Key Insights

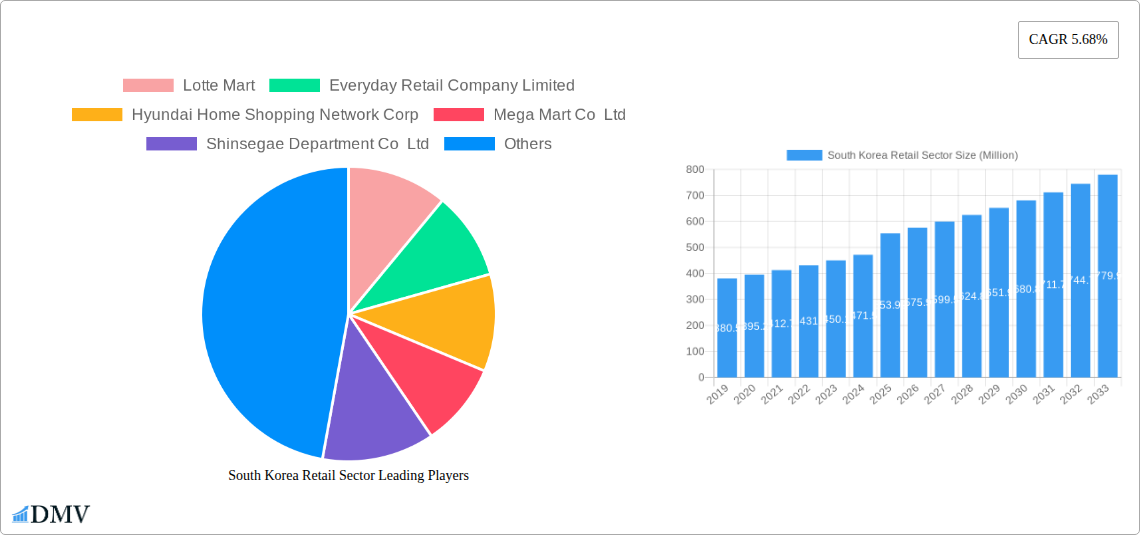

The South Korean retail sector is poised for robust growth, projected to reach a market size of USD 553.92 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.68% through 2033. This dynamic market is driven by a confluence of factors, including increasing disposable incomes, a digitally savvy population embracing online shopping, and a growing demand for premium and specialized products across various segments. The "Personal Care and Household" and "Electronic and Household Appliances" sectors are anticipated to be significant growth engines, fueled by consumer interest in health, wellness, and smart home technologies. Furthermore, the continued evolution of the "Online" distribution channel, supported by efficient logistics and innovative e-commerce platforms, will play a crucial role in this expansion, making it a preferred choice for a growing segment of consumers.

South Korea Retail Sector Market Size (In Million)

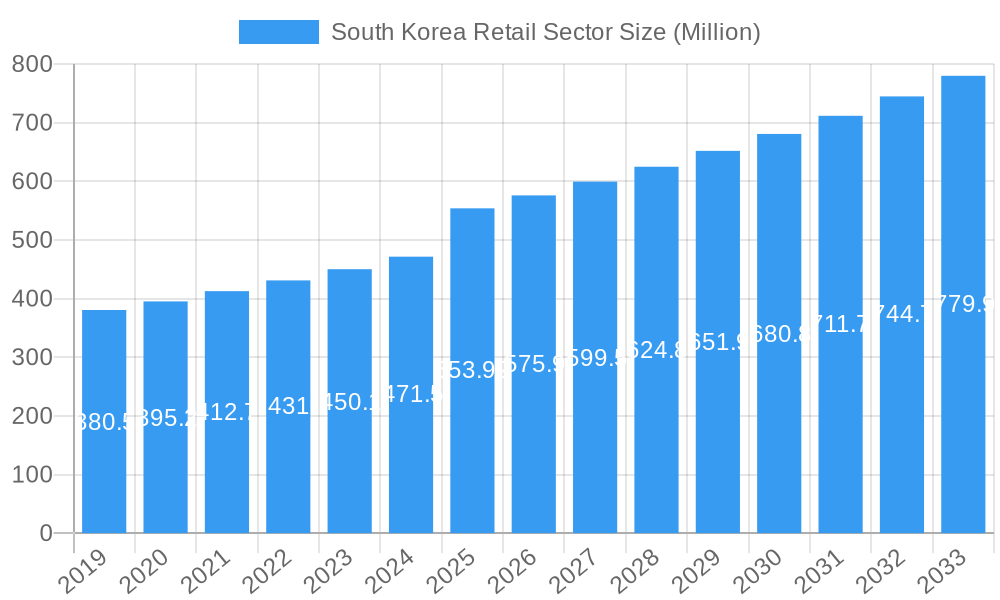

While growth is strong, the sector also faces certain restraints. Intensifying competition among both traditional brick-and-mortar retailers and a burgeoning online marketplace necessitates continuous innovation and customer-centric strategies. Retailers must navigate evolving consumer preferences, with a growing emphasis on sustainability and ethical sourcing, which will likely influence purchasing decisions. Key players like Lotte Mart, E-Mart Inc., and Homeplus Co Ltd are actively adapting by enhancing their online presence, diversifying product offerings, and investing in personalized customer experiences. The rise of discount retailers and private labels also presents a competitive challenge, requiring established brands to differentiate through quality, brand loyalty, and unique value propositions. Strategic investment in technology, data analytics for understanding consumer behavior, and optimized supply chain management will be critical for sustained success and navigating these competitive pressures.

South Korea Retail Sector Company Market Share

Here is an SEO-optimized, insightful report description for the South Korea Retail Sector:

South Korea Retail Sector Market Composition & Trends

This comprehensive report delves into the dynamic South Korea retail sector, offering an in-depth analysis of its market composition and prevailing trends. We meticulously evaluate market concentration, identifying key players and their respective market shares, projected to reach over $XXX Million by 2025. Innovation catalysts are explored, highlighting how technological advancements and evolving consumer preferences are reshaping the retail landscape, with a significant focus on the burgeoning e-commerce segment projected to account for XX% of total retail sales in 2025. The report scrutinizes the regulatory landscapes influencing operations, including import/export policies and consumer protection laws, and examines the impact of substitute products and their penetration. End-user profiles are detailed, segmenting consumers by demographics, purchasing power, and lifestyle, crucial for strategic targeting. Furthermore, we provide an exhaustive overview of Mergers & Acquisitions (M&A) activities within the South Korean retail market, detailing deal values estimated to exceed $XXX Million in the forecast period, and outlining key strategies employed by major companies like Shinsegae Department Co Ltd and E-Mart Inc.

- Market Share Distribution: Estimated breakdown of key player contributions and segment dominance.

- M&A Deal Values: Analysis of strategic acquisitions and their financial implications, with projected figures.

- Innovation Drivers: Identification of technological and consumer-driven forces propelling market evolution.

- Regulatory Impact: Assessment of government policies and their influence on retail operations and growth.

South Korea Retail Sector Industry Evolution

The South Korea retail sector is undergoing a profound transformation, driven by rapid technological advancements and a sophisticated, digitally-savvy consumer base. Our analysis traces the industry's evolution from 2019 through to the projected landscape of 2033, with a base and estimated year of 2025. The market growth trajectory is characterized by a robust Compound Annual Growth Rate (CAGR) of XX% during the historical period and a projected XX% CAGR for the forecast period of 2025–2033. Technological advancements, particularly in artificial intelligence (AI), data analytics, and the integration of augmented reality (AR) and virtual reality (VR) in shopping experiences, are revolutionizing how consumers interact with brands and products. Shifting consumer demands are at the forefront of this evolution, with a pronounced preference for personalized shopping experiences, sustainable products, and seamless omnichannel integration. The adoption of mobile commerce, already high, is expected to continue its upward trend, reaching XX% of total online retail sales by 2025. The rise of quick commerce and same-day delivery services further exemplifies the industry's agility in responding to evolving consumer expectations for speed and convenience. Furthermore, the influence of K-culture and global trends, particularly in fashion and beauty, continues to shape product assortments and marketing strategies. The penetration of new payment methods, including contactless and digital wallets, further streamlines the purchasing journey. This dynamic environment necessitates continuous adaptation and innovation from retailers seeking to maintain a competitive edge.

Leading Regions, Countries, or Segments in South Korea Retail Sector

The South Korea retail sector is a multifaceted ecosystem with distinct leading segments driving its overall growth and sophistication. Among the Product Types, Food, Beverage, and Tobacco Products and Electronic and Household Appliances consistently demonstrate robust demand, fueled by household needs and technological adoption, respectively. The Apparel, Footwear, and Accessories segment remains a significant contributor, heavily influenced by global fashion trends and the strong influence of K-culture. In terms of Distribution Channels, the Online segment has experienced exponential growth, projected to command a market share of XX% by 2025, driven by convenience, wider product selection, and competitive pricing offered by e-commerce giants and platforms like E-Mart Inc. and Costco Wholesale Korea Ltd. Conversely, Offline channels, particularly department stores and specialized retail outlets such as those operated by Shinsegae Department Co Ltd and Lotte Mart, continue to evolve by offering experiential retail, personalized services, and curated product assortments to attract consumers seeking a more tangible shopping experience.

- Dominant Product Segments:

- Food, Beverage, and Tobacco Products: Sustained demand driven by daily consumption and evolving dietary preferences.

- Electronic and Household Appliances: High adoption rates due to technological innovation and consumer desire for upgraded home environments.

- Apparel, Footwear, and Accessories: Strong performance fueled by fashion-conscious consumers and the global impact of K-fashion.

- Dominant Distribution Channels:

- Online: Experiencing rapid expansion due to convenience, personalized recommendations, and competitive pricing strategies by companies like Everyday Retail Company Limited.

- Offline: Adapting through experiential retail, premium services, and unique in-store concepts to complement online offerings, as exemplified by Grand Department Store Co Ltd.

- Key Drivers for Segment Dominance:

- Investment Trends: Significant capital allocation into digital infrastructure and logistics for online channels, and into store redesigns and customer experience enhancement for offline.

- Regulatory Support: Policies promoting digital transformation and e-commerce growth, alongside regulations ensuring fair competition in both online and offline spaces.

- Consumer Behavior Shifts: Increasing preference for convenience, personalization, and the integration of digital and physical retail experiences, with segments like Pharmaceuticals and Luxury Goods also seeing growth through targeted online and offline strategies.

South Korea Retail Sector Product Innovations

Product innovation in the South Korea retail sector is characterized by a strong emphasis on digitalization, sustainability, and personalized experiences. Companies are investing in smart retail solutions, integrating AI-powered recommendations, virtual try-on technologies for apparel, and IoT devices for enhanced household appliance functionality. The Food, Beverage, and Tobacco Products segment is witnessing innovations in plant-based alternatives, premium craft beverages, and personalized nutrition solutions. For Electronic and Household Appliances, the focus is on energy efficiency, smart home integration, and user-friendly interfaces. Apparel and Accessories are seeing advancements in sustainable materials, customizable designs, and augmented reality fitting rooms. This relentless pursuit of novel product offerings and enhanced user engagement by players like Mega Mart Co Ltd is crucial for maintaining a competitive edge and capturing evolving consumer preferences.

Propelling Factors for South Korea Retail Sector Growth

Several key factors are propelling the growth of the South Korea retail sector. Technologically, the widespread adoption of high-speed internet and mobile penetration facilitates the rapid expansion of e-commerce and omnichannel strategies, creating seamless shopping experiences. Economically, a strong and affluent consumer base with high disposable incomes actively seeks out quality products and innovative retail concepts. Government initiatives promoting digital transformation and consumer-friendly regulations further foster a conducive environment for growth. The increasing demand for premium and specialized goods, from luxury items to health and wellness products, also acts as a significant growth catalyst. The strategic expansion of international brands, such as the recent entry of Five Guys, introduces new competition and drives innovation across the market.

Obstacles in the South Korea Retail Sector Market

Despite its robust growth, the South Korea retail sector faces several obstacles. Intensifying competition from both domestic and international players, particularly in the online space, puts pressure on profit margins. Evolving consumer expectations for faster delivery and hyper-personalization necessitate continuous investment in logistics and technology, which can be capital-intensive. Supply chain disruptions, exacerbated by global events, can impact product availability and costs. Regulatory challenges, including evolving e-commerce laws and data privacy concerns, require constant vigilance and adaptation. Furthermore, the saturation in certain market segments and the increasing cost of customer acquisition present significant hurdles for retailers aiming for sustained growth.

Future Opportunities in South Korea Retail Sector

The South Korea retail sector is ripe with future opportunities. The burgeoning elderly population presents a growing market for specialized goods and services, including healthcare products and accessible retail solutions. The continued expansion of the premium and luxury segments offers significant potential for high-value transactions. Further integration of AI and personalized marketing across all retail touchpoints will unlock deeper consumer engagement. The growing global interest in K-culture also presents an opportunity for Korean retailers to expand their reach internationally through e-commerce platforms and strategic partnerships. The development of innovative retail technologies, such as advanced robotics in warehousing and AI-driven inventory management, will also drive efficiency and create new service models.

Major Players in the South Korea Retail Sector Ecosystem

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc.

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd

- Five Guys

Key Developments in South Korea Retail Sector Industry

- September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

- June 2023: US Burger Chain Five Guys opened its first store in Seoul's Seocho District. Located on Gangnam-aero Road between Gangnam and Sinnonhyeon subway stations, the branch includes two floors and an area of 588 sq m. Five Guys will also offer the same food quality in South Korea as in America, with no localized items for the domestic market.

Strategic South Korea Retail Sector Market Forecast

The strategic forecast for the South Korea retail sector indicates continued robust growth, driven by ongoing digital transformation and evolving consumer preferences. The sustained investment in e-commerce infrastructure, coupled with a growing demand for personalized shopping experiences and sustainable products, will be key growth catalysts. Emerging opportunities in niche markets, such as the senior care sector and specialized luxury goods, alongside the potential for further international expansion of Korean retail brands, will contribute significantly to market expansion. The sector's ability to integrate innovative technologies like AI, AR, and advanced logistics will be paramount in capitalizing on these opportunities and maintaining a competitive edge in the dynamic South Korean market through 2033.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence