Key Insights

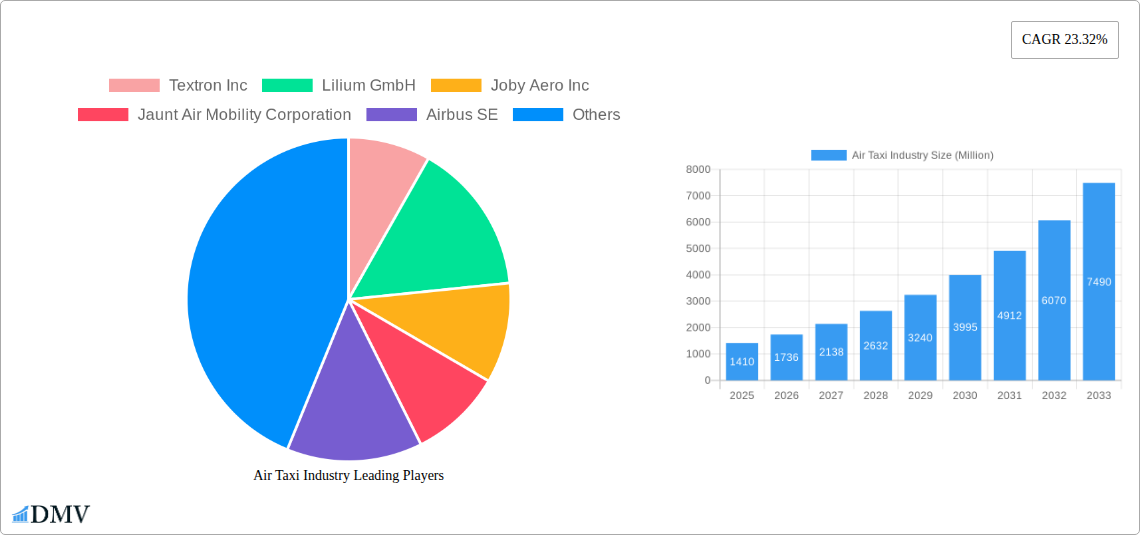

The air taxi industry is poised for explosive growth, projected to reach a market size of $1.41 billion in 2025 and experience a compound annual growth rate (CAGR) of 23.32% from 2025 to 2033. Several factors drive this expansion. Firstly, increasing urbanization and traffic congestion in major cities create a compelling need for faster, more efficient urban transportation. Secondly, advancements in electric vertical takeoff and landing (eVTOL) technology are making air taxis increasingly viable and safe. Thirdly, growing investments from both established aerospace companies like Boeing and Textron and innovative startups like Lilium and Joby Aero are fueling the development and deployment of these vehicles. The market is segmented by mode of operation, with piloted and autonomous air taxis representing distinct segments, each with its own growth trajectory. While autonomous operations present long-term potential, piloted air taxis are likely to dominate the market in the near future due to regulatory and safety considerations. Regional variations are expected, with North America and Asia-Pacific anticipated to be leading markets due to high technological adoption rates, strong government support, and substantial private investment. However, Europe and other regions will also experience significant growth driven by similar factors, albeit potentially at a slightly slower pace.

Air Taxi Industry Market Size (In Billion)

Challenges remain, however. Regulatory hurdles surrounding air traffic management, safety certifications, and airspace integration need to be addressed. The high initial investment costs associated with developing and deploying air taxi infrastructure and the need for robust safety measures also present significant obstacles. Nevertheless, the overall market outlook remains positive, suggesting substantial opportunities for both investors and industry participants. The successful navigation of these challenges will ultimately determine the speed and extent of the industry’s growth. The forecast period, 2025-2033, signifies a period of significant transformation and market maturity, making it a prime time for strategic investment and technological innovation.

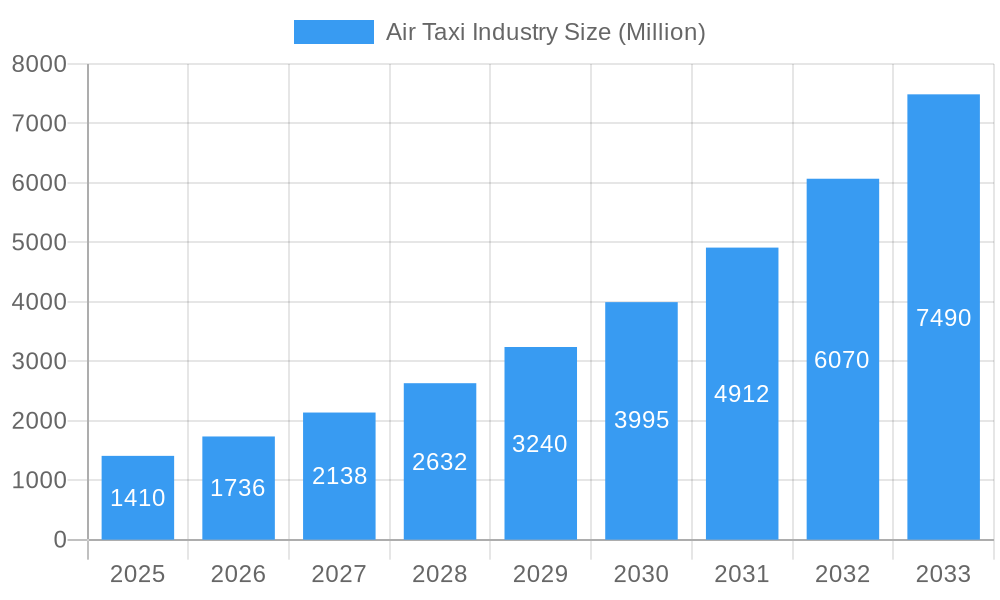

Air Taxi Industry Company Market Share

Air Taxi Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning air taxi industry, projecting a market valuation of $XX Million by 2033. The study covers the period 2019-2033, with 2025 serving as both the base and estimated year. Key players like Textron Inc, Lilium GmbH, Joby Aero Inc, and Airbus SE are examined alongside emerging technologies and regulatory landscapes shaping this transformative sector. This report is indispensable for investors, industry stakeholders, and policymakers seeking to understand the market's potential and navigate its complexities.

Air Taxi Industry Market Composition & Trends

This section delves into the intricate dynamics of the air taxi market, analyzing its concentration, innovation drivers, regulatory hurdles, competitive substitutes, and end-user profiles. The report meticulously examines the market share distribution amongst key players, revealing a currently fragmented landscape with emerging dominance from certain companies. For example, Textron Inc and Airbus SE currently hold significant shares, though this is projected to shift with the influx of new players and technological advancements. The analysis also quantifies the value of recent mergers and acquisitions (M&A) in the sector, revealing a total M&A deal value of approximately $XX Million during the historical period (2019-2024).

- Market Concentration: Currently fragmented, shifting towards consolidation.

- Innovation Catalysts: Advancements in battery technology, autonomous flight systems, and urban air mobility (UAM) infrastructure development.

- Regulatory Landscape: Evolving regulations impacting certification, airspace management, and operational safety.

- Substitute Products: Helicopters, private jets (for longer distances), and traditional ground transportation.

- End-User Profiles: High-net-worth individuals, businesses requiring rapid transport, and potentially, the mass market in the later forecast period.

- M&A Activities: Significant M&A activity observed in the historical period (2019-2024), with a projected increase during the forecast period (2025-2033). The report details specific deals and their financial implications.

Air Taxi Industry Industry Evolution

This section charts the transformative journey of the air taxi industry, from its nascent stages to its projected exponential growth. We analyze market growth trajectories, pinpointing a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Technological advancements, particularly in electric vertical takeoff and landing (eVTOL) aircraft and autonomous flight capabilities, are identified as key drivers. The report also examines the evolving consumer preferences, highlighting a shift towards on-demand, convenient, and sustainable air travel solutions. Adoption metrics, including the number of operational air taxi routes and passenger numbers, are provided to illustrate the industry's progress. The shift from piloted to autonomous models will be a key focus, showing the gradual rise in autonomous operation and the related impacts on safety and market penetration.

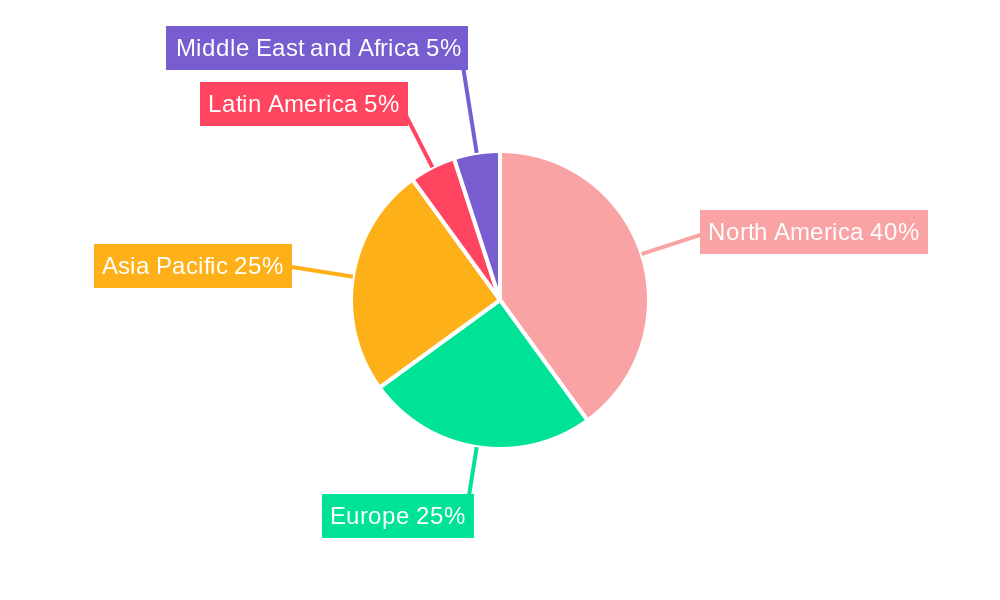

Leading Regions, Countries, or Segments in Air Taxi Industry

This section identifies the leading regions and segments within the air taxi industry. Currently, North America and Europe are dominant due to robust regulatory frameworks, substantial investments, and strong technological capabilities. However, the report forecasts rapid growth in the Asia-Pacific region driven by increasing urbanization and supportive government initiatives.

- Key Drivers for North America Dominance: High venture capital investments, advanced technological development, relatively mature regulatory frameworks.

- Key Drivers for European Dominance: Governmental support for UAM initiatives, strong aerospace industry presence, significant R&D investment.

- Key Drivers for Asia-Pacific Growth: Rapid urbanization, increasing disposable income, supportive government policies promoting technological advancements.

Mode of Operation: The report projects that the piloted segment will dominate in the short term (2025-2030), with a gradual shift towards autonomous operations in the later forecast period (2030-2033). This shift will be impacted by regulatory approvals, public perception of safety, and technological maturity.

Air Taxi Industry Product Innovations

This section showcases the groundbreaking innovations shaping the air taxi sector. Advancements in electric propulsion systems, advanced air traffic management (ATM) technologies, and the development of more efficient and quieter eVTOL aircraft are discussed. The report highlights the unique selling propositions of various air taxi models, emphasizing factors such as speed, range, passenger capacity, and cost-effectiveness. The integration of AI and machine learning for autonomous operation and predictive maintenance is also discussed.

Propelling Factors for Air Taxi Industry Growth

Several factors are driving the rapid expansion of the air taxi industry. Technological advancements, including the development of safer, more efficient, and quieter eVTOL aircraft, are paramount. Favorable economic conditions, such as increasing disposable incomes and the demand for faster and more convenient transportation, are also significant. Supportive government regulations and policies, including initiatives to develop UAM infrastructure and streamline the certification process, are critical in fostering industry growth.

Obstacles in the Air Taxi Industry Market

Despite its immense potential, the air taxi industry faces several significant challenges. Regulatory hurdles, including the certification of eVTOL aircraft and the establishment of safe and efficient air traffic management systems, pose significant barriers to entry. Supply chain disruptions can impact the timely production and deployment of air taxi vehicles. Finally, intense competition among established aerospace companies and emerging startups creates a dynamic and competitive landscape, adding to the challenges.

Future Opportunities in Air Taxi Industry

The air taxi industry presents exciting future opportunities. Expansion into new geographical markets, especially in developing economies with growing urban populations, offers significant potential. Technological advancements, such as improved battery technology, further automation, and the integration of air taxis with broader transportation networks, will continue to drive growth. Emerging consumer trends, such as the increasing demand for sustainable and personalized travel options, further enhance the industry's prospects.

Major Players in the Air Taxi Industry Ecosystem

- Textron Inc

- Lilium GmbH

- Joby Aero Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Hyundai Motor Company

- Volocopter GmbH

- Wisk Aero LL

- Guangzhou EHang Intelligent Technology Co Ltd

- The Boeing Company

Key Developments in Air Taxi Industry Industry

- 2023-03: Joby Aero announces partnership with Toyota for mass production of eVTOL aircraft.

- 2022-11: Airbus secures significant funding for its CityAirbus NextGen program.

- 2022-07: Volocopter completes its first crewed autonomous flight in Singapore.

- [Insert further relevant developments with year/month and impact on market dynamics]

Strategic Air Taxi Industry Market Forecast

The air taxi industry is poised for remarkable growth, driven by technological leaps, supportive regulations, and burgeoning demand. The market’s projected expansion presents significant opportunities for investors and industry players alike. The convergence of autonomous flight capabilities and improved battery technology promises to revolutionize urban mobility, transforming the way people and goods are transported. This report provides crucial insights for navigating this exciting and rapidly evolving market.

Air Taxi Industry Segmentation

-

1. Mode of Operation

- 1.1. Piloted

- 1.2. Autonomous

Air Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Air Taxi Industry Regional Market Share

Geographic Coverage of Air Taxi Industry

Air Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Piloted Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6. North America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7. Europe Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8. Asia Pacific Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9. Latin America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10. Middle East and Africa Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lilium GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jaunt Air Mobility Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Motor Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volocopter GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wisk Aero LL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Guangzhou EHang Intelligent Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Air Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 3: North America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 4: North America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 7: Europe Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 8: Europe Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 11: Asia Pacific Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 12: Asia Pacific Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 15: Latin America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 16: Latin America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 19: Middle East and Africa Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 20: Middle East and Africa Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 2: Global Air Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 4: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 8: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 15: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 23: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Latin America Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 28: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Israel Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Taxi Industry?

The projected CAGR is approximately 23.32%.

2. Which companies are prominent players in the Air Taxi Industry?

Key companies in the market include Textron Inc, Lilium GmbH, Joby Aero Inc, Jaunt Air Mobility Corporation, Airbus SE, Hyundai Motor Company, Volocopter GmbH, Wisk Aero LL, Guangzhou EHang Intelligent Technology Co Ltd, The Boeing Company.

3. What are the main segments of the Air Taxi Industry?

The market segments include Mode of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.41 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Piloted Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Taxi Industry?

To stay informed about further developments, trends, and reports in the Air Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence