Key Insights

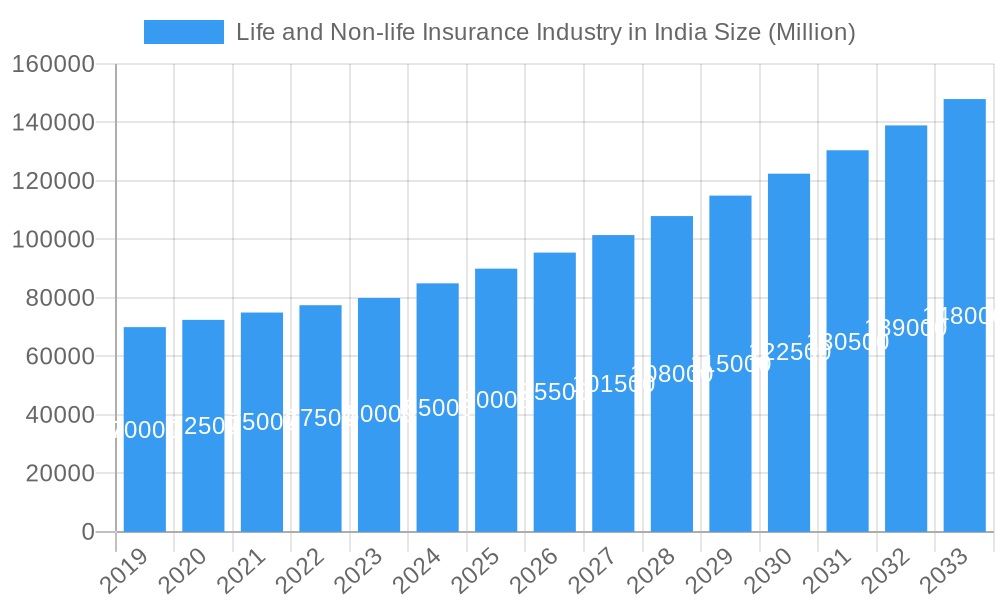

The Indian insurance market, encompassing both life and non-life segments, is poised for robust expansion, with an estimated market size of approximately USD 90,000 million in 2025. This growth is propelled by a Compound Annual Growth Rate (CAGR) exceeding 7.00%, indicating sustained momentum over the forecast period of 2025-2033. A significant driver for this expansion is the increasing awareness of financial security and the need for risk mitigation among the burgeoning Indian population, coupled with rising disposable incomes. Government initiatives promoting financial inclusion, such as Pradhan Mantri Jan Dhan Yojana, and the development of digital insurance platforms are further augmenting market penetration. The life insurance segment, comprising individual and group policies, is expected to remain a dominant force, driven by long-term savings goals and protection needs. Simultaneously, the non-life insurance sector, fueled by a growing economy and increased demand for motor, health, and fire insurance, is also witnessing substantial growth. The strategic expansion of distribution channels, including bancassurance partnerships and direct sales models, is crucial in reaching a wider customer base across both urban and rural landscapes.

Life and Non-life Insurance Industry in India Market Size (In Billion)

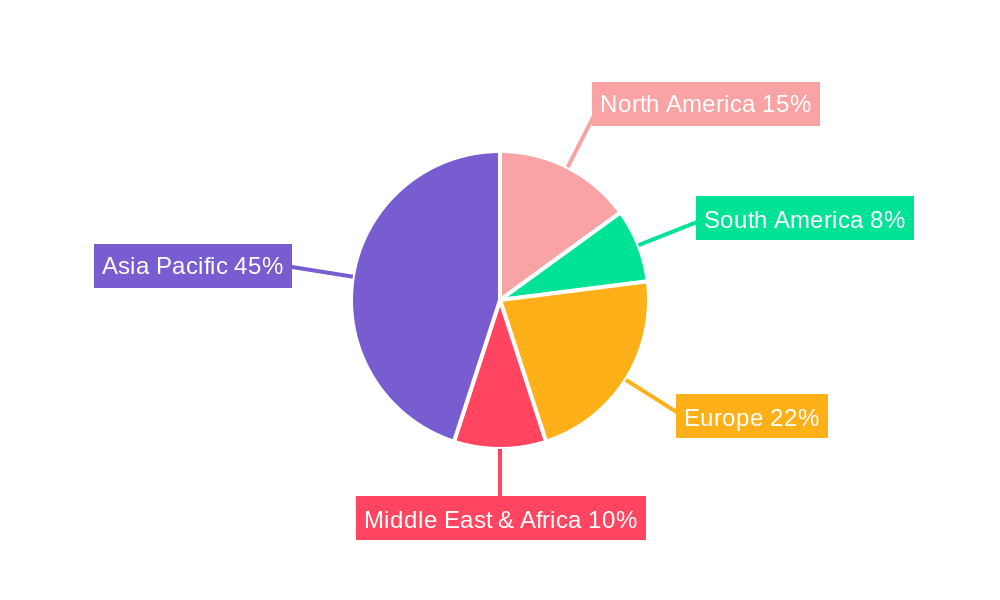

The market's trajectory is further shaped by evolving consumer preferences towards personalized insurance products and the increasing adoption of technology, leading to more efficient claims processing and customer service. Emerging trends like embedded insurance, where insurance is offered as part of other purchases, and the rise of InsurTech companies are injecting innovation and competition into the industry. However, certain restraints, such as regulatory complexities and the need for greater insurance literacy in certain segments of the population, could pose challenges. Despite these, the overall outlook for the Indian insurance market remains exceptionally positive, driven by demographic advantages, economic development, and proactive industry players. Key companies like Life Insurance Corporation of India, SBI Life Insurance, and ICICI Prudential Life Insurance are at the forefront, actively contributing to the market's growth and shaping its future. The Asia Pacific region, with India as a major contributor, is expected to be a significant market, leveraging its large population and rapidly developing economy to capitalize on these growth opportunities.

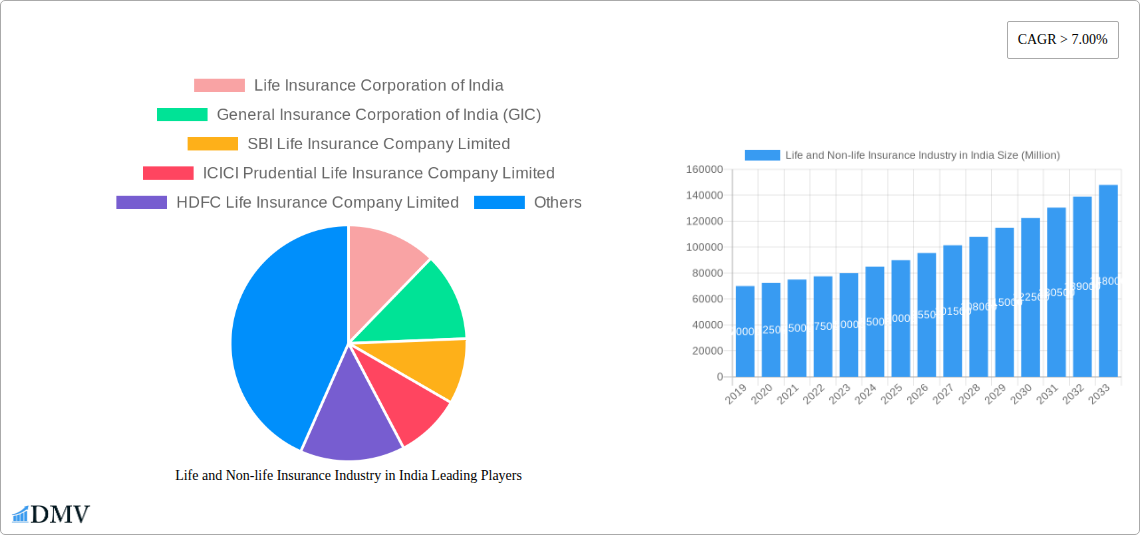

Life and Non-life Insurance Industry in India Company Market Share

This in-depth report offers an unparalleled view into the Life and Non-life Insurance Industry in India, meticulously analyzing its current market composition, historical trajectory, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is your definitive guide to navigating the dynamic Indian insurance sector. Discover critical insights into market concentration, regulatory shifts, evolving consumer needs, and emerging growth drivers. Whether you're an investor, insurer, policymaker, or industry professional, this report provides the essential data and strategic foresight to make informed decisions and capitalize on the immense opportunities within India's burgeoning insurance market.

Life and Non-life Insurance Industry in India Market Composition & Trends

The Indian insurance sector, a critical component of the nation's financial architecture, exhibits a fascinating market composition shaped by both established public sector entities and a rapidly expanding private player ecosystem. Market concentration is characterized by the significant, though evolving, presence of giants like Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC), alongside aggressive growth from private leaders such as SBI Life Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, and HDFC Life Insurance Company Limited. The non-life segment is similarly dominated by key players including New India Assurance Co Ltd, United India Insurance Company Limited, National Insurance Company Limited, and The Oriental Insurance Company Ltd, with Shriram Life Insurance Company Ltd also holding a notable position.

Innovation catalysts are primarily driven by technological integration, a focus on diverse product development across life (individual, group) and non-life (fire, motors, marine, health, others) segments, and a strategic expansion of distribution channels. The regulatory landscape, overseen by IRDAI, continues to foster a competitive yet stable environment, encouraging market penetration. Substitute products, while present in savings and investment avenues, are increasingly being integrated into comprehensive insurance offerings. End-user profiles are diversifying, with a growing demand for tailored solutions driven by increased financial literacy and rising disposable incomes. Merger and acquisition (M&A) activities, though perhaps less frequent in recent years, remain a key mechanism for consolidation and market expansion, with deal values in the multi-crore range reflecting strategic valuations.

Life and Non-life Insurance Industry in India Industry Evolution

The Life and Non-life Insurance Industry in India has undergone a remarkable transformation, evolving from a largely state-controlled domain to a vibrant, competitive marketplace. The historical period from 2019 to 2024 has witnessed significant market growth trajectories propelled by a growing middle class, increased awareness of financial security, and supportive government policies aimed at enhancing insurance penetration. Technological advancements have been a paramount driver, with the adoption of digital platforms for policy issuance, claims processing, and customer service revolutionizing operational efficiencies and customer engagement. Insurers have increasingly leveraged data analytics and artificial intelligence to personalize product offerings and enhance risk assessment.

Shifting consumer demands have played a crucial role in this evolution. A growing preference for customized insurance solutions, coupled with an increased interest in health and wellness, has spurred innovation in product design. The rise of online channels and mobile applications has empowered consumers with greater access to information and a more streamlined purchasing experience. The Life Insurance Corporation of India (LIC), despite the formidable growth of private players, has maintained a dominant market share, particularly in life insurance, due to its extensive reach and established trust. However, private insurers have consistently demonstrated agility, capturing significant market share through innovative product launches, aggressive marketing campaigns, and strategic partnerships, especially in niche segments.

The non-life sector has seen robust growth in motor and health insurance, driven by mandatory regulations and increasing awareness of medical costs. The General Insurance Corporation of India (GIC) continues to play a pivotal role in the reinsurance space, supporting the stability of the entire industry. The adoption of InsurTech solutions has become a key differentiator, with companies investing heavily in digital infrastructure to enhance customer experience and streamline operations. The industry's growth rate, which has seen consistent positive double-digit figures in various segments, reflects the immense untapped potential of the Indian market. The forecast period from 2025 to 2033 is expected to build upon these foundations, with further acceleration in digital adoption, product innovation, and market penetration, especially in rural and semi-urban areas.

Leading Regions, Countries, or Segments in Life and Non-life Insurance Industry in India

Within the expansive Life and Non-life Insurance Industry in India, a granular analysis reveals dominant segments driven by distinct market dynamics and consumer behaviors.

Dominant Segments:

Life Insurance: Individual Policies

- Drivers: Growing disposable incomes, increasing financial literacy, greater awareness of long-term financial planning for retirement and family protection.

- In-depth Analysis: The individual life insurance segment forms the bedrock of the Indian life insurance market. Products like term insurance, endowment plans, and unit-linked insurance plans (ULIPs) catering to individual needs for wealth creation and risk mitigation are highly sought after. The expansion of bancassurance models and direct sales forces by major players like SBI Life Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, and HDFC Life Insurance Company Limited has been instrumental in reaching a wider customer base. The sheer volume of individual policyholders seeking financial security and a hedge against life's uncertainties makes this segment the largest revenue generator.

Non-life Insurance: Motors Insurance

- Drivers: Mandatory third-party liability insurance for vehicles, rapid growth in vehicle sales (two-wheelers, cars, commercial vehicles), and increasing awareness of comprehensive coverage against damage and theft.

- In-depth Analysis: The motor insurance segment, encompassing both mandatory third-party liability and voluntary comprehensive policies, is a consistently high-performing area within non-life insurance. The increasing vehicle parc across India, coupled with stricter enforcement of motor insurance regulations, ensures a steady demand. Players like New India Assurance Co Ltd, United India Insurance Company Limited, and The Oriental Insurance Company Ltd have historically held strong positions. The adoption of telematics and usage-based insurance (UBI) is also emerging as a trend, offering personalized premiums based on driving behavior, further enhancing the segment's appeal.

Distribution Channel: Banks (Bancassurance)

- Drivers: Existing customer relationships, widespread branch networks, trust factor associated with banking institutions, and their ability to offer bundled financial products.

- In-depth Analysis: Banks have emerged as a formidable distribution channel for both life and non-life insurance products. The bancassurance model leverages the vast customer base and inherent trust that banks command. For insurers, it provides immediate access to a large pool of potential customers. Key banking partners collaborate with leading insurance companies, offering a diverse range of products that complement banking services. This channel has been particularly effective in driving penetration for both group and individual life insurance policies, as well as health and motor insurance.

Life and Non-life Insurance Industry in India Product Innovations

Product innovation in the Life and Non-life Insurance Industry in India is increasingly focused on customization and holistic protection. In the life segment, Unit Linked Insurance Plans (ULIPs) have evolved to offer greater flexibility in fund choices and reduced charges, appealing to investors seeking market-linked returns with insurance cover. Health insurance products are now featuring wellness benefits, preventive care discounts, and specialized coverage for critical illnesses and long-term diseases, reflecting a proactive approach to health management. For non-life, innovations include parametric insurance solutions that trigger payouts based on pre-defined parameters like weather events, offering faster claim settlement. Usage-based insurance (UBI) in motor insurance, leveraging telematics, is gaining traction, promising personalized premiums based on driving habits, thereby enhancing customer engagement and risk management.

Propelling Factors for Life and Non-life Insurance Industry in India Growth

The growth of the Life and Non-life Insurance Industry in India is propelled by several interconnected factors. Economic growth and rising disposable incomes enhance the affordability and demand for insurance products. Increasing financial literacy and awareness about the importance of financial security and risk mitigation are crucial drivers. Supportive regulatory frameworks by IRDAI, fostering competition and consumer protection, create a conducive environment for expansion. Furthermore, the digital revolution and InsurTech innovations are expanding reach, improving customer experience, and driving operational efficiencies. The young demographic profile of India presents a long-term growth opportunity, as younger generations are more inclined towards early financial planning.

Obstacles in the Life and Non-life Insurance Industry in India Market

Despite robust growth, the Life and Non-life Insurance Industry in India faces several obstacles. Low insurance penetration, particularly in rural areas, signifies a significant untapped market but also a challenge in reaching these demographics. Complex regulatory compliance can be a burden for smaller players, while evolving regulations require continuous adaptation. Low-interest rate regimes can impact the profitability of traditional savings-oriented life insurance products. Consumer perception and trust issues, stemming from historical mis-selling incidents, can hinder adoption. Price sensitivity and a preference for traditional savings instruments over pure insurance products also pose a challenge. Infrastructure gaps and last-mile connectivity in certain regions can impede effective service delivery and claims settlement.

Future Opportunities in Life and Non-life Insurance Industry in India

The Life and Non-life Insurance Industry in India is poised for substantial future opportunities. The untapped rural market presents immense potential for product innovation and distribution expansion. The growing demand for health and wellness insurance, driven by increased health consciousness, offers significant growth avenues. The adoption of InsurTech and AI presents opportunities for personalized product offerings, streamlined claims, and enhanced customer engagement. Emerging segments like cyber insurance and climate-risk insurance are gaining traction. Furthermore, product bundling with other financial services and a focus on micro-insurance for low-income groups can unlock new customer bases. The increasing focus on financial inclusion by the government will further bolster these opportunities.

Major Players in the Life and Non-life Insurance Industry in India Ecosystem

- Life Insurance Corporation of India

- General Insurance Corporation of India (GIC)

- SBI Life Insurance Company Limited

- ICICI Prudential Life Insurance Company Limited

- HDFC Life Insurance Company Limited

- New India Assurance Co Ltd

- United India Insurance Company Limited

- National Insurance Company Limited

- The Oriental Insurance Company Ltd

- Shriram Life Insurance Company Ltd

Key Developments in Life and Non-life Insurance Industry in India Industry

- 2022: Life Insurance Corporation of India (LIC) paid out 70.39% of the total industry payouts, underscoring its significant market presence.

- 2022: Private insurers covered the remaining 29.61% of total payouts, indicating their growing share and impact.

- 2021-22: Benefits paid out as a result of surrenders or withdrawals rose to 1.58 lakh crore.

- 2021-22: LIC accounted for 60.09% of surrender/withdrawal benefits, while private insurers handled the remainder, reflecting varying policyholder behavior and product structures.

- 2021-22: Unit Linked Insurance Plans (ULIPs) constituted 1.96% of total surrender benefits for LIC, compared to a substantial 78.29% for private insurers, highlighting different product strategies and investment horizons.

- 2022: LIC maintained extensive reach with offices in 688 out of 750 districts nationwide (92% coverage), demonstrating its deep penetration.

- 2022: Private sector insurers covered 79% of all districts, with offices in 596 districts, showcasing their widespread network and growing accessibility.

- 2022: LIC and commercial insurers collectively covered 92% of all districts in the nation, indicating robust insurance infrastructure across the country.

Strategic Life and Non-life Insurance Industry in India Market Forecast

The strategic outlook for the Life and Non-life Insurance Industry in India from 2025 to 2033 is exceptionally positive, driven by a confluence of robust growth catalysts. The persistent rise in disposable incomes and a rapidly urbanizing population will continue to fuel demand for both life and non-life insurance products, with health and motor insurance likely to see sustained high growth. The government's continued emphasis on financial inclusion and insurance penetration, coupled with favorable regulatory reforms, will further accelerate market expansion. InsurTech adoption will be a key differentiator, enabling insurers to offer more personalized products, improve customer experience through digital channels, and enhance operational efficiency. The forecast period is expected to witness a significant surge in market penetration, especially in Tier 2 and Tier 3 cities, and a diversification of product offerings to cater to evolving consumer needs, making India a pivotal market in the global insurance landscape.

Life and Non-life Insurance Industry in India Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Fire

- 1.2.2. Motors

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Life and Non-life Insurance Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life and Non-life Insurance Industry in India Regional Market Share

Geographic Coverage of Life and Non-life Insurance Industry in India

Life and Non-life Insurance Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Insurance Penetration at Global Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motors

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Fire

- 6.1.2.2. Motors

- 6.1.2.3. Marine

- 6.1.2.4. Health

- 6.1.2.5. Others

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Brokers

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Fire

- 7.1.2.2. Motors

- 7.1.2.3. Marine

- 7.1.2.4. Health

- 7.1.2.5. Others

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Brokers

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Fire

- 8.1.2.2. Motors

- 8.1.2.3. Marine

- 8.1.2.4. Health

- 8.1.2.5. Others

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Brokers

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Fire

- 9.1.2.2. Motors

- 9.1.2.3. Marine

- 9.1.2.4. Health

- 9.1.2.5. Others

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Brokers

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-life Insurance

- 10.1.2.1. Fire

- 10.1.2.2. Motors

- 10.1.2.3. Marine

- 10.1.2.4. Health

- 10.1.2.5. Others

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Brokers

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Life Insurance Corporation of India

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Insurance Corporation of India (GIC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SBI Life Insurance Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICICI Prudential Life Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HDFC Life Insurance Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 New India Assurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United India Insurance Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 National Insurance Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Oriental Insurance Company Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shriram Life Insurance Company Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Life Insurance Corporation of India

List of Figures

- Figure 1: Global Life and Non-life Insurance Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2025 & 2033

- Figure 3: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Life and Non-life Insurance Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2025 & 2033

- Figure 9: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2025 & 2033

- Figure 10: South America Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Life and Non-life Insurance Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2025 & 2033

- Figure 15: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2025 & 2033

- Figure 21: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2025 & 2033

- Figure 22: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2025 & 2033

- Figure 27: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2025 & 2033

- Figure 28: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 2: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 5: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 11: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 17: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 29: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 38: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life and Non-life Insurance Industry in India?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Life and Non-life Insurance Industry in India?

Key companies in the market include Life Insurance Corporation of India, General Insurance Corporation of India (GIC), SBI Life Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, HDFC Life Insurance Company Limited, New India Assurance Co Ltd, United India Insurance Company Limited, National Insurance Company Limited, The Oriental Insurance Company Ltd, Shriram Life Insurance Company Ltd*List Not Exhaustive.

3. What are the main segments of the Life and Non-life Insurance Industry in India?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Insurance Penetration at Global Landscape.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, LIC paid out 70.39 % of the total payouts, and private insurers covered the remaining 29.61 %. The benefits paid as a result of surrenders or withdrawals rose to 1.58 lakh crore in 2021-22, with LIC accounting for 60.09 % and private insurers for the remainder. ULIP policies made for 1.96 % of the total surrender benefits for the LIC and 78.29 % for private insurers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life and Non-life Insurance Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life and Non-life Insurance Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life and Non-life Insurance Industry in India?

To stay informed about further developments, trends, and reports in the Life and Non-life Insurance Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence