Key Insights

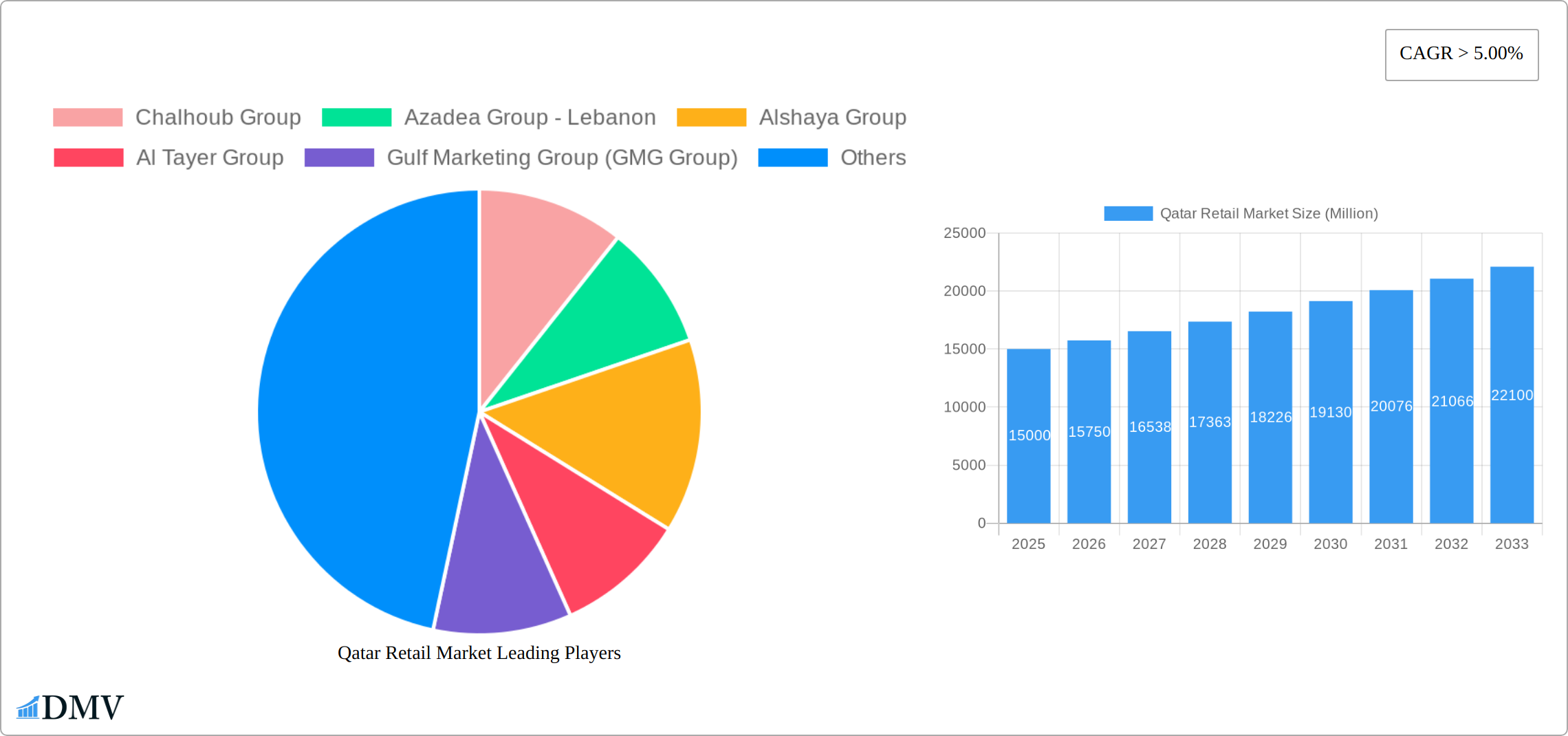

The Qatar retail market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2019-2033, presents a robust and expanding landscape. Driven by a burgeoning population, rising disposable incomes, and a strong government focus on infrastructure development and tourism, the market is poised for significant growth. The influx of international brands and the development of modern shopping malls and e-commerce platforms are key trends shaping the sector. While competition among established players like Chalhoub Group, Azadea Group, Alshaya Group, and Majid Al Futtaim Retail remains intense, opportunities exist for specialized retailers and niche brands to cater to evolving consumer preferences. Furthermore, the government's initiatives to diversify the economy and attract foreign investment further contribute to the market's positive outlook. Challenges include maintaining competitiveness amidst regional economic fluctuations and adapting to the evolving preferences of increasingly sophisticated consumers. The market segmentation likely encompasses various categories including fashion, food & beverages, electronics, and home goods, with further sub-segmentation by price point and brand type. The market size in 2025 is estimated at $15 Billion, reflecting the strong growth trajectory, and is projected to surpass $20 Billion by 2030.

Qatar Retail Market Market Size (In Billion)

The forecast period of 2025-2033 offers substantial potential for both domestic and international companies looking to establish or expand their presence in Qatar. Success will depend on understanding the specific needs and preferences of the Qatari consumer, leveraging advanced technologies like e-commerce, and developing sustainable business models that are responsive to market shifts and government regulations. A focus on delivering exceptional customer service and fostering brand loyalty will be critical in a competitive market. Data from the historical period (2019-2024) would further refine the estimates, providing a more precise understanding of market fluctuations.

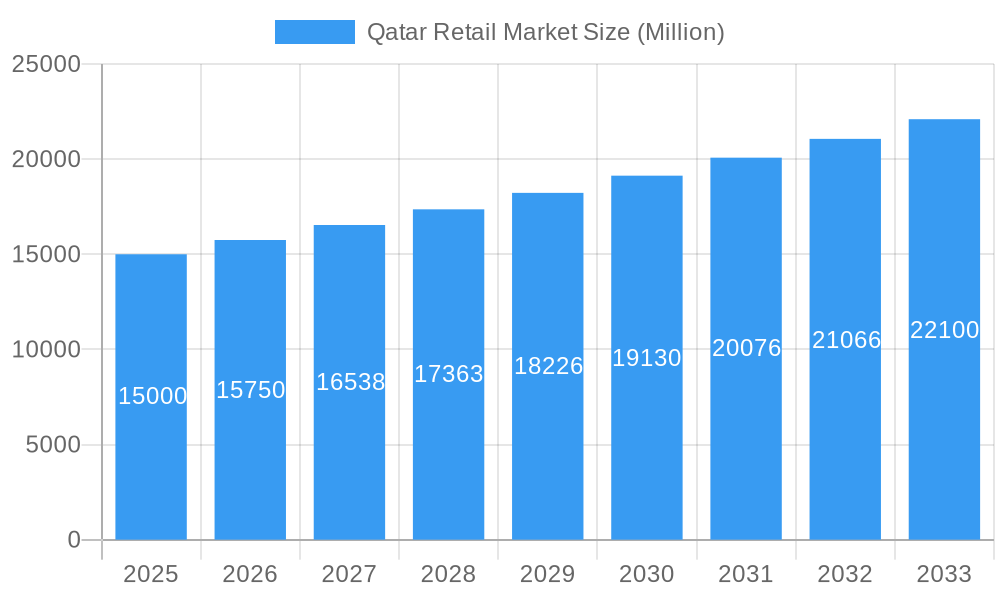

Qatar Retail Market Company Market Share

Qatar Retail Market Market Composition & Trends

The Qatar Retail Market is a dynamic and evolving sector, characterized by a mix of established players and new entrants striving for market share. Market concentration in the Qatar retail sector is moderate, with key players like Chalhoub Group, Azadea Group, and Alshaya Group holding significant portions of the market. The top three companies together account for approximately 40% of the market share, indicating room for smaller players to grow.

- Innovation Catalysts: The market is driven by innovations in retail technology, such as AI-driven personalized shopping experiences and omnichannel retail solutions. These innovations are spurred by consumer demand for seamless shopping experiences.

- Regulatory Landscapes: The Qatari government's supportive policies for foreign investment and business-friendly environment foster growth in the retail sector. Regulations such as the Qatar National Vision 2030 aim to diversify the economy, indirectly benefiting the retail market.

- Substitute Products: The rise of e-commerce platforms offers substitutes to traditional retail, compelling brick-and-mortar stores to innovate or partner with online entities.

- End-User Profiles: The market serves a diverse demographic, from affluent expatriates to local families, with varying preferences that retailers must cater to.

- M&A Activities: Recent mergers and acquisitions, valued at over 500 Million USD in the last five years, reflect a strategy of consolidation and expansion among key players.

Qatar Retail Market Industry Evolution

The Qatar Retail Market is experiencing a dynamic and accelerated evolution, with significant shifts projected from 2019 through to 2033. The established base year of 2025 serves as a critical inflection point, with the market size estimated at a robust 15 billion USD. A compelling Compound Annual Growth Rate (CAGR) of 5% is anticipated during the forecast period spanning 2025 to 2033. This upward trajectory is propelled by a confluence of rapid technological integration and a pronounced evolution in consumer preferences and behaviors.

Technological advancements are profoundly reshaping the retail landscape. The pervasive integration of Artificial Intelligence (AI) and machine learning is not only elevating customer experiences through hyper-personalization but also significantly optimizing operational efficiencies for retailers. The adoption rate of AI in retail operations has seen a remarkable surge, increasing by approximately 20% annually since 2020. Concurrently, the global health crisis acted as a powerful catalyst for the acceleration of online shopping, resulting in a substantial 30% expansion in e-commerce sales within Qatar in 2022 alone.

Consumer demands are increasingly sophisticated, with a pronounced inclination towards highly personalized shopping journeys and a growing emphasis on sustainable and ethically sourced products. In response, retailers are strategically investing in advanced technologies designed to deliver tailored recommendations and curated shopping experiences. Furthermore, there's a significant expansion in the availability of eco-friendly product lines and sustainable packaging solutions. This continuous evolution is intrinsically linked to the imperative of meeting evolving consumer expectations and capitalizing on the potential for further technological innovation and implementation.

Leading Regions, Countries, or Segments in Qatar Retail Market

The Doha metropolitan area stands out as the dominant region within the Qatar Retail Market. Several factors contribute to its dominance:

- Investment Trends: Significant investments in retail infrastructure and luxury shopping complexes, such as the Doha Festival City, have attracted both local and international brands.

- Regulatory Support: The Qatari government's initiatives to boost tourism and economic diversification directly benefit the retail sector in Doha.

- Consumer Base: A large expatriate population with high disposable income fuels demand for diverse retail offerings.

In-depth analysis reveals that Doha's strategic location and the government's vision to position it as a global hub for commerce and tourism play crucial roles. The city's infrastructure supports a thriving retail environment, with modern malls and shopping districts catering to a wide range of consumer needs. The retail segment of luxury goods and electronics particularly thrives in Doha, driven by the city's affluent demographic.

Qatar Retail Market Product Innovations

Innovations within the Qatar Retail Market are strategically designed to both enhance the customer journey and bolster operational effectiveness. Leading retailers are harnessing the power of AI and machine learning to deliver deeply personalized shopping experiences, deploying sophisticated systems that analyze customer behavior patterns to provide highly relevant recommendations. Simultaneously, a discernible and growing trend towards sustainable retail practices is emerging, with companies actively introducing eco-friendly product assortments and pioneering responsible packaging solutions. These forward-thinking innovations not only cater directly to consumer demands for personalization and sustainability but also critically position retailers for competitive advantage in an increasingly dynamic and crowded marketplace.

Propelling Factors for Qatar Retail Market Growth

The robust expansion of the Qatar Retail Market is underpinned by several pivotal growth drivers:

- Technological Advancements: The widespread adoption of AI-powered solutions and seamless omnichannel retail strategies is revolutionizing customer engagement and significantly enhancing operational efficiencies across the board.

- Economic Prosperity: Qatar's strong and resilient economy, bolstered by an exceptionally high GDP per capita, provides a powerful foundation for sustained and robust consumer spending within the retail sector.

- Supportive Regulatory Environment: Proactive government initiatives, most notably the ambitious Qatar National Vision 2030, foster a conducive and favorable business ecosystem that actively encourages and supports retail sector expansion and investment.

These fundamental drivers, complemented by a growing expatriate population and a thriving tourism sector, collectively contribute to the market's sustained and impressive growth trajectory.

Obstacles in the Qatar Retail Market Market

Despite growth opportunities, the Qatar Retail Market faces several challenges:

- Regulatory Challenges: Compliance with local regulations can be complex, particularly for foreign retailers.

- Supply Chain Disruptions: Global events can disrupt supply chains, impacting product availability and costs.

- Competitive Pressures: Intense competition among retailers can lead to price wars, affecting profit margins.

These obstacles require strategic planning and adaptability to navigate successfully.

Future Opportunities in Qatar Retail Market

The Qatar Retail Market is poised for future growth through several emerging opportunities:

- E-commerce Expansion: The growing trend towards online shopping offers significant potential for retailers to expand their digital presence.

- Sustainable Retail: Increasing consumer demand for eco-friendly products presents an opportunity for retailers to differentiate themselves.

- Tourism Growth: As Qatar continues to develop as a tourism destination, the retail sector can capitalize on increased visitor spending.

These opportunities align with global trends and local market dynamics, promising a vibrant future for the Qatar Retail Market.

Major Players in the Qatar Retail Market Ecosystem

- Chalhoub Group

- Azadea Group - Lebanon

- Alshaya Group

- Al Tayer Group

- Gulf Marketing Group (GMG Group)

- Gourmia

- Tayama

- Majid al futtaim retail

- Al Mana

- Al Jassim Group

List Not Exhaustive

Key Developments in Qatar Retail Market Industry

- September 2022: Chalhoub Group acquired a majority share of Threads Styling, a personal shopping platform and online luxury retailer in London. This acquisition, except for the shares held by Sophie Hill, Threads Styling's founder and CEO, enhances Chalhoub Group's portfolio and market reach.

- May 2022: AZADEA Group and BOSE in the UAE formed a partnership. AZADEA Group, known for its innovative collaborations, partnered with BOSE to expand its lifestyle brand portfolio and strengthen its position in the UAE. This partnership aims to provide customers with a seamless and enhanced shopping experience.

These developments signify strategic moves to enhance market presence and customer engagement.

Strategic Qatar Retail Market Market Forecast

The strategic outlook for the Qatar Retail Market forecasts continued and substantial growth potential extending through to 2033. Key drivers underpinning this optimistic projection include the ongoing embrace of cutting-edge retail technologies, the sustained expansion of the e-commerce channel, and the increasing prominence of sustainable retail methodologies. The market is poised to benefit significantly from escalating levels of tourism and a growing expatriate demographic, both of which will invariably stimulate demand for a wider spectrum of retail offerings. As retailers adeptly navigate evolving consumer preferences and strategically capitalize on emerging opportunities, the Qatar Retail Market is exceptionally well-positioned for continued success and prosperity in the years ahead.

Qatar Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Speciality Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Qatar Retail Market Segmentation By Geography

- 1. Qatar

Qatar Retail Market Regional Market Share

Geographic Coverage of Qatar Retail Market

Qatar Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income and Affluent Standard of Living is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Speciality Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chalhoub Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Azadea Group - Lebanon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alshaya Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Tayer Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Marketing Group (GMG Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gourmia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tayama

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Majid al futtaim retail

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Mana

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Jassim Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chalhoub Group

List of Figures

- Figure 1: Qatar Retail Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Qatar Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Retail Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Qatar Retail Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Qatar Retail Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Qatar Retail Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Qatar Retail Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Qatar Retail Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Retail Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Qatar Retail Market?

Key companies in the market include Chalhoub Group, Azadea Group - Lebanon, Alshaya Group, Al Tayer Group, Gulf Marketing Group (GMG Group), Gourmia, Tayama, Majid al futtaim retail, Al Mana, Al Jassim Group**List Not Exhaustive.

3. What are the main segments of the Qatar Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Disposable Income and Affluent Standard of Living is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, Chalhoub Group acquired a majority share of Threads Styling, a personal shopping platform and online luxury retailer in London. Except for the shares held by Sophie Hill, Threads Styling's founder, and CEO, Chalhoub Group purchased all of the company's shares.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Retail Market?

To stay informed about further developments, trends, and reports in the Qatar Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence