Key Insights

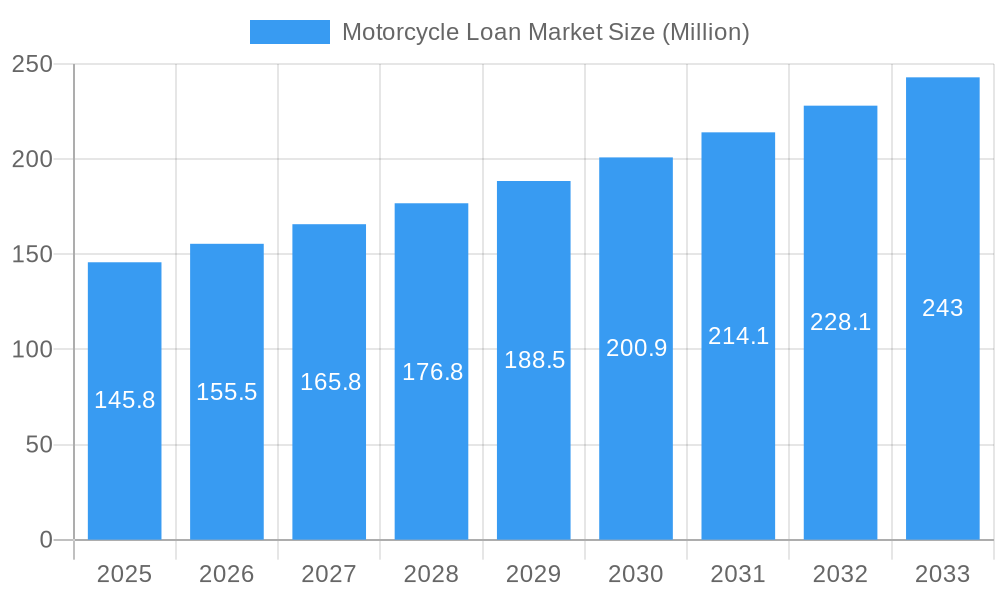

The global motorcycle loan market is poised for significant expansion, projected to reach a substantial USD 145.80 million by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of 6.61%, this growth trajectory indicates a dynamic and expanding sector within the broader automotive finance landscape. Key growth enablers include the increasing affordability and accessibility of motorcycles as a mode of transportation, particularly in emerging economies, coupled with a rising disposable income among the target demographic. Furthermore, evolving consumer preferences towards personalized and flexible financing options are spurring demand. Financial institutions are actively developing tailored loan products, including attractive interest rates and extended repayment periods, to cater to diverse customer needs. The expanding network of Non-Banking Financial Companies (NBFCs) and the innovative offerings from Fintech companies are also playing a crucial role in democratizing access to motorcycle financing, thereby fueling market growth.

Motorcycle Loan Market Market Size (In Million)

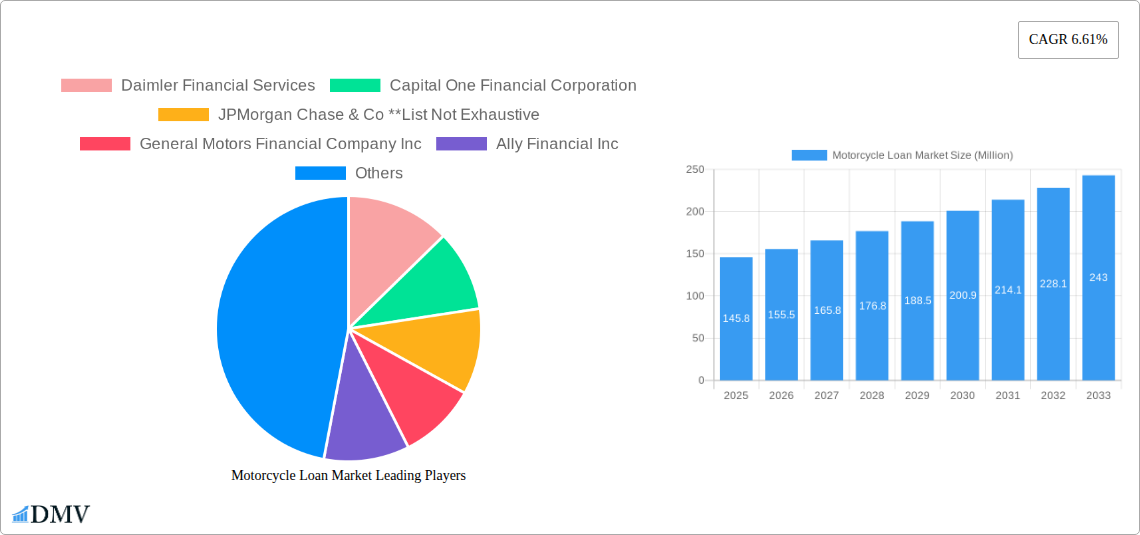

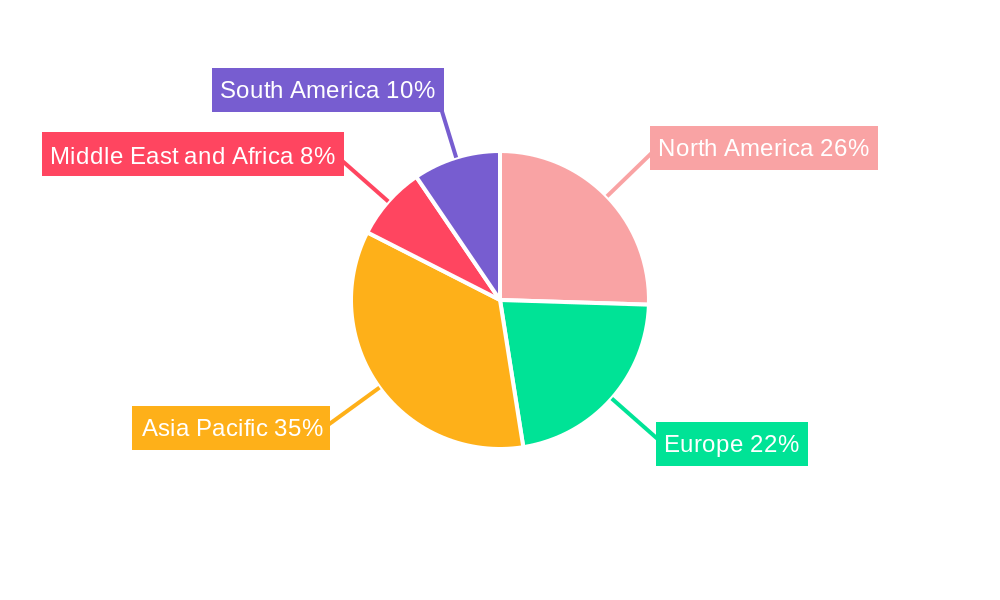

The market segmentation reveals a diverse demand across various vehicle types, with two-wheelers representing a significant portion, owing to their widespread adoption for daily commuting and leisure. Passenger cars and commercial vehicles also contribute to the overall market, reflecting the versatility of financing solutions offered. The distribution of loan amounts, ranging from less than 25% to over 75% of the vehicle's value, highlights the varied financial capacities of consumers. Similarly, loan tenures spanning less than 3 years to over 5 years underscore the flexibility that borrowers seek. Geographically, Asia Pacific, led by India and China, is expected to be a dominant region, driven by a large young population and increasing urbanization. North America and Europe continue to be mature markets with a steady demand for motorcycle financing, while emerging markets in the Middle East, Africa, and South America present significant untapped potential for future growth. Leading financial institutions like Daimler Financial Services, Capital One Financial Corporation, and prominent automotive manufacturers' captive finance arms are instrumental in shaping the market's competitive landscape.

Motorcycle Loan Market Company Market Share

Motorcycle Loan Market: Comprehensive Analysis and Future Forecast (2019–2033)

Unlock critical insights into the dynamic Motorcycle Loan Market with this in-depth report. Covering the historical period (2019–2024), base year (2025), and a robust forecast period (2025–2033), this research provides strategic intelligence on market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Essential for stakeholders seeking to understand market concentration, M&A activities, regulatory landscapes, and end-user profiles, this report offers a data-driven roadmap for navigating the global motorcycle finance landscape.

Motorcycle Loan Market Market Composition & Trends

The Motorcycle Loan Market exhibits a moderately concentrated structure, with key players vying for market share through innovative financing solutions and strategic partnerships. Market concentration is influenced by the increasing involvement of Non-Banking Financial Services (NBFCs) and Original Equipment Manufacturers (OEMs) in providing tailored loan products. Innovation catalysts include the development of digital lending platforms, blockchain-based loan processing, and flexible repayment structures catering to diverse consumer needs, particularly for two-wheelers. Regulatory landscapes, while varying by region, are generally evolving to support financial inclusion and consumer protection, impacting loan eligibility criteria and interest rate caps. Substitute products, such as personal loans and leasing options, present a competitive challenge, yet the specialized nature of motorcycle financing, including options for new and used vehicles, ensures continued demand. End-user profiles are diverse, ranging from daily commuters seeking affordable transportation to enthusiasts looking for premium models. Mergers and acquisitions (M&A) activities, such as the significant acquisition of Mandala Multifinance by Mitsubishi UFJ Financial Group for approximately USD 465 Million, underscore a trend towards consolidation and expansion into emerging markets. The average market share distribution indicates a strong presence of Banks and NBFCs, each holding substantial portions of the market.

Motorcycle Loan Market Industry Evolution

The Motorcycle Loan Market has witnessed significant evolution driven by a confluence of economic factors, technological advancements, and shifting consumer preferences. Over the historical period (2019–2024), the market experienced a steady growth trajectory, fueled by rising disposable incomes in emerging economies and the increasing demand for personal mobility solutions. The COVID-19 pandemic initially posed challenges due to supply chain disruptions and economic uncertainty, but it also accelerated the adoption of digital channels for loan applications and processing. Technological advancements have been a pivotal force in this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for credit scoring and risk assessment has streamlined the loan approval process, making it faster and more accessible. Fintech companies have played a crucial role in introducing innovative digital platforms, offering seamless online application experiences and reducing the reliance on traditional brick-and-mortar branches.

Consumer demands have also undergone a transformation. There is a growing preference for flexible loan tenures, with a significant segment seeking options of "less than 3 Years" and "3-5 Years" to manage their financial commitments effectively. The desire for customized loan packages, including options for accessories and insurance bundled with the vehicle purchase, has become more pronounced. Furthermore, the increasing environmental consciousness is indirectly influencing the market, with a nascent but growing interest in financing electric motorcycles. As of the base year (2025), the market is projected to have grown at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the historical period, a testament to its resilience and adaptive capacity. The expansion of the pre-owned motorcycle segment, facilitated by robust financing options, has also contributed significantly to overall market growth, making motorcycle ownership accessible to a wider demographic. The shift towards online-first financial services is expected to continue, pushing traditional lenders to enhance their digital offerings and customer experience to remain competitive.

Leading Regions, Countries, or Segments in Motorcycle Loan Market

The dominance within the Motorcycle Loan Market is multifaceted, with specific regions, countries, and segments exhibiting distinct growth patterns and drivers. Across Vehicle Type, the Two-Wheeler segment consistently leads, particularly in Asia-Pacific and developing economies where motorcycles are a primary mode of transportation for a significant portion of the population. This dominance is attributed to their affordability, fuel efficiency, and maneuverability in congested urban environments.

In terms of Provider Type, NBFCs (Non-Banking Financial Services) have emerged as a formidable force, often offering more flexible lending criteria and faster processing times compared to traditional banks. This is especially prevalent in markets where regulatory frameworks are still evolving or where a large unbanked or underbanked population exists. However, Banks still command a significant share due to their established trust, broader customer base, and access to capital. OEM (Original Equipment Manufacturer) financing arms are also crucial, often providing attractive promotional offers and bundled packages to drive sales of their own brands.

Analyzing the Percentage of Amount Sanctioned, the 51-75% and More than 75% brackets are indicative of substantial financing for vehicle purchases, reflecting the need for significant credit to acquire new or relatively high-value used motorcycles. Conversely, the Less than 25% and 25-50% segments cater to smaller loans, potentially for older used models or accessory financing.

Regarding Tenure, the 3-5 Years bracket is a sweet spot for many consumers, offering a balance between manageable monthly payments and an acceptable repayment period. The "Less than 3 Years" tenure is popular for budget-conscious buyers or those opting for smaller capacity motorcycles, while "More than 5 Years" is less common but available for higher-value acquisitions.

Key drivers for dominance in these segments include:

- Investment Trends: Significant investments by financial institutions and private equity firms into NBFCs and fintech startups are fueling expansion and innovation, particularly in high-growth regions.

- Regulatory Support: Favorable government policies promoting financial inclusion and vehicle ownership, coupled with streamlined licensing for lending institutions, can bolster specific segments.

- Economic Development: Rising disposable incomes and a growing middle class in emerging markets directly translate to increased demand for motorcycle financing.

- Urbanization: Rapid urbanization globally drives the need for efficient and affordable personal transportation, thus boosting the two-wheeler loan market.

Regionally, Asia-Pacific stands out as the largest market due to its massive population, strong economic growth, and deep-rooted reliance on motorcycles. Within this region, countries like India, Indonesia, and Vietnam are pivotal, showcasing high volumes of two-wheeler sales and a corresponding demand for financing. The dominance of the two-wheeler segment is a defining characteristic of this market.

Motorcycle Loan Market Product Innovations

Product innovations in the Motorcycle Loan Market are increasingly focused on enhancing customer convenience, accessibility, and affordability. Digital-first lending platforms are a significant innovation, allowing for end-to-end online application, document submission, and approval processes, often within hours. Smart financing solutions are emerging, integrating AI-driven credit assessment to offer personalized loan terms based on individual financial profiles and risk assessments. These innovations aim to reduce processing times and broaden access to credit for a wider range of consumers. Furthermore, innovative insurance and warranty packages are being bundled with loan offers, providing a comprehensive ownership solution. Some providers are exploring flexible repayment options, including pay-as-you-earn schemes or deferred payment options, to cater to the fluctuating incomes of riders. The focus is on creating a seamless, transparent, and customer-centric financing experience.

Propelling Factors for Motorcycle Loan Market Growth

Several key factors are propelling the growth of the Motorcycle Loan Market. Technologically, the widespread adoption of digital lending platforms and mobile banking applications has significantly streamlined the loan application and approval process, making it faster and more accessible. Economically, rising disposable incomes in emerging markets and the increasing affordability of motorcycles as a mode of personal transportation are creating substantial demand. Furthermore, favorable government initiatives aimed at promoting small and medium-sized enterprises (SMEs) and supporting individual entrepreneurship, which often relies on motorcycles for delivery and service operations, are also contributing to market expansion. The increasing urbanization globally also drives demand for efficient and cost-effective transportation solutions.

Obstacles in the Motorcycle Loan Market Market

Despite robust growth, the Motorcycle Loan Market faces several obstacles. Regulatory challenges, including stringent lending norms, capital adequacy requirements, and varying interest rate caps across different jurisdictions, can hinder operational efficiency and market expansion. Supply chain disruptions, as witnessed in recent years, can impact vehicle availability, indirectly affecting loan demand and disbursement. Competitive pressures from a growing number of lenders, including traditional banks, NBFCs, and emerging fintech players, can lead to margin compression and increased marketing costs. Moreover, economic downturns and rising inflation can impact consumer purchasing power and increase the risk of loan defaults, posing a significant challenge for lenders.

Future Opportunities in Motorcycle Loan Market

The Motorcycle Loan Market presents numerous future opportunities. The burgeoning electric motorcycle segment offers a nascent but rapidly growing avenue for specialized financing. Expanding into underserved rural and semi-urban markets with tailored loan products can tap into a vast, untapped customer base. The increasing digitalization of financial services opens avenues for leveraging AI and blockchain for more efficient credit scoring and fraud detection. Furthermore, strategic partnerships between OEMs, dealerships, and financial institutions can create integrated ecosystems, offering bundled financing and service packages that enhance customer loyalty and market reach. The growing demand for pre-owned motorcycles also presents an opportunity for developing robust and accessible financing solutions for this segment.

Major Players in the Motorcycle Loan Market Ecosystem

- Daimler Financial Services

- Capital One Financial Corporation

- JPMorgan Chase & Co

- General Motors Financial Company Inc

- Ally Financial Inc

- Bank of American Corporation

- Ford Motor Credit Company

- GM Financial Inc

- Mitsubishi HC Capital UK PLC

- Toyota Financial Services

Key Developments in Motorcycle Loan Market Industry

- June 2023: Mitsubishi UFJ Financial Group acquired listed Indonesian motorcycle loan company Mandala Multifinance for 7 trillion IDT (USD 465 Million). The Japanese financial giant will hold 70.6% through its subsidiary MUFG Bank and 10% through Adira Dinamika Multi Finance, a subsidiary of Bank Danamon. MUFG will conduct a mandatory tender offer for the remaining 19.4% stake of Mandala Multifinance after the completion of the acquisition, which is expected by early next year. The purchase is subject to regulatory approvals. This acquisition signals significant consolidation and expansion into emerging markets.

- May 2023: Suzuki Motorcycle India inked a pact with Bajaj Finance, the lending arm of Bajaj Finserv, to finance the former's two-wheelers. As part of this agreement, customers will get easy access to retail financing options on the purchase of Suzuki two-wheelers. This partnership exemplifies strategic alliances to enhance retail financing accessibility and boost sales.

Strategic Motorcycle Loan Market Market Forecast

The Motorcycle Loan Market is poised for sustained growth, driven by ongoing technological integration, expanding access to credit in emerging economies, and a consistent demand for affordable personal transportation. Strategic forecasting indicates that the market will benefit significantly from the increasing adoption of digital lending solutions, which enhance efficiency and customer experience. The growing preference for electric motorcycles will open new avenues for specialized financing products. Furthermore, strategic alliances between financial institutions and vehicle manufacturers, coupled with potential expansions into underdeveloped regions, will be crucial growth catalysts. The market's ability to adapt to evolving consumer needs and regulatory landscapes will be paramount in realizing its substantial future potential.

Motorcycle Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Two-Wheeler

- 1.2. Passenger Car

- 1.3. Commercial Vehicle

-

2. Provider Type

- 2.1. Banks

- 2.2. NBFCs (Non-Banking Financial Services)

- 2.3. OEM (Original Equipment Manufacturer)

- 2.4. Other Provider Types (Fintech Companies)

-

3. Percentage of Amount Sanctioned

- 3.1. Less than 25%

- 3.2. 25-50%

- 3.3. 51-75%

- 3.4. More than 75%

-

4. Tenure

- 4.1. Less than 3 Years

- 4.2. 3-5 Years

- 4.3. More than 5 Years

Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Vietnam

- 3.5. Austrilia

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Motorcycle Loan Market Regional Market Share

Geographic Coverage of Motorcycle Loan Market

Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Motorcycles will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-Wheeler

- 5.1.2. Passenger Car

- 5.1.3. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. NBFCs (Non-Banking Financial Services)

- 5.2.3. OEM (Original Equipment Manufacturer)

- 5.2.4. Other Provider Types (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.3.1. Less than 25%

- 5.3.2. 25-50%

- 5.3.3. 51-75%

- 5.3.4. More than 75%

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than 3 Years

- 5.4.2. 3-5 Years

- 5.4.3. More than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Two-Wheeler

- 6.1.2. Passenger Car

- 6.1.3. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Banks

- 6.2.2. NBFCs (Non-Banking Financial Services)

- 6.2.3. OEM (Original Equipment Manufacturer)

- 6.2.4. Other Provider Types (Fintech Companies)

- 6.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 6.3.1. Less than 25%

- 6.3.2. 25-50%

- 6.3.3. 51-75%

- 6.3.4. More than 75%

- 6.4. Market Analysis, Insights and Forecast - by Tenure

- 6.4.1. Less than 3 Years

- 6.4.2. 3-5 Years

- 6.4.3. More than 5 Years

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Two-Wheeler

- 7.1.2. Passenger Car

- 7.1.3. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Banks

- 7.2.2. NBFCs (Non-Banking Financial Services)

- 7.2.3. OEM (Original Equipment Manufacturer)

- 7.2.4. Other Provider Types (Fintech Companies)

- 7.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 7.3.1. Less than 25%

- 7.3.2. 25-50%

- 7.3.3. 51-75%

- 7.3.4. More than 75%

- 7.4. Market Analysis, Insights and Forecast - by Tenure

- 7.4.1. Less than 3 Years

- 7.4.2. 3-5 Years

- 7.4.3. More than 5 Years

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Two-Wheeler

- 8.1.2. Passenger Car

- 8.1.3. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Banks

- 8.2.2. NBFCs (Non-Banking Financial Services)

- 8.2.3. OEM (Original Equipment Manufacturer)

- 8.2.4. Other Provider Types (Fintech Companies)

- 8.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 8.3.1. Less than 25%

- 8.3.2. 25-50%

- 8.3.3. 51-75%

- 8.3.4. More than 75%

- 8.4. Market Analysis, Insights and Forecast - by Tenure

- 8.4.1. Less than 3 Years

- 8.4.2. 3-5 Years

- 8.4.3. More than 5 Years

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East and Africa Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Two-Wheeler

- 9.1.2. Passenger Car

- 9.1.3. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Banks

- 9.2.2. NBFCs (Non-Banking Financial Services)

- 9.2.3. OEM (Original Equipment Manufacturer)

- 9.2.4. Other Provider Types (Fintech Companies)

- 9.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 9.3.1. Less than 25%

- 9.3.2. 25-50%

- 9.3.3. 51-75%

- 9.3.4. More than 75%

- 9.4. Market Analysis, Insights and Forecast - by Tenure

- 9.4.1. Less than 3 Years

- 9.4.2. 3-5 Years

- 9.4.3. More than 5 Years

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. South America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Two-Wheeler

- 10.1.2. Passenger Car

- 10.1.3. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Banks

- 10.2.2. NBFCs (Non-Banking Financial Services)

- 10.2.3. OEM (Original Equipment Manufacturer)

- 10.2.4. Other Provider Types (Fintech Companies)

- 10.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 10.3.1. Less than 25%

- 10.3.2. 25-50%

- 10.3.3. 51-75%

- 10.3.4. More than 75%

- 10.4. Market Analysis, Insights and Forecast - by Tenure

- 10.4.1. Less than 3 Years

- 10.4.2. 3-5 Years

- 10.4.3. More than 5 Years

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daimler Financial Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Capital One Financial Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JPMorgan Chase & Co **List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Motors Financial Company Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ally Financial Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of American Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ford Motor Credit Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GM Financial Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi HC Capital UK PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyota Financial Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Daimler Financial Services

List of Figures

- Figure 1: Global Motorcycle Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 5: North America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: North America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 7: North America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 8: North America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 9: North America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 10: North America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 15: Europe Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 16: Europe Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 17: Europe Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 18: Europe Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 19: Europe Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 20: Europe Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 25: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 26: Asia Pacific Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 27: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 28: Asia Pacific Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 29: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 30: Asia Pacific Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 35: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 36: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 37: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 38: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 39: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 40: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: South America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: South America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 45: South America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 46: South America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 47: South America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 48: South America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 49: South America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 50: South America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 51: South America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 3: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 4: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 5: Global Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 8: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 9: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 10: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: USA Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 17: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: UK Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 27: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 28: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 29: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: India Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Austrilia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 38: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 39: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 40: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Egypt Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: UAE Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 47: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 48: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 49: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Argentina Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Colombia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorcycle Loan Market?

The projected CAGR is approximately 6.61%.

2. Which companies are prominent players in the Motorcycle Loan Market?

Key companies in the market include Daimler Financial Services, Capital One Financial Corporation, JPMorgan Chase & Co **List Not Exhaustive, General Motors Financial Company Inc, Ally Financial Inc, Bank of American Corporation, Ford Motor Credit Company, GM Financial Inc, Mitsubishi HC Capital UK PLC, Toyota Financial Services.

3. What are the main segments of the Motorcycle Loan Market?

The market segments include Vehicle Type, Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 145.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Increasing Sales of Motorcycles will Drive the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Mitsubishi UFJ Financial Group acquired listed Indonesian motorcycle loan company Mandala Multifinance for 7 trillion IDT ( USD 465 million). The Japanese financial giant will hold 70.6% through its subsidiary MUFG Bank and 10% through Adira Dinamika Multi Finance, a subsidiary of Bank Danamon. MUFG will conduct a mandatory tender offer for the remaining 19.4% stake of Mandala Multifinance after the completion of the acquisition, which is expected by early next year. The purchase is subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence