Key Insights

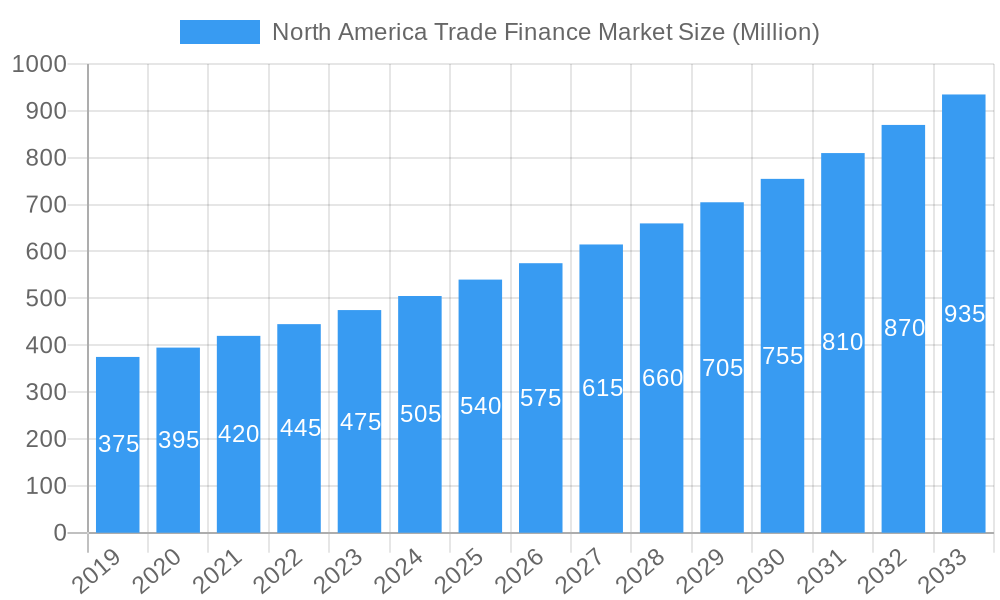

The North American trade finance market is poised for robust expansion, driven by a projected Compound Annual Growth Rate (CAGR) exceeding 7.50%. With an estimated market size of approximately $550 million in 2025, the sector is set to witness significant value creation through 2033. This growth is primarily propelled by a surge in international trade activities, the increasing adoption of digital trade finance solutions, and a growing demand for complex financial instruments like Performance Bank Guarantees and Letters of Credit to mitigate risks. The North American region, particularly the United States, benefits from a well-established banking infrastructure and a dynamic business environment conducive to cross-border transactions. Emerging trends such as the integration of blockchain technology for enhanced transparency and efficiency, and the rise of supply chain finance, are further fueling market momentum. The increasing complexity of global supply chains and the need for streamlined payment processes are creating a fertile ground for innovative trade finance products and services.

North America Trade Finance Market Market Size (In Million)

Despite the promising growth trajectory, certain restraints may temper the market’s full potential. These include evolving regulatory landscapes across different countries, the inherent complexity of international trade agreements, and the lingering effects of geopolitical uncertainties that can disrupt trade flows. Furthermore, the significant capital requirements for trade finance operations and the potential for credit defaults present ongoing challenges. However, the dominant drivers, including the expansion of e-commerce, the growing need for working capital among businesses engaged in international trade, and the increasing involvement of non-banking financial institutions and fintech companies, are expected to outweigh these restraints. The market segments are diversified, with Non-Documentary trade finance anticipated to gain traction alongside traditional Documentary instruments. Banks, along with specialized Trade Finance Companies and Insurance Companies, are key players facilitating this growth. Applications for trade finance are predominantly international, underscoring the global nature of the market.

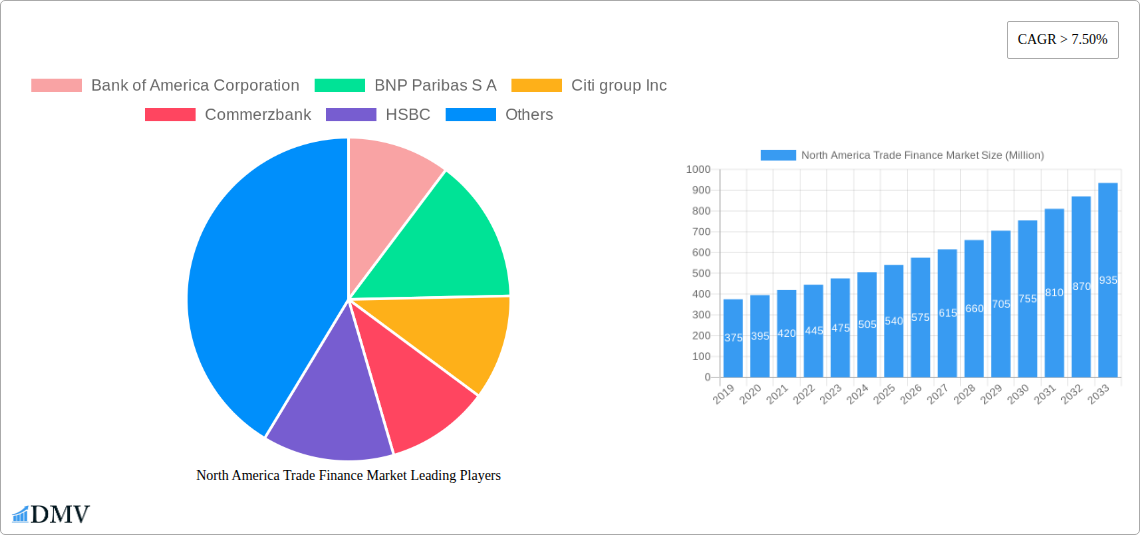

North America Trade Finance Market Company Market Share

North America Trade Finance Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

Dive deep into the dynamic North America Trade Finance Market with this exhaustive report. Spanning the historical period of 2019-2024, the base year of 2025, and projecting growth through 2033, this analysis provides unparalleled insights for stakeholders. Understand market composition, industry evolution, leading segments, and future opportunities within the global trade finance landscape, with a specific focus on key players like Bank of America Corporation, BNP Paribas S.A., Citi group Inc., Commerzbank, HSBC, Wells Fargo, JPMorgan Chase & Co., Mitsubishi UFJ Financial Inc., Santander Bank, Scotiabank, and Standard Chartered Bank. This report is your indispensable guide to navigating the complexities and capitalizing on the vast potential of the North American trade finance sector, including its documentary trade finance (encompassing Performance Bank Guarantee and Letter of Credit) and non-documentary segments, powered by banks, trade finance companies, insurance companies, and other specialized service providers for both domestic and international applications.

North America Trade Finance Market Market Composition & Trends

The North America Trade Finance Market exhibits a dynamic composition shaped by evolving regulatory frameworks, technological innovation, and shifting global trade patterns. Market concentration, while significant among established financial institutions, is increasingly influenced by the emergence of specialized trade finance companies and fintech solutions, fostering a more competitive and innovative ecosystem. Key innovation catalysts include the drive for trade finance digitization, enhanced supply chain finance solutions, and the integration of blockchain technology to streamline processes and mitigate risks. The regulatory landscape, characterized by stringent compliance requirements, also plays a pivotal role in shaping market strategies and product development. End-user profiles range from large multinational corporations seeking efficient cross-border transaction management to small and medium-sized enterprises (SMEs) requiring accessible and flexible financing options. Merger and acquisition (M&A) activities are expected to remain a significant trend, with reported deal values in the range of tens of millions to hundreds of millions of dollars, as larger players seek to consolidate market share and acquire innovative technologies. For instance, the acquisition of U.S.-based GlobalTrade Corporation by Komgo in December 2022, providing digitization solutions to over 120 multinational clients, highlights this trend. The market share distribution is highly concentrated among a few dominant banks, but the growth of alternative financiers is steadily increasing their presence.

North America Trade Finance Market Industry Evolution

The North America Trade Finance Market has undergone a profound evolution, transforming from a traditionally paper-based system to a digitally-driven and increasingly sophisticated financial sector. Over the historical period of 2019-2024, the market witnessed steady growth driven by an increasing volume of international trade and the growing need for secure and efficient cross-border transactions. However, the true transformative phase has been propelled by technological advancements and shifting consumer demands. The adoption of digital platforms for trade finance operations has accelerated, enhancing transparency, reducing processing times, and lowering operational costs. This digital revolution is evident in the increased adoption of electronic Letters of Credit and digital bank guarantees, which have become increasingly prevalent.

The base year of 2025 serves as a pivotal point, reflecting the culmination of these early digital shifts and setting the stage for accelerated innovation. The forecast period of 2025–2033 is projected to witness a compound annual growth rate (CAGR) of approximately 5-7%, driven by several key factors. Firstly, the continued expansion of global trade, particularly in sectors like manufacturing, technology, and agriculture, will sustain the demand for trade finance instruments. Secondly, the ongoing digitalization of trade processes, including the implementation of AI and machine learning for risk assessment and fraud detection, will further enhance efficiency and accessibility. For example, the integration of advanced analytics can provide real-time insights into trade flows and credit risks, enabling financial institutions to offer more tailored and competitive financing solutions.

Furthermore, evolving consumer demands are playing a crucial role. Businesses, especially SMEs, are increasingly seeking faster, more flexible, and user-friendly trade finance solutions. This has spurred the development of innovative products that cater to specific industry needs and risk appetites. The industry development in November 2021, where Ripple announced the launch of Ripple Liquidity Hub for US banks and fintech firms, allowing users to invest in and trade cryptocurrencies, exemplifies the broader trend of financial technology integration and the exploration of new digital assets within the financial ecosystem, indirectly influencing the landscape of trade finance by potentially offering alternative liquidity solutions and payment mechanisms. This continuous adaptation to technological paradigms and user expectations is fundamentally reshaping the North America Trade Finance Market.

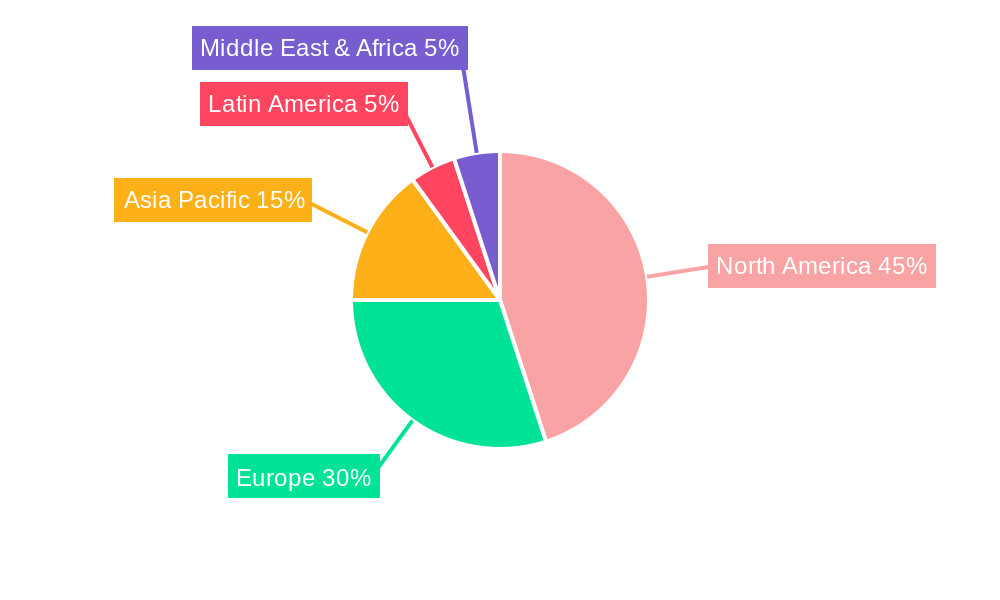

Leading Regions, Countries, or Segments in North America Trade Finance Market

The North America Trade Finance Market is a multifaceted landscape with distinct regional strengths and segment dominance. Within the North American context, the United States consistently emerges as the leading country, driven by its vast and diversified economy, robust financial infrastructure, and high volume of international trade. Its influence is further amplified by the presence of major global financial institutions headquartered in the country, actively participating in and shaping the trade finance ecosystem.

Analyzing the segmentation, the Product category reveals a strong prevalence of Documentary trade finance instruments. Specifically, Letters of Credit remain a cornerstone, facilitating secure international transactions by providing payment assurances. Performance Bank Guarantees also hold significant importance, particularly in large-scale infrastructure and construction projects, ensuring contractual obligations are met. While Non-Documentary forms of trade finance are gaining traction, particularly for simpler or repeat transactions, the inherent need for security in cross-border dealings keeps documentary instruments at the forefront.

In terms of Service Providers, Banks unequivocally dominate the North America Trade Finance Market. Their established networks, extensive capital reserves, and comprehensive regulatory compliance capabilities position them as the primary providers of trade finance solutions. However, Trade Finance Companies are increasingly carving out significant niches, offering specialized expertise and often more agile solutions, particularly for SMEs or complex financing needs. Insurance Companies play a crucial role in mitigating risks associated with international trade, offering credit insurance and other forms of protection that underpin many trade finance transactions.

From an Application perspective, International trade finance significantly outweighs Domestic applications. This is a direct reflection of the global interconnectedness of North American economies and the substantial volume of goods and services traded across borders. Key drivers for this dominance include:

- Investment Trends: Significant foreign direct investment (FDI) and portfolio investments into and out of North America necessitate robust trade finance mechanisms to facilitate the underlying trade flows.

- Regulatory Support: While regulations can be complex, governmental policies aimed at promoting international trade and providing export credit support, particularly in countries like the United States through entities like the Export-Import Bank (EXIM), indirectly bolster the international segment.

- Economic Interdependence: The strong economic ties between North America and other global regions, particularly Asia and Europe, fuel a continuous demand for international trade finance services.

- E-commerce Growth: The surge in cross-border e-commerce has created new avenues and increased the volume of smaller, yet frequent, international transactions, further driving the demand for international trade finance solutions.

The dominance of the international segment, coupled with the strength of banks as service providers and documentary instruments as product types, underscores the core characteristics of the North America Trade Finance Market, emphasizing security, reliability, and global reach.

North America Trade Finance Market Product Innovations

Product innovation in the North America Trade Finance Market is increasingly focused on enhancing efficiency, mitigating risk, and expanding accessibility. The evolution of Documentary instruments, such as Letters of Credit, is seeing the integration of digital platforms that allow for electronic submission, tracking, and verification, significantly reducing processing times and the potential for errors. Innovations in Performance Bank Guarantees are focusing on greater standardization and digital issuance, making them more accessible for a wider range of project sizes. Beyond traditional offerings, Non-Documentary solutions are emerging, leveraging technology for streamlined, often faster, financing for less complex or recurring trade transactions. Furthermore, the development of integrated supply chain finance platforms, which offer solutions beyond simple transaction financing, represents a significant innovation, enabling businesses to optimize working capital across their entire supply chain. These advancements are geared towards providing unique selling propositions such as real-time visibility, automated compliance checks, and enhanced risk assessment capabilities, ultimately empowering businesses engaged in both domestic and international trade.

Propelling Factors for North America Trade Finance Market Growth

Several key factors are propelling the growth of the North America Trade Finance Market. Technological advancements are paramount, with the widespread adoption of digitization, blockchain, and AI enabling faster, more secure, and cost-effective trade finance operations. The growing volume of global trade itself, despite geopolitical fluctuations, continues to be a fundamental driver. Furthermore, economic recovery and expansion in key North American economies stimulate increased business activity and cross-border commerce. Regulatory initiatives aimed at facilitating trade and supporting exporters also play a crucial role. For instance, government-backed export credit agencies provide essential guarantees and financing that underpins a significant portion of international trade activities, making trade finance more accessible and less risky for businesses. The increasing demand from SMEs for more accessible and flexible financing solutions also contributes significantly to market expansion.

Obstacles in the North America Trade Finance Market Market

Despite robust growth, the North America Trade Finance Market faces several obstacles. Stringent regulatory compliance requirements, while crucial for stability, can increase operational costs and complexity for financial institutions. Supply chain disruptions, exacerbated by global events and geopolitical tensions, can lead to increased risks for trade finance providers and impact the ability of businesses to meet contractual obligations. Intense competition from both traditional banks and emerging fintech players puts pressure on margins. Furthermore, a lack of widespread digital literacy and infrastructure in certain segments of the market can hinder the adoption of innovative digital solutions. The perception of trade finance as a complex and often inaccessible product for smaller businesses also remains a barrier to broader market penetration.

Future Opportunities in North America Trade Finance Market

The North America Trade Finance Market presents numerous future opportunities. The continued expansion of emerging markets offers significant potential for increased trade flows and associated financing needs. The ongoing development and adoption of new technologies like distributed ledger technology (DLT) and smart contracts promise to revolutionize trade finance by enhancing transparency, security, and efficiency. The growing trend of sustainable trade finance and the increasing demand for ESG (Environmental, Social, and Governance) compliance in business operations present a significant opportunity for innovative financial products. Furthermore, the focus on supporting SMEs in accessing global markets through simplified and digitalized trade finance solutions will continue to be a key growth area. The integration of trade finance with other financial services, such as payments and supply chain management, will also unlock new avenues for growth.

Major Players in the North America Trade Finance Market Ecosystem

- Bank of America Corporation

- BNP Paribas S.A.

- Citi group Inc.

- Commerzbank

- HSBC

- Wells Fargo

- JPMorgan Chase & Co.

- Mitsubishi UFJ Financial Inc.

- Santander Bank

- Scotiabank

- Standard Chartered Bank

Key Developments in North America Trade Finance Market Industry

- December 2022: Komgo acquired U.S.-based GlobalTrade Corporation. The two companies provide trade finance digitization solutions to over 120 multinational clients, helping them connect to sources of financing.

- November 2021: Ripple announced the launch of Ripple Liquidity Hub for US banks and fintech firms, which allows users to invest in and trade cryptocurrencies.

Strategic North America Trade Finance Market Market Forecast

The strategic outlook for the North America Trade Finance Market remains highly positive, driven by a confluence of accelerating digitalization, robust trade expansion, and evolving financial technologies. The forecast period (2025-2033) is expected to witness sustained growth as businesses increasingly leverage digital platforms for seamless cross-border transactions and enhanced risk management. Opportunities abound in supporting SMEs, integrating sustainable finance practices, and capitalizing on advancements in blockchain and AI to further streamline operations. The market's inherent resilience, coupled with continuous innovation from major players and the emergence of agile fintech solutions, positions it for significant expansion and continued relevance in facilitating global commerce.

North America Trade Finance Market Segmentation

-

1. Product

-

1.1. Documentary

- 1.1.1. Performance Bank Guarantee

- 1.1.2. Letter of Credit

- 1.1.3. Others

- 1.2. Non-Documentary

-

1.1. Documentary

-

2. Service Provider

- 2.1. Banks

- 2.2. Trade Finance Companies

- 2.3. Insurance Companies

- 2.4. Other Service Providers

-

3. Application

- 3.1. Domestic

- 3.2. International

North America Trade Finance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Trade Finance Market Regional Market Share

Geographic Coverage of North America Trade Finance Market

North America Trade Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Technology Implementation in Trade Finance Platforms Makes Way for Startups

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Trade Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Documentary

- 5.1.1.1. Performance Bank Guarantee

- 5.1.1.2. Letter of Credit

- 5.1.1.3. Others

- 5.1.2. Non-Documentary

- 5.1.1. Documentary

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Banks

- 5.2.2. Trade Finance Companies

- 5.2.3. Insurance Companies

- 5.2.4. Other Service Providers

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank of America Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BNP Paribas S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Citi group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Commerzbank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HSBC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wells Fargo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JPMorgan Chase & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi UFJ Financial Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Santander Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scotiabank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Standard Chartered Bank**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bank of America Corporation

List of Figures

- Figure 1: North America Trade Finance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Trade Finance Market Share (%) by Company 2025

List of Tables

- Table 1: North America Trade Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Trade Finance Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: North America Trade Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Trade Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Trade Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: North America Trade Finance Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 7: North America Trade Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: North America Trade Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Trade Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Trade Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Trade Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Trade Finance Market?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the North America Trade Finance Market?

Key companies in the market include Bank of America Corporation, BNP Paribas S A, Citi group Inc, Commerzbank, HSBC, Wells Fargo, JPMorgan Chase & Co, Mitsubishi UFJ Financial Inc, Santander Bank, Scotiabank, Standard Chartered Bank**List Not Exhaustive.

3. What are the main segments of the North America Trade Finance Market?

The market segments include Product, Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Technology Implementation in Trade Finance Platforms Makes Way for Startups.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Komgo acquired U.S.-based GlobalTrade Corporation. The two companies provide trade finance digitization solutions to over 120 multinational clients, helping them connect to sources of financing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Trade Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Trade Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Trade Finance Market?

To stay informed about further developments, trends, and reports in the North America Trade Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence