Key Insights

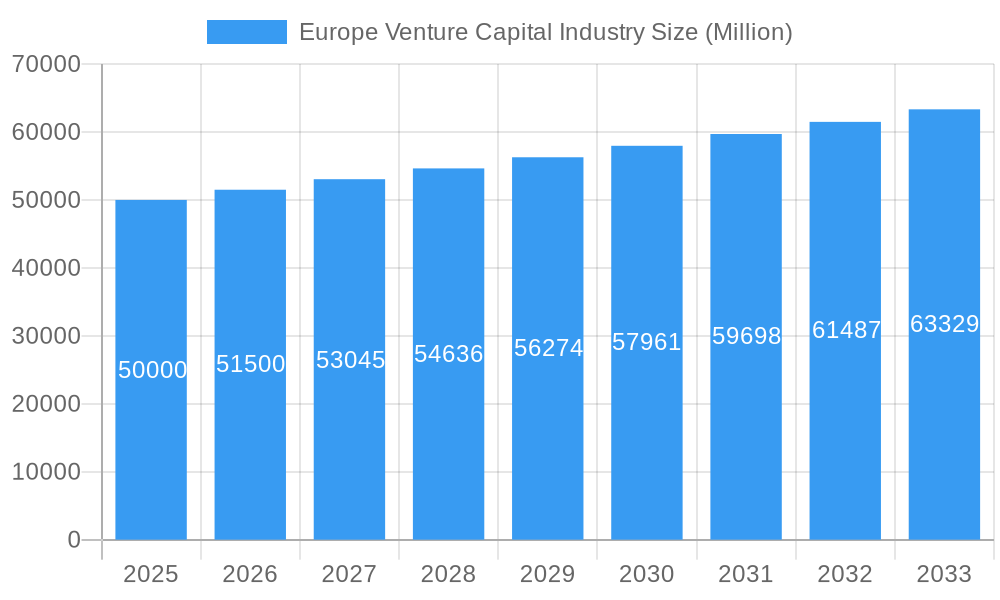

The European Venture Capital (VC) market is experiencing substantial expansion, propelled by a vibrant startup ecosystem and significant technological advancements across key sectors including Fintech, Pharma & Biotech, and IT. Leading VC firms such as Atomico, Accel Partners, and BGF underscore strong investor confidence. While preliminary data suggests a Compound Annual Growth Rate (CAGR) above 3%, a definitive figure necessitates further analysis of the 2019-2024 market size. However, considering the persistent global upward trend in VC investments and Europe's robust tech hubs (Germany, UK, France), the 2025 market size is projected to reach approximately €8.74 billion, reflecting a conservative estimate based on sustained growth and recent industry reports. This projected valuation highlights the dynamic and evolving nature of the European VC landscape. The market is segmented by industry, geography (led by the UK, Germany, and Finland), and investment stage, with early-stage investments showing considerable potential. Growth is further fueled by increased early-stage funding availability, favorable government innovation policies, and the rise of successful European unicorns, attracting global attention and capital.

Europe Venture Capital Industry Market Size (In Billion)

Despite this promising growth trajectory, challenges persist. Regulatory complexities, uneven access to capital across European regions, and the inherent risks of venture capital investments pose potential limitations. The market's future performance will be contingent upon macroeconomic stability, the global competitiveness of European startups, and continued successful exits via IPOs or acquisitions. The forecast period (2025-2033) anticipates continued expansion, with an estimated CAGR of 13.87%. Overcoming existing challenges and capitalizing on emerging opportunities within diverse industry segments will be crucial for achieving this growth. The long-term outlook for the European VC industry remains optimistic, driven by ongoing technological innovation and a supportive entrepreneurial environment.

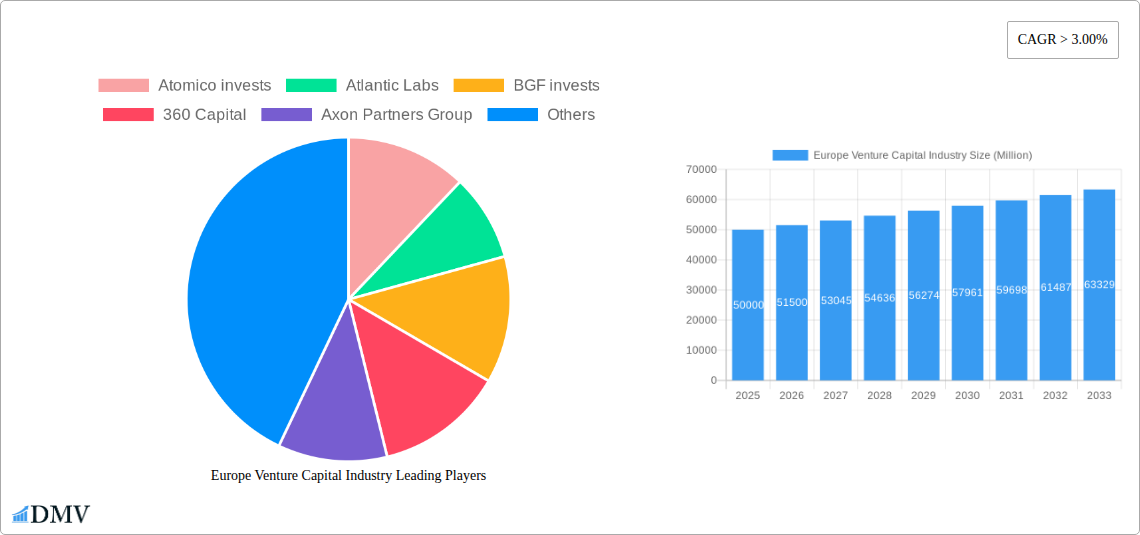

Europe Venture Capital Industry Company Market Share

Europe Venture Capital Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European Venture Capital industry, covering the period from 2019 to 2033, with a base year of 2025. It offers a comprehensive overview of market composition, trends, leading players, and future growth prospects, providing crucial insights for investors, entrepreneurs, and industry stakeholders. The report meticulously analyzes investment trends across various sectors and geographies, identifying key opportunities and challenges within the dynamic European VC landscape. Market values are expressed in Millions.

Europe Venture Capital Industry Market Composition & Trends

This section delves into the competitive dynamics of the European Venture Capital market, evaluating market concentration, innovation drivers, regulatory frameworks, and merger & acquisition (M&A) activity. We analyze the market share distribution among key players like Atomico, Accel Partners, and BGF Invests, and examine the impact of M&A deals exceeding €XX Million on market consolidation. The analysis considers the influence of substitute products and end-user profiles, painting a comprehensive picture of the industry's structure and competitive pressures.

- Market Concentration: Highly fragmented with a few dominant players controlling xx% of the market. Significant regional variations exist.

- Innovation Catalysts: Government initiatives, technological advancements (e.g., AI, blockchain), and a thriving startup ecosystem.

- Regulatory Landscape: Varying regulations across European countries impact investment flows and deal structures.

- M&A Activity: XX M&A deals valued at over €XX Million were recorded between 2019 and 2024, indicating a trend of consolidation. The average deal size was approximately €XX Million.

- Substitute Products/Services: Limited direct substitutes, but alternative funding sources (e.g., angel investors, private equity) exert competitive pressure.

- End-User Profiles: Early-stage startups, growth-stage companies, and established businesses seeking expansion capital.

Europe Venture Capital Industry Industry Evolution

This section analyzes the evolution of the European Venture Capital industry, focusing on market growth trajectories, technological advancements, and changing investor preferences. We examine the impact of factors such as increased digitalization, the rise of specialized VC funds, and evolving regulatory landscapes on market dynamics. The analysis projects a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033, driven primarily by increased startup activity and growing investor interest in specific sectors. Specific data points regarding growth rates and adoption metrics for key technologies within the industry will be detailed.

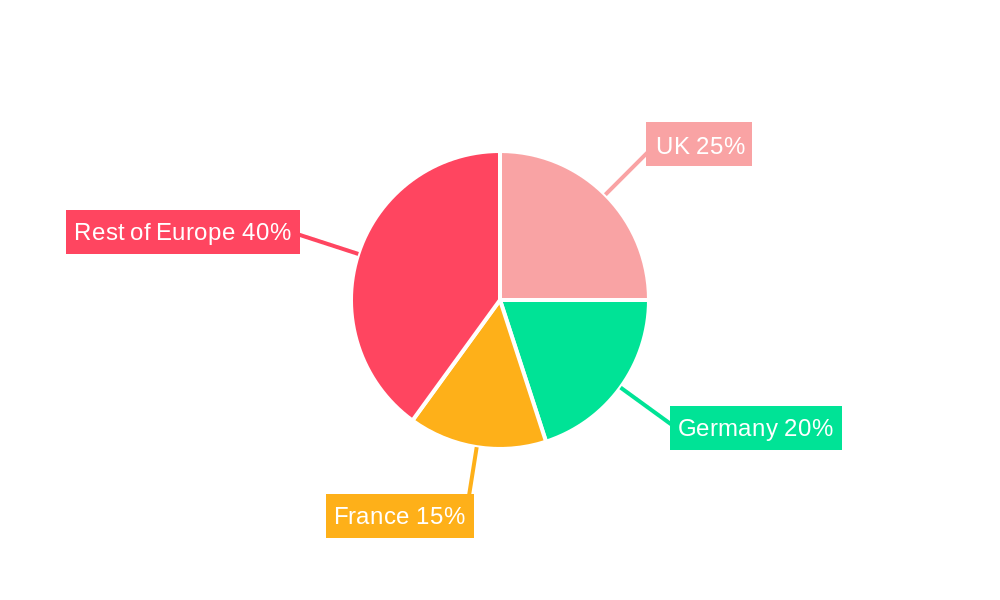

Leading Regions, Countries, or Segments in Europe Venture Capital Industry

This section identifies the leading regions, countries, and investment segments within the European Venture Capital market. The analysis considers investment volume, deal flow, and the presence of leading VC firms to pinpoint dominant areas.

Key Drivers:

- Investment Trends: A strong preference for Fintech, followed by Pharma and Biotech, demonstrating significant growth potential in these sectors.

- Regulatory Support: Favorable government policies and initiatives in certain countries (e.g., UK, Germany) attract significant VC investment.

Dominant Regions/Countries:

- UK: Remains a leading hub due to its established ecosystem and access to global capital.

- Germany: Experiencing rapid growth fueled by strong domestic demand and government support for innovation.

- Finland: A rising star in the Nordic region with a strong focus on technology and sustainability.

- Spain: Showcasing significant growth in Fintech and other sectors.

Dominant Investment Segments:

- Fintech: Attracting the largest share of investment due to its rapid growth and disruptive potential.

- Pharma and Biotech: Benefitting from substantial R&D investment and a focus on innovation.

- IT Hardware and Services: Consistent growth driven by technological advancements and growing digitalization.

Europe Venture Capital Industry Product Innovations

The European Venture Capital industry is characterized by continuous innovation in investment strategies, fund structures, and portfolio management tools. The adoption of data-driven decision-making, the use of AI for due diligence, and the emergence of specialized funds catering to specific industry niches demonstrate ongoing technological advancements. These innovations significantly enhance efficiency and increase the likelihood of successful investments. Furthermore, unique selling propositions among VC firms often include specialized industry expertise, extensive networks, and value-added services offered to portfolio companies.

Propelling Factors for Europe Venture Capital Industry Growth

The European Venture Capital market is experiencing robust growth driven by a confluence of factors. Technological advancements, particularly in AI, blockchain, and fintech, are creating numerous investment opportunities. Favorable economic conditions in several European countries and supportive government policies, including tax incentives and grants, stimulate investment. Furthermore, the increasing availability of early-stage funding and the rise of successful exits are attracting more investors.

Obstacles in the Europe Venture Capital Industry Market

Despite the positive outlook, challenges remain. Regulatory uncertainties across different European jurisdictions create complexities for investment. Competition for top-tier deals is intense, with numerous established and new VC firms vying for the same opportunities. Supply chain disruptions and macroeconomic instability also pose potential risks to investment returns.

Future Opportunities in Europe Venture Capital Industry

The future holds immense potential. Untapped markets in Southern and Eastern Europe present significant opportunities. Emerging technologies such as quantum computing and advanced materials are attracting increasing attention. A growing focus on sustainability and impact investing is opening new avenues for VC funds.

Major Players in the Europe Venture Capital Industry Ecosystem

- Atomico

- Atlantic Labs

- BGF Invests

- 360 Capital

- Axon Partners Group

- Acton Capital

- Bonsai Venture Capita

- Accel Partners

- Active Venture

- AAC Capital

- Adara Ventures

Key Developments in Europe Venture Capital Industry Industry

- October 2021: Sequoia Capital announces a shift to a singular, permanent fund structure, impacting the industry's traditional fund timelines and capital return strategies.

- February 2022: France's Prime Minister announces a new publicly funded initiative aiming to create 10 tech companies with a net worth exceeding €100 Billion by 2030, significantly boosting the European tech sector.

Strategic Europe Venture Capital Industry Market Forecast

The European Venture Capital market is poised for continued growth, driven by technological advancements, favorable regulatory environments in key regions, and an increasing number of high-growth startups. The forecast period (2025-2033) anticipates a robust expansion, with opportunities concentrated in Fintech, Pharma & Biotech, and sustainable technologies. The market's dynamic nature necessitates continuous monitoring of evolving trends and proactive adaptation to maintain competitiveness.

Europe Venture Capital Industry Segmentation

-

1. Deal Size - Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry of Investment

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries of Investment

Europe Venture Capital Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Venture Capital Industry Regional Market Share

Geographic Coverage of Europe Venture Capital Industry

Europe Venture Capital Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United States' role in VC rounds in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry of Investment

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries of Investment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Atomico invests

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atlantic Labs

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BGF invests

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 360 Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axon Partners Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acton Capital

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bonsai Venture Capita

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accel Partners

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Active Venture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AAC Capital

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adara Ventures

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Atomico invests

List of Figures

- Figure 1: Europe Venture Capital Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Venture Capital Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 2: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 3: Europe Venture Capital Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 5: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 6: Europe Venture Capital Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Venture Capital Industry?

The projected CAGR is approximately 13.87%.

2. Which companies are prominent players in the Europe Venture Capital Industry?

Key companies in the market include Atomico invests, Atlantic Labs, BGF invests, 360 Capital, Axon Partners Group, Acton Capital, Bonsai Venture Capita, Accel Partners, Active Venture, AAC Capital, Adara Ventures.

3. What are the main segments of the Europe Venture Capital Industry?

The market segments include Deal Size - Stage of Investment, Industry of Investment.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United States' role in VC rounds in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: France's Prime Minister, Bruno Le Maire, announced the plans of creating a new fund to boost the technological sector in Europe. The target of the fund is to establish 10 technological companies having a net worth of more than Euro 100 billion by the end of 2030. Moreover, the fund will be publicly funded to finance new technological startups emerging in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Venture Capital Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Venture Capital Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Venture Capital Industry?

To stay informed about further developments, trends, and reports in the Europe Venture Capital Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence