Key Insights

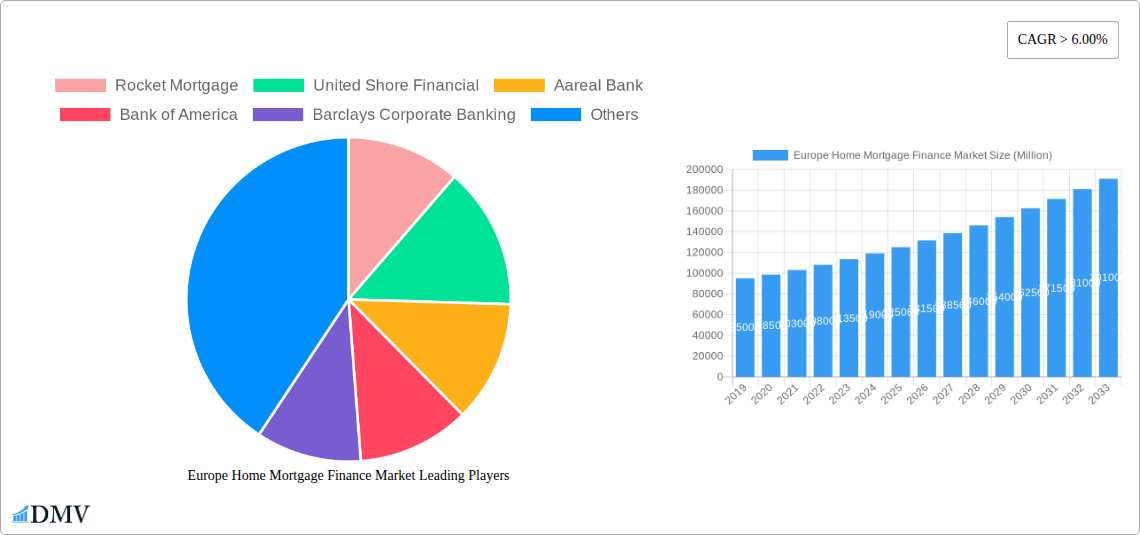

The European Home Mortgage Finance Market is poised for substantial growth, projected to exceed $150,000 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of over 6.00%. This expansion is fueled by a combination of favorable economic conditions, increasing homeownership aspirations across key European nations, and a growing demand for housing renovation and upgrades. The market's primary drivers include sustained low-interest rate environments, government initiatives aimed at promoting homeownership, and a burgeoning population seeking to invest in real estate for both personal use and as a wealth-building strategy. The refinance segment, in particular, is expected to see significant traction as homeowners look to capitalize on favorable lending terms to reduce their monthly payments or access equity for other financial needs.

Europe Home Mortgage Finance Market Market Size (In Billion)

The market's segmentation reveals a diverse landscape, with Banks and Housing Finance Companies dominating the provider spectrum, offering a range of mortgage products. Fixed-rate mortgage loans continue to be a preferred choice for many borrowers seeking payment predictability, while adjustable-rate mortgage loans offer potential cost savings in certain economic scenarios. Geographically, the market is characterized by strong activity in major economies like the United Kingdom, Germany, and France, but also exhibits promising growth potential in emerging markets within Eastern Europe. Despite the positive outlook, the market faces certain restraints, including evolving regulatory frameworks, potential economic downturns impacting borrower affordability, and increasing competition from digital mortgage platforms. However, the overarching trend of increasing real estate investment and the persistent need for housing finance are expected to propel the market forward.

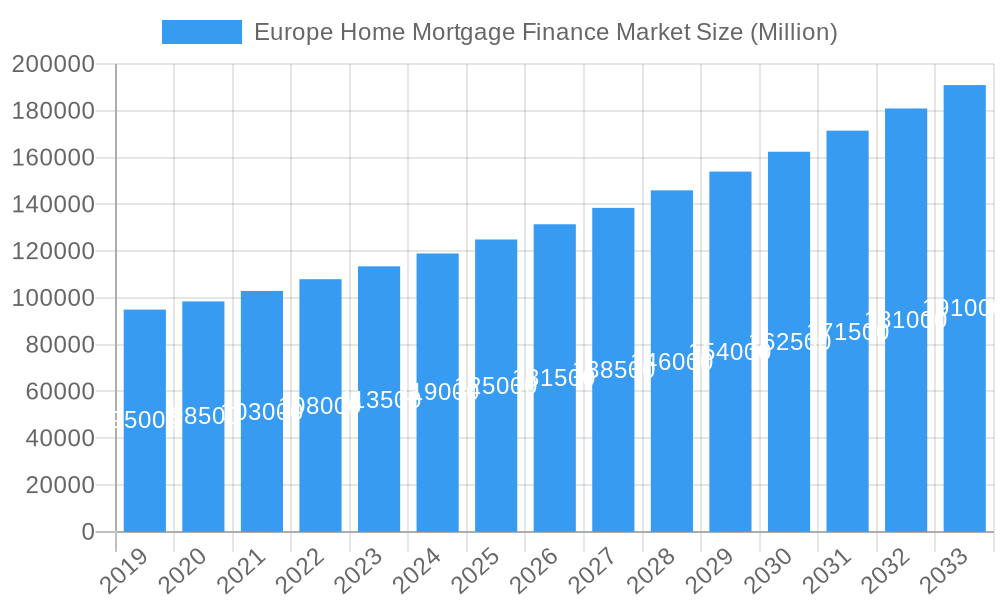

Europe Home Mortgage Finance Market Company Market Share

This in-depth report provides an exhaustive analysis of the Europe Home Mortgage Finance Market, a critical sector driving real estate investment and homeownership across the continent. Delving into historical trends, current dynamics, and future projections from 2019 to 2033, with a base year of 2025, this research meticulously dissects the market's composition, evolutionary trajectory, and growth catalysts. Stakeholders seeking to understand the European mortgage lending landscape, home loan financing, and real estate finance trends will find invaluable insights, including market share analysis, strategic developments, and competitive intelligence. This report is your definitive guide to navigating the complexities and opportunities within the European housing finance sector.

Europe Home Mortgage Finance Market Market Composition & Trends

The Europe Home Mortgage Finance Market is characterized by a dynamic interplay of established financial institutions and emerging fintech players, driving a competitive yet opportunity-rich environment. Market concentration varies across different European nations, with some markets exhibiting dominance by a few large banking groups while others showcase a more fragmented landscape. Innovation is a key catalyst, with digital mortgage platforms, AI-driven underwriting, and blockchain solutions gradually reshaping the lending process, enhancing efficiency and customer experience. The regulatory landscape, while generally stable, can present localized challenges and opportunities, with directives like the European Mortgage Credit Directive influencing consumer protection and market practices. Substitute products, such as rental agreements and alternative financing options, exist but the intrinsic value of homeownership continues to drive demand for mortgages. End-user profiles are diverse, ranging from first-time homebuyers seeking affordable housing solutions to seasoned investors looking to expand their property portfolios. Mergers and acquisitions (M&A) activities are also significant, as larger institutions seek to consolidate market share, acquire technological capabilities, or expand their geographic reach. For instance, significant M&A deals in the European banking sector can have ripple effects on mortgage finance. The market share distribution is influenced by factors like interest rates, economic stability, and government housing policies.

Europe Home Mortgage Finance Market Industry Evolution

The Europe Home Mortgage Finance Market has undergone a significant transformation driven by technological advancements, evolving consumer preferences, and a shifting economic climate. Over the historical period 2019-2024, the market witnessed a steady growth trajectory, primarily fueled by low interest rates and increasing demand for homeownership. The advent of digital platforms has revolutionized the mortgage application and approval process, leading to a surge in online mortgage services and a reduction in traditional branch visits. This digital shift has been particularly pronounced in countries with advanced digital infrastructure and a tech-savvy population. Technological advancements have enabled faster processing times, greater transparency, and personalized customer experiences, thereby enhancing borrower satisfaction. Furthermore, the increasing adoption of sophisticated analytics and data processing tools has allowed lenders to better assess risk, streamline underwriting, and offer more tailored mortgage products.

The European mortgage market has also seen a heightened focus on sustainability and green finance, with an increasing number of consumers opting for energy-efficient homes and seeking green mortgage options. This trend is being supported by government initiatives and incentives aimed at promoting eco-friendly housing. Consumer demands have shifted towards greater flexibility and customization in mortgage products. Borrowers are increasingly seeking fixed-rate mortgages for long-term financial planning and adjustable-rate mortgages for potential short-term savings. The refinancing segment has also gained prominence, especially during periods of fluctuating interest rates, as homeowners look to secure more favorable loan terms.

Looking ahead, the Europe Home Mortgage Finance Market is projected to continue its expansion, albeit at a more moderate pace, influenced by economic forecasts and monetary policy adjustments. The market growth rate is expected to be influenced by factors such as GDP growth, inflation, and employment levels across key European economies. The increasing urbanization and the demand for affordable housing in major cities will continue to be significant drivers. The industry is also observing a growing trend towards specialized mortgage products catering to specific demographics, such as young professionals, expatriates, and self-employed individuals. The adoption metrics for digital mortgage solutions are anticipated to rise significantly, with a substantial portion of mortgage applications expected to be processed online in the coming years. The European mortgage industry is adapting to these evolving dynamics to remain competitive and meet the diverse needs of its customer base.

Leading Regions, Countries, or Segments in Europe Home Mortgage Finance Market

The Europe Home Mortgage Finance Market is a complex ecosystem where different regions, countries, and segments exhibit distinct growth patterns and dominance factors.

Dominant Segments by Application:

- Home Purchase: This segment consistently represents the largest share of the market, driven by the fundamental human desire for homeownership. Factors contributing to its dominance include population growth, urbanization, and government policies that encourage property acquisition. The availability of affordable housing and attractive mortgage rates are key drivers.

- Refinance: The refinance segment experiences significant fluctuations depending on interest rate movements and economic conditions. When interest rates fall, homeowners actively seek to refinance their existing mortgages to lower monthly payments or shorten their loan terms. This segment plays a crucial role in providing financial flexibility to existing property owners.

- Home Improvement: While smaller than home purchase and refinance, the home improvement segment is steadily growing as homeowners invest in upgrading their properties to enhance value and comfort. This is often facilitated by home equity loans or specific renovation financing products.

- Other Applications: This encompasses a range of niche mortgage uses, such as debt consolidation or financing investment properties, which contribute to the overall market size.

Dominant Segments by Providers:

- Banks: Traditional banks remain the primary providers of mortgage finance across Europe. Their established reputations, extensive branch networks, and broad customer base give them a significant advantage. They offer a comprehensive range of mortgage products and often leverage their existing customer relationships.

- Housing Finance Companies: These specialized institutions play a vital role, particularly in countries where they are well-established. They often focus on specific market niches and can offer more tailored solutions than larger, more generalized banks.

- Real Estate Agents: While not direct lenders, real estate agents are crucial facilitators in the mortgage process, connecting buyers with lenders and guiding them through the application stages. Their influence is significant in driving business to various financial providers.

Dominant Segments by Interest Rate:

- Fixed Rate Mortgage Loan: In many European countries, fixed-rate mortgages are highly preferred due to their predictability and protection against rising interest rates. This segment is particularly strong in markets with historical interest rate volatility.

- Adjustable Rate Mortgage Loan: While less prevalent than fixed-rate loans in some regions, adjustable-rate mortgages offer potential initial cost savings, making them attractive to borrowers who anticipate selling or refinancing before significant rate increases.

Leading Regions and Countries:

- United Kingdom: Historically a robust mortgage market, the UK, with its strong property culture and well-developed financial services sector, is a significant player. Factors driving its dominance include a high rate of homeownership and a competitive lending environment.

- Germany: With a large economy and a preference for stable, long-term financial planning, Germany exhibits a strong demand for European mortgage finance. The prevalence of fixed-rate mortgage loans and a stable housing market contributes to its leading position.

- France: The French mortgage market is also substantial, supported by government initiatives aimed at promoting homeownership and a well-established banking system.

- Other Notable Markets: Spain, Italy, and the Netherlands are also significant contributors to the Europe Home Mortgage Finance Market, each with its unique economic drivers and regulatory frameworks shaping mortgage demand and supply. Investment trends in these regions, coupled with supportive regulatory environments, fuel the growth of their respective mortgage sectors.

Europe Home Mortgage Finance Market Product Innovations

The Europe Home Mortgage Finance Market is experiencing a wave of innovation aimed at enhancing borrower experience and operational efficiency. Digital mortgage platforms are a prime example, offering end-to-end online application, document submission, and approval processes. Fintech companies are introducing AI-powered credit scoring models that provide faster and more accurate risk assessments, potentially leading to quicker loan approvals. Furthermore, there's a growing trend towards personalized mortgage solutions, with lenders leveraging data analytics to offer products tailored to individual financial situations and life stages. The introduction of "green mortgages" incentivizes energy-efficient home purchases, aligning with sustainability goals. Performance metrics for these innovations include reduced processing times, lower operational costs for lenders, and increased customer satisfaction, as evidenced by higher Net Promoter Scores and faster application turnaround times.

Propelling Factors for Europe Home Mortgage Finance Market Growth

Several key factors are propelling the growth of the Europe Home Mortgage Finance Market. Technological advancements, such as digitalization and AI, are streamlining application processes and improving accessibility. Favorable economic conditions, including sustained employment rates and moderate inflation, boost consumer confidence and the ability to afford mortgage payments. Government initiatives aimed at promoting homeownership, such as subsidies for first-time buyers or tax incentives for property investment, also significantly contribute. The increasing demand for housing in urban centers and the growing preference for stable long-term investments further fuel market expansion.

Obstacles in the Europe Home Mortgage Finance Market Market

Despite positive growth, the Europe Home Mortgage Finance Market faces several obstacles. Stringent regulatory challenges and compliance requirements can increase operational costs and slow down the lending process. Economic uncertainties, including potential interest rate hikes and inflationary pressures, can dampen borrower demand and increase the risk of defaults. Supply chain disruptions in the construction industry can impact property availability and affordability, indirectly affecting mortgage demand. Furthermore, intense competitive pressures from traditional banks, challenger banks, and fintech companies can lead to margin compression. The sheer volume of documentation and the complexity of underwriting processes can also pose challenges for both lenders and borrowers.

Future Opportunities in Europe Home Mortgage Finance Market

Emerging opportunities within the Europe Home Mortgage Finance Market are abundant. The growing demand for sustainable and green mortgages presents a significant avenue for growth, aligning with environmental objectives. The increasing adoption of digital lending platforms and proptech solutions offers opportunities for enhanced efficiency and new customer acquisition strategies. The underserved markets and demographic segments, such as younger generations and expatriates, represent untapped potential. Furthermore, innovative financing models, such as fractional ownership or flexible repayment structures, could cater to evolving consumer needs. The continuous development of data analytics and AI presents opportunities for more personalized and efficient mortgage offerings.

Major Players in the Europe Home Mortgage Finance Market Ecosystem

- Rocket Mortgage

- United Shore Financial

- Aareal Bank

- Bank of America

- Barclays Corporate Banking

- BNP Paribas

- Citibank Europe PLC

- Crédit Agricole

- Deutsche Bank AG

- Goldman Sachs

Key Developments in Europe Home Mortgage Finance Market Industry

- November 2022: Rocket Mortgage introduced a conventional loan option for purchasing or refinancing manufactured homes, expanding accessibility in the US mortgage market, indirectly influencing the global fintech mortgage landscape.

- November 2022: The Council of Europe Development Bank (CEB) approved four new loans totaling EUR 232.5 Million to support affordable housing and social development. A significant EUR 25 Million was allocated to Kosovo for its 'Adequate Social Housing Programme,' aimed at establishing a sustainable social and affordable housing system. This highlights efforts towards increasing the availability of affordable housing finance across Europe.

Strategic Europe Home Mortgage Finance Market Market Forecast

The Europe Home Mortgage Finance Market is poised for strategic growth, driven by ongoing digitalization, a persistent demand for homeownership, and increasing emphasis on sustainable financing. Key growth catalysts include the continued innovation in digital mortgage solutions, which are expected to improve accessibility and reduce processing times. Favorable economic outlooks in various European nations, coupled with supportive government policies aimed at bolstering the housing sector, will further propel market expansion. Emerging opportunities in green finance and catering to underserved demographics present significant avenues for lenders to diversify their portfolios and capture new market share. The market's ability to adapt to evolving consumer preferences and regulatory landscapes will be crucial for sustained growth and profitability in the forecast period 2025-2033.

Europe Home Mortgage Finance Market Segmentation

-

1. Application

- 1.1. Home Purchase

- 1.2. Refinance

- 1.3. Home Improvement

- 1.4. Other Applications

-

2. Providers

- 2.1. Banks

- 2.2. Housing Finance Companies

- 2.3. Real Estate Agents

-

3. Interest Rate

- 3.1. Fixed Rate Mortgage Loan

- 3.2. Adjustable Rate Mortgage Loan

Europe Home Mortgage Finance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Mortgage Finance Market Regional Market Share

Geographic Coverage of Europe Home Mortgage Finance Market

Europe Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Number of Salaried Individuals is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Purchase

- 5.1.2. Refinance

- 5.1.3. Home Improvement

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Providers

- 5.2.1. Banks

- 5.2.2. Housing Finance Companies

- 5.2.3. Real Estate Agents

- 5.3. Market Analysis, Insights and Forecast - by Interest Rate

- 5.3.1. Fixed Rate Mortgage Loan

- 5.3.2. Adjustable Rate Mortgage Loan

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rocket Mortgage

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Shore Financial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aareal Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of America

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Barclays Corporate Banking

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BNP Paribas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Citibank Europe PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crédit Agricole

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deutsche Bank AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Goldman Sachs**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rocket Mortgage

List of Figures

- Figure 1: Europe Home Mortgage Finance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Home Mortgage Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Europe Home Mortgage Finance Market Revenue Million Forecast, by Providers 2020 & 2033

- Table 3: Europe Home Mortgage Finance Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 4: Europe Home Mortgage Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Home Mortgage Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Home Mortgage Finance Market Revenue Million Forecast, by Providers 2020 & 2033

- Table 7: Europe Home Mortgage Finance Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 8: Europe Home Mortgage Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Home Mortgage Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Mortgage Finance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Europe Home Mortgage Finance Market?

Key companies in the market include Rocket Mortgage, United Shore Financial, Aareal Bank, Bank of America, Barclays Corporate Banking, BNP Paribas, Citibank Europe PLC, Crédit Agricole, Deutsche Bank AG, Goldman Sachs**List Not Exhaustive.

3. What are the main segments of the Europe Home Mortgage Finance Market?

The market segments include Application, Providers, Interest Rate.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Number of Salaried Individuals is Driving the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Rocket Mortgage, the nation's largest mortgage lender and a part of Rocket Companies, today introduced a conventional loan option for Americans interested in purchasing or refinancing a manufactured home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the Europe Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence