Key Insights

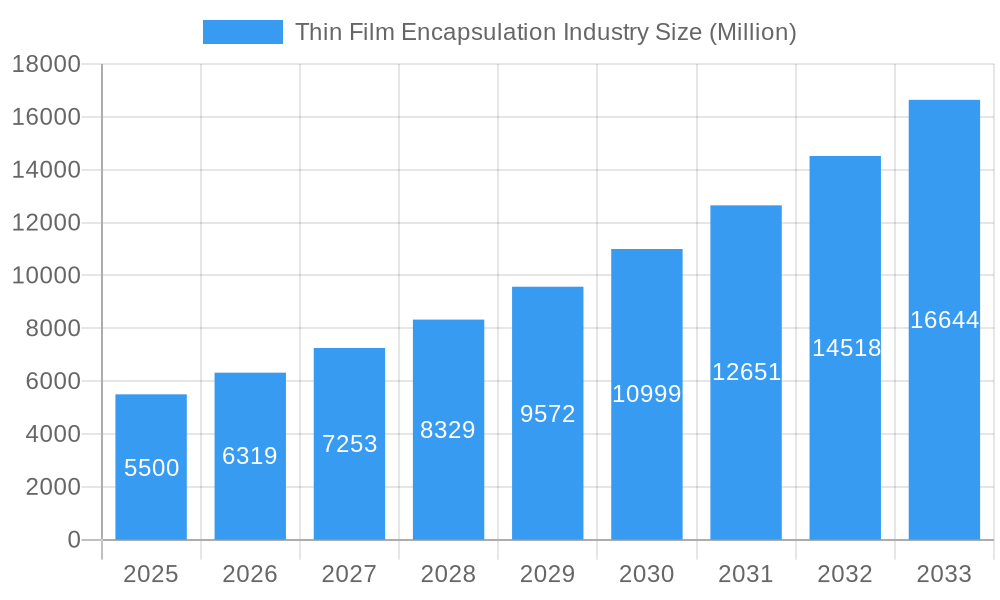

The Thin Film Encapsulation (TFE) market is set for substantial growth, projected at a CAGR of 14.80% and reaching a market size of $0.2 billion by 2025. This expansion is driven by increasing demand for advanced display technologies, especially flexible OLEDs in consumer electronics, and the growing adoption of thin-film photovoltaics in renewable energy. TFE's key benefits, including superior moisture and oxygen barrier properties, ultra-thin profiles, and flexible substrate compatibility, are critical for these applications. Advancements in Plasma-enhanced Chemical Vapor Deposition (PECVD) and Atomic Layer Deposition (ALD) are enhancing encapsulation quality, efficiency, and cost-effectiveness, accelerating market penetration. The trend towards energy efficiency and miniaturization in electronic devices further bolsters TFE's significance.

Thin Film Encapsulation Industry Market Size (In Million)

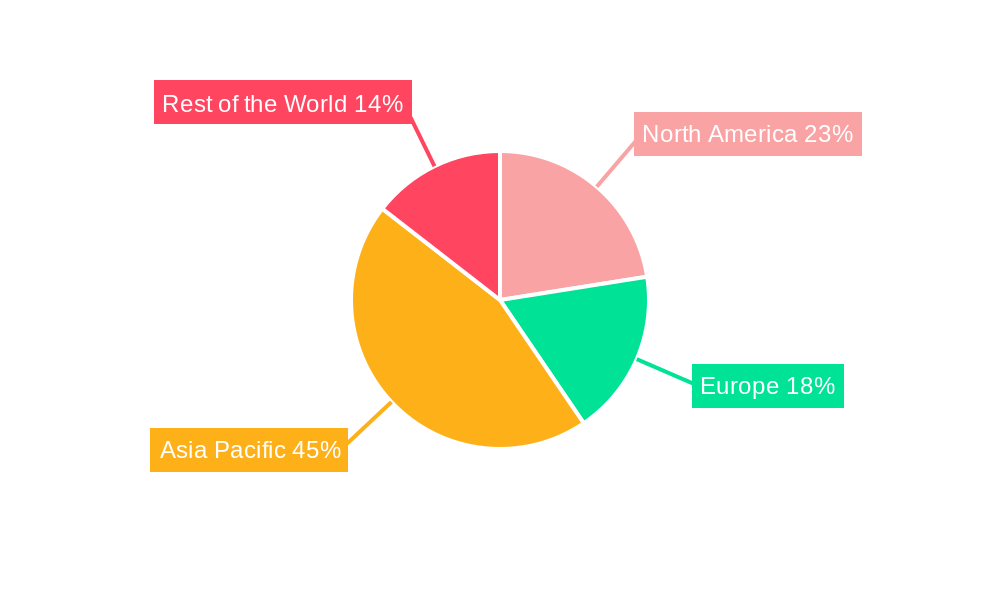

Market challenges include the high initial investment in advanced deposition equipment and difficulties in achieving uniform, defect-free encapsulation on large flexible substrates for demanding applications like high-efficiency solar cells. However, robust demand and ongoing technological innovation are expected to overcome these hurdles. The market is segmented by technology, with PECVD and ALD being prominent, and by application, with flexible OLED displays and thin-film photovoltaics leading in size and growth. Asia Pacific is expected to lead the market due to its strong electronics manufacturing base, followed by North America and Europe, driven by R&D investments in advanced solar solutions.

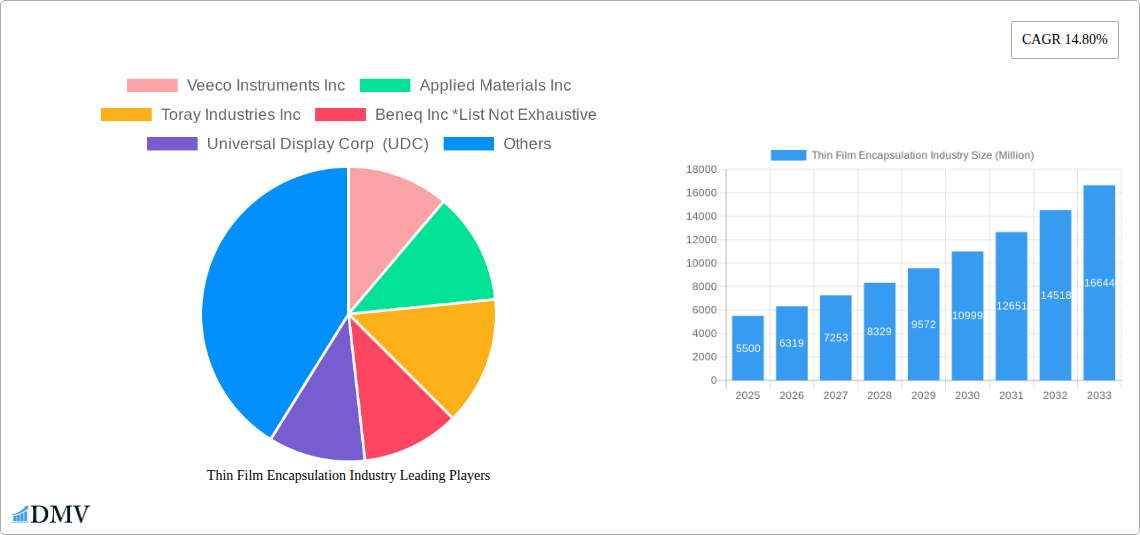

Thin Film Encapsulation Industry Company Market Share

Thin Film Encapsulation Industry Market Composition & Trends

The global Thin Film Encapsulation (TFE) market is characterized by a dynamic and evolving landscape, driven by relentless innovation and increasing demand for advanced display and energy solutions. While market concentration is moderate, key players like Veeco Instruments Inc, Applied Materials Inc, and Universal Display Corp (UDC) hold significant influence. The market is a burgeoning sector within the broader electronics and materials science industries, with an estimated market size projected to reach hundreds of billions of dollars by the forecast period. Innovation is primarily fueled by the pursuit of enhanced device longevity, flexibility, and miniaturization across applications like flexible OLED displays and thin-film photovoltaics. Regulatory landscapes, while still developing, are increasingly focusing on environmental sustainability and material safety, impacting material choices and manufacturing processes. Substitute products, such as thicker glass encapsulation or alternative barrier films, are gradually being outcompeted by the superior performance of TFE in specific high-value applications. End-user profiles are diverse, ranging from consumer electronics manufacturers demanding robust and flexible displays to renewable energy companies seeking efficient and durable solar cells. Mergers and acquisitions (M&A) activity is on the rise, as companies strategically acquire technologies or market access to solidify their competitive positions. M&A deal values are anticipated to escalate, reflecting the high growth potential and strategic importance of this sector.

- Market Share Distribution: Concentrated among a few dominant players, with increasing fragmentation in niche segments.

- M&A Deal Values: Expected to rise significantly due to strategic consolidation and technology acquisition.

- Innovation Catalysts: Advancements in Plasma-enhanced chemical vapor deposition (PECVD) and Atomic layer deposition (ALD) technologies are key drivers.

- End-User Segments: Primarily driven by the consumer electronics (OLED displays and lighting) and renewable energy (thin-film solar) sectors.

Thin Film Encapsulation Industry Industry Evolution

The thin film encapsulation industry has witnessed a dramatic and consistent upward trajectory since its inception, driven by pivotal technological advancements and evolving market demands. Spanning the historical period of 2019–2024 and projecting through to 2033, this market has transformed from a niche technology to an indispensable component in cutting-edge electronic devices. The base year of 2025 serves as a crucial benchmark, with significant growth anticipated to continue through the forecast period of 2025–2033. Early stages of the industry were defined by the development and refinement of deposition techniques, primarily Plasma-enhanced chemical vapor deposition (PECVD) and Vacuum Thermal Evaporation (VTE), enabling the creation of effective barrier layers. As the demand for flexible and durable displays surged, particularly for flexible OLED displays and flexible OLED lighting, the industry responded with innovations in Atomic layer deposition (ALD), offering superior conformality and atomic-level control.

The study period of 2019–2033 highlights a consistent compound annual growth rate (CAGR) estimated to be in the double digits, a testament to the market's robust expansion. This growth is intrinsically linked to the increasing adoption of OLED technology in smartphones, wearables, televisions, and automotive displays. The quest for thinner, lighter, and more resilient electronic devices has propelled the need for TFE solutions that can withstand environmental stressors like moisture and oxygen, thereby extending product lifespan and improving performance. Furthermore, the burgeoning thin-film photovoltaics sector is another significant contributor to market evolution. As the world pivots towards renewable energy sources, the demand for efficient, lightweight, and flexible solar cells that can be integrated into various surfaces is escalating. TFE plays a critical role in protecting these sensitive photovoltaic cells from degradation, enhancing their efficiency and durability in diverse environmental conditions.

The evolution of inkjet printing as a viable TFE method, particularly for micro-OLED applications, represents a significant leap forward, offering potential cost reductions and scalability. This technological diversification is crucial for meeting the diverse needs of a rapidly expanding market. Consumer demand for immersive visual experiences, foldable devices, and aesthetically pleasing, integrated lighting solutions continuously pushes the boundaries of what electronic devices can achieve, directly translating into increased demand for advanced TFE solutions. The industry's ability to adapt and innovate, driven by companies like Samsung SDI and LG Chem, has been instrumental in its sustained growth and its critical role in shaping the future of electronics and energy.

Leading Regions, Countries, or Segments in Thin Film Encapsulation Industry

The Thin Film Encapsulation (TFE) Industry is experiencing significant growth and diversification across key regions and technological segments. Asia-Pacific, particularly South Korea, Taiwan, and China, stands as the dominant region, driven by its robust electronics manufacturing ecosystem, extensive research and development capabilities, and a high concentration of leading display manufacturers. This dominance is further amplified by substantial government investments in advanced materials and semiconductor technologies.

Within the Technology segment, Atomic Layer Deposition (ALD) and Plasma-enhanced chemical vapor deposition (PECVD) are currently leading the charge. ALD's precise, conformal, and uniform film deposition at the atomic level makes it ideal for intricate encapsulation requirements of high-end displays, particularly in the flexible OLED Display application. PECVD, while more established, continues to offer cost-effectiveness and scalability for a broader range of TFE applications, including both displays and thin-film photovoltaics. Inkjet Printing is rapidly emerging as a disruptive technology, especially for micro-OLED and niche display applications, offering potential for reduced manufacturing costs and the ability to pattern functional layers precisely. Vacuum Thermal Evaporation (VTE) remains relevant for specific material depositions but is less prevalent for bulk encapsulation compared to ALD and PECVD.

In terms of Application, Flexible OLED Display is the primary growth engine for the TFE market. The insatiable demand for smartphones, wearables, tablets, and advanced televisions that feature vibrant, flexible, and energy-efficient displays directly translates into a massive market for TFE solutions that ensure their longevity and performance. The seamless integration of TFE into foldable and rollable display technologies is a critical factor driving this segment's dominance. Thin-Film Photovoltaics represents a rapidly expanding secondary application. As the global push for renewable energy intensifies, TFE is crucial for protecting the sensitive active layers of thin-film solar cells from environmental degradation, enhancing their efficiency, durability, and enabling their integration into building materials and flexible substrates. Flexible OLED Lighting is a growing niche, offering unique design possibilities for architectural and automotive lighting, further fueling the demand for advanced TFE.

- Dominant Region: Asia-Pacific (South Korea, Taiwan, China)

- Key Drivers:

- Strong presence of leading display and electronics manufacturers.

- Extensive R&D infrastructure and government support for advanced materials.

- High volume production of OLED displays and consumer electronics.

- Key Drivers:

- Leading Technology Segment:

- Atomic Layer Deposition (ALD): Precision and conformality for high-performance displays.

- Plasma-enhanced chemical vapor deposition (PECVD): Scalability and cost-effectiveness for various applications.

- Dominant Application Segment:

- Flexible OLED Display: Driven by consumer demand for innovative electronic devices.

- Thin-Film Photovoltaics: Fueled by the global shift towards renewable energy.

Thin Film Encapsulation Industry Product Innovations

Product innovations in the thin film encapsulation industry are primarily focused on achieving ultra-thin, highly effective barrier layers with superior flexibility and environmental resistance. Companies are developing multi-layer inorganic and organic barrier stacks that significantly reduce moisture vapor transmission rates (MVTR) and oxygen transmission rates (OTR), crucial for extending the lifespan of sensitive electronic components. Advancements in ALD processes allow for the deposition of ultra-thin, pinhole-free layers, enabling thinner and more flexible encapsulation solutions. Novel organic materials are being engineered to improve flexibility and crack resistance, critical for foldable and wearable devices. Furthermore, research is ongoing into functional TFE layers that can also provide anti-reflective properties or enhanced light extraction for displays and solar cells. These innovations are directly impacting device performance, enabling the creation of thinner, lighter, and more durable products across various applications.

Propelling Factors for Thin Film Encapsulation Industry Growth

The thin film encapsulation industry is propelled by a confluence of powerful factors. The exponential growth in the flexible OLED display market, driven by consumer demand for innovative smartphones, wearables, and televisions, is a primary catalyst. The increasing adoption of OLED technology in automotive displays and interior lighting further expands this demand. Concurrently, the global imperative for sustainable energy solutions fuels the growth of the thin-film photovoltaics sector, where TFE is vital for enhancing the durability and efficiency of solar cells. Technological advancements in deposition techniques like Atomic Layer Deposition (ALD) and Inkjet Printing are enabling more cost-effective and higher-performance encapsulation solutions, making TFE accessible for a wider range of applications. Regulatory pushes for energy efficiency and extended product lifespans also indirectly support the adoption of robust encapsulation technologies.

Obstacles in the Thin Film Encapsulation Industry Market

Despite its robust growth, the thin film encapsulation industry faces several obstacles. The high cost of advanced deposition equipment, particularly for ALD, can be a significant barrier to entry for smaller manufacturers. The complexity of multi-layer TFE processes and the need for stringent quality control can lead to manufacturing challenges and yield issues. Supply chain disruptions for specialized precursor materials and the reliance on a few key suppliers can create vulnerabilities. Intense competition and price pressure from established players and emerging technologies necessitate continuous innovation and cost optimization. Developing standardized testing methodologies for TFE performance across diverse applications also remains a challenge, complicating market adoption and product benchmarking.

Future Opportunities in Thin Film Encapsulation Industry

Emerging opportunities in the thin film encapsulation industry are abundant and span across various technological frontiers. The rapid development of micro-OLED displays for augmented reality (AR) and virtual reality (VR) headsets presents a significant growth avenue, requiring highly precise and compact encapsulation. The expansion of flexible and transparent solar cells into novel applications, such as building-integrated photovoltaics (BIPV) and wearable electronics, will drive demand for robust and lightweight TFE solutions. The automotive industry's increasing integration of displays and lighting will create new markets for specialized TFE. Furthermore, advancements in 3D printing and additive manufacturing could unlock new, cost-effective methods for TFE deposition, opening up possibilities for complex geometries and personalized encapsulation.

Major Players in the Thin Film Encapsulation Industry Ecosystem

- Veeco Instruments Inc

- Applied Materials Inc

- Toray Industries Inc

- Beneq Inc

- Universal Display Corp (UDC)

- 3M

- Meyer Burger Technology Limited

- LG Chem

- Aixtron SE

- Kateeva

- BASF (Rolic) AG

- Lotus Applied Technology

- Samsung SDI

- Bystronic Glass

- Angstrom Engineering Inc

- AMS Technologies

Key Developments in Thin Film Encapsulation Industry Industry

- April 2022: Samsung Display began developing a thinner quantum dot (QD)-OLED panel, aiming to reduce glass substrates to one. This innovation could enable a rollable QD-OLED format.

- December 2021: Unijet, an Inkjet printing firm, supplied inkjet equipment for micro OLED to China's Sidtek, for thin-film encapsulation of micro OLED displays. This marked Unijet's first commercial production supply of TFE inkjet equipment.

Strategic Thin Film Encapsulation Industry Market Forecast

The strategic Thin Film Encapsulation Industry market forecast indicates robust and sustained growth, driven by the insatiable demand for advanced electronic displays and the burgeoning renewable energy sector. The continued evolution of OLED technology, particularly in foldable and rollable formats, coupled with the rapid expansion of thin-film solar cells, presents significant market potential. Innovations in ALD, inkjet printing, and novel material science are expected to further enhance encapsulation performance, driving adoption across a wider array of applications. Anticipated investments in R&D and manufacturing capacity by key players will solidify the market's expansion, presenting lucrative opportunities for stakeholders in the coming years.

Thin Film Encapsulation Industry Segmentation

-

1. Technology

- 1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 1.2. Atomic layer deposition (ALD)

- 1.3. Inkjet Printing

- 1.4. Vacuum Thermal Evaporation (VTE)

- 1.5. Other Technologies

-

2. Application

- 2.1. Flexible OLED Display

- 2.2. Thin-Film Photovoltaics

- 2.3. Flexible OLED Lighting

- 2.4. Other Applications

Thin Film Encapsulation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Thin Film Encapsulation Industry Regional Market Share

Geographic Coverage of Thin Film Encapsulation Industry

Thin Film Encapsulation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Microelectronics and Consumer Electronics Products; Increased Adoption of Flexible OLED Displays for Smartphones and Smart Wearables

- 3.3. Market Restrains

- 3.3.1. High Capital Investment in R&D for Developing Upgraded Products; Augmented Growth of Flexible Glass

- 3.4. Market Trends

- 3.4.1. Flexible OLED Display Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 5.1.2. Atomic layer deposition (ALD)

- 5.1.3. Inkjet Printing

- 5.1.4. Vacuum Thermal Evaporation (VTE)

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Flexible OLED Display

- 5.2.2. Thin-Film Photovoltaics

- 5.2.3. Flexible OLED Lighting

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 6.1.2. Atomic layer deposition (ALD)

- 6.1.3. Inkjet Printing

- 6.1.4. Vacuum Thermal Evaporation (VTE)

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Flexible OLED Display

- 6.2.2. Thin-Film Photovoltaics

- 6.2.3. Flexible OLED Lighting

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 7.1.2. Atomic layer deposition (ALD)

- 7.1.3. Inkjet Printing

- 7.1.4. Vacuum Thermal Evaporation (VTE)

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Flexible OLED Display

- 7.2.2. Thin-Film Photovoltaics

- 7.2.3. Flexible OLED Lighting

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 8.1.2. Atomic layer deposition (ALD)

- 8.1.3. Inkjet Printing

- 8.1.4. Vacuum Thermal Evaporation (VTE)

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Flexible OLED Display

- 8.2.2. Thin-Film Photovoltaics

- 8.2.3. Flexible OLED Lighting

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 9.1.2. Atomic layer deposition (ALD)

- 9.1.3. Inkjet Printing

- 9.1.4. Vacuum Thermal Evaporation (VTE)

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Flexible OLED Display

- 9.2.2. Thin-Film Photovoltaics

- 9.2.3. Flexible OLED Lighting

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Veeco Instruments Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Applied Materials Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toray Industries Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Beneq Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Universal Display Corp (UDC)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3M

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Meyer Burger Technology Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LG Chem

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Aixtron SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kateeva

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BASF (Rolic) AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Lotus Applied Technology

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Samsung SDI

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bystronic Glass

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Angstrom Engineering Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 AMS Technologies

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Veeco Instruments Inc

List of Figures

- Figure 1: Global Thin Film Encapsulation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Encapsulation Industry?

The projected CAGR is approximately 20%.

2. Which companies are prominent players in the Thin Film Encapsulation Industry?

Key companies in the market include Veeco Instruments Inc, Applied Materials Inc, Toray Industries Inc, Beneq Inc *List Not Exhaustive, Universal Display Corp (UDC), 3M, Meyer Burger Technology Limited, LG Chem, Aixtron SE, Kateeva, BASF (Rolic) AG, Lotus Applied Technology, Samsung SDI, Bystronic Glass, Angstrom Engineering Inc, AMS Technologies.

3. What are the main segments of the Thin Film Encapsulation Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Microelectronics and Consumer Electronics Products; Increased Adoption of Flexible OLED Displays for Smartphones and Smart Wearables.

6. What are the notable trends driving market growth?

Flexible OLED Display Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Capital Investment in R&D for Developing Upgraded Products; Augmented Growth of Flexible Glass.

8. Can you provide examples of recent developments in the market?

April 2022 - Samsung Display started working on developing a thinner version of its quantum dot (QD)-OLED panel with the aim is to reduce the use of glass substrates to one. The project's success will enable the company to launch the new version of QD-OLED in a rollable format.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Encapsulation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Encapsulation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Encapsulation Industry?

To stay informed about further developments, trends, and reports in the Thin Film Encapsulation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence