Key Insights

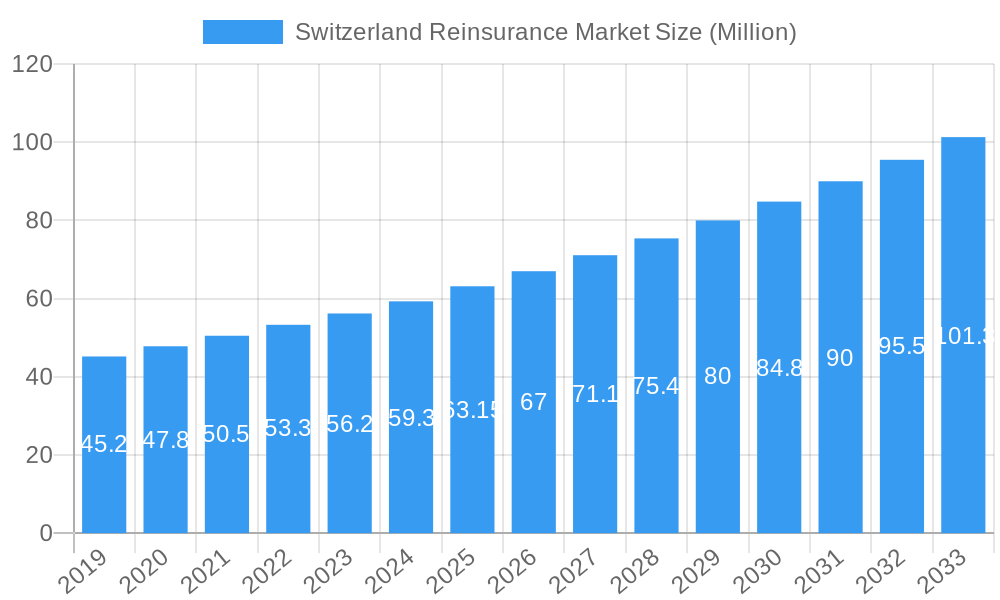

The Switzerland reinsurance market is poised for robust expansion, with a projected market size of USD 63.15 million in 2025, driven by a healthy CAGR of 6.23% over the forecast period of 2025-2033. This growth is underpinned by the critical role reinsurance plays in the Swiss financial ecosystem, providing a vital safety net for insurers against catastrophic events and large claims. Key drivers fueling this expansion include increasing demand for sophisticated risk management solutions, the growing complexity of insured risks, and the continuous pursuit of enhanced solvency by primary insurers. Furthermore, regulatory shifts and evolving capital requirements are compelling insurers to seek more efficient ways to manage their exposure, thereby stimulating the demand for reinsurance services. The market is characterized by a significant concentration of established global players, leading to a competitive landscape where innovation and specialized offerings are paramount.

Switzerland Reinsurance Market Market Size (In Million)

The reinsurance market in Switzerland is segmented across various types, applications, and distribution channels, reflecting the diverse needs of its clientele. Facultative reinsurance, offering tailored coverage for specific risks, and treaty reinsurance, providing broader protection, both contribute to the market's dynamism. In terms of applications, Property & Casualty Reinsurance and Life & Health Reinsurance represent the primary segments, catering to distinct risk profiles and demand patterns. The distribution landscape is a mix of direct sales and broker-led engagements, with an increasing inclination towards digital platforms, as evidenced by the growth in online distribution channels. While the Swiss market benefits from a stable economic environment and a strong regulatory framework, potential restraints include intense competition from international reinsurers and the ongoing challenge of pricing complex risks accurately in an increasingly volatile global environment. Nevertheless, the market's inherent strengths and the strategic importance of reinsurance for financial stability suggest a promising outlook.

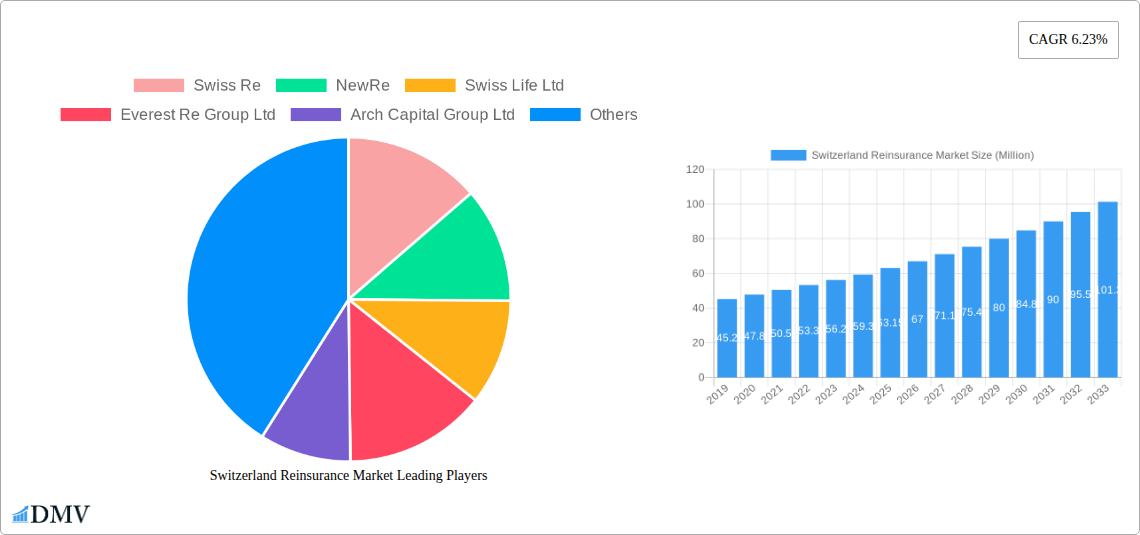

Switzerland Reinsurance Market Company Market Share

This in-depth report provides a comprehensive analysis of the Switzerland Reinsurance Market, offering critical insights into its current composition, historical evolution, and projected trajectory through 2033. Leveraging sophisticated market intelligence, the study delves into market concentration, innovation, regulatory landscapes, and competitive dynamics. With a focus on facultative reinsurance, treaty reinsurance, property & casualty reinsurance, and life & health reinsurance, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the growth potential of the Swiss reinsurance sector.

Switzerland Reinsurance Market Market Composition & Trends

The Switzerland Reinsurance Market is characterized by a sophisticated and highly concentrated landscape, dominated by established global players and specialized Swiss entities. Market concentration is evident in the significant market share held by key companies, with Swiss Re and NewRe consistently leading the pack, collectively commanding an estimated XX% of the market. Innovation is a primary catalyst, driven by advancements in data analytics, AI-powered risk assessment, and parametric insurance solutions, particularly within the Property & Casualty Reinsurance segment. The regulatory environment, overseen by FINMA, is stringent yet supportive of innovation, fostering a stable operating framework. Substitute products are emerging, including alternative risk transfer mechanisms and direct insurance offerings with enhanced resilience features, though they currently represent a minor threat to traditional reinsurance. End-user profiles are diverse, ranging from large multinational corporations seeking comprehensive risk mitigation to specialized insurers requiring tailored reinsurance capacity. Mergers & Acquisitions (M&A) activities are a significant feature, indicative of consolidation and strategic expansion. For instance, the November 2023 announcement of Arch Capital Group Ltd.'s agreement to acquire RMIC Companies, Inc. (RMIC) for an estimated deal value of $XXX Million underscores this trend. Similarly, the July 2022 completion of Swiss Life International's acquisition of elipsLife for an estimated $XXX Million highlights the ongoing consolidation and focus on niche markets. The market share distribution reveals that Treaty Reinsurance constitutes the largest segment, estimated at XX% of the total market value, followed by Facultative Reinsurance at XX%. In terms of application, Property & Casualty Reinsurance accounts for XX% of the market revenue, while Life & Health Reinsurance contributes XX%.

Switzerland Reinsurance Market Industry Evolution

The Switzerland Reinsurance Market has undergone a significant evolution, marked by robust growth trajectories, accelerated technological advancements, and a dynamic shift in consumer demands. Over the historical period of 2019–2024, the market has demonstrated resilience, weathering global economic fluctuations and an increasing frequency of natural catastrophes. The estimated market size in the base year of 2025 is projected to reach approximately $XXX Billion, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This growth is propelled by a confluence of factors, including the increasing complexity of global risks, the rising awareness of climate change impacts, and the growing demand for sophisticated risk management solutions. Technological advancements have been a cornerstone of this evolution. The adoption of artificial intelligence (AI) and machine learning (ML) is revolutionizing underwriting processes, claims management, and fraud detection, leading to greater efficiency and accuracy. Predictive analytics are enabling reinsurers to better model and price emerging risks, such as cyber threats and pandemics. Furthermore, the integration of blockchain technology is enhancing transparency and security in reinsurance transactions. Shifting consumer demands are also playing a pivotal role. Insured entities are increasingly seeking customized reinsurance products that address their specific risk profiles, moving away from one-size-fits-all solutions. The emphasis on sustainability and Environmental, Social, and Governance (ESG) factors is also influencing product development, with a growing demand for reinsurers to offer solutions that support climate resilience and responsible corporate practices. The Life & Health Reinsurance segment, in particular, has witnessed a surge in demand for solutions related to longevity risk, chronic diseases, and mental health coverage. The Property & Casualty Reinsurance segment continues to be influenced by evolving weather patterns, leading to increased demand for catastrophe coverage. The market's ability to adapt to these evolving dynamics, coupled with its inherent stability and strong financial footing, positions Switzerland as a preeminent global hub for reinsurance services. The market is projected to grow from an estimated $XXX Billion in 2024 to $XXX Billion by 2033, reflecting a steady expansion driven by innovation and market demand.

Leading Regions, Countries, or Segments in Switzerland Reinsurance Market

Within the Switzerland Reinsurance Market, the dominance is clearly established across specific segments and distribution channels, driven by distinct market dynamics and strategic advantages. Treaty Reinsurance stands out as the most dominant segment, commanding an estimated XX% of the market share. This dominance is attributed to its ability to provide broad, long-term coverage for insurers against various risks, offering stability and capacity essential for the robust Swiss insurance sector. The consistent demand for Property & Casualty Reinsurance, estimated at XX% of the market, further solidifies its leading position. This is fueled by Switzerland's highly developed industrial and financial sectors, which face a diverse range of property and casualty risks, from operational liabilities to complex construction projects and natural disasters.

The Broker distribution channel is overwhelmingly the preferred route for reinsurance transactions, accounting for an estimated XX% of the market. This preference stems from the intricate nature of reinsurance contracts, the need for specialized expertise in risk assessment and negotiation, and the global reach that brokers provide. Brokers act as crucial intermediaries, connecting cedents (insurers) with reinsurers and facilitating access to optimal capacity and terms. The expertise they offer in navigating complex global markets and specialized risks is invaluable.

In terms of Mode, Offline transactions continue to hold a significant majority, estimated at XX%, reflecting the traditional emphasis on personal relationships, in-depth consultations, and the high-stakes nature of reinsurance agreements. While Online channels are gaining traction, particularly for standard risk placements and data exchange, the complexity and bespoke nature of many reinsurance deals still favor face-to-face interactions and comprehensive documentation.

Key drivers for the dominance of these segments include:

- Regulatory Support and Financial Stability: Switzerland's stable political environment and robust regulatory framework, overseen by FINMA, foster a climate of trust and security, attracting significant reinsurance business. This stability is crucial for long-term treaty agreements.

- Global Hub for Expertise: Switzerland's reputation as a global financial center, coupled with the presence of highly specialized reinsurance professionals, makes it a preferred location for both cedents and reinsurers seeking sophisticated risk solutions.

- Diversified Economic Base: The country's diversified economy, encompassing strong financial services, pharmaceuticals, and advanced manufacturing, generates a continuous need for comprehensive property and casualty insurance and, consequently, reinsurance.

- Innovation in Risk Modeling: Leading Swiss reinsurers are at the forefront of developing advanced risk modeling techniques, particularly for complex and emerging risks like climate change and cyber threats, which further strengthens the demand for their expertise in treaty and property & casualty reinsurance.

The market value for Treaty Reinsurance is estimated at $XXX Million in 2025, projected to grow to $XXX Million by 2033. Property & Casualty Reinsurance is valued at $XXX Million in 2025, with a forecast of $XXX Million by 2033. The Broker channel is estimated to facilitate transactions worth $XXX Million in 2025, growing to $XXX Million by 2033.

Switzerland Reinsurance Market Product Innovations

Switzerland's reinsurance market is a hotbed of product innovation, driven by the need to address evolving risk landscapes and capitalize on technological advancements. Reinsurers are increasingly developing parametric insurance solutions that trigger payouts based on pre-defined events, such as specific wind speeds or rainfall levels, offering faster claims settlements for natural catastrophe risks. Furthermore, there's a growing focus on cyber reinsurance, with enhanced coverage for data breaches, business interruption due to cyberattacks, and ransomware events, reflecting the escalating threat landscape. Product performance is being benchmarked against traditional indemnity policies, with a focus on improved risk transfer efficiency and reduced claims friction. Innovations in Life & Health Reinsurance are also prominent, with new products addressing longevity risk, critical illness, and mental health, leveraging data analytics to offer more personalized and preventative solutions. The adoption of AI in underwriting is leading to more accurate pricing and tailored product features, enhancing the overall value proposition for insurers.

Propelling Factors for Switzerland Reinsurance Market Growth

Several key factors are propelling the growth of the Switzerland Reinsurance Market. The escalating frequency and severity of natural catastrophes, amplified by climate change, are creating a sustained demand for robust Property & Casualty Reinsurance capacity. Technological advancements, particularly in AI and big data analytics, are enhancing underwriting accuracy, risk modeling, and operational efficiency, enabling reinsurers to offer more competitive products and services. Furthermore, the increasing interconnectedness of global economies and supply chains amplifies the need for comprehensive risk management solutions, including specialized reinsurance for emerging threats like cyber warfare and pandemics. A supportive regulatory environment, characterized by financial stability and a commitment to innovation, further bolsters investor confidence and market expansion. The robust financial strength of Swiss reinsurers, built over decades, provides the necessary capital to underwrite large and complex risks, attracting global cedents seeking reliable partners.

Obstacles in the Switzerland Reinsurance Market Market

Despite its strengths, the Switzerland Reinsurance Market faces several obstacles. Intense competition from established global reinsurers and emerging market players can exert downward pressure on pricing and profit margins. The increasing sophistication of cyber threats and the difficulty in accurately modeling their long-term impact pose a significant underwriting challenge. Regulatory changes, both domestically and internationally, can introduce new compliance burdens and complexities, impacting operational costs and market access. Furthermore, economic uncertainties, such as inflation and interest rate fluctuations, can affect investment income and the overall profitability of reinsurance portfolios. The potential for increased frequency and severity of climate-related events also introduces volatility and can lead to significant claims payouts, straining capital reserves.

Future Opportunities in Switzerland Reinsurance Market

The future of the Switzerland Reinsurance Market is rife with opportunities. The growing demand for tailored Life & Health Reinsurance solutions, driven by an aging global population and increased awareness of chronic diseases, presents a significant growth avenue. The burgeoning Insurtech sector offers opportunities for collaboration and innovation, with potential for developing new distribution channels and risk assessment tools. Emerging markets, particularly in Asia and Africa, represent untapped potential for reinsurance penetration as economies develop and insurance penetration rises. Furthermore, the increasing focus on sustainable finance and ESG principles creates opportunities for reinsurers to develop and offer products that support climate resilience and other environmental initiatives, aligning with global sustainability goals. The ongoing digitalization of the insurance industry also opens avenues for developing advanced data analytics services and technology-driven risk management solutions.

Major Players in the Switzerland Reinsurance Market Ecosystem

- Swiss Re

- NewRe

- Swiss Life Ltd

- Everest Re Group Ltd

- Arch Capital Group Ltd

- RenaissanceRe

- EUROPA Re Ltd

- Allianz SE Reinsurance

- SCOR

Key Developments in Switzerland Reinsurance Market Industry

- November 2023: Arch U.S. MI Holdings, a wholly owned subsidiary of Arch Capital Group Ltd., announced it has entered into a definitive agreement to acquire RMIC Companies, Inc. (RMIC) and its subsidiaries that together comprise the run-off mortgage insurance business of Old Republic International Corporation. This move signifies a strategic expansion in the mortgage insurance sector and highlights a trend towards consolidation and specialization within the broader reinsurance ecosystem.

- July 2022: Swiss Life International completed the acquisition of elipsLife, an insurance company for institutional clients such as pension funds and corporations. This development underscores the strategic focus on institutional business and the growth of tailored solutions for corporate clients within the Swiss Life group, impacting the competitive landscape of the Life & Health Reinsurance segment.

Strategic Switzerland Reinsurance Market Market Forecast

The strategic outlook for the Switzerland Reinsurance Market remains highly positive, driven by a confluence of enduring strengths and emerging opportunities. The market's intrinsic value proposition—its robust financial stability, deep pool of specialized talent, and sophisticated regulatory framework—will continue to attract global capital and expertise. Anticipated growth will be fueled by the escalating demand for comprehensive risk management in the face of increasing climate-related volatility and the evolving nature of global threats. Innovations in parametric insurance, AI-driven underwriting, and sustainable reinsurance products are poised to redefine market offerings and drive new revenue streams. As the global insurance industry continues its digital transformation, Swiss reinsurers are well-positioned to leverage technological advancements for enhanced efficiency and expanded market reach, ensuring continued leadership in the global reinsurance landscape through 2033.

Switzerland Reinsurance Market Segmentation

-

1. Type

- 1.1. Facultative Reinsurance

- 1.2. Treaty Reinsurance

-

2. Application

- 2.1. Property & Casualty Reinsurance

- 2.2. Life & Health Reinsurance

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Broker

-

4. Mode

- 4.1. Online

- 4.2. Offline

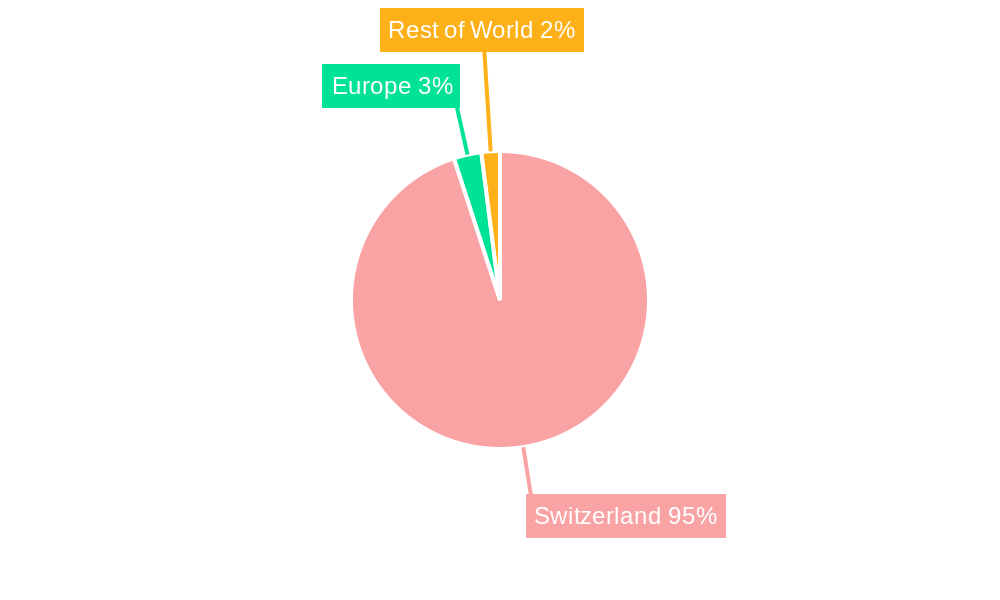

Switzerland Reinsurance Market Segmentation By Geography

- 1. Switzerland

Switzerland Reinsurance Market Regional Market Share

Geographic Coverage of Switzerland Reinsurance Market

Switzerland Reinsurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Reinsurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facultative Reinsurance

- 5.1.2. Treaty Reinsurance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Property & Casualty Reinsurance

- 5.2.2. Life & Health Reinsurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Broker

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiss Re

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NewRe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Swiss Life Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Everest Re Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arch Capital Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RenaissanceRe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EUROPA Re Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz SE Reinsurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCOR**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Swiss Re

List of Figures

- Figure 1: Switzerland Reinsurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Switzerland Reinsurance Market Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 8: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 9: Switzerland Reinsurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Switzerland Reinsurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 18: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 19: Switzerland Reinsurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Switzerland Reinsurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Reinsurance Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Switzerland Reinsurance Market?

Key companies in the market include Swiss Re, NewRe, Swiss Life Ltd, Everest Re Group Ltd, Arch Capital Group Ltd, RenaissanceRe, EUROPA Re Ltd, Allianz SE Reinsurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Switzerland Reinsurance Market?

The market segments include Type, Application, Distribution Channel, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Arch U.S. MI Holdings, a wholly owned subsidiary of Arch Capital Group Ltd., announced it has entered into a definitive agreement to acquire RMIC Companies, Inc. (RMIC) and its subsidiaries that together comprise the run-off mortgage insurance business of Old Republic International Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Reinsurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Reinsurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Reinsurance Market?

To stay informed about further developments, trends, and reports in the Switzerland Reinsurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence