Key Insights

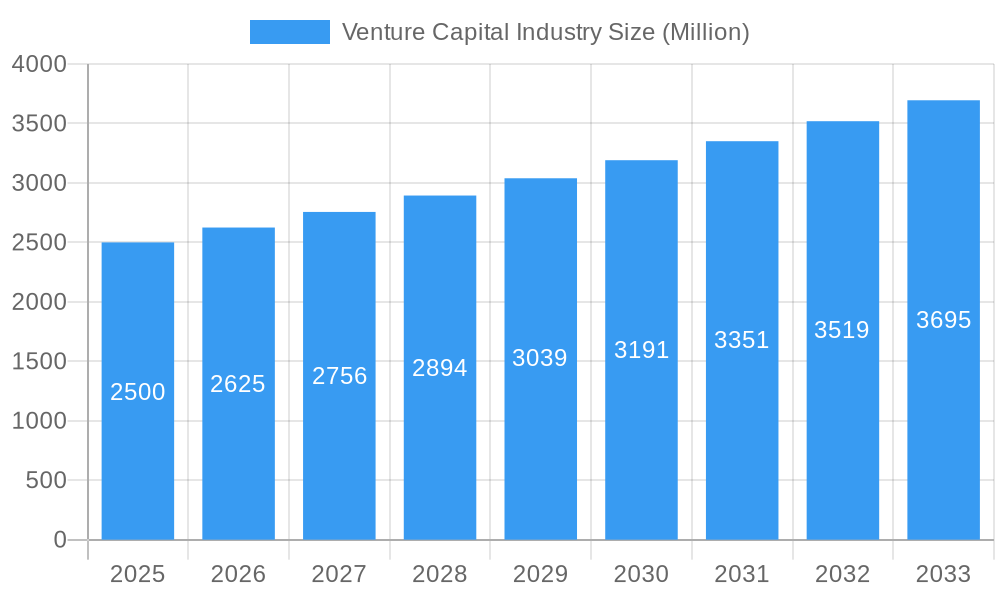

The venture capital (VC) industry is experiencing robust growth, fueled by a confluence of factors. A compound annual growth rate (CAGR) exceeding 5% indicates a consistently expanding market, projected to reach significant valuation by 2033. This expansion is driven by several key elements: the increasing number of innovative startups across diverse sectors (particularly technology, healthcare, and renewable energy), the readily available pool of high-net-worth individuals and institutional investors seeking high-growth opportunities, and the ongoing digital transformation reshaping various industries. Furthermore, government initiatives promoting entrepreneurship and technological advancement in many regions are further stimulating VC investment. The competitive landscape is marked by both established players like Tiger Global Management, Sequoia Capital, and Accel and emerging funds, resulting in a dynamic and intensely competitive investment environment.

Venture Capital Industry Market Size (In Billion)

However, the VC market is not without its challenges. Economic downturns, regulatory uncertainties in certain sectors, and the inherent risk associated with early-stage investments create periods of volatility. Successful exits (through IPOs or acquisitions) remain crucial for the overall health of the VC ecosystem. Furthermore, the increasing competition for promising startups necessitates a sophisticated approach to due diligence, deal structuring, and portfolio management. Geographic diversification and a focus on sectors displaying resilience to economic fluctuations are key strategies employed by successful VC firms to mitigate risk and maximize returns. The industry’s long-term success hinges on a balance between aggressive growth strategies and careful risk management in an ever-evolving technological and economic landscape. Segmentation within the industry, though not detailed here, is likely driven by investment stage (seed, Series A, etc.), industry focus, and geographic location.

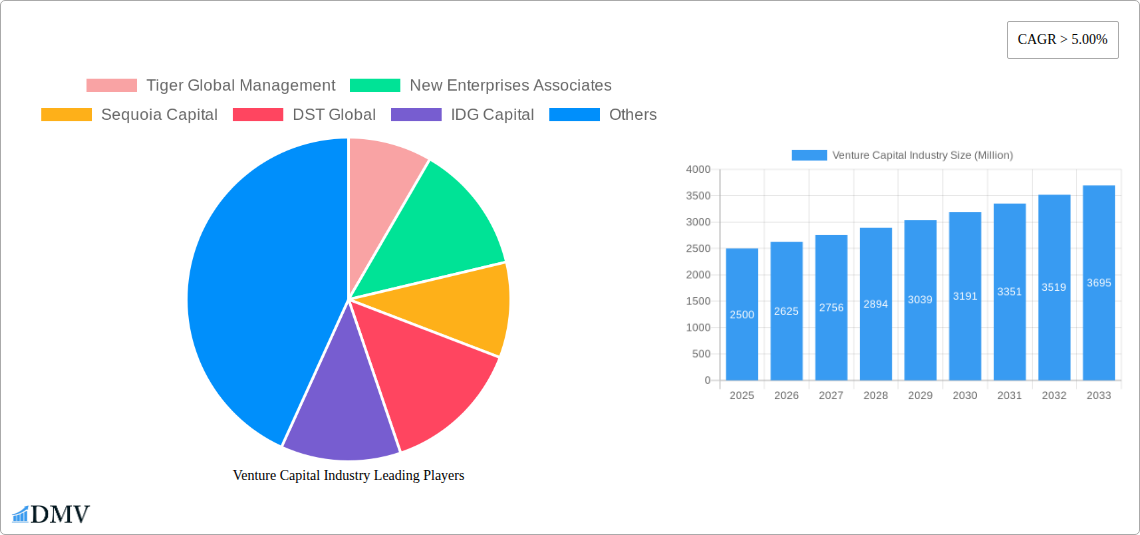

Venture Capital Industry Company Market Share

Venture Capital Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Venture Capital (VC) industry, encompassing market trends, leading players, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering stakeholders a comprehensive understanding of this dynamic market. This report is crucial for investors, entrepreneurs, and industry professionals seeking to navigate the complexities of the VC landscape and capitalize on emerging opportunities. The report projects a market value exceeding xx Million by 2033.

Venture Capital Industry Market Composition & Trends

This section evaluates the market concentration, innovation catalysts, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity within the VC industry. We analyze market share distribution among key players and delve into the financial implications of M&A deals.

Market Concentration: The VC industry exhibits a moderately concentrated landscape, with a few dominant players like Sequoia Capital and Tiger Global Management commanding significant market share. However, a large number of smaller firms contribute to the overall market activity. Estimated market share distribution in 2025: Sequoia Capital (xx%), Tiger Global Management (xx%), New Enterprises Associates (xx%), and others (xx%).

Innovation Catalysts: Technological advancements, particularly in areas like Artificial Intelligence (AI), Fintech, and Biotechnology, are driving significant innovation within the VC space. This fuels investment in disruptive technologies and startups.

Regulatory Landscape: Varying regulatory frameworks across different jurisdictions influence investment decisions and operational strategies. Compliance requirements and changes in regulations significantly impact VC activities.

Substitute Products/Services: While direct substitutes for VC funding are limited, alternative financing options such as angel investors and crowdfunding pose competitive pressures.

End-User Profiles: The primary end-users are startups across diverse sectors seeking capital for growth and expansion. The report segments end-users based on industry, stage of development, and geographical location.

M&A Activities: The VC industry witnesses frequent M&A activity, with larger firms acquiring smaller firms to expand their portfolio and market reach. The total value of M&A deals in 2024 is estimated at xx Million, with an average deal size of xx Million.

Venture Capital Industry Industry Evolution

This section analyzes the evolution of the VC industry, focusing on market growth trajectories, technological advancements, and shifting consumer demands from 2019 to 2025. We present specific data points including growth rates and adoption metrics to illustrate industry dynamics. The period shows a significant shift towards later-stage investments and increased competition among VCs. The global VC market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven primarily by increasing investments in technology and healthcare sectors. The adoption of digital tools and online platforms for deal sourcing and management significantly enhanced operational efficiency and broadened geographical reach during this period. Furthermore, the rise of thematic investing (focused on specific technologies or industries) has reshaped the investment landscape. The increased focus on ESG (Environmental, Social, and Governance) factors is also influencing investment decisions and portfolio construction.

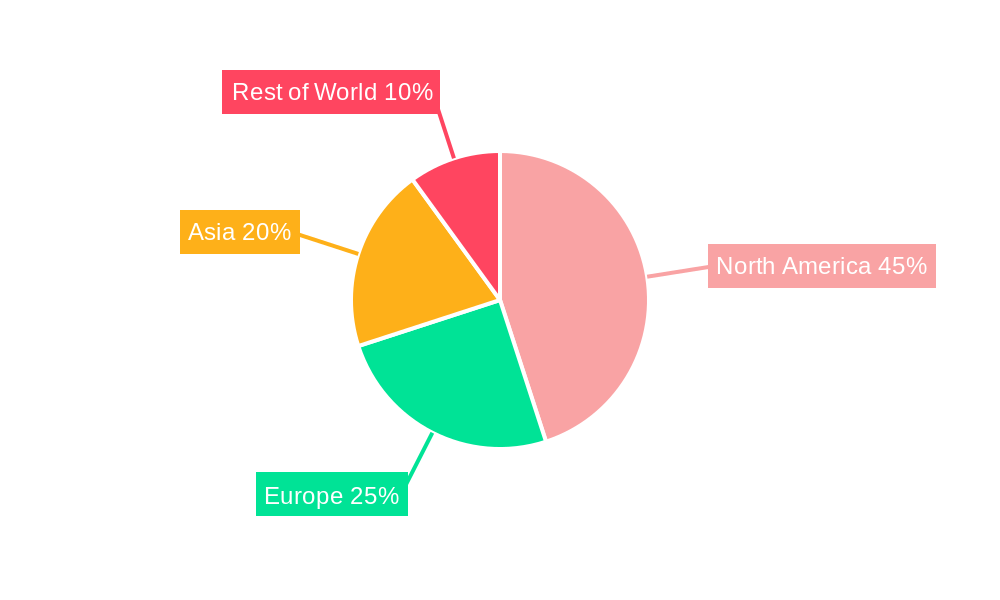

Leading Regions, Countries, or Segments in Venture Capital Industry

This section delves into the preeminent geographical hubs, nations, and industry verticals that command significant influence and capital within the venture capital landscape. We employ a structured approach, utilizing bullet points to delineate pivotal drivers such as evolving investment trends and robust regulatory frameworks, while employing detailed paragraphs to offer a comprehensive analysis of the underlying factors contributing to this dominance.

-

The Americas (Dominant Region): The Americas, with a pronounced leadership from the United States, continue to set the pace in venture capital investment volume and the velocity of deal origination. This sustained preeminence is intrinsically linked to a highly developed startup ecosystem, an unparalleled availability of capital, and a consistently supportive regulatory environment. The presence of a deep bench of seasoned investors and visionary entrepreneurs, coupled with unfettered access to cutting-edge technologies and a sophisticated financial market infrastructure, are foundational pillars of this enduring dominance.

-

Europe (Significant Growth & Maturation): Europe is experiencing a robust and accelerating trajectory in venture capital investment, with particular dynamism observed in key markets like the United Kingdom, Germany, and France. This upward momentum is largely attributable to a burgeoning number of innovative technology startups and a proactive stance from governments in fostering supportive policy landscapes that encourage innovation and investment.

-

Asia (Rapid Expansion & Emerging Powerhouse): Asia, spearheaded by the economic giants of China and India, is emerging as a critical and rapidly expanding frontier for venture capital. Driven by ambitious government initiatives aimed at fostering innovation, a surge in entrepreneurial spirit, and the immense potential of its vast consumer base, the region is attracting substantial and growing investment flows.

Venture Capital Industry Product Innovations

While the venture capital industry does not manufacture tangible "products" in the conventional sense, its innovation is profoundly evident in the continuous refinement of investment strategies, the optimization of deal-making processes, and the pioneering of novel fund structures. This includes the development of specialized thematic funds tailored to emerging sectors. Furthermore, the industry is strategically leveraging advancements in data analytics and artificial intelligence to enhance critical functions such as deal sourcing, rigorous due diligence, and sophisticated portfolio management. These technological integrations are instrumental in boosting operational efficiency, mitigating investment risks, and ultimately amplifying returns for stakeholders. A noteworthy evolution is the rise of impact investing, which prioritizes companies demonstrating positive social and environmental outcomes, representing a significant innovation in the VC investment paradigm.

Propelling Factors for Venture Capital Industry Growth

The expansion and vitality of the venture capital industry are propelled by a confluence of strategic factors:

- Technological Advancements: Perpetual breakthroughs across domains such as Artificial Intelligence, biotechnology, and other transformative fields are consistently generating a rich pipeline of investment opportunities within high-growth, disruptive sectors.

- Economic Resilience and Expansion: Favorable economic conditions, characterized by robust growth and increasing consumer purchasing power, serve as a catalyst for entrepreneurial ventures and amplify the demand for venture capital funding.

- Proactive Government Support & Policy Frameworks: Governments globally are increasingly implementing forward-thinking policies designed to cultivate entrepreneurship and attract venture capital investment. These often include attractive tax incentives, dedicated funding programs, and streamlined regulatory processes.

Obstacles in the Venture Capital Industry Market

Despite the growth potential, several factors hinder market expansion:

- Regulatory uncertainty: Changing regulations and compliance requirements across different jurisdictions create uncertainty and can impede investment decisions.

- Competitive pressures: The intense competition among VC firms for attractive investment opportunities can lead to inflated valuations and higher risk-taking.

- Geopolitical risks: Global economic and political instability can impact investment sentiment and reduce VC activity.

Future Opportunities in Venture Capital Industry

Emerging opportunities include:

- Investment in sustainable technologies: Growing demand for environmentally friendly solutions creates vast opportunities for investment in renewable energy, green technology, and sustainable agriculture.

- Expansion into new markets: Developing economies and frontier markets present significant growth potential for VC investment.

- Focus on impact investing: The increasing awareness of ESG factors is driving investments in companies with positive social and environmental impact.

Major Players in the Venture Capital Industry Ecosystem

- Tiger Global Management

- New Enterprises Associates

- Sequoia Capital

- DST Global

- IDG Capital

- Index Ventures

- Healthcare Royalty Partners

- GGV Capital

- Nanjing Zijin Investment

- Greylock Partners

Key Developments in Venture Capital Industry

- Q4 2020: The Americas region demonstrated significant capital deployment, recording USD 41 billion in venture capital investments spread across 2,725 deals. The United States alone contributed USD 38.8 billion through 2,526 transactions. Concurrently, Europe witnessed substantial activity, with USD 14.3 billion raised across 1,192 deals.

- 2022: IDG Capital Vietnam's confirmation of an investment in METAIN signals a strategic intent to pioneer the burgeoning trend of NFT-empowered real estate within Vietnam. This development underscores the escalating interest and investment flowing into blockchain technology and its diverse applications, including the real estate sector.

Strategic Venture Capital Industry Market Forecast

The venture capital industry is strategically positioned for sustained and significant growth, propelled by the relentless pace of technological innovation, a burgeoning entrepreneurial spirit, and a consistently supportive global policy environment. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of XX% over the forecast period spanning 2025-2033. This expansion will be characterized by abundant investment opportunities across a diverse spectrum of sectors, prominently including Artificial Intelligence, Fintech, and sustainable technology solutions. The increasing integration of data-driven decision-making methodologies and the strategic expansion into novel geographical markets are anticipated to further bolster the industry's robust growth trajectory. Moreover, the growing emphasis on impact investing and the integration of Environmental, Social, and Governance (ESG) principles will undoubtedly shape and guide investment strategies in the forthcoming years.

Venture Capital Industry Segmentation

-

1. Type

- 1.1. Local Investors

- 1.2. International Investors

-

2. Industry

- 2.1. Real Estate

- 2.2. Financial Services

- 2.3. Food & Beverages

- 2.4. Healthcare

- 2.5. Transport & Logistics

- 2.6. IT & ITeS

- 2.7. Education

- 2.8. Other Industries

Venture Capital Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Venture Capital Industry Regional Market Share

Geographic Coverage of Venture Capital Industry

Venture Capital Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Distribution of Start-Ups Witnessing Venture Capital Industry Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Local Investors

- 5.1.2. International Investors

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Real Estate

- 5.2.2. Financial Services

- 5.2.3. Food & Beverages

- 5.2.4. Healthcare

- 5.2.5. Transport & Logistics

- 5.2.6. IT & ITeS

- 5.2.7. Education

- 5.2.8. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Local Investors

- 6.1.2. International Investors

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Real Estate

- 6.2.2. Financial Services

- 6.2.3. Food & Beverages

- 6.2.4. Healthcare

- 6.2.5. Transport & Logistics

- 6.2.6. IT & ITeS

- 6.2.7. Education

- 6.2.8. Other Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Local Investors

- 7.1.2. International Investors

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Real Estate

- 7.2.2. Financial Services

- 7.2.3. Food & Beverages

- 7.2.4. Healthcare

- 7.2.5. Transport & Logistics

- 7.2.6. IT & ITeS

- 7.2.7. Education

- 7.2.8. Other Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Local Investors

- 8.1.2. International Investors

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Real Estate

- 8.2.2. Financial Services

- 8.2.3. Food & Beverages

- 8.2.4. Healthcare

- 8.2.5. Transport & Logistics

- 8.2.6. IT & ITeS

- 8.2.7. Education

- 8.2.8. Other Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Local Investors

- 9.1.2. International Investors

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Real Estate

- 9.2.2. Financial Services

- 9.2.3. Food & Beverages

- 9.2.4. Healthcare

- 9.2.5. Transport & Logistics

- 9.2.6. IT & ITeS

- 9.2.7. Education

- 9.2.8. Other Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Local Investors

- 10.1.2. International Investors

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Real Estate

- 10.2.2. Financial Services

- 10.2.3. Food & Beverages

- 10.2.4. Healthcare

- 10.2.5. Transport & Logistics

- 10.2.6. IT & ITeS

- 10.2.7. Education

- 10.2.8. Other Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tiger Global Management

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 New Enterprises Associates

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sequoia Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DST Global

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IDG Capital

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Index Ventures

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Healthcare Royalty Partners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GGV Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nanjing Zijin Investment

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Greylock Partners**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tiger Global Management

List of Figures

- Figure 1: Global Venture Capital Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Latin America Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Latin America Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 11: Latin America Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 12: Latin America Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 17: Europe Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 23: Asia Pacific Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Asia Pacific Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Venture Capital Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Venture Capital Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Venture Capital Industry Revenue (Million), by Industry 2025 & 2033

- Figure 29: Middle East and Africa Venture Capital Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Middle East and Africa Venture Capital Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Venture Capital Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Venture Capital Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 9: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 12: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 15: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Venture Capital Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Venture Capital Industry Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Global Venture Capital Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Venture Capital Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Venture Capital Industry?

Key companies in the market include Tiger Global Management, New Enterprises Associates, Sequoia Capital, DST Global, IDG Capital, Index Ventures, Healthcare Royalty Partners, GGV Capital, Nanjing Zijin Investment, Greylock Partners**List Not Exhaustive.

3. What are the main segments of the Venture Capital Industry?

The market segments include Type, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Distribution of Start-Ups Witnessing Venture Capital Industry Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, IDG Capital Vietnam Confirms Investment in METAIN to Lead NFT-Empowered Real Estate Trend in Vietnam. IDG Capital also shows its ambition to lead the NFT Real estate trend and reveals its plan to proactively engage with global investors to attract investment into the Vietnam real estate market. With the high security, instantaneous settlement, transparent, seamless transaction process, blockchain, smart contract, and NFT (Non-fungible token) technology is transforming the real estate industry and will become the key trend in the next decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Venture Capital Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Venture Capital Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Venture Capital Industry?

To stay informed about further developments, trends, and reports in the Venture Capital Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence