Key Insights

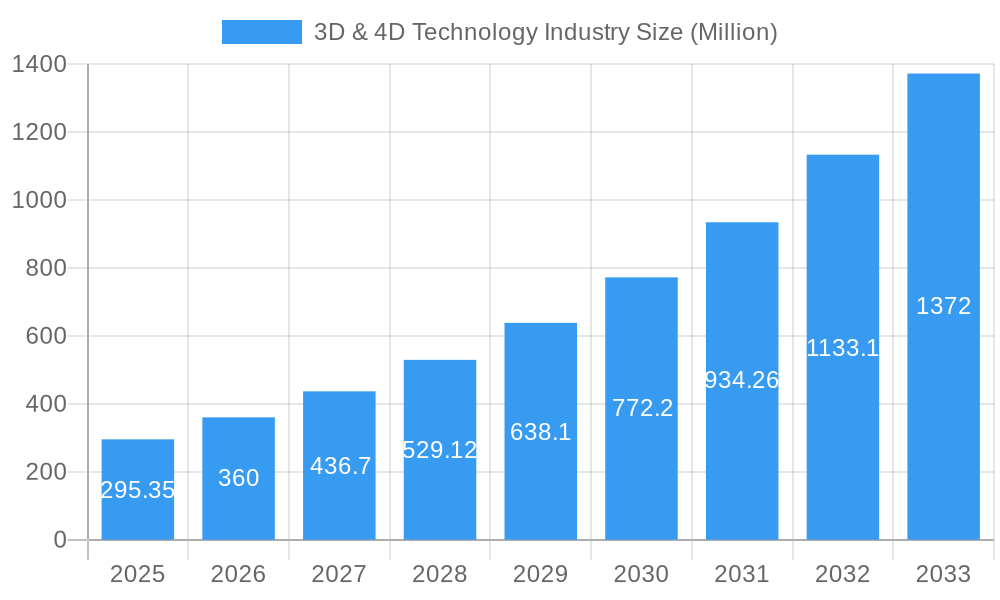

The 3D & 4D technology market, currently valued at $295.35 million in 2025, is experiencing explosive growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 21.82% from 2025 to 2033. This robust expansion is driven by several key factors. The increasing adoption of 3D printing across diverse industries like healthcare (for prosthetics and surgical planning), entertainment and media (for advanced visual effects and immersive gaming experiences), and education (for interactive learning tools) is a major catalyst. Advancements in 3D sensor technology, enabling more accurate and detailed 3D mapping and object recognition, are fueling demand across sectors such as automotive and robotics. Furthermore, the integration of 3D technologies into integrated circuits and transistors is pushing the boundaries of computing power and miniaturization, paving the way for smaller, faster, and more energy-efficient devices. The growing popularity of 3D gaming and virtual/augmented reality applications also significantly contributes to market growth. While potential restraints such as high initial investment costs for some technologies and the need for specialized expertise could impact market penetration, the overall market outlook remains exceptionally positive.

3D & 4D Technology Industry Market Size (In Million)

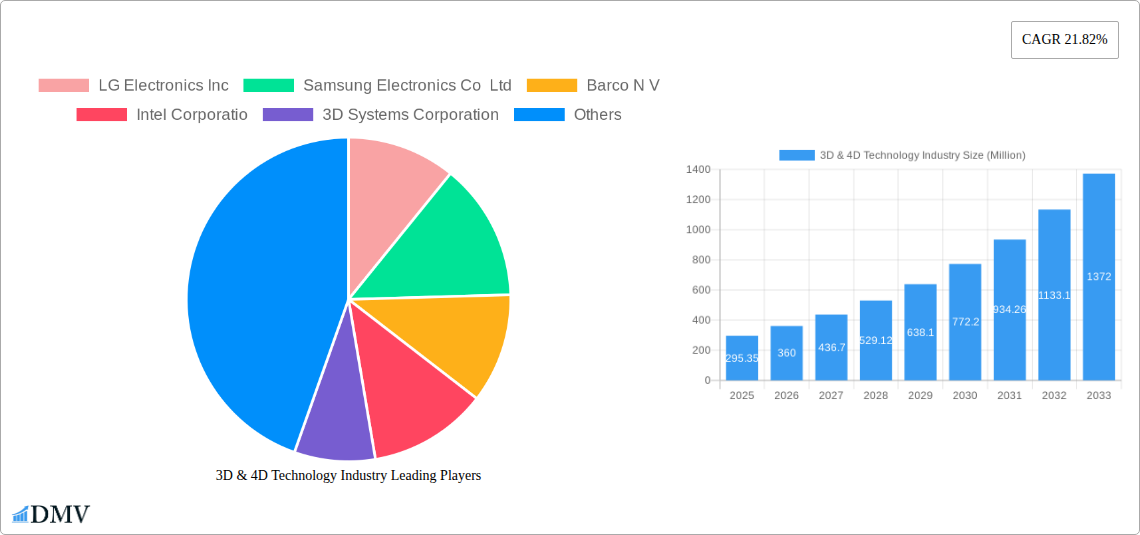

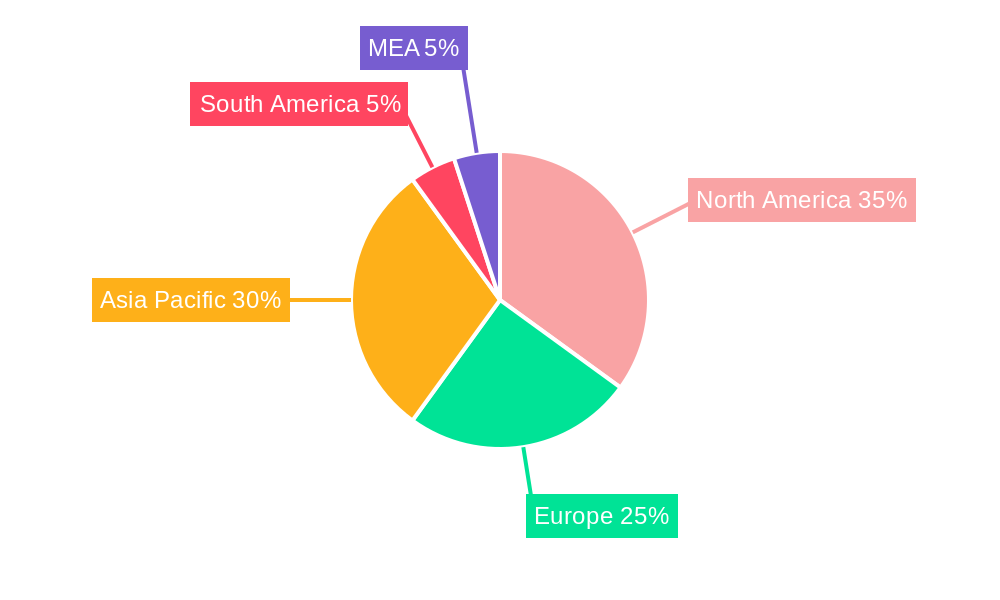

The competitive landscape is dominated by established players like LG Electronics, Samsung Electronics, and Intel, alongside specialized 3D technology companies such as 3D Systems and Autodesk. These companies are continuously innovating and investing in research and development to enhance existing technologies and create new applications. Geographic growth is expected to be robust across all regions, with North America and Asia-Pacific anticipated as leading markets due to high technological adoption and significant investments in research and development. Europe and other regions are also expected to show considerable growth, driven by increasing awareness and acceptance of 3D and 4D technologies across various industries. The long-term forecast suggests a substantial market expansion, driven by continued technological advancements and the ever-growing demand for innovative solutions across a wide range of sectors.

3D & 4D Technology Industry Company Market Share

3D & 4D Technology Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the 3D & 4D technology industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth potential. The market is projected to reach xx Million by 2033, representing a significant expansion from its value in 2025 (xx Million). Key players like LG Electronics Inc, Samsung Electronics Co Ltd, and many more are shaping the industry's trajectory.

3D & 4D Technology Industry Market Composition & Trends

The 3D & 4D technology market exhibits a moderately concentrated structure, with several major players holding significant market share. Market share distribution among the top five players is estimated at approximately 60% in 2025, with the remaining share dispersed across numerous smaller companies and niche players. Innovation is a key catalyst, driven by advancements in materials science, computing power, and software algorithms. The regulatory landscape varies significantly across different regions, influencing market access and product approval processes. Substitute products, such as traditional manufacturing methods, present competitive pressures. The end-user profile encompasses diverse sectors, including healthcare, entertainment, education, and manufacturing. M&A activity has been significant, with notable deals totaling over $xx Million in the past five years, signaling consolidation and expansion within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share (2025).

- Innovation Catalysts: Advancements in materials science, computing power, and software.

- Regulatory Landscape: Varies significantly by region, impacting market access.

- Substitute Products: Traditional manufacturing methods pose competitive pressures.

- End-User Profile: Diverse sectors including healthcare, entertainment, education, and manufacturing.

- M&A Activity: Significant; total deal value exceeding $xx Million over the past five years.

3D & 4D Technology Industry Industry Evolution

The 3D & 4D technology industry has experienced remarkable growth over the past five years, with a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024. This growth is projected to continue, with a forecasted CAGR of xx% from 2025 to 2033. Technological advancements, particularly in 3D printing, 3D sensing, and integrated circuits, have been key drivers of this expansion. Consumer demand is shifting towards more personalized, customized products and experiences, fueling the adoption of 3D & 4D technologies across various sectors. Adoption rates are significantly higher in developed economies, with developing nations exhibiting increasing interest and investment. The market is expected to witness increased competition and fragmentation as more companies enter the sector, pushing innovation and driving down costs. The convergence of 3D and 4D technologies with other advancements like AI and IoT will further drive market growth. By 2033, the market is anticipated to see a significant boost in consumer adoption, particularly in the entertainment and healthcare segments, supported by improved affordability and enhanced product capabilities.

Leading Regions, Countries, or Segments in 3D & 4D Technology Industry

North America currently dominates the 3D & 4D technology market, driven by significant investments in R&D, strong technological infrastructure, and a high concentration of major industry players. Asia-Pacific is a rapidly emerging region, poised for substantial growth, supported by expanding manufacturing capacities and increasing consumer demand.

By Products:

- 3D Printers: Leading segment, driven by advancements in printing speed, material diversity, and affordability.

- 3D Sensors: Strong growth fueled by demand in automotive, robotics, and healthcare sectors.

- 3D Integrated Circuits: Significant expansion due to the need for higher processing power and miniaturization in electronics.

- 3D Gaming: High adoption rate due to immersive experiences and technological advancements.

By End-User Industry:

- Healthcare: High growth potential due to applications in prosthetics, personalized medicine, and surgical planning.

- Entertainment & Media: Strong demand due to immersive gaming, film production, and interactive experiences.

- Education: Increasing adoption for hands-on learning and creating innovative educational tools.

Key Drivers:

- High R&D investments in North America.

- Growing manufacturing capacity and consumer demand in Asia-Pacific.

- Government regulations and support in specific sectors (e.g., healthcare).

3D & 4D Technology Industry Product Innovations

Recent advancements include the development of high-resolution 3D printers capable of producing intricate designs with improved accuracy and speed. New 3D sensor technologies offer enhanced precision and range, facilitating applications in autonomous vehicles and robotics. The integration of AI and machine learning algorithms has led to automated design tools and enhanced product quality control. Unique selling propositions center around increased speed, precision, and affordability, while technological advancements primarily focus on improved materials, processing speeds, and integration with other technologies.

Propelling Factors for 3D & 4D Technology Industry Growth

Several factors fuel 3D & 4D technology market growth: Technological advancements (e.g., improved printing speed and resolution), increasing demand for personalized products, rising investments in R&D, supportive government policies promoting digital manufacturing (e.g., tax incentives), and growing adoption across diverse sectors. The decreasing cost of 3D printers is also making this technology accessible to a wider range of users.

Obstacles in the 3D & 4D Technology Industry Market

Challenges include the high initial investment costs for advanced equipment, potential supply chain disruptions impacting material availability, stringent regulatory approvals in certain industries, and intense competition from established players and new entrants. Intellectual property rights and concerns surrounding data security also pose challenges.

Future Opportunities in 3D & 4D Technology Industry

Future opportunities lie in expanding applications in new sectors (e.g., construction, aerospace), the development of novel materials with enhanced properties, improved software integration for streamlined workflows, and further integration with emerging technologies like AI and IoT to create smart, adaptive systems. The convergence of 3D and 4D printing with bioprinting holds vast potential for personalized medicine and tissue regeneration.

Major Players in the 3D & 4D Technology Industry Ecosystem

Key Developments in 3D & 4D Technology Industry Industry

- June 2023: Epic Games and LVMH partnered to create immersive product experiences using virtual fitting rooms, augmented reality, and digital twins, signifying the growing role of 3D technology in luxury retail.

- May 2023: Formlabs and Hawk Ridge Systems partnered to expand access to digital manufacturing technologies in North America, potentially accelerating adoption across various industries through increased accessibility.

Strategic 3D & 4D Technology Industry Market Forecast

The 3D & 4D technology market is poised for sustained growth, driven by continued technological advancements, increasing consumer demand for personalized products, and expanding applications across diverse industries. The convergence with AI and IoT will open new avenues for innovation, and increased accessibility will further drive market expansion, resulting in a significant increase in market value by 2033.

3D & 4D Technology Industry Segmentation

-

1. Products

- 1.1. 3D Sensors

- 1.2. 3D Integrated Circuits

- 1.3. 3D Transistors

- 1.4. 3D Printer

- 1.5. 3D Gaming

- 1.6. Other Products

-

2. End-User Industry

- 2.1. Healthcare

- 2.2. Entertainment & Media

- 2.3. Education

- 2.4. Other End-user Industries

3D & 4D Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

3D & 4D Technology Industry Regional Market Share

Geographic Coverage of 3D & 4D Technology Industry

3D & 4D Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of 3D Technology Across Various End-User Industries; Increasing Demand for 3D Technology in the Entertainment Industry; Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 3.3. Market Restrains

- 3.3.1. High Product Associated Costs and Availability of 3D Printing Materials

- 3.4. Market Trends

- 3.4.1. Increasing Applications of 3D Printing Across Various End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. 3D Sensors

- 5.1.2. 3D Integrated Circuits

- 5.1.3. 3D Transistors

- 5.1.4. 3D Printer

- 5.1.5. 3D Gaming

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Healthcare

- 5.2.2. Entertainment & Media

- 5.2.3. Education

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. 3D Sensors

- 6.1.2. 3D Integrated Circuits

- 6.1.3. 3D Transistors

- 6.1.4. 3D Printer

- 6.1.5. 3D Gaming

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Healthcare

- 6.2.2. Entertainment & Media

- 6.2.3. Education

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. Europe 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. 3D Sensors

- 7.1.2. 3D Integrated Circuits

- 7.1.3. 3D Transistors

- 7.1.4. 3D Printer

- 7.1.5. 3D Gaming

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Healthcare

- 7.2.2. Entertainment & Media

- 7.2.3. Education

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Asia 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. 3D Sensors

- 8.1.2. 3D Integrated Circuits

- 8.1.3. 3D Transistors

- 8.1.4. 3D Printer

- 8.1.5. 3D Gaming

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Healthcare

- 8.2.2. Entertainment & Media

- 8.2.3. Education

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Australia and New Zealand 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. 3D Sensors

- 9.1.2. 3D Integrated Circuits

- 9.1.3. 3D Transistors

- 9.1.4. 3D Printer

- 9.1.5. 3D Gaming

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Healthcare

- 9.2.2. Entertainment & Media

- 9.2.3. Education

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Latin America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. 3D Sensors

- 10.1.2. 3D Integrated Circuits

- 10.1.3. 3D Transistors

- 10.1.4. 3D Printer

- 10.1.5. 3D Gaming

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Healthcare

- 10.2.2. Entertainment & Media

- 10.2.3. Education

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. Middle East and Africa 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Products

- 11.1.1. 3D Sensors

- 11.1.2. 3D Integrated Circuits

- 11.1.3. 3D Transistors

- 11.1.4. 3D Printer

- 11.1.5. 3D Gaming

- 11.1.6. Other Products

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Healthcare

- 11.2.2. Entertainment & Media

- 11.2.3. Education

- 11.2.4. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Products

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 LG Electronics Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Electronics Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Barco N V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Intel Corporatio

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 3D Systems Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Autodesk Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Stratus's Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dolby Laboratories Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global 3D & 4D Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 3: North America 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 4: North America 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 9: Europe 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 10: Europe 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 15: Asia 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 16: Asia 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 21: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 22: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 27: Latin America 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 28: Latin America 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Latin America 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Latin America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 33: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 34: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 35: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 36: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 2: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global 3D & 4D Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 5: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 8: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 11: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 14: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 17: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 20: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 21: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D & 4D Technology Industry?

The projected CAGR is approximately 21.82%.

2. Which companies are prominent players in the 3D & 4D Technology Industry?

Key companies in the market include LG Electronics Inc, Samsung Electronics Co Ltd, Barco N V, Intel Corporatio, 3D Systems Corporation, Autodesk Inc, Stratus's Inc, Dolby Laboratories Inc, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the 3D & 4D Technology Industry?

The market segments include Products, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 295.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of 3D Technology Across Various End-User Industries; Increasing Demand for 3D Technology in the Entertainment Industry; Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology.

6. What are the notable trends driving market growth?

Increasing Applications of 3D Printing Across Various End-user Industries.

7. Are there any restraints impacting market growth?

High Product Associated Costs and Availability of 3D Printing Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Epic Games, the creators of Fortnite and Unreal Engine, and LVMH, a France-based luxury goods conglomerate, partnered to modernize the Group's creative process and offer clients new immersive product discovery experiences. Due to this strategic partnership with Epic, LVMH and its brands will be able to provide experiences like virtual fitting rooms and fashion shows, 360-degree product carousels, augmented reality, the development of digital twins, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D & 4D Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D & 4D Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D & 4D Technology Industry?

To stay informed about further developments, trends, and reports in the 3D & 4D Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence