Key Insights

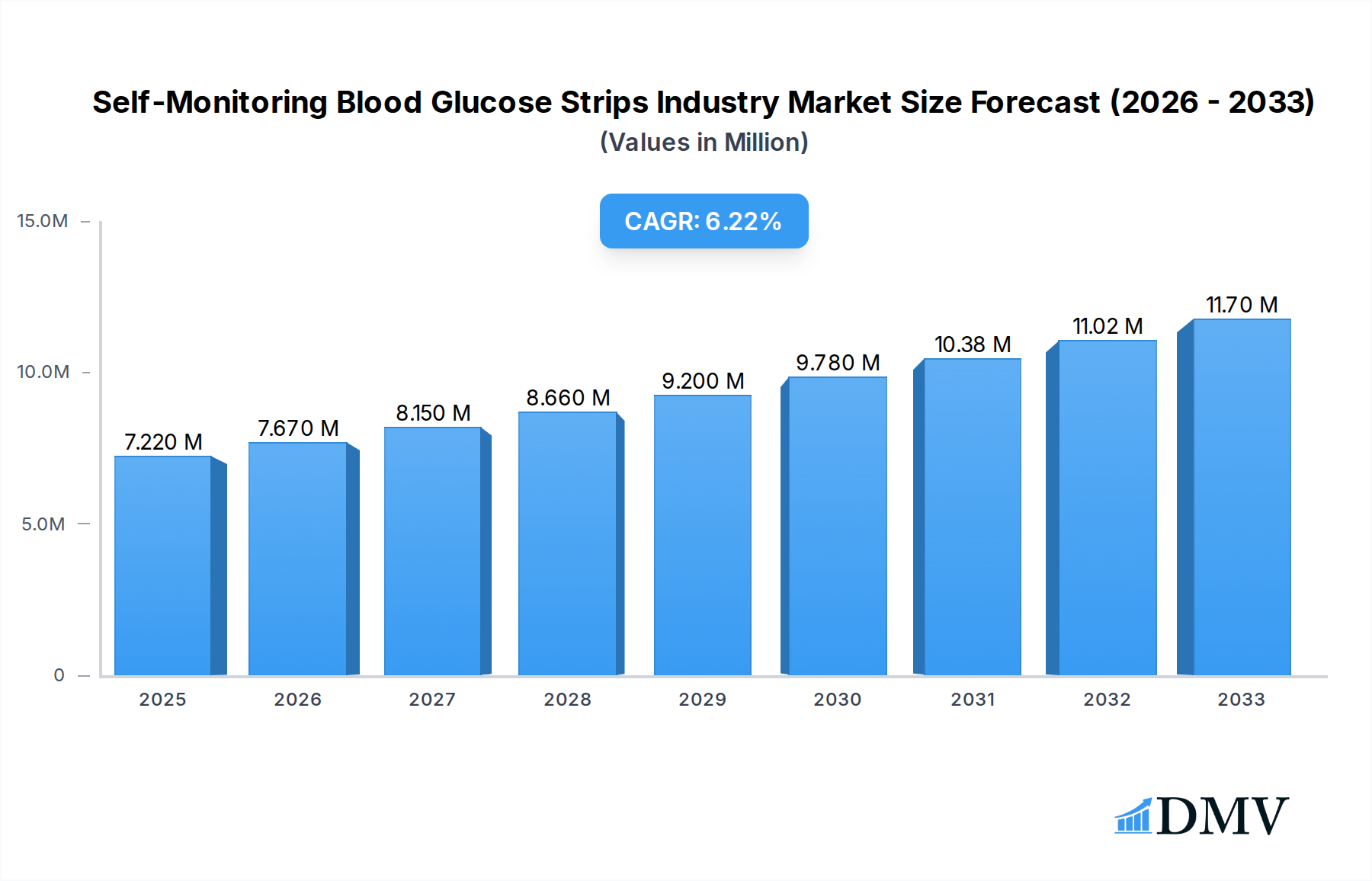

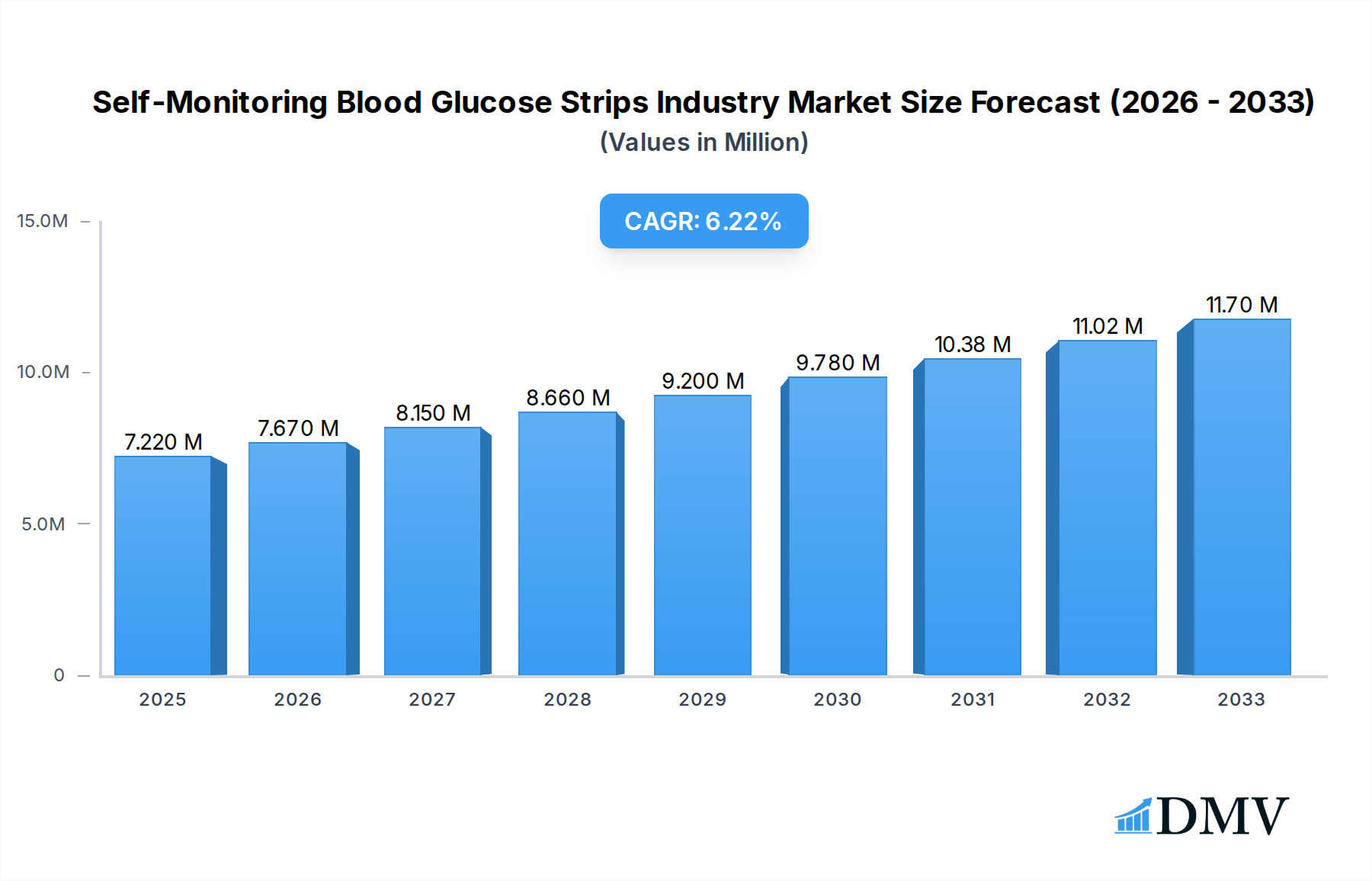

The global Self-Monitoring Blood Glucose Strips market is projected for robust growth, with an estimated market size of $7.22 billion in 2025, driven by a compelling CAGR of 6.23%. This expansion is fueled by the increasing prevalence of diabetes worldwide, a growing awareness among individuals about proactive health management, and significant advancements in diagnostic technologies that offer greater accuracy and ease of use. The market is further bolstered by supportive government initiatives aimed at improving diabetes care access and reimbursement policies that encourage the adoption of self-monitoring devices. Key segments within this industry include Glucometer Devices, Test Strips, and Lancets, with test strips representing a substantial portion of the market's value due to their recurring purchase nature. Leading companies such as Roche Diabetes Care, Abbott Diabetes Care, and Agamatrix are continuously innovating, introducing more sophisticated and user-friendly products that cater to the evolving needs of diabetic patients, thereby shaping the competitive landscape and driving market dynamism.

Self-Monitoring Blood Glucose Strips Industry Market Size (In Million)

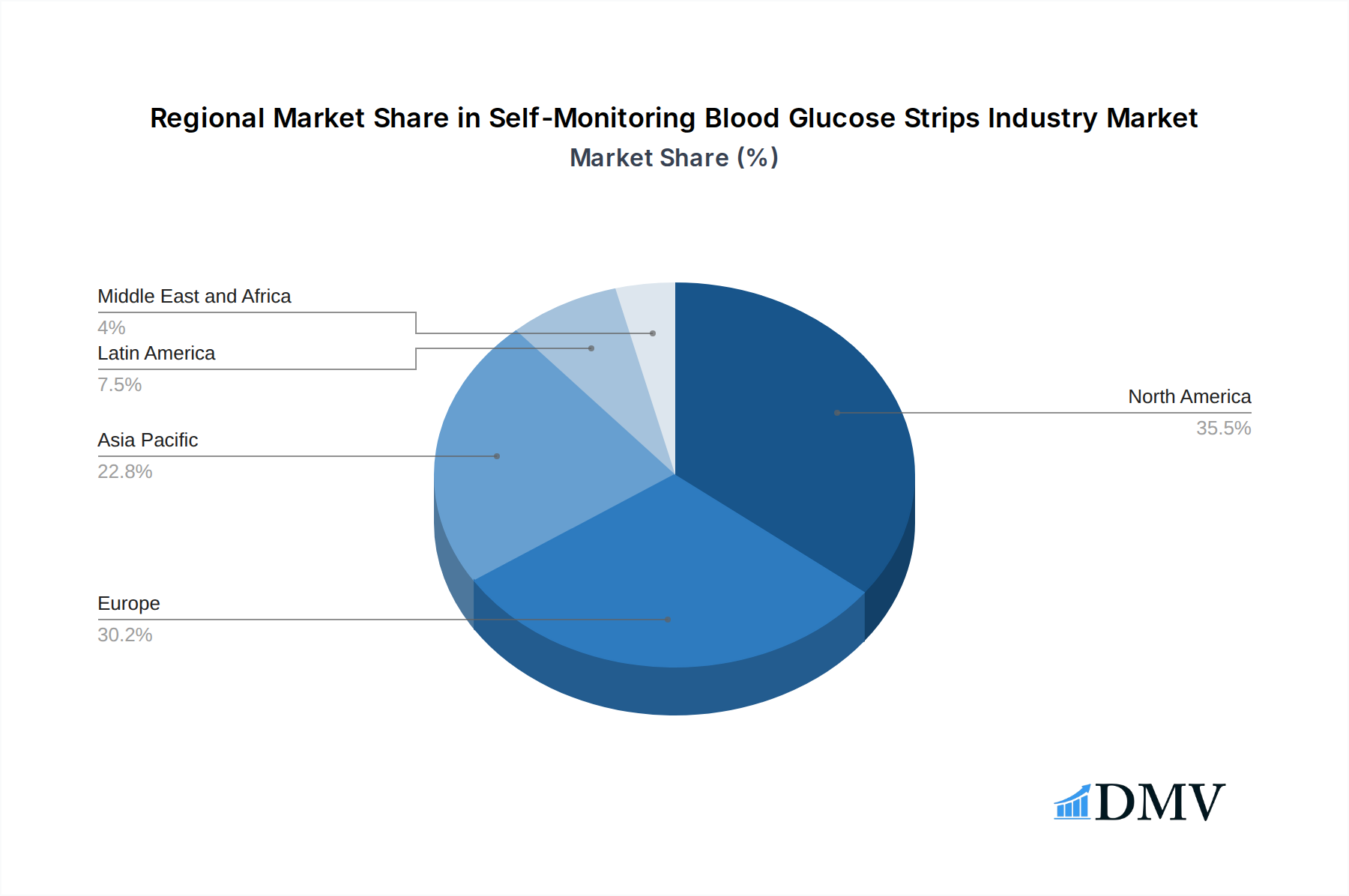

The market's trajectory is also influenced by emerging trends like the integration of connected glucometer devices with mobile applications for seamless data tracking and sharing with healthcare providers, and the development of continuous glucose monitoring (CGM) systems that offer a more comprehensive view of glucose levels. However, certain restraints, such as the high cost of some advanced testing technologies and the availability of alternative diagnostic methods, could present challenges. Geographically, North America and Europe currently dominate the market, driven by high diabetes rates and advanced healthcare infrastructure. The Asia Pacific region, however, is expected to witness the fastest growth due to a rapidly expanding patient base, increasing disposable incomes, and a growing focus on preventative healthcare. This dynamic environment, characterized by both significant opportunities and evolving challenges, presents a fertile ground for innovation and strategic expansion within the self-monitoring blood glucose strips industry.

Self-Monitoring Blood Glucose Strips Industry Company Market Share

This comprehensive report delves into the dynamic self-monitoring blood glucose strips industry, meticulously analyzing its market composition and evolving trends. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this research provides unparalleled insights for stakeholders. The market exhibits a moderately concentrated landscape, with key players like Agamatrix, Roche Diabetes Care, Abbott Diabetes Care, and Rossmax International holding significant market share. The company share analysis reveals a competitive environment driven by ongoing innovation catalysts, including advancements in biosensor technology and connectivity features. Regulatory landscapes, such as the April 2023 NHS England recommendations, play a crucial role in shaping market access and adoption. While substitute products exist, the demand for accurate and convenient blood glucose monitoring remains robust. End-user profiles are increasingly diverse, encompassing Type 1 and Type 2 diabetes patients, gestational diabetes, and pre-diabetes individuals, all seeking effective glucose management solutions. Mergers and acquisitions (M&A) activities, with an estimated M&A deal value of $500 Million, are expected to further consolidate the market and drive strategic partnerships. The report will detail these aspects, offering a clear picture of the current market standing and future trajectory of the blood glucose test strips market.

Self-Monitoring Blood Glucose Strips Industry Industry Evolution

The self-monitoring blood glucose strips industry has undergone a remarkable transformation, driven by a confluence of technological breakthroughs, evolving patient needs, and a growing global diabetes epidemic. Over the historical period of 2019–2024, the market demonstrated a steady growth trajectory, fueled by an increasing prevalence of diabetes worldwide and a greater emphasis on proactive health management. The base year of 2025 serves as a critical pivot point, with the forecast period of 2025–2033 projecting accelerated growth. This evolution is intrinsically linked to continuous technological advancements in blood glucose testing strips, moving beyond basic electrochemical sensing to incorporate features like smaller sample sizes, faster test times, and improved accuracy. The integration of smart technology has been a significant catalyst, with the advent of Bluetooth-enabled glucometers and mobile diabetes management applications transforming the user experience. As evidenced by LifeScan's June 2022 announcement regarding improved glycemic control through their connected OneTouch meter and app, real-world evidence is increasingly validating the benefits of these digital health solutions. Consumer demand is also shifting, with a growing preference for user-friendly, discreet, and data-rich monitoring devices. This demand is further amplified by rising healthcare awareness and the desire for personalized diabetes management strategies. The self-monitoring blood glucose strips market is thus not just about the strips themselves, but the entire ecosystem of connected devices and digital platforms that empower individuals to take greater control of their health. Market growth rates have consistently hovered around the 7-9% CAGR during the historical period, and projections suggest this trend will continue, potentially accelerating to 10-12% CAGR during the forecast period, as new markets emerge and existing ones deepen their adoption of advanced monitoring technologies. The introduction of novel materials and manufacturing processes for glucose test strips has also contributed to cost efficiencies and enhanced performance metrics, making these essential diagnostic tools more accessible globally. The increasing focus on preventive healthcare and early diagnosis of diabetes further propels the demand for reliable self-monitoring solutions.

Leading Regions, Countries, or Segments in Self-Monitoring Blood Glucose Strips Industry

The dominance within the self-monitoring blood glucose strips industry is multifaceted, with key regions and segments exhibiting distinct growth drivers and market penetration. Globally, North America and Europe have historically led the market, driven by a high prevalence of diabetes, advanced healthcare infrastructure, and a strong emphasis on patient self-management. However, the Asia-Pacific region is emerging as a significant growth powerhouse, fueled by increasing diabetes rates, a burgeoning middle class with greater disposable income, and expanding healthcare access. Within the Component segment, Test Strips constitute the largest and most crucial segment of the blood glucose monitoring market. This dominance is attributed to their consumable nature, requiring regular replacement, and their direct correlation with the widespread adoption of glucometer devices. The demand for glucometer devices remains robust, serving as the gateway for test strip usage. While Lancets are also essential components, their market share is comparatively smaller due to advancements in lancet technology that allow for fewer required per day and the development of alternative blood sampling methods.

- North America: Characterized by high diabetes prevalence, robust reimbursement policies, and a mature market for advanced connected diabetes management systems. Key drivers include early adoption of new technologies and a strong patient focus on glycemic control. Investment trends favor digital health integration and continuous glucose monitoring (CGM) technologies, which indirectly influence the demand for traditional blood glucose test strips.

- Europe: Similar to North America, Europe boasts a well-established market with a focus on evidence-based treatment guidelines and patient education. Regulatory bodies play a significant role in shaping product approvals and market access. The NHS England recommendations from April 2023 highlight the ongoing evaluation and refinement of commissioning strategies for blood glucose meters, testing strips, and lancets, indicating a mature yet actively managed market.

- Asia-Pacific: This region is experiencing exponential growth driven by rising diabetes incidence, increasing awareness, and improving economic conditions. Countries like China and India are major contributors, with a growing demand for affordable and accessible blood glucose monitoring solutions. Investment trends are shifting towards localized manufacturing and the development of cost-effective devices. Regulatory support is gradually improving, facilitating market entry for both domestic and international players.

- Latin America and Middle East & Africa: These regions represent emerging markets with significant untapped potential. Growth is driven by increasing diabetes diagnoses, government initiatives to improve healthcare access, and the gradual adoption of self-monitoring practices. Challenges include affordability and infrastructure development, but the long-term outlook is promising for the self-monitoring blood glucose strips industry.

Self-Monitoring Blood Glucose Strips Industry Product Innovations

Product innovation in the self-monitoring blood glucose strips industry is relentlessly focused on enhancing user convenience, accuracy, and connectivity. Manufacturers are developing blood glucose test strips that require smaller blood samples, offer faster test results within seconds, and boast improved accuracy to minimize discrepancies. Key advancements include the incorporation of novel enzyme technologies for greater stability and precision, and the development of strips with wider hematocrit ranges to accommodate diverse patient populations. Furthermore, the integration of these strips with smart glucometers and mobile applications is revolutionizing data management, enabling seamless tracking, trend analysis, and the sharing of vital information with healthcare providers. The unique selling proposition of these innovations lies in their ability to empower individuals with diabetes to achieve better glycemic control through more informed and proactive self-management.

Propelling Factors for Self-Monitoring Blood Glucose Strips Industry Growth

Several key factors are propelling the growth of the self-monitoring blood glucose strips industry. The ever-increasing global prevalence of diabetes, driven by lifestyle changes and an aging population, creates a sustained and expanding demand for glucose monitoring. Technological advancements, particularly in biosensor technology and wireless connectivity, are leading to more accurate, user-friendly, and integrated blood glucose testing solutions. Government initiatives and healthcare policies promoting early diagnosis and regular monitoring further stimulate market growth. Economic factors, such as rising disposable incomes in emerging markets, enhance affordability and access to these essential medical devices.

Obstacles in the Self-Monitoring Blood Glucose Strips Industry Market

Despite robust growth, the self-monitoring blood glucose strips industry faces several obstacles. Stringent regulatory approvals for new technologies and products can be time-consuming and costly, slowing down market entry. Supply chain disruptions, as experienced globally in recent years, can impact the availability and pricing of raw materials for blood glucose test strips. Intense competition among established and emerging players exerts downward pressure on prices, potentially affecting profit margins. Furthermore, the growing adoption of Continuous Glucose Monitoring (CGM) systems, while a part of the broader diabetes management landscape, presents a competitive alternative for certain patient segments seeking real-time, trend-based glucose data.

Future Opportunities in Self-Monitoring Blood Glucose Strips Industry

The self-monitoring blood glucose strips industry is poised for significant future opportunities. The expansion of healthcare access and improved economic conditions in emerging markets present vast untapped potential for blood glucose monitoring solutions. Advancements in AI and machine learning offer avenues for developing smarter algorithms within connected glucometer systems, providing personalized insights and predictive analytics for diabetes management. The integration of glucose test strips with other wearable health devices and the development of integrated diabetes care platforms represent a significant opportunity for creating comprehensive digital health ecosystems. The increasing focus on personalized medicine and preventative healthcare further amplifies the demand for accurate and accessible self-monitoring tools.

Major Players in the Self-Monitoring Blood Glucose Strips Industry Ecosystem

- Agamatrix

- Roche Diabetes Care

- Abbott Diabetes Care

- Rossmax International

- Medisana

- Acon

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia Diabetes Care

Key Developments in Self-Monitoring Blood Glucose Strips Industry Industry

- April 2023: NHS England released recommendations for commissioning after the national evaluation of blood glucose meters, testing strips, and lancets, indicating a focus on evidence-based procurement and optimized patient care pathways.

- June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) published Real World Evidence of Improved Glycemic Control in People with Diabetes. This study highlighted the benefits of using a Bluetooth-connected blood glucose meter with a mobile diabetes management application, specifically the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter, synced via Bluetooth wireless technology, in supporting improved glycemic control.

Strategic Self-Monitoring Blood Glucose Strips Industry Market Forecast

The strategic forecast for the self-monitoring blood glucose strips industry is characterized by sustained growth, driven by the global surge in diabetes prevalence and continuous technological innovation. The increasing adoption of connected devices and digital health platforms will further integrate blood glucose test strips into a comprehensive diabetes management ecosystem, offering enhanced data insights and personalized care. Emerging markets represent significant untapped potential, with rising healthcare expenditure and increased awareness driving demand for accessible and affordable monitoring solutions. Strategic partnerships and potential M&A activities will likely shape the competitive landscape, fostering innovation and market consolidation. The industry's ability to adapt to evolving regulatory frameworks and integrate with broader telehealth initiatives will be critical for capitalizing on future opportunities and maintaining a strong market position.

Self-Monitoring Blood Glucose Strips Industry Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Self-Monitoring Blood Glucose Strips Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Self-Monitoring Blood Glucose Strips Industry Regional Market Share

Geographic Coverage of Self-Monitoring Blood Glucose Strips Industry

Self-Monitoring Blood Glucose Strips Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The glucometer devices segment is expected to register the highest CAGR over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Agamatrix

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roche Diabetes Care

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abbott Diabetes Care

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rossmax International*List Not Exhaustive 7 2 Company Share Analysi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medisana

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bionime Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arkray

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LifeScan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ascensia Diabetes Care

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Agamatrix

List of Figures

- Figure 1: Global Self-Monitoring Blood Glucose Strips Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 7: Europe Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Japan Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Malaysia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Philippines Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 36: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oman Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Egypt Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Iran Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Monitoring Blood Glucose Strips Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Self-Monitoring Blood Glucose Strips Industry?

Key companies in the market include Agamatrix, Roche Diabetes Care, Abbott Diabetes Care, Rossmax International*List Not Exhaustive 7 2 Company Share Analysi, Medisana, Acon, Bionime Corporation, Arkray, LifeScan, Ascensia Diabetes Care.

3. What are the main segments of the Self-Monitoring Blood Glucose Strips Industry?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

The glucometer devices segment is expected to register the highest CAGR over the forecast period.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

April 2023: NHS england relased recommendations for commissioning after the national evaluation of blood glucose meters, testing strips, and lancets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Monitoring Blood Glucose Strips Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Monitoring Blood Glucose Strips Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Monitoring Blood Glucose Strips Industry?

To stay informed about further developments, trends, and reports in the Self-Monitoring Blood Glucose Strips Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence