Key Insights

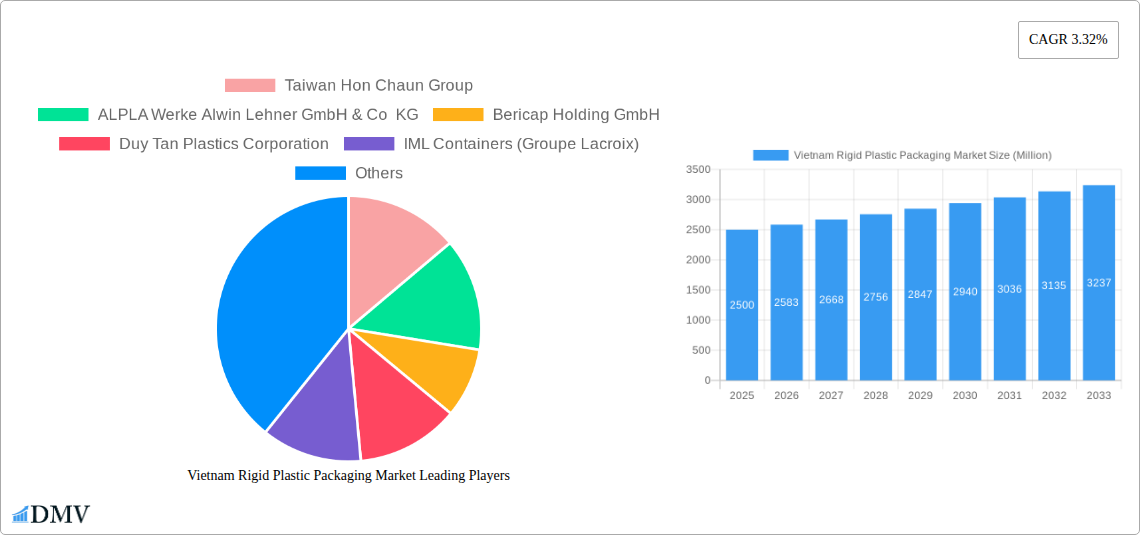

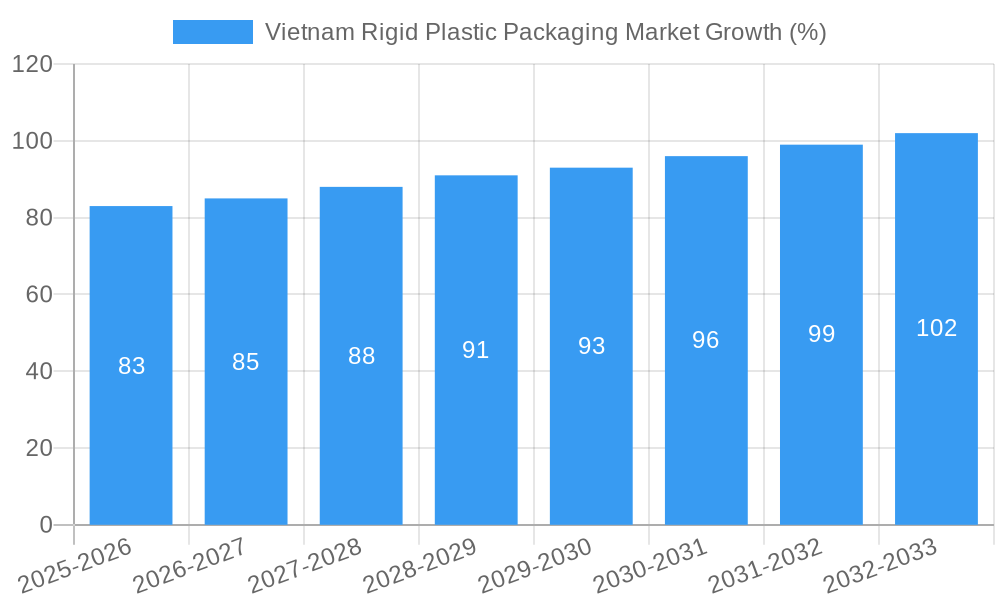

The Vietnam rigid plastic packaging market, valued at approximately $XXX million in 2025, is projected to experience robust growth, driven by a burgeoning consumer goods sector, rising disposable incomes, and increasing demand for convenient and cost-effective packaging solutions. The market's 3.32% CAGR from 2019-2033 indicates a steady expansion, fueled by the country's economic development and its position as a significant manufacturing hub in Southeast Asia. Key drivers include the growth of e-commerce, leading to higher demand for protective packaging, and the increasing adoption of lightweight and durable plastic packaging materials to minimize transportation costs. However, environmental concerns surrounding plastic waste and stricter government regulations regarding plastic usage pose significant restraints. The market is segmented by packaging type (bottles, containers, films, etc.), application (food and beverage, consumer goods, pharmaceuticals, etc.), and material type (PET, HDPE, PP, etc.). The competitive landscape involves a mix of established international players like Taiwan Hon Chaun Group, ALPLA, Bericap, and Greif, alongside a growing number of domestic companies such as Inplas Vietnam and Duy Tan Plastics. The strategic focus of established players is on technological innovation, offering sustainable packaging solutions, and expanding production capacity to meet the growing demand, while local players aim for enhanced efficiency and competitive pricing.

The forecast period (2025-2033) suggests continued expansion, with potential growth spurred by innovations in sustainable packaging materials and increased investments in recycling infrastructure. This will likely lead to a more diverse market with a greater emphasis on eco-friendly solutions. While challenges remain related to environmental concerns and regulatory changes, the overall outlook remains positive, particularly for companies that can effectively address sustainability issues and cater to the evolving preferences of Vietnamese consumers. Successful market penetration will hinge on understanding evolving consumer preferences, adapting to the regulatory landscape, and embracing sustainable practices.

Vietnam Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Vietnam rigid plastic packaging market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this thriving market. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Vietnam Rigid Plastic Packaging Market Composition & Trends

This section meticulously evaluates the Vietnam rigid plastic packaging market's structure and evolving dynamics. We delve into market concentration, analyzing the share distribution among key players like Taiwan Hon Chaun Group, ALPLA Werke Alwin Lehner GmbH & Co KG, and Duy Tan Plastics Corporation. Innovation catalysts, such as advancements in materials science and sustainable packaging solutions, are examined alongside the regulatory landscape and its impact on market growth. The influence of substitute products and evolving end-user preferences across various sectors (e.g., food & beverage, consumer goods) are comprehensively assessed. Furthermore, the report scrutinizes M&A activities within the market, including deal values and their implications for market consolidation.

- Market Concentration: xx% market share held by top 5 players in 2025.

- M&A Activity: xx Million in total deal value recorded between 2019-2024.

- Regulatory Landscape: Analysis of existing and upcoming regulations impacting material usage and sustainability.

- Substitute Products: Impact of alternative packaging materials (e.g., paperboard, glass) on market share.

Vietnam Rigid Plastic Packaging Market Industry Evolution

This section traces the historical and projected evolution of the Vietnam rigid plastic packaging market. We analyze market growth trajectories from 2019 to 2024, highlighting key milestones and inflection points. Technological advancements, such as the adoption of lightweighting techniques and improved barrier properties, are assessed in detail, along with their impact on production costs and product performance. Moreover, the report examines shifting consumer preferences towards sustainable and convenient packaging, and their effect on market demand. The analysis includes specific data points on growth rates and adoption metrics for key technologies. We delve into the impact of the COVID-19 pandemic and its lasting effects on the supply chain and consumer behaviour, projecting future growth based on multiple scenarios.

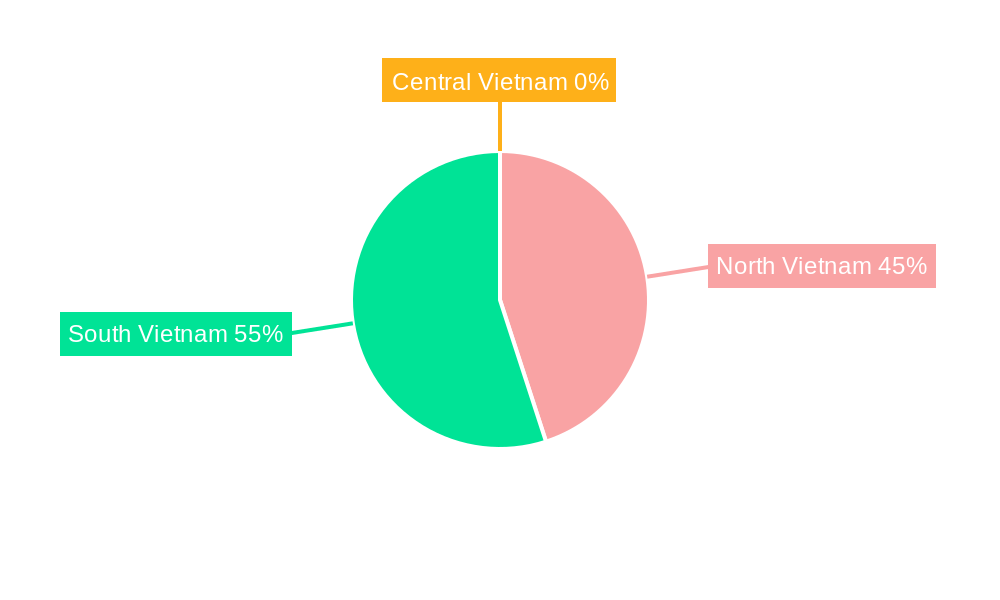

Leading Regions, Countries, or Segments in Vietnam Rigid Plastic Packaging Market

This section identifies the leading regions, countries, or segments within the Vietnam rigid plastic packaging market. The report provides a detailed analysis of the dominance factors in the leading segment (e.g., specific types of rigid plastic packaging such as bottles, containers, etc.) through both paragraph form and bullet points, detailing the reasons behind their success.

- Key Drivers (e.g., for the leading segment):

- Strong economic growth driving consumer demand.

- Government incentives for the development of sustainable packaging solutions.

- Significant investment in advanced manufacturing facilities.

- Increasing demand from specific end-use industries.

Vietnam Rigid Plastic Packaging Market Product Innovations

This section showcases recent product innovations in the Vietnam rigid plastic packaging market. We highlight unique selling propositions (USPs) such as enhanced barrier properties, lightweight designs, and improved recyclability, focusing on their impact on market competitiveness. The analysis includes examples of technological advancements and their application in diverse end-use applications. The discussion encompasses the integration of smart packaging features and other innovations designed to enhance product safety, branding, and consumer experience.

Propelling Factors for Vietnam Rigid Plastic Packaging Market Growth

Several factors are driving the growth of the Vietnam rigid plastic packaging market. These include the burgeoning consumer goods sector, the increasing popularity of convenience foods, and government initiatives promoting domestic manufacturing. Technological advancements, like the development of more sustainable and recyclable plastics, are also fueling growth. The favourable economic environment and increasing foreign direct investment are creating a supportive backdrop for market expansion.

Obstacles in the Vietnam Rigid Plastic Packaging Market

Despite the positive outlook, the Vietnam rigid plastic packaging market faces challenges. Fluctuations in raw material prices and concerns about environmental impact are notable constraints. Competition from alternative packaging materials, stringent regulatory requirements related to recyclability and waste management, and potential supply chain disruptions pose further obstacles to market growth. These factors can influence pricing strategies and overall market profitability.

Future Opportunities in Vietnam Rigid Plastic Packaging Market

The Vietnam rigid plastic packaging market presents numerous growth opportunities. The rising demand for sustainable and eco-friendly packaging materials creates a strong impetus for innovation. The potential for increased exports and the expansion into niche market segments further bolster the market's future prospects. Focusing on specialized applications and developing innovative packaging solutions will be crucial to unlock the market's full potential.

Major Players in the Vietnam Rigid Plastic Packaging Market Ecosystem

- Taiwan Hon Chaun Group

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Bericap Holding GmbH

- Duy Tan Plastics Corporation

- IML Containers (Groupe Lacroix)

- Inplas Vietnam JSC

- Indorama Ventures Vietnam

- Greif Inc

Key Developments in Vietnam Rigid Plastic Packaging Market Industry

- May 2024: ALPLA Werke Alwin Lehner GmbH & Co. KG launched a recyclable PET wine bottle, eight times lighter than its glass counterpart, aiming for 1 Million units by 2025.

- May 2024: Greif Inc. showcased innovative plastic drum packaging solutions at ProPak Asia 2024 in Thailand.

Strategic Vietnam Rigid Plastic Packaging Market Forecast

The Vietnam rigid plastic packaging market is poised for robust growth driven by rising consumer demand, technological advancements, and favorable government policies. The market's potential is significant, particularly in sustainable packaging solutions. Continued investment in innovation and sustainable practices will be key to unlocking this potential and shaping the future of the industry.

Vietnam Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 2.5. Polyvinyl Chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Vietnam Rigid Plastic Packaging Market Segmentation By Geography

- 1. Vietnam

Vietnam Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam

- 3.3. Market Restrains

- 3.3.1. Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Segment is Estimated to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.5. Polyvinyl Chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Taiwan Hon Chaun Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bericap Holding GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duy Tan Plastics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IML Containers (Groupe Lacroix)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inplas Vietnam JSC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indorama Ventures Vietnam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Greif Inc 8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Taiwan Hon Chaun Group

List of Figures

- Figure 1: Vietnam Rigid Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Rigid Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by End-Use Industries 2019 & 2032

- Table 5: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 8: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by End-Use Industries 2019 & 2032

- Table 9: Vietnam Rigid Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the Vietnam Rigid Plastic Packaging Market?

Key companies in the market include Taiwan Hon Chaun Group, ALPLA Werke Alwin Lehner GmbH & Co KG, Bericap Holding GmbH, Duy Tan Plastics Corporation, IML Containers (Groupe Lacroix), Inplas Vietnam JSC, Indorama Ventures Vietnam, Greif Inc 8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Vietnam Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam.

6. What are the notable trends driving market growth?

Polyethylene (PE) Segment is Estimated to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Tourism to Boost Food and Beverage Industry; Availability of Variety of Plastic Packaging Products in Vietnam.

8. Can you provide examples of recent developments in the market?

May 2024: ALPLA Werke Alwin Lehner GmbH & Co. KG, an Austria-based company with operations in Vietnam, unveiled a recyclable wine bottle crafted from Polyethylene Terephthalate (PET). This new bottle is approximately eight times lighter than its glass counterpart. Looking ahead, the company aims to produce a million units of this bottle by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Vietnam Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence