Key Insights

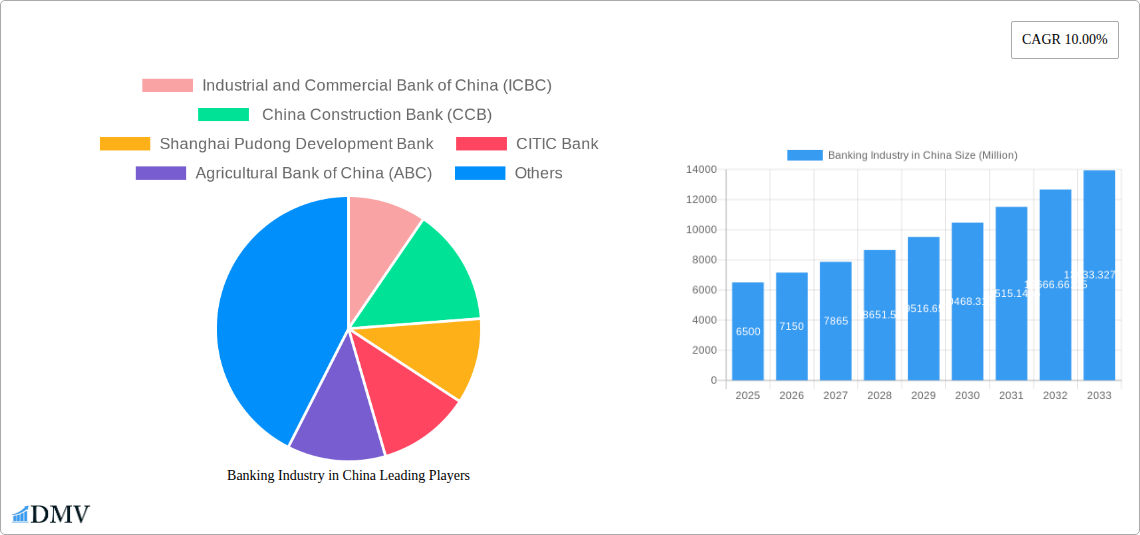

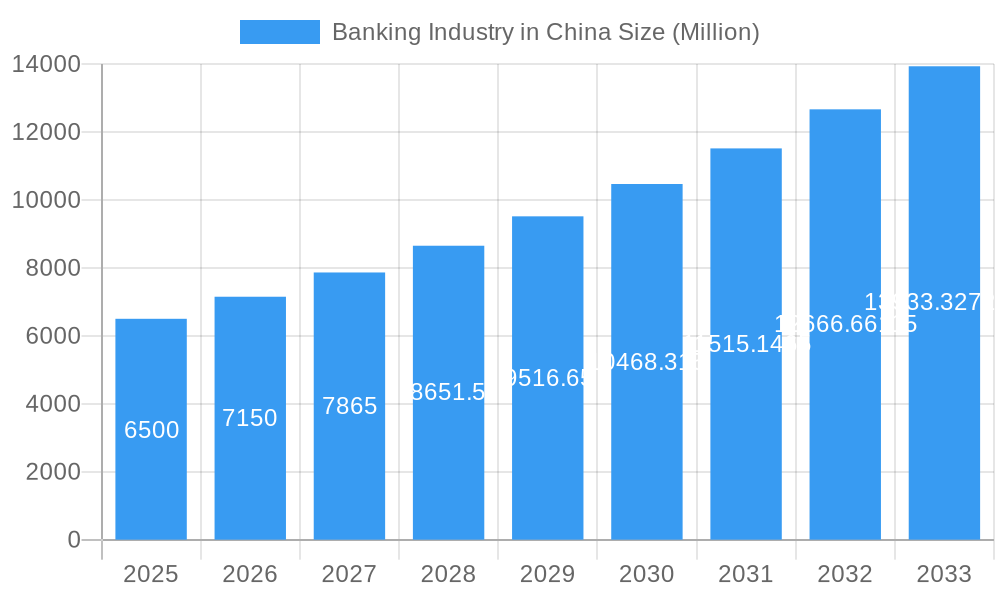

The Chinese banking industry is poised for significant expansion, projected to reach a substantial market size of approximately USD 6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.00% expected to propel it to an estimated USD 12,600 million by 2033. This impressive growth is largely fueled by the nation's burgeoning digital economy and increasing consumer adoption of sophisticated financial products. Key drivers include the widespread implementation of advanced financial technologies (FinTech), the government's continued support for financial inclusion, and the growing demand for personalized banking services. The proliferation of mobile banking, online payment systems, and innovative lending platforms are transforming how Chinese consumers interact with financial institutions, creating new revenue streams and enhancing operational efficiencies for major players. The industry is witnessing a surge in demand for transactional and savings accounts, alongside a steady rise in the adoption of debit and credit cards, reflecting a growing disposable income and a more consumer-driven economy. Furthermore, the expansion of digital loan products, catering to both individual and business needs, is a significant contributor to market expansion.

Banking Industry in China Market Size (In Billion)

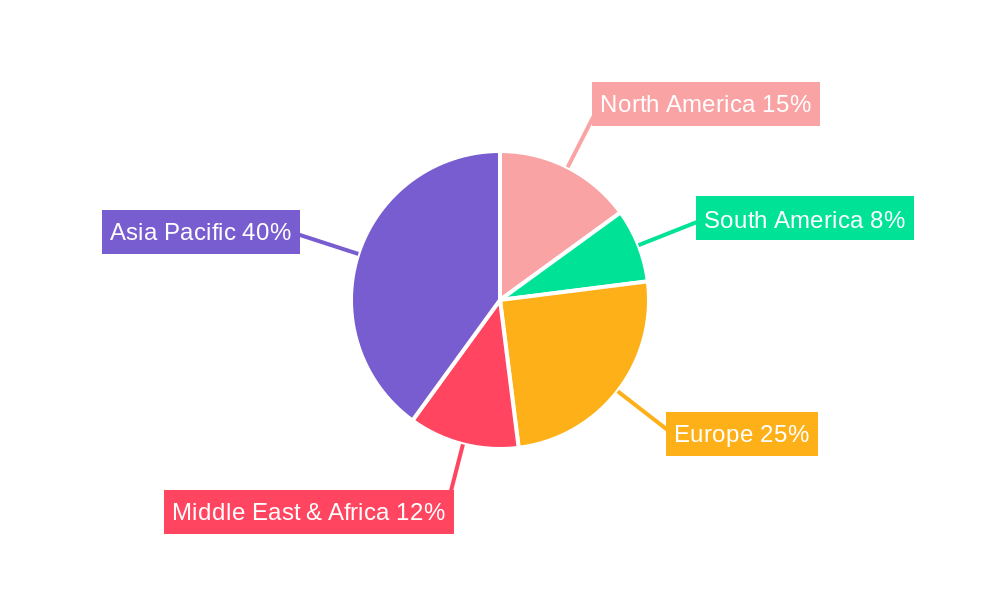

The market is characterized by intense competition among established state-owned giants and increasingly agile private banks, driving innovation across product offerings and service delivery. Trends such as the integration of artificial intelligence (AI) for personalized customer experiences, the adoption of blockchain for secure and efficient transactions, and the development of green finance initiatives are shaping the future of banking in China. However, the industry also faces certain restraints, including evolving regulatory landscapes that necessitate constant adaptation, cybersecurity concerns in an increasingly digital environment, and the ongoing need to address the digital divide for certain segments of the population. Despite these challenges, the strong underlying economic growth, coupled with a rapidly digitizing society, creates a fertile ground for sustained growth. The market is segmented across various products like Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, and Loans, with significant contributions from the Software and Services industries within the broader banking ecosystem. Direct sales and distributor channels are both crucial for reaching diverse customer segments across North America, South America, Europe, the Middle East & Africa, and particularly within the Asia Pacific region, with China itself being the dominant market.

Banking Industry in China Company Market Share

The Chinese banking sector exhibits a dynamic market composition shaped by intense competition and rapid innovation. The market is characterized by a blend of state-owned giants and increasingly agile private and international players, driving a complex interplay of market share distribution. Dominant players like the Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), and the Agricultural Bank of China (ABC) hold substantial market influence, though strategic acquisitions and partnerships are reshaping the landscape. Innovation catalysts are largely driven by the rapid adoption of digital technologies, fintech integration, and evolving customer expectations for seamless financial services. Regulatory frameworks, while robust, are continually adapting to foster healthy competition and financial stability, influencing everything from lending practices to digital yuan development. Substitute products and services, particularly from burgeoning fintech companies offering payment solutions and alternative lending platforms, present a constant challenge and opportunity for traditional banks. End-user profiles range from individual consumers seeking accessible savings and credit solutions to large enterprises requiring sophisticated financial management and investment services.

- Market Share Distribution: While state-owned banks command a significant portion, there's a growing share for entities like Shanghai Pudong Development Bank and Ping An Bank.

- M&A Activities: The historical period saw strategic alliances and smaller acquisitions aimed at expanding digital capabilities and customer reach, with estimated deal values in the xx Million range.

- Innovation Catalysts: Fintech adoption, regulatory push for digital transformation, and a young, tech-savvy demographic.

- Regulatory Landscape: Focus on financial stability, digital currency development, and anti-monopoly measures.

- Substitute Products: Mobile payment platforms, peer-to-peer lending, and wealth management apps.

- End-User Profiles: Retail consumers (transactional, savings, credit), SMEs (loans, working capital), and large corporations (corporate banking, treasury services).

Banking Industry in China Industry Evolution

The Chinese banking industry has undergone a profound transformation, evolving from a traditionally state-controlled sector to a sophisticated and technologically advanced financial ecosystem. This evolution is marked by robust market growth trajectories, significantly propelled by the nation's economic expansion and increasing disposable incomes. Technological advancements have been a cornerstone of this metamorphosis. The widespread adoption of mobile banking, digital payment systems, and the burgeoning exploration of central bank digital currencies (CBDCs) have fundamentally altered customer interaction and operational efficiency. As of the base year 2025, the digital channel penetration is estimated to be over 80% for retail banking services, a testament to this rapid shift.

Shifting consumer demands play a pivotal role in this ongoing evolution. Chinese consumers, particularly the younger generations, expect instant, personalized, and seamless financial experiences. This has spurred banks to invest heavily in data analytics, artificial intelligence, and cloud computing to offer customized product recommendations, intuitive user interfaces, and omnichannel service delivery. The market growth rate in terms of digital transaction volume has consistently outpaced overall GDP growth, averaging an impressive 15% annually during the historical period of 2019–2024. The increasing sophistication of financial products, from diversified investment options to innovative lending solutions for small and medium-sized enterprises (SMEs), reflects this demand. Furthermore, the regulatory environment, while maintaining a focus on stability, has actively encouraged innovation, particularly in areas like green finance and inclusive banking, further shaping the industry's growth narrative. The forecast period of 2025–2033 is expected to witness continued growth, driven by further digitalization, the integration of AI in risk management and customer service, and the potential widespread adoption of digital yuan, solidifying China's position as a global leader in financial innovation.

Leading Regions, Countries, or Segments in Banking Industry in China

The Chinese banking industry showcases distinct leadership across various segments, driven by a confluence of economic, demographic, and technological factors. In terms of geographic dominance, the Tier-1 cities, notably Beijing, Shanghai, Guangzhou, and Shenzhen, serve as the epicenters of banking innovation and market activity. These metropolises, with their dense populations, high disposable incomes, and concentration of corporate headquarters, naturally lead in the adoption and demand for a wide array of banking products and services. The Product segment exhibiting the most significant dominance is Loans, particularly to SMEs and large corporations, reflecting China's manufacturing and export-driven economy. However, Transactional Accounts and Debit Cards also show pervasive leadership due to the sheer volume of daily economic activity.

The Industry segment of Software and Services is rapidly gaining prominence as banks invest heavily in digital transformation to meet evolving consumer needs and enhance operational efficiency. This includes everything from core banking systems to AI-powered customer service bots. The Channel of Direct Sales, both online and offline, remains crucial, but Distributor networks, including fintech partnerships and agent banking, are expanding significantly, offering wider reach and specialized services. Regulatory support for financial inclusion and technological advancement further fuels the growth in these leading segments. The base year 2025 sees digital banking adoption rates exceeding 80% in these leading regions, with an estimated xx Million in digital transaction value. Investment trends are heavily skewed towards digital infrastructure and data analytics, while regulatory support for fintech innovation encourages the growth of software and services.

- Dominant Region: Tier-1 Cities (e.g., Shanghai, Beijing)

- Key Drivers: High population density, significant disposable income, concentration of businesses.

- In-depth Analysis: These cities are early adopters of new financial technologies and products, serving as testing grounds for innovations that are subsequently rolled out nationwide.

- Dominant Product Segment: Loans (especially SME and Corporate)

- Key Drivers: Economic growth, manufacturing sector needs, government support for businesses.

- In-depth Analysis: The extensive industrial base necessitates significant credit facilities, making loans the cornerstone of the banking sector's revenue.

- Emerging Dominant Industry Segment: Software & Services

- Key Drivers: Digital transformation initiatives, demand for personalized banking, fintech integration.

- In-depth Analysis: Banks are increasingly outsourcing or developing their own software and service platforms to compete in the digital age and enhance customer experience.

- Dominant Channel: Direct Sales (Online & Offline) supported by expanding Distributor Networks

- Key Drivers: Omnichannel banking strategies, fintech partnerships, agent banking expansion.

- In-depth Analysis: While direct customer interaction remains vital, the strategic use of distributors and partnerships allows banks to reach underserved markets and offer specialized solutions.

Banking Industry in China Product Innovations

The Chinese banking industry is a hotbed of product innovation, continuously pushing the boundaries of financial services. A key trend is the hyper-personalization of Transactional Accounts and Savings Accounts, leveraging AI and big data to offer tailored interest rates, fee structures, and rewards programs that cater to individual spending habits and financial goals. Debit Cards and Credit Cards are evolving beyond mere payment tools, integrating loyalty programs, insurance benefits, and even carbon footprint tracking features. The lending landscape is dynamic, with innovations in Loans including AI-driven credit scoring for SMEs, allowing for faster approvals and more flexible repayment terms, reaching an estimated xx Million in new SME loan issuances annually. Beyond these core offerings, the industry is witnessing significant development in wealth management platforms, digital investment products, and integrated financial super-apps that bundle banking services with lifestyle and e-commerce functionalities. The unique selling proposition lies in seamless integration, user-friendliness, and the ability to provide a holistic financial life management experience, powered by cutting-edge technological advancements.

Propelling Factors for Banking Industry in China Growth

Several interconnected factors are propelling the banking industry in China towards continued growth. The robust economic expansion and increasing per capita income create a larger pool of potential customers and greater demand for financial services. Technological advancements, particularly the widespread adoption of mobile internet and sophisticated fintech solutions, are enabling banks to reach a broader customer base, reduce operational costs, and offer innovative digital products. Government initiatives promoting financial inclusion, supporting SMEs, and encouraging digital transformation provide a conducive regulatory environment. The increasing sophistication of Chinese consumers, who are becoming more financially literate and demanding personalized, convenient banking experiences, further fuels this growth.

- Economic Growth: Sustained GDP expansion leads to increased disposable income and demand for financial products.

- Technological Advigoration: Widespread smartphone penetration and advanced fintech drive digital banking adoption and innovation.

- Government Support: Policies encouraging financial inclusion, SME financing, and digital transformation.

- Consumer Demand: Growing financial literacy and preference for personalized, convenient, and integrated banking solutions.

Obstacles in the Banking Industry in China Market

Despite its strong growth trajectory, the banking industry in China faces several significant obstacles. Intense competition, both from established domestic banks and agile fintech firms, puts pressure on margins and necessitates continuous innovation. Regulatory scrutiny, while aimed at ensuring stability, can also create compliance burdens and slow down the introduction of new products. Supply chain disruptions, although less directly impacting core banking services, can affect the broader economic environment upon which the industry relies, leading to potential increases in non-performing loans. Furthermore, managing the cybersecurity risks associated with an increasingly digitalized financial ecosystem and ensuring data privacy remain paramount challenges, requiring substantial ongoing investment in security infrastructure and protocols. The estimated impact of increased regulatory compliance on operational costs can be in the range of xx Million annually.

- Intense Competition: Pressure from domestic banks and fintech companies.

- Regulatory Hurdles: Evolving compliance requirements and potential impact on innovation speed.

- Economic Volatility: Global and domestic economic fluctuations affecting lending and investment.

- Cybersecurity Threats: Protecting sensitive customer data in an increasingly digital landscape.

Future Opportunities in Banking Industry in China

The banking industry in China is poised for significant future opportunities, largely driven by ongoing digital transformation and evolving consumer needs. The continued expansion of the digital yuan is expected to create new avenues for payment systems and financial integration. Emerging markets within China, particularly in less developed regions, offer substantial potential for expanding financial inclusion through digital channels and agent banking networks. The increasing focus on green finance presents an opportunity for banks to develop and offer innovative sustainable investment and lending products. Furthermore, the integration of AI and blockchain technologies holds the promise of revolutionizing risk management, fraud detection, and customer service, leading to more efficient and personalized banking experiences. The growth potential in wealth management services for an aging population and the burgeoning digital economy also presents a vast opportunity.

- Digital Yuan Expansion: New payment ecosystems and financial integration possibilities.

- Emerging Market Penetration: Expanding financial inclusion in less developed regions.

- Green Finance: Development of sustainable investment and lending products.

- AI & Blockchain Integration: Revolutionizing operations and customer engagement.

Major Players in the Banking Industry in China Ecosystem

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Shanghai Pudong Development Bank

- CITIC Bank

- Agricultural Bank of China (ABC)

- China Everbright Bank

- Bank of China (BOC)

- Ping An Bank

- Bank of Communications

- China Merchants Bank

Key Developments in Banking Industry in China Industry

- 2019: Increased focus on fintech integration and digital banking platforms.

- 2020: Accelerated digital transformation due to the global pandemic, with a surge in mobile banking usage.

- 2021: Continued pilot programs and discussions around the central bank digital currency (CBDC), the digital yuan.

- 2022: Strengthened regulatory oversight on data privacy and anti-monopoly practices in the tech and finance sectors.

- 2023: Growing emphasis on green finance initiatives and sustainable banking practices.

- 2024: Enhanced efforts to support small and medium-sized enterprises (SMEs) through targeted loan programs.

Strategic Banking Industry in China Market Forecast

The strategic outlook for the banking industry in China is characterized by robust growth, driven by sustained economic momentum and an accelerated digital transformation. The forecast period of 2025–2033 is expected to witness continued innovation in product offerings, particularly in areas of personalized finance, wealth management, and green finance, catering to an increasingly sophisticated consumer base. The widespread adoption of the digital yuan and advancements in AI and blockchain technologies will further redefine operational efficiencies and customer engagement models. While challenges related to competition and regulatory evolution persist, the industry's adaptability and the significant market potential, estimated to reach xx Million in market size by 2033, position it for a dynamic and prosperous future.

Banking Industry in China Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Channel

- 3.1. Direct Sales

- 3.2. Distributor

Banking Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking Industry in China Regional Market Share

Geographic Coverage of Banking Industry in China

Banking Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Technology and Digitalization Trends are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Transactional Accounts

- 6.1.2. Savings Accounts

- 6.1.3. Debit Cards

- 6.1.4. Credit Cards

- 6.1.5. Loans

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by Channel

- 6.3.1. Direct Sales

- 6.3.2. Distributor

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Transactional Accounts

- 7.1.2. Savings Accounts

- 7.1.3. Debit Cards

- 7.1.4. Credit Cards

- 7.1.5. Loans

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by Channel

- 7.3.1. Direct Sales

- 7.3.2. Distributor

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Transactional Accounts

- 8.1.2. Savings Accounts

- 8.1.3. Debit Cards

- 8.1.4. Credit Cards

- 8.1.5. Loans

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by Channel

- 8.3.1. Direct Sales

- 8.3.2. Distributor

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Transactional Accounts

- 9.1.2. Savings Accounts

- 9.1.3. Debit Cards

- 9.1.4. Credit Cards

- 9.1.5. Loans

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by Channel

- 9.3.1. Direct Sales

- 9.3.2. Distributor

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Transactional Accounts

- 10.1.2. Savings Accounts

- 10.1.3. Debit Cards

- 10.1.4. Credit Cards

- 10.1.5. Loans

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.3. Market Analysis, Insights and Forecast - by Channel

- 10.3.1. Direct Sales

- 10.3.2. Distributor

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Construction Bank (CCB)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Pudong Development Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CITIC Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agricultural Bank of China (ABC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Everbright Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bank of China (BOC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ping An Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bank of Communications

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Merchants Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

List of Figures

- Figure 1: Global Banking Industry in China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 7: North America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 8: North America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 11: South America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 13: South America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 14: South America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 15: South America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 16: South America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 19: Europe Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 21: Europe Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 22: Europe Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 23: Europe Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 24: Europe Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East & Africa Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 29: Middle East & Africa Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Middle East & Africa Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 31: Middle East & Africa Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 32: Middle East & Africa Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 35: Asia Pacific Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 37: Asia Pacific Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 38: Asia Pacific Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 39: Asia Pacific Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 40: Asia Pacific Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Banking Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 4: Global Banking Industry in China Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 7: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 15: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 21: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 22: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 34: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 35: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 43: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 44: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 45: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking Industry in China?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Banking Industry in China?

Key companies in the market include Industrial and Commercial Bank of China (ICBC) , China Construction Bank (CCB) , Shanghai Pudong Development Bank , CITIC Bank, Agricultural Bank of China (ABC) , China Everbright Bank , Bank of China (BOC) , Ping An Bank , Bank of Communications , China Merchants Bank .

3. What are the main segments of the Banking Industry in China?

The market segments include Product, Industry, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Technology and Digitalization Trends are Driving the Market.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking Industry in China?

To stay informed about further developments, trends, and reports in the Banking Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence