Key Insights

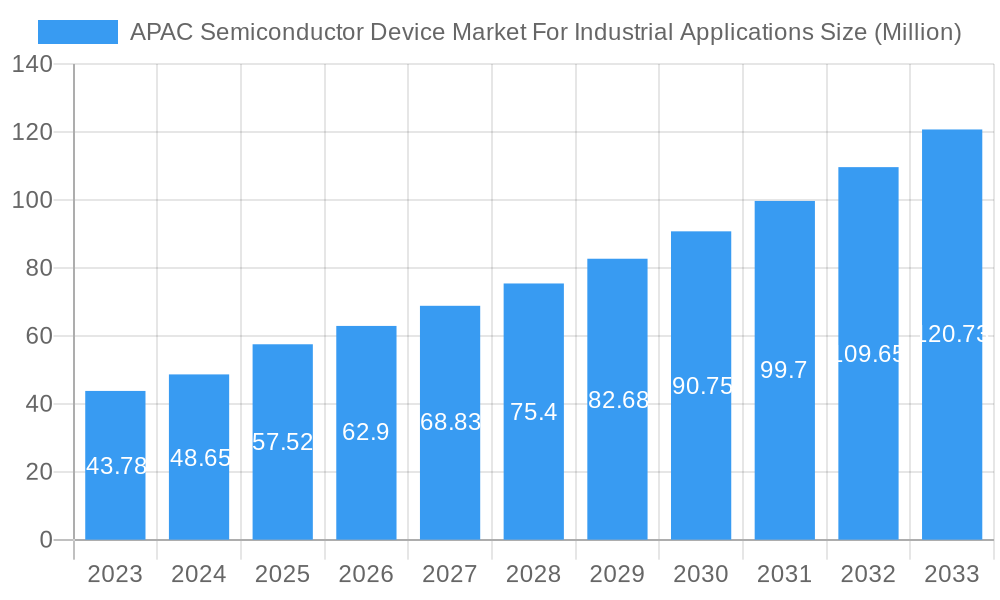

The APAC Semiconductor Device Market for Industrial Applications is poised for significant expansion, projected to reach a substantial $57.52 billion by 2025. This growth trajectory is underscored by a robust Compound Annual Growth Rate (CAGR) of 9.50%, indicating a dynamic and rapidly evolving market. Key drivers fueling this surge include the escalating adoption of Industry 4.0 technologies, such as automation, IoT, and AI, across various industrial sectors like manufacturing, energy, and transportation. The increasing demand for advanced semiconductor solutions that enable enhanced efficiency, precision, and connectivity in industrial processes is a primary catalyst. Furthermore, the ongoing digital transformation initiatives within industrial enterprises across the Asia-Pacific region are creating a fertile ground for the deployment of sophisticated semiconductor devices. Trends like miniaturization, increased power efficiency, and the development of specialized chips for niche industrial applications are shaping the market landscape.

APAC Semiconductor Device Market For Industrial Applications Market Size (In Million)

Despite the strong growth, the market faces certain restraints, including the inherent cyclical nature of the semiconductor industry and geopolitical tensions that can disrupt supply chains. However, these challenges are being mitigated by strategic investments in domestic semiconductor manufacturing capabilities and diversification of sourcing strategies. The market segmentation reveals a diverse landscape with Integrated Circuits leading the charge, followed by Discrete Semiconductors, Sensors, and Optoelectronics. Within Integrated Circuits, microprocessors and microcontrollers are expected to witness substantial demand due to their crucial role in industrial automation and control systems. Geographically, China is anticipated to remain a dominant force, driven by its vast industrial base and government support for the semiconductor ecosystem. India and Japan are also expected to contribute significantly to market growth, fueled by their expanding manufacturing sectors and technological advancements.

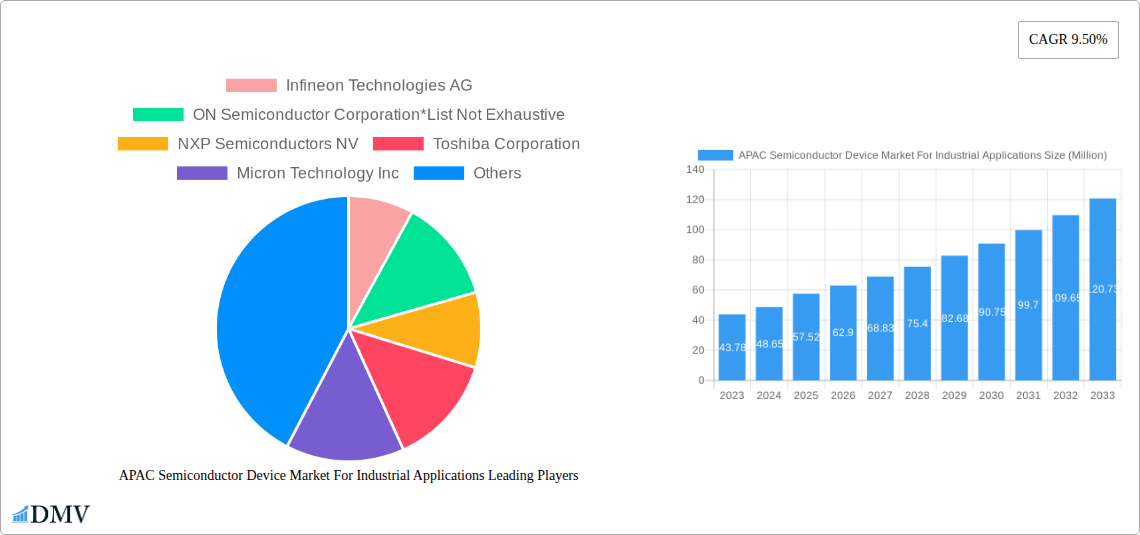

APAC Semiconductor Device Market For Industrial Applications Company Market Share

APAC Semiconductor Device Market for Industrial Applications: Comprehensive Market Insight and Forecast (2019-2033)

This in-depth report provides an authoritative analysis of the APAC Semiconductor Device Market for Industrial Applications, offering critical intelligence for stakeholders navigating this dynamic sector. Covering a study period from 2019 to 2033, with a base year of 2025, this research delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, and a detailed competitive landscape. Leveraging high-ranking keywords such as industrial semiconductors, Asia-Pacific semiconductor market, IoT devices, AI chips, automotive semiconductors, and 5G infrastructure, this report is meticulously crafted for optimal search visibility and stakeholder engagement.

APAC Semiconductor Device Market For Industrial Applications Market Composition & Trends

The APAC Semiconductor Device Market for Industrial Applications is characterized by a moderately concentrated landscape, driven by substantial investments in advanced manufacturing and a robust ecosystem of innovative players. Key innovation catalysts include the escalating demand for AI-powered industrial automation, the pervasive integration of IoT sensors across manufacturing verticals, and the continuous push for greater energy efficiency in power semiconductors. Regulatory frameworks, while varied across the region, are generally supportive of semiconductor development, particularly in fostering domestic production capabilities and R&D initiatives. The threat of substitute products is relatively low for high-performance industrial semiconductors, given their specialized requirements. End-user profiles are diverse, ranging from automotive manufacturers and telecommunications providers to factory automation integrators and renewable energy developers. Mergers and acquisitions (M&A) activities are strategically shaping the market, with recent deals valued in the billions of dollars, aimed at consolidating market share, acquiring cutting-edge technologies, and expanding geographical reach. The market share distribution is dynamic, with leading players continually vying for dominance through technological differentiation and strategic partnerships. XXX

APAC Semiconductor Device Market For Industrial Applications Industry Evolution

The APAC Semiconductor Device Market for Industrial Applications has witnessed a profound industry evolution, marked by consistent year-over-year growth and an accelerated pace of technological advancement. Over the historical period (2019-2024), the market demonstrated resilience, fueled by the burgeoning adoption of industrial automation solutions and the critical role of semiconductors in enabling smart factory initiatives. The estimated market size for 2025 is projected to be substantial, driven by ongoing digital transformation across key industrial sectors. Technological advancements have been pivotal, with breakthroughs in advanced packaging technologies, the development of higher performance integrated circuits (ICs), and the miniaturization of sensors empowering more sophisticated industrial machinery and communication systems. The shift towards Industry 4.0 principles has fundamentally reshaped consumer demands, leading to a greater emphasis on reliability, power efficiency, and intelligent functionalities in semiconductor components. For instance, the adoption rate of AI-enabled microcontrollers has seen a significant surge, directly correlating with the increased deployment of predictive maintenance systems and autonomous robotics in factories. Similarly, the demand for high-speed, low-latency communication chips for 5G-enabled industrial networks has consistently outpaced supply. The market growth trajectory is projected to remain robust throughout the forecast period (2025-2033), with an anticipated Compound Annual Growth Rate (CAGR) of xx% driven by emerging applications in areas like the Industrial Internet of Things (IIoT) and advanced robotics. Specific data points, such as the xx% increase in demand for SiC power devices in electric vehicle charging infrastructure and the xx% growth in the market for industrial Ethernet controllers, underscore the industry's dynamic expansion. XXX

Leading Regions, Countries, or Segments in APAC Semiconductor Device Market For Industrial Applications

The APAC Semiconductor Device Market for Industrial Applications is undeniably dominated by China as a leading country, driven by its colossal manufacturing base and significant government-backed initiatives to bolster its domestic semiconductor industry. The country's dominance stems from a confluence of factors, including substantial investment trends in advanced manufacturing facilities, robust government support through favorable policies and subsidies, and a rapidly expanding domestic market for industrial automation and IoT solutions. China's strategic focus on building a self-reliant semiconductor ecosystem, from design to manufacturing, positions it as a powerhouse in the production and consumption of industrial semiconductor devices.

Beyond China, Japan plays a crucial role, particularly in high-precision sensors and specialized integrated circuits. Its dominance is underpinned by a long-standing legacy of technological innovation, a strong emphasis on quality and reliability, and a well-established network of advanced research and development institutions. The Japanese market benefits from its sophisticated automotive sector and its leading position in robotics and industrial machinery, all of which demand cutting-edge semiconductor solutions.

South Korea, while not explicitly listed as a primary country, also exerts significant influence, especially in memory ICs and advanced foundry services, contributing to the overall regional strength. The Rest of Asia-Pacific region, encompassing countries like Taiwan, Singapore, and Vietnam, exhibits substantial growth potential, driven by increasing foreign direct investment in manufacturing and the expansion of their own burgeoning technology sectors.

Within the Device Type segmentation, Integrated Circuits (ICs) represent the largest and fastest-growing segment. This broad category includes:

- Microcontrollers (MCU): Essential for embedded control in a vast array of industrial equipment, from simple sensors to complex robotic systems. The increasing complexity of industrial automation fuels the demand for MCUs with enhanced processing power and connectivity features.

- Analog ICs: Critical for signal conditioning, power management, and interface functions in industrial environments, ensuring the smooth operation of diverse machinery.

- Logic ICs: Fundamental building blocks for digital circuits, enabling the control and decision-making processes within industrial systems.

- Memory ICs: Crucial for data storage and retrieval in industrial PCs, controllers, and data acquisition systems, supporting the increasing data volumes generated by smart factories.

The dominance of ICs is further amplified by the rapid advancements in Microprocessors (MPU) and Digital Signal Processors (DSP), which are integral to enabling sophisticated artificial intelligence and machine learning capabilities within industrial applications, driving the trend towards more intelligent and autonomous industrial operations.

APAC Semiconductor Device Market For Industrial Applications Product Innovations

Recent product innovations in the APAC Semiconductor Device Market for Industrial Applications are revolutionizing industrial efficiency and connectivity. Advancements in power semiconductors, particularly silicon carbide (SiC) and gallium nitride (GaN) technologies, are delivering unprecedented levels of energy efficiency and thermal management in industrial power supplies and motor drives. The development of highly integrated IoT sensors with extended battery life and enhanced data processing capabilities is enabling pervasive connectivity across factory floors and remote industrial sites. Furthermore, specialized AI accelerators integrated into microcontrollers are bringing on-device intelligence to edge devices, enabling real-time decision-making and reducing reliance on cloud connectivity. These innovations are characterized by their compact form factors, superior performance metrics, and enhanced reliability, crucial for demanding industrial environments.

Propelling Factors for APAC Semiconductor Device Market For Industrial Applications Growth

The APAC Semiconductor Device Market for Industrial Applications is propelled by a confluence of powerful factors. The widespread adoption of Industry 4.0 principles and the Industrial Internet of Things (IIoT) is a primary growth driver, necessitating sophisticated semiconductor solutions for automation, data analytics, and interconnected systems. Government initiatives across APAC, aimed at fostering domestic semiconductor manufacturing and R&D, such as subsidies and tax incentives, are creating a fertile ground for market expansion. The escalating demand for energy-efficient solutions, particularly in power semiconductors for renewable energy and electric vehicles, further fuels growth. The ongoing digital transformation across sectors like automotive, telecommunications, and manufacturing is creating an insatiable appetite for advanced integrated circuits, sensors, and discrete semiconductors. Finally, the strategic expansion of 5G infrastructure is enabling new industrial applications requiring high-speed, low-latency communication, directly boosting demand for relevant semiconductor components.

Obstacles in the APAC Semiconductor Device Market For Industrial Applications Market

Despite robust growth, the APAC Semiconductor Device Market for Industrial Applications faces several obstacles. Supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, continue to pose a significant challenge, leading to extended lead times and price volatility for critical raw materials and components. Stringent regulatory challenges and evolving compliance standards across different countries can create complexities for market entry and product development. Intense competitive pressures from both established global players and emerging regional manufacturers result in price erosion and necessitate continuous innovation to maintain market share. Furthermore, the skilled labor shortage in semiconductor design and manufacturing can hinder the pace of technological advancement and production scaling. The high capital investment required for advanced semiconductor fabrication facilities also presents a substantial barrier to entry for new players.

Future Opportunities in APAC Semiconductor Device Market For Industrial Applications

Emerging opportunities in the APAC Semiconductor Device Market for Industrial Applications are vast and transformative. The burgeoning demand for edge AI solutions in industrial settings, enabling real-time data processing and autonomous decision-making, presents a significant growth avenue. The continuous expansion of the electric vehicle (EV) market is driving substantial demand for high-performance power semiconductors and related ICs. The global push towards sustainability and green technologies creates opportunities for energy-efficient semiconductor solutions in smart grids, industrial automation, and renewable energy systems. Furthermore, the increasing adoption of robotics and automation in diverse industries, from logistics to agriculture, will continue to fuel the demand for advanced microcontrollers and sensors. The ongoing development and deployment of 5G and future wireless technologies will unlock new industrial applications requiring high-bandwidth, low-latency connectivity, thereby expanding the market for specialized semiconductor devices.

Major Players in the APAC Semiconductor Device Market For Industrial Applications Ecosystem

- Infineon Technologies AG

- ON Semiconductor Corporation

- NXP Semiconductors NV

- Toshiba Corporation

- Micron Technology Inc

- Rohm Co Ltd

- Kyocera Corporation

- Xilinx Inc

- Texas Instruments Inc

- Broadcom Inc

- STMicroelectronics NV

- Qualcomm Incorporated

- Samsung Electronics Co Ltd

- Renesas Electronics Corporation

- SK Hynix Inc

- Advanced Semiconductor Engineering Inc

- Nvidia Corporation

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Intel Corporation

- Fujitsu Semiconductor Ltd

Key Developments in APAC Semiconductor Device Market For Industrial Applications Industry

- May 2024: SK Hynix has unveiled ZUFS 4.0, a cutting-edge solution designed specifically for on-device AI applications in mobile devices, notably smartphones. Positioned as a flagship offering, the company anticipates that ZUFS 4.0 will not only solidify its leadership in AI memory within the NAND segment but also further leverage its success in high-speed DRAM, as seen with HBM.

- March 2024: Toshiba has introduced eight new products to its M4K Group within the TXZ+ Family of Advanced Class 32-bit microcontrollers. These microcontrollers are powered by the Cortex-M4 core with FPU. The latest additions come in four different package types and boast an enhanced flash memory capacity of 512KB/1MB, a significant upgrade from Toshiba's previous maximum of 256KB. Additionally, the RAM capacity has been boosted from 24KB to 64KB across the range.

Strategic APAC Semiconductor Device Market For Industrial Applications Market Forecast

The strategic forecast for the APAC Semiconductor Device Market for Industrial Applications points towards sustained and accelerated growth, driven by fundamental shifts in industrial paradigms. The ongoing digital transformation, characterized by the pervasive adoption of IoT, AI, and automation, will continue to be the primary growth catalyst. Emerging opportunities in advanced robotics, edge computing, and the burgeoning electric vehicle sector will further bolster market expansion. Investments in next-generation semiconductor technologies, such as AI accelerators and high-performance power devices, are projected to unlock new application areas and deepen market penetration. The commitment of governments across APAC to fostering semiconductor self-sufficiency and innovation will ensure a robust and dynamic market environment, presenting significant potential for both established players and new entrants looking to capitalize on the region's industrial resurgence.

APAC Semiconductor Device Market For Industrial Applications Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

- 2. Countries

- 3. China

- 4. Japan

- 5. India

- 6. Rest of Asia-Pacific

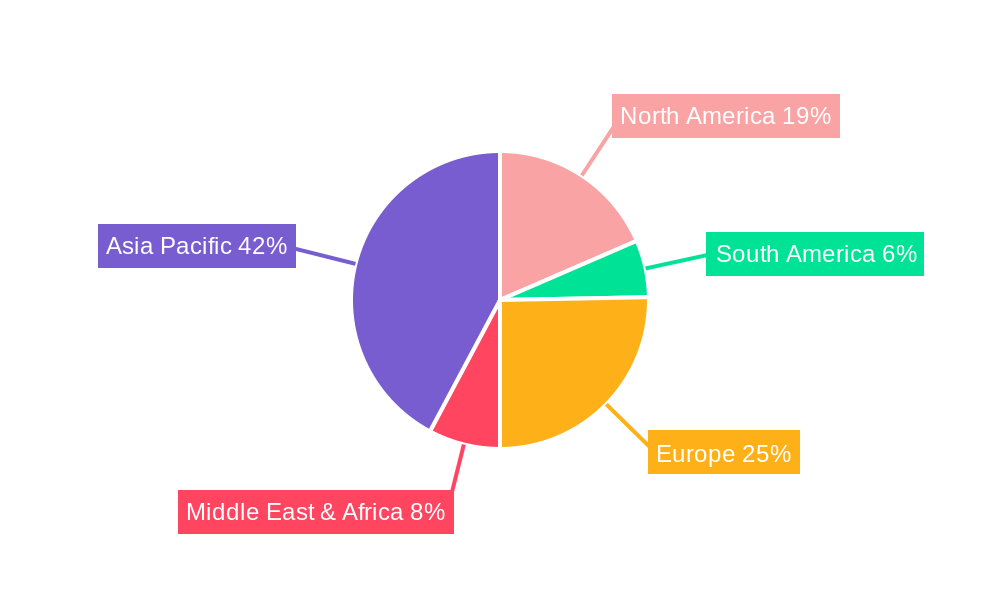

APAC Semiconductor Device Market For Industrial Applications Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Semiconductor Device Market For Industrial Applications Regional Market Share

Geographic Coverage of APAC Semiconductor Device Market For Industrial Applications

APAC Semiconductor Device Market For Industrial Applications REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Technologies like IoT and AI; Industry 4.0 Investments Driving The Demand For Automation

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

- 3.4. Market Trends

- 3.4.1. Industry 4.0 Investments Driving The Demand For Automation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.3. Market Analysis, Insights and Forecast - by China

- 5.4. Market Analysis, Insights and Forecast - by Japan

- 5.5. Market Analysis, Insights and Forecast - by India

- 5.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessors (MPU)

- 6.1.4.4.2. Microcontrollers (MCU)

- 6.1.4.4.3. Digital Signal Processors

- 6.2. Market Analysis, Insights and Forecast - by Countries

- 6.3. Market Analysis, Insights and Forecast - by China

- 6.4. Market Analysis, Insights and Forecast - by Japan

- 6.5. Market Analysis, Insights and Forecast - by India

- 6.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. South America APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessors (MPU)

- 7.1.4.4.2. Microcontrollers (MCU)

- 7.1.4.4.3. Digital Signal Processors

- 7.2. Market Analysis, Insights and Forecast - by Countries

- 7.3. Market Analysis, Insights and Forecast - by China

- 7.4. Market Analysis, Insights and Forecast - by Japan

- 7.5. Market Analysis, Insights and Forecast - by India

- 7.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Europe APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessors (MPU)

- 8.1.4.4.2. Microcontrollers (MCU)

- 8.1.4.4.3. Digital Signal Processors

- 8.2. Market Analysis, Insights and Forecast - by Countries

- 8.3. Market Analysis, Insights and Forecast - by China

- 8.4. Market Analysis, Insights and Forecast - by Japan

- 8.5. Market Analysis, Insights and Forecast - by India

- 8.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessors (MPU)

- 9.1.4.4.2. Microcontrollers (MCU)

- 9.1.4.4.3. Digital Signal Processors

- 9.2. Market Analysis, Insights and Forecast - by Countries

- 9.3. Market Analysis, Insights and Forecast - by China

- 9.4. Market Analysis, Insights and Forecast - by Japan

- 9.5. Market Analysis, Insights and Forecast - by India

- 9.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Asia Pacific APAC Semiconductor Device Market For Industrial Applications Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Discrete Semiconductors

- 10.1.2. Optoelectronics

- 10.1.3. Sensors

- 10.1.4. Integrated Circuits

- 10.1.4.1. Analog

- 10.1.4.2. Logic

- 10.1.4.3. Memory

- 10.1.4.4. Micro

- 10.1.4.4.1. Microprocessors (MPU)

- 10.1.4.4.2. Microcontrollers (MCU)

- 10.1.4.4.3. Digital Signal Processors

- 10.2. Market Analysis, Insights and Forecast - by Countries

- 10.3. Market Analysis, Insights and Forecast - by China

- 10.4. Market Analysis, Insights and Forecast - by Japan

- 10.5. Market Analysis, Insights and Forecast - by India

- 10.6. Market Analysis, Insights and Forecast - by Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ON Semiconductor Corporation*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micron Technology Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rohm Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kyocera Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xilinx Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Broadcom Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 STMicroelectronics NV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qualcomm Incorporated

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Samsung Electronics Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Renesas Electronics Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SK Hynix Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Advanced Semiconductor Engineering Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nvidia Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Intel Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Fujitsu Semiconductor Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global APAC Semiconductor Device Market For Industrial Applications Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 3: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 4: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Countries 2025 & 2033

- Figure 5: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Countries 2025 & 2033

- Figure 6: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by China 2025 & 2033

- Figure 7: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by China 2025 & 2033

- Figure 8: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Japan 2025 & 2033

- Figure 9: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Japan 2025 & 2033

- Figure 10: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by India 2025 & 2033

- Figure 11: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by India 2025 & 2033

- Figure 12: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Rest of Asia-Pacific 2025 & 2033

- Figure 13: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Rest of Asia-Pacific 2025 & 2033

- Figure 14: North America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Country 2025 & 2033

- Figure 15: North America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 17: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 18: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Countries 2025 & 2033

- Figure 19: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Countries 2025 & 2033

- Figure 20: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by China 2025 & 2033

- Figure 21: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by China 2025 & 2033

- Figure 22: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Japan 2025 & 2033

- Figure 23: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Japan 2025 & 2033

- Figure 24: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by India 2025 & 2033

- Figure 25: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by India 2025 & 2033

- Figure 26: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Rest of Asia-Pacific 2025 & 2033

- Figure 27: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Rest of Asia-Pacific 2025 & 2033

- Figure 28: South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Country 2025 & 2033

- Figure 29: South America APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 31: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 32: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Countries 2025 & 2033

- Figure 33: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Countries 2025 & 2033

- Figure 34: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by China 2025 & 2033

- Figure 35: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by China 2025 & 2033

- Figure 36: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Japan 2025 & 2033

- Figure 37: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Japan 2025 & 2033

- Figure 38: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by India 2025 & 2033

- Figure 39: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by India 2025 & 2033

- Figure 40: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Rest of Asia-Pacific 2025 & 2033

- Figure 41: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Rest of Asia-Pacific 2025 & 2033

- Figure 42: Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Country 2025 & 2033

- Figure 43: Europe APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 45: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Countries 2025 & 2033

- Figure 47: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Countries 2025 & 2033

- Figure 48: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by China 2025 & 2033

- Figure 49: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by China 2025 & 2033

- Figure 50: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Japan 2025 & 2033

- Figure 51: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Japan 2025 & 2033

- Figure 52: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by India 2025 & 2033

- Figure 53: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by India 2025 & 2033

- Figure 54: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Rest of Asia-Pacific 2025 & 2033

- Figure 55: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Rest of Asia-Pacific 2025 & 2033

- Figure 56: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Country 2025 & 2033

- Figure 57: Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 59: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 60: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Countries 2025 & 2033

- Figure 61: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Countries 2025 & 2033

- Figure 62: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by China 2025 & 2033

- Figure 63: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by China 2025 & 2033

- Figure 64: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Japan 2025 & 2033

- Figure 65: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Japan 2025 & 2033

- Figure 66: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by India 2025 & 2033

- Figure 67: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by India 2025 & 2033

- Figure 68: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Rest of Asia-Pacific 2025 & 2033

- Figure 69: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Rest of Asia-Pacific 2025 & 2033

- Figure 70: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million), by Country 2025 & 2033

- Figure 71: Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 3: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 4: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 5: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 6: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 7: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 9: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 10: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 11: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 12: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 13: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 14: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 19: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 20: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 21: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 22: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 23: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 24: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Brazil APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Argentina APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 29: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 30: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 31: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 32: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 33: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 34: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 35: United Kingdom APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Germany APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: France APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Spain APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Benelux APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Nordics APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 45: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 46: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 47: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 48: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 49: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 50: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 51: Turkey APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Israel APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: GCC APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: North Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 58: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Countries 2020 & 2033

- Table 59: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by China 2020 & 2033

- Table 60: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Japan 2020 & 2033

- Table 61: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by India 2020 & 2033

- Table 62: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Rest of Asia-Pacific 2020 & 2033

- Table 63: Global APAC Semiconductor Device Market For Industrial Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 64: China APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 65: India APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Japan APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: South Korea APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: ASEAN APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 69: Oceania APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific APAC Semiconductor Device Market For Industrial Applications Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Semiconductor Device Market For Industrial Applications?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the APAC Semiconductor Device Market For Industrial Applications?

Key companies in the market include Infineon Technologies AG, ON Semiconductor Corporation*List Not Exhaustive, NXP Semiconductors NV, Toshiba Corporation, Micron Technology Inc, Rohm Co Ltd, Kyocera Corporation, Xilinx Inc, Texas Instruments Inc, Broadcom Inc, STMicroelectronics NV, Qualcomm Incorporated, Samsung Electronics Co Ltd, Renesas Electronics Corporation, SK Hynix Inc, Advanced Semiconductor Engineering Inc, Nvidia Corporation, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the APAC Semiconductor Device Market For Industrial Applications?

The market segments include Device Type, Countries, China, Japan, India, Rest of Asia-Pacific.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Technologies like IoT and AI; Industry 4.0 Investments Driving The Demand For Automation.

6. What are the notable trends driving market growth?

Industry 4.0 Investments Driving The Demand For Automation.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions Resulting in Semiconductor Chip Shortage.

8. Can you provide examples of recent developments in the market?

May 2024: SK Hynix has unveiled ZUFS 4.0, a cutting-edge solution designed specifically for on-device AI applications in mobile devices, notably smartphones. Positioned as a flagship offering, the company anticipates that ZUFS 4.0 will not only solidify its leadership in AI memory within the NAND segment but also further leverage its success in high-speed DRAM, as seen with HBM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Semiconductor Device Market For Industrial Applications," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Semiconductor Device Market For Industrial Applications report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Semiconductor Device Market For Industrial Applications?

To stay informed about further developments, trends, and reports in the APAC Semiconductor Device Market For Industrial Applications, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence