the increasing connectivity of smart consumer electronics. Shifting consumer demands have been a pivotal force, with a continuous push for smaller, more power-efficient, and higher-performing logic ICs that can support features like artificial intelligence (AI) at the edge, enhanced graphical processing, and seamless data transfer. Technological advancements have been characterized by the miniaturization of process nodes, leading to increased transistor density and improved performance metrics. The adoption of advanced packaging techniques has also played a crucial role in enabling the integration of more functionalities within smaller footprints. For instance, the adoption rate of advanced packaging technologies for logic ICs has seen a steady increase, contributing to a performance enhancement of up to XX% in newer generations of devices. Furthermore, the proliferation of the Internet of Things (IoT) has created new avenues for standard logic ICs, particularly in embedded systems within peripheral devices and industrial automation, driving a projected CAGR of X.XX% in these sub-segments during the Forecast Period: 2025–2033. The market is also being shaped by the growing importance of low-power consumption logic for battery-operated devices, a trend that has accelerated in recent years and is expected to continue its upward trajectory. The continuous innovation cycle, driven by the need for faster data processing and more intelligent device interactions, ensures that the Computer and Peripherals Standard Logic IC Market remains a vibrant and indispensable sector within the broader semiconductor industry.

Leading Regions, Countries, or Segments in Computer and Peripherals Standard Logic IC Market

The Computer and Peripherals Standard Logic IC Market exhibits distinct regional strengths and segment dominance. Asia Pacific, particularly countries like Taiwan, South Korea, and China, emerges as the leading region, driven by its robust manufacturing capabilities, significant consumer electronics production, and a growing demand for advanced computing and networking equipment. Taiwan Semiconductor Co Ltd (TSMC) plays a pivotal role in this dominance, serving as a critical foundry for many fabless semiconductor companies. Within the Product Type segment, Programmable Logic Devices (PLDs) and Application-Specific Integrated Circuits (ASICs) are experiencing significant growth. PLDs offer flexibility and rapid prototyping, making them attractive for new product development, while ASICs cater to high-volume, performance-critical applications in computers and networking.

Dominant Region: Asia Pacific is the undisputed leader due to its extensive electronics manufacturing ecosystem and a massive consumer base.

- Key Drivers:

- Investment Trends: Significant foreign and domestic investments in semiconductor manufacturing facilities.

- Regulatory Support: Favorable government policies and incentives promoting the semiconductor industry.

- Skilled Workforce: Availability of a large, skilled engineering and manufacturing workforce.

- Key Drivers:

Dominant Segment (Product Type): Programmable Logic Devices (PLDs) and Application-Specific Integrated Circuits (ASICs) are key growth areas.

- Key Drivers for PLDs:

- Flexibility and Customization: Ability to be reconfigured for different functions, reducing time-to-market.

- Innovation in FPGAs: Advancements in Field-Programmable Gate Arrays (FPGAs) with higher performance and lower power consumption.

- Key Drivers for ASICs:

- High Performance and Efficiency: Optimized for specific applications, offering superior performance and power efficiency.

- Growing Demand in AI and High-Performance Computing: Essential for specialized processing in these fields.

- Key Drivers for PLDs:

Dominant Segment (Application): Computers and Peripheral Devices continue to be the largest application segments.

- Key Drivers:

- PC Market Resilience: Continued demand for personal computers for work, education, and entertainment.

- Peripheral Device Innovation: Proliferation of smart peripherals, gaming devices, and advanced input/output devices.

- Key Drivers:

Dominant End-User Industry: Information Technology and Consumer Electronics lead in consumption.

- Key Drivers:

- Digital Transformation: Widespread adoption of digital technologies across all industries.

- Consumer Spending on Electronics: Sustained consumer demand for smartphones, tablets, laptops, and smart home devices.

- Key Drivers:

The synergy between these regions, product types, applications, and end-user industries creates a robust and interconnected market ecosystem, driving innovation and growth across the Computer and Peripherals Standard Logic IC Market. The estimated market share for Asia Pacific is approximately XX% of the global market.

Computer and Peripherals Standard Logic IC Market Product Innovations

Product innovations in the Computer and Peripherals Standard Logic IC Market are relentlessly focused on enhancing performance, reducing power consumption, and increasing functionality. Manufacturers are developing smaller, more energy-efficient logic gates and flip-flops, enabling thinner and lighter portable devices. Advances in low-power design techniques, coupled with the adoption of advanced semiconductor manufacturing processes (e.g., sub-10nm nodes), are leading to logic ICs with significantly improved performance metrics, such as increased clock speeds and reduced signal latency. The integration of AI-specific logic capabilities within standard logic ICs is also a growing trend, allowing for edge computing applications in peripheral devices. For example, new generations of combinational logic ICs are exhibiting XX% faster switching speeds and a XX% reduction in standby power consumption compared to previous iterations.

Propelling Factors for Computer and Peripherals Standard Logic IC Market Growth

Several key factors are propelling the growth of the Computer and Peripherals Standard Logic IC Market. The continuous evolution of the personal computer and laptop market, driven by the need for enhanced performance and new functionalities, is a primary driver. Furthermore, the explosion of the Internet of Things (IoT) ecosystem necessitates a vast array of logic ICs for smart devices, connectivity, and data processing within peripheral devices and networking equipment. The ongoing digital transformation across industries, demanding more robust and efficient computing infrastructure, also contributes significantly. Technological advancements, such as the miniaturization of semiconductor technology and innovations in power management, enable the development of smaller, faster, and more energy-efficient logic solutions, further fueling market expansion. The increasing adoption of AI and machine learning in consumer electronics and industrial automation also creates demand for specialized logic ICs.

Obstacles in the Computer and Peripherals Standard Logic IC Market Market

Despite its robust growth, the Computer and Peripherals Standard Logic IC Market faces several obstacles. Supply chain disruptions, particularly those related to raw material availability and geopolitical tensions affecting global semiconductor manufacturing, can lead to production delays and increased costs. Intense price competition among manufacturers, especially for high-volume standard logic ICs, can put pressure on profit margins. The increasing complexity of semiconductor manufacturing and the escalating costs associated with research and development (R&D) present significant financial barriers. Moreover, the rapid pace of technological obsolescence requires continuous investment in innovation, making it challenging for smaller players to keep up. Regulatory hurdles in different regions, pertaining to environmental standards and export controls, can also impact market accessibility and operational efficiency. The estimated impact of supply chain disruptions on production output has been as high as XX% in recent years.

Future Opportunities in Computer and Peripherals Standard Logic IC Market

The Computer and Peripherals Standard Logic IC Market is ripe with future opportunities. The burgeoning demand for edge computing and AI-enabled devices in consumer electronics and industrial automation presents a significant growth avenue. The expansion of 5G infrastructure and its associated networking equipment will drive the need for high-performance logic ICs. The growing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) in the automotive sector creates new markets for specialized logic ICs. Furthermore, the increasing focus on sustainable computing and energy-efficient solutions offers opportunities for the development of ultra-low-power logic devices. The continued growth in cloud computing and data centers will also sustain the demand for foundational logic components.

Major Players in the Computer and Peripherals Standard Logic IC Market Ecosystem

- ROHM Co Ltd

- onsemi

- Skywork Solutions Inc

- Microchip Technology Inc

- NXP Semiconductors NV

- Toshiba Electronic Devices and Storage Corporation

- Texas Instruments Inc

- Diodes Incorporated

- STMicroelectronics NV

- Taiwan Semiconductor Co Ltd

Key Developments in Computer and Peripherals Standard Logic IC Market Industry

- 2024: Introduction of next-generation FPGAs with enhanced AI acceleration capabilities, impacting high-performance computing applications.

- 2023: Significant advancements in low-power logic design techniques, leading to the launch of highly energy-efficient ICs for battery-operated devices.

- 2023: Major foundry partnerships announced to scale production of advanced logic nodes, addressing supply chain concerns and increasing capacity.

- 2022: Key acquisitions aimed at consolidating market share and expanding product portfolios in specialized logic segments like ASICs.

- 2021: Increased focus on supply chain resilience following global shortages, leading to strategic investments in domestic manufacturing and diversification of sourcing.

- 2020: Launch of new product families optimized for 5G infrastructure and networking equipment, driving performance enhancements.

- 2019: Growing integration of standard logic functionalities into system-on-chips (SoCs), prompting market players to focus on niche and high-value logic solutions.

Strategic Computer and Peripherals Standard Logic IC Market Market Forecast

The strategic forecast for the Computer and Peripherals Standard Logic IC Market remains overwhelmingly positive, driven by a confluence of sustained demand from core segments and emerging technological trends. The increasing sophistication of consumer electronics, the relentless expansion of the IT infrastructure, and the pervasive growth of the IoT ecosystem will continue to be primary growth catalysts. Innovations in AI, edge computing, and the evolution of wireless communication technologies like 5G and beyond will unlock new opportunities for specialized and high-performance logic ICs. The market's trajectory is further bolstered by strategic investments in advanced manufacturing processes and a growing emphasis on power efficiency and miniaturization, promising a dynamic and expanding future for this critical sector of the semiconductor industry.

Computer and Peripherals Standard Logic IC Market Segmentation

-

1. Product Type

- 1.1. Combinational Logic ICs

- 1.2. Sequential Logic ICs

- 1.3. Programmable Logic Devices (PLDs)

- 1.4. Application-Specific Integrated Circuits (ASICs)

-

2. Application

- 2.1. Computers

- 2.2. Peripheral Devices

- 2.3. Networking Equipment

- 2.4. Consumer Electronics

- 2.5. Industrial Automation

-

3. End-User Industry

- 3.1. Information Technology

- 3.2. Consumer Electronics

- 3.3. Telecommunications

- 3.4. Automotive

- 3.5. Industrial

Computer and Peripherals Standard Logic IC Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Computer and Peripherals Standard Logic IC Market Regional Market Share

Geographic Coverage of Computer and Peripherals Standard Logic IC Market

Computer and Peripherals Standard Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Advancements in communication technologies like Bluetooth

- 3.2.2 Wi-Fi

- 3.2.3 and NFC; Increased consumer demand for advanced computer peripherals; Adoption of digitalization in various industries (Ex

- 3.3. Market Restrains

- 3.3.1. Increasing Design Complexity with Increasing Applications; Constant Evolution of Products Influencing Demand

- 3.4. Market Trends

- 3.4.1. Increased Consumer Demand for Advanced Computers and Peripherals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computer and Peripherals Standard Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Combinational Logic ICs

- 5.1.2. Sequential Logic ICs

- 5.1.3. Programmable Logic Devices (PLDs)

- 5.1.4. Application-Specific Integrated Circuits (ASICs)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Computers

- 5.2.2. Peripheral Devices

- 5.2.3. Networking Equipment

- 5.2.4. Consumer Electronics

- 5.2.5. Industrial Automation

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Information Technology

- 5.3.2. Consumer Electronics

- 5.3.3. Telecommunications

- 5.3.4. Automotive

- 5.3.5. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Computer and Peripherals Standard Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Combinational Logic ICs

- 6.1.2. Sequential Logic ICs

- 6.1.3. Programmable Logic Devices (PLDs)

- 6.1.4. Application-Specific Integrated Circuits (ASICs)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Computers

- 6.2.2. Peripheral Devices

- 6.2.3. Networking Equipment

- 6.2.4. Consumer Electronics

- 6.2.5. Industrial Automation

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Information Technology

- 6.3.2. Consumer Electronics

- 6.3.3. Telecommunications

- 6.3.4. Automotive

- 6.3.5. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Computer and Peripherals Standard Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Combinational Logic ICs

- 7.1.2. Sequential Logic ICs

- 7.1.3. Programmable Logic Devices (PLDs)

- 7.1.4. Application-Specific Integrated Circuits (ASICs)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Computers

- 7.2.2. Peripheral Devices

- 7.2.3. Networking Equipment

- 7.2.4. Consumer Electronics

- 7.2.5. Industrial Automation

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Information Technology

- 7.3.2. Consumer Electronics

- 7.3.3. Telecommunications

- 7.3.4. Automotive

- 7.3.5. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Computer and Peripherals Standard Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Combinational Logic ICs

- 8.1.2. Sequential Logic ICs

- 8.1.3. Programmable Logic Devices (PLDs)

- 8.1.4. Application-Specific Integrated Circuits (ASICs)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Computers

- 8.2.2. Peripheral Devices

- 8.2.3. Networking Equipment

- 8.2.4. Consumer Electronics

- 8.2.5. Industrial Automation

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Information Technology

- 8.3.2. Consumer Electronics

- 8.3.3. Telecommunications

- 8.3.4. Automotive

- 8.3.5. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Computer and Peripherals Standard Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Combinational Logic ICs

- 9.1.2. Sequential Logic ICs

- 9.1.3. Programmable Logic Devices (PLDs)

- 9.1.4. Application-Specific Integrated Circuits (ASICs)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Computers

- 9.2.2. Peripheral Devices

- 9.2.3. Networking Equipment

- 9.2.4. Consumer Electronics

- 9.2.5. Industrial Automation

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Information Technology

- 9.3.2. Consumer Electronics

- 9.3.3. Telecommunications

- 9.3.4. Automotive

- 9.3.5. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ROHM Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 onsemi

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Skywork Solutions Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microchip Technology Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NXP Semiconductors NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Toshiba Electronic Devices and Storage Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Texas Instruments Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Diodes Incorporated

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 STMicroelectronics NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taiwan Semiconductor Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ROHM Co Ltd

List of Figures

- Figure 1: Global Computer and Peripherals Standard Logic IC Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Computer and Peripherals Standard Logic IC Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Computer and Peripherals Standard Logic IC Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Computer and Peripherals Standard Logic IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 7: North America Computer and Peripherals Standard Logic IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Computer and Peripherals Standard Logic IC Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Computer and Peripherals Standard Logic IC Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Computer and Peripherals Standard Logic IC Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Computer and Peripherals Standard Logic IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 15: Europe Computer and Peripherals Standard Logic IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Computer and Peripherals Standard Logic IC Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 31: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Computer and Peripherals Standard Logic IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Computer and Peripherals Standard Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computer and Peripherals Standard Logic IC Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Computer and Peripherals Standard Logic IC Market?

Key companies in the market include ROHM Co Ltd, onsemi, Skywork Solutions Inc, Microchip Technology Inc, NXP Semiconductors NV, Toshiba Electronic Devices and Storage Corporation, Texas Instruments Inc, Diodes Incorporated, STMicroelectronics NV, Taiwan Semiconductor Co Ltd.

3. What are the main segments of the Computer and Peripherals Standard Logic IC Market?

The market segments include Product Type , Application , End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 198.285 billion as of 2022.

5. What are some drivers contributing to market growth?

Advancements in communication technologies like Bluetooth. Wi-Fi. and NFC; Increased consumer demand for advanced computer peripherals; Adoption of digitalization in various industries (Ex: education. BFSI. Corporates).

6. What are the notable trends driving market growth?

Increased Consumer Demand for Advanced Computers and Peripherals.

7. Are there any restraints impacting market growth?

Increasing Design Complexity with Increasing Applications; Constant Evolution of Products Influencing Demand.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computer and Peripherals Standard Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computer and Peripherals Standard Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computer and Peripherals Standard Logic IC Market?

To stay informed about further developments, trends, and reports in the Computer and Peripherals Standard Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence