Key Insights

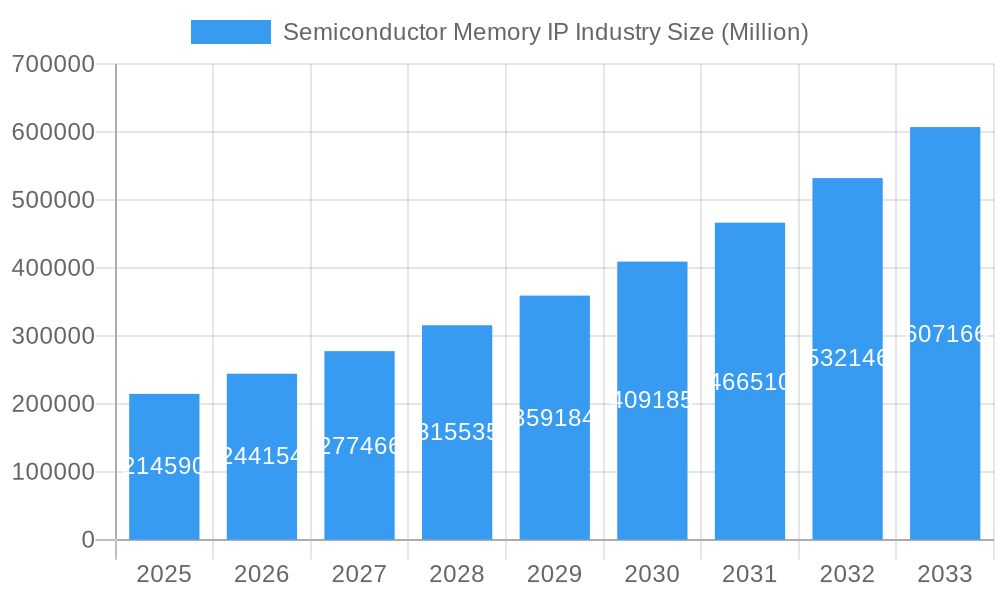

The global Semiconductor Memory IP market is poised for significant expansion, projected to reach an impressive USD 214.59 billion in 2025 and grow at a robust CAGR of 13.8% through 2033. This surge is primarily fueled by the escalating demand for advanced memory solutions across a multitude of burgeoning industries. The Consumer Electronics sector remains a dominant force, driven by the relentless innovation in smartphones, wearables, and smart home devices, all of which require increasingly sophisticated and high-capacity memory IP. Similarly, the Automotive industry is witnessing a dramatic uptake of semiconductor memory IP, essential for powering advanced driver-assistance systems (ADAS), in-car infotainment, and autonomous driving technologies. The Industrial sector, encompassing IoT devices, automation, and smart manufacturing, also presents a substantial growth avenue, demanding reliable and efficient memory solutions. Furthermore, the Networking segment, crucial for the expansion of 5G infrastructure and data centers, necessitates high-performance memory IP to handle the ever-increasing data traffic. Emerging trends such as the rise of artificial intelligence (AI) and machine learning (ML) further amplify the need for specialized memory architectures, including volatile and non-volatile memory types, to support complex computational tasks and large datasets.

Semiconductor Memory IP Industry Market Size (In Billion)

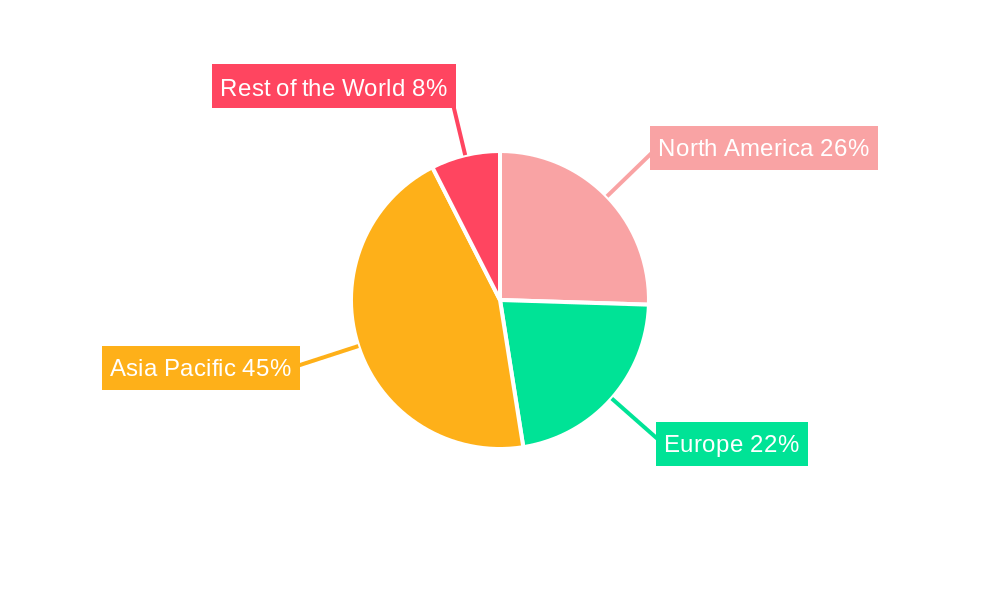

Despite the strong growth trajectory, certain challenges could temper the market's pace. Supply chain disruptions, geopolitical uncertainties, and the intricate complexities involved in developing cutting-edge semiconductor IP can act as potential restraints. Nevertheless, the industry is actively addressing these hurdles through strategic collaborations, diversification of manufacturing capabilities, and continuous research and development efforts. Companies like Arm Holdings, Synopsys Inc., and Cadence Design Systems Inc. are at the forefront, offering a comprehensive suite of Memory IP solutions, including volatile memory (like DRAM and SRAM) and non-volatile memory (such as NAND flash and NOR flash), as well as other specialized IP cores. The market's regional dynamics indicate a strong presence in Asia Pacific, particularly in China, Japan, and South Korea, which are major hubs for semiconductor manufacturing and consumption. North America and Europe also represent significant markets, driven by innovation in consumer electronics, automotive, and industrial applications.

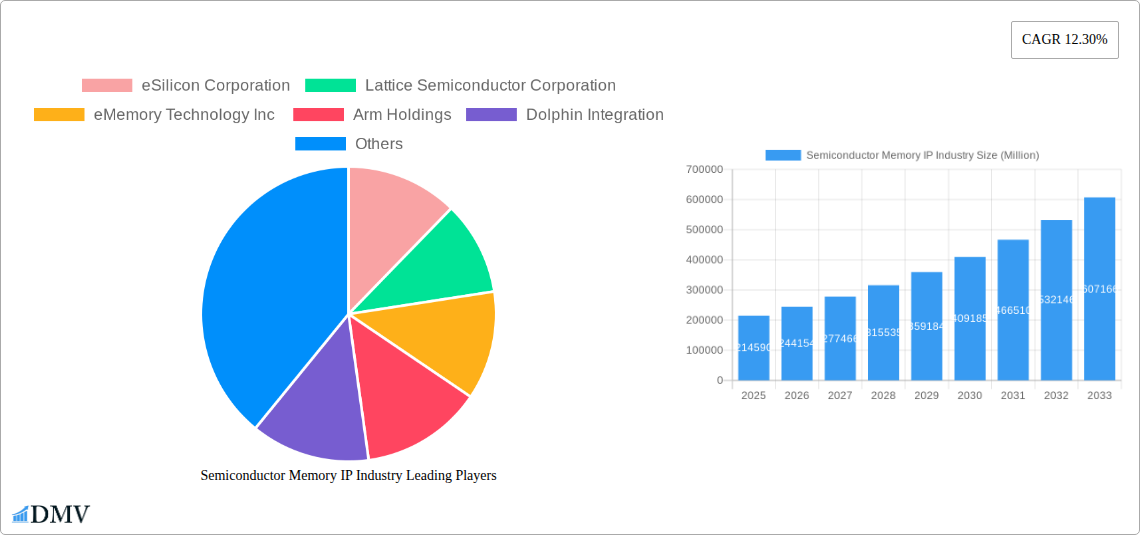

Semiconductor Memory IP Industry Company Market Share

The Semiconductor Memory Intellectual Property (IP) industry is a dynamic and increasingly concentrated sector, driven by relentless innovation and evolving end-user demands. Analysis of market concentration reveals a landscape shaped by a few dominant players, with Arm Holdings, Synopsys Inc, and Cadence Design Systems Inc holding significant influence due to their comprehensive IP portfolios and strong ecosystem partnerships. The study period, spanning 2019–2033, with a base year of 2025, encompasses a transformative era for memory IP. Innovation catalysts are manifold, including the burgeoning demand for higher data storage and faster processing speeds across Consumer Electronics, Automotive, and Industrial sectors. Regulatory landscapes, while generally supportive of technological advancement, are increasingly focusing on data security and supply chain resilience, impacting IP licensing and development strategies. Substitute products, such as advancements in alternative memory technologies, continue to emerge, pushing IP providers to innovate at an accelerated pace. End-user profiles are diversifying, with AI, IoT, and high-performance computing demanding specialized memory solutions. Mergers and Acquisitions (M&A) activities are a key indicator of industry consolidation and strategic positioning, with notable deals in the historical period valued in the billions, further shaping market share distribution. For instance, the historical period of 2019–2024 saw significant consolidation as companies like Mentor Graphics Corporation (now part of Siemens Digital Industries Software) and other key players pursued strategic acquisitions to broaden their IP offerings and market reach, with M&A deal values in the billions.

Semiconductor Memory IP Industry Industry Evolution

The Semiconductor Memory IP industry is experiencing a remarkable evolution, characterized by robust market growth trajectories, continuous technological advancements, and a significant shift in consumer and industrial demands. The forecast period of 2025–2033 promises sustained expansion, building upon the foundation laid during the historical period of 2019–2024 and the base year of 2025. This evolution is fundamentally driven by the insatiable appetite for more efficient and higher-performing memory solutions across a diverse array of end-user industries.

Technological advancements are at the forefront of this evolution. The relentless pursuit of increased density, reduced power consumption, and enhanced speed is pushing the boundaries of conventional memory architectures. This includes significant progress in Non-Volatile Memory (NVM) technologies, such as advanced NAND and emerging memory types like resistive RAM (ReRAM) and phase-change memory (PCM), which are increasingly finding applications beyond traditional storage, penetrating embedded systems and edge computing devices. Volatile Memory, primarily DRAM, continues to see innovations in bandwidth and capacity, crucial for high-performance computing and AI workloads. Companies are investing heavily in IP cores that support these advanced memory technologies, enabling chip designers to integrate state-of-the-art memory subsystems into their System-on-Chips (SoCs).

Shifting consumer and industrial demands are a potent catalyst for this evolution. The proliferation of smart devices, the exponential growth of data generated by the Internet of Things (IoT), the increasing complexity of artificial intelligence (AI) and machine learning (ML) algorithms, and the burgeoning requirements of the automotive sector for advanced driver-assistance systems (ADAS) and autonomous driving all necessitate more sophisticated memory solutions. The Consumer Electronics segment, a consistent demand driver, is now complemented by the rapidly expanding Automotive sector, which requires high reliability and specialized memory for safety-critical applications. The Industrial sector, driven by automation and Industry 4.0 initiatives, also presents substantial growth opportunities. Networking infrastructure, supporting global data traffic, continues to demand high-speed, high-capacity memory solutions. The adoption of these advanced memory IP solutions is accelerating, with projected growth rates in the high single digits and double digits for specific segments, demonstrating the industry's responsiveness to market needs. For instance, the adoption of specialized memory IP for AI accelerators is projected to grow at over 25% annually during the forecast period, underscoring the transformative impact of these technological shifts.

Leading Regions, Countries, or Segments in Semiconductor Memory IP Industry

The Semiconductor Memory IP Industry exhibits distinct regional strengths and segment dominance, with Asia Pacific emerging as a powerhouse driven by robust manufacturing capabilities and a burgeoning demand for advanced electronic devices. Within the product segmentation, Non-Volatile Memory is demonstrating significant leadership, outpacing its Volatile counterpart in certain high-growth applications. The Consumer Electronics and Automotive end-user industries are particularly influential in dictating regional and segment leadership.

Dominant Region: Asia Pacific

The Asia Pacific region, encompassing countries like South Korea, Taiwan, China, and Japan, stands as the undisputed leader in the Semiconductor Memory IP industry. This dominance is multifaceted, driven by:

- Manufacturing Prowess: The region houses the world's largest semiconductor manufacturing facilities, including foundries and memory fabrication plants, creating a natural ecosystem for IP development and deployment.

- Government Support and Investment: Numerous governments in Asia Pacific have prioritized the semiconductor industry through substantial investments, tax incentives, and favorable regulatory policies aimed at fostering domestic innovation and reducing reliance on foreign IP.

- Booming Consumer Market: The sheer size and growth of the consumer electronics market in Asia Pacific, coupled with increasing disposable incomes, fuels a continuous demand for memory-intensive devices.

- Emerging Automotive Hubs: Countries like China are rapidly expanding their automotive manufacturing and EV production, creating a substantial demand for automotive-grade memory IP.

Dominant Segment: Non-Volatile Memory (NVM)

Within the product segmentation, Non-Volatile Memory is increasingly becoming a segment of paramount importance. While Volatile Memory remains critical for high-performance applications, the versatility and application breadth of NVM are driving its accelerated growth.

- Ubiquitous Application: NVM is integral to virtually every electronic device, from smartphones and wearables (Consumer Electronics) to automotive infotainment systems and ADAS (Automotive), and industrial control systems (Industrial).

- Technological Advancements: Innovations in NAND flash, and the rapid development of emerging NVM technologies like 3D NAND, ReRAM, and MRAM, offer higher densities, improved endurance, and lower power consumption, making them ideal for a wider range of applications.

- Data Storage Demands: The explosion of data generated by IoT devices and the increasing need for persistent storage in edge computing environments are significantly bolstering the demand for advanced NVM solutions.

Key End-User Industry Drivers:

- Consumer Electronics: Remains a foundational pillar, with constant demand for higher storage capacities and faster read/write speeds in smartphones, tablets, laptops, and gaming consoles.

- Automotive: A rapidly growing driver, demanding highly reliable, automotive-qualified memory for critical functions such as infotainment, navigation, ADAS, and autonomous driving systems. The transition to electric vehicles (EVs) further amplifies this demand.

- Industrial: Fueled by Industry 4.0, automation, and the Industrial Internet of Things (IIoT), this sector requires robust and secure memory solutions for data logging, control systems, and embedded applications.

- Networking: Continues to be a significant segment, demanding high-speed, high-density memory for routers, switches, and data center infrastructure to manage ever-increasing network traffic.

The interplay of these factors solidifies Asia Pacific's leadership and propels Non-Volatile Memory to the forefront of the Semiconductor Memory IP Industry.

Semiconductor Memory IP Industry Product Innovations

The Semiconductor Memory IP industry is characterized by a relentless pace of product innovation, directly addressing the burgeoning needs of diverse end-user industries. Companies like Arm Holdings and Synopsys Inc are at the vanguard, offering highly optimized IP cores for both volatile and non-volatile memory. Innovations are focused on enhancing memory density, boosting read/write speeds, and significantly reducing power consumption. Unique selling propositions include IP that supports advanced manufacturing processes, enabling smaller and more power-efficient memory subsystems. For instance, the development of low-power memory controllers for edge AI applications and high-bandwidth memory (HBM) interfaces for AI accelerators represent significant technological advancements, delivering performance metrics like hundreds of gigabytes per second bandwidth and microampere-level standby power.

Propelling Factors for Semiconductor Memory IP Industry Growth

Several key factors are propelling the growth of the Semiconductor Memory IP industry. The explosive growth of data generated by the Internet of Things (IoT) and Artificial Intelligence (AI) applications creates an insatiable demand for efficient and high-capacity memory solutions. Advancements in semiconductor manufacturing technologies, such as 3D NAND and advanced DRAM architectures, enable denser and faster memory chips, requiring specialized IP to manage them. Furthermore, the increasing complexity of consumer electronics and the rapid expansion of the automotive sector, particularly in autonomous driving and electric vehicles, are significant demand drivers. Favorable government initiatives in key regions, aiming to bolster domestic semiconductor capabilities, also contribute to a supportive ecosystem for IP development and adoption.

Obstacles in the Semiconductor Memory IP Industry Market

Despite robust growth, the Semiconductor Memory IP industry faces significant obstacles. Geopolitical tensions and trade restrictions can disrupt global supply chains, impacting the availability of raw materials and the timely delivery of advanced manufacturing equipment. The high cost of research and development for cutting-edge memory technologies, coupled with long product development cycles, presents a substantial financial barrier for smaller players. Intense competition from established IP providers and the constant threat of technological obsolescence due to rapid innovation cycles also pose significant challenges. Furthermore, increasing regulatory scrutiny concerning data privacy and security necessitates the development of more robust and secure memory IP, adding complexity and cost to the development process.

Future Opportunities in Semiconductor Memory IP Industry

The future of the Semiconductor Memory IP industry is brimming with opportunities. The continued expansion of AI and machine learning, particularly at the edge, will drive demand for specialized, low-power memory solutions. The burgeoning metaverse and immersive technologies will require significantly higher bandwidth and lower latency memory. The automotive sector's transition towards fully autonomous vehicles presents a massive opportunity for advanced, safety-critical memory IP. Furthermore, the exploration and commercialization of novel memory technologies beyond current NAND and DRAM paradigms, such as memristors and ferroelectric RAM (FeRAM), offer potential for disruptive innovation and new market segments. The increasing adoption of advanced packaging technologies also creates opportunities for integrated memory solutions.

Major Players in the Semiconductor Memory IP Industry Ecosystem

- Arm Holdings

- Synopsys Inc

- Cadence Design Systems Inc

- eMemory Technology Inc

- Lattice Semiconductor Corporation

- eSilicon Corporation

- Rambus Inc

- Dolphin Integration

- ARM Limited

Key Developments in Semiconductor Memory IP Industry Industry

- Q1 2024: Launch of next-generation LPDDR5X memory IP by a major IP vendor, offering significant improvements in power efficiency and bandwidth for mobile and automotive applications.

- Q4 2023: Announcement of a strategic partnership between a leading semiconductor design company and an AI hardware startup to develop optimized memory solutions for deep learning inference.

- Q3 2023: Introduction of advanced error correction code (ECC) IP for enterprise-grade SSDs, enhancing data integrity and reliability for cloud computing.

- Q2 2023: Significant investment in emerging memory technologies, such as MRAM, by venture capital firms, indicating growing market confidence in their potential.

- Q1 2023: Release of automotive-grade embedded flash IP, meeting stringent reliability and temperature requirements for in-car systems.

- 2022: Major merger activity, consolidating IP portfolios and expanding market reach for key players in the memory IP space.

- 2021: Increased focus on security features within memory IP, addressing growing concerns around data breaches and intellectual property theft.

- 2020: Advancements in 3D NAND controller IP, enabling higher storage densities and improved performance in consumer devices.

- 2019: Introduction of highly configurable memory IP solutions, allowing chip designers greater flexibility in tailoring memory subsystems to specific application needs.

Strategic Semiconductor Memory IP Industry Market Forecast

The Semiconductor Memory IP industry is poised for continued robust growth, driven by the pervasive digitization of economies and the relentless pursuit of technological advancement. Key growth catalysts include the accelerating adoption of AI, the expansion of IoT devices, and the transformative shift in the automotive sector towards electrification and autonomy. Opportunities in emerging markets and the continuous innovation in memory technologies, such as advanced NVM and specialized architectures for data-intensive applications, will further propel market expansion. The strategic forecast indicates a market ripe for innovation, where companies offering high-performance, power-efficient, and secure memory IP solutions will capture significant market share. The estimated market size in 2025 is projected to be in the tens of billions, with a sustained Compound Annual Growth Rate (CAGR) of approximately 7-9% through 2033.

Semiconductor Memory IP Industry Segmentation

-

1. Product

- 1.1. Volatile Memory

- 1.2. Non - Volatile Memory

- 1.3. Other Products

-

2. End -user Industry

- 2.1. Consumer Electronics

- 2.2. Industrial

- 2.3. Automotive

- 2.4. Networking

- 2.5. Other End-user Industries

Semiconductor Memory IP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Taiwan

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Semiconductor Memory IP Industry Regional Market Share

Geographic Coverage of Semiconductor Memory IP Industry

Semiconductor Memory IP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Complex Chip Design and Multi core Technologies; Increasing Investments in the Semiconductor Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Systems

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Volatile Memory

- 5.1.2. Non - Volatile Memory

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End -user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Industrial

- 5.2.3. Automotive

- 5.2.4. Networking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Volatile Memory

- 6.1.2. Non - Volatile Memory

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End -user Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Industrial

- 6.2.3. Automotive

- 6.2.4. Networking

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Volatile Memory

- 7.1.2. Non - Volatile Memory

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End -user Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Industrial

- 7.2.3. Automotive

- 7.2.4. Networking

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Volatile Memory

- 8.1.2. Non - Volatile Memory

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End -user Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Industrial

- 8.2.3. Automotive

- 8.2.4. Networking

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Volatile Memory

- 9.1.2. Non - Volatile Memory

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End -user Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Industrial

- 9.2.3. Automotive

- 9.2.4. Networking

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 eSilicon Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lattice Semiconductor Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 eMemory Technology Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arm Holdings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dolphin Integration

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ARM Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rambus Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Synopsys Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mentor Graphics Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cadence Design Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 eSilicon Corporation

List of Figures

- Figure 1: Global Semiconductor Memory IP Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Memory IP Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 8: North America Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 9: North America Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 10: North America Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 11: North America Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 16: Europe Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 20: Europe Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 21: Europe Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 22: Europe Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 23: Europe Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 28: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 32: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 33: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 34: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 35: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 40: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 41: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 44: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 45: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 46: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 47: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 4: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 5: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 10: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 11: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 20: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 21: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 32: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 34: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 35: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: China Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: China Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Japan Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: South Korea Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Korea Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Taiwan Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Taiwan Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 48: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 49: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 50: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 51: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Memory IP Industry?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the Semiconductor Memory IP Industry?

Key companies in the market include eSilicon Corporation, Lattice Semiconductor Corporation, eMemory Technology Inc , Arm Holdings, Dolphin Integration, ARM Limited, Rambus Inc, Synopsys Inc, Mentor Graphics Corporation, Cadence Design Systems Inc.

3. What are the main segments of the Semiconductor Memory IP Industry?

The market segments include Product, End -user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Complex Chip Design and Multi core Technologies; Increasing Investments in the Semiconductor Industry.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Cost of Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Memory IP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Memory IP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Memory IP Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Memory IP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence