Key Insights

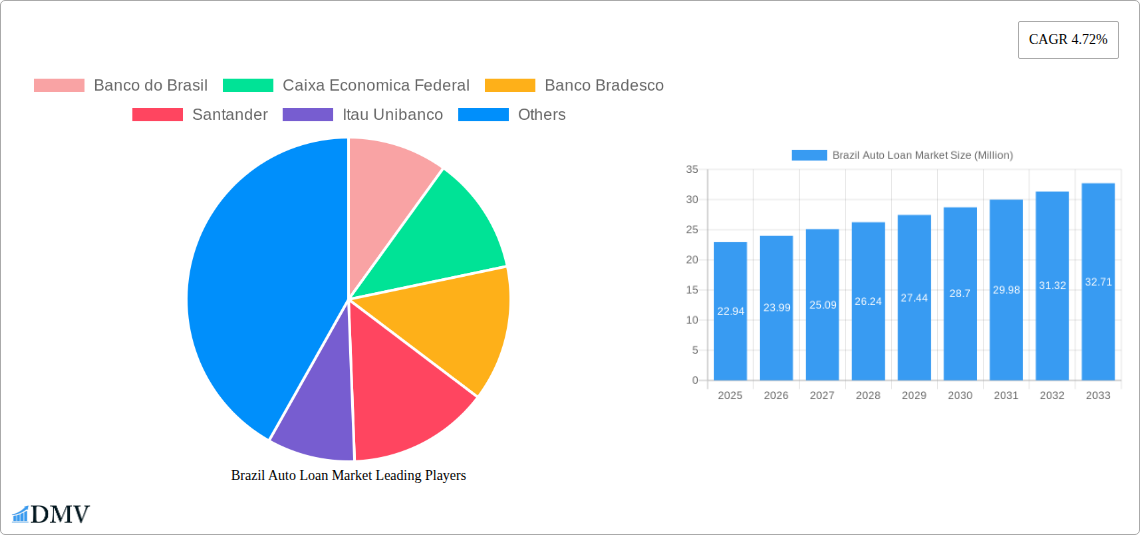

The Brazil Auto Loan Market is projected to reach a substantial valuation of USD 22.94 million, demonstrating robust growth driven by an anticipated Compound Annual Growth Rate (CAGR) of 4.72% over the forecast period of 2025-2033. This expansion is underpinned by a confluence of supportive economic factors and evolving consumer preferences within the automotive sector. Key drivers likely include increasing disposable incomes, government initiatives aimed at stimulating vehicle sales, and a growing demand for personal mobility, particularly within the passenger vehicle segment. Furthermore, the expanding presence of both traditional banking institutions and agile Non-Banking Financial Companies (NBFCs) and Fintech firms is enhancing accessibility to auto financing, broadening the market's reach across various consumer demographics. The market's dynamism is further reflected in the diverse ownership segments, encompassing both new and used vehicles, catering to a wider spectrum of affordability and choice for Brazilian consumers.

Brazil Auto Loan Market Market Size (In Million)

The market's trajectory will be shaped by evolving consumer needs and the financial landscape. While the passenger vehicle segment is expected to remain a dominant force, the commercial vehicle segment is also poised for growth, driven by logistics and transportation demands. Innovations in lending practices, including digital platforms and tailored loan products, are set to boost adoption rates across all tenure options, from shorter-term loans to longer commitments exceeding five years. Despite significant growth potential, the market may encounter certain restraints such as fluctuating interest rates, economic uncertainties, and evolving regulatory frameworks. However, the strong presence of established players like Banco do Brasil, Caixa Econômica Federal, Santander, and the emergence of digital-first providers like Nubank underscore a competitive yet expanding environment. The Brazil auto loan market is characterized by its resilience and capacity to adapt to economic shifts, ensuring sustained progress throughout the study period.

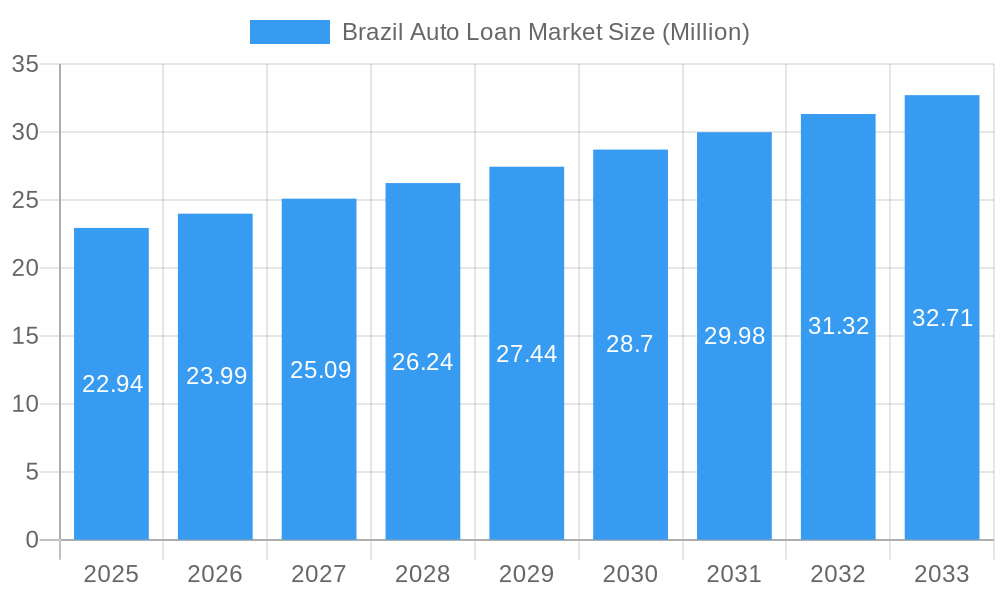

Brazil Auto Loan Market Company Market Share

This in-depth report offers a strategic overview of the dynamic Brazil Auto Loan Market, providing actionable insights for stakeholders navigating this rapidly evolving sector. Covering the study period of 2019 to 2033, with 2025 as the base and estimated year, and a forecast period from 2025 to 2033, this analysis delves into historical trends, current market dynamics, and future projections. We meticulously examine key market segments, industry developments, and the competitive landscape, equipping businesses with the intelligence needed for informed decision-making and strategic planning.

Brazil Auto Loan Market Market Composition & Trends

The Brazil Auto Loan Market exhibits a moderate to high level of concentration, with established financial institutions like Banco do Brasil, Caixa Economica Federal, Banco Bradesco, Santander, and Itau Unibanco holding significant market share. However, the emergence of innovative Fintech Companies and the growing influence of NBFCs (Non Banking Financials Companies) are introducing competitive pressures and driving innovation catalysts. The regulatory landscape, overseen by entities such as the Central Bank of Brazil, influences lending practices, interest rates, and consumer protection measures. Substitute products, including car-sharing services and public transportation, offer alternatives, but the aspirational ownership of vehicles continues to drive demand. End-user profiles vary from individual consumers seeking personal mobility to businesses requiring Commercial Vehicle financing. Mergers & Acquisitions (M&A) activities are observed, though not as pervasive as in more mature markets, reflecting strategic consolidation and expansion efforts. For instance, the JPMorgan Chase & Co. acquisition of a larger stake in C6 Bank underscores the increasing integration of digital banking with auto finance. Market share distribution is influenced by factors such as loan tenor, vehicle type, and provider type, with banks generally leading in volume. Estimated M&A deal values are still developing, but strategic partnerships are on the rise.

- Market Concentration: Moderate to High, with key players dominating but increasing competition from digital entities.

- Innovation Catalysts: Fintech disruptors, digital lending platforms, and enhanced customer experience demands.

- Regulatory Landscape: Central Bank of Brazil's oversight, influencing interest rates, credit scoring, and transparency.

- Substitute Products: Car-sharing, ride-hailing services, and robust public transport networks.

- End-User Profiles: Individual consumers (personal mobility), small & medium enterprises (fleet expansion), large corporations (commercial vehicle financing).

- M&A Activities: Strategic acquisitions and partnerships to expand digital offerings and market reach.

Brazil Auto Loan Market Industry Evolution

The Brazil Auto Loan Market has witnessed a transformative evolution throughout the historical period of 2019-2024 and is projected for significant growth during the forecast period of 2025-2033. This evolution is characterized by shifting consumer demands towards more accessible and digitalized financing solutions, coupled with technological advancements that have streamlined the loan application and approval processes. The market has moved from predominantly branch-based transactions to a hybrid model incorporating online portals and mobile applications. Growth trajectories have been influenced by economic cycles, interest rate fluctuations, and government policies aimed at stimulating the automotive sector. For example, in August 2023, JPMorgan Chase & Co. increased its ownership in C6 Bank, signaling confidence in the Brazilian digital banking landscape and its potential to offer comprehensive digital auto finance solutions, including credit evaluation, credit review, and payment solutions. This strategic move highlights the increasing importance of integrated digital ecosystems for auto lending.

Technological advancements, such as the implementation of AI for credit scoring and blockchain for secure transaction processing, are further shaping the industry. Adoption metrics for digital auto loan platforms have seen a substantial increase, with a growing percentage of consumers preferring online channels for their financing needs. The Passenger Vehicle segment, particularly for New Vehicles, has historically driven significant loan volumes, but the Used Vehicles market is also gaining traction due to affordability. The rise of NBFCs and Fintech Companies has introduced innovative financing products and flexible Tenures (Less than Three Years, 3-5 Years, More Than 5 Years), catering to a broader spectrum of borrower profiles and financial capabilities. The market's growth rate is expected to be robust, driven by an expanding middle class, urbanization, and the ongoing need for personal and commercial transportation. The October 2023 development where BYD partnered with Santander Brazil for new energy vehicle financing is a clear indicator of the industry's alignment with global trends towards sustainable mobility and the financing of electric and hybrid vehicles. This strategic cooperation is expected to boost the adoption of eco-friendly transportation and create new avenues for auto loan providers. The overall trajectory points towards a more digital, customer-centric, and diversified auto loan market in Brazil.

Leading Regions, Countries, or Segments in Brazil Auto Loan Market

The Brazil Auto Loan Market exhibits distinct leadership across various segments, driven by demographic, economic, and infrastructural factors. The São Paulo metropolitan area consistently emerges as the leading region due to its high population density, substantial economic activity, and a higher concentration of disposable income, directly translating into greater demand for both Passenger Vehicles and Commercial Vehicles. Within the Vehicle Type segment, Passenger Vehicles dominate the market share in terms of loan volume. This is primarily driven by individual consumer demand for personal mobility and the aspirational aspect of vehicle ownership in Brazil. However, the Commercial Vehicle segment, encompassing trucks, vans, and buses, is crucial for supporting the nation's extensive logistics and transportation networks and shows steady growth, particularly with the expansion of e-commerce.

In terms of Ownership, New Vehicles traditionally attract a larger proportion of auto loans due to higher financing options and manufacturers' incentives. Nevertheless, the Used Vehicles segment is experiencing a notable upswing. This is a direct consequence of economic pressures and the increasing affordability of pre-owned vehicles, making them an attractive option for a wider demographic. This segment is characterized by different risk profiles and often shorter loan tenures, presenting unique opportunities and challenges for lenders.

When examining Provider Type, Banks continue to hold a dominant position, leveraging their established customer base, trust, and extensive branch networks. However, NBFCs (Non Banking Financials Companies) are rapidly gaining ground by offering more flexible lending criteria and specialized products, particularly in the used car market. Fintech Companies are also becoming increasingly influential, driving innovation in digital lending platforms, offering streamlined application processes, and catering to a younger, tech-savvy demographic. Credit Unions play a role in specific communities, offering localized services.

The Tenure segment reveals a preference for 3-5 Years loans, striking a balance between manageable monthly payments and the overall cost of financing. Loans with Less Than Three Years tenure are popular for newer vehicles or for consumers seeking quicker ownership, while More Than 5 Years options cater to individuals or businesses requiring lower monthly outlays. The BYD-Santander strategic cooperation highlights the growing importance of financing for electric and new energy vehicles, a segment poised for significant expansion.

- Dominant Region: São Paulo metropolitan area, driven by population density, economic activity, and consumer spending power.

- Leading Vehicle Type: Passenger Vehicles, fueled by individual ownership aspirations and daily transportation needs.

- Growth Segment - Vehicle Type: Commercial Vehicles, vital for logistics and supporting business operations.

- Dominant Ownership: New Vehicles, benefiting from manufacturer incentives and wider financing availability.

- Growing Ownership Segment: Used Vehicles, driven by affordability and economic considerations.

- Leading Provider Type: Banks, due to established infrastructure and trust.

- Emerging Provider Type: NBFCs and Fintech Companies, offering flexibility and digital solutions.

- Preferred Tenure: 3-5 Years, balancing affordability and repayment speed.

- Key Driver - Investment Trends: Increased investment in digital infrastructure by banks and fintechs to enhance customer experience and streamline processes.

- Key Driver - Regulatory Support: Evolving regulations that balance consumer protection with fostering market competition and innovation.

Brazil Auto Loan Market Product Innovations

The Brazil Auto Loan Market is witnessing a surge in product innovations driven by technological advancements and evolving consumer expectations. Lenders are increasingly offering digital-first loan origination platforms, enabling seamless online applications, instant credit assessments, and faster disbursement of funds. Personalized loan offerings, tailored to individual credit profiles and vehicle preferences, are becoming more prevalent. Innovations in credit scoring models, incorporating alternative data sources beyond traditional financial history, are expanding access to credit for underbanked populations. Partnerships between automakers and financial institutions, like the BYD-Santander agreement, are leading to bundled financing packages and exclusive deals for electric and new energy vehicles. Performance metrics for these innovations include reduced turnaround times for loan approvals, increased customer satisfaction scores, and improved loan portfolio performance through better risk assessment. Unique selling propositions revolve around convenience, speed, transparency, and competitive interest rates.

Propelling Factors for Brazil Auto Loan Market Growth

Several key factors are propelling the Brazil Auto Loan Market forward. Economically, a projected uptick in GDP and a stable inflation rate are expected to boost consumer confidence and purchasing power, leading to increased demand for vehicles and, consequently, auto loans. Technologically, the widespread adoption of digital platforms and AI-powered credit assessment tools are making the loan application process more efficient and accessible. Regulatory frameworks that promote financial inclusion and transparency, alongside potential government incentives for vehicle purchases, also play a crucial role. The growing middle class and urbanization in Brazil continue to fuel the desire for personal mobility, a fundamental driver for the auto loan sector.

- Economic Recovery & Growth: Positive GDP forecasts and stable inflation enhancing consumer purchasing power.

- Technological Advancements: Digital lending platforms, AI for credit scoring, and mobile banking increasing accessibility and efficiency.

- Favorable Regulatory Environment: Policies encouraging financial inclusion and transparency in lending practices.

- Urbanization & Middle Class Expansion: Growing demand for personal transportation solutions.

- Government Incentives: Potential policies to stimulate new vehicle sales and automotive industry growth.

Obstacles in the Brazil Auto Loan Market Market

Despite robust growth prospects, the Brazil Auto Loan Market faces several obstacles. High interest rates, a persistent challenge in the Brazilian economy, can make loan repayments prohibitively expensive for some consumers, thereby dampening demand. Regulatory complexities and evolving compliance requirements can pose challenges for financial institutions, especially smaller players. Supply chain disruptions impacting vehicle availability and pricing can indirectly affect the auto loan market by limiting the supply of vehicles that can be financed. Furthermore, intense competition among banks, NBFCs, and fintech companies can lead to tighter margins and increased marketing expenditure. Economic volatility and unemployment fluctuations can also lead to higher default rates, posing a risk to lenders.

- High Interest Rates: Increasing the cost of borrowing and potentially reducing loan uptake.

- Regulatory Hurdles: Complex compliance requirements and evolving legal frameworks.

- Vehicle Supply Chain Disruptions: Affecting vehicle availability and price, impacting financing demand.

- Economic Volatility: Fluctuations in GDP and employment rates impacting borrower repayment capacity.

- Intense Competition: Leading to margin compression and increased operational costs.

Future Opportunities in Brazil Auto Loan Market

The Brazil Auto Loan Market is ripe with future opportunities. The rapidly expanding new energy vehicle (NEV) segment presents a significant avenue for growth, especially with the strategic collaborations between automotive giants like BYD and financial institutions like Santander. The increasing adoption of digital financial services by younger demographics opens up opportunities for fintech companies to capture market share through innovative, user-friendly platforms. Furthermore, the untapped potential in less developed regions of Brazil offers an opportunity for market expansion. The growing demand for used vehicles, driven by economic factors, will continue to be a lucrative segment for lenders willing to adapt their risk assessment models.

- New Energy Vehicle Financing: Growing demand for electric and hybrid vehicles creates a new financing frontier.

- Digital Lending Expansion: Capturing a tech-savvy younger demographic through innovative online platforms.

- Geographic Expansion: Tapping into underserved regions with growing urbanization and economic activity.

- Used Vehicle Market Growth: Catering to affordability-conscious consumers with specialized financing solutions.

- Partnerships and Collaborations: Leveraging strategic alliances to offer bundled services and exclusive deals.

Major Players in the Brazil Auto Loan Market Ecosystem

- Banco do Brasil

- Caixa Economica Federal

- Banco Bradesco

- Santander

- Itau Unibanco

- HSBC

- BV Financeira

- Banco Pan

- Banco Safra

- Nubank

Key Developments in Brazil Auto Loan Market Industry

- October 2023: Chinese new energy vehicle and battery giant BYD formally reached a strategic cooperation agreement with the Brazilian division of Santander, a leader in the domestic auto finance industry. This collaboration is expected to significantly boost the financing and adoption of BYD's electric vehicles in Brazil.

- August 2023: JPMorgan Chase & Co. raised its ownership in C6, a prominent Brazilian digital bank, from 40% to 46%. Through this strategic cooperation, Brazilian consumers can enjoy comprehensive digital auto finance solutions, including credit evaluation, credit review, and payment solutions, signaling a deeper integration of digital banking and auto financing services.

Strategic Brazil Auto Loan Market Market Forecast

The Brazil Auto Loan Market is poised for significant expansion, driven by a confluence of favorable economic conditions, technological innovation, and evolving consumer preferences. The increasing demand for both new and used vehicles, coupled with the burgeoning interest in electric and new energy vehicles, will create substantial opportunities for lenders. The ongoing digital transformation of the financial sector, with fintech companies playing a pivotal role, will further streamline access to credit and enhance customer experience. Strategic partnerships between automotive manufacturers and financial institutions are expected to drive market penetration and product diversification. Projections indicate sustained growth throughout the forecast period, making it an attractive market for investment and innovation in the automotive finance sector.

Brazil Auto Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. NBFCs (Non Banking Financials Companies)

- 3.3. Credit Unions

- 3.4. Other Provider Types (Fintech Companies)

-

4. Tenure

- 4.1. Less than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

Brazil Auto Loan Market Segmentation By Geography

- 1. Brazil

Brazil Auto Loan Market Regional Market Share

Geographic Coverage of Brazil Auto Loan Market

Brazil Auto Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Quick Processing of Loan through Digital Banking

- 3.3. Market Restrains

- 3.3.1. Quick Processing of Loan through Digital Banking

- 3.4. Market Trends

- 3.4.1. Sales of Used Cars in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Auto Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. NBFCs (Non Banking Financials Companies)

- 5.3.3. Credit Unions

- 5.3.4. Other Provider Types (Fintech Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Banco do Brasil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caixa Economica Federal

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banco Bradesco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Santander

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Itau Unibanco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HSBC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BV Financeira

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Banco Pan

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Banco Safra

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nubank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Banco do Brasil

List of Figures

- Figure 1: Brazil Auto Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Auto Loan Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Auto Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Brazil Auto Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Brazil Auto Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: Brazil Auto Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 5: Brazil Auto Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: Brazil Auto Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 7: Brazil Auto Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: Brazil Auto Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: Brazil Auto Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Brazil Auto Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Brazil Auto Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Brazil Auto Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Brazil Auto Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 14: Brazil Auto Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 15: Brazil Auto Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Brazil Auto Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 17: Brazil Auto Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: Brazil Auto Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 19: Brazil Auto Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Brazil Auto Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Auto Loan Market?

The projected CAGR is approximately 4.72%.

2. Which companies are prominent players in the Brazil Auto Loan Market?

Key companies in the market include Banco do Brasil, Caixa Economica Federal, Banco Bradesco, Santander, Itau Unibanco, HSBC, BV Financeira, Banco Pan, Banco Safra, Nubank**List Not Exhaustive.

3. What are the main segments of the Brazil Auto Loan Market?

The market segments include Vehicle Type, Ownership, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Quick Processing of Loan through Digital Banking.

6. What are the notable trends driving market growth?

Sales of Used Cars in Brazil.

7. Are there any restraints impacting market growth?

Quick Processing of Loan through Digital Banking.

8. Can you provide examples of recent developments in the market?

October 2023: Chinese new energy vehicle and battery giant BYD formally reached a strategic cooperation agreement with the Brazilian division of Santander, a leader in the domestic auto finance industry

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Auto Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Auto Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Auto Loan Market?

To stay informed about further developments, trends, and reports in the Brazil Auto Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence