Key Insights

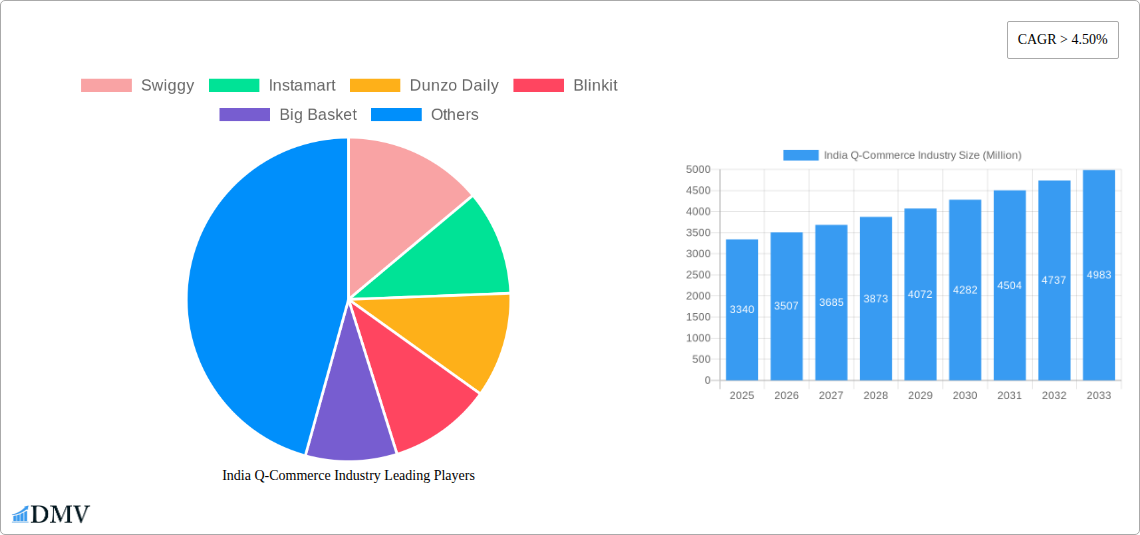

The Indian Quick Commerce (Q-Commerce) industry is poised for robust growth, with an estimated market size of USD 3.34 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 4.50% over the forecast period of 2025-2033. This expansion is significantly driven by evolving consumer lifestyles, increased urbanization, and a growing demand for instant gratification. The convenience of rapid delivery for essential items such as groceries, personal care products, and fresh food is a primary catalyst. Q-commerce platforms are effectively tapping into this demand, offering delivery within minutes, which resonates strongly with the fast-paced lives of urban Indian consumers. The proliferation of smartphones and widespread internet penetration further bolsters this trend, making these services accessible to a broader demographic.

India Q-Commerce Industry Market Size (In Billion)

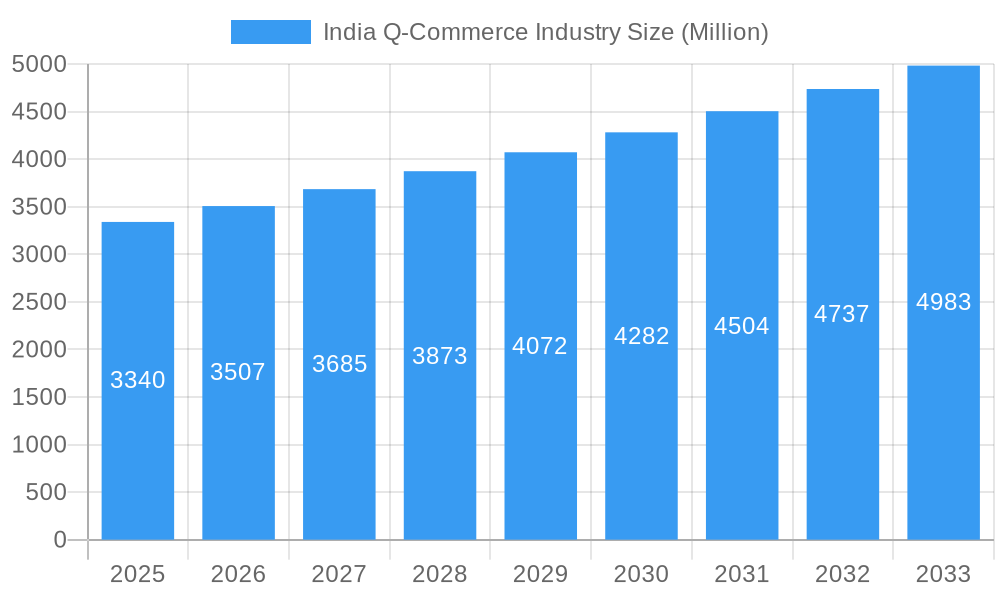

The competitive landscape is dynamic, featuring both pure-play Q-commerce specialists like Zepto and Blinkit, alongside established e-commerce giants and food delivery platforms such as Swiggy (Instamart) and Zomato (formerly Grofers), and Flipkart (Quick). These players are constantly innovating to capture market share through expanded product assortments, enhanced delivery networks, and strategic partnerships. However, the industry faces certain restraints, including the high operational costs associated with maintaining quick delivery times, the challenge of achieving profitability amidst intense competition, and ensuring consistent product quality, especially for fresh produce. Despite these hurdles, the underlying demand for speed and convenience suggests a promising trajectory for the Indian Q-commerce market.

India Q-Commerce Industry Company Market Share

India Q-Commerce Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

Unlock the explosive potential of India's Quick Commerce (Q-Commerce) market with this in-depth, SEO-optimized report. Delve into the dynamic landscape, from burgeoning grocery delivery to the swift rise of fresh food and personal care essentials. This report, meticulously crafted for stakeholders, investors, and industry leaders, provides unparalleled insights into market composition, evolution, and future trajectories, powered by robust data and expert analysis covering the period 2019–2033, with a base and estimated year of 2025.

India Q-Commerce Industry Market Composition & Trends

The Indian Q-Commerce market is characterized by intense competition and evolving consumer preferences, making it a fertile ground for rapid expansion. Market concentration remains high, with key players vying for significant market share. Innovation catalysts are diverse, ranging from advanced logistics and dark store models to hyper-localized inventory management. The regulatory landscape, while still maturing, is increasingly influencing operational strategies and investment decisions. Substitute products, particularly traditional e-commerce and brick-and-mortar retail, continue to present a competitive challenge, though the speed and convenience offered by Q-Commerce are carving out a distinct niche. End-user profiles are predominantly urban, tech-savvy consumers seeking instant gratification for everyday needs. Mergers and Acquisitions (M&A) activities are a significant trend, reshaping the competitive hierarchy. For instance, the Walmart acquisition of Flipkart in December 2023 signifies a major consolidation and expansion of Q-Commerce capabilities.

- Market Share Distribution: Dominated by a few key players, with the top 5 companies holding an estimated 75% of the market share by 2025.

- M&A Deal Values: Anticipated to reach over 500 Million in strategic acquisitions by 2025, indicating consolidation and talent acquisition.

- Innovation Focus: Dark stores, AI-powered inventory management, and optimized last-mile delivery solutions are key areas of investment.

- Regulatory Impact: Evolving policies on e-commerce, gig worker rights, and data privacy are shaping market entry and operational models.

- Consumer Adoption: Growing at an impressive rate of over 60% annually in urban centers, driven by convenience and a wider product assortment.

India Q-Commerce Industry Industry Evolution

The evolution of India's Q-Commerce industry is a compelling narrative of rapid technological adoption, shifting consumer behaviors, and strategic market penetration. From its nascent stages in the historical period of 2019–2024, the sector has witnessed exponential growth, driven by the fundamental need for immediate access to goods and services. Initially focused on a limited range of products, the industry has dramatically expanded its offerings to encompass a wide spectrum of consumer needs, including groceries, fresh produce, pharmaceuticals, and even ready-to-eat meals. This diversification has been fueled by significant investments from venture capitalists and established e-commerce giants, recognizing the immense potential of the Indian market.

Technological advancements have been pivotal in this evolution. The deployment of sophisticated algorithms for demand forecasting, inventory optimization, and route planning has enabled Q-Commerce players to achieve their signature delivery times, often within minutes. The development and widespread adoption of a robust gig economy infrastructure have provided the necessary workforce for efficient last-mile delivery. Furthermore, the increasing penetration of smartphones and high-speed internet across India has democratized access to these services, bringing them within reach of a larger consumer base.

Shifting consumer demands have also played a crucial role. The post-pandemic era has accelerated the preference for convenience and contactless delivery. Consumers are increasingly willing to pay a premium for speed and reliability, especially for essential items. This behavioral shift has been a powerful catalyst for the Q-Commerce sector, encouraging companies to invest heavily in expanding their delivery networks and dark store infrastructure. The competitive landscape has intensified, with established players like Swiggy (Instamart) and Blinkit, alongside newer entrants and traditional retailers venturing into quick commerce, each striving to capture market share through enhanced service offerings, wider product availability, and aggressive pricing strategies. The journey from a niche delivery service to a mainstream retail channel underscores the transformative power of innovation and consumer-centric strategies in shaping the future of commerce in India.

Leading Regions, Countries, or Segments in India Q-Commerce Industry

The dominance within the Indian Q-Commerce industry is a multifaceted phenomenon, heavily influenced by regional economic strengths, population density, and the specific product segments that resonate most with consumers. While the entire nation is a target market, the Tier-1 metropolitan cities consistently emerge as the leading regions, driven by a confluence of factors that create a fertile ground for rapid Q-Commerce adoption. These cities boast a higher disposable income, a more tech-savvy population, and a greater demand for convenience-driven services. The sheer density of population in these urban sprawls also allows for greater operational efficiency and reduced delivery times, which are the cornerstones of the Q-Commerce model.

Within the broader Product Type segment, Groceries currently holds a commanding lead, reflecting the daily necessity and high repurchase rate of these items. Consumers have readily embraced the convenience of having fresh produce, pantry staples, and dairy products delivered to their doorstep within minutes. This has been further bolstered by dedicated efforts from players like Big Basket and Flipkart Quick to optimize their grocery delivery infrastructure. However, Fresh Food is rapidly gaining traction, driven by the growing health consciousness and demand for ready-to-eat meals and gourmet options. Companies like Zomato with Zomato Instant are specifically targeting this segment, aiming to bridge the gap between home-cooked meals and quick delivery. Personal Care products are also witnessing steady growth, fueled by impulse purchases and the convenience of replenishing essentials without a dedicated store visit.

From a Company Type perspective, both Pureplay and Non-pureplay models are carving out significant market presence. Pureplay Q-Commerce companies like Zepto and Blinkit have built their entire operational infrastructure around the quick delivery model, allowing for agile decision-making and focused innovation. On the other hand, non-pureplay entities, such as Swiggy (Instamart) and Flipkart Quick (backed by Walmart), leverage their existing large customer bases, established logistics networks, and brand recognition to swiftly enter and expand in the Q-Commerce space. This dual approach indicates a mature market where both dedicated specialists and diversified giants can thrive.

- Dominant Region: Tier-1 metropolitan cities (e.g., Delhi-NCR, Mumbai, Bengaluru, Chennai, Kolkata, Hyderabad) due to higher disposable incomes, population density, and tech adoption.

- Key Drivers for Regional Dominance:

- Investment Trends: Significant venture capital and corporate funding flowing into urban tech ecosystems.

- Regulatory Support: Relatively more streamlined regulatory frameworks for e-commerce and delivery services in major cities.

- Consumer Behavior: High demand for instant gratification and convenience services.

- Infrastructure: Better road networks and logistics capabilities supporting faster deliveries.

- Leading Product Segment: Groceries, owing to their essential nature and high frequency of purchase.

- Emerging Product Segment: Fresh Food, driven by evolving dietary habits and the demand for healthy, convenient meal options.

- Company Type Dynamics:

- Pureplay: Agility, specialized operational focus, and rapid innovation.

- Non-pureplay: Leveraging existing customer base, brand trust, and integrated logistics.

India Q-Commerce Industry Product Innovations

India's Q-Commerce industry is a hotbed of product innovation, focused on enhancing speed, efficiency, and customer satisfaction. Key advancements include the development of sophisticated dark store models, strategically located in densely populated urban areas to minimize delivery times. These micro-fulfillment centers are equipped with AI-powered inventory management systems that predict demand with high accuracy, ensuring optimal stock levels for fast-moving consumer goods. The application of advanced routing algorithms for delivery partners optimizes routes in real-time, factoring in traffic conditions and order density, leading to delivery times of as low as 10-15 minutes for select product categories. Furthermore, innovations in packaging for temperature-sensitive items like fresh produce and frozen foods ensure product integrity upon arrival. The performance metrics for these innovations are impressive, with average delivery times improving by over 30% in the past two years, and customer retention rates seeing a significant boost due to enhanced reliability.

Propelling Factors for India Q-Commerce Industry Growth

Several key factors are propelling the rapid growth of India's Q-Commerce industry. The burgeoning digital infrastructure, characterized by widespread smartphone penetration and affordable data, has created a vast user base accessible to Q-Commerce platforms. The significant increase in disposable income among the urban population, coupled with a growing preference for convenience and instant gratification, is a major demand driver. Furthermore, technological advancements in logistics, AI-powered inventory management, and efficient last-mile delivery solutions have made the ultra-fast delivery model economically viable. The government's focus on digital India and supportive policies for e-commerce are also contributing to a favorable business environment. The changing consumer lifestyle, with busy schedules and a desire for time-saving solutions, further fuels the adoption of Q-Commerce for everyday needs.

Obstacles in the India Q-Commerce Industry Market

Despite its rapid expansion, the India Q-Commerce industry faces several significant obstacles. High operational costs, particularly those associated with maintaining dark stores, inventory, and a large delivery fleet, pose a persistent challenge to profitability. Intense competition from both established and emerging players leads to price wars and pressure on margins. Logistical complexities in densely populated urban areas, including traffic congestion and last-mile delivery hurdles, can impact delivery times and efficiency. Regulatory uncertainties surrounding gig worker rights and e-commerce operations can also create operational and legal challenges. Furthermore, ensuring product quality and consistency, especially for fresh produce, remains a critical concern for maintaining customer trust and reducing returns. The significant upfront investment required for infrastructure and technology also acts as a barrier to entry for smaller players.

Future Opportunities in India Q-Commerce Industry

The future of India's Q-Commerce industry is rife with opportunities for expansion and innovation. The untapped potential in Tier-2 and Tier-3 cities presents a significant growth avenue as digital penetration increases. Innovations in sustainable delivery models, such as electric vehicles and optimized packaging, can cater to a growing eco-conscious consumer base. Expanding product categories beyond groceries, such as pharmaceuticals, electronics, and specialized niche products, offers diversification and revenue growth. The integration of AI and machine learning for hyper-personalization of offers and predictive demand management will enhance customer loyalty. Furthermore, strategic partnerships with local businesses and manufacturers can broaden product assortments and create unique value propositions. The continued evolution of technology and consumer behavior will undoubtedly unlock new frontiers in the Q-Commerce space.

Major Players in the India Q-Commerce Industry Ecosystem

- Swiggy

- Instamart

- Dunzo Daily

- Blinkit

- Big Basket

- Zepto

- Grofers

- Flipkart Quick

- Supr Daily

- Zomato

Key Developments in India Q-Commerce Industry Industry

- February 2023: Zomato launched a quick commerce delivery service known as Zomato Instant, aiming to provide customers with home-style cooked food at affordable prices.

- December 2023: Walmart acquired Flipkart, entered into a quick commerce delivery business, and launched its services in 20 cities in India.

Strategic India Q-Commerce Industry Market Forecast

The strategic forecast for India's Q-Commerce industry is exceptionally bright, driven by a potent combination of increasing urbanization, evolving consumer lifestyles, and relentless technological innovation. The market is projected to witness sustained high growth rates, expanding beyond its current stronghold in metropolitan areas to penetrate smaller cities. Key growth catalysts include the continuous refinement of delivery logistics, enabling even faster fulfillment times and a wider product selection. Investments in AI and data analytics will further optimize inventory management and personalize customer experiences, fostering loyalty and reducing churn. The increasing adoption of hybrid models, blending online convenience with offline accessibility, also presents a significant opportunity. As the digital economy matures in India, Q-Commerce is poised to become an indispensable part of daily life, offering unparalleled convenience and accessibility to a diverse range of products, thereby solidifying its position as a transformative force in the Indian retail landscape.

India Q-Commerce Industry Segmentation

-

1. Product Type

- 1.1. Groceries

- 1.2. Personal Care

- 1.3. Fresh Food

- 1.4. Other Product Types

-

2. Company Type

- 2.1. Pureplay

- 2.2. Non-pureplay

India Q-Commerce Industry Segmentation By Geography

- 1. India

India Q-Commerce Industry Regional Market Share

Geographic Coverage of India Q-Commerce Industry

India Q-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.4. Market Trends

- 3.4.1. Rising Entry of Startups into the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Q-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Groceries

- 5.1.2. Personal Care

- 5.1.3. Fresh Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Company Type

- 5.2.1. Pureplay

- 5.2.2. Non-pureplay

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiggy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Instamart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dunzo Daily

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blinkit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Big Basket

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zepto

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grofers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flipkart Quick

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supr Daily

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zomato**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Swiggy

List of Figures

- Figure 1: India Q-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Q-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 4: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 5: India Q-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Q-Commerce Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 10: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 11: India Q-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Q-Commerce Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Q-Commerce Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the India Q-Commerce Industry?

Key companies in the market include Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, Zomato**List Not Exhaustive.

3. What are the main segments of the India Q-Commerce Industry?

The market segments include Product Type, Company Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

6. What are the notable trends driving market growth?

Rising Entry of Startups into the Market.

7. Are there any restraints impacting market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Zomato launched a quick commerce delivery service known as Zomato Instant. The aim is to provide customers with home-style cooked food at affordable prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Q-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Q-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Q-Commerce Industry?

To stay informed about further developments, trends, and reports in the India Q-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence