Key Insights

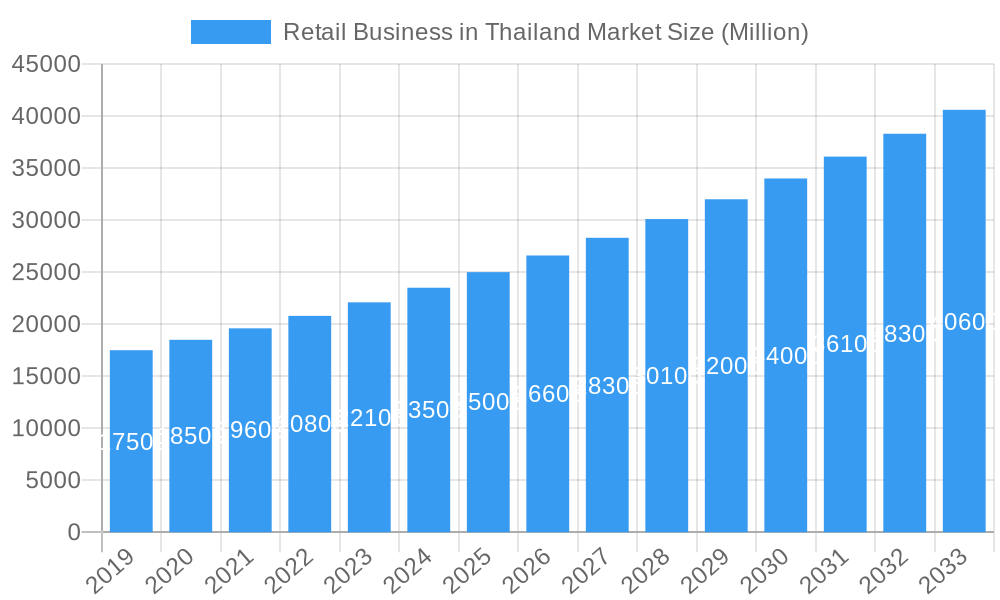

Thailand's retail market is projected to reach a substantial size of $150 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.9% from the base year 2025 through 2033. This growth is propelled by increasing disposable incomes, accelerating urbanization, and a surge in inbound tourism, all contributing to elevated consumer spending. The market's dynamism is further supported by key segments such as Food and Beverage and Tobacco Products, Personal and Household Care, and Electronic and Household Appliances, alongside the significant Apparel, Footwear, and Accessories sector. The evolution of distribution channels, driven by e-commerce adoption and the expansion of modern retail formats, is enhancing consumer convenience and choice.

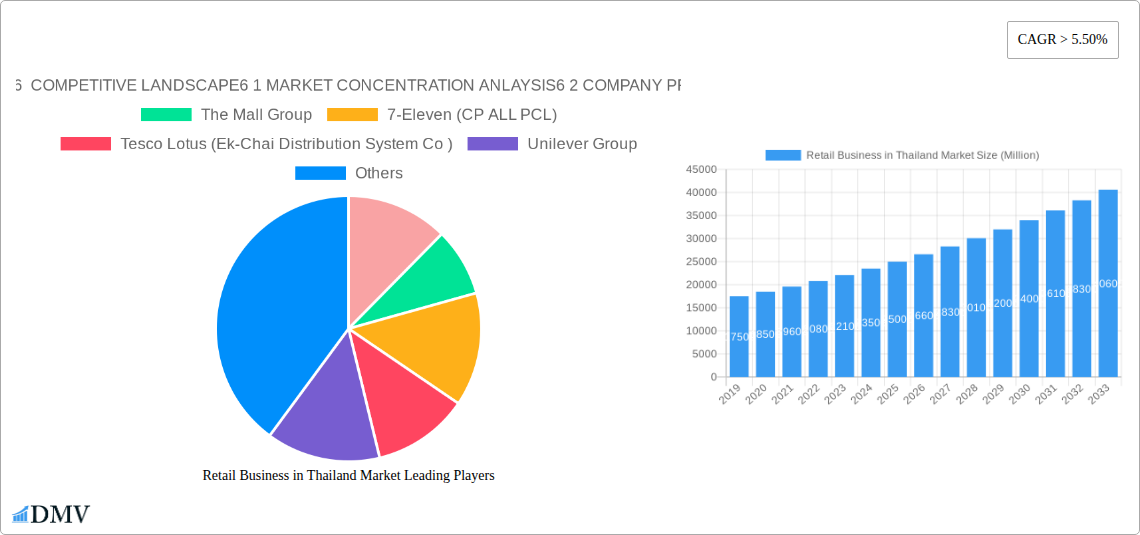

Retail Business in Thailand Market Market Size (In Billion)

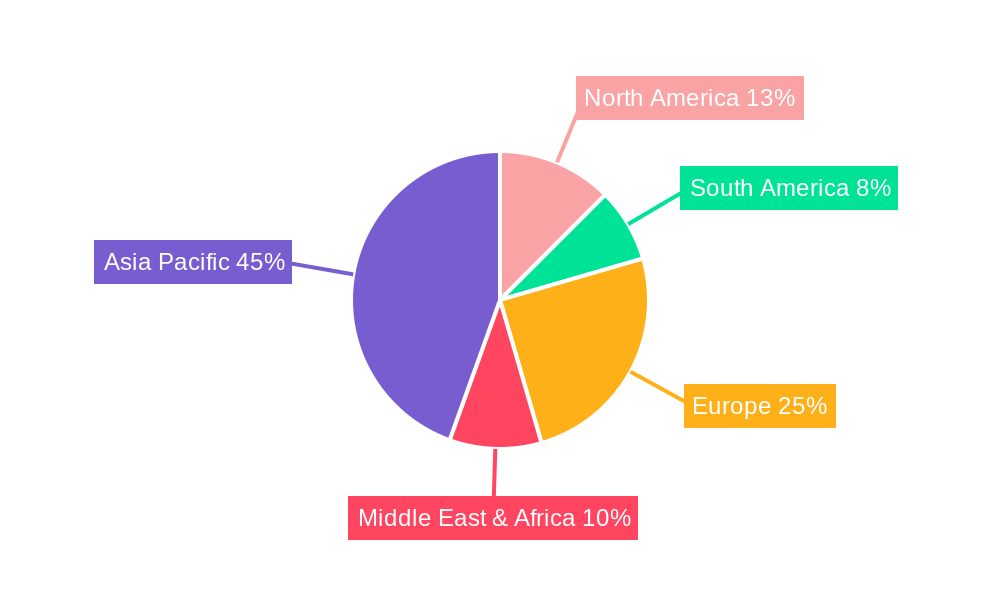

Despite economic slowdowns, currency fluctuations, and rising operational costs posing potential challenges, strategic investments in omnichannel strategies and enhanced customer experiences by leading players including The Mall Group, 7-Eleven (CP ALL PCL), Tesco Lotus (Ek-Chai Distribution System Co), Unilever Group, and Alibaba Group Holdings Limited are expected to mitigate these restraints. The competitive landscape, while dominated by major entities, offers avenues for niche players and innovative startups, particularly within specialized product categories and online retail. The Asia Pacific region, with a focus on China and ASEAN countries, is anticipated to remain a pivotal contributor to market performance, underpinned by strong economic fundamentals and robust consumer spending power.

Retail Business in Thailand Market Company Market Share

Retail Business in Thailand Market Market Composition & Trends

The Thai retail market is characterized by a dynamic blend of established players and emerging innovators, presenting a complex and evolving landscape. Market concentration analysis reveals a competitive arena where key conglomerates hold significant influence. For instance, the CP Group, through its extensive 7-Eleven convenience store network and Big C supermarkets, commands a substantial market share. Similarly, The Mall Group and Central Group (encompassing Robinson and FamilyMart) are major forces in department stores and supermarkets, respectively. Tesco Lotus (Ek-Chai Distribution System Co.) remains a formidable presence, adapting to evolving consumer preferences. While large players dominate, niche segments are catered to by specialized retailers like Watsons in personal care and Villa Market for premium groceries, alongside a burgeoning online retail sector driven by giants such as Alibaba Group Holdings Limited. M&A activities, though not extensively detailed, are crucial for consolidation and expansion, with estimated deal values projected to reach tens of millions of USD. Innovation is driven by advancements in e-commerce, supply chain logistics, and personalized consumer experiences. The regulatory environment is generally supportive of business, though compliance with evolving consumer protection laws and digital trade regulations is essential. Substitute products are abundant across all categories, from private label brands challenging national ones to the growing popularity of direct-to-consumer models. End-user profiles are diverse, ranging from budget-conscious consumers to affluent shoppers seeking premium goods and services, with a significant segment actively embracing digital channels.

Retail Business in Thailand Market Industry Evolution

The Thai retail industry has undergone a profound transformation, evolving from traditional brick-and-mortar establishments to a sophisticated omnichannel ecosystem. The study period from 2019 to 2033, with a base year of 2025, highlights a consistent upward trajectory in market growth. In the historical period (2019–2024), the market witnessed steady expansion fueled by rising disposable incomes and a growing middle class. The forecast period (2025–2033) projects continued robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5-7%. This evolution is significantly influenced by technological advancements. The rapid adoption of mobile technology has spurred the growth of e-commerce, with online sales now representing a substantial and rapidly increasing portion of the total retail market. This digital shift has forced traditional retailers to invest heavily in their online presence, developing sophisticated e-commerce platforms, mobile applications, and integrated online-offline shopping experiences.

Shifting consumer demands are another critical factor shaping the industry. Thai consumers are increasingly sophisticated, demanding convenience, personalization, and ethical sourcing. This has led to a greater emphasis on curated product assortments, loyalty programs, and experiential retail. The demand for organic and sustainable products is on the rise, particularly in the Food and Beverage and Personal and Household Care segments. Furthermore, the younger generation of consumers, the Gen Z demographic, is highly influenced by social media trends and celebrity endorsements, pushing brands to engage in more authentic and interactive marketing campaigns. The retail sector's ability to adapt to these changing preferences, leveraging data analytics to understand consumer behavior and personalize offerings, will be paramount for future success. The integration of Artificial Intelligence (AI) for personalized recommendations, AI-powered chatbots for customer service, and advanced data analytics for inventory management are becoming industry standards. The rise of "quick commerce" models, offering rapid delivery of everyday essentials, is also a notable trend, particularly in urban centers like Bangkok. This continuous adaptation to technological innovation and evolving consumer expectations defines the dynamic evolution of the Thai retail market.

Leading Regions, Countries, or Segments in Retail Business in Thailand Market

The Thai retail market is a complex tapestry of diverse segments and distribution channels, each contributing to the overall market dynamism. Among the product segments, Food and Beverage and Tobacco Products consistently emerge as the dominant force, accounting for a significant portion of retail expenditure due to its essential nature and high consumption frequency. This segment benefits from a vast network of supermarkets and convenience stores, with 7-Eleven (CP ALL PCL) and Big C (Central Group) leading the charge in accessibility and product variety. Personal and Household Care is another substantial segment, driven by a growing population and increasing disposable incomes, with retailers like Watsons and Unilever Group playing pivotal roles.

In terms of distribution channels, Supermarkets represent the most prevalent and widely patronized channel, offering a comprehensive range of products and serving a broad demographic. However, the Online channel is experiencing explosive growth, propelled by increasing internet penetration, smartphone adoption, and the convenience it offers. E-commerce platforms, supported by major players like Alibaba Group Holdings Limited, are rapidly gaining market share. Specialty Stores cater to specific consumer needs and preferences, ranging from fashion and electronics to health and beauty, offering a more curated shopping experience.

The dominance of specific regions within Thailand is largely concentrated in the Greater Bangkok Metropolitan Area, which accounts for the largest share of retail sales due to its high population density, economic activity, and concentration of disposable income. However, significant retail development is also observed in major provincial cities, driven by urbanization and improved infrastructure.

Key drivers for segment dominance include:

- Investment Trends: Major retail conglomerates are continuously investing in expanding their store networks, enhancing their online capabilities, and optimizing their supply chains to reach a wider customer base across the country.

- Regulatory Support: Government policies that encourage domestic and foreign investment in the retail sector, coupled with initiatives to promote digital commerce, further bolster growth in specific segments and channels.

- Consumer Demographics & Behavior: The evolving preferences of the Thai consumer, including a growing demand for convenience, value for money, and unique product offerings, directly influence the success of different segments and channels. The increasing digital savviness of younger generations strongly favors the Online channel.

- Infrastructure Development: Improvements in logistics and transportation networks facilitate the efficient distribution of goods, supporting the expansion of both physical and online retail operations across different regions.

The synergy between these factors ensures that while Food and Beverage remains a cornerstone, the Online channel's rapid ascent is reshaping the competitive landscape, offering new avenues for growth and innovation across all product categories.

Retail Business in Thailand Market Product Innovations

Product innovation within the Thai retail market is increasingly focused on enhanced functionality, sustainability, and personalized consumer experiences. In the Food and Beverage sector, this translates to the development of healthier options, plant-based alternatives, and convenient ready-to-eat meals with extended shelf lives. Personal and Household Care brands are introducing eco-friendly packaging, natural ingredients, and multi-functional products that cater to the growing demand for sustainable and efficient solutions. The Apparel, Footwear, and Accessories segment is seeing a rise in smart textiles, customizable designs, and the integration of technology into wearable items. The impact of these innovations is measured by increased consumer adoption rates, improved product performance metrics such as durability and efficacy, and a stronger competitive edge for brands that can effectively communicate their unique selling propositions.

Propelling Factors for Retail Business in Thailand Market Growth

Several key factors are propelling the growth of the retail business in Thailand. Economic growth and rising disposable incomes are fundamental drivers, enabling consumers to spend more on a wider range of goods and services. The increasing adoption of e-commerce and digital payment solutions has revolutionized accessibility and convenience, with a significant portion of the population actively participating in online shopping. Furthermore, government initiatives promoting digital transformation and consumer protection create a more favorable and secure environment for retail businesses to thrive. The strategic expansion of modern retail formats, including convenience stores and hypermarkets, into emerging urban and rural areas, coupled with the growing influence of social media marketing and influencer collaborations, also significantly contributes to market expansion by reaching and engaging diverse consumer segments.

Obstacles in the Retail Business in Thailand Market Market

Despite robust growth, the Thai retail market faces several obstacles. Intense competition from both domestic and international players, particularly in online retail, can lead to price wars and pressure on profit margins. Supply chain disruptions, exacerbated by global events and logistical challenges, can impact inventory availability and delivery times. Evolving consumer preferences and expectations require continuous adaptation, with businesses needing to invest heavily in innovation and customer experience to stay relevant. Regulatory complexities, including evolving e-commerce laws and import/export regulations, can pose compliance challenges. Furthermore, economic uncertainties and fluctuating currency exchange rates can impact consumer spending power and import costs.

Future Opportunities in Retail Business in Thailand Market

The Thai retail market presents numerous future opportunities. The burgeoning e-commerce sector continues to offer significant growth potential, with further expansion into niche categories and subscription-based models. The increasing demand for sustainable and ethically sourced products opens doors for brands focusing on eco-friendly and socially responsible offerings. Technological advancements, such as the integration of AI for personalized shopping experiences, augmented reality for virtual try-ons, and blockchain for supply chain transparency, will create new avenues for innovation. The growing tourism sector presents an ongoing opportunity for retailers catering to both domestic and international visitors, particularly in premium and experiential retail. Expanding into underserved provincial markets with tailored offerings also represents a significant growth avenue.

Major Players in the Retail Business in Thailand Market Ecosystem

- The Mall Group

- 7-Eleven (CP ALL PCL)

- Tesco Lotus (Ek-Chai Distribution System Co )

- Unilever Group

- Big C (Central Group)

- Robinson (Central Group)

- FamilyMart (Central Group)

- Alibaba Group Holdings Limited

- Foodland

- Watsons

- CP ALL PCL

- Procter & Gamble

- Thai Samsung Electronics Ltd

- MaxValu

- Villa Market

- Lawson 108

- UFM Supermarket

- Rimping Supermarket

Key Developments in Retail Business in Thailand Market Industry

- August 2020: Tesco Lotus partnered with DHL Supply Chain Thailand. This partnership will see DHL Supply Chain manage Tesco Lotus's warehouse operations in Surat Thani, a 51,500 square meters (sqm) facility that houses its inventory of groceries that cater to consumers in Southern Thailand. The DHL team will handle the inbound and outbound activities, inventory management, and temperature-optimal storage of fresh and frozen food products.

Strategic Retail Business in Thailand Market Market Forecast

The strategic retail business in Thailand market is poised for continued expansion, driven by a confluence of robust economic factors and evolving consumer behaviors. The increasing adoption of digital technologies, particularly in e-commerce and mobile payments, will remain a significant growth catalyst. Investments in advanced logistics and supply chain management are crucial for enhancing efficiency and meeting the growing demand for faster delivery. The Thai market's receptiveness to innovative retail formats, including experiential stores and personalized shopping journeys, presents further opportunities for differentiation and market penetration. As disposable incomes continue to rise and consumer preferences diversify, the market offers substantial potential for both established players and agile new entrants to capture market share and drive sustainable growth throughout the forecast period of 2025–2033.

Retail Business in Thailand Market Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Business in Thailand Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Business in Thailand Market Regional Market Share

Geographic Coverage of Retail Business in Thailand Market

Retail Business in Thailand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverage and Tobacco Products

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Industrial and Automotive

- 6.1.6. Electronic and Household Appliances

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverage and Tobacco Products

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Industrial and Automotive

- 7.1.6. Electronic and Household Appliances

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverage and Tobacco Products

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Industrial and Automotive

- 8.1.6. Electronic and Household Appliances

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverage and Tobacco Products

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Industrial and Automotive

- 9.1.6. Electronic and Household Appliances

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverage and Tobacco Products

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Industrial and Automotive

- 10.1.6. Electronic and Household Appliances

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Mall Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 7-Eleven (CP ALL PCL)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tesco Lotus (Ek-Chai Distribution System Co )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big C (Central Group)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robinson (Central Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FamilyMart (Central Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alibaba Group Holdings Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Foodland

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Watsons

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CP ALL PCL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Procter & Gamble

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Thai Samsung Electronics Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MaxValu

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Villa Market

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Other Players in the Country (Lawson 108 UFM Supermarket Rimping Supermarket etc )*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES

List of Figures

- Figure 1: Global Retail Business in Thailand Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Business in Thailand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Business in Thailand Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Retail Business in Thailand Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES, The Mall Group, 7-Eleven (CP ALL PCL), Tesco Lotus (Ek-Chai Distribution System Co ), Unilever Group, Big C (Central Group), Robinson (Central Group), FamilyMart (Central Group), Alibaba Group Holdings Limited, Foodland, Watsons, CP ALL PCL, Procter & Gamble, Thai Samsung Electronics Ltd, MaxValu, Villa Market, Other Players in the Country (Lawson 108 UFM Supermarket Rimping Supermarket etc )*List Not Exhaustive.

3. What are the main segments of the Retail Business in Thailand Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2020 - Tesco Lotus partnered with DHL Supply Chain Thailand. This partnership will see DHL Supply Chain manage Tesco Lotus's warehouse operations in Surat Thani, a 51,500 square meters (sqm) facility that houses its inventory of groceries that cater to consumers in Southern Thailand. The DHL team will handle the inbound and outbound activities, inventory management, and temperature-optimal storage of fresh and frozen food products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Business in Thailand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Business in Thailand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Business in Thailand Market?

To stay informed about further developments, trends, and reports in the Retail Business in Thailand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence