Key Insights

The Australian retail market, projected to reach 551.11 billion AUD by 2025 with a CAGR of 3.1% through 2033, is experiencing significant expansion. This growth is propelled by demographic shifts, including population increases and rising disposable incomes, which enhance consumer spending. The burgeoning e-commerce sector and the adoption of omnichannel strategies are fundamentally reshaping the retail environment, offering unparalleled convenience and choice. Furthermore, the integration of advanced technologies, such as AI-driven personalization and sophisticated supply chain management, is optimizing operational efficiency and elevating the customer experience. Key challenges include intensifying competition from international and online retailers, demanding continuous adaptation to evolving consumer preferences. Managing operational costs, including labor and logistics, also poses a significant profitability hurdle. The market is diversified across essential sectors like groceries, apparel, electronics, and home goods. Dominant players, including Coles Group, Woolworths Group Ltd, and Wesfarmers Ltd, are strategically investing in both physical store enhancements and digital infrastructure to fortify their market positions. Retail activity is primarily concentrated in major urban centers like Sydney and Melbourne, yet robust engagement is observed across all Australian states and territories.

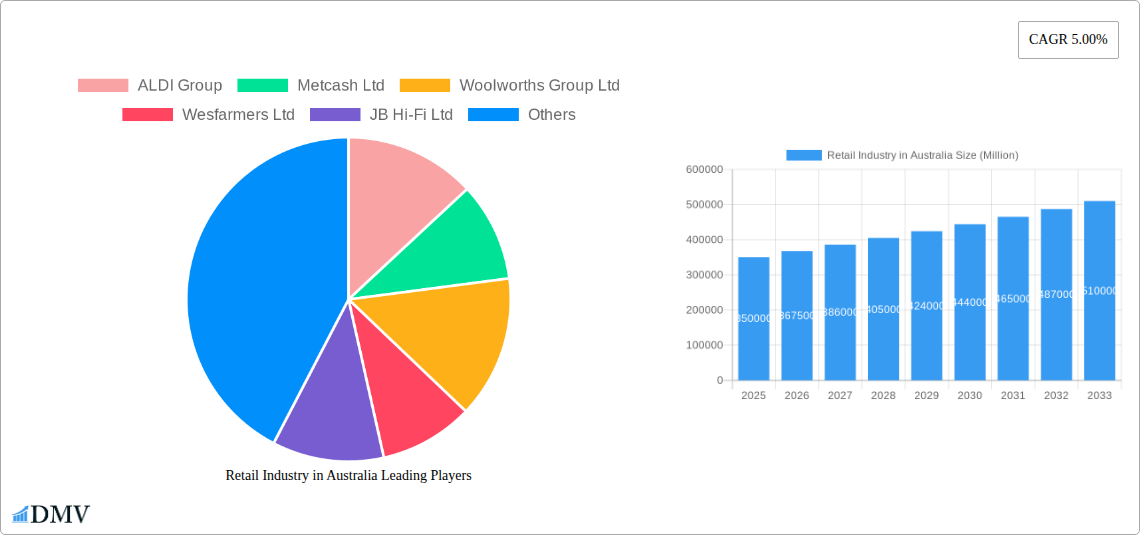

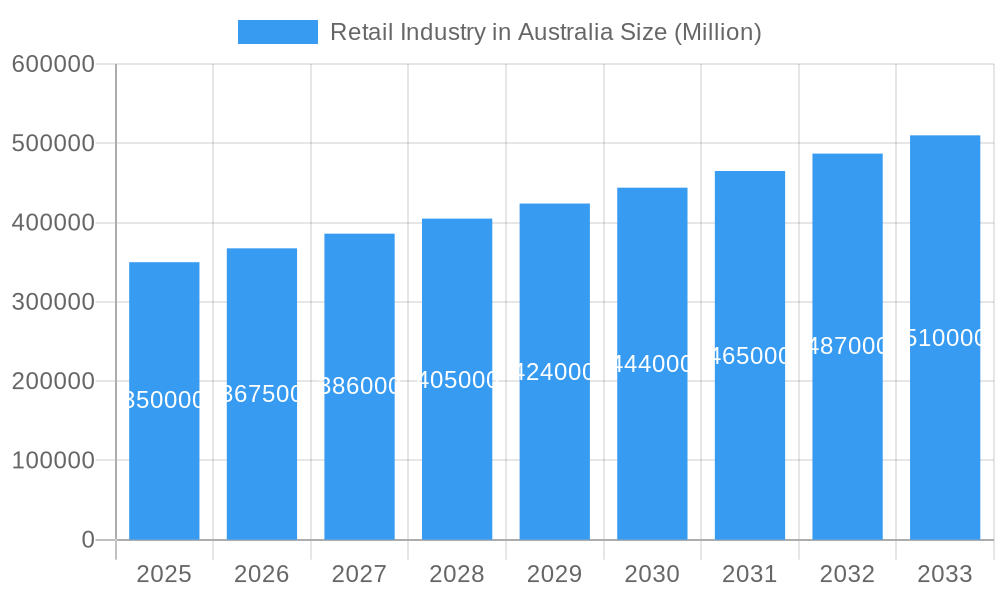

Retail Industry in Australia Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, potentially modulated by macroeconomic variables such as inflation and interest rates. Market share competition is expected to escalate, with a premium placed on exceptional customer experiences, operational excellence, and strategic alliances. Smaller retailers must leverage niche specializations, robust branding, and effective digital marketing to compete effectively. Overall, the Australian retail market presents a promising landscape for growth and innovation. Success will be contingent upon agility, strategic foresight, and an unwavering commitment to customer-centricity.

Retail Industry in Australia Company Market Share

Retail Industry in Australia: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Australian retail industry, offering invaluable data and projections for stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is crucial for understanding the current market landscape and anticipating future trends. The Australian retail market, valued at xx Million in 2024, is expected to reach xx Million by 2033, presenting both significant opportunities and challenges.

Retail Industry in Australia Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Australian retail sector. We delve into the market share distribution of key players, including ALDI Group, Metcash Ltd, Woolworths Group Ltd, Wesfarmers Ltd, JB Hi-Fi Ltd, Coles Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, and Kogan.com Ltd (list not exhaustive), and explore the impact of mergers and acquisitions (M&A) activities. The report examines the influence of substitute products and evolving end-user profiles, providing a comprehensive overview of market concentration and future projections.

- Market Share Distribution (2024): Woolworths Group Ltd holds an estimated xx% market share, followed by Coles Group at xx%, with other players such as ALDI and Wesfarmers holding significant, but smaller shares.

- M&A Activity (2019-2024): Total M&A deal value estimated at xx Million, with a focus on strategic acquisitions driving consolidation within specific segments.

- Regulatory Landscape: Analysis of relevant regulations impacting pricing, advertising, and consumer protection.

- Innovation Catalysts: Examination of factors driving innovation, including technological advancements and consumer demand for sustainable and ethical products.

Retail Industry in Australia Industry Evolution

This section charts the evolution of the Australian retail industry from 2019 to 2033, tracing market growth trajectories, analyzing technological advancements, and exploring the shifting preferences of Australian consumers. Specific data points illustrating growth rates and technology adoption metrics are provided, offering valuable insights into the industry's dynamic nature. The influence of e-commerce, omnichannel strategies, and the rise of personalized shopping experiences are examined in detail, alongside the impact of external factors like economic fluctuations and changing demographics. We analyze the impact of the COVID-19 pandemic and its lasting effects on consumer behavior and retail strategies. Growth rates are projected to fluctuate, peaking at xx% in [Year] and slowing to xx% by 2033 due to market saturation and economic factors.

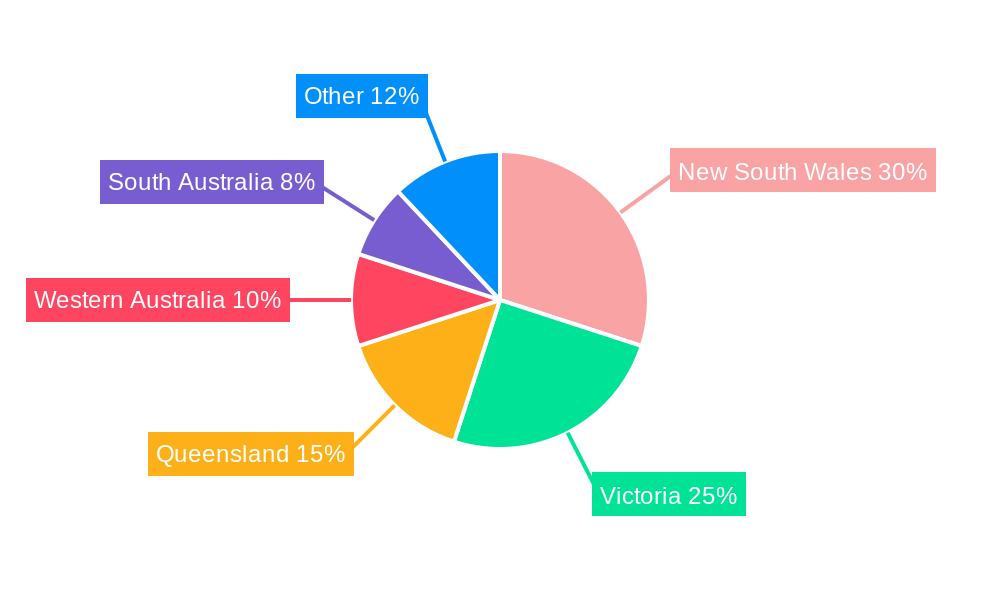

Leading Regions, Countries, or Segments in Retail Industry in Australia

This section identifies the dominant regions and segments within the Australian retail market. We explore the factors driving their success, including investment trends, regulatory support, and consumer demographics.

Key Drivers of Dominance:

- Major Metropolitan Areas: Sydney, Melbourne, and Brisbane continue to dominate due to high population density and consumer spending.

- E-commerce Growth: Significant expansion in online retail channels driving growth across all regions.

- Government Initiatives: Support for small businesses and regional development.

In-depth Analysis: The dominance of specific segments (e.g., grocery, apparel, electronics) is analyzed, highlighting factors like consumer preferences, pricing strategies, and brand loyalty. Detailed market sizing for each segment, with projections to 2033, will be included.

Retail Industry in Australia Product Innovations

This section details significant product innovations, highlighting unique selling propositions (USPs) and technological advancements driving market growth. Examples of emerging trends include personalized shopping experiences enabled by AI, the rise of sustainable and ethical products, and the increasing integration of technology within physical retail stores (e.g., smart shelves, interactive displays).

Propelling Factors for Retail Industry in Australia Growth

Key growth drivers are identified, including technological advancements (e.g., e-commerce, mobile payments), economic factors (e.g., rising disposable incomes, increased consumer confidence), and supportive government policies (e.g., infrastructure investments, tax incentives for businesses).

Obstacles in the Retail Industry in Australia Market

This section analyzes significant barriers to growth, including intense competition, supply chain disruptions (with quantifiable impacts on costs and delivery times), and regulatory challenges impacting business operations.

Future Opportunities in Retail Industry in Australia

Emerging opportunities are discussed, such as the expansion into new market segments (e.g., sustainable products, personalized experiences), the adoption of new technologies (e.g., AI-powered retail solutions, blockchain for supply chain transparency), and catering to evolving consumer preferences.

Major Players in the Retail Industry in Australia Ecosystem

- ALDI Group

- Metcash Ltd

- Woolworths Group Ltd

- Wesfarmers Ltd

- JB Hi-Fi Ltd

- Coles Group

- Kmart Australia Ltd

- Myer Group Pty Ltd

- David Jones Properties Pty Ltd

- Kogan.com Ltd (List not exhaustive)

Key Developments in Retail Industry in Australia Industry

- November 2020: Wesfarmers expands Kmart footprint with new store openings in Victoria and Western Australia. This demonstrates a continued investment in physical retail despite the growth of e-commerce.

Strategic Retail Industry in Australia Market Forecast

The Australian retail market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic investments by major players. The forecast period (2025-2033) anticipates robust expansion, with specific growth rates detailed within the full report. However, challenges remain, requiring adaptable strategies to navigate competitive pressures and economic uncertainties. The report concludes with actionable insights for businesses seeking to thrive in this dynamic market.

Retail Industry in Australia Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Industry in Australia Regional Market Share

Geographic Coverage of Retail Industry in Australia

Retail Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverages

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Electronic and Household Appliances

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverages

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Electronic and Household Appliances

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverages

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Electronic and Household Appliances

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverages

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Electronic and Household Appliances

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverages

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Electronic and Household Appliances

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALDI Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metcash Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Woolworths Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wesfarmers Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JB Hi-Fi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coles Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kmart Australia Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Myer Group Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 David Jones Properties Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kogan com Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ALDI Group

List of Figures

- Figure 1: Global Retail Industry in Australia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Industry in Australia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry in Australia?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Retail Industry in Australia?

Key companies in the market include ALDI Group, Metcash Ltd, Woolworths Group Ltd, Wesfarmers Ltd, JB Hi-Fi Ltd, Coles Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, Kogan com Ltd**List Not Exhaustive.

3. What are the main segments of the Retail Industry in Australia?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 551.11 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2020, Wesfarmers retail businesses continued to expand their business. Kmart opened new stores in Camberwell and Casey in Victoria and Cockburn in Western Australia, all converted from Target stores, alongside its newest K Hub store in Bairnsdale in regional Victoria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry in Australia?

To stay informed about further developments, trends, and reports in the Retail Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence