Key Insights

The Singapore retail market is a dynamic sector characterized by sustained growth, with a Compound Annual Growth Rate (CAGR) exceeding 3.7%. This expansion is propelled by a growing affluent demographic, increasing disposable incomes, and a strong consumer preference for convenient, omnichannel shopping. Key growth catalysts include the rapid advancement of e-commerce, the integration of innovative retail technologies like personalized marketing and data analytics, and the rising appeal of experiential retail concepts. The market is segmented across diverse retail formats, including supermarkets, convenience stores, and online platforms, each serving distinct consumer demands. Intense competition prevails among established retailers and agile startups. Despite challenges such as escalating operational expenses and heightened competition from both regional and international brands, Singapore's robust economic framework and supportive government initiatives are expected to foster continued market expansion.

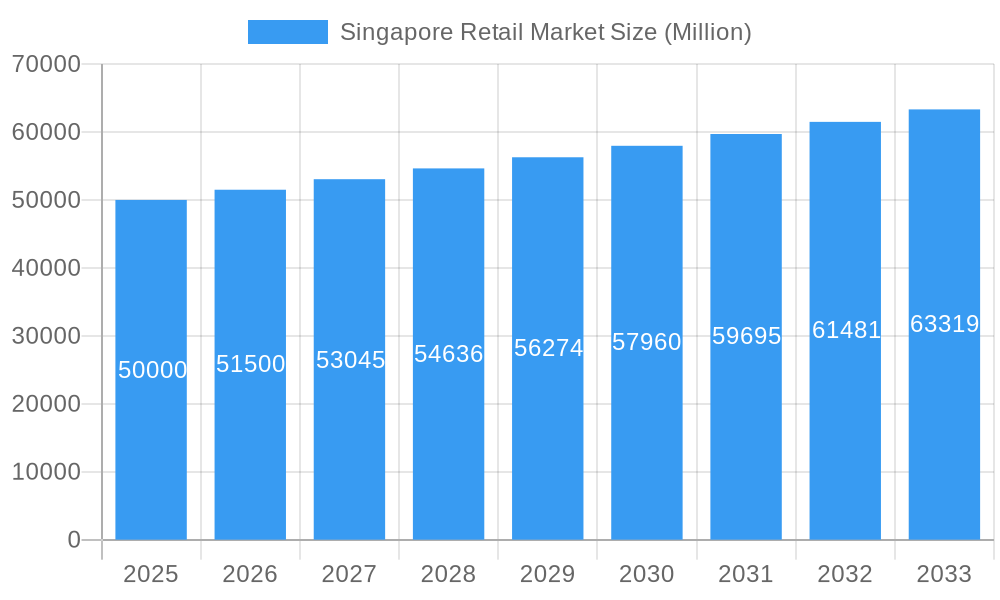

Singapore Retail Market Market Size (In Billion)

For the forecast period of 2025 to 2033, the market is projected to continue its upward trajectory, driven by the ongoing surge in e-commerce adoption and the enhancement of advanced supply chain management systems. Furthermore, retailers' increasing commitment to sustainable practices, influenced by heightened consumer environmental awareness, will shape market evolution. Leading enterprises are strategically investing in omnichannel infrastructure and product portfolio diversification to secure their competitive positions. Market share distribution is anticipated to remain primarily concentrated within Singapore, with limited immediate international expansion due to the market's established domestic competition. The market's future success is intrinsically tied to Singapore's economic resilience and its capacity to adapt to evolving global retail trends. The market size is estimated to reach 144.42 billion in the base year 2025.

Singapore Retail Market Company Market Share

Singapore Retail Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Singapore retail market, offering a comprehensive analysis of its composition, trends, and future outlook. From market size and share distribution to key players and emerging opportunities, this research delivers actionable intelligence for stakeholders seeking to navigate this competitive landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are expressed in Millions.

Singapore Retail Market Composition & Trends

This section examines the intricate structure of the Singapore retail market, analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user demographics, and the landscape of mergers and acquisitions (M&A). The historical period (2019-2024) reveals a market characterized by [insert descriptive paragraph on market concentration, e.g., a relatively high level of concentration with a few dominant players controlling a significant market share. This is further complicated by the rise of e-commerce and changing consumer preferences.]. The estimated market size in 2025 is projected at xx Million, with an anticipated compound annual growth rate (CAGR) of xx% during the forecast period.

Key Aspects:

- Market Share Distribution: [Insert data on market share distribution amongst major players like Sheng Siong Group Ltd, NTUC, and Dairy Farm International Holdings (DFI). Use percentages and provide a brief description of how the market is segmented (e.g., supermarkets, hypermarkets, convenience stores, e-commerce etc.).]

- Innovation Catalysts: The market witnesses continuous innovation driven by [mention factors like technological advancements, evolving consumer preferences, and government initiatives].

- Regulatory Landscape: [Describe the regulatory environment impacting the retail sector, including licenses, permits, and consumer protection laws.]

- Substitute Products: The rise of online retail and alternative shopping channels pose a significant challenge to traditional brick-and-mortar stores.

- End-User Profiles: [Describe the key demographic segments within the Singaporean retail market; e.g., age, income levels, lifestyle preferences.]

- M&A Activities: The Singapore retail landscape has seen notable M&A activity in recent years, with deals valued at approximately xx Million in the period 2019-2024. [Provide specific examples of mergers and acquisitions if available, with deal values.]

Singapore Retail Market Industry Evolution

This section delves into the evolutionary path of the Singapore retail market, focusing on market growth trajectories, technological advancements, and evolving consumer demands. The historical period (2019-2024) showed a [Describe the market's overall trajectory – growth, stagnation, decline etc. Back this up with quantifiable data, growth rates, etc.]. This evolution is heavily influenced by factors like [Elaborate on how technological advancements, like the rise of e-commerce and mobile payments, have impacted the retail sector. Add data on adoption rates if available. Also explain how shifting consumer demands, such as preference for convenience and online shopping, have shaped the industry. Quantify these changes with data if possible. Include discussion of omnichannel retail strategies and their impact.] The forecast period (2025-2033) is expected to witness [Project future trends and growth based on current trajectory. Include growth rate projections and other relevant data].

Leading Regions, Countries, or Segments in Singapore Retail Market

This section identifies the dominant segments within the Singapore retail market, analyzing the key factors driving their success.

- Key Drivers:

- Investment Trends: Significant investments in [mention specific areas like e-commerce infrastructure, supply chain optimization, and technological upgrades.]

- Regulatory Support: Government initiatives focused on [mention supportive policies like digitalization, infrastructure development, and consumer protection.]

[Insert a paragraph providing a detailed explanation of why a particular region or segment is dominant in the Singapore retail market. This analysis should be supported by relevant data and market insights. This will likely be focused on urban areas with high population density and spending power.]

Singapore Retail Market Product Innovations

The Singapore retail market is characterized by continuous product innovation. Retailers are leveraging technology to enhance customer experience through features like personalized recommendations, seamless omnichannel integration, and advanced inventory management systems. This includes the adoption of innovative payment solutions and the implementation of data-driven marketing strategies. Unique selling propositions are increasingly built around convenience, personalization, and superior customer service.

Propelling Factors for Singapore Retail Market Growth

Several factors drive the growth of the Singapore retail market. Technological advancements, particularly e-commerce and mobile payments, fuel significant growth, alongside robust economic conditions and supportive government policies promoting innovation and digitalization. Furthermore, increasing disposable incomes and a growing preference for convenience and personalized shopping experiences also contribute to this growth.

Obstacles in the Singapore Retail Market Market

Despite its growth potential, the Singapore retail market faces challenges. Intense competition from both established players and new entrants, coupled with rising operational costs and supply chain disruptions, create headwinds for businesses. Regulatory hurdles and evolving consumer expectations also necessitate constant adaptation and innovation for sustained success. The impact of these factors is estimated to have resulted in [insert quantifiable impact, e.g., a xx% reduction in profit margins for certain segments in 2024].

Future Opportunities in Singapore Retail Market

The future holds exciting opportunities for Singapore’s retail market. The rise of sustainable and ethical consumption, the increasing adoption of technologies such as AI and AR for enhanced shopping experiences, and the expansion into new market segments like personalized health and wellness retail, represent promising avenues for growth and innovation. Further development of the omnichannel strategy will also be key.

Major Players in the Singapore Retail Market Ecosystem

- Japan Foods Holding Ltd

- Sheng Siong Group Ltd

- Watsons

- RedMart Ltd

- ABR Holdings Ltd

- NTUC

- QAF Limited

- U Stars

- Dairy Farm International Holdings (DFI)

- Font Creative Pte Ltd

Key Developments in Singapore Retail Market Industry

- April 2021: Closure of Singaporean retailer Naiise due to pandemic-related struggles.

[Add more key developments with dates and brief descriptions of their impact on the market dynamics. Include information such as new product launches, successful marketing campaigns, significant mergers and acquisitions, significant policy changes etc.]

Strategic Singapore Retail Market Market Forecast

The Singapore retail market is poised for continued growth, driven by factors such as increasing urbanization, rising disposable incomes, and technological advancements. While challenges remain, the market’s adaptability and the government’s supportive policies suggest a positive outlook for the forecast period (2025-2033), with substantial opportunities for businesses that embrace innovation and meet the evolving needs of consumers. The market is expected to reach xx Million by 2033.

Singapore Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 2.2. Specialty Stores

- 2.3. Department Stores

- 2.4. E-commerce

- 2.5. Other Distribution Channels

Singapore Retail Market Segmentation By Geography

- 1. Singapore

Singapore Retail Market Regional Market Share

Geographic Coverage of Singapore Retail Market

Singapore Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upgrading Technology is Helping the Market to Record More Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 5.2.2. Specialty Stores

- 5.2.3. Department Stores

- 5.2.4. E-commerce

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Foods Holding Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sheng Siong Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Watsons

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedMart Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABR Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NTUC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QAF Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 U Stars

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dairy Farm International Holdings (DFI)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Font Creative Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Japan Foods Holding Ltd

List of Figures

- Figure 1: Singapore Retail Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Singapore Retail Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Singapore Retail Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Retail Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Singapore Retail Market?

Key companies in the market include Japan Foods Holding Ltd, Sheng Siong Group Ltd, Watsons, RedMart Ltd, ABR Holdings Ltd, NTUC, QAF Limited, U Stars, Dairy Farm International Holdings (DFI), Font Creative Pte Ltd.

3. What are the main segments of the Singapore Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 144.42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upgrading Technology is Helping the Market to Record More Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2021, Singapore homegrown retailer Naiise has shut down after struggling to survive through the pandemic, with its owner Dennis Tay filing for personal bankruptcy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Retail Market?

To stay informed about further developments, trends, and reports in the Singapore Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence