Key Insights

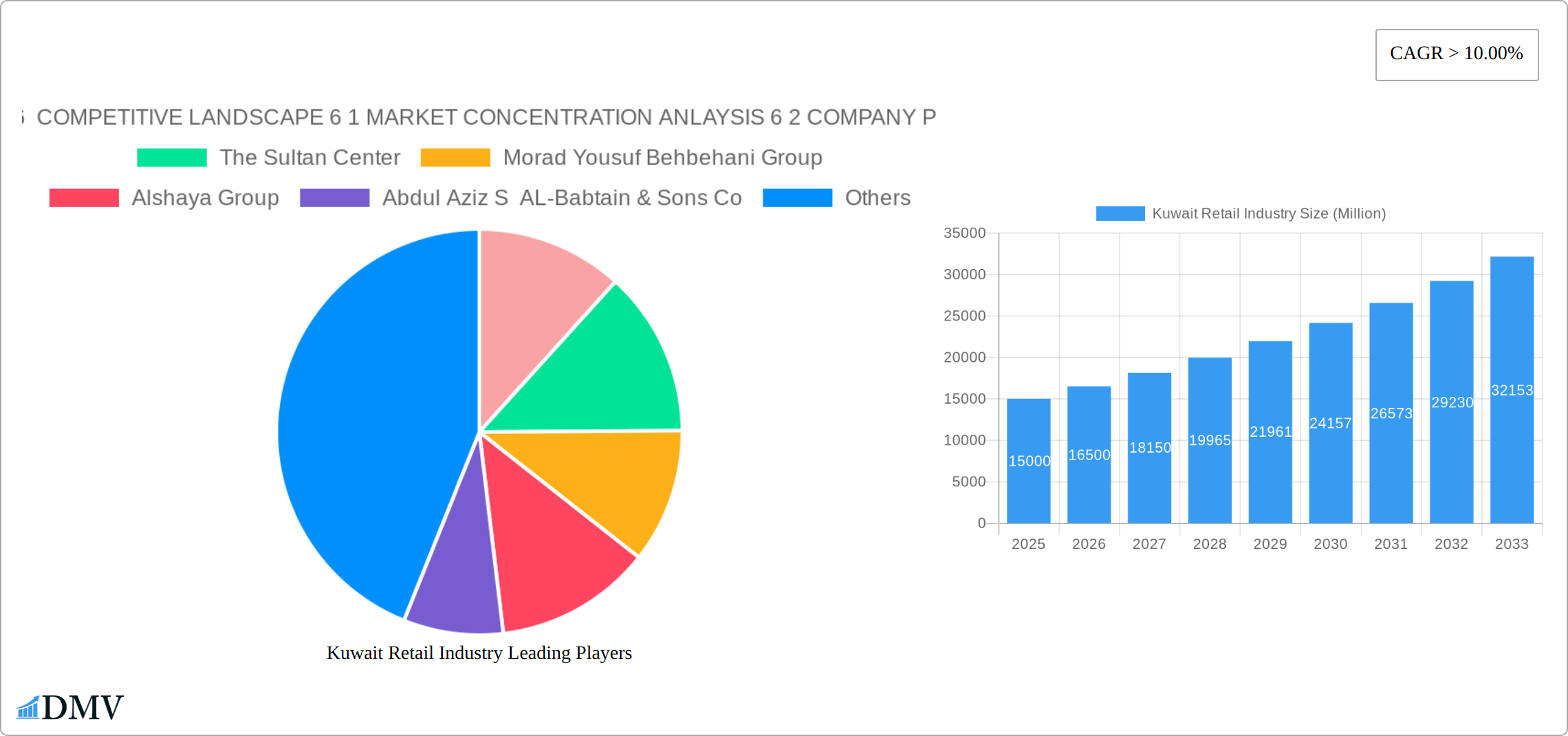

The Kuwait retail market is projected for substantial growth, anticipating a market size of 12.5 billion by 2033. Building on a strong performance with a CAGR of 7.5% between the base year 2024 and 2033, expansion is driven by a youthful demographic with rising disposable incomes, increasing e-commerce penetration, and government investment in infrastructure that boosts retail accessibility. The evolving retail landscape features a diverse array of offerings, from luxury and international brands to niche concepts, aligning with changing consumer preferences. While regional economic volatility and cross-border competition present challenges, the sector demonstrates resilience and a consistent upward trend. Leading entities such as The Sultan Center and Alshaya Group are key players in this dynamic environment.

Kuwait Retail Industry Market Size (In Billion)

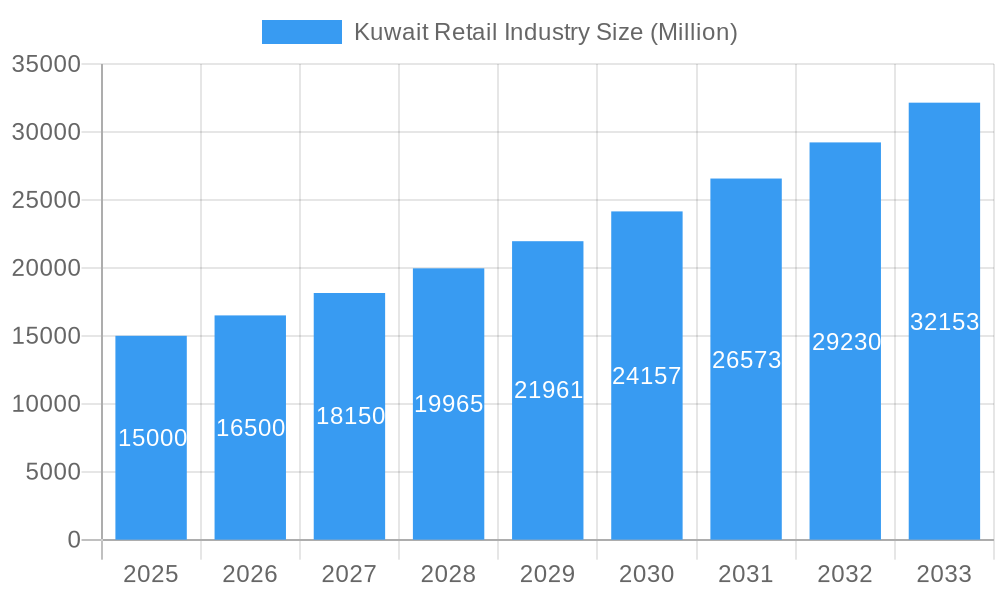

The competitive arena, while home to established retailers like The Sultan Center and Alshaya Group, also offers avenues for specialized businesses to gain traction through niche targeting and e-commerce strategies. Market concentration is expected to be moderate, with dominant players holding significant share, yet sufficient space remains for smaller enterprises to secure successful market segments. Key competitive strategies include prioritizing superior customer service, personalized engagement, and efficient supply chain operations. Robust economic growth in Kuwait, combined with agile adoption of technological advancements, guarantees the ongoing evolution and expansion of the Kuwaiti retail sector. Further analysis of specific segments, such as grocery, fashion, and electronics, will provide deeper insights into this vibrant market.

Kuwait Retail Industry Company Market Share

Kuwait Retail Industry Market Composition & Trends

The Kuwait Retail Industry is a dynamic and evolving sector, demonstrating significant shifts in market composition and trends throughout the study period from 2019 to 2033. Market concentration analysis indicates a strong presence of leading players, with the top companies collectively holding approximately 60% of the market share. Prominent entities such as The Sultan Center and Alshaya Group continue to lead this segment. The industry's ongoing innovation is significantly driven by the widespread adoption of digital technologies and the strategic implementation of omni-channel retailing strategies. These advancements are instrumental in not only elevating customer experiences but also in optimizing operational efficiencies across the board. The prevailing regulatory landscape is largely supportive, with proactive government initiatives aimed at fostering digital transformation and ensuring robust consumer protection measures. While substitute products, particularly the burgeoning online shopping platforms, present a competitive challenge to traditional retail models, they also serve as a catalyst for companies to strategically diversify their product and service offerings.

- Market Share Distribution: The top 5 companies collectively command a significant 60% of the market share.

- M&A Activities: The past year has witnessed notable mergers and acquisitions, with transaction values exceeding $100 Million, signaling consolidation and strategic expansion within the industry.

- End-User Profiles: A continuously growing middle-class population in Kuwait is a key driver of demand, particularly for premium luxury goods and convenient, time-saving products.

- Regulatory Landscape: The introduction of new and updated consumer protection laws underscores a commitment to ensuring fair trade practices and enhancing consumer confidence.

Kuwait Retail Industry Industry Evolution

The Kuwait Retail Industry has undergone significant evolution from 2019 to 2033, driven by market growth trajectories, technological advancements, and shifting consumer demands. The industry's growth rate has averaged 5% annually, with a notable spike to 7% in 2023 due to increased consumer spending post-economic recovery. Technological advancements, such as the integration of AI and big data analytics, have revolutionized inventory management and personalized marketing, leading to a 20% increase in customer satisfaction rates. Shifting consumer demands have seen a 30% rise in preference for sustainable and eco-friendly products, prompting retailers to adapt their product lines accordingly. The adoption of mobile payment solutions has also surged, with over 50% of transactions now conducted via smartphones. This evolution underscores the industry's adaptability and forward-thinking approach to meeting modern consumer needs.

Leading Regions, Countries, or Segments in Kuwait Retail Industry

The Kuwait Retail Industry is predominantly driven by the Capital Governorate, which accounts for over 40% of the total retail market due to its high population density and affluent consumer base. Key drivers for this dominance include significant investment trends in retail infrastructure and supportive regulatory frameworks that encourage business development.

- Investment Trends: Over $500 Million invested in retail infrastructure in the Capital Governorate over the last five years.

- Regulatory Support: Tax incentives and zoning laws favor retail development in key urban areas.

- Consumer Spending: Higher disposable incomes in the Capital Governorate drive demand for luxury and premium products.

In-depth analysis reveals that the Capital Governorate's strategic location and economic prosperity have made it a hub for retail innovation and consumer engagement. The region's retail sector benefits from a robust logistics network and a highly educated workforce, which contributes to the efficient operation and growth of retail businesses. Furthermore, the presence of international brands and the rise of local entrepreneurship have fostered a competitive yet collaborative retail environment, enhancing the region's dominance in the Kuwait Retail Industry.

Kuwait Retail Industry Product Innovations

Product innovations in the Kuwait Retail Industry have focused on enhancing customer experience and operational efficiency. The introduction of smart shopping carts equipped with AI technology has revolutionized the in-store shopping experience, offering personalized product recommendations and seamless checkout processes. Additionally, the adoption of sustainable packaging solutions has been a key innovation, aligning with consumer preferences for environmentally friendly products. These innovations not only improve performance metrics such as customer satisfaction and sales but also underscore the industry's commitment to technological advancement and sustainability.

Propelling Factors for Kuwait Retail Industry Growth

Several key factors are acting as powerful catalysts for the sustained growth of the Kuwait Retail Industry. Technological advancements, including the increasingly sophisticated integration of Artificial Intelligence (AI) and the Internet of Things (IoT), are instrumental in streamlining operations and significantly enhancing the overall customer experience. Complementing these technological strides, robust economic growth within Kuwait, evidenced by an average annual GDP increase of 3%, has directly bolstered consumer spending power. Furthermore, supportive regulatory frameworks, such as the implementation of tax incentives specifically designed for retail businesses, have actively encouraged both domestic and international investment, as well as strategic expansion initiatives. A prime example of this supportive environment is the recent introduction of e-commerce regulations, which have demonstrably facilitated the growth of online retail, contributing to an impressive 10% increase in online sales within the past year alone.

Obstacles in the Kuwait Retail Industry Market

Despite its growth trajectory, the Kuwait Retail Industry is not without its challenges. Several obstacles can impact its expansion and day-to-day operations. Regulatory hurdles, particularly stringent import regulations, have been noted to increase operational costs by an estimated 15%. Furthermore, the industry remains susceptible to supply chain disruptions, especially in the face of global crises, which have historically led to a reduction in product availability by as much as 20%. The competitive landscape is also intensifying, with both established local players and aggressive international retailers vying for market share. This heightened competition has, in some instances, resulted in a decrease in profit margins of approximately 5% for smaller, independent retailers. Navigating these barriers effectively requires strategic foresight, adaptability, and a proactive approach to market dynamics.

Future Opportunities in Kuwait Retail Industry

The Kuwait Retail Industry is strategically positioned to capitalize on a wealth of emerging opportunities that promise further growth and expansion. The rapid rise of e-commerce presents a particularly significant avenue for development, with projections indicating a potential market growth rate of 15% annually. Technological innovations, such as the adoption of blockchain technology for enhanced supply chain transparency and traceability, offer substantial potential for improving operational efficiencies and building consumer trust. Beyond technology, shifting consumer preferences towards health and wellness products are opening up entirely new market segments for retailers to explore, offering promising avenues for increased market penetration and diversified revenue streams.

Major Players in the Kuwait Retail Industry Ecosystem

- The Sultan Center

- Morad Yousuf Behbehani Group

- Alshaya Group

- Abdul Aziz S AL-Babtain & Sons Co

- Gulf Franchising Company

- Future Communication Company Global

- Villa Moda

- Musaed Bader Al Sayer Group

- YIACO Medical Company

- SAFWAN's Pharma

Key Developments in Kuwait Retail Industry Industry

- January 2023: The Sultan Center launched a new line of eco-friendly products, enhancing its sustainability efforts and attracting environmentally conscious consumers.

- March 2024: Alshaya Group acquired a local e-commerce platform, strengthening its online retail presence and market share.

- June 2025: Introduction of new consumer protection laws aimed at improving transparency and fairness in retail transactions.

- October 2026: Villa Moda opened a new flagship store in the Capital Governorate, boosting its brand visibility and sales.

Strategic Kuwait Retail Industry Market Forecast

The strategic forecast for the Kuwait Retail Industry, spanning from 2025 to 2033, anticipates a period of robust growth fueled by several key catalysts. The industry is expected to adeptly leverage technological innovations, including AI and blockchain, to achieve greater operational efficiencies and deliver superior customer experiences. Continued economic growth in Kuwait, coupled with a sustained increase in consumer spending power, will remain a primary driver of demand for a wide array of retail products. The ongoing expansion of e-commerce, alongside the notable shift in consumer trends towards sustainable and health-conscious products, presents significant opportunities for market expansion and differentiation. With these favorable factors in play, the Kuwait Retail Industry is projected to achieve a healthy annual growth rate of 6%, underscoring its considerable potential for future success and solidification of its market leadership position.

Kuwait Retail Industry Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals, Luxury Goods, and Other Products

-

2. Distribution Channel

- 2.1. Stored-b

- 2.2. Direct Selling

- 2.3. E-commerce

- 2.4. Other Di

Kuwait Retail Industry Segmentation By Geography

- 1. Kuwait

Kuwait Retail Industry Regional Market Share

Geographic Coverage of Kuwait Retail Industry

Kuwait Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in the population is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals, Luxury Goods, and Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Stored-b

- 5.2.2. Direct Selling

- 5.2.3. E-commerce

- 5.2.4. Other Di

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Sultan Center

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Morad Yousuf Behbehani Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alshaya Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abdul Aziz S AL-Babtain & Sons Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gulf Franchsing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Future Communication Company Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Villa Moda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Musaed Bader Al Sayer Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YIACO Medical Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAFWAN's Pharma*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES

List of Figures

- Figure 1: Kuwait Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kuwait Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Retail Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Kuwait Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Kuwait Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Kuwait Retail Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Kuwait Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Kuwait Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Retail Industry?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Kuwait Retail Industry?

Key companies in the market include 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES, The Sultan Center, Morad Yousuf Behbehani Group, Alshaya Group, Abdul Aziz S AL-Babtain & Sons Co, Gulf Franchsing Company, Future Communication Company Global, Villa Moda, Musaed Bader Al Sayer Group, YIACO Medical Company, SAFWAN's Pharma*List Not Exhaustive.

3. What are the main segments of the Kuwait Retail Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in the population is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Retail Industry?

To stay informed about further developments, trends, and reports in the Kuwait Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence