Key Insights

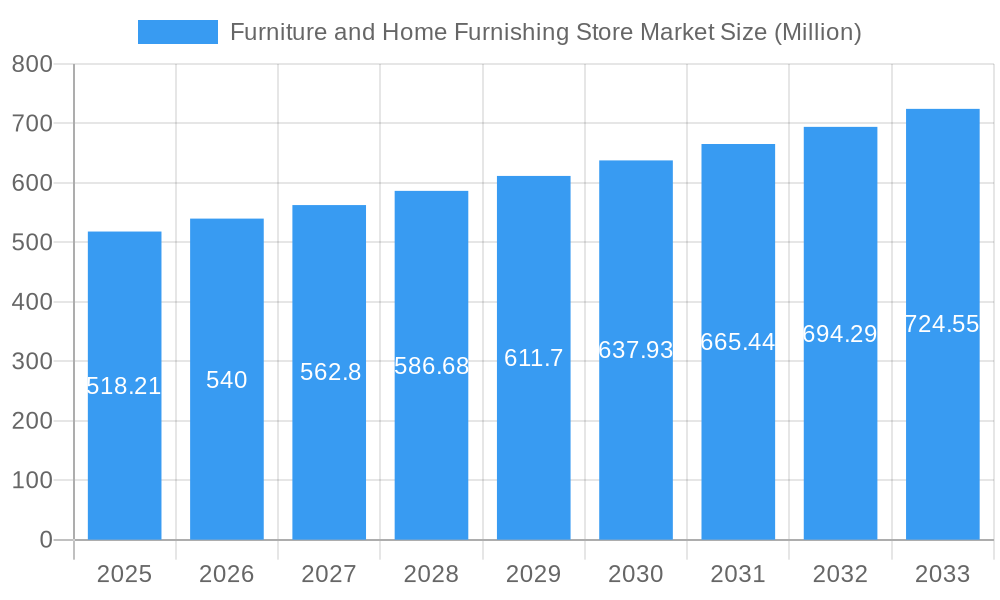

The global furniture and home furnishing store market, valued at $518.21 million in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes in developing economies, coupled with increasing urbanization and a shift towards improved home aesthetics, fuel demand for diverse furniture and home furnishing products. The trend towards online shopping and e-commerce platforms continues to reshape the retail landscape, offering consumers greater convenience and access to a wider variety of products. Furthermore, innovative product designs incorporating sustainable materials and smart home technology are gaining traction, catering to environmentally conscious consumers and enhancing the overall home experience. However, fluctuating raw material prices and global supply chain disruptions pose challenges to market expansion. Competition among established players and emerging brands is intense, necessitating continuous innovation and strategic marketing to capture market share. The market is segmented by product type (e.g., bedroom furniture, living room furniture, kitchen furniture), price point, and distribution channel (online vs. offline). Key players, including Ashley Furniture Industries, Herman Miller, and IKEA, are strategically investing in omnichannel strategies and expanding their product portfolios to maintain a competitive edge.

Furniture and Home Furnishing Store Market Market Size (In Million)

The forecast period (2025-2033) anticipates a compounded annual growth rate (CAGR) of 4.15%, indicating a consistent, albeit moderate, expansion of the market. This growth trajectory is projected to be influenced by the continued evolution of consumer preferences, technological advancements, and the ongoing adaptation of retail strategies by major players. Geographic variations in market growth will likely be influenced by economic conditions, urbanization rates, and prevailing cultural preferences for home furnishings. Regions with strong economic growth and a burgeoning middle class are expected to exhibit higher growth rates than those with slower economic progress. Successful companies will focus on providing value, customization, and sustainable practices to maintain their position in this dynamic and competitive landscape.

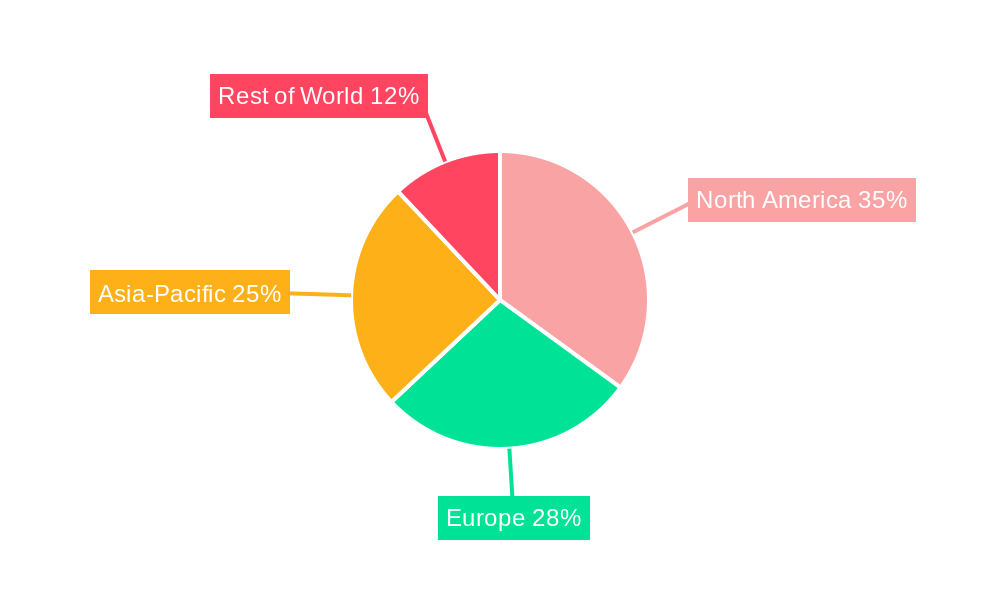

Furniture and Home Furnishing Store Market Company Market Share

Furniture and Home Furnishing Store Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Furniture and Home Furnishing Store Market, offering a comprehensive overview of market dynamics, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking to understand the current state and future trajectory of this dynamic industry.

Furniture and Home Furnishing Store Market Composition & Trends

This section delves into the intricate structure of the furniture and home furnishing store market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. We examine the market share distribution among key players like Ashley Furniture Industries, Heritage Home Group, Herman Miller, Inter Ikea System, Steelcase, The Home Depot, Bed Bath & Beyond, Nitori Holdings, Williams Sonoma, and Global Furniture (list not exhaustive), quantifying their influence on overall market dynamics.

- Market Concentration: The market exhibits a [xx]% concentration ratio, with the top five players controlling [xx]% of the market share in 2025. This concentration is expected to [increase/decrease] to [xx]% by 2033.

- Innovation Catalysts: E-commerce expansion, sustainable material adoption, and personalized design tools are driving innovation.

- Regulatory Landscape: Environmental regulations and safety standards significantly influence manufacturing and product design.

- Substitute Products: The rise of second-hand furniture and rental services presents competitive challenges.

- End-User Profiles: The report segments end-users based on demographics, lifestyle, and spending patterns.

- M&A Activities: The report details significant M&A transactions, analyzing deal values and their impact on market consolidation. For instance, the Havenly acquisition of The Inside in February 2022 demonstrates the growing consolidation in the direct-to-consumer segment. The total M&A deal value in the period 2019-2024 was estimated at $XX Million.

Furniture and Home Furnishing Store Market Industry Evolution

The furniture and home furnishing store market is undergoing a dynamic transformation, marked by significant historical growth and a promising projected trajectory. This section meticulously analyzes these trends, highlighting the profound influence of technological advancements and the ever-evolving landscape of consumer preferences. We delve into the market's growth rates from 2019 to 2024, providing a solid foundation for understanding current momentum. Looking ahead, we offer comprehensive projections for the period between 2025 and 2033, anticipating sustained expansion. Key drivers shaping this evolution include the undeniable rise of e-commerce, creating new avenues for customer reach and purchasing. Simultaneously, there is an escalating demand for furniture that is not only aesthetically pleasing but also sustainable and ethically sourced, reflecting a growing consumer consciousness. The shift towards personalization and customization is also a critical factor, empowering consumers to curate spaces that truly reflect their individual style and needs. Furthermore, the integration of cutting-edge technologies such as advanced 3D design tools and immersive virtual reality experiences is revolutionizing furniture visualization, allowing customers to envision products in their own homes with unprecedented accuracy. This technological integration is directly fueling the impressive growth observed in online furniture sales. The anticipated Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be [xx]%, underscoring the robust future of this market.

Leading Regions, Countries, or Segments in Furniture and Home Furnishing Store Market

This section identifies the leading regions, countries, and segments within the furniture and home furnishing store market. The [Region/Country] is currently the dominant market, primarily driven by [xx].

- Key Drivers for [Region/Country] Dominance:

- Strong economic growth and rising disposable incomes.

- Favorable government policies promoting the furniture industry.

- High levels of urbanization and new construction activity.

- Well-established distribution networks.

- Growing demand for modern and stylish furniture.

Further analysis reveals the significant contribution of [specific segment] to the overall market growth. This is explained in detail through paragraphs within the report.

Furniture and Home Furnishing Store Market Product Innovations

The market is witnessing significant product innovations, including the integration of smart technology into furniture (e.g., adjustable height desks, motorized sofas), eco-friendly materials and manufacturing processes, and increased focus on modular and customizable designs that cater to space-saving and personalized needs. This drives competitiveness and satisfies evolving consumer preferences.

Propelling Factors for Furniture and Home Furnishing Store Market Growth

The robust growth observed in the furniture and home furnishing store market is a direct result of a confluence of powerful economic and social forces. Rising disposable incomes across various demographics are enabling consumers to invest more in enhancing their living spaces. Concurrently, increasing rates of urbanization and a consistent demand for homeownership are creating a sustained need for furniture and home furnishings. The burgeoning trend of home improvement and renovation projects further fuels this demand, as individuals seek to update and personalize their surroundings. The ever-expanding e-commerce sector has also played a pivotal role, democratizing access to a wider array of products and simplifying the purchasing process. Beyond these consumer-driven factors, supportive government initiatives aimed at boosting infrastructure development indirectly contribute to increased construction and subsequent demand for furnishings. The widespread adoption of hybrid work models has also influenced purchasing decisions, with many individuals prioritizing comfortable and functional home office setups. Moreover, continuous innovation in materials and manufacturing techniques is leading to the development of higher quality, more durable, and aesthetically diverse products, significantly enhancing consumer satisfaction and driving market expansion.

Obstacles in the Furniture and Home Furnishing Store Market

Despite its strong growth potential, the furniture and home furnishing store market is not without its challenges. Fluctuations in the prices of raw materials, such as timber, metals, and textiles, can significantly impact production costs and profit margins, creating an element of unpredictability for manufacturers and retailers alike. The global supply chain has also proven to be susceptible to disruptions, as evidenced by quantified impacts experienced in [year], leading to delays in production and delivery, and ultimately affecting customer satisfaction. The intensifying competition from online retailers, who often offer competitive pricing and wider selections, presents a significant hurdle for traditional brick-and-mortar stores. Furthermore, the increasing stringency of environmental regulations, while crucial for sustainability, can lead to higher manufacturing costs as businesses adapt to more eco-friendly practices and materials. The collective impact of these obstacles on overall market growth and profitability is a subject of ongoing analysis and is discussed in detail within this report.

Future Opportunities in Furniture and Home Furnishing Store Market

Emerging opportunities exist in areas such as sustainable and eco-friendly furniture, smart home integration, customization and personalization services, and expanding into new markets with growing middle classes. Focus on rental furniture models and increased use of augmented reality/virtual reality in online shopping experiences are also key potential growth areas.

Major Players in the Furniture and Home Furnishing Store Market Ecosystem

- Ashley Furniture Industries: A global leader known for its diverse range of home furnishings and affordable luxury.

- Heritage Home Group: A prominent entity comprising several well-established furniture brands, offering a wide spectrum of styles and price points.

- Herman Miller: Renowned for its iconic, design-forward furniture and a strong focus on ergonomic office solutions.

- Inter Ikea System: The world's largest furniture retailer, celebrated for its stylish, functional, and budget-friendly home furnishings, often sold flat-packed.

- Steelcase: A leading provider of innovative office furniture and workspace solutions, emphasizing productivity and well-being.

- The Home Depot: While a home improvement giant, it also offers a substantial and growing selection of furniture and home decor.

- Bed Bath & Beyond: A comprehensive retailer specializing in home goods, including a wide array of furniture, bedding, and bath essentials.

- Nitori Holdings: A major Japanese retailer offering a broad range of home furnishings at competitive prices, with an increasing international presence.

- Williams Sonoma: A premium retailer offering high-quality home furnishings, kitchenware, and decorative items, with a focus on curated collections.

- Global Furniture: A significant player in the furniture manufacturing and distribution landscape, known for its diverse product lines catering to various market segments.

Key Developments in Furniture and Home Furnishing Store Market Industry

- October 2023: Pottery Barn (Williams-Sonoma) launched a new home furnishings collaboration inspired by the film "Elf," capitalizing on the holiday season and leveraging brand licensing for increased market penetration.

- August 2022: Inter Ikea Group invested in Flow Loop, a water-recycling shower solution, showcasing a commitment to sustainability and aligning with growing consumer demand for eco-friendly products.

- February 2022: Havenly's acquisition of The Inside strengthened its direct-to-consumer presence and expanded its design services portfolio, indicating a trend toward market consolidation within the online interior design sector.

Strategic Furniture and Home Furnishing Store Market Forecast

The furniture and home furnishing store market is poised for continued growth, driven by the factors outlined previously. The forecast predicts a [xx]% CAGR from 2025 to 2033, reaching a market size of $XX Million by 2033. This growth will be particularly pronounced in segments focusing on sustainable products, customized solutions, and advanced technologies. Opportunities for players lie in adapting to evolving consumer preferences, embracing digitalization, and strengthening supply chain resilience.

Furniture and Home Furnishing Store Market Segmentation

-

1. Type

- 1.1. Furniture Stores

- 1.2. Home Furnishing Stores

-

2. Ownership

- 2.1. Retail Chains

- 2.2. Independent Stores

-

3. Store Type

- 3.1. Exclusive/Retail Showrooms

- 3.2. Inclusive Retailers/Dealers Store

Furniture and Home Furnishing Store Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

Furniture and Home Furnishing Store Market Regional Market Share

Geographic Coverage of Furniture and Home Furnishing Store Market

Furniture and Home Furnishing Store Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing popularity of DIY furniture and home decor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Furniture and Home Furnishing Store Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Furniture Stores

- 5.1.2. Home Furnishing Stores

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Retail Chains

- 5.2.2. Independent Stores

- 5.3. Market Analysis, Insights and Forecast - by Store Type

- 5.3.1. Exclusive/Retail Showrooms

- 5.3.2. Inclusive Retailers/Dealers Store

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Furniture and Home Furnishing Store Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Furniture Stores

- 6.1.2. Home Furnishing Stores

- 6.2. Market Analysis, Insights and Forecast - by Ownership

- 6.2.1. Retail Chains

- 6.2.2. Independent Stores

- 6.3. Market Analysis, Insights and Forecast - by Store Type

- 6.3.1. Exclusive/Retail Showrooms

- 6.3.2. Inclusive Retailers/Dealers Store

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Furniture and Home Furnishing Store Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Furniture Stores

- 7.1.2. Home Furnishing Stores

- 7.2. Market Analysis, Insights and Forecast - by Ownership

- 7.2.1. Retail Chains

- 7.2.2. Independent Stores

- 7.3. Market Analysis, Insights and Forecast - by Store Type

- 7.3.1. Exclusive/Retail Showrooms

- 7.3.2. Inclusive Retailers/Dealers Store

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Furniture and Home Furnishing Store Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Furniture Stores

- 8.1.2. Home Furnishing Stores

- 8.2. Market Analysis, Insights and Forecast - by Ownership

- 8.2.1. Retail Chains

- 8.2.2. Independent Stores

- 8.3. Market Analysis, Insights and Forecast - by Store Type

- 8.3.1. Exclusive/Retail Showrooms

- 8.3.2. Inclusive Retailers/Dealers Store

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Furniture and Home Furnishing Store Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Furniture Stores

- 9.1.2. Home Furnishing Stores

- 9.2. Market Analysis, Insights and Forecast - by Ownership

- 9.2.1. Retail Chains

- 9.2.2. Independent Stores

- 9.3. Market Analysis, Insights and Forecast - by Store Type

- 9.3.1. Exclusive/Retail Showrooms

- 9.3.2. Inclusive Retailers/Dealers Store

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ashley Furniture Industries

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Heritage Home Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Herman Miller

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Inter Ikea System

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Steelcase

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Home Depot

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bed Bath & Beyond

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nitori Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Williams Sonoma

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Global Furniture*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Ashley Furniture Industries

List of Figures

- Figure 1: Global Furniture and Home Furnishing Store Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Furniture and Home Furnishing Store Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Furniture and Home Furnishing Store Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Furniture and Home Furnishing Store Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Furniture and Home Furnishing Store Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Furniture and Home Furnishing Store Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Furniture and Home Furnishing Store Market Revenue (Million), by Ownership 2025 & 2033

- Figure 8: North America Furniture and Home Furnishing Store Market Volume (Billion), by Ownership 2025 & 2033

- Figure 9: North America Furniture and Home Furnishing Store Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 10: North America Furniture and Home Furnishing Store Market Volume Share (%), by Ownership 2025 & 2033

- Figure 11: North America Furniture and Home Furnishing Store Market Revenue (Million), by Store Type 2025 & 2033

- Figure 12: North America Furniture and Home Furnishing Store Market Volume (Billion), by Store Type 2025 & 2033

- Figure 13: North America Furniture and Home Furnishing Store Market Revenue Share (%), by Store Type 2025 & 2033

- Figure 14: North America Furniture and Home Furnishing Store Market Volume Share (%), by Store Type 2025 & 2033

- Figure 15: North America Furniture and Home Furnishing Store Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Furniture and Home Furnishing Store Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Furniture and Home Furnishing Store Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Furniture and Home Furnishing Store Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Furniture and Home Furnishing Store Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Furniture and Home Furnishing Store Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Furniture and Home Furnishing Store Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Furniture and Home Furnishing Store Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Furniture and Home Furnishing Store Market Revenue (Million), by Ownership 2025 & 2033

- Figure 24: Europe Furniture and Home Furnishing Store Market Volume (Billion), by Ownership 2025 & 2033

- Figure 25: Europe Furniture and Home Furnishing Store Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 26: Europe Furniture and Home Furnishing Store Market Volume Share (%), by Ownership 2025 & 2033

- Figure 27: Europe Furniture and Home Furnishing Store Market Revenue (Million), by Store Type 2025 & 2033

- Figure 28: Europe Furniture and Home Furnishing Store Market Volume (Billion), by Store Type 2025 & 2033

- Figure 29: Europe Furniture and Home Furnishing Store Market Revenue Share (%), by Store Type 2025 & 2033

- Figure 30: Europe Furniture and Home Furnishing Store Market Volume Share (%), by Store Type 2025 & 2033

- Figure 31: Europe Furniture and Home Furnishing Store Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Furniture and Home Furnishing Store Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Furniture and Home Furnishing Store Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Furniture and Home Furnishing Store Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Furniture and Home Furnishing Store Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Furniture and Home Furnishing Store Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Asia Pacific Furniture and Home Furnishing Store Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Furniture and Home Furnishing Store Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Furniture and Home Furnishing Store Market Revenue (Million), by Ownership 2025 & 2033

- Figure 40: Asia Pacific Furniture and Home Furnishing Store Market Volume (Billion), by Ownership 2025 & 2033

- Figure 41: Asia Pacific Furniture and Home Furnishing Store Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 42: Asia Pacific Furniture and Home Furnishing Store Market Volume Share (%), by Ownership 2025 & 2033

- Figure 43: Asia Pacific Furniture and Home Furnishing Store Market Revenue (Million), by Store Type 2025 & 2033

- Figure 44: Asia Pacific Furniture and Home Furnishing Store Market Volume (Billion), by Store Type 2025 & 2033

- Figure 45: Asia Pacific Furniture and Home Furnishing Store Market Revenue Share (%), by Store Type 2025 & 2033

- Figure 46: Asia Pacific Furniture and Home Furnishing Store Market Volume Share (%), by Store Type 2025 & 2033

- Figure 47: Asia Pacific Furniture and Home Furnishing Store Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Furniture and Home Furnishing Store Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Furniture and Home Furnishing Store Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Furniture and Home Furnishing Store Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Furniture and Home Furnishing Store Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East Furniture and Home Furnishing Store Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East Furniture and Home Furnishing Store Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East Furniture and Home Furnishing Store Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East Furniture and Home Furnishing Store Market Revenue (Million), by Ownership 2025 & 2033

- Figure 56: Middle East Furniture and Home Furnishing Store Market Volume (Billion), by Ownership 2025 & 2033

- Figure 57: Middle East Furniture and Home Furnishing Store Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 58: Middle East Furniture and Home Furnishing Store Market Volume Share (%), by Ownership 2025 & 2033

- Figure 59: Middle East Furniture and Home Furnishing Store Market Revenue (Million), by Store Type 2025 & 2033

- Figure 60: Middle East Furniture and Home Furnishing Store Market Volume (Billion), by Store Type 2025 & 2033

- Figure 61: Middle East Furniture and Home Furnishing Store Market Revenue Share (%), by Store Type 2025 & 2033

- Figure 62: Middle East Furniture and Home Furnishing Store Market Volume Share (%), by Store Type 2025 & 2033

- Figure 63: Middle East Furniture and Home Furnishing Store Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East Furniture and Home Furnishing Store Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East Furniture and Home Furnishing Store Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East Furniture and Home Furnishing Store Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 5: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Store Type 2020 & 2033

- Table 6: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Store Type 2020 & 2033

- Table 7: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 12: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 13: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Store Type 2020 & 2033

- Table 14: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Store Type 2020 & 2033

- Table 15: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 20: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 21: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Store Type 2020 & 2033

- Table 22: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Store Type 2020 & 2033

- Table 23: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 28: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 29: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Store Type 2020 & 2033

- Table 30: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Store Type 2020 & 2033

- Table 31: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 36: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 37: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Store Type 2020 & 2033

- Table 38: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Store Type 2020 & 2033

- Table 39: Global Furniture and Home Furnishing Store Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Furniture and Home Furnishing Store Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture and Home Furnishing Store Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Furniture and Home Furnishing Store Market?

Key companies in the market include Ashley Furniture Industries, Heritage Home Group, Herman Miller, Inter Ikea System, Steelcase, The Home Depot, Bed Bath & Beyond, Nitori Holdings, Williams Sonoma, Global Furniture*List Not Exhaustive.

3. What are the main segments of the Furniture and Home Furnishing Store Market?

The market segments include Type, Ownership, Store Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 518.21 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing popularity of DIY furniture and home decor.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Pottery Barn, a portfolio brand of Williams-Sonoma, Inc, the world’s largest digital-first, design-led and sustainable home retailer launched new home furnishings collaboration inspired by the beloved holiday film, Elf

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Furniture and Home Furnishing Store Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Furniture and Home Furnishing Store Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Furniture and Home Furnishing Store Market?

To stay informed about further developments, trends, and reports in the Furniture and Home Furnishing Store Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence