Key Insights

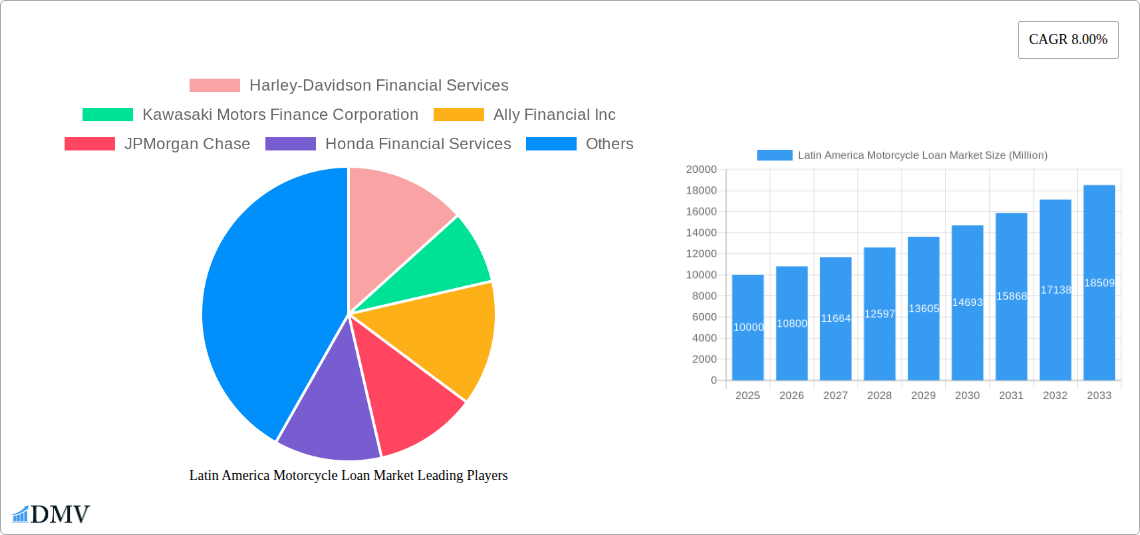

The Latin America motorcycle loan market is poised for significant expansion, projected to reach a substantial market size by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.00%, indicating a consistent and strong upward trajectory. The increasing popularity of motorcycles as a primary mode of transportation, especially in emerging economies within Latin America, is a primary driver. Factors such as affordability compared to other vehicle types, ease of navigating congested urban areas, and a growing culture of motorcycle riding for leisure and commuting contribute to this demand. Furthermore, the expansion of financial services catering specifically to motorcycle purchases, including flexible loan options and increased accessibility through digital platforms, is fueling market penetration. This growing demand for personal mobility solutions is creating a fertile ground for financial institutions and Original Equipment Manufacturers (OEMs) to offer specialized financing.

Latin America Motorcycle Loan Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. Two-wheelers are expected to dominate the vehicle type segment, reflecting the prevalent use of motorcycles across various income groups for daily commutes and small business operations. In terms of provider type, Banks and NBFCs will likely lead, offering diverse financing solutions, while OEMs will play a crucial role in providing bundled financing packages. Fintech companies are emerging as significant players, leveraging technology to offer streamlined loan application and approval processes, thereby enhancing customer experience and accessibility. The loan sanction percentage and tenure segments indicate a trend towards flexible financing, with a notable demand for loans covering a significant portion of the motorcycle's value and varying repayment periods to suit diverse financial capabilities. Brazil, as a major economy within Latin America, is expected to be a key contributor to the market's growth, followed by other significant markets like Mexico and Colombia.

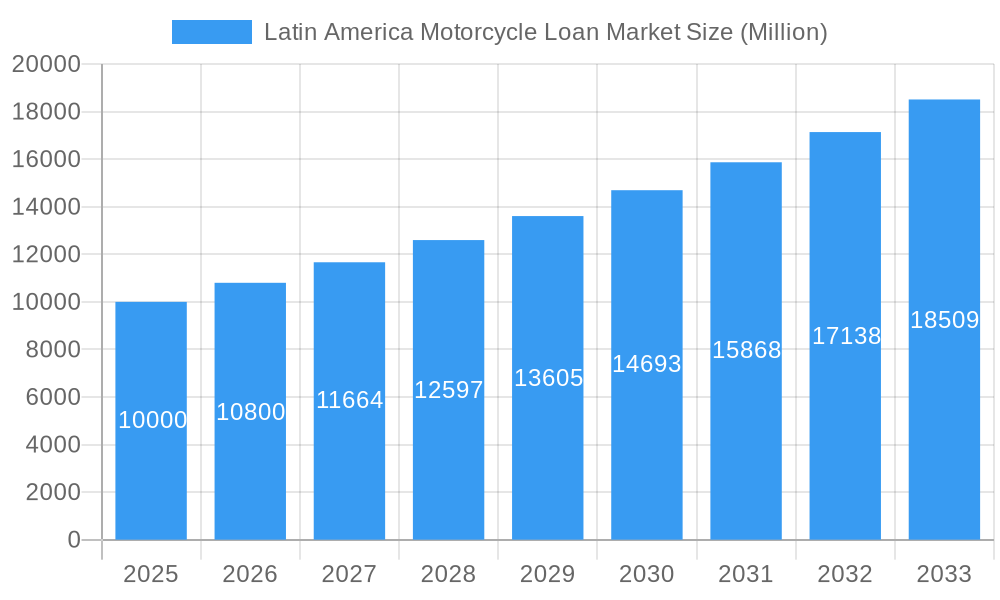

Latin America Motorcycle Loan Market Company Market Share

Unlock unparalleled understanding of the dynamic Latin America motorcycle loan market. This in-depth report provides a robust analysis of market dynamics, key players, emerging trends, and future projections, essential for stakeholders seeking to navigate and capitalize on this burgeoning sector. Covering the period from 2019 to 2033, with a base year of 2025, this research offers strategic insights into the two-wheeler financing landscape across the region.

Latin America Motorcycle Loan Market Market Composition & Trends

The Latin America motorcycle loan market is characterized by a diverse competitive landscape, with a moderate concentration of key players influencing market share distribution. Innovation catalysts are primarily driven by advancements in digital lending platforms and the increasing adoption of fintech solutions, particularly for motorcycle financing. Regulatory frameworks, while evolving, present a mixed environment for lenders, with some nations fostering easier access to credit while others maintain stricter oversight. Substitute products, such as used motorcycle sales or alternative transportation modes, exert some pressure, but the demand for new and accessible two-wheelers, fueled by economic necessity and lifestyle choices, remains robust. End-user profiles are varied, encompassing urban commuters, small business owners, and delivery personnel, all seeking affordable motorcycle loans. Merger and acquisition (M&A) activities are anticipated to grow as established financial institutions and fintech disruptors seek to expand their market reach and consolidate offerings. Specific M&A deal values are projected to be significant, with early-stage predictions suggesting billions of USD in transactions over the forecast period.

Latin America Motorcycle Loan Market Industry Evolution

The Latin America motorcycle loan market has witnessed a significant evolutionary trajectory, driven by a confluence of economic development, technological innovation, and shifting consumer preferences. Over the historical period (2019-2024), the market experienced steady growth, punctuated by increased demand for two-wheelers as an economical and efficient mode of transportation, especially in urban centers and developing economies. The motorcycle finance industry has been a critical enabler of this growth, providing accessible credit solutions to a broad demographic. Technological advancements, particularly in the realm of digital lending and blockchain-enabled credit scoring, have begun to streamline the loan application and approval processes, reducing operational costs for lenders and improving the customer experience. This digital transformation has led to a surge in online motorcycle loans and a greater emphasis on data analytics for risk assessment.

Consumer demand has shifted towards flexible repayment options and lower interest rates, pushing financial institutions to innovate their product portfolios. The rise of the gig economy and the demand for last-mile delivery services have further propelled the need for commercial motorcycle financing, creating a niche yet significant segment within the broader market. The market growth trajectory is projected to accelerate, with an estimated compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). Adoption metrics for digital loan platforms are expected to reach over 75% by 2030. This evolution is not merely about increased loan volumes but also about a more inclusive and efficient financial ecosystem supporting the motorcycle ownership aspirations of a wider population. The integration of AI for credit underwriting and personalized loan offers is also a key trend shaping the future of two-wheeler financing in Latin America.

Leading Regions, Countries, or Segments in Latin America Motorcycle Loan Market

The dominance within the Latin America motorcycle loan market is multifaceted, with Brazil and Mexico consistently emerging as leading regions due to their substantial populations, robust automotive sectors, and a strong cultural affinity for motorcycles.

- Dominant Country - Brazil: Brazil commands a significant share due to its large urban populations and the widespread use of motorcycles for commuting and commercial purposes. High disposable incomes in certain segments, coupled with accessible motorcycle financing options, contribute to its leadership. Investment trends in this market are leaning towards digital lending platforms that cater to the unbanked and underbanked populations. Regulatory support for financial inclusion, while sometimes complex, has facilitated the growth of NBFCs (Non-Banking Financial Services) offering specialized motorcycle loans.

- Leading Segment by Vehicle Type - Two-Wheeler: Unsurprisingly, the Two-Wheeler segment is the undisputed leader, directly aligning with the core focus of the motorcycle loan market. This segment benefits from lower purchase prices compared to passenger cars, making them more attainable for a wider segment of the population. The demand for fuel-efficient and cost-effective transportation in many Latin American countries further solidifies the dominance of two-wheelers.

- Leading Segment by Provider Type - OEM (Original Equipment Manufacturer) Financiers and Banks: Both OEM (Original Equipment Manufacturer) financiers, such as Honda Financial Services and Yamaha Motor Finance Corporation, and traditional Banks hold significant market share. OEM financiers offer tailored loan products directly linked to vehicle sales, often with attractive promotional rates, while banks provide broader lending solutions. NBFCs are rapidly gaining traction, especially in underserved markets, offering specialized and often quicker loan processing.

- Leading Segment by Percentage of Amount Sanctioned - 51-75%: A substantial portion of motorcycle loans falls within the 51-75% sanctioned amount bracket. This indicates that a significant number of borrowers are seeking financing for the majority of the motorcycle's value, often with a down payment. This range reflects the purchasing power of the average consumer looking to acquire a new or used motorcycle.

- Leading Segment by Tenure - Less than 3 Years: The Less than 3 Years tenure is prevalent for motorcycle loans. This preference is driven by the lower overall cost of motorcycles and the desire to minimize interest payments, making shorter-term loans more financially appealing for many borrowers.

The interplay of these factors – strong regional demand, the inherent appeal of two-wheelers, the dual strength of OEM and traditional banking finance, a sweet spot in financing percentages, and a preference for shorter repayment periods – creates a robust and dynamic market for motorcycle loans across Latin America.

Latin America Motorcycle Loan Market Product Innovations

Innovation in the Latin America motorcycle loan market is rapidly transforming accessibility and customer experience. Lenders are increasingly leveraging digital platforms for end-to-end loan origination, allowing for faster approvals and reduced paperwork. Unique selling propositions include the introduction of "pay-as-you-go" financing models and usage-based insurance integration within loan packages. These advancements cater to the dynamic needs of riders, especially those in the gig economy. Performance metrics show a notable reduction in loan processing times, with some digital applications being approved within hours, compared to days for traditional methods. Technological advancements are also focusing on enhanced data analytics for more accurate credit risk assessment, enabling lenders to offer competitive interest rates even to individuals with less-than-perfect credit histories, thus expanding the reach of motorcycle finance.

Propelling Factors for Latin America Motorcycle Loan Market Growth

Several key growth drivers are propelling the Latin America motorcycle loan market forward. Economically, increasing urbanization and the demand for affordable transportation are paramount, especially in densely populated cities. The rising cost of public transportation and fuel efficiency of motorcycles make them an attractive alternative. Technologically, the widespread adoption of smartphones and the growth of fintech solutions are enabling easier access to loan applications and faster approvals, democratizing credit. Regulatory initiatives aimed at financial inclusion and supporting small businesses also play a crucial role. For example, government incentives for small business owners often include accessible financing for essential assets like motorcycles, driving demand for commercial motorcycle loans.

Obstacles in the Latin America Motorcycle Loan Market Market

Despite robust growth, the Latin America motorcycle loan market faces several obstacles. Regulatory challenges persist, with varying compliance requirements across different countries, impacting the scalability of lending operations. Economic volatility and currency fluctuations can affect borrowers' repayment capacity and lenders' risk assessment. Supply chain disruptions for motorcycle parts and new vehicle availability can indirectly impact loan demand. Furthermore, intense competitive pressures from both established financial institutions and emerging fintech companies can lead to pressure on margins. The prevalence of informal lending practices in some regions also presents a challenge to formal credit market penetration.

Future Opportunities in Latin America Motorcycle Loan Market

Emerging opportunities in the Latin America motorcycle loan market are substantial. The untapped potential in rural and semi-urban areas presents a significant growth avenue for affordable motorcycle financing. Advancements in blockchain technology offer opportunities for secure and transparent loan processing and identity verification, further enhancing efficiency. The growing trend of e-commerce and the increasing demand for last-mile delivery services will continue to drive demand for commercial motorcycle loans. Furthermore, the development of specialized loan products for electric motorcycles, as the region embraces sustainable transportation, represents a nascent yet promising segment for innovation and market expansion.

Major Players in the Latin America Motorcycle Loan Market Ecosystem

- Harley-Davidson Financial Services

- Kawasaki Motors Finance Corporation

- Ally Financial Inc

- JPMorgan Chase

- Honda Financial Services

- Bank of America Corporation

- Wells Fargo

- TD Bank

- Yamaha Motor Finance Corporation

- Mountain America Credit Union

Key Developments in Latin America Motorcycle Loan Market Industry

- March 2023: Clave Créditos S.A., an affiliate of Latin America-focused fintech Clave, and Santander Consumer S.A., a Santander Group company, announced an agreement for Clave to digitally originate and service consumer loans in Argentina, signaling a growing trend of fintech-bank collaborations in the region.

- September 2022: Faurecia, a company of the world's leading automotive technology group FORVIA, announced a USD 210 million loan with Latin American banks, underscoring significant investment and financial backing within the broader automotive and mobility sectors in the region.

Strategic Latin America Motorcycle Loan Market Market Forecast

The strategic forecast for the Latin America motorcycle loan market is overwhelmingly positive, driven by a sustained demand for economical transportation and the increasing penetration of digital financial services. Growth catalysts include further technological integration, leading to more streamlined and accessible two-wheeler financing, particularly for segments previously underserved by traditional banking. Emerging markets within the region present significant untapped potential, while the ongoing expansion of the gig economy and e-commerce logistics will continue to fuel demand for commercial motorcycle loans. The strategic focus will be on leveraging data analytics for personalized loan offerings and exploring partnerships that enhance customer reach and service delivery. The market is poised for sustained growth, driven by innovation and a deepening understanding of consumer needs in this vibrant economic landscape.

Latin America Motorcycle Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Two-Wheeler

- 1.2. Passenger Car

- 1.3. Commercial Vehicle

-

2. Provider Type

- 2.1. Banks

- 2.2. NBFCs (Non-Banking Financial Services)

- 2.3. OEM (Original Equipment Manufacturer)

- 2.4. Others (Fintech Companies)

-

3. Percentage of Amount Sanctioned

- 3.1. Less than 25%

- 3.2. 25-50%

- 3.3. 51-75%

- 3.4. More than 75%

-

4. Tenure

- 4.1. Less than 3 Years

- 4.2. 3-5 Years

- 4.3. More than 5 Years

Latin America Motorcycle Loan Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Motorcycle Loan Market Regional Market Share

Geographic Coverage of Latin America Motorcycle Loan Market

Latin America Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Rising Motorcycle Ownership in Latin America Fuels Motorcycle Loan Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-Wheeler

- 5.1.2. Passenger Car

- 5.1.3. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. NBFCs (Non-Banking Financial Services)

- 5.2.3. OEM (Original Equipment Manufacturer)

- 5.2.4. Others (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.3.1. Less than 25%

- 5.3.2. 25-50%

- 5.3.3. 51-75%

- 5.3.4. More than 75%

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than 3 Years

- 5.4.2. 3-5 Years

- 5.4.3. More than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Harley-Davidson Financial Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kawasaki Motors Finance Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ally Financial Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JPMorgan Chase

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honda Financial Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of American Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wells Fargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TD Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamaha motor finance corporation **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mountain America Credit Union

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Harley-Davidson Financial Services

List of Figures

- Figure 1: Latin America Motorcycle Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Motorcycle Loan Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Latin America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 3: Latin America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 4: Latin America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 5: Latin America Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Latin America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 8: Latin America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 9: Latin America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 10: Latin America Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Brazil Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Argentina Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Chile Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Colombia Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Peru Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Venezuela Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ecuador Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bolivia Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Paraguay Latin America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Motorcycle Loan Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Latin America Motorcycle Loan Market?

Key companies in the market include Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc, JPMorgan Chase, Honda Financial Services, Bank of American Corporation, Wells Fargo, TD Bank, Yamaha motor finance corporation **List Not Exhaustive, Mountain America Credit Union.

3. What are the main segments of the Latin America Motorcycle Loan Market?

The market segments include Vehicle Type, Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Rising Motorcycle Ownership in Latin America Fuels Motorcycle Loan Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

March 2023: Clave Créditos S.A., an affiliate of Latin America-focused fintech Clave, and Santander Consumer S.A., a Santander Group company, announced an agreement for Clave to digitally originate and service consumer loans in Argentina.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the Latin America Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence