Key Insights

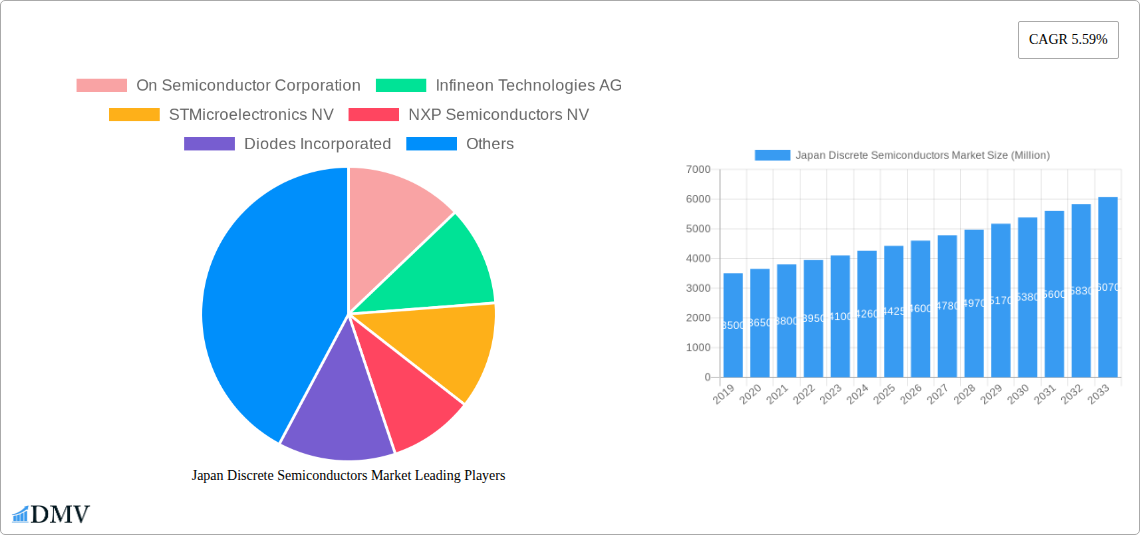

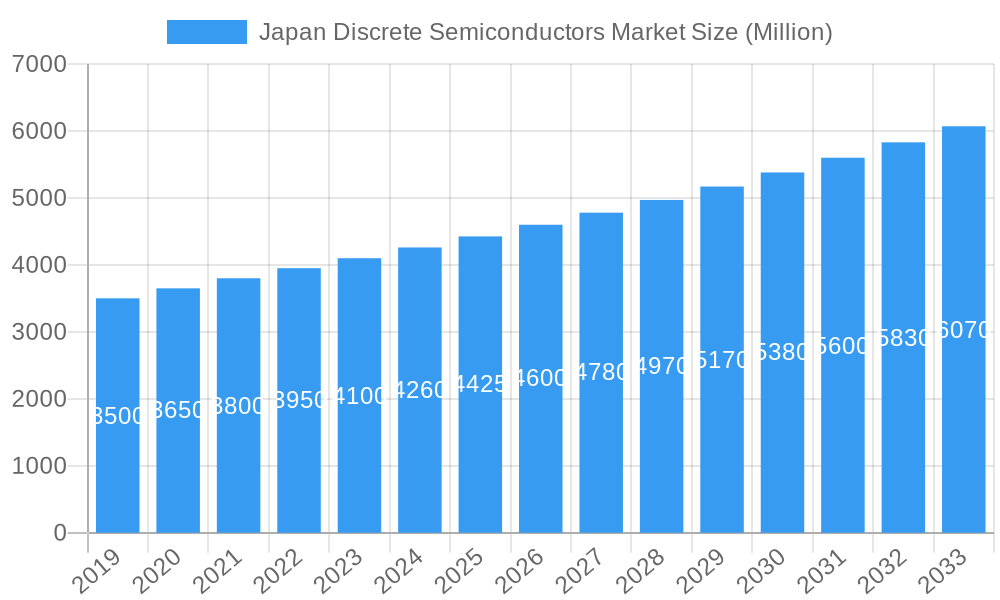

The Japan Discrete Semiconductors Market is poised for robust expansion, projected to reach approximately ¥4.26 million by 2025 and maintain a healthy Compound Annual Growth Rate (CAGR) of 5.59% through to 2033. This growth is underpinned by several significant drivers, including the accelerating adoption of electric vehicles (EVs) within Japan's prominent automotive sector, the persistent demand for advanced consumer electronics, and the burgeoning expansion of industrial automation and smart manufacturing initiatives. Furthermore, the nation's continued investment in cutting-edge communication infrastructure, such as 5G deployment, necessitates a substantial increase in discrete semiconductor components for enhanced network performance and reliability. The market's trajectory also benefits from the increasing complexity and miniaturization of electronic devices, driving demand for high-performance and specialized discrete semiconductor solutions.

Japan Discrete Semiconductors Market Market Size (In Billion)

The market landscape is characterized by a dynamic interplay of key trends and strategic initiatives. A significant trend is the increasing demand for power discrete semiconductors, particularly MOSFETs and IGBTs, to manage and control power efficiently in applications ranging from automotive powertrains to industrial inverters. The growing emphasis on energy efficiency and sustainability across all end-user verticals further amplifies this demand. However, certain restraints, such as global supply chain vulnerabilities and the rising costs of raw materials, could present challenges. Despite these potential headwinds, companies are actively investing in research and development to innovate new materials and manufacturing processes, aiming to mitigate these constraints. Strategic collaborations and mergers, coupled with a focus on high-growth segments like automotive and industrial electronics, are expected to shape the competitive environment and drive future market dynamics in Japan.

Japan Discrete Semiconductors Market Company Market Share

This comprehensive report provides an in-depth analysis of the Japan Discrete Semiconductors Market, covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period from 2025 to 2033. We delve into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, and future opportunities. Our analysis is informed by cutting-edge industry developments and a meticulous examination of key players, offering strategic insights for stakeholders navigating this dynamic sector.

Report Scope:

Key Market Segments:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Type: Diode, Small Signal Transistor, Power Transistor (MOSFET Power Transistor, IGBT Power Transistor, Other Power Transistor), Rectifier, Thyristor

- End-user Vertical: Automotive, Consumer Electronics, Communication, Industrial, Other End-user Verticals

Japan Discrete Semiconductors Market Market Composition & Trends

The Japan Discrete Semiconductors Market exhibits a moderately concentrated landscape, driven by robust innovation and stringent quality standards. Key trends revolve around the increasing demand for high-performance components in automotive electrification, advanced consumer electronics, and burgeoning industrial automation. Regulatory frameworks in Japan, emphasizing energy efficiency and safety, further shape market dynamics, promoting the adoption of advanced discrete semiconductor technologies. Substitute products, while present in some lower-tier applications, struggle to match the reliability and specialized performance of discrete semiconductors in critical Japanese industries. End-user profiles are diverse, with a strong emphasis on quality, longevity, and cutting-edge features, driving significant investments in R&D and advanced manufacturing. Merger and acquisition (M&A) activities, though not as frequent as in other global semiconductor markets, are strategic, focusing on acquiring specialized technologies or expanding market access, with recent M&A deal values in the range of several hundred million to over one billion Yen.

- Market Share Distribution: analysis of key players' market share will reveal leaders in specific discrete semiconductor categories.

- M&A Activities: focus on strategic acquisitions aimed at technological enhancement and market consolidation.

- Innovation Catalysts: government initiatives, academic research collaborations, and intense competition among leading Japanese and international semiconductor companies are key drivers.

- Regulatory Impact: environmental regulations and industry standards significantly influence product development and adoption.

Japan Discrete Semiconductors Market Industry Evolution

The Japan Discrete Semiconductors Market has undergone a significant evolutionary trajectory, marked by relentless technological advancements and a consistent adaptation to evolving end-user demands. Historically, Japan has been a powerhouse in semiconductor manufacturing, and the discrete segment, despite the rise of integrated circuits, remains crucial due to its critical role in power management, signal processing, and control across numerous applications. The market has witnessed a steady growth driven by Japan's strong manufacturing base and its early adoption of advanced technologies. The historical period (2019-2024) saw a pronounced surge in demand from the automotive sector, particularly with the global push towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely heavily on high-performance power discrete semiconductors like MOSFETs and IGBTs. Consumer electronics also continued to be a significant contributor, with the miniaturization and increased functionality of devices requiring smaller and more efficient discrete components. The communication sector, fueled by 5G infrastructure deployment and the proliferation of smart devices, has also been a consistent demand driver.

Technological advancements have been paramount in this evolution. The shift towards wide-bandgap (WBG) materials, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), has been a major theme, enabling higher efficiency, faster switching speeds, and greater power density. This is particularly relevant for power discrete semiconductors. For instance, the adoption of SiC MOSFETs in EV inverters and high-power charging infrastructure is a testament to their superior performance over traditional silicon-based counterparts. Similarly, advancements in packaging technologies have allowed for smaller footprints and improved thermal management, crucial for dense electronic designs.

Shifting consumer demands have also played a pivotal role. Consumers increasingly expect more sophisticated features in their devices, from enhanced energy efficiency in home appliances to greater connectivity and processing power in personal electronics. This translates into a continuous need for more advanced and specialized discrete semiconductors. For example, the growing popularity of smart home devices necessitates a wide array of discrete components for sensing, control, and power management. The industrial sector's drive towards Industry 4.0, with its emphasis on automation, robotics, and the Industrial Internet of Things (IIoT), has further amplified the demand for robust and reliable discrete semiconductors capable of operating in harsh environments and under demanding conditions. The market's growth rate during the historical period averaged around 5-7% annually, with the forecast period (2025-2033) expected to see continued, albeit potentially moderated, growth as mature markets saturate and new technological frontiers emerge. Adoption metrics for advanced discrete components, especially in power applications, have shown a significant upward trend, indicating a strong market receptiveness to innovation.

Leading Regions, Countries, or Segments in Japan Discrete Semiconductors Market

Within the Japan Discrete Semiconductors Market, the Power Transistor segment, particularly MOSFET Power Transistors and IGBT Power Transistors, emerges as the most dominant and rapidly growing category. This dominance is primarily fueled by the insatiable demand from the Automotive and Industrial end-user verticals, which are undergoing significant technological transformations. Japan's leading position in the global automotive industry, with its strong focus on electric vehicles (EVs) and hybrid electric vehicles (HEVs), makes it a critical market for high-power discrete semiconductors used in power management units, inverters, onboard chargers, and battery management systems. The continued evolution of ADAS and autonomous driving technologies further escalates the need for sophisticated power discrete components.

In the industrial sector, the drive towards automation, energy efficiency, and the adoption of Industry 4.0 principles are creating substantial demand. This includes applications like robotics, industrial motor drives, renewable energy systems (solar and wind power converters), and advanced power supplies for manufacturing equipment. The stringent requirements for reliability, efficiency, and durability in industrial settings make Japan's high-quality power discrete semiconductors highly sought after. The Communication vertical also plays a significant role, especially with the ongoing rollout of 5G infrastructure and the proliferation of high-speed communication devices, which require efficient power management solutions often utilizing discrete transistors.

- Key Drivers for Power Transistors (MOSFET & IGBT) Dominance:

- Automotive Electrification: Surge in EV/HEV production and the need for efficient power conversion.

- Industrial Automation & Industry 4.0: Growth in robotics, smart manufacturing, and IIoT applications.

- Renewable Energy Integration: Increased deployment of solar and wind power systems requiring advanced power converters.

- Government Initiatives: Supportive policies for technological advancement and energy efficiency.

- Technological Advancements: Development of Wide-Bandgap (WBG) semiconductors like SiC and GaN offering superior performance.

The Automotive end-user vertical stands out as the leading segment, directly benefiting from the growth in power transistors. Japan's reputation for high-quality and innovative automotive manufacturing ensures a consistent demand for advanced discrete semiconductors that meet rigorous safety and performance standards. The transition to electric mobility is not just a trend but a fundamental shift, solidifying the automotive sector's position as the primary driver for discrete semiconductor innovation and consumption in Japan. While other segments like consumer electronics and communication are substantial, the sheer volume and high-value nature of discrete semiconductors required for automotive applications give it the edge. The Other End-user Verticals category also holds potential, encompassing areas like aerospace, defense, and medical devices, where specialized and highly reliable discrete components are indispensable.

Japan Discrete Semiconductors Market Product Innovations

The Japan Discrete Semiconductors Market is characterized by continuous product innovation, driven by the pursuit of higher efficiency, smaller form factors, and enhanced performance. Recent advancements include the development of next-generation Silicon Carbide (SiC) MOSFETs offering improved power density and lower switching losses, crucial for EV powertrains and high-power industrial applications. Innovations in IGBT technology focus on higher voltage ratings and faster switching speeds for improved energy conversion in renewable energy systems and industrial motor drives. Furthermore, low-power discrete components are seeing advancements in miniaturization and improved thermal management for the rapidly expanding IoT and consumer electronics markets. Applications range from advanced automotive safety systems and electric vehicle charging infrastructure to energy-efficient industrial automation and sophisticated communication devices.

Propelling Factors for Japan Discrete Semiconductors Market Growth

Several key factors are propelling the growth of the Japan Discrete Semiconductors Market. Technologically, the global shift towards electrification, particularly in the automotive sector with the rise of EVs, creates immense demand for power discrete semiconductors. Furthermore, the industrial sector's embrace of Industry 4.0 and automation necessitates reliable and efficient discrete components for control systems and power management. Economically, Japan's strong industrial base and its commitment to technological innovation provide a fertile ground for market expansion. Regulatory influences, such as government incentives for renewable energy adoption and stricter energy efficiency standards, are also significant drivers, pushing the demand for advanced discrete solutions.

Obstacles in the Japan Discrete Semiconductors Market Market

Despite robust growth, the Japan Discrete Semiconductors Market faces certain obstacles. Supply chain disruptions, exacerbated by global geopolitical events and natural disasters, can impact the availability and cost of raw materials and finished products, leading to price volatility. Intense competition from global semiconductor manufacturers, particularly those with lower production costs, presents a constant challenge. Furthermore, while Japan excels in innovation, the high cost of R&D and advanced manufacturing can be a barrier to entry for smaller players. Regulatory hurdles related to environmental compliance and product certification, although promoting quality, can also add to development timelines and costs.

Future Opportunities in Japan Discrete Semiconductors Market

The Japan Discrete Semiconductors Market is ripe with future opportunities. The continued expansion of electric mobility, including not just passenger vehicles but also commercial vehicles and infrastructure, will drive sustained demand for high-performance power discrete semiconductors. The growing adoption of renewable energy sources, such as solar and wind power, and the development of smart grids present significant opportunities for discrete components used in power conversion and management. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart homes, industrial IoT, and connected devices, will require a vast array of small-signal and power discrete components. Moreover, advancements in areas like artificial intelligence (AI) and machine learning, particularly in data centers, will necessitate specialized discrete solutions for power management and signal processing.

Major Players in the Japan Discrete Semiconductors Market Ecosystem

- On Semiconductor Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- Diodes Incorporated

- Toshiba Electronic Devices & Storage Corporation

- ABB Ltd

- Nexperia BV

- Semikron Danfoss Holding A/S (Danfoss A/S)

- Eaton Corporation PLC

- Hitachi Energy Ltd (Hitachi Ltd )

- Mitsubishi Electric Corp

- Fuji Electric Co Ltd

- Analog Devices Inc

- Vishay Intertechnology Inc

- Renesas Electronics Corporation

- ROHM Co Ltd

- Microchip Technology

- Qorvo Inc

- Wolfspeed Inc

- Texas Instruments Inc

- Littelfuse Inc

- WeEn Semiconductor

Key Developments in Japan Discrete Semiconductors Market Industry

- May 2024: Infineon Technologies is expanding its SiC MOSFET development to encompass voltages below 650 V. The company has introduced its latest offering, the CoolSiCMOSFET 400 V family, built on the second-generation (G2) technology, which debuted earlier this year. This new MOSFET lineup is designed for the AC/DC stage of AI servers, aligning with Infineon's recent PSU roadmap. Beyond server applications, these devices find a niche in inverter motor control, solar and energy storage systems, SMPS, and even solid-state circuit breakers in residential settings, impacting the high-performance discrete power segment.

- April 2024: Fuji Electric Co., Ltd. (FE) has introduced its latest offering, the HPnCSeries. This new line features large-capacity industrial IGBT modules specifically designed for applications such as power converters in solar and wind energy systems. By enhancing both current and voltage ratings, these products boost the capacity and shrink the footprint of the power converters they're integrated into. This, in turn, aids in cutting down power generation expenses, signaling advancements in industrial IGBT solutions for renewable energy.

Strategic Japan Discrete Semiconductors Market Market Forecast

The Japan Discrete Semiconductors Market is poised for sustained growth, driven by key strategic factors. The ongoing electrification of the automotive sector, coupled with government support for green initiatives, will continue to fuel demand for high-efficiency power discrete semiconductors. Advancements in Wide-Bandgap materials like SiC and GaN will unlock new performance benchmarks, creating opportunities in demanding applications such as electric vehicle charging and industrial power supplies. The increasing complexity and connectivity of consumer electronics and the expansion of 5G infrastructure will necessitate a greater number of sophisticated discrete components for signal processing and power management. The market's forecast indicates robust growth, with strategic investments in R&D and advanced manufacturing crucial for capitalizing on emerging trends and maintaining a competitive edge in this vital segment of the semiconductor industry.

Japan Discrete Semiconductors Market Segmentation

-

1. Type

- 1.1. Diode

- 1.2. Small Signal Transistor

-

1.3. Power Transistor

- 1.3.1. MOSFET Power Transistor

- 1.3.2. IGBT Power Transistor

- 1.3.3. Other Power Transistor

- 1.4. Rectifier

- 1.5. Thyristor

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Communication

- 2.4. Industrial

- 2.5. Other End-user Verticals

Japan Discrete Semiconductors Market Segmentation By Geography

- 1. Japan

Japan Discrete Semiconductors Market Regional Market Share

Geographic Coverage of Japan Discrete Semiconductors Market

Japan Discrete Semiconductors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment; Increasing Demand for Green Energy Power Generation Drives the Market

- 3.3. Market Restrains

- 3.3.1. Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment; Increasing Demand for Green Energy Power Generation Drives the Market

- 3.4. Market Trends

- 3.4.1. Power Transistors are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Discrete Semiconductors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diode

- 5.1.2. Small Signal Transistor

- 5.1.3. Power Transistor

- 5.1.3.1. MOSFET Power Transistor

- 5.1.3.2. IGBT Power Transistor

- 5.1.3.3. Other Power Transistor

- 5.1.4. Rectifier

- 5.1.5. Thyristor

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Communication

- 5.2.4. Industrial

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 On Semiconductor Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STMicroelectronics NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NXP Semiconductors NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Diodes Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toshiba Electronic Devices & Storage Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABB Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nexperia BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eaton Corporation PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi Energy Ltd (Hitachi Ltd )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mitsubishi Electric Corp

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fuji Electric Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Analog Devices Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Vishay Intertechnology Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Renesas Electronics Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ROHM Co Ltd

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Microchip Technology

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Qorvo Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Wolfspeed Inc

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Texas Instruments Inc

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Littelfuse Inc

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 WeEn Semiconductor

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 On Semiconductor Corporation

List of Figures

- Figure 1: Japan Discrete Semiconductors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Discrete Semiconductors Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Discrete Semiconductors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Discrete Semiconductors Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Japan Discrete Semiconductors Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Japan Discrete Semiconductors Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Japan Discrete Semiconductors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Discrete Semiconductors Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Japan Discrete Semiconductors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Japan Discrete Semiconductors Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Japan Discrete Semiconductors Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Japan Discrete Semiconductors Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Japan Discrete Semiconductors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Discrete Semiconductors Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Discrete Semiconductors Market?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Japan Discrete Semiconductors Market?

Key companies in the market include On Semiconductor Corporation, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, Diodes Incorporated, Toshiba Electronic Devices & Storage Corporation, ABB Ltd, Nexperia BV, Semikron Danfoss Holding A/S (Danfoss A/S), Eaton Corporation PLC, Hitachi Energy Ltd (Hitachi Ltd ), Mitsubishi Electric Corp, Fuji Electric Co Ltd, Analog Devices Inc, Vishay Intertechnology Inc, Renesas Electronics Corporation, ROHM Co Ltd, Microchip Technology, Qorvo Inc, Wolfspeed Inc, Texas Instruments Inc, Littelfuse Inc, WeEn Semiconductor.

3. What are the main segments of the Japan Discrete Semiconductors Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment; Increasing Demand for Green Energy Power Generation Drives the Market.

6. What are the notable trends driving market growth?

Power Transistors are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment; Increasing Demand for Green Energy Power Generation Drives the Market.

8. Can you provide examples of recent developments in the market?

May 2024: Infineon Technologies is expanding its SiC MOSFET development to encompass voltages below 650 V. The company has introduced its latest offering, the CoolSiCMOSFET 400 V family, built on the second-generation (G2) technology, which debuted earlier this year. This new MOSFET lineup is designed for the AC/DC stage of AI servers, aligning with Infineon's recent PSU roadmap. Beyond server applications, these devices find a niche in inverter motor control, solar and energy storage systems, SMPS, and even solid-state circuit breakers in residential settings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Discrete Semiconductors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Discrete Semiconductors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Discrete Semiconductors Market?

To stay informed about further developments, trends, and reports in the Japan Discrete Semiconductors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence