Key Insights

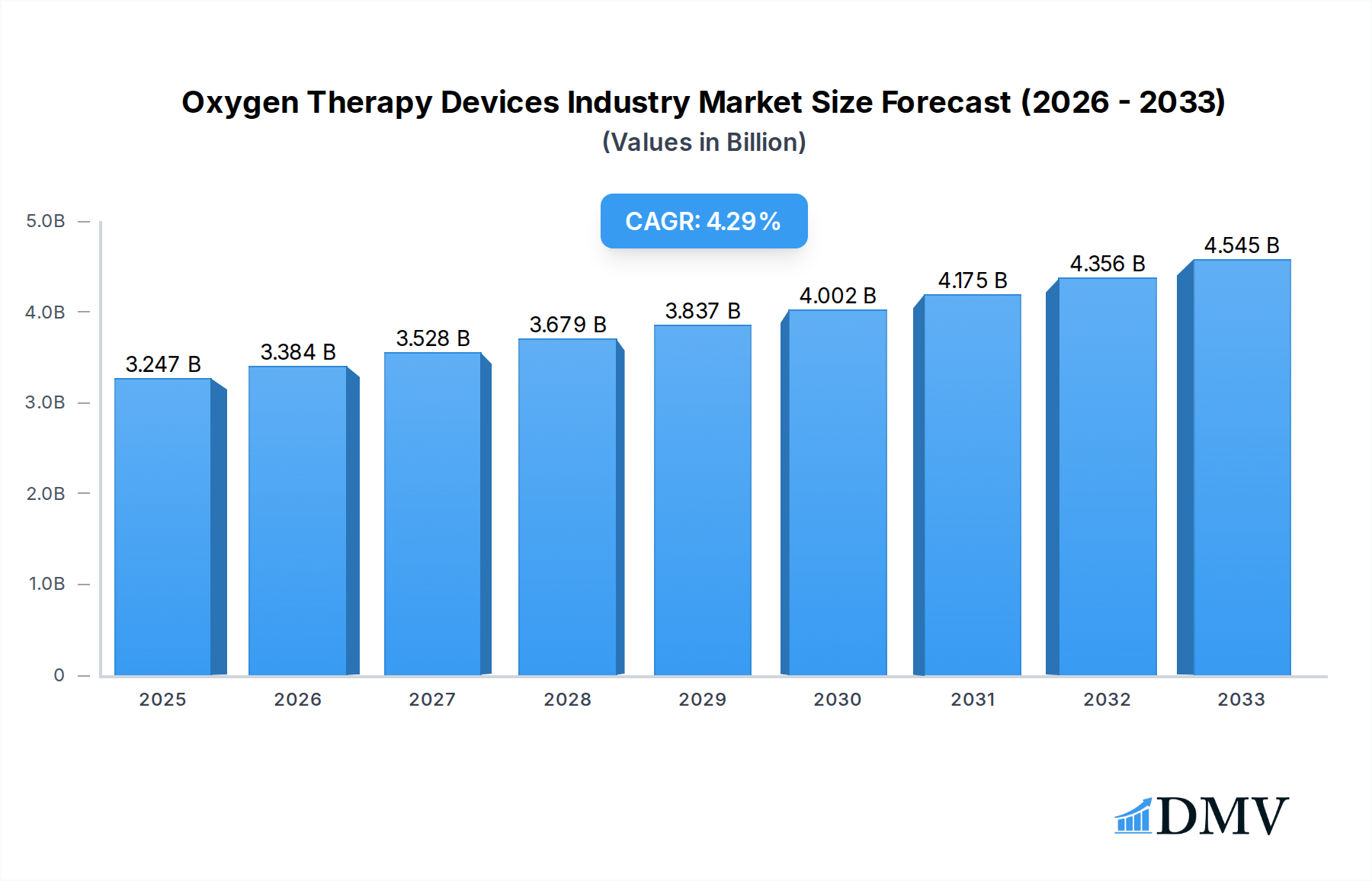

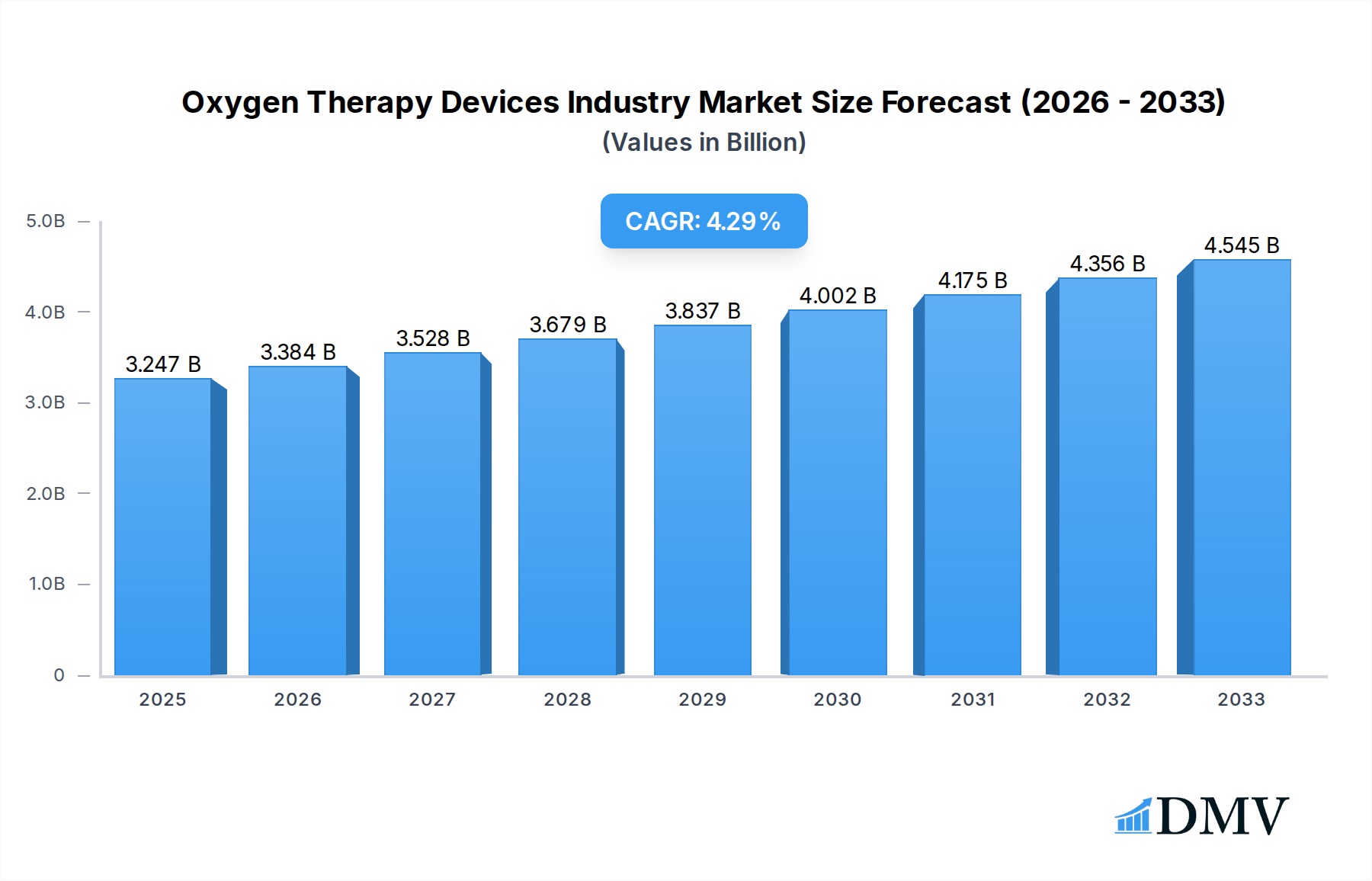

The global Hyperbaric Oxygen Therapy (HBOT) Devices market is poised for significant expansion, projected to reach $3247 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 4.3% during the forecast period of 2025-2033. This growth is primarily propelled by the increasing prevalence of chronic conditions like diabetic foot ulcers and decompression sickness, which are effectively managed with HBOT. Advances in technology, leading to more sophisticated and accessible monoplace and multiplace HBOT devices, are further fueling market penetration. The growing awareness among healthcare professionals and patients regarding the therapeutic benefits of hyperbaric oxygen therapy for a wider range of applications, including infection treatment and general wound healing, also contributes to this upward trajectory.

Oxygen Therapy Devices Industry Market Size (In Billion)

The market's expansion is also influenced by evolving healthcare infrastructure and increasing investments in advanced medical equipment, particularly in developed regions. However, the market faces certain restraints, such as the high initial cost of HBOT systems and the need for specialized training for healthcare personnel. Nevertheless, emerging economies present significant growth opportunities, with a rising demand for advanced medical treatments and improving healthcare access. The competitive landscape is characterized by key players focusing on product innovation, strategic collaborations, and expanding their geographical reach to cater to the diverse needs of the global market. The trend towards developing portable and user-friendly HBOT devices is also expected to shape the market's future.

Oxygen Therapy Devices Industry Company Market Share

Oxygen Therapy Devices Industry Market Composition & Trends

The Oxygen Therapy Devices Industry is characterized by a dynamic market structure with significant growth potential, driven by increasing awareness of hyperbaric oxygen therapy (HBOT) applications and technological advancements. The market concentration is moderate, with key players continually investing in research and development to introduce innovative solutions for wound healing, decompression sickness, diabetic foot ulcers, gas embolism, and infection treatment. Regulatory landscapes, while stringent, are evolving to accommodate the growing evidence supporting HBOT's efficacy. Substitute products are limited, as HBOT offers unique therapeutic benefits. End-user profiles encompass hospitals, clinics, and increasingly, homecare settings, reflecting a shift towards accessible patient care. Mergers and acquisitions (M&A) activities are anticipated to increase as larger entities seek to consolidate market share and expand their product portfolios, with recent M&A deal values expected to reach $XXX million. The market share distribution is expected to see continued dominance by monoplace HBOT devices due to their widespread adoption and cost-effectiveness, though multiplace HBOT devices will remain crucial for specialized applications.

Oxygen Therapy Devices Industry Industry Evolution

The Oxygen Therapy Devices Industry has witnessed remarkable evolution over the historical period (2019–2024), transitioning from niche medical applications to a more mainstream therapeutic modality. The study period (2019–2033) encompasses a significant trajectory of growth, with the base year (2025) and estimated year (2025) reflecting a robust expansion phase. Technological advancements have been a cornerstone of this evolution, leading to the development of more sophisticated and patient-friendly hyperbaric oxygen therapy (HBOT) systems. The shift in consumer demands is palpable, with an increasing number of patients and healthcare providers recognizing the efficacy of HBOT in treating a wide array of conditions, including chronic non-healing wounds, neurological disorders, and post-operative recovery. This growing acceptance is supported by a wealth of clinical research and positive patient outcomes, contributing to an anticipated compound annual growth rate (CAGR) of approximately XX% during the forecast period (2025–2033).

Key milestones in this evolution include:

- Increased Adoption in Chronic Wound Management: The proven effectiveness of HBOT in accelerating wound healing, particularly for diabetic foot ulcers and other complex wounds, has been a significant growth catalyst. This has led to expanded indications and greater reimbursement from insurance providers, making HBOT more accessible.

- Technological Refinements: Innovations in device design have focused on enhancing patient comfort, safety, and ease of operation. This includes advancements in pressure control, oxygen delivery systems, and patient monitoring capabilities, making monoplace HBOT devices more appealing for diverse settings.

- Growing Awareness of Neurological Benefits: Emerging research into the potential of HBOT for conditions such as stroke recovery, traumatic brain injury, and post-concussion syndrome has opened new avenues for market growth.

- Expansion of Homecare HBOT: The development of more compact and user-friendly HBOT systems is facilitating their adoption in homecare settings, empowering patients to receive therapy conveniently, further driving market expansion.

- Integration with Standard Treatment Protocols: HBOT is increasingly being integrated as an adjunct therapy rather than a standalone treatment, enhancing its perceived value and adoption rates across various medical specialties.

The market's trajectory is strongly influenced by investments in R&D, favorable reimbursement policies, and a growing understanding of HBOT's multi-faceted therapeutic potential. The industry's ability to adapt to evolving healthcare needs and technological breakthroughs will be crucial for sustained growth throughout the forecast period. The market size is projected to reach $XX billion by 2033.

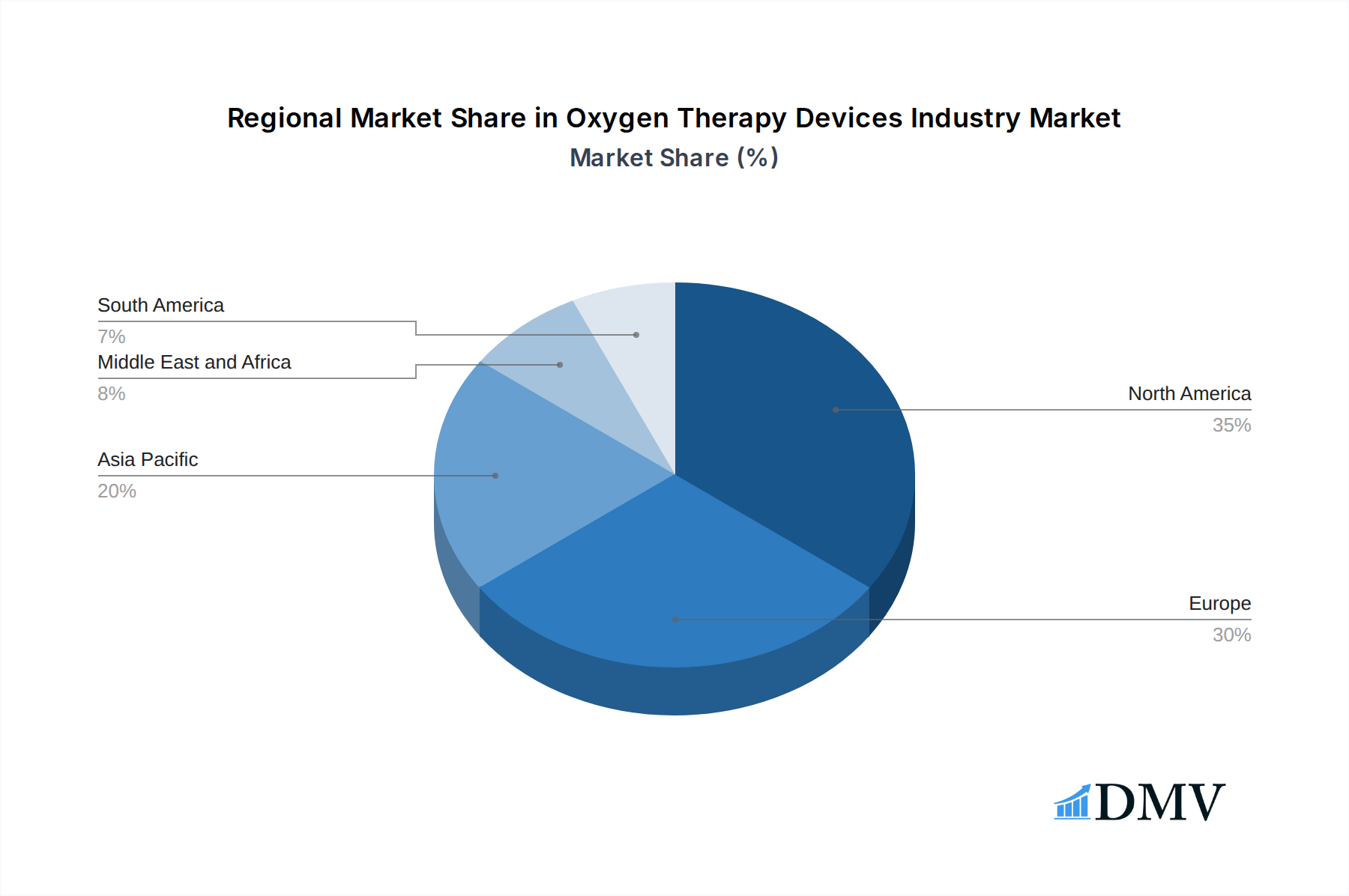

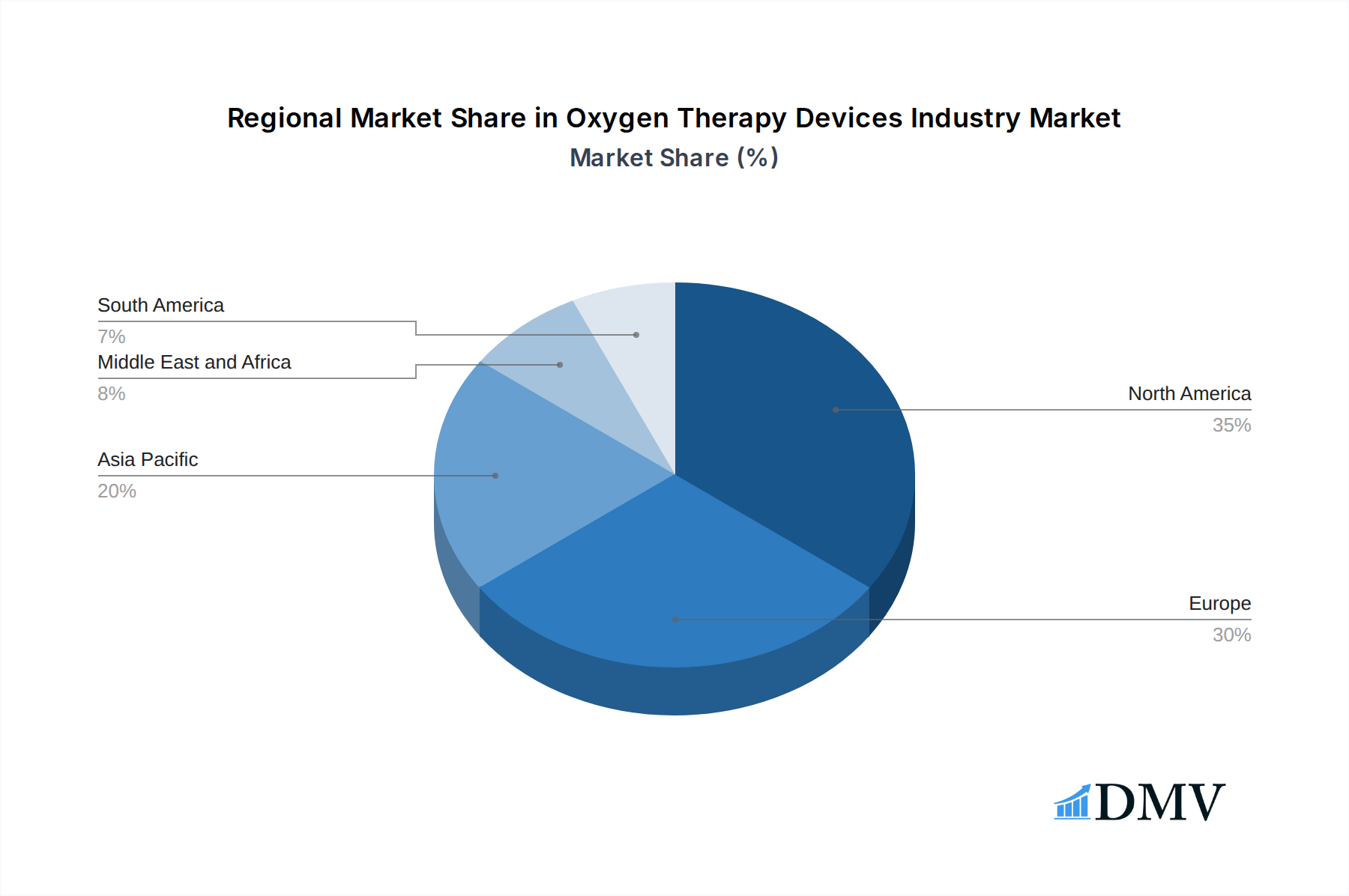

Leading Regions, Countries, or Segments in Oxygen Therapy Devices Industry

The Oxygen Therapy Devices Industry landscape is dominated by regions and segments demonstrating significant healthcare infrastructure, robust investment in medical technologies, and a high prevalence of conditions benefiting from hyperbaric oxygen therapy (HBOT). North America, particularly the United States, has consistently led the market due to its advanced healthcare system, substantial research funding, and a high incidence of chronic diseases like diabetes, which leads to conditions like diabetic foot ulcers. The strong emphasis on wound care and rehabilitation further bolsters the demand for HBOT.

Key Drivers for Regional Dominance:

- Advanced Healthcare Infrastructure: Well-established hospital networks, specialized wound care centers, and the presence of leading research institutions facilitate the adoption and integration of HBOT.

- Favorable Reimbursement Policies: Comprehensive insurance coverage for specific HBOT indications in countries like the US significantly drives patient access and market growth.

- High Prevalence of Target Conditions: A high incidence of diabetic foot ulcers, decompression sickness (due to recreational activities), and other chronic wounds creates a consistent demand for therapeutic solutions.

- Technological Adoption and Innovation: Regions with a strong appetite for adopting cutting-edge medical devices and a thriving ecosystem for innovation contribute to market leadership.

In terms of Product Type, Monoplace HBOT Devices currently hold the largest market share and are projected to continue their dominance throughout the forecast period. Their widespread adoption is attributed to their cost-effectiveness, ease of installation, and suitability for a broader range of clinical settings, including smaller clinics and outpatient facilities.

- Monoplace HBOT Devices: These devices offer individualized treatment chambers, making them highly versatile for various applications, including wound healing and decompression sickness. Their growing affordability and ease of use are key drivers.

- Multiplace HBOT Devices: While requiring larger infrastructure and higher initial investment, multiplace devices remain critical for institutions that handle a high volume of patients or require specialized protocols. They are particularly important for treating severe cases of decompression sickness and gas embolism.

- Topical HBOT Devices: Though a smaller segment, topical HBOT is gaining traction for localized wound treatment, offering a less invasive alternative for certain applications.

Among the Application segments, Wound Healing is the most significant driver for the Oxygen Therapy Devices Industry. This encompasses a broad spectrum of conditions, including diabetic foot ulcers, pressure ulcers, and chronic non-healing wounds, where HBOT has demonstrated remarkable efficacy in promoting tissue regeneration and reducing amputation rates.

- Wound Healing: This segment, driven by the increasing prevalence of diabetes and its complications, represents the largest market share. The ability of HBOT to deliver high concentrations of oxygen to hypoxic tissues is crucial for accelerating the healing process.

- Diabetic Foot Ulcers: A critical sub-segment within wound healing, demanding specialized HBOT interventions to prevent severe complications and amputations.

- Decompression Sickness: A primary application for HBOT, particularly in diving and aviation industries, where rapid and effective treatment is paramount.

- Infection Treatment: HBOT's ability to enhance the efficacy of antibiotics and boost the immune system makes it valuable in treating certain chronic infections.

- Gas Embolism: A life-threatening condition requiring immediate HBOT intervention for survival and recovery.

Countries like Germany and the UK also exhibit significant market presence due to their well-developed healthcare systems and increasing focus on advanced wound care. Emerging economies in Asia-Pacific are showing promising growth due to rising healthcare expenditure and a growing awareness of HBOT's therapeutic benefits.

Oxygen Therapy Devices Industry Regional Market Share

Oxygen Therapy Devices Industry Product Innovations

Product innovations in the Oxygen Therapy Devices Industry are primarily focused on enhancing patient comfort, improving treatment efficiency, and expanding the range of treatable conditions. Manufacturers are developing lighter, more portable monoplace HBOT devices with intuitive user interfaces and advanced safety features. Innovations in oxygen delivery systems are enabling precise control of oxygen concentration and pressure, optimizing therapeutic outcomes for wound healing, diabetic foot ulcers, and decompression sickness. Furthermore, advancements in biomaterials and adjunctive therapies are being explored to complement HBOT's effects, leading to more comprehensive treatment protocols. The development of integrated monitoring systems and remote patient management capabilities also signifies a push towards more personalized and accessible HBOT solutions.

Propelling Factors for Oxygen Therapy Devices Industry Growth

Several key factors are propelling the Oxygen Therapy Devices Industry forward. The increasing global prevalence of chronic diseases, particularly diabetes, leading to a rise in diabetic foot ulcers and other complex wounds, is a primary driver. Technological advancements in HBOT devices, making them more accessible, user-friendly, and cost-effective, are also crucial. Favorable reimbursement policies in various regions for specific indications like wound healing are enhancing market access. Furthermore, growing clinical evidence supporting the efficacy of hyperbaric oxygen therapy for a wider range of conditions, including neurological disorders and infection treatment, is expanding the application scope. Increased awareness among healthcare professionals and patients about the benefits of HBOT is also contributing significantly to market expansion.

Obstacles in the Oxygen Therapy Devices Industry Market

Despite its growth potential, the Oxygen Therapy Devices Industry faces certain obstacles. High initial capital investment for some multiplace HBOT devices can be a deterrent for smaller healthcare facilities. Stringent regulatory approval processes in certain markets can lead to delays in product launches. The limited availability of trained HBOT technicians and healthcare professionals can also pose a challenge to widespread adoption. Furthermore, evolving reimbursement landscapes and the need for consistent clinical evidence to justify cost-effectiveness for all potential applications remain ongoing considerations. Supply chain disruptions, though often temporary, can impact manufacturing and delivery timelines, affecting market dynamics.

Future Opportunities in Oxygen Therapy Devices Industry

The Oxygen Therapy Devices Industry is poised for significant future opportunities. The expanding applications of HBOT in areas such as neurological rehabilitation, post-operative recovery, and even sports medicine present substantial growth potential. The development of more compact, portable, and affordable topical HBOT devices can unlock new markets, particularly in homecare and emerging economies. Increased focus on personalized medicine and precision therapy will drive the demand for advanced HBOT systems with sophisticated monitoring and control features. Partnerships between device manufacturers and research institutions to explore novel therapeutic applications and generate robust clinical data will be key to unlocking future growth avenues.

Major Players in the Oxygen Therapy Devices Industry Ecosystem

- SOS Medical Group Ltd

- Hyperbaric SAC

- Environmental Tectonics Corporation

- Sechrist Industries Inc

- HYPERBARIC MODULAR SYSTEMS INC (HMS)

- Hearmec Co Ltd

- Fink Engineering

- HAUX-LIFE-SUPPORT GmbH

- Hpotech Hyperbaric Solutions

Key Developments in Oxygen Therapy Devices Industry Industry

- February 2023: Maui Health opened a new outpatient facility in Hawaii that will offer a comprehensive approach for patients with nonhealing wounds, with treatments including hyperbaric oxygen therapy. This development underscores the growing recognition of HBOT's role in advanced wound care.

- August 2022: HBOT-India launched one of the first medical-grade hyperbaric oxygen therapy in Gurugram, Delhi NCR. Adding hyperbaric oxygen therapy to the standard of care reduces the risk of major amputation by approximately 20-30 % and increases the wound healing rate by 9-10 times. This launch signifies the expansion of advanced HBOT services in emerging markets and highlights its proven impact on critical patient outcomes.

Strategic Oxygen Therapy Devices Industry Market Forecast

The Oxygen Therapy Devices Industry is projected for sustained and robust growth throughout the forecast period (2025–2033). Key growth catalysts include the escalating global burden of chronic diseases, particularly diabetes and associated diabetic foot ulcers, driving demand for effective wound healing solutions. Advancements in monoplace HBOT devices, making them more accessible and cost-effective, will further fuel market penetration. The expanding body of clinical evidence supporting HBOT's efficacy in diverse applications, from decompression sickness to infection treatment, is continuously broadening its therapeutic scope. Strategic investments in research and development, coupled with favorable reimbursement policies in key markets, are expected to create a highly favorable environment for market expansion. The industry's ability to innovate and adapt to evolving healthcare needs will be paramount in realizing its full market potential, reaching an estimated market size of $XX billion by 2033.

Oxygen Therapy Devices Industry Segmentation

-

1. Application

- 1.1. Decompression Sickness

- 1.2. Diabetic Foot Ulcers

- 1.3. Gas Embolism

- 1.4. Infection Treatment

- 1.5. Wound Healing

- 1.6. Other Applications

-

2. Product Type

- 2.1. Monoplace HBOT Devices

- 2.2. Multiplace HBOT Devices

- 2.3. Topical HBOT Devices

Oxygen Therapy Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Oxygen Therapy Devices Industry Regional Market Share

Geographic Coverage of Oxygen Therapy Devices Industry

Oxygen Therapy Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Acute and Chronic Wounds; Widening Application of HBOT Devices in Cosmetic Procedures and Wound Healing; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Hyperbaric Oxygen Therapy; Widening Gap Between Off-label Uses and FDA-approved Uses

- 3.4. Market Trends

- 3.4.1. Monoplace HBOT Devices Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Decompression Sickness

- 5.1.2. Diabetic Foot Ulcers

- 5.1.3. Gas Embolism

- 5.1.4. Infection Treatment

- 5.1.5. Wound Healing

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Monoplace HBOT Devices

- 5.2.2. Multiplace HBOT Devices

- 5.2.3. Topical HBOT Devices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Decompression Sickness

- 6.1.2. Diabetic Foot Ulcers

- 6.1.3. Gas Embolism

- 6.1.4. Infection Treatment

- 6.1.5. Wound Healing

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Monoplace HBOT Devices

- 6.2.2. Multiplace HBOT Devices

- 6.2.3. Topical HBOT Devices

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Decompression Sickness

- 7.1.2. Diabetic Foot Ulcers

- 7.1.3. Gas Embolism

- 7.1.4. Infection Treatment

- 7.1.5. Wound Healing

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Monoplace HBOT Devices

- 7.2.2. Multiplace HBOT Devices

- 7.2.3. Topical HBOT Devices

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Decompression Sickness

- 8.1.2. Diabetic Foot Ulcers

- 8.1.3. Gas Embolism

- 8.1.4. Infection Treatment

- 8.1.5. Wound Healing

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Monoplace HBOT Devices

- 8.2.2. Multiplace HBOT Devices

- 8.2.3. Topical HBOT Devices

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Decompression Sickness

- 9.1.2. Diabetic Foot Ulcers

- 9.1.3. Gas Embolism

- 9.1.4. Infection Treatment

- 9.1.5. Wound Healing

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Monoplace HBOT Devices

- 9.2.2. Multiplace HBOT Devices

- 9.2.3. Topical HBOT Devices

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Oxygen Therapy Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Decompression Sickness

- 10.1.2. Diabetic Foot Ulcers

- 10.1.3. Gas Embolism

- 10.1.4. Infection Treatment

- 10.1.5. Wound Healing

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Monoplace HBOT Devices

- 10.2.2. Multiplace HBOT Devices

- 10.2.3. Topical HBOT Devices

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SOS Medical Group Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyperbaric SAC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Environmental Tectonics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sechrist Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HYPERBARIC MODULAR SYSTEMS INC (HMS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hearmec Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fink Engineering

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HAUX-LIFE-SUPPORT GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hpotech Hyperbaric Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 SOS Medical Group Ltd

List of Figures

- Figure 1: Global Oxygen Therapy Devices Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Oxygen Therapy Devices Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Oxygen Therapy Devices Industry Revenue (million), by Application 2025 & 2033

- Figure 4: North America Oxygen Therapy Devices Industry Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Oxygen Therapy Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Oxygen Therapy Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Oxygen Therapy Devices Industry Revenue (million), by Product Type 2025 & 2033

- Figure 8: North America Oxygen Therapy Devices Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 9: North America Oxygen Therapy Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Oxygen Therapy Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 11: North America Oxygen Therapy Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 12: North America Oxygen Therapy Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Oxygen Therapy Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Oxygen Therapy Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Oxygen Therapy Devices Industry Revenue (million), by Application 2025 & 2033

- Figure 16: Europe Oxygen Therapy Devices Industry Volume (K Unit), by Application 2025 & 2033

- Figure 17: Europe Oxygen Therapy Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Oxygen Therapy Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Oxygen Therapy Devices Industry Revenue (million), by Product Type 2025 & 2033

- Figure 20: Europe Oxygen Therapy Devices Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Oxygen Therapy Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Oxygen Therapy Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Oxygen Therapy Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Oxygen Therapy Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Oxygen Therapy Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Oxygen Therapy Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Oxygen Therapy Devices Industry Revenue (million), by Application 2025 & 2033

- Figure 28: Asia Pacific Oxygen Therapy Devices Industry Volume (K Unit), by Application 2025 & 2033

- Figure 29: Asia Pacific Oxygen Therapy Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Oxygen Therapy Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Oxygen Therapy Devices Industry Revenue (million), by Product Type 2025 & 2033

- Figure 32: Asia Pacific Oxygen Therapy Devices Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 33: Asia Pacific Oxygen Therapy Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Asia Pacific Oxygen Therapy Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Oxygen Therapy Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Oxygen Therapy Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Oxygen Therapy Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Oxygen Therapy Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Oxygen Therapy Devices Industry Revenue (million), by Application 2025 & 2033

- Figure 40: Middle East and Africa Oxygen Therapy Devices Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Middle East and Africa Oxygen Therapy Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East and Africa Oxygen Therapy Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East and Africa Oxygen Therapy Devices Industry Revenue (million), by Product Type 2025 & 2033

- Figure 44: Middle East and Africa Oxygen Therapy Devices Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 45: Middle East and Africa Oxygen Therapy Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Middle East and Africa Oxygen Therapy Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Middle East and Africa Oxygen Therapy Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Oxygen Therapy Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Oxygen Therapy Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Oxygen Therapy Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Oxygen Therapy Devices Industry Revenue (million), by Application 2025 & 2033

- Figure 52: South America Oxygen Therapy Devices Industry Volume (K Unit), by Application 2025 & 2033

- Figure 53: South America Oxygen Therapy Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: South America Oxygen Therapy Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: South America Oxygen Therapy Devices Industry Revenue (million), by Product Type 2025 & 2033

- Figure 56: South America Oxygen Therapy Devices Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 57: South America Oxygen Therapy Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 58: South America Oxygen Therapy Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 59: South America Oxygen Therapy Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 60: South America Oxygen Therapy Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Oxygen Therapy Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Oxygen Therapy Devices Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 5: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 23: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Germany Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 40: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 41: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: China Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Japan Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: India Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 56: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 57: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 58: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 59: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: GCC Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Application 2020 & 2033

- Table 68: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 70: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 71: Global Oxygen Therapy Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 72: Global Oxygen Therapy Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Oxygen Therapy Devices Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Oxygen Therapy Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxygen Therapy Devices Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Oxygen Therapy Devices Industry?

Key companies in the market include SOS Medical Group Ltd, Hyperbaric SAC, Environmental Tectonics Corporation, Sechrist Industries Inc, HYPERBARIC MODULAR SYSTEMS INC (HMS), Hearmec Co Ltd, Fink Engineering, HAUX-LIFE-SUPPORT GmbH, Hpotech Hyperbaric Solutions.

3. What are the main segments of the Oxygen Therapy Devices Industry?

The market segments include Application, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3247 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Acute and Chronic Wounds; Widening Application of HBOT Devices in Cosmetic Procedures and Wound Healing; Technological Advancements.

6. What are the notable trends driving market growth?

Monoplace HBOT Devices Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Hyperbaric Oxygen Therapy; Widening Gap Between Off-label Uses and FDA-approved Uses.

8. Can you provide examples of recent developments in the market?

February 2023: Maui Health opened a new outpatient facility in Hawaii that will offer a comprehensive approach for patients with nonhealing wounds, with treatments including hyperbaric oxygen therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oxygen Therapy Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oxygen Therapy Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oxygen Therapy Devices Industry?

To stay informed about further developments, trends, and reports in the Oxygen Therapy Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence