Key Insights

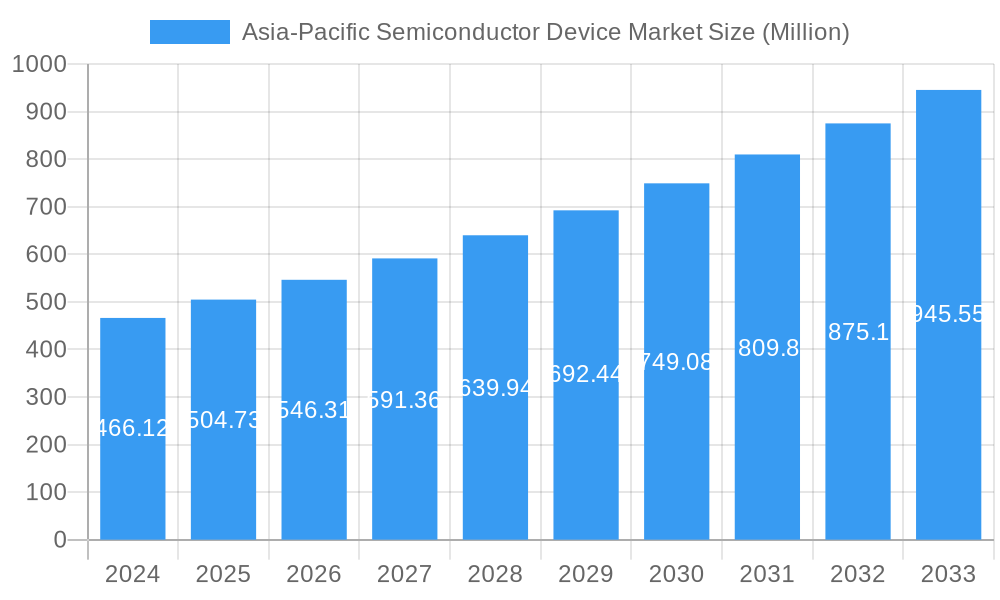

The Asia-Pacific Semiconductor Device Market is projected to experience robust expansion, driven by an escalating demand for advanced electronic components across a multitude of end-user verticals. With a current market size estimated at $466.12 million and a projected Compound Annual Growth Rate (CAGR) of 8.34%, the region is poised for significant value creation throughout the forecast period of 2025-2033. Key growth engines include the burgeoning automotive sector, with increasing adoption of electric and autonomous vehicles, and the rapidly evolving communication industry, fueled by the ongoing rollout of 5G networks and the proliferation of connected devices. Furthermore, the consumer electronics segment, encompassing smartphones, wearables, and smart home appliances, continues to be a strong contributor, driven by rising disposable incomes and a constant appetite for innovation. The industrial sector's embrace of automation and Industry 4.0 principles, alongside the ever-growing need for computing power and data storage solutions, further solidifies the upward trajectory of this dynamic market.

Asia-Pacific Semiconductor Device Market Market Size (In Million)

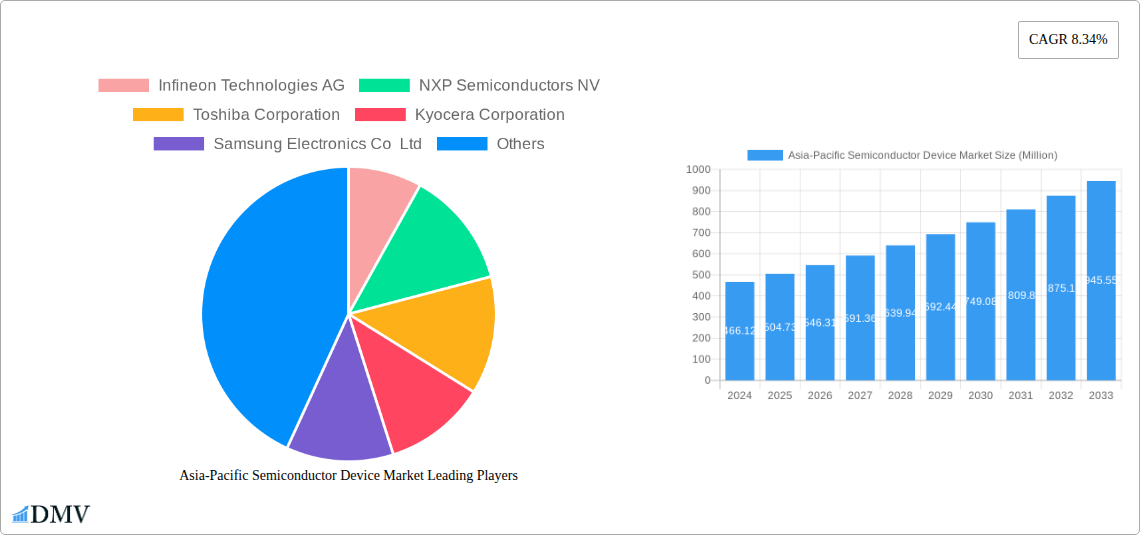

The market's segmentation reveals a diversified landscape. Discrete Semiconductors, Optoelectronics, and Sensors are fundamental to a wide array of applications, while Integrated Circuits (ICs) represent a critical and rapidly advancing segment. Within ICs, Analog, Logic, Memory, and Microcontrollers (MCUs), including Microprocessors (MPUs) and Digital Signal Processors (DSPs), are experiencing heightened demand. Leading global players such as Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Samsung Electronics Co. Ltd., Broadcom Inc., and Taiwan Semiconductor Manufacturing Company (TSMC) Limited are actively investing in research and development and expanding their manufacturing capabilities within the Asia-Pacific region to capitalize on these opportunities. The region's strategic importance is further highlighted by its diverse economic landscape, encompassing major markets like China, Japan, South Korea, and India, alongside emerging economies in Southeast Asia. This intricate interplay of technological advancements, evolving consumer preferences, and strategic investments underscores the Asia-Pacific Semiconductor Device Market's pivotal role in the global technology ecosystem.

Asia-Pacific Semiconductor Device Market Company Market Share

This in-depth report offers a panoramic view of the Asia-Pacific semiconductor device market, providing critical insights for stakeholders seeking to navigate this dynamic and rapidly evolving landscape. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period extending to 2033, this analysis delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. With an estimated market size of xx Million in 2025, this report highlights the pivotal role of semiconductor manufacturing, integrated circuits (ICs), and discrete semiconductors in driving regional and global technological advancements.

Asia-Pacific Semiconductor Device Market Market Composition & Trends

The Asia-Pacific semiconductor device market is characterized by intense competition and continuous innovation, with market concentration varying across different segments. Key innovation catalysts include substantial R&D investments from leading semiconductor companies and government support for advanced manufacturing. The regulatory landscape, while generally supportive of industry growth, presents complexities in trade and intellectual property. Substitute products are emerging, particularly in areas like advanced packaging and system-on-chip (SoC) integration, but the fundamental demand for high-performance semiconductor devices remains robust. End-user profiles are increasingly sophisticated, driven by the burgeoning automotive, communication, and consumer electronics sectors. Mergers and acquisitions (M&A) activities are significant, with recent deals valued in the hundreds of Millions of dollars, aimed at consolidating market share and acquiring critical technologies. For instance, the establishment of VisionPower Semiconductor Manufacturing Company Pte Ltd ("VSMC") through a joint venture between Vanguard International Semiconductor Corporation and NXP Semiconductors N.V. underscores strategic consolidations for specialized production capabilities, aiming to capture a significant market share in the power management and analog products segment. Market share distribution is highly concentrated among a few key players, with Taiwan Semiconductor Manufacturing Company (TSMC) Limited leading in foundry services and Samsung Electronics Co Ltd dominating in memory solutions.

Asia-Pacific Semiconductor Device Market Industry Evolution

The Asia-Pacific semiconductor device market has witnessed a remarkable trajectory of growth and transformation. From 2019 to 2024, the historical period showcased a compound annual growth rate (CAGR) of approximately 8.5%, fueled by escalating demand for advanced electronics across various industries. The base year of 2025 projects a market valuation of xx Million, with a projected CAGR of 7.2% through 2033. Technological advancements have been the bedrock of this evolution. The miniaturization of integrated circuits (ICs), driven by Moore's Law, continues to push the boundaries of processing power and energy efficiency. Innovations in materials science, such as the increasing adoption of Gallium Nitride (GaN) and Silicon Carbide (SiC) for discrete semiconductors, are enabling higher power density and improved performance in applications like electric vehicles and renewable energy systems. Shifting consumer demands are a significant influencing factor. The proliferation of smartphones, wearable devices, and the expanding Internet of Things (IoT) ecosystem are creating an insatiable appetite for sophisticated semiconductor solutions. Furthermore, the rapid digitalization of industries, including the transition to 5G networks and the growth of cloud computing, necessitates a robust supply of advanced microprocessors (MPU), microcontrollers (MCU), and memory chips. The increasing complexity of AI algorithms and the demand for real-time data processing in industrial automation and automotive electronics are also propelling the market forward. For example, the adoption rate of advanced driver-assistance systems (ADAS) in vehicles, which heavily rely on powerful automotive semiconductors, has seen a year-over-year increase of over 15% in the past two years, underscoring the direct correlation between end-user needs and semiconductor market growth. The communication sector, both wired and wireless, remains a primary consumer of high-bandwidth integrated circuits, including advanced logic and digital signal processors (DSP). The sustained investment in 5G infrastructure and the ongoing development of next-generation wireless technologies ensure a continuous demand surge.

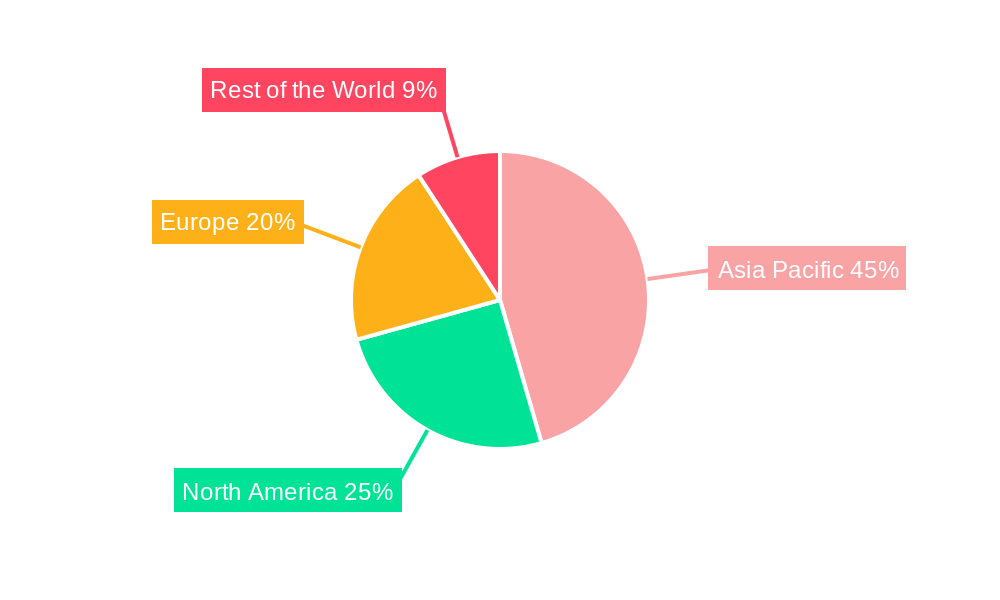

Leading Regions, Countries, or Segments in Asia-Pacific Semiconductor Device Market

Within the vast Asia-Pacific semiconductor device market, Taiwan stands out as a dominant force, primarily due to the unparalleled leadership of Taiwan Semiconductor Manufacturing Company (TSMC) Limited in advanced semiconductor manufacturing. TSMC’s dominance in foundry services, particularly in producing cutting-edge integrated circuits (ICs), underpins Taiwan’s strategic importance. The Integrated Circuits segment, encompassing Analog, Logic, Memory, and Micro (Microprocessors (MPU), Microcontrollers (MCU), Digital Signal Processors), is the most significant contributor to the overall market value.

- Key Drivers for Taiwan's Dominance:

- Technological Prowess: TSMC's relentless investment in research and development, enabling them to offer the most advanced process nodes (e.g., 3nm, 2nm) for chip fabrication. This attracts major fabless semiconductor companies globally.

- Government Support & Investment: The Taiwanese government has historically prioritized the semiconductor industry, providing significant incentives, R&D grants, and infrastructure development to foster growth and attract foreign investment.

- Skilled Workforce: A deep pool of highly skilled engineers and technicians, crucial for complex semiconductor manufacturing processes.

- Ecosystem Strength: A well-established ecosystem of supporting industries, including materials suppliers, equipment manufacturers, and design houses, further solidifies Taiwan’s competitive advantage.

The Integrated Circuits segment itself is driven by diverse end-user verticals. The Automotive sector is experiencing a rapid expansion, with increasing demand for advanced logic and microcontrollers for electric vehicles (EVs), autonomous driving systems, and in-car infotainment. The Communication sector, especially the ongoing rollout of 5G and the development of 6G, is a massive consumer of high-performance digital signal processors (DSP) and analog ICs. The Consumer electronics market, encompassing smartphones, gaming consoles, and smart home devices, consistently drives demand for memory and logic chips. The Industrial sector is increasingly adopting automation and IoT solutions, leading to a surge in demand for industrial-grade microcontrollers and power management ICs. Computing/Data Storage remains a foundational segment, with data centers and high-performance computing (HPC) requiring vast quantities of advanced processors and memory.

The dominance of the Integrated Circuits segment is further amplified by the rapid advancements in microprocessor (MPU) and microcontroller (MCU) technologies, enabling more powerful and energy-efficient devices across all end-user verticals. The increasing complexity of artificial intelligence (AI) and machine learning (ML) applications is particularly boosting the demand for specialized AI accelerators and advanced logic chips. The reliance of these emerging technologies on cutting-edge integrated circuits manufactured by Taiwanese foundries cements Taiwan's position at the forefront of the global semiconductor industry.

Asia-Pacific Semiconductor Device Market Product Innovations

Product innovations in the Asia-Pacific semiconductor device market are primarily focused on enhancing performance, reducing power consumption, and increasing functionality. Leading companies are pushing the boundaries in integrated circuits (ICs) with the development of advanced microprocessors (MPUs) and microcontrollers (MCUs) boasting higher clock speeds and more efficient architectures. Innovations in memory technology, such as the transition to DDR5 and the exploration of next-generation non-volatile memory, are crucial for faster data access and storage. In discrete semiconductors, the adoption of wide-bandgap materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) is enabling smaller, more efficient power devices for electric vehicles and power supplies. The development of novel sensors with improved sensitivity and lower power consumption is driving the expansion of IoT applications.

Propelling Factors for Asia-Pacific Semiconductor Device Market Growth

The Asia-Pacific semiconductor device market is propelled by several interconnected factors. Firstly, the relentless technological advancement in integrated circuits (ICs), particularly in microprocessors (MPU) and microcontrollers (MCU), fuels demand for more powerful and efficient electronic devices. Secondly, robust economic growth across the region, driven by a burgeoning middle class and increasing disposable incomes, translates to higher consumption of consumer electronics. Thirdly, government initiatives and substantial investments in the semiconductor industry, aimed at achieving technological self-sufficiency and fostering innovation in areas like AI semiconductors, are critical. The widespread adoption of 5G technology and the expansion of the Internet of Things (IoT) ecosystem create a significant demand for a diverse range of semiconductor devices, from discrete semiconductors to complex logic and analog chips.

Obstacles in the Asia-Pacific Semiconductor Device Market Market

Despite the robust growth, the Asia-Pacific semiconductor device market faces several obstacles. Regulatory complexities and trade tensions can disrupt global supply chains and impact market access for certain components. Supply chain disruptions, as evidenced by recent global events, pose a significant risk to production and timely delivery of essential semiconductor manufacturing equipment and raw materials. Intense competitive pressures, particularly in the highly commoditized segments of discrete semiconductors and certain memory products, can lead to price erosion. Furthermore, the ever-increasing cost of advanced semiconductor fabrication facilities and the escalating R&D expenses present substantial financial hurdles for many companies, particularly smaller players. Intellectual property disputes also remain a recurring concern within the industry.

Future Opportunities in Asia-Pacific Semiconductor Device Market

The Asia-Pacific semiconductor device market is ripe with future opportunities. The accelerating adoption of Artificial Intelligence (AI) and Machine Learning (ML) across industries presents a significant avenue for growth in advanced microprocessors (MPUs), digital signal processors (DSPs), and specialized AI accelerators. The continuous expansion of the electric vehicle (EV) market will drive substantial demand for power management ICs, discrete semiconductors, and advanced sensors. The ongoing development of smart city infrastructure and the proliferation of IoT devices will create sustained demand for a wide array of semiconductor devices, from low-power microcontrollers (MCUs) to sophisticated analog ICs. Emerging markets in Southeast Asia and South Asia are poised for rapid growth, offering new frontiers for market penetration and expansion for semiconductor companies.

Major Players in the Asia-Pacific Semiconductor Device Market Ecosystem

- Infineon Technologies AG

- NXP Semiconductors NV

- Toshiba Corporation

- Kyocera Corporation

- Samsung Electronics Co Ltd

- Broadcom Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- SK Hynix Inc

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Intel Corporation

- Fujitsu Semiconductor Ltd

Key Developments in Asia-Pacific Semiconductor Device Market Industry

- June 2024: Vanguard International Semiconductor Corporation and NXP Semiconductors N.V. unveiled their collaboration to establish VisionPower Semiconductor Manufacturing Company Pte Ltd ("VSMC"), a joint venture aimed at constructing a cutting-edge 300mm semiconductor wafer facility in Singapore. This new facility will specialize in producing 130nm to 40nm mixed-signal, power management, and analog products, with a strategic focus on automotive, industrial, consumer, and mobile applications. Notably, the joint venture plans to leverage process technologies licensed from TSMC.

- April 2024: Infineon Technologies AG, a prominent power systems and IoT player, is bolstering its outsourced backend manufacturing presence in Europe. The company has unveiled a strategic, multi-year collaboration with Amkor Technology, Inc., a key player in semiconductor packaging and testing services. As part of this partnership, both entities will jointly run a specialized packaging and testing facility at Amkor's Porto manufacturing hub.

Strategic Asia-Pacific Semiconductor Device Market Market Forecast

The strategic forecast for the Asia-Pacific semiconductor device market anticipates continued robust growth, driven by secular trends such as digital transformation, the electrification of transportation, and the expansion of connectivity. Investments in advanced manufacturing capabilities and R&D for next-generation integrated circuits (ICs) and discrete semiconductors will remain crucial for market leadership. The increasing demand for specialized semiconductor solutions tailored for AI, 5G, and IoT applications presents significant market potential. Strategic partnerships and collaborations, like the VSMC joint venture, will be vital for expanding production capacity and accessing advanced process technologies. The market is expected to witness sustained growth in the automotive, communication, and industrial end-user verticals, solidifying the region's position as a global hub for semiconductor innovation and production.

Asia-Pacific Semiconductor Device Market Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

-

2. End-User Vertical

- 2.1. Automotive

- 2.2. Communication (Wired and Wireless)

- 2.3. Consumer

- 2.4. Industrial

- 2.5. Computing/Data Storage

Asia-Pacific Semiconductor Device Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Semiconductor Device Market Regional Market Share

Geographic Coverage of Asia-Pacific Semiconductor Device Market

Asia-Pacific Semiconductor Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Emergence of new technologies like AI

- 3.2.2 and IoT; Increasing demand for Evs and ADAS; Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 3.3. Market Restrains

- 3.3.1. Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Semiconductor Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Automotive

- 5.2.2. Communication (Wired and Wireless)

- 5.2.3. Consumer

- 5.2.4. Industrial

- 5.2.5. Computing/Data Storage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NXP Semiconductors NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toshiba Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kyocera Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Broadcom Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 STMicroelectronics NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Renesas Electronics Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Hynix Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intel Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fujitsu Semiconductor Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Asia-Pacific Semiconductor Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Semiconductor Device Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 3: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 6: Asia-Pacific Semiconductor Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Semiconductor Device Market?

The projected CAGR is approximately 8.34%.

2. Which companies are prominent players in the Asia-Pacific Semiconductor Device Market?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Samsung Electronics Co Ltd, Broadcom Inc, STMicroelectronics NV, Renesas Electronics Corporation, SK Hynix Inc, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the Asia-Pacific Semiconductor Device Market?

The market segments include Device Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 466.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of new technologies like AI. and IoT; Increasing demand for Evs and ADAS; Increased Deployment of 5G and Rising Demand for 5G Smartphones.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins.

8. Can you provide examples of recent developments in the market?

June 2024 - Vanguard International Semiconductor Corporation and NXP Semiconductors N.V. have unveiled their collaboration to establish VisionPower Semiconductor Manufacturing Company Pte Ltd ("VSMC"), a joint venture aimed at constructing a cutting-edge 300mm semiconductor wafer facility in Singapore. This new facility will specialize in producing 130nm to 40nm mixed-signal, power management, and analog products, with a strategic focus on automotive, industrial, consumer, and mobile applications. Notably, the joint venture plans to leverage process technologies licensed from TSMC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Semiconductor Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Semiconductor Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Semiconductor Device Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Semiconductor Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence