Key Insights

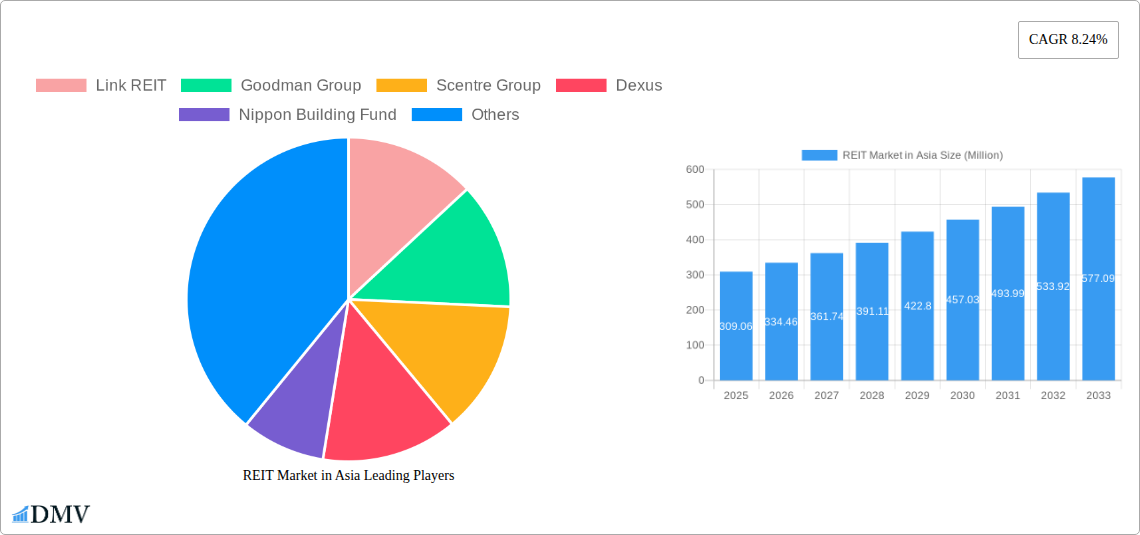

The Asia REIT market is poised for substantial expansion, projected to reach a market size of USD 309.06 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.24% anticipated throughout the forecast period extending to 2033. This significant growth is primarily fueled by increasing institutional investor interest in real estate as an alternative asset class, particularly in light of evolving economic landscapes and the search for stable income streams. Key drivers include the burgeoning demand for modern warehousing and logistics facilities driven by e-commerce growth, and the accelerated development of communication centers and data centers to support the digital economy. Furthermore, the ongoing urbanization across the region and the increasing demand for flexible and secure storage solutions are propelling the self-storage facilities segment. Governments are also playing a role through supportive regulatory frameworks and initiatives aimed at boosting real estate investment trusts as a means to foster capital formation and economic development.

REIT Market in Asia Market Size (In Million)

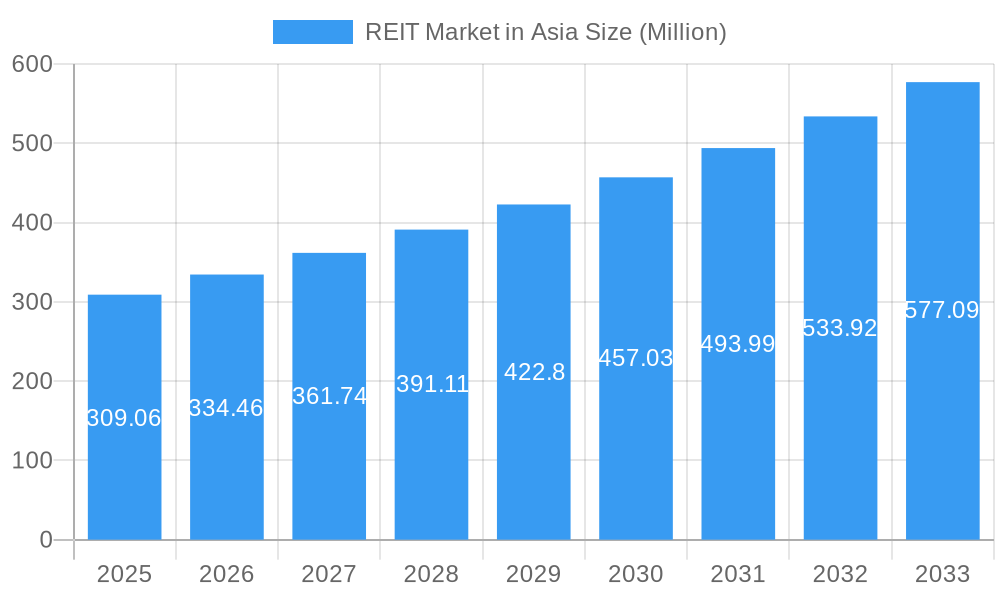

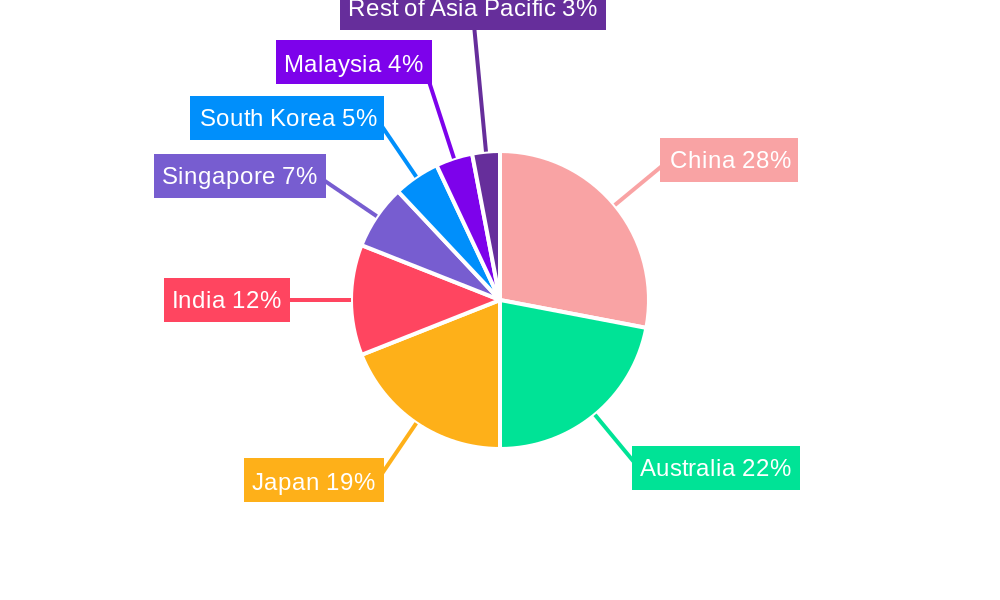

The market dynamics are further shaped by emerging trends such as the increasing adoption of sustainable real estate practices, focusing on energy efficiency and green building certifications, which are becoming key differentiators for attracting investors and tenants. The integration of technology, including smart building solutions and AI-driven property management, is also a significant trend enhancing operational efficiency and tenant experience. However, the market faces certain restraints, including evolving interest rate environments that can impact borrowing costs and property valuations, and the potential for oversupply in certain sub-sectors or geographies if development outpaces demand. Geographically, China, Australia, Japan, and India are expected to be the dominant markets, driven by their large economies, increasing urbanization, and active real estate investment scenes. The Rest of Asia-Pacific region also presents significant untapped potential for growth. Leading companies like Goodman Group, Scentre Group, and Link REIT are actively shaping the market through strategic acquisitions, development projects, and innovative investment strategies.

REIT Market in Asia Company Market Share

This in-depth report provides a definitive analysis of the REIT Market in Asia, offering critical insights and strategic forecasts for stakeholders navigating this dynamic sector. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging sophisticated analytical tools and real-time data, this report empowers investors, developers, and policymakers with the knowledge to capitalize on the burgeoning Asian real estate investment trust landscape.

REIT Market in Asia Market Composition & Trends

The REIT Market in Asia is characterized by a sophisticated and evolving composition, driven by increasing institutional investor interest and favorable regulatory frameworks. Market concentration varies across sub-segments, with the industrial and commercial sectors exhibiting robust activity. Innovation catalysts include the growing demand for logistics and data center facilities, fueled by e-commerce expansion and digital transformation across the region. Regulatory landscapes are continuously adapting to encourage foreign investment and enhance transparency, bolstering market confidence. Substitute products, such as direct property investments, are increasingly being overshadowed by the liquidity and diversification benefits offered by REITs. End-user profiles range from institutional investors seeking stable income streams to retail investors looking for accessible real estate exposure. Mergers and acquisitions (M&A) activity is a significant trend, with strategic consolidations aimed at achieving economies of scale and expanding geographic reach. M&A deal values are projected to surge as key players seek to enhance their portfolios. The market share distribution is dynamic, with leading players strategically acquiring assets to solidify their positions.

REIT Market in Asia Industry Evolution

The evolution of the REIT Market in Asia is a testament to its resilience and adaptability, marked by consistent growth trajectories and a proactive embrace of technological advancements. Over the historical period (2019-2024), the market has witnessed a significant upward trend, driven by robust economic development across key Asian economies and a growing appetite for yield-generating assets. The increasing sophistication of investment vehicles and a deepening understanding of REIT structures by both institutional and retail investors have been pivotal. Technological advancements, particularly in property management software and data analytics, have enhanced operational efficiencies for REITs, leading to improved asset performance and investor returns. Furthermore, the integration of Environmental, Social, and Governance (ESG) principles is reshaping investment strategies, with a growing emphasis on sustainable and socially responsible real estate development. Shifting consumer demands, influenced by urbanization, demographic changes, and evolving lifestyle preferences, are also dictating the types of properties that REITs are acquiring and developing. For instance, the surge in e-commerce has amplified demand for modern logistics and warehousing facilities, while the aging population in many Asian countries is creating opportunities in senior living and healthcare-related real estate. The market has demonstrated a steady compound annual growth rate (CAGR) of approximately 8-12% during the historical period, with projections indicating a sustained robust expansion through the forecast period (2025-2033). Adoption metrics for different property types, such as industrial REITs and data center REITs, show accelerated growth, reflecting their alignment with current economic megatrends. The regulatory environment has also played a crucial role, with several countries implementing or refining REIT frameworks to attract capital and foster a more transparent and efficient real estate investment ecosystem. This continuous evolution positions the REIT Market in Asia as a pivotal component of the region's financial and real estate sectors, poised for significant future growth.

Leading Regions, Countries, or Segments in REIT Market in Asia

The REIT Market in Asia is predominantly led by a confluence of geographically diverse yet strategically aligned regions and countries, with specific property types emerging as dominant segments. Among the geographies, Japan and Australia consistently lead in terms of market size, maturity, and investor sophistication. Japan boasts a well-established REIT market with a long history of public listings and significant asset under management, particularly in commercial and retail sectors. Australia offers a robust regulatory framework and a strong appetite for diverse real estate assets, including industrial, office, and retail properties. China is rapidly emerging as a powerhouse, driven by rapid urbanization, a growing middle class, and government initiatives to promote REITs as an alternative investment avenue, particularly for infrastructure and logistics assets.

Key drivers for this regional dominance include:

- Investment Trends: Significant foreign direct investment (FDI) inflows into these countries, seeking stable income and capital appreciation. The presence of large institutional investors and pension funds actively allocating capital to real estate is a crucial factor.

- Regulatory Support: Favorable tax regimes, clear legal frameworks for REIT formation and operation, and supportive government policies designed to attract capital and promote market liquidity are critical enablers. For example, the introduction of REITs in China has opened up a vast new market for real estate securitization.

- Economic Growth and Urbanization: High GDP growth rates, coupled with rapid urbanization and infrastructure development in countries like China and India, create sustained demand for various real estate assets.

- Market Maturity and Investor Awareness: Established markets like Japan and Australia benefit from decades of experience, leading to greater investor understanding and trust in REIT structures.

In terms of segments, the Industrial sector, encompassing warehouses and logistics facilities, is experiencing unprecedented growth. This surge is primarily fueled by the exponential rise of e-commerce and the subsequent demand for efficient supply chain infrastructure. Commercial REITs, particularly those focused on office spaces in prime urban centers and shopping malls catering to evolving consumer habits, also hold significant sway. However, the rapid digital transformation has given a substantial boost to Self-storage facilities and data centers, emerging as highly attractive investment avenues due to their recurring revenue models and strong demand from technology-driven businesses. While residential REITs are gaining traction, particularly in countries with housing shortages, their market share remains relatively smaller compared to industrial and commercial segments. The "Rest of Asia-Pacific" region, including emerging markets like India and South Korea, presents immense growth potential, driven by increasing disposable incomes and ongoing development projects, gradually contributing to the overall market expansion and diversification.

REIT Market in Asia Product Innovations

Product innovations within the REIT Market in Asia are increasingly focused on enhancing investor returns and addressing evolving market demands. This includes the development of specialized REITs, such as those targeting the booming logistics and data center sectors, which offer high yields and long-term leases. Innovations in property technology (PropTech) are transforming asset management, leading to more efficient operations, predictive maintenance, and improved tenant experiences. For instance, the integration of AI and IoT in smart buildings optimizes energy consumption and space utilization, thereby boosting profitability. Furthermore, the introduction of ESG-compliant REITs, focusing on sustainable development and social impact, is attracting a new wave of ethically-minded investors. Performance metrics are being refined to include a broader range of sustainability indicators alongside traditional financial returns, offering unique selling propositions that differentiate these innovative products in a competitive market.

Propelling Factors for REIT Market in Asia Growth

Several key factors are propelling the robust growth of the REIT Market in Asia. Economically, rapid urbanization and a growing middle class across the region are creating sustained demand for various real estate assets, from residential properties to modern industrial facilities. Technologically, the digital transformation and the e-commerce boom are driving significant investment into logistics, data centers, and communication infrastructure, all of which are core to REIT portfolios. Regulatory advancements, including the liberalization of REIT frameworks in emerging markets like China and ongoing refinements in established markets, are crucial in attracting foreign and domestic capital, enhancing liquidity, and improving transparency. For example, the introduction of new REIT categories and tax incentives in countries like India has significantly boosted investor interest.

Obstacles in the REIT Market in Asia Market

Despite its strong growth trajectory, the REIT Market in Asia faces several significant obstacles. Regulatory challenges, though diminishing in some markets, can still pose barriers to entry and operation, particularly in less mature economies where frameworks may be evolving or inconsistent. Supply chain disruptions, exacerbated by global events, can impact construction timelines and costs for new developments, affecting project profitability. Competitive pressures are intensifying as more domestic and international players enter the market, potentially leading to higher acquisition costs and lower yields. Furthermore, geopolitical uncertainties and fluctuating interest rate environments can introduce volatility and dampen investor sentiment, impacting capital flows and asset valuations.

Future Opportunities in REIT Market in Asia

The REIT Market in Asia is poised for significant future opportunities. Emerging markets, such as India and Vietnam, present vast untapped potential due to rapid economic development and growing demand for diversified real estate assets. The increasing adoption of green building technologies and sustainable investment strategies opens avenues for ESG-focused REITs, attracting a growing pool of socially conscious investors. Furthermore, the burgeoning digital economy continues to fuel demand for data centers and specialized logistics facilities, creating niche investment opportunities. The evolving needs of an aging population also present opportunities in the healthcare and senior living real estate sectors, which are currently underserved in many Asian countries.

Major Players in the REIT Market in Asia Ecosystem

- Link REIT

- Goodman Group

- Scentre Group

- Dexus

- Nippon Building Fund

- Mirvac

- Japan RE Investment Corporation

- GPT

- Stockland

- Capital Land Mall Trust

- Ascendas REIT

- Japan Retail Fund

Key Developments in REIT Market in Asia Industry

- May 2023: Brookfield India Real Estate Investment Trust (REIT) and Singapore’s sovereign wealth fund GIC established a strategic platform to acquire two large commercial assets totaling 6.5 million sq ft from Brookfield Asset Management’s private real estate funds in an equal partnership. The acquisition includes commercial properties in Brookfield’s Downtown Powai, Mumbai, and Candor TechSpace, Sector 48, Gurugram, for a combined enterprise value of approximately USD 1.4 billion.

- March 2023: Sabana Industrial REIT entered into agreements with Keppel EaaS, a wholly-owned subsidiary of Keppel Infrastructure, to implement sustainability solutions and initiatives across the REIT’s selected portfolio properties.

Strategic REIT Market in Asia Market Forecast

The strategic REIT Market in Asia forecast indicates a period of sustained and robust growth, driven by ongoing economic expansion, favorable demographic shifts, and continued regulatory support. Emerging technologies and a growing emphasis on sustainability will shape investment strategies, favoring specialized REITs focused on logistics, data centers, and green real estate. The increasing participation of institutional investors and the ongoing liberalization of REIT regulations in key markets will further enhance market liquidity and diversification. The region's dynamic economic landscape and evolving consumer preferences present a fertile ground for innovative real estate investment trusts, solidifying the REIT market's position as a crucial component of Asia's financial ecosystem and a compelling investment avenue for the foreseeable future.

REIT Market in Asia Segmentation

-

1. Type

- 1.1. Industrial

- 1.2. Commercial

- 1.3. Residential

-

2. Application

- 2.1. Warehouses and communication centers

- 2.2. Self-storage facilities and data centers

- 2.3. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. Singapore

- 3.6. South Korea

- 3.7. Malaysia

- 3.8. Rest of Asia-Pacific

REIT Market in Asia Segmentation By Geography

- 1. China

- 2. Australia

- 3. Japan

- 4. India

- 5. Singapore

- 6. South Korea

- 7. Malaysia

- 8. Rest of Asia Pacific

REIT Market in Asia Regional Market Share

Geographic Coverage of REIT Market in Asia

REIT Market in Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Urbanization is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growth in Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial

- 5.1.2. Commercial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Warehouses and communication centers

- 5.2.2. Self-storage facilities and data centers

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Australia

- 5.3.3. Japan

- 5.3.4. India

- 5.3.5. Singapore

- 5.3.6. South Korea

- 5.3.7. Malaysia

- 5.3.8. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Australia

- 5.4.3. Japan

- 5.4.4. India

- 5.4.5. Singapore

- 5.4.6. South Korea

- 5.4.7. Malaysia

- 5.4.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Industrial

- 6.1.2. Commercial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Warehouses and communication centers

- 6.2.2. Self-storage facilities and data centers

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Australia

- 6.3.3. Japan

- 6.3.4. India

- 6.3.5. Singapore

- 6.3.6. South Korea

- 6.3.7. Malaysia

- 6.3.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Australia REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Industrial

- 7.1.2. Commercial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Warehouses and communication centers

- 7.2.2. Self-storage facilities and data centers

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Australia

- 7.3.3. Japan

- 7.3.4. India

- 7.3.5. Singapore

- 7.3.6. South Korea

- 7.3.7. Malaysia

- 7.3.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Industrial

- 8.1.2. Commercial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Warehouses and communication centers

- 8.2.2. Self-storage facilities and data centers

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Australia

- 8.3.3. Japan

- 8.3.4. India

- 8.3.5. Singapore

- 8.3.6. South Korea

- 8.3.7. Malaysia

- 8.3.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Industrial

- 9.1.2. Commercial

- 9.1.3. Residential

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Warehouses and communication centers

- 9.2.2. Self-storage facilities and data centers

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Australia

- 9.3.3. Japan

- 9.3.4. India

- 9.3.5. Singapore

- 9.3.6. South Korea

- 9.3.7. Malaysia

- 9.3.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Singapore REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Industrial

- 10.1.2. Commercial

- 10.1.3. Residential

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Warehouses and communication centers

- 10.2.2. Self-storage facilities and data centers

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Australia

- 10.3.3. Japan

- 10.3.4. India

- 10.3.5. Singapore

- 10.3.6. South Korea

- 10.3.7. Malaysia

- 10.3.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Korea REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Industrial

- 11.1.2. Commercial

- 11.1.3. Residential

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Warehouses and communication centers

- 11.2.2. Self-storage facilities and data centers

- 11.2.3. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Australia

- 11.3.3. Japan

- 11.3.4. India

- 11.3.5. Singapore

- 11.3.6. South Korea

- 11.3.7. Malaysia

- 11.3.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Malaysia REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Industrial

- 12.1.2. Commercial

- 12.1.3. Residential

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Warehouses and communication centers

- 12.2.2. Self-storage facilities and data centers

- 12.2.3. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. Australia

- 12.3.3. Japan

- 12.3.4. India

- 12.3.5. Singapore

- 12.3.6. South Korea

- 12.3.7. Malaysia

- 12.3.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Asia Pacific REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Industrial

- 13.1.2. Commercial

- 13.1.3. Residential

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Warehouses and communication centers

- 13.2.2. Self-storage facilities and data centers

- 13.2.3. Other Applications

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. Australia

- 13.3.3. Japan

- 13.3.4. India

- 13.3.5. Singapore

- 13.3.6. South Korea

- 13.3.7. Malaysia

- 13.3.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Link REIT

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Goodman Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Scentre Group

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Dexus

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Nippon Building Fund

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mirvac

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Japan RE Investment Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 GPT

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Stockland

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Capital Land Mall Trust

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Ascendas REIT

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Japan Retail Fund**List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Link REIT

List of Figures

- Figure 1: REIT Market in Asia Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: REIT Market in Asia Share (%) by Company 2025

List of Tables

- Table 1: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 2: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 3: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 4: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 5: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: REIT Market in Asia Revenue Million Forecast, by Region 2020 & 2033

- Table 8: REIT Market in Asia Volume Billion Forecast, by Region 2020 & 2033

- Table 9: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 10: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 11: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 12: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 13: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 17: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 18: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 19: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 20: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 21: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 24: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 25: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 26: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 27: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 28: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 29: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 32: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 33: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 34: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 35: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 36: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 37: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 40: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 41: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 42: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 43: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 44: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 45: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 48: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 49: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 50: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 51: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 52: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 53: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 56: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 57: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 58: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 59: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 60: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 61: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 64: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 65: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 66: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 67: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 68: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 69: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 71: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 72: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the REIT Market in Asia?

The projected CAGR is approximately 8.24%.

2. Which companies are prominent players in the REIT Market in Asia?

Key companies in the market include Link REIT, Goodman Group, Scentre Group, Dexus, Nippon Building Fund, Mirvac, Japan RE Investment Corporation, GPT, Stockland, Capital Land Mall Trust, Ascendas REIT, Japan Retail Fund**List Not Exhaustive.

3. What are the main segments of the REIT Market in Asia?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 309.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Growth in Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Urbanization is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Brookfield India Real Estate Investment Trust (REIT) and Singapore’s sovereign wealth fund GIC set up a strategic platform to acquire two large commercial assets totaling 6.5 million sq ft from Brookfield Asset Management’s private real estate funds in an equal partnership. The acquisition includes commercial properties in Brookfield’s Downtown Powai, Mumbai, and Candor TechSpace, Sector 48, Gurugram, for a combined enterprise value of around USD 1.4 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "REIT Market in Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the REIT Market in Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the REIT Market in Asia?

To stay informed about further developments, trends, and reports in the REIT Market in Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence