Key Insights

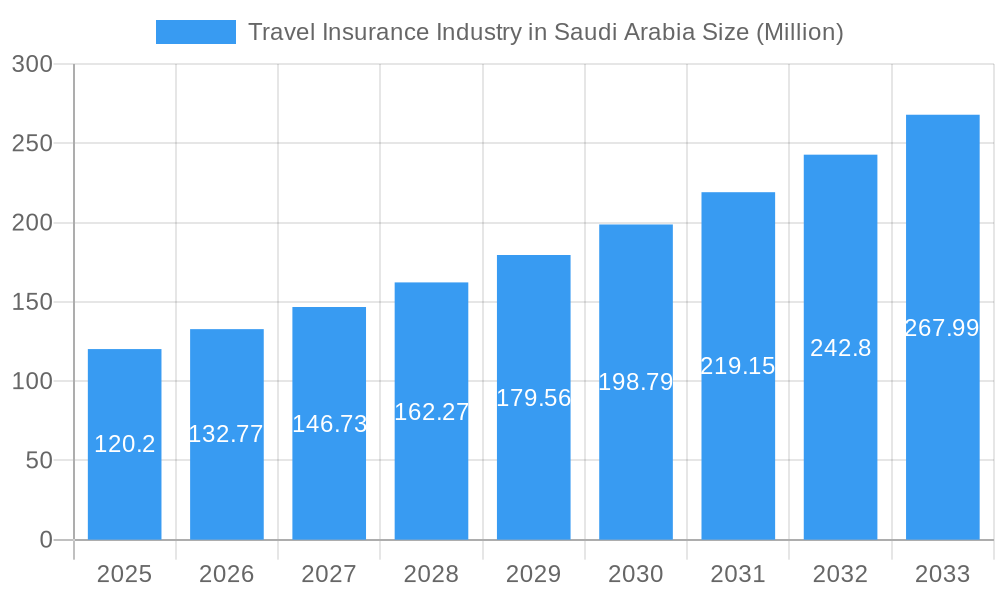

The Saudi Arabian travel insurance market is poised for significant expansion, projected to reach a substantial USD 120.20 million by 2025, demonstrating robust growth potential. This expansion is fueled by a compelling Compound Annual Growth Rate (CAGR) of 10.48% during the study period (2019-2033), indicating a dynamic and increasingly vital sector. Key drivers for this surge include a growing outbound tourism segment, a rising middle class with increased disposable income for travel, and a heightened awareness of the importance of financial protection against unforeseen travel disruptions. Furthermore, the Kingdom's ambitious Vision 2030 initiative, which aims to boost tourism and diversify the economy, is a significant catalyst, encouraging more residents to explore international destinations and, consequently, seek comprehensive travel insurance solutions. The market is evolving to cater to diverse traveler needs, with a clear trend towards more personalized and digitalized offerings, making travel insurance more accessible and appealing to a wider demographic.

Travel Insurance Industry in Saudi Arabia Market Size (In Million)

The market's segmentation reveals a strategic landscape where annual multi-trip travel insurance is likely to gain prominence as frequent travelers seek convenience and cost-effectiveness. Distribution channels are shifting, with online travel agents (OTAs) and direct sales experiencing accelerated adoption, reflecting the digital transformation of consumer purchasing habits. This trend is supported by insurance providers investing in user-friendly online platforms and mobile applications. For end-users, family travelers and business travelers represent core segments, driven by the need for comprehensive coverage for dependents and the imperative to mitigate business risks. The rising prominence of senior citizens as a travel demographic also presents a significant opportunity for specialized insurance products. As the market matures, innovation in policy offerings, such as coverage for pandemics and adventure sports, coupled with strategic partnerships between insurers and travel service providers, will be crucial for sustained growth and market leadership.

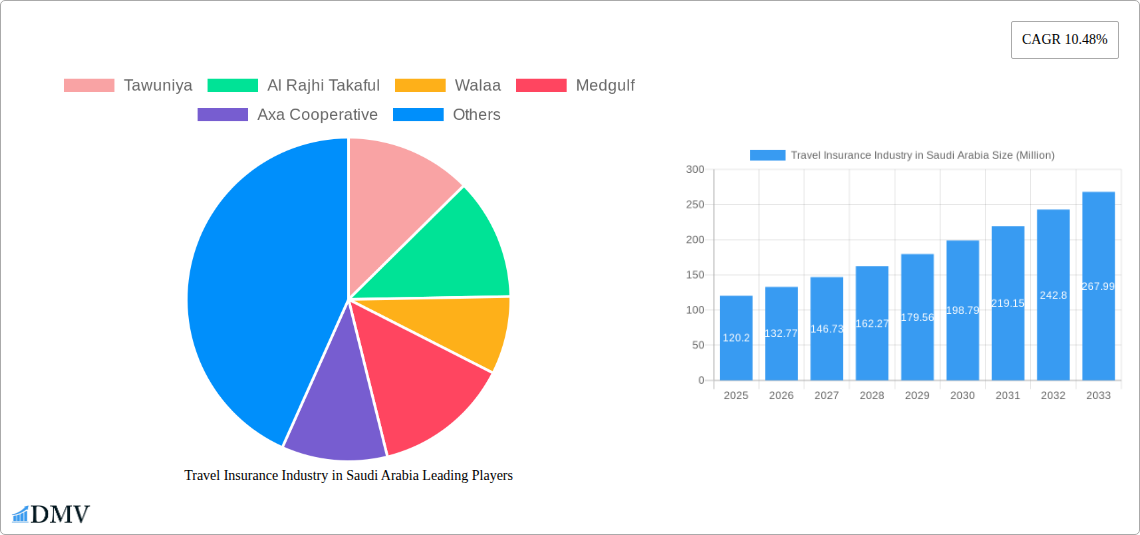

Travel Insurance Industry in Saudi Arabia Company Market Share

Unveiling the Saudi Arabian Travel Insurance Landscape: A Comprehensive Market Analysis

This in-depth report provides an unparalleled view into the burgeoning Travel Insurance Industry in Saudi Arabia. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into market dynamics, regulatory frameworks, and future trajectories. We equip stakeholders with critical insights for strategic decision-making in this rapidly evolving sector.

Travel Insurance Industry in Saudi Arabia Market Composition & Trends

The Saudi Arabian Travel Insurance Market is characterized by a dynamic interplay of established players and emerging innovators. Market concentration is moderate, with key companies like Tawuniya, Al Rajhi Takaful, and Walaa holding significant market share. Innovation is driven by a growing demand for comprehensive travel insurance coverage, particularly for family travelers and business travelers. Regulatory oversight by the Saudi Central Bank (SAMA) plays a crucial role in shaping market practices and ensuring consumer protection. Substitute products, such as basic medical emergency cover embedded in other financial products, are present but do not fully address the nuanced risks associated with modern travel. The end-user profile is diversifying, with senior citizens and education travelers also emerging as key segments. Merger and acquisition activities, such as the approved merger between SABB Takaful and Walaa Insurance, are reshaping the competitive landscape, with an estimated M&A deal value of XXX Million in the historical period. Market share distribution among leading insurers is projected to shift by XXX% by 2033 due to evolving consumer preferences and digital adoption.

Travel Insurance Industry in Saudi Arabia Industry Evolution

The Saudi Arabian Travel Insurance Industry has witnessed a remarkable evolution, driven by robust economic growth, increasing outbound tourism, and a proactive regulatory environment. The historical period (2019-2024) saw steady growth, with an average annual growth rate of approximately XX%, primarily fueled by increased domestic travel during global disruptions and a gradual resurgence of international journeys. Technological advancements have been a significant catalyst, with digital insurance solution providers like eBaoTech Corporation collaborating with companies such as Walaa Cooperative Insurance Company to deploy advanced platforms like Digicore. This collaboration, initiated in January 2022, has significantly enhanced Walaa's operational efficiency and enabled the launch of new digital products, improving customer experience and streamlining claims processing. Shifting consumer demands are also playing a pivotal role, with a growing preference for personalized travel insurance plans that offer wider coverage for unforeseen events, including travel disruptions, medical emergencies, and baggage loss. The base year of 2025 marks a pivotal point, with the market poised for accelerated growth in the forecast period (2025-2033). This growth will be further propelled by government initiatives aimed at boosting tourism and a greater awareness among Saudi citizens about the importance of securing their travel investments. The adoption rate of online purchase channels for travel insurance has surged, reaching an estimated XX% by 2024, underscoring the digital transformation underway within the sector.

Leading Regions, Countries, or Segments in Travel Insurance Industry in Saudi Arabia

The Travel Insurance Industry in Saudi Arabia is largely dominated by the Direct Sales distribution channel and the Annual Multi-trip Travel Insurance segment, reflecting the lifestyle and travel patterns of its primary demographic. The widespread adoption of digital platforms and the increasing frequency of travel among certain segments make direct sales, both online and through insurer websites, the most accessible and preferred method for purchasing travel insurance. This is further bolstered by the fact that many Saudi residents undertake multiple trips throughout the year, whether for business, leisure, or religious purposes, making annual policies a cost-effective and convenient choice.

Key drivers for the dominance of these segments include:

- Technological Integration: The proliferation of smartphones and internet penetration in Saudi Arabia has facilitated seamless online transactions, making direct sales channels highly effective. Insurers are investing heavily in user-friendly digital interfaces to cater to this demand.

- Growing Business Travel: Saudi Arabia's ambition to become a global business hub has led to a significant increase in business travelers, who often require comprehensive and flexible annual multi-trip policies to cover their frequent international engagements.

- Family Travel Trends: A strong cultural emphasis on family outings and vacations fuels the demand for family travelers seeking robust coverage for all members, often opting for annual plans for recurring trips.

- Regulatory Support: SAMA's progressive approach to digital transformation and consumer protection indirectly supports the growth of direct online sales by fostering trust and transparency.

While Online Travel Agents (OTAs) and Brokers also play a role, the direct channel often offers more personalized options and competitive pricing, particularly for annual policies. The dominance of Annual Multi-trip Travel Insurance is a clear indicator of the travel habits of the Saudi populace, prioritizing long-term coverage over single-trip solutions for frequent adventurers. The Others segment for end-users, encompassing Education Travelers, is also showing promising growth as more Saudi students opt for international academic pursuits.

Travel Insurance Industry in Saudi Arabia Product Innovations

Product innovation in the Saudi Arabian Travel Insurance Industry is a key differentiator. Companies are increasingly offering customized policies that cater to specific travel needs, such as adventure sports coverage, pre-existing medical condition cover, and enhanced cancellation protection. Technological advancements are enabling the development of AI-powered claims processing and personalized risk assessment tools, leading to faster and more efficient service delivery. For instance, Walaa's adoption of eBaoTech's Digicore platform allows for the swift deployment of new, innovative products with unique selling propositions, such as bundled travel insurance with visa assistance or flexible payment options. These innovations are enhancing customer experience and driving market growth, with a projected XX% increase in the adoption of value-added services by 2025.

Propelling Factors for Travel Insurance Industry in Saudi Arabia Growth

Several factors are propelling the growth of the Travel Insurance Industry in Saudi Arabia. The kingdom's ambitious Vision 2030 is a significant driver, with substantial investments in tourism infrastructure and a focus on attracting international visitors, thereby increasing the demand for travel insurance. Increasing disposable incomes and a growing middle class are leading to more frequent and diverse travel patterns. Furthermore, heightened global awareness of travel-related risks, amplified by recent international events, has made consumers more inclined to purchase comprehensive travel insurance coverage. Regulatory support from SAMA, encouraging digital adoption and fair practices, also plays a crucial role. The positive economic outlook and the government's commitment to diversifying the economy beyond oil are creating a fertile ground for the expansion of the insurance sector, including travel insurance.

Obstacles in the Travel Insurance Industry in Saudi Arabia Market

Despite its growth potential, the Travel Insurance Industry in Saudi Arabia faces several obstacles. Limited consumer awareness regarding the comprehensive benefits of travel insurance remains a challenge, with many opting for basic coverage or none at all. Fierce competitive pressures among existing players can lead to price wars, impacting profitability. Regulatory complexities and the need for continuous compliance with evolving SAMA guidelines can be burdensome for smaller entities. Additionally, the potential for supply chain disruptions impacting the tourism sector, due to unforeseen global events, can indirectly affect travel insurance demand. The penetration rate of travel insurance is still relatively low compared to more mature markets, standing at an estimated XX% in the historical period, indicating a significant untapped market but also highlighting the educational barrier to overcome.

Future Opportunities in Travel Insurance Industry in Saudi Arabia

The Travel Insurance Industry in Saudi Arabia is poised for significant future opportunities. The ongoing development of new tourism destinations and the expansion of religious tourism present vast untapped markets. The increasing adoption of digital technologies, such as blockchain for secure claims processing and AI for personalized product recommendations, offers avenues for innovation and enhanced customer engagement. The growing segment of senior citizens seeking international travel, combined with the rising number of education travelers, presents specialized market niches. Furthermore, the potential for partnerships with airlines, hotels, and online travel agencies can expand distribution channels and customer reach, leading to an estimated market expansion of XX% by 2030.

Major Players in the Travel Insurance Industry in Saudi Arabia Ecosystem

- Tawuniya

- Al Rajhi Takaful

- Walaa Insurance

- Medgulf

- Axa Cooperative

- Malath Insurance

- Wataniya Insurance

- TATA AIG

- Insubuy

- SAICO

Key Developments in Travel Insurance Industry in Saudi Arabia Industry

- August 2022: Bahrain and Saudi Arabia discussed cooperation to foster diverse business opportunities in tourism and promote its sustainability in line with international developments, indirectly boosting travel insurance demand.

- February 2022: The Saudi Central Bank (SAMA) approved the proposed merger between SABB Takaful and Walaa Insurance, signifying consolidation and potential for expanded market reach.

- January 2022: eBaoTech Corporation collaborated with Walaa Cooperative Insurance Company to deploy its Digicore platform, launching new products and significantly improving operational efficiency and technological advancements for Walaa's commercial and consumer lines.

Strategic Travel Insurance Industry in Saudi Arabia Market Forecast

The Travel Insurance Industry in Saudi Arabia is projected for robust growth in the coming years. Key growth catalysts include the government's ambitious tourism initiatives, a rising propensity for international travel among Saudi citizens, and the increasing adoption of digital channels for policy purchase. The market is expected to benefit from enhanced product innovation, catering to diverse traveler needs, and a growing awareness of the importance of comprehensive protection. Strategic investments in technology and a focus on customer-centric solutions will be crucial for sustained growth. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated market size of XXX Million by 2033.

Travel Insurance Industry in Saudi Arabia Segmentation

-

1. Insurance Coverage

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-trip Travel Insurance

- 1.3. Others

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Online Travel Agents

- 2.3. Airports And Hotels

- 2.4. Brokers

- 2.5. Other Insurance Intermediaries

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Business Travelers

- 3.3. Family Travelers

- 3.4. Others (Education Travelers, etc)

Travel Insurance Industry in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Travel Insurance Industry in Saudi Arabia Regional Market Share

Geographic Coverage of Travel Insurance Industry in Saudi Arabia

Travel Insurance Industry in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Domestic Travel is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-trip Travel Insurance

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Online Travel Agents

- 5.2.3. Airports And Hotels

- 5.2.4. Brokers

- 5.2.5. Other Insurance Intermediaries

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Business Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others (Education Travelers, etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6. North America Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-trip Travel Insurance

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct Sales

- 6.2.2. Online Travel Agents

- 6.2.3. Airports And Hotels

- 6.2.4. Brokers

- 6.2.5. Other Insurance Intermediaries

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Senior Citizens

- 6.3.2. Business Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others (Education Travelers, etc)

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7. South America Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-trip Travel Insurance

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct Sales

- 7.2.2. Online Travel Agents

- 7.2.3. Airports And Hotels

- 7.2.4. Brokers

- 7.2.5. Other Insurance Intermediaries

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Senior Citizens

- 7.3.2. Business Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others (Education Travelers, etc)

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8. Europe Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-trip Travel Insurance

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct Sales

- 8.2.2. Online Travel Agents

- 8.2.3. Airports And Hotels

- 8.2.4. Brokers

- 8.2.5. Other Insurance Intermediaries

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Senior Citizens

- 8.3.2. Business Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others (Education Travelers, etc)

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9. Middle East & Africa Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-trip Travel Insurance

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct Sales

- 9.2.2. Online Travel Agents

- 9.2.3. Airports And Hotels

- 9.2.4. Brokers

- 9.2.5. Other Insurance Intermediaries

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Senior Citizens

- 9.3.2. Business Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others (Education Travelers, etc)

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10. Asia Pacific Travel Insurance Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-trip Travel Insurance

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct Sales

- 10.2.2. Online Travel Agents

- 10.2.3. Airports And Hotels

- 10.2.4. Brokers

- 10.2.5. Other Insurance Intermediaries

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Senior Citizens

- 10.3.2. Business Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others (Education Travelers, etc)

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tawuniya

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Al Rajhi Takaful

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Walaa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medgulf

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Axa Cooperative

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Malath Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wataniya Insurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TATA AIG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insubuy

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAICO**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tawuniya

List of Figures

- Figure 1: Global Travel Insurance Industry in Saudi Arabia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Travel Insurance Industry in Saudi Arabia Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Insurance Coverage 2025 & 2033

- Figure 4: North America Travel Insurance Industry in Saudi Arabia Volume (Million), by Insurance Coverage 2025 & 2033

- Figure 5: North America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 6: North America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Insurance Coverage 2025 & 2033

- Figure 7: North America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Travel Insurance Industry in Saudi Arabia Volume (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Travel Insurance Industry in Saudi Arabia Revenue (Million), by End-User 2025 & 2033

- Figure 12: North America Travel Insurance Industry in Saudi Arabia Volume (Million), by End-User 2025 & 2033

- Figure 13: North America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Travel Insurance Industry in Saudi Arabia Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Travel Insurance Industry in Saudi Arabia Volume (Million), by Country 2025 & 2033

- Figure 17: North America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Insurance Coverage 2025 & 2033

- Figure 20: South America Travel Insurance Industry in Saudi Arabia Volume (Million), by Insurance Coverage 2025 & 2033

- Figure 21: South America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 22: South America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Insurance Coverage 2025 & 2033

- Figure 23: South America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: South America Travel Insurance Industry in Saudi Arabia Volume (Million), by Distribution Channel 2025 & 2033

- Figure 25: South America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: South America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: South America Travel Insurance Industry in Saudi Arabia Revenue (Million), by End-User 2025 & 2033

- Figure 28: South America Travel Insurance Industry in Saudi Arabia Volume (Million), by End-User 2025 & 2033

- Figure 29: South America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Travel Insurance Industry in Saudi Arabia Volume Share (%), by End-User 2025 & 2033

- Figure 31: South America Travel Insurance Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Travel Insurance Industry in Saudi Arabia Volume (Million), by Country 2025 & 2033

- Figure 33: South America Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Travel Insurance Industry in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Travel Insurance Industry in Saudi Arabia Revenue (Million), by Insurance Coverage 2025 & 2033

- Figure 36: Europe Travel Insurance Industry in Saudi Arabia Volume (Million), by Insurance Coverage 2025 & 2033

- Figure 37: Europe Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 38: Europe Travel Insurance Industry in Saudi Arabia Volume Share (%), by Insurance Coverage 2025 & 2033

- Figure 39: Europe Travel Insurance Industry in Saudi Arabia Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Europe Travel Insurance Industry in Saudi Arabia Volume (Million), by Distribution Channel 2025 & 2033

- Figure 41: Europe Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Europe Travel Insurance Industry in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Europe Travel Insurance Industry in Saudi Arabia Revenue (Million), by End-User 2025 & 2033

- Figure 44: Europe Travel Insurance Industry in Saudi Arabia Volume (Million), by End-User 2025 & 2033

- Figure 45: Europe Travel Insurance Industry in Saudi Arabia Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Europe Travel Insurance Industry in Saudi Arabia Volume Share (%), by End-User 2025 & 2033

- Figure 47: Europe Travel Insurance Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Travel Insurance Industry in Saudi Arabia Volume (Million), by Country 2025 & 2033

- Figure 49: Europe Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Travel Insurance Industry in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue (Million), by Insurance Coverage 2025 & 2033

- Figure 52: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume (Million), by Insurance Coverage 2025 & 2033

- Figure 53: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 54: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume Share (%), by Insurance Coverage 2025 & 2033

- Figure 55: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume (Million), by Distribution Channel 2025 & 2033

- Figure 57: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue (Million), by End-User 2025 & 2033

- Figure 60: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume (Million), by End-User 2025 & 2033

- Figure 61: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume Share (%), by End-User 2025 & 2033

- Figure 63: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue (Million), by Insurance Coverage 2025 & 2033

- Figure 68: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume (Million), by Insurance Coverage 2025 & 2033

- Figure 69: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 70: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume Share (%), by Insurance Coverage 2025 & 2033

- Figure 71: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume (Million), by Distribution Channel 2025 & 2033

- Figure 73: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue (Million), by End-User 2025 & 2033

- Figure 76: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume (Million), by End-User 2025 & 2033

- Figure 77: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume Share (%), by End-User 2025 & 2033

- Figure 79: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Travel Insurance Industry in Saudi Arabia Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 2: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 3: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 7: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 10: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 11: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 15: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Country 2020 & 2033

- Table 17: United States Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 24: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 25: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 29: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 38: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 39: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 43: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Germany Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: France Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Italy Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Spain Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Russia Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Benelux Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Nordics Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 64: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 65: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 68: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 69: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Country 2020 & 2033

- Table 71: Turkey Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Israel Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: GCC Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: North Africa Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: South Africa Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 83: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 84: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Insurance Coverage 2020 & 2033

- Table 85: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 86: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 87: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by End-User 2020 & 2033

- Table 88: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by End-User 2020 & 2033

- Table 89: Global Travel Insurance Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global Travel Insurance Industry in Saudi Arabia Volume Million Forecast, by Country 2020 & 2033

- Table 91: China Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: India Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: Japan Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: South Korea Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: Oceania Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Travel Insurance Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Travel Insurance Industry in Saudi Arabia Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Insurance Industry in Saudi Arabia?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the Travel Insurance Industry in Saudi Arabia?

Key companies in the market include Tawuniya, Al Rajhi Takaful, Walaa, Medgulf, Axa Cooperative, Malath Insurance, Wataniya Insurance, TATA AIG, Insubuy, SAICO**List Not Exhaustive.

3. What are the main segments of the Travel Insurance Industry in Saudi Arabia?

The market segments include Insurance Coverage, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 120.20 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Domestic Travel is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In August 2022, Bahrain and Saudi Arabia discussed cooperation to create diverse business opportunities in the sector of tourism and promote its sustainability in line with international developments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Insurance Industry in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Insurance Industry in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Insurance Industry in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Travel Insurance Industry in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence