Key Insights

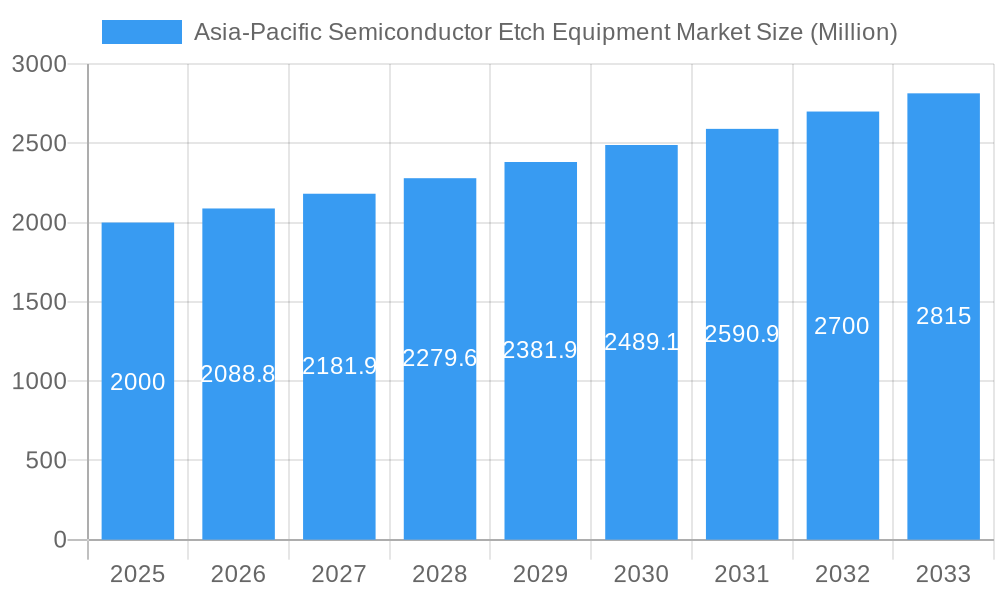

The Asia-Pacific semiconductor etch equipment market, valued at approximately $19970 million in 2025, is projected to experience robust growth with a compound annual growth rate (CAGR) of 5.7% from 2025 to 2033. This expansion is driven by the region's burgeoning semiconductor industry, particularly in China, South Korea, and Taiwan. The increasing demand for high-performance chips supporting 5G, IoT, and AI applications fuels the need for advanced etching equipment. Government initiatives and R&D investments in semiconductor manufacturing further bolster market growth, promoting innovations like high-density plasma etching for improved precision and efficiency. The market is segmented by product type (high-density and low-density etch equipment), etching type (conductor, dielectric, and polysilicon etching), and applications (logic and memory, power devices, and MEMS). Key market players include Lam Research, Applied Materials, and Tokyo Electron, alongside emerging regional competitors.

Asia-Pacific Semiconductor Etch Equipment Market Market Size (In Billion)

Challenges include fluctuations in global semiconductor demand, geopolitical uncertainties, and supply chain disruptions. High capital expenditure for advanced equipment and the need for continuous technological upgrades can impact market accessibility and short-term profitability. Despite these factors, the long-term outlook remains positive due to the Asia-Pacific's strategic importance in global semiconductor manufacturing and ongoing technological advancements. Opportunities exist for specialized equipment providers within specific market segments.

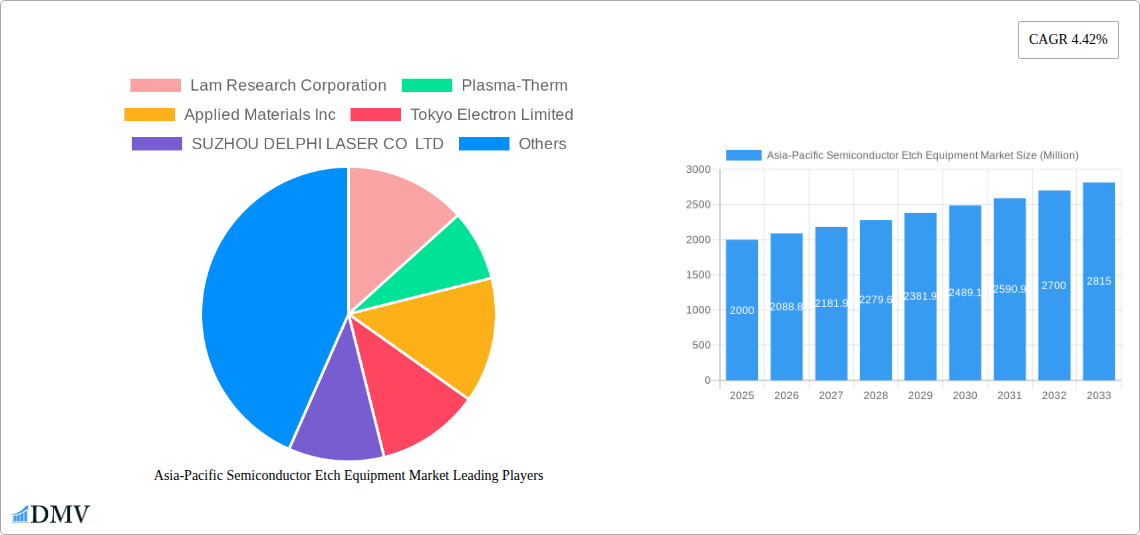

Asia-Pacific Semiconductor Etch Equipment Market Company Market Share

Asia-Pacific Semiconductor Etch Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific semiconductor etch equipment market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast extending to 2033, this report unveils market trends, technological advancements, and key players shaping the future of semiconductor manufacturing in the region. The market is expected to reach xx Million by 2033, experiencing a CAGR of xx% during the forecast period.

Asia-Pacific Semiconductor Etch Equipment Market Composition & Trends

The Asia-Pacific semiconductor etch equipment market is characterized by a moderately concentrated landscape, with key players like Lam Research Corporation, Applied Materials Inc, and Tokyo Electron Limited holding significant market share. The exact distribution is detailed within the report, revealing the competitive dynamics and strategic positioning of each company. Innovation is a crucial driver, fueled by the relentless demand for smaller, faster, and more power-efficient chips. Government regulations, particularly in countries like China and South Korea, play a significant role in shaping investment strategies and market access. Substitute products are limited, given the specialized nature of semiconductor etch equipment, but alternative etching techniques are being explored. End-users primarily comprise major semiconductor manufacturers across various applications. M&A activity, while not overly frequent, has the potential to significantly reshape the competitive landscape, with past deals valued at (xx Million) influencing market concentration. The report analyzes the past five years of M&A activities, providing deal values and strategic implications.

- Market Concentration: Moderately concentrated, dominated by a few key players.

- Innovation Catalysts: Demand for advanced semiconductor nodes and performance improvements.

- Regulatory Landscape: Varied across the region, impacting market access and investment decisions.

- Substitute Products: Limited, but alternative etching techniques are under development.

- End-User Profile: Primarily major semiconductor manufacturers.

- M&A Activity: Moderate levels with significant impact on market share.

Asia-Pacific Semiconductor Etch Equipment Market Industry Evolution

The Asia-Pacific semiconductor etch equipment market has witnessed robust growth over the historical period (2019-2024), driven by escalating demand for semiconductors across various applications, including consumer electronics, automotive, and 5G infrastructure. Technological advancements, particularly in high-density etch equipment and advanced etching techniques, have further propelled market expansion. The market growth trajectory is projected to continue its upward trend throughout the forecast period (2025-2033), albeit at a moderated pace compared to previous years. This moderation reflects the cyclical nature of the semiconductor industry and potential challenges related to global economic conditions. Consumer demand for sophisticated electronic devices remains a key driver, pushing the need for advanced semiconductor manufacturing capabilities. Specific growth rates and adoption metrics for key technologies are provided within the detailed report. The adoption of advanced node technologies is expected to increase significantly from xx% in 2024 to xx% by 2033.

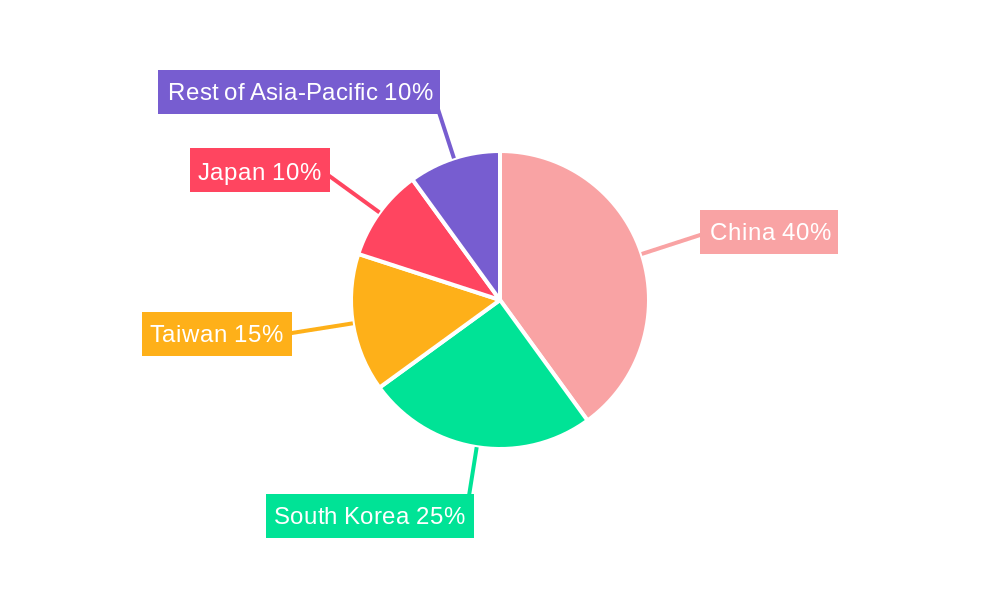

Leading Regions, Countries, or Segments in Asia-Pacific Semiconductor Etch Equipment Market

China and South Korea currently dominate the Asia-Pacific semiconductor etch equipment market, driven by substantial investments in domestic semiconductor manufacturing capabilities and supportive government policies. However, other nations like India and Taiwan are rapidly emerging as significant players, especially due to recent policy shifts.

Key Drivers:

- China: Massive investments in domestic chip manufacturing, robust government support.

- South Korea: Strong presence of leading semiconductor manufacturers, technological advancements.

- India: Emerging as a hub for semiconductor manufacturing due to recent government initiatives and foreign investments (USD 7.5 Billion chip plant).

- Taiwan: Continued strength in semiconductor manufacturing capabilities, advanced technology focus.

- Japan: Established semiconductor industry, focus on advanced technologies.

Segment Dominance:

- By Product Type: High-density etch equipment is the leading segment due to the increasing demand for advanced semiconductor nodes.

- By Etching Type: Conductor etching currently holds the largest market share, followed by dielectric etching.

- By Application: The logic and memory segment dominates due to the high volume of chips required for these applications.

Asia-Pacific Semiconductor Etch Equipment Market Product Innovations

Recent innovations focus on enhancing etch process control, improving throughput, and reducing equipment footprint. The launch of Tokyo Electron's Episode UL platform exemplifies this trend, offering advantages like flexible multi-chamber configurations, significant footprint savings, ease of maintenance, and advanced smart tool features, ultimately boosting fab productivity. Other key players are also aggressively pursuing innovation in areas such as AI-powered process optimization and the development of new materials for advanced etch processes. These innovations are directly influencing market dynamics and shaping competitive advantages.

Propelling Factors for Asia-Pacific Semiconductor Etch Equipment Market Growth

Several factors drive the growth of the Asia-Pacific semiconductor etch equipment market. Firstly, the escalating demand for semiconductors across various applications, such as smartphones, automobiles, and 5G infrastructure, fuels the need for advanced manufacturing equipment. Secondly, technological advancements leading to smaller and more powerful chips necessitate sophisticated etch equipment. Lastly, supportive government policies and incentives in several countries within the region encourage investments in domestic semiconductor manufacturing. These factors, coupled with increased R&D spending and innovations, ensure significant market expansion.

Obstacles in the Asia-Pacific Semiconductor Etch Equipment Market

The Asia-Pacific semiconductor etch equipment market faces challenges such as the cyclical nature of the semiconductor industry, leading to periods of reduced demand. Supply chain disruptions due to geopolitical factors and the COVID-19 pandemic have also created bottlenecks and price volatility. Intense competition among established and emerging players further adds to the complexity. These factors can influence the overall market growth rate and profitability for companies in this sector. The exact quantifiable impact of these factors is thoroughly analyzed within the report.

Future Opportunities in Asia-Pacific Semiconductor Etch Equipment Market

Significant opportunities exist in the Asia-Pacific semiconductor etch equipment market. The growth of new applications like AI and IoT is driving demand for advanced semiconductors, increasing the need for high-performance etch equipment. The development of new materials and processes presents opportunities for innovation. Expansion into emerging markets within the region, particularly in South Asia, also holds significant potential. These opportunities are thoroughly explored in the full report.

Major Players in the Asia-Pacific Semiconductor Etch Equipment Market Ecosystem

- Lam Research Corporation

- Plasma-Therm

- Applied Materials Inc

- Tokyo Electron Limited

- SUZHOU DELPHI LASER CO LTD

- Gigalane

- NAURA Technology Group Co Ltd

- Panasonic Corporation

- Hitachi High Technologies

Key Developments in Asia-Pacific Semiconductor Etch Equipment Market Industry

- August 2021: Tokyo Electron launched its advanced etch platform, Episode UL, enhancing fab productivity.

- September 2021: India and Taiwan's discussions regarding a mutual agreement to bring chip manufacturing to South Asia, potentially involving a USD 7.5 Billion chip plant, indicate a significant shift in regional semiconductor manufacturing.

Strategic Asia-Pacific Semiconductor Etch Equipment Market Forecast

The Asia-Pacific semiconductor etch equipment market is poised for continued growth, driven by ongoing technological advancements, increasing demand for semiconductors, and supportive government policies. Emerging technologies and the expansion of semiconductor manufacturing in various countries in the region will present substantial growth opportunities. The market is expected to witness significant expansion over the next decade, presenting lucrative prospects for established and emerging players alike. The detailed forecast, inclusive of market sizing and growth rates, provides comprehensive insights into the future of this dynamic market.

Asia-Pacific Semiconductor Etch Equipment Market Segmentation

-

1. Product Type

- 1.1. High-density Etch Equipment

- 1.2. Low-density Etch Equipment

-

2. Etching Type

- 2.1. Conductor Etching

- 2.2. Dielectric Etching

- 2.3. Polysilicon Etching

-

3. Application

- 3.1. Logic and Memory

- 3.2. Power Devices

- 3.3. MEMS

Asia-Pacific Semiconductor Etch Equipment Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Semiconductor Etch Equipment Market Regional Market Share

Geographic Coverage of Asia-Pacific Semiconductor Etch Equipment Market

Asia-Pacific Semiconductor Etch Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The growth in adoption of smart electronic devices in the region; Government initiative Programs in the region for domestic semiconductor manufacturing

- 3.3. Market Restrains

- 3.3.1. New semiconductor acts in Europe and America

- 3.4. Market Trends

- 3.4.1. Power devices is expected to grow in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Semiconductor Etch Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Etch Equipment

- 5.1.2. Low-density Etch Equipment

- 5.2. Market Analysis, Insights and Forecast - by Etching Type

- 5.2.1. Conductor Etching

- 5.2.2. Dielectric Etching

- 5.2.3. Polysilicon Etching

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logic and Memory

- 5.3.2. Power Devices

- 5.3.3. MEMS

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Plasma-Therm

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Applied Materials Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tokyo Electron Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SUZHOU DELPHI LASER CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gigalane

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NAURA Technology Group Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hitachi High Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: Asia-Pacific Semiconductor Etch Equipment Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Semiconductor Etch Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Etching Type 2020 & 2033

- Table 4: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 5: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Etching Type 2020 & 2033

- Table 12: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 13: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Semiconductor Etch Equipment Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Asia-Pacific Semiconductor Etch Equipment Market?

Key companies in the market include Lam Research Corporation, Plasma-Therm, Applied Materials Inc, Tokyo Electron Limited, SUZHOU DELPHI LASER CO LTD, Gigalane, NAURA Technology Group Co Ltd, Panasonic Corporation, Hitachi High Technologies.

3. What are the main segments of the Asia-Pacific Semiconductor Etch Equipment Market?

The market segments include Product Type, Etching Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19970 million as of 2022.

5. What are some drivers contributing to market growth?

The growth in adoption of smart electronic devices in the region; Government initiative Programs in the region for domestic semiconductor manufacturing.

6. What are the notable trends driving market growth?

Power devices is expected to grow in the market.

7. Are there any restraints impacting market growth?

New semiconductor acts in Europe and America.

8. Can you provide examples of recent developments in the market?

September 2021: India and Taiwan are in talks for a mutual agreement to bring chip manufacturing to the Asia-Pacific, mainly in South Asia, along with tariff reductions on components for producing semiconductors by the end of this year. In addition, this deal would also bring a chip plant worth an estimated USD 7.5 billion to India to supply everything from electric cars to 5G devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Semiconductor Etch Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Semiconductor Etch Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Semiconductor Etch Equipment Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Semiconductor Etch Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence