Key Insights

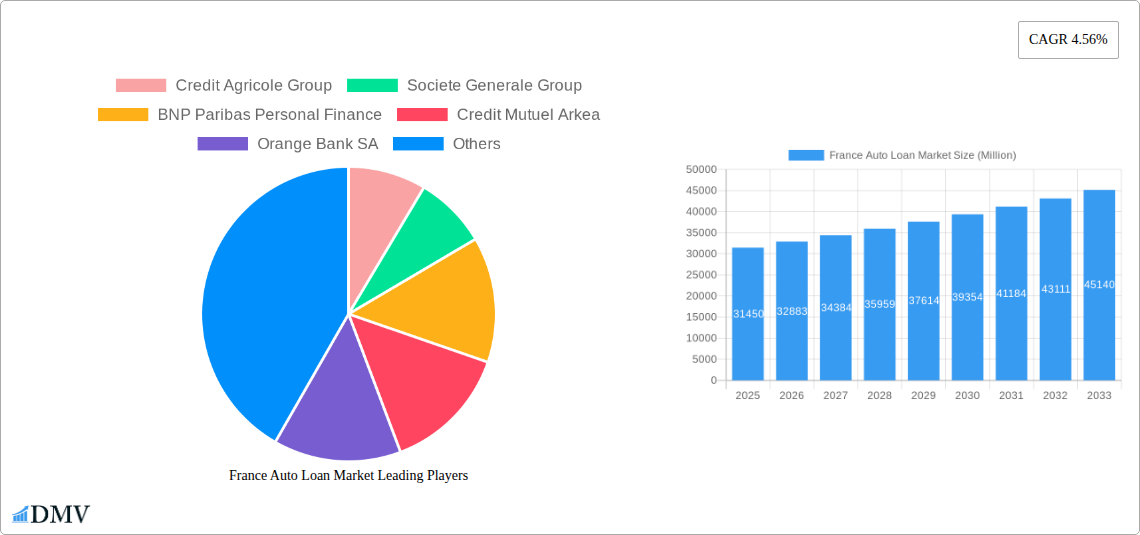

The French auto loan market is poised for robust expansion, projected to reach a significant valuation by 2033. With a Compound Annual Growth Rate (CAGR) of 4.56%, the market demonstrates a steady upward trajectory, fueled by a confluence of dynamic drivers and evolving consumer behaviors. The sheer volume of passenger vehicles and the ongoing demand within the commercial vehicle segment are foundational pillars supporting this growth. Furthermore, the market benefits from a healthy appetite for both new and used vehicles, indicating a diversified demand across different price points and consumer preferences. The increasing accessibility of financing through a variety of providers, including traditional banks, Non-Banking Financial Companies (NBFCs), credit unions, and the burgeoning fintech sector, plays a crucial role in simplifying the car acquisition process for a wider demographic. This multi-faceted financing ecosystem caters to diverse needs, enhancing market liquidity and consumer confidence.

France Auto Loan Market Market Size (In Billion)

The loan tenure structure also reflects an adaptable market, with offerings spanning short-term (<3 years), medium-term (3-5 years), and longer-term (>5 years) options, accommodating a broad spectrum of financial capabilities and vehicle purchase intentions. While the market enjoys strong growth momentum, potential restraints such as fluctuating interest rates, stricter regulatory environments for lending, and economic uncertainties could present challenges. However, these are likely to be mitigated by ongoing innovation in financing products and a persistent demand for personal and commercial mobility solutions. The market's evolution will also be shaped by emerging trends, including the rise of electric vehicle (EV) financing, digitalized loan application processes, and tailored loan packages for specific vehicle types or ownership models, all contributing to a dynamic and evolving landscape within the French automotive finance sector.

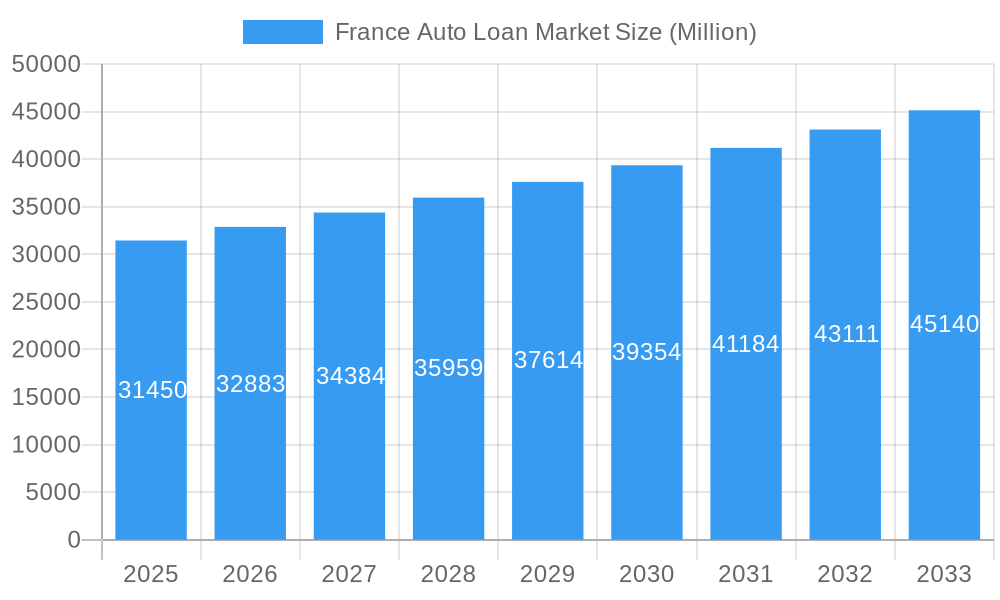

France Auto Loan Market Company Market Share

France Auto Loan Market: Comprehensive Analysis and Forecast 2019-2033

This in-depth report offers a definitive analysis of the France Auto Loan Market, a crucial sector within the French automotive finance landscape. Covering the historical period of 2019-2024 and extending to a strategic forecast period of 2025-2033, with the base year and estimated year as 2025, this study provides actionable insights for stakeholders. We delve into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, key players, and significant developments. This report is essential for banks, NBFCs, credit unions, fintech companies, automotive manufacturers, and investors seeking to understand and capitalize on the dynamic French auto financing market.

France Auto Loan Market Market Composition & Trends

The France Auto Loan Market exhibits a moderate to high concentration, with established financial institutions dominating market share. Key innovation catalysts include the increasing adoption of digital lending platforms and the growing demand for flexible financing solutions. Regulatory landscapes, while evolving, generally support market growth with frameworks aimed at consumer protection and financial stability. Substitute products, such as leasing and personal loans, present competition, yet auto loans remain the preferred choice for outright vehicle ownership. End-user profiles are diverse, ranging from first-time car buyers to fleet managers, all seeking accessible and competitive financing. Mergers and acquisitions (M&A) activity, while not rampant, has seen strategic consolidations to enhance market reach and service offerings. For example, the June 2023 development involving BNP Paribas Personal Finance and Orange Bank signifies a shift towards consolidation and specialization within the market. Market share distribution is influenced by brand loyalty, interest rate competitiveness, and the breadth of loan products offered.

- Market Share Distribution: Dominated by major banking groups, with a growing presence of specialized NBFCs and fintech players.

- M&A Deal Values: Transactions are often strategic, focusing on acquiring customer bases or technological capabilities rather than outright market dominance. Specific deal values are subject to private negotiation, but typically range in the tens to hundreds of millions of Euros for significant acquisitions.

France Auto Loan Market Industry Evolution

The France Auto Loan Market has undergone significant evolution, driven by technological advancements, shifting consumer preferences, and a dynamic economic environment. Over the study period of 2019–2033, the market has witnessed a steady upward trajectory in loan volumes, albeit with fluctuations influenced by economic cycles and the COVID-19 pandemic. The base year of 2025 marks a critical juncture where market recovery and sustained growth are anticipated. Technological advancements, particularly the rise of digital auto loans, have revolutionized the application and approval process, leading to increased efficiency and customer convenience. Online loan applications have become commonplace, with many lenders offering instant loan approvals and paperless documentation. This digital transformation has also fueled the growth of fintech companies entering the auto loan space, often with more agile and customer-centric approaches. Consumer demand has also evolved, with a growing preference for flexible auto financing options, including shorter loan tenures and the possibility of early repayment without hefty penalties. The increasing popularity of electric vehicles (EVs) and hybrid vehicles is also influencing the market, with lenders potentially offering specialized financing for these greener alternatives, potentially impacting future growth rates and adoption metrics of these new vehicle types. The forecast period of 2025–2033 is expected to see continued innovation in loan products, a further penetration of digital channels, and a greater emphasis on personalized financing solutions.

Leading Regions, Countries, or Segments in France Auto Loan Market

The France Auto Loan Market is characterized by strong performance across several key segments, driven by distinct factors. Within Vehicle Type, Passenger Vehicles represent the dominant segment, fueled by consistent consumer demand for personal transportation. Commercial Vehicles, while smaller, show steady growth driven by business needs and the expansion of delivery services. In terms of Ownership, both New Vehicles and Used Vehicles segments are robust. The New Vehicle segment benefits from manufacturers' financing offers and evolving model releases, while the Used Vehicle segment caters to budget-conscious buyers seeking value.

The Provider Type landscape is primarily dominated by Banks, which leverage their established customer bases and extensive branch networks. NBFCs and Credit Unions play a vital role in offering niche products and serving specific customer segments. The emergence of Other Provider Types, notably Fintech Companies, is a significant trend, bringing innovation in digital platforms and faster processing times.

Analyzing Tenure, the 3-5 Years segment is a significant driver, offering a balance between manageable monthly payments and reasonable vehicle ownership periods. The Less Than Three Years segment is popular for those seeking shorter-term commitments or upgrading vehicles frequently, while the More Than 5 Years segment appeals to buyers prioritizing lower monthly outlays.

- Passenger Vehicles: Consistent demand from individuals and families for personal mobility, supported by attractive manufacturer financing deals.

- New Vehicles: Driven by technological advancements in automotive, manufacturer incentives, and consumer desire for the latest models.

- Banks: Dominant provider type due to trust, wide product range, and established customer relationships.

- 3-5 Years Tenure: Offers a balanced repayment structure, appealing to a broad segment of the car-buying population.

- Regulatory Support: Government initiatives promoting vehicle ownership and stable economic conditions contribute to consistent demand across segments.

- Investment Trends: Financial institutions continue to invest in digital infrastructure and customer service to enhance their competitive edge in these key segments.

France Auto Loan Market Product Innovations

Product innovations in the France Auto Loan Market are increasingly focused on enhancing customer experience and flexibility. Lenders are introducing digital auto loan platforms that streamline the application and approval process, offering instant loan decisions and paperless transactions. Unique selling propositions include personalized loan offers based on individual credit profiles, competitive interest rates, and flexible repayment schedules. Technological advancements are enabling more sophisticated risk assessment, allowing for greater inclusivity in lending. Furthermore, some institutions are exploring green auto loan products with preferential rates for electric and hybrid vehicles, aligning with sustainability trends and government incentives.

Propelling Factors for France Auto Loan Market Growth

The France Auto Loan Market is propelled by several key factors. Economic stability and a growing disposable income among French consumers are fundamental drivers of vehicle purchasing power. Technological advancements, particularly the digitalization of the lending process, are making auto loans more accessible and convenient. Government incentives aimed at stimulating the automotive industry and promoting the adoption of cleaner vehicles also play a significant role. Furthermore, the availability of competitive interest rates from a diverse range of financial institutions, including traditional banks, NBFCs, and emerging fintech players, fosters market growth.

- Economic Growth & Consumer Confidence: A healthy French economy translates to increased consumer spending on major purchases like vehicles.

- Digitalization of Lending: Online application portals, AI-driven credit scoring, and e-signature capabilities reduce friction and accelerate loan disbursement.

- Government Initiatives: Tax incentives for new vehicle purchases, particularly EVs, indirectly boost demand for auto financing.

- Competitive Interest Rates: A saturated market with numerous providers ensures competitive pricing, attracting more borrowers.

Obstacles in the France Auto Loan Market Market

Despite its growth, the France Auto Loan Market faces several obstacles. Stringent regulatory requirements related to lending practices and consumer protection can increase operational costs and complexity for financial institutions. Economic downturns and rising inflation can lead to decreased consumer confidence and reduced demand for new vehicles and financing. Supply chain disruptions in the automotive industry can impact vehicle availability, consequently affecting the demand for auto loans. Furthermore, intense competitive pressures from a multitude of providers can lead to tighter profit margins.

- Regulatory Compliance: Adhering to evolving financial regulations demands significant investment in compliance infrastructure.

- Economic Volatility: Recessions or periods of high inflation can dampen consumer appetite for long-term financial commitments like auto loans.

- Automotive Supply Chain Issues: Limited vehicle availability due to chip shortages or production halts can directly reduce loan origination.

- Intense Competition: Price wars and aggressive marketing by numerous lenders can squeeze profit margins.

Future Opportunities in France Auto Loan Market

The France Auto Loan Market presents numerous future opportunities. The burgeoning electric vehicle (EV) market offers a significant avenue for growth, with potential for specialized loan products and attractive financing packages to encourage adoption. The increasing reliance on digital channels opens doors for fintech companies and established players to innovate in online customer acquisition and loan servicing. A growing demand for flexible and personalized financing solutions creates opportunities for tailored loan products that cater to diverse consumer needs. Furthermore, the used car market continues to offer a substantial segment for auto financing, particularly for budget-conscious buyers.

- Electric Vehicle Financing: Tailored loan products and incentives for EVs represent a rapidly expanding niche.

- Digital Transformation: Continued investment in user-friendly online platforms and mobile applications will be crucial for customer acquisition.

- Personalized Loan Products: Leveraging data analytics to offer customized loan terms and repayment structures.

- Used Vehicle Market Expansion: Capitalizing on the persistent demand for affordable pre-owned vehicles.

Major Players in the France Auto Loan Market Ecosystem

- Credit Agricole Group

- Societe Generale Group

- BNP Paribas Personal Finance

- Credit Mutuel Arkea

- Orange Bank SA

- Carrefour Banque SA

- Toyota France Management

- Capitole Finance - Tofinso

- Cofidis SA

- AXA Banque

Key Developments in France Auto Loan Market Industry

- June 2023: BNP Paribas Personal Finance entered into exclusive talks with Orange SA to take on its Orange Bank clients, letting the French mobile phone carrier walk away from the business. The partnership is part of Orange’s plan to progressively withdraw Orange Bank from the retail banking market in France and Spain. This development signals consolidation within the market and a strategic shift for both entities, potentially impacting market share and customer acquisition strategies.

- September 2022: Cofidis France launched a new solidarity scheme to support 40 associations in its territory, 'Missions Booster.' The company offered each of its 1,500 employees 3 days of volunteer work to help associations in their area, i.e., 4,500 days offered to the non-profit sector. This initiative highlights the growing importance of Corporate Social Responsibility (CSR) within the financial sector, potentially enhancing brand reputation and employee engagement, which can indirectly influence customer loyalty.

Strategic France Auto Loan Market Market Forecast

The France Auto Loan Market is poised for robust growth, driven by a confluence of favorable economic conditions, technological innovation, and evolving consumer preferences. The forecast period of 2025–2033 is expected to witness a significant expansion in loan volumes, fueled by increasing demand for both new and used vehicles. The continued digitalization of the lending process, coupled with the rise of agile fintech players, will enhance accessibility and convenience. Emerging opportunities in electric vehicle financing and personalized loan products will further propel market expansion. Strategic investments in digital infrastructure and customer-centric offerings will be crucial for market participants to capitalize on the projected growth and secure a competitive advantage in this dynamic financial landscape.

France Auto Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. NBFCs (Non Banking Financials Companies)

- 3.3. Credit Unions

- 3.4. Other Provider Types (Fintech Companies)

-

4. Tenure

- 4.1. Less than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

France Auto Loan Market Segmentation By Geography

- 1. France

France Auto Loan Market Regional Market Share

Geographic Coverage of France Auto Loan Market

France Auto Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Quick Processing of Loan through Digital Banking

- 3.3. Market Restrains

- 3.3.1. Quick Processing of Loan through Digital Banking

- 3.4. Market Trends

- 3.4.1. Increasing Number of Registered Passenger Cars in France

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Auto Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. NBFCs (Non Banking Financials Companies)

- 5.3.3. Credit Unions

- 5.3.4. Other Provider Types (Fintech Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. France

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Credit Agricole Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Societe Generale Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BNP Paribas Personal Finance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Credit Mutuel Arkea

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Orange Bank SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carrefour Banque SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toyota France Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Capitole Finance - Tofinso

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cofidis SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AXA Banque**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Credit Agricole Group

List of Figures

- Figure 1: France Auto Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Auto Loan Market Share (%) by Company 2025

List of Tables

- Table 1: France Auto Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: France Auto Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: France Auto Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: France Auto Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 5: France Auto Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: France Auto Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 7: France Auto Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: France Auto Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: France Auto Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: France Auto Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: France Auto Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: France Auto Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: France Auto Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 14: France Auto Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 15: France Auto Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: France Auto Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 17: France Auto Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: France Auto Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 19: France Auto Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: France Auto Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Auto Loan Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the France Auto Loan Market?

Key companies in the market include Credit Agricole Group, Societe Generale Group, BNP Paribas Personal Finance, Credit Mutuel Arkea, Orange Bank SA, Carrefour Banque SA, Toyota France Management, Capitole Finance - Tofinso, Cofidis SA, AXA Banque**List Not Exhaustive.

3. What are the main segments of the France Auto Loan Market?

The market segments include Vehicle Type, Ownership, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Quick Processing of Loan through Digital Banking.

6. What are the notable trends driving market growth?

Increasing Number of Registered Passenger Cars in France.

7. Are there any restraints impacting market growth?

Quick Processing of Loan through Digital Banking.

8. Can you provide examples of recent developments in the market?

June 2023: BNP Paribas Personal Finance entered into exclusive talks with Orange SA to take on its Orange Bank clients, letting the French mobile phone carrier walk away from the business. The partnership is part of Orange’s plan to progressively withdraw Orange Bank from the retail banking market in France and Spain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Auto Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Auto Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Auto Loan Market?

To stay informed about further developments, trends, and reports in the France Auto Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence