Key Insights

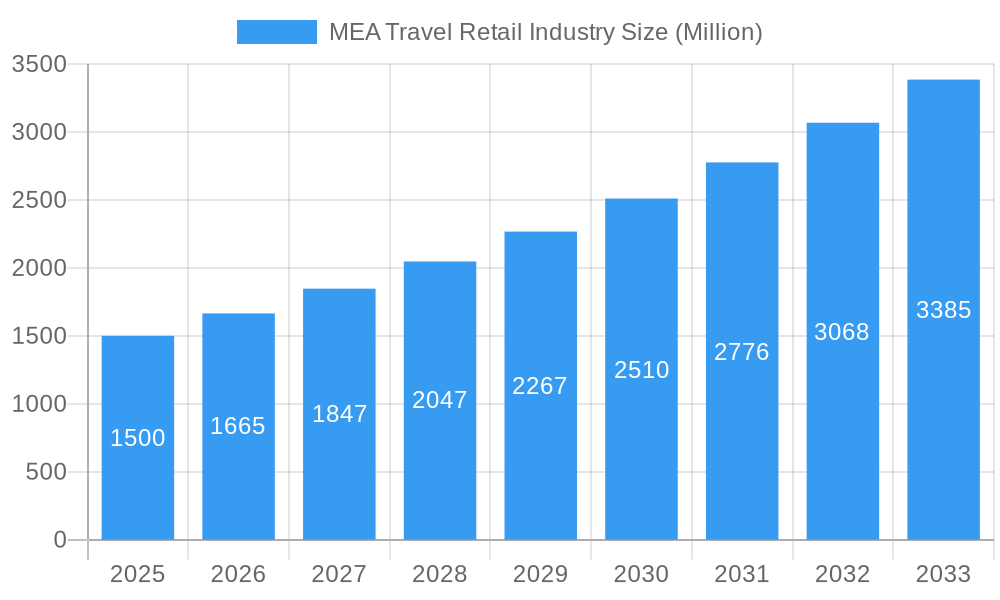

The Middle East and Africa (MEA) travel retail market is experiencing significant expansion. This growth is propelled by escalating tourist arrivals, heightened disposable incomes, and a robust demand for premium goods and exclusive experiences. The market, valued at $72.57 billion in the base year 2025, is projected to achieve a compound annual growth rate (CAGR) of 5.4% throughout the forecast period (2025-2033). Primary growth catalysts include the ongoing development of airport infrastructure across the region, the widespread adoption of online travel booking platforms that simplify the shopping journey, and a rising consumer inclination towards duty-free purchases. Additionally, strategic collaborations between retailers and airlines are instrumental in enriching product assortments and bolstering customer loyalty initiatives, thereby driving increased sales. The sector encounters certain challenges, including the impact of volatile oil prices on consumer expenditure and potential geopolitical uncertainties in specific areas. Nevertheless, the long-term market trajectory remains positive, underpinned by substantial investments in tourism infrastructure and the continuous expansion of the middle class throughout the MEA region.

MEA Travel Retail Industry Market Size (In Billion)

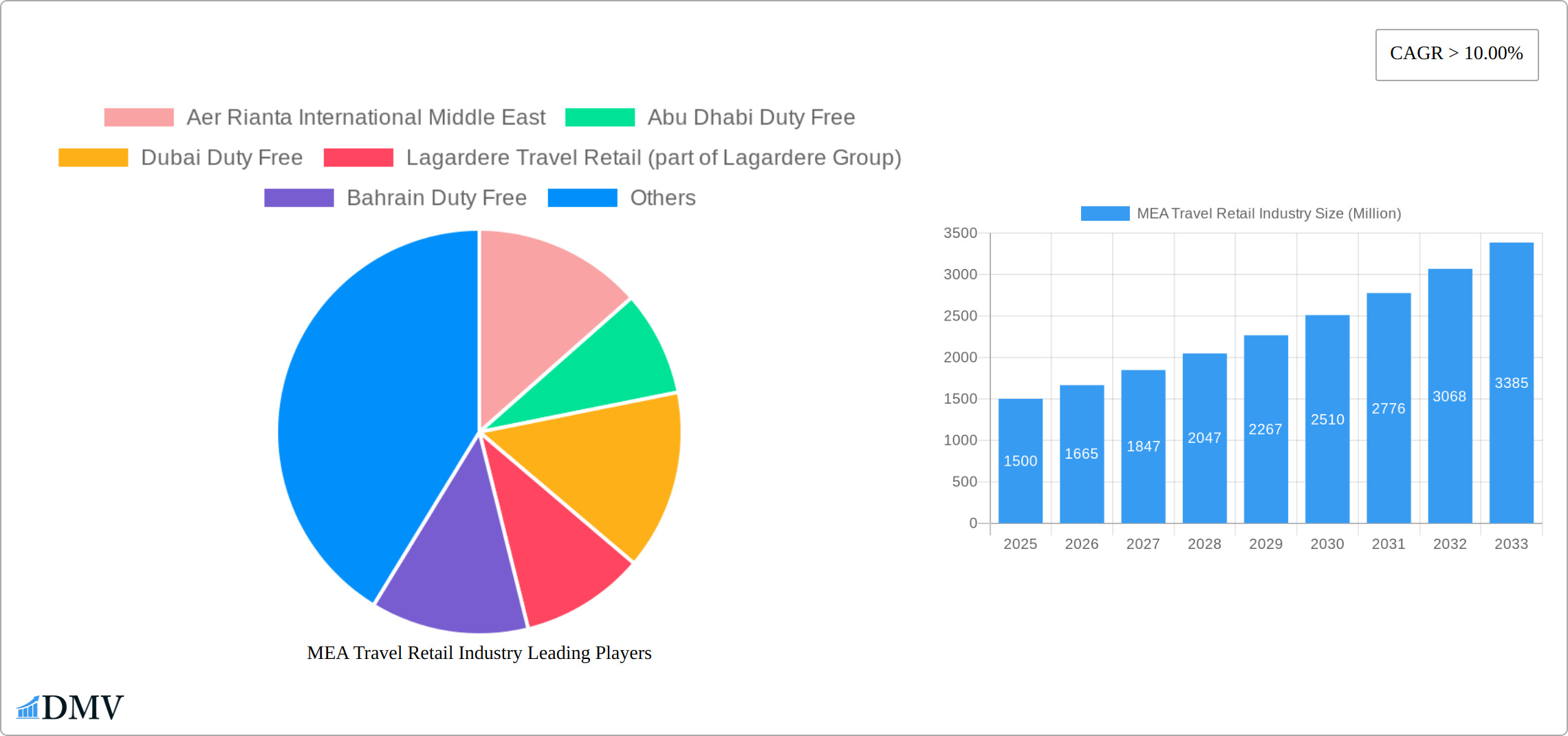

The MEA travel retail market is segmented by product categories such as perfumes & cosmetics, spirits & wine, confectionery, and tobacco. Further segmentation includes airport type, differentiating between major international hubs and smaller regional airports, and by country. Leading market participants, including Dufry AG, Aer Rianta International Middle East, and Dubai Duty Free, hold a dominant position, capitalizing on their extensive networks and strong brand recognition. However, the competitive landscape is evolving with the emergence of new entrants and online retailers vying for market share, fostering innovation and competitive pricing strategies. The forecast period is anticipated to witness further industry consolidation, with established players acquiring smaller entities to expand their geographical footprint and product portfolios. To ensure success, companies must prioritize delivering personalized shopping experiences, utilize data analytics to comprehend consumer preferences, and adapt to evolving consumer behaviors.

MEA Travel Retail Industry Company Market Share

MEA Travel Retail Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) travel retail industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current trends, and future growth potential. The market is estimated at XX Million in 2025, showcasing significant opportunities for investment and expansion.

MEA Travel Retail Industry Market Composition & Trends

This section offers a comprehensive analysis of the MEA travel retail market's current structure, its competitive dynamics, and the pivotal trends shaping its ongoing evolution. We meticulously evaluate market concentration, underscoring the significant influence of established global players like Dubai Duty Free and Dufry AG. Alongside these giants, we also spotlight the crucial contributions of prominent regional operators such as Abu Dhabi Duty Free and Aer Rianta International Middle East. The report further scrutinizes the multifaceted impact of evolving regulatory frameworks, the increasing presence of substitute products, and the ever-changing landscape of consumer preferences on overall market dynamics. Our analysis extends to M&A activities, quantifying deal values (estimated at approximately XX Million annually during the historical period) and assessing their profound influence on market share distribution and competitive positioning.

- Market Concentration: The market exhibits high concentration, characterized by the dominance of a select few major players who collectively command a substantial share of the market.

- Innovation Catalysts: Key drivers of innovation include the rapid advancement of retail technology, the strategic implementation of personalized customer experiences, and a growing commitment to sustainability initiatives.

- Regulatory Landscape: A thorough examination of governmental policies and airport-specific regulations, detailing their impact on market accessibility and operational frameworks.

- Substitute Products: The escalating influence of e-commerce and online retail channels on shaping and potentially altering traditional consumer purchasing habits within the travel retail space.

- End-User Profiles: In-depth segmentation of traveler demographics, meticulously detailing their purchasing behaviors, spending patterns, and propensity for various product categories.

- M&A Activity: A detailed analysis of significant mergers and acquisitions, including their financial implications, strategic rationales, and anticipated impact on market consolidation. Deals involving key industry players are estimated to have an aggregate value of approximately XX Million during the 2019-2024 period.

MEA Travel Retail Industry Industry Evolution

This section provides a comprehensive and forward-looking analysis of the MEA travel retail industry's growth trajectory, spanning from 2019 through to 2033. We meticulously examine the transformative impact of technological advancements, including the widespread adoption of mobile payments, sophisticated digital marketing strategies, and the development of highly personalized shopping experiences. Concurrently, we assess the industry's response to shifting consumer demands, which increasingly favor luxury goods, authentically locally sourced products, and a strong emphasis on sustainable and ethical practices. The report quantifies projected market growth rates, forecasting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, driven by key factors such as sustained growth in air passenger traffic, rising disposable incomes across the region, and the dynamic evolution of global tourism patterns. Our analysis incorporates critical technological adoption metrics, such as the increasing prevalence of mobile payment usage and the growing popularity of online pre-ordering, to vividly illustrate the evolving consumer behavior. The profound impact of the COVID-19 pandemic on market performance and the subsequent implementation of recovery strategies are also comprehensively addressed, featuring data on passenger traffic recovery rates and the re-emergence of travel retail. This in-depth analysis offers invaluable strategic insights into the industry's continuous evolution and provides robust forecasts for future growth prospects.

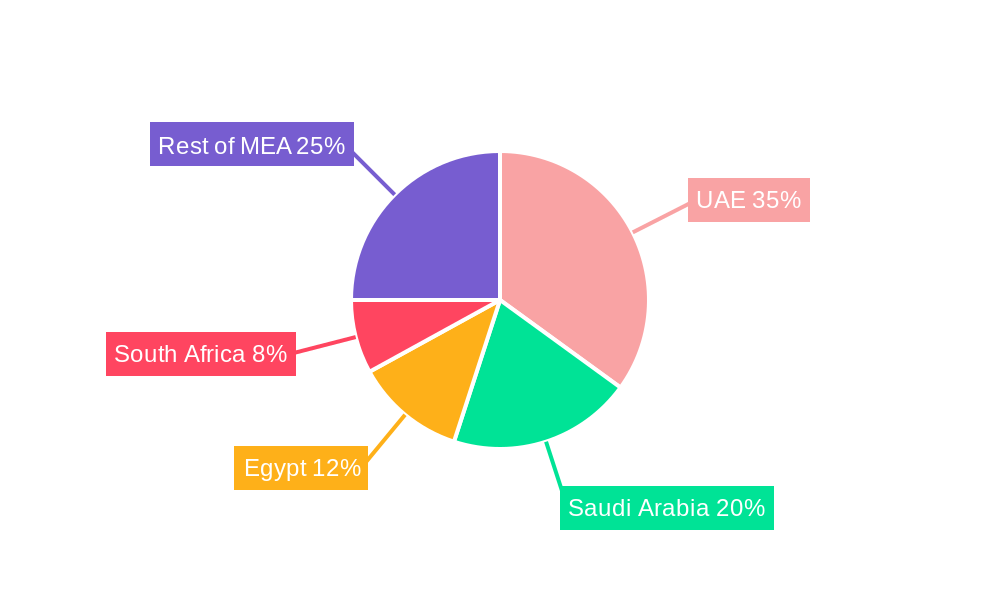

Leading Regions, Countries, or Segments in MEA Travel Retail Industry

This section meticulously identifies and analyzes the most prominent regions, countries, and specific market segments within the MEA travel retail landscape, offering a detailed exploration of the underlying factors that contribute to their leading positions. The United Arab Emirates (UAE), with Dubai at its forefront, consistently stands out as a paramount hub. This dominance is attributed to its exceptionally high air passenger traffic and its strategically pivotal geographic location, serving as a crucial gateway between continents.

- Key Drivers for UAE Dominance:

- Exceptional Air Passenger Traffic: Dubai International Airport (DXB) solidifies its position as one of the world's busiest international airports, driving significant footfall for travel retail.

- Unparalleled Strategic Location: Serving as a central nexus connecting major markets in Asia, Europe, and Africa, enhancing its appeal for transit passengers and international travelers.

- Robust Government Support: Proactive governmental policies and attractive investment incentives specifically tailored to foster growth and innovation within the travel retail sector.

- Sustained Tourism Growth: The UAE's consistent focus on promoting tourism and enhancing its appeal as a destination directly translates into increased overall consumer spending within its travel retail environments.

Furthermore, the report extends its analysis to encompass the performance of other significant regions, including the broader Gulf Cooperation Council (GCC) countries, the dynamic markets of North Africa, and the emerging opportunities in sub-Saharan Africa. We meticulously assess their respective market sizes, projected growth rates, and unique market characteristics. Critical regional variations in consumer behavior, diverse regulatory frameworks, and differing levels of infrastructure development are thoroughly discussed, providing a nuanced and comprehensive understanding of the overall MEA travel retail market landscape.

MEA Travel Retail Industry Product Innovations

The MEA travel retail industry is witnessing a wave of transformative product and service innovations. Prominent among these is the burgeoning trend of experiential retail, designed to create memorable and engaging shopping journeys for travelers. Companies are increasingly deploying personalized offers delivered directly through sophisticated mobile applications, enhancing customer convenience and relevance. A significant and growing emphasis is also being placed on products that are not only sustainable but also ethically sourced, aligning with evolving consumer values. To further elevate the shopping experience and boost customer engagement, businesses are strategically integrating advanced technologies. These include AI-driven recommendation engines that provide tailored product suggestions and augmented reality (AR) applications that offer immersive product visualizations. The successful integration of these cutting-edge technologies is projected to contribute significantly to revenue growth, with an estimated XX Million in sales by 2033 directly attributable to these innovative initiatives.

Propelling Factors for MEA Travel Retail Industry Growth

Several factors contribute to the growth of the MEA travel retail market. The continuous expansion of airport infrastructure and increased air passenger traffic are key drivers. Furthermore, rising disposable incomes and a growing middle class in several MEA countries fuel consumer spending. Favorable government policies supporting tourism and trade also play a vital role. Finally, technological advancements enhancing the shopping experience further boost market growth.

Obstacles in the MEA Travel Industry Market

The MEA travel retail market faces several challenges. Regulatory complexities and varying customs regulations across different countries can hinder smooth operations. Supply chain disruptions and fluctuating currency exchange rates pose risks to profitability. Intense competition among established players and the entry of new businesses create pressure on margins. These factors can significantly affect revenue projections, potentially reducing the annual growth rate by an estimated XX% in certain years.

Future Opportunities in MEA Travel Retail Industry

The MEA travel retail market presents promising opportunities. Expansion into untapped markets within Africa offers significant growth potential. The adoption of innovative technologies, such as augmented reality and AI, can enhance customer experiences. Focusing on sustainable and ethically sourced products can attract environmentally conscious travelers. The growing demand for premium and luxury goods presents opportunities for high-value retail segments.

Major Players in the MEA Travel Retail Industry Ecosystem

- Aer Rianta International Middle East

- Abu Dhabi Duty Free

- Dubai Duty Free

- Lagardere Travel Retail (part of Lagardere Group)

- Bahrain Duty Free

- Beirut Duty Free

- Big Five Duty Free Stores

- Hamila Duty Free

- Kreol Travel Retail

- Pernod Ricard Global Travel Retail

- Dufry AG

- EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)

Key Developments in MEA Travel Retail Industry Industry

- June 2021: Leading French luxury brand Louis Vuitton announced plans to open a boutique at Dubai International (DXB) by the end of 2021 in partnership with Dubai Duty-Free. This significantly enhanced the luxury offerings at DXB and attracted high-spending clientele, boosting overall revenue.

- June 2021: Dubai Duty Free launched an ecosystem restoration journey "Plant a Tree, Plant A Legacy" initiative. This environmentally conscious initiative improved the brand's image, attracting environmentally conscious consumers and potentially increasing sales through positive brand association.

Strategic MEA Travel Retail Industry Market Forecast

The MEA travel retail market is poised for continued growth driven by infrastructure development, increased air passenger traffic, rising disposable incomes, and technological advancements. The focus on sustainable practices, personalized experiences, and luxury offerings will further shape market dynamics. Despite challenges, the long-term outlook remains positive, with substantial growth potential across various segments and regions. The market is projected to reach XX Million by 2033.

MEA Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine and Spirits

- 1.4. Food and Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

- 1.7. Others (Stationery, Electronics, etc.)

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Others (Railway Stations, Border, Downtown)

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

MEA Travel Retail Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

MEA Travel Retail Industry Regional Market Share

Geographic Coverage of MEA Travel Retail Industry

MEA Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The UAE has been Playing a Key Role in Attracting More Customers and thus Recording Year-on-Year Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine and Spirits

- 5.1.4. Food and Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others (Stationery, Electronics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Others (Railway Stations, Border, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Arab Emirates MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine and Spirits

- 6.1.4. Food and Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.1.7. Others (Stationery, Electronics, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.2.4. Others (Railway Stations, Border, Downtown)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine and Spirits

- 7.1.4. Food and Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.1.7. Others (Stationery, Electronics, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.2.4. Others (Railway Stations, Border, Downtown)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fashion and Accessories

- 8.1.2. Jewellery and Watches

- 8.1.3. Wine and Spirits

- 8.1.4. Food and Confectionary

- 8.1.5. Fragnances and Cosmetics

- 8.1.6. Tobacco

- 8.1.7. Others (Stationery, Electronics, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Airports

- 8.2.2. Airlines

- 8.2.3. Ferries

- 8.2.4. Others (Railway Stations, Border, Downtown)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fashion and Accessories

- 9.1.2. Jewellery and Watches

- 9.1.3. Wine and Spirits

- 9.1.4. Food and Confectionary

- 9.1.5. Fragnances and Cosmetics

- 9.1.6. Tobacco

- 9.1.7. Others (Stationery, Electronics, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Airports

- 9.2.2. Airlines

- 9.2.3. Ferries

- 9.2.4. Others (Railway Stations, Border, Downtown)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Aer Rianta International Middle East

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abu Dhabi Duty Free

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dubai Duty Free

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lagardere Travel Retail (part of Lagardere Group)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bahrain Duty Free

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Beirut Duty Free

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Big Five Duty Free Stores

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hamila Duty Free

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kreol Travel Retail

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pernod Ricard Global Travel Retail

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dufry AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Aer Rianta International Middle East

List of Figures

- Figure 1: Global MEA Travel Retail Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South Africa MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: South Africa MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: South Africa MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: South Africa MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South Africa MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: South Africa MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Africa MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South Africa MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Travel Retail Industry?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the MEA Travel Retail Industry?

Key companies in the market include Aer Rianta International Middle East, Abu Dhabi Duty Free, Dubai Duty Free, Lagardere Travel Retail (part of Lagardere Group), Bahrain Duty Free, Beirut Duty Free, Big Five Duty Free Stores, Hamila Duty Free, Kreol Travel Retail, Pernod Ricard Global Travel Retail, Dufry AG, EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)**List Not Exhaustive.

3. What are the main segments of the MEA Travel Retail Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The UAE has been Playing a Key Role in Attracting More Customers and thus Recording Year-on-Year Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2021, Leading French luxury brand Louis Vuitton announced plans to open a boutique at Dubai International (DXB) by the end of 2021 in partnership with Dubai Duty-Free.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Travel Retail Industry?

To stay informed about further developments, trends, and reports in the MEA Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence