Key Insights

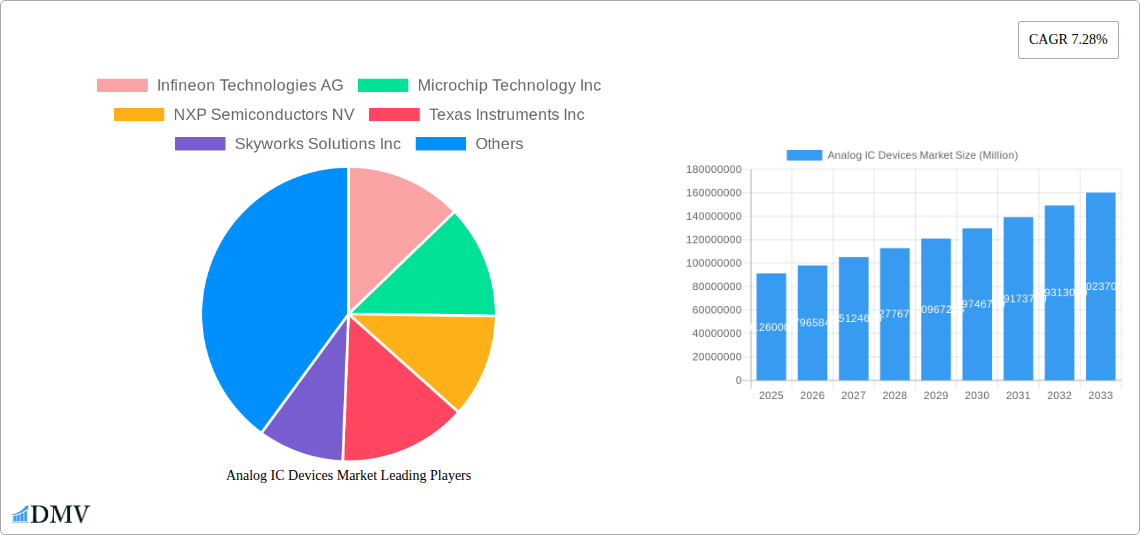

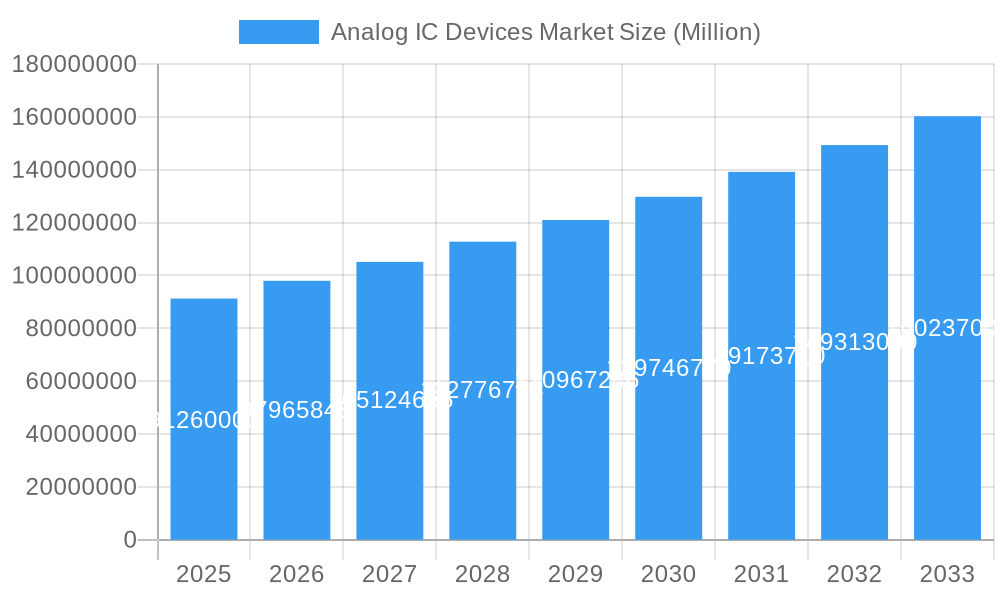

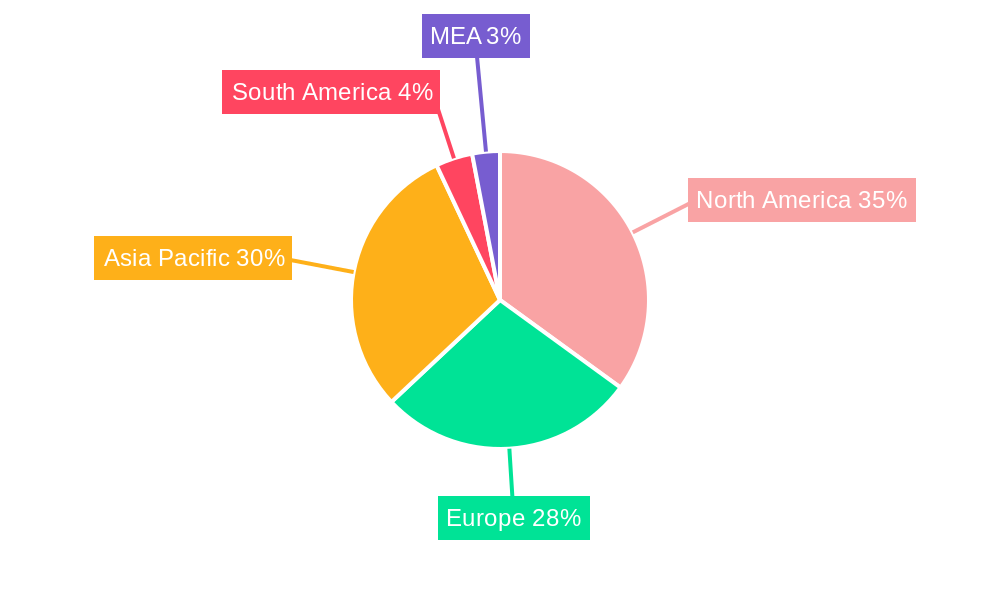

The Analog Integrated Circuit (IC) Devices market is experiencing robust growth, projected to reach \$91.26 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.28% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for sophisticated electronics in consumer goods, particularly smartphones and wearables, fuels significant growth in general-purpose ICs and application-specific ICs (ASICs). The automotive sector's rapid adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) significantly boosts the demand for high-performance amplifiers and comparators for signal conditioning. Furthermore, the expansion of 5G and other high-speed communication networks is creating substantial demand for specialized analog ICs, contributing to the market's overall expansion. Geographically, North America and Asia Pacific are expected to dominate the market, with strong growth anticipated in emerging economies due to rising disposable incomes and increased electronic consumption. Competition among major players such as Infineon Technologies, Texas Instruments, and Analog Devices is fierce, driving innovation and cost reductions. However, the market faces challenges such as increasing complexity in IC design and manufacturing, potential supply chain disruptions, and the ongoing technological transition to digital solutions, which could restrain growth in some segments. Nevertheless, the long-term outlook for the analog IC market remains positive, driven by continuous technological advancements and the growing demand for analog functionality across various sectors.

Analog IC Devices Market Market Size (In Million)

The substantial growth in the Analog IC market is a testament to its indispensable role in modern electronics. The diverse applications across consumer electronics, automotive, communications, and computer sectors guarantee sustained demand. While competition remains intense, continuous innovation in design and manufacturing processes, coupled with government initiatives promoting technological advancements, particularly in areas like ADAS and 5G, will further propel market growth. Specific segments like amplifiers and comparators, crucial for signal processing, will benefit greatly from the proliferation of high-precision applications in these sectors. Strategic partnerships and mergers and acquisitions are anticipated among key players to consolidate market share and accelerate technological breakthroughs. The geographical spread of growth further underscores the market's global reach and potential for sustained expansion throughout the forecast period.

Analog IC Devices Market Company Market Share

Analog IC Devices Market: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Analog IC Devices market, providing a detailed understanding of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an indispensable resource for stakeholders seeking to navigate this dynamic market. The global Analog IC Devices market is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Analog IC Devices Market Composition & Trends

This section delves into the intricate structure of the Analog IC Devices market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a moderately concentrated landscape, with key players holding significant market share. However, the emergence of innovative startups and technological advancements fosters a dynamic competitive environment.

Market Share Distribution (2024 Estimate):

- Texas Instruments Inc: xx%

- Analog Devices Inc: xx%

- STMicroelectronics NV: xx%

- Infineon Technologies AG: xx%

- Others: xx%

Innovation Catalysts: The relentless pursuit of miniaturization, enhanced power efficiency, and improved signal processing capabilities are driving innovation. The development of advanced materials and manufacturing processes further fuels this progress.

Regulatory Landscape: Government regulations regarding energy efficiency and emission standards significantly influence the adoption of analog ICs across various industries. Stringent quality and safety standards also impact market dynamics.

Substitute Products: While digital ICs offer certain advantages, analog ICs remain irreplaceable in applications demanding high precision, high speed, or low power consumption.

End-User Profiles: The market caters to a diverse range of end-users across consumer electronics, automotive, communication, and industrial sectors. Each sector presents unique needs and growth opportunities.

M&A Activities: The last five years have witnessed several strategic mergers and acquisitions, totaling an estimated value of xx Million. These activities reflect the industry's consolidation trend and the pursuit of technological synergies. Examples include [mention specific notable M&A deals, if data is available].

Analog IC Devices Market Industry Evolution

This section provides a deep dive into the evolutionary path of the Analog IC Devices market, examining its growth trajectories, technological advancements, and the evolving demands of consumers. The market has witnessed a consistent expansion driven by technological advancements and increasing demand across diverse applications. The historical period (2019-2024) showed a CAGR of xx%, driven primarily by the growth of the automotive and consumer electronics sectors. The forecast period (2025-2033) anticipates continued growth, fueled by the rising adoption of IoT devices, autonomous vehicles, and 5G communication technologies. Specific growth rates will vary across different segments and regions, with the automotive and industrial segments experiencing particularly strong growth. The adoption of new technologies like AI and machine learning is expected to accelerate the demand for advanced analog ICs capable of handling complex data processing and real-time control functionalities. Consumer demand for higher-performing, more energy-efficient, and smaller-sized devices will continue to drive the need for continuous innovation in analog IC technology. Advancements in materials science, manufacturing processes, and design methodologies will enable the development of analog ICs with higher performance, lower power consumption, and greater integration.

Leading Regions, Countries, or Segments in Analog IC Devices Market

This section identifies the dominant regions, countries, and market segments within the Analog IC Devices market, analyzing factors contributing to their leadership.

Dominant Regions: [Specify dominant regions, e.g., North America, Asia Pacific] dominate the market due to factors including strong technological advancements, robust manufacturing capabilities, and high demand across key end-user industries.

Dominant Countries: [Specify dominant countries within the dominant regions, e.g., USA, China, Japan, Germany] are at the forefront due to established manufacturing bases, favorable government policies, and a high concentration of key players.

Dominant Segments:

By Type: The Amplifiers/Comparators (Signal Conditioning) segment holds a leading position due to their widespread use across diverse applications requiring signal amplification and processing. The Application-Specific IC segment is projected to show strong growth due to increasing customization demands from different end-user industries.

By Application: The Automotive segment is currently the fastest-growing segment, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs). The Consumer Electronics segment maintains a significant market share due to its broad applications in smartphones, wearables, and home appliances.

Key Drivers:

- Investment Trends: Significant investments in R&D and manufacturing capabilities are propelling market growth in leading regions and segments.

- Regulatory Support: Government initiatives promoting technological advancements and energy efficiency are boosting market demand.

- Technological Advancements: Innovations in materials science and design methodologies continuously improve the performance and functionality of analog ICs, expanding application opportunities.

Analog IC Devices Market Product Innovations

Recent years have witnessed significant breakthroughs in Analog IC Devices, resulting in highly integrated, energy-efficient, and high-performance products. Advancements in fabrication technologies (like smaller node sizes) have enabled the creation of sophisticated analog ICs for applications requiring superior signal integrity, precision, and speed. These innovations focus on miniaturization, noise reduction, and wider bandwidths, catering to the increasing demands of the automotive, consumer electronics, and industrial sectors. For instance, the incorporation of advanced materials has significantly improved power efficiency and reduced the overall size of analog ICs.

Propelling Factors for Analog IC Devices Market Growth

The Analog IC Devices market is experiencing exponential growth due to several converging factors. The burgeoning Internet of Things (IoT) is a primary driver, with its vast network of connected devices demanding efficient and precise analog ICs for sensing and signal processing. The increasing adoption of electric vehicles (EVs) and the consequent rise of advanced driver-assistance systems (ADAS) create a significant demand for sophisticated analog ICs to manage power, sensing, and control functions. The expansion of 5G networks further fuels growth by increasing the demand for high-speed data transmission and signal processing capabilities. Moreover, the continuous advancement in semiconductor technology and manufacturing processes reduces the cost and improves the performance of analog ICs, enhancing market accessibility and adoption.

Obstacles in the Analog IC Devices Market

Despite the positive growth trajectory, the Analog IC Devices market faces several challenges. Supply chain disruptions, particularly the scarcity of essential raw materials and components, can significantly impact production and delivery timelines. The intense competition among established players and the emergence of new entrants leads to price pressures and necessitates continuous innovation to maintain market share. Stringent regulatory requirements and compliance standards in certain sectors, such as automotive and medical, increase development costs and time-to-market, making it imperative to stay updated on evolving regulations.

Future Opportunities in Analog IC Devices Market

The future of the Analog IC Devices market holds immense promise. The growing adoption of artificial intelligence (AI) and machine learning (ML) presents exciting opportunities for the development of specialized analog ICs capable of handling complex data processing tasks and real-time control functions. The rise of wearable technology and the expansion of the healthcare industry create significant demand for energy-efficient and miniaturized analog ICs for various medical devices and health monitoring applications. Furthermore, exploration of new materials and innovative fabrication techniques will enable the creation of higher-performance and more power-efficient analog ICs, catering to the demands of emerging applications.

Major Players in the Analog IC Devices Market Ecosystem

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- Texas Instruments Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- ON Semiconductor

- Renesas Electronics Corporation

- Qorvo Inc

- Richtek Technology Corporation (MediaTek Inc )

- Analog Devices Inc

Key Developments in Analog IC Devices Market Industry

October 2023: Vitesco Technologies and Infineon Technologies AG announced a multi-year collaboration to integrate Infineon's AURIX TC4x microcontroller family into Vitesco's next-generation vehicle controllers (starting 2027). This significantly strengthens Infineon's position in the automotive sector.

September 2023: Intelligent Hardware Korea (IHWK) and Microchip Technology partnered to develop a neuromorphic analog computing platform using Microchip's SuperFlash memBrain technology. This development underscores the growing significance of neuromorphic computing in AI applications.

Strategic Analog IC Devices Market Forecast

The Analog IC Devices market is poised for sustained growth, driven by technological advancements, increasing demand across diverse sectors, and the emergence of new applications. The continuous innovation in semiconductor technology, coupled with the rising adoption of IoT devices, electric vehicles, and 5G networks, will create significant opportunities for growth in the coming years. Specific segments like automotive and industrial are expected to exhibit particularly strong growth, propelled by the integration of advanced functionalities and the increasing demand for higher performance and efficiency. The long-term outlook remains positive, with the market expected to achieve substantial growth and expansion across various geographic regions.

Analog IC Devices Market Segmentation

-

1. Type

-

1.1. General-Purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-Specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-Purpose IC

Analog IC Devices Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Analog IC Devices Market Regional Market Share

Geographic Coverage of Analog IC Devices Market

Analog IC Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Cell Phone within Communication Segment to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-Purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-Specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-Purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General-Purpose IC

- 6.1.1.1. Interface

- 6.1.1.2. Power Management

- 6.1.1.3. Signal Conversion

- 6.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 6.1.2. Application-Specific IC

- 6.1.2.1. Consumer

- 6.1.2.1.1. Audio/Video

- 6.1.2.1.2. Digital Still Camera and Camcorder

- 6.1.2.1.3. Other Consumers

- 6.1.2.2. Automotive

- 6.1.2.2.1. Infotainment

- 6.1.2.2.2. Other Infotainment

- 6.1.2.3. Communication

- 6.1.2.3.1. Cell Phone

- 6.1.2.3.2. Infrastructure

- 6.1.2.3.3. Wired Communication

- 6.1.2.3.4. Short Range

- 6.1.2.3.5. Other Wireless

- 6.1.2.4. Computer

- 6.1.2.4.1. Computer System and Display

- 6.1.2.4.2. Computer Periphery

- 6.1.2.4.3. Storage

- 6.1.2.4.4. Other Computers

- 6.1.2.5. Industrial and Others

- 6.1.2.1. Consumer

- 6.1.1. General-Purpose IC

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General-Purpose IC

- 7.1.1.1. Interface

- 7.1.1.2. Power Management

- 7.1.1.3. Signal Conversion

- 7.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 7.1.2. Application-Specific IC

- 7.1.2.1. Consumer

- 7.1.2.1.1. Audio/Video

- 7.1.2.1.2. Digital Still Camera and Camcorder

- 7.1.2.1.3. Other Consumers

- 7.1.2.2. Automotive

- 7.1.2.2.1. Infotainment

- 7.1.2.2.2. Other Infotainment

- 7.1.2.3. Communication

- 7.1.2.3.1. Cell Phone

- 7.1.2.3.2. Infrastructure

- 7.1.2.3.3. Wired Communication

- 7.1.2.3.4. Short Range

- 7.1.2.3.5. Other Wireless

- 7.1.2.4. Computer

- 7.1.2.4.1. Computer System and Display

- 7.1.2.4.2. Computer Periphery

- 7.1.2.4.3. Storage

- 7.1.2.4.4. Other Computers

- 7.1.2.5. Industrial and Others

- 7.1.2.1. Consumer

- 7.1.1. General-Purpose IC

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General-Purpose IC

- 8.1.1.1. Interface

- 8.1.1.2. Power Management

- 8.1.1.3. Signal Conversion

- 8.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 8.1.2. Application-Specific IC

- 8.1.2.1. Consumer

- 8.1.2.1.1. Audio/Video

- 8.1.2.1.2. Digital Still Camera and Camcorder

- 8.1.2.1.3. Other Consumers

- 8.1.2.2. Automotive

- 8.1.2.2.1. Infotainment

- 8.1.2.2.2. Other Infotainment

- 8.1.2.3. Communication

- 8.1.2.3.1. Cell Phone

- 8.1.2.3.2. Infrastructure

- 8.1.2.3.3. Wired Communication

- 8.1.2.3.4. Short Range

- 8.1.2.3.5. Other Wireless

- 8.1.2.4. Computer

- 8.1.2.4.1. Computer System and Display

- 8.1.2.4.2. Computer Periphery

- 8.1.2.4.3. Storage

- 8.1.2.4.4. Other Computers

- 8.1.2.5. Industrial and Others

- 8.1.2.1. Consumer

- 8.1.1. General-Purpose IC

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General-Purpose IC

- 9.1.1.1. Interface

- 9.1.1.2. Power Management

- 9.1.1.3. Signal Conversion

- 9.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 9.1.2. Application-Specific IC

- 9.1.2.1. Consumer

- 9.1.2.1.1. Audio/Video

- 9.1.2.1.2. Digital Still Camera and Camcorder

- 9.1.2.1.3. Other Consumers

- 9.1.2.2. Automotive

- 9.1.2.2.1. Infotainment

- 9.1.2.2.2. Other Infotainment

- 9.1.2.3. Communication

- 9.1.2.3.1. Cell Phone

- 9.1.2.3.2. Infrastructure

- 9.1.2.3.3. Wired Communication

- 9.1.2.3.4. Short Range

- 9.1.2.3.5. Other Wireless

- 9.1.2.4. Computer

- 9.1.2.4.1. Computer System and Display

- 9.1.2.4.2. Computer Periphery

- 9.1.2.4.3. Storage

- 9.1.2.4.4. Other Computers

- 9.1.2.5. Industrial and Others

- 9.1.2.1. Consumer

- 9.1.1. General-Purpose IC

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General-Purpose IC

- 10.1.1.1. Interface

- 10.1.1.2. Power Management

- 10.1.1.3. Signal Conversion

- 10.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 10.1.2. Application-Specific IC

- 10.1.2.1. Consumer

- 10.1.2.1.1. Audio/Video

- 10.1.2.1.2. Digital Still Camera and Camcorder

- 10.1.2.1.3. Other Consumers

- 10.1.2.2. Automotive

- 10.1.2.2.1. Infotainment

- 10.1.2.2.2. Other Infotainment

- 10.1.2.3. Communication

- 10.1.2.3.1. Cell Phone

- 10.1.2.3.2. Infrastructure

- 10.1.2.3.3. Wired Communication

- 10.1.2.3.4. Short Range

- 10.1.2.3.5. Other Wireless

- 10.1.2.4. Computer

- 10.1.2.4.1. Computer System and Display

- 10.1.2.4.2. Computer Periphery

- 10.1.2.4.3. Storage

- 10.1.2.4.4. Other Computers

- 10.1.2.5. Industrial and Others

- 10.1.2.1. Consumer

- 10.1.1. General-Purpose IC

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. General-Purpose IC

- 11.1.1.1. Interface

- 11.1.1.2. Power Management

- 11.1.1.3. Signal Conversion

- 11.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 11.1.2. Application-Specific IC

- 11.1.2.1. Consumer

- 11.1.2.1.1. Audio/Video

- 11.1.2.1.2. Digital Still Camera and Camcorder

- 11.1.2.1.3. Other Consumers

- 11.1.2.2. Automotive

- 11.1.2.2.1. Infotainment

- 11.1.2.2.2. Other Infotainment

- 11.1.2.3. Communication

- 11.1.2.3.1. Cell Phone

- 11.1.2.3.2. Infrastructure

- 11.1.2.3.3. Wired Communication

- 11.1.2.3.4. Short Range

- 11.1.2.3.5. Other Wireless

- 11.1.2.4. Computer

- 11.1.2.4.1. Computer System and Display

- 11.1.2.4.2. Computer Periphery

- 11.1.2.4.3. Storage

- 11.1.2.4.4. Other Computers

- 11.1.2.5. Industrial and Others

- 11.1.2.1. Consumer

- 11.1.1. General-Purpose IC

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infineon Technologies AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Microchip Technology Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NXP Semiconductors NV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Texas Instruments Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Skyworks Solutions Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 STMicroelectronics NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ON Semiconductor

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Renesas Electronics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Qorvo Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Richtek Technology Corporation (MediaTek Inc )

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Analog Devices Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Analog IC Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Analog IC Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 12: Europe Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 13: Europe Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Asia Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Asia Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Asia Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Latin America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Latin America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Latin America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Latin America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Latin America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Latin America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Middle East and Africa Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 45: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East and Africa Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Analog IC Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Analog IC Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog IC Devices Market?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Analog IC Devices Market?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, Texas Instruments Inc, Skyworks Solutions Inc, STMicroelectronics NV, ON Semiconductor, Renesas Electronics Corporation, Qorvo Inc, Richtek Technology Corporation (MediaTek Inc ), Analog Devices Inc.

3. What are the main segments of the Analog IC Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets.

6. What are the notable trends driving market growth?

Cell Phone within Communication Segment to Hold Major Share.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2023 - Vitesco Technologies and Infineon Technologies AG announced the reinforcement of their longstanding collaboration. In the forthcoming generation of master and zone controllers for electric-electronic vehicle architectures (E/E architectures), as well as in their new electrification system solutions, Vitesco Technologies will incorporate the AURIX TC4x microcontroller family from Infineon. This strategic partnership, set to commence in 2027, is expected to span multiple years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog IC Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog IC Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog IC Devices Market?

To stay informed about further developments, trends, and reports in the Analog IC Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence