Key Insights

The global dental insurance market is set for substantial growth, projected to reach $117.7 billion by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. Increasing awareness of oral health's link to overall well-being is compelling individuals and corporations to adopt comprehensive dental coverage. The rising incidence of dental conditions, alongside advancements in treatments and technologies, further fuels market demand. Businesses are increasingly offering dental insurance as a key employee benefit to attract and retain talent. Additionally, the aging global population, with a higher susceptibility to dental ailments, presents a significant demographic driver. A shift towards value-based care and preventive dental practices is also shaping market dynamics, promoting plans that cover regular check-ups and cleanings.

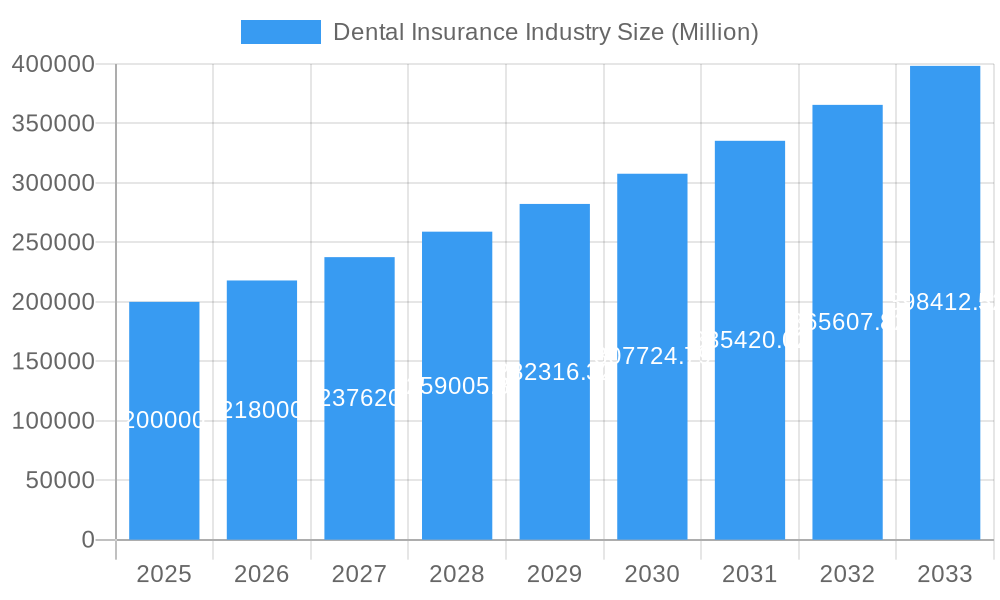

Dental Insurance Industry Market Size (In Billion)

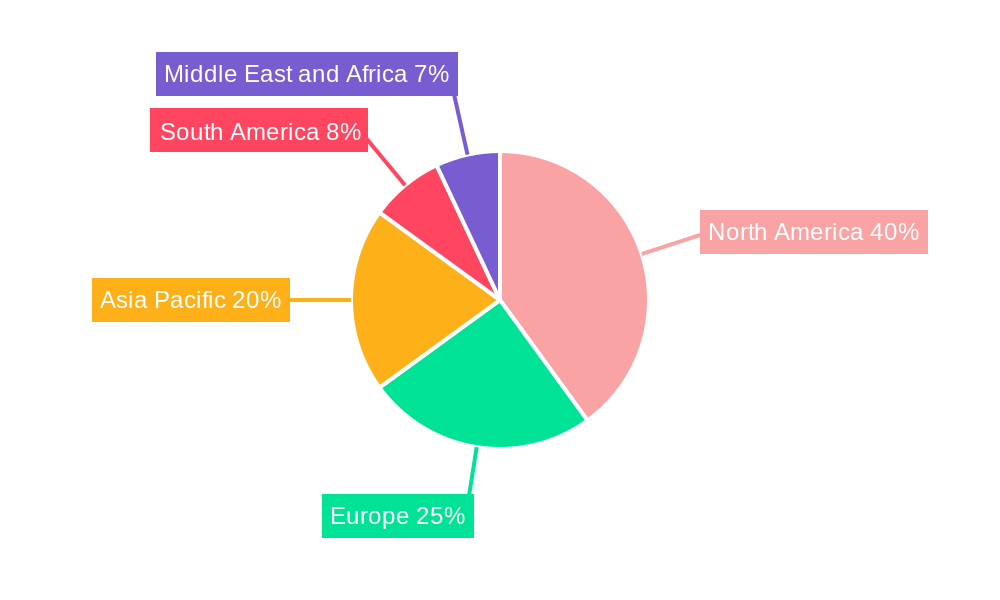

The market segmentation highlights a diverse landscape, with Dental Preferred Provider Organizations (DPPO) anticipated to hold a leading share due to their balance of cost-effectiveness and provider choice. Preventive procedures represent the largest segment by procedure type, underscoring the industry's proactive stance on oral health. Both individual consumers and corporate clients prioritizing employee benefits are significant end-users. Geographically, North America is expected to dominate the market, supported by high healthcare expenditure and established insurance infrastructure. However, the Asia Pacific region is projected to experience the fastest growth, driven by increasing disposable incomes, heightened health consciousness, and expanding healthcare access. Potential restraints include the premium costs of comprehensive plans and varied governmental support for dental care across regions. Despite these challenges, the ongoing emphasis on improved oral health and continuous innovation in insurance products are poised to propel the dental insurance market forward.

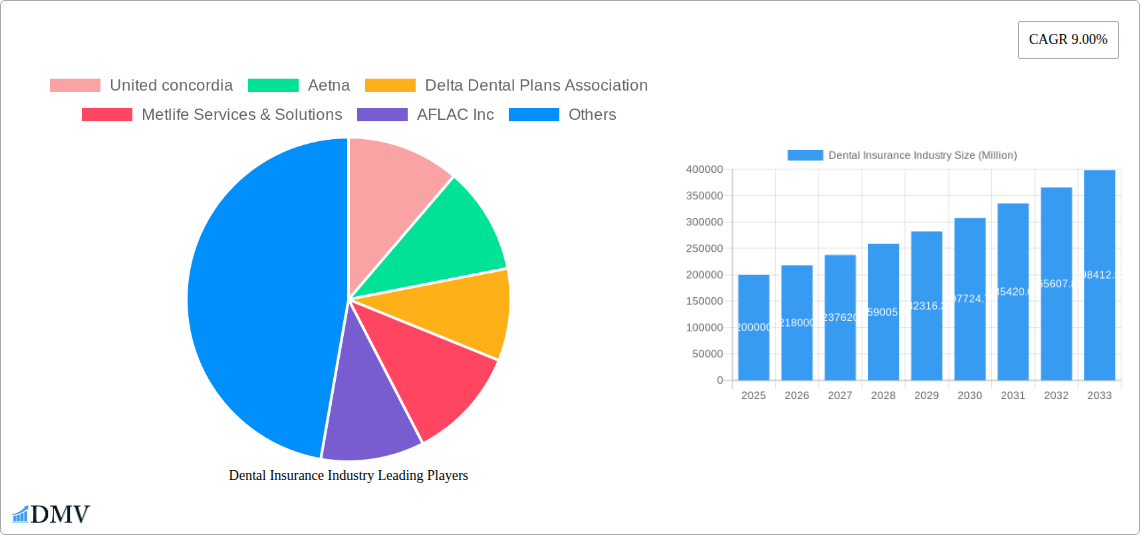

Dental Insurance Industry Company Market Share

Dental Insurance Industry Market Composition & Trends

This comprehensive report delves into the intricate market composition of the dental insurance industry, analyzing key trends and providing actionable insights for stakeholders. We examine the market concentration dynamics, identifying leading players and their market share distribution, which is estimated to be highly fragmented with the top five companies holding approximately 65% of the market share. Innovation catalysts, including the integration of telehealth for consultations and digital claims processing, are explored for their potential to reshape service delivery. The evolving regulatory landscapes across major economies are dissected, highlighting their impact on market access and operational frameworks. We also assess the influence of substitute products and services, such as direct patient financing and dental savings plans, on the traditional dental insurance model. End-user profiles are meticulously profiled, categorizing demand drivers for individuals, corporates, and specific demographic segments like senior citizens, adults, and minors. Furthermore, the report scrutinizes Mergers & Acquisitions (M&A) activities, with M&A deal values estimated to reach over USD 5 Million in the historical period, signaling consolidation and strategic expansion within the industry.

- Market Concentration: Highly fragmented, with top players dominating market share.

- Innovation Catalysts: Telehealth adoption, digital claims, AI in underwriting.

- Regulatory Landscape: Continuous evolution impacting product design and pricing.

- Substitute Products: Direct financing and savings plans pose competitive threats.

- End-User Profiles: Differentiated needs for individuals, corporates, and demographics.

- M&A Activities: Strategic consolidations driving market expansion and synergy.

Dental Insurance Industry Industry Evolution

The dental insurance industry has undergone a significant evolution, characterized by dynamic market growth trajectories, rapid technological advancements, and a profound shift in consumer demands. From its nascent stages, the industry has transitioned into a mature yet rapidly innovating sector, driven by increasing awareness of oral health's importance and its correlation with overall well-being. The historical period (2019–2024) witnessed a steady Compound Annual Growth Rate (CAGR) of approximately 6.8%, fueled by expanding employer-sponsored plans and a growing number of individuals seeking standalone dental coverage. Technological advancements have been a pivotal force in this evolution. The integration of artificial intelligence (AI) in underwriting and claims processing has streamlined operations, reducing administrative costs and enhancing customer experience. Furthermore, the adoption of big data analytics enables insurers to gain deeper insights into consumer behavior, risk assessment, and personalized product development. The shift in consumer demands is evident in the increasing preference for comprehensive plans that cover a wider range of procedures, including cosmetic dentistry, and a growing interest in preventive care services. This demand has pushed insurers to offer more flexible and customizable plans, moving away from one-size-fits-all solutions. The rise of digital platforms and mobile applications has also revolutionized how consumers interact with their dental insurance providers, facilitating easier access to information, provider networks, and claim submissions. The forecast period (2025–2033) is projected to see this growth accelerate, with an estimated CAGR of 7.5%, driven by ongoing technological integration, an aging global population with increased dental care needs, and expanding market penetration in emerging economies. The industry's ability to adapt to these evolving dynamics, embracing innovation and catering to diverse consumer needs, will be crucial for sustained success.

Leading Regions, Countries, or Segments in Dental Insurance Industry

The dental insurance industry exhibits distinct leadership across various segments, driven by a confluence of factors including robust healthcare infrastructure, favorable regulatory environments, and evolving consumer needs. Among the coverage types, Dental Preferred Provider Organizations (DPPO) consistently dominate the market, accounting for an estimated 55% of the total market share due to their flexibility in provider choice and cost-effectiveness for consumers. Dental Health Maintenance Organizations (DHMO) follow, holding approximately 30% of the market, particularly in regions with a strong emphasis on managed care. The leading regions for dental insurance penetration are North America and Western Europe, driven by high per capita income, established healthcare systems, and a strong culture of preventive healthcare. Within these regions, the United States emerges as the largest single market, benefiting from a mature insurance ecosystem and a significant proportion of its population covered by employer-sponsored dental plans.

Key drivers underpinning this dominance include:

- Investment Trends: Significant investments by insurance giants in digital transformation, enabling seamless online enrollment, claims processing, and customer service. For instance, investments in AI-powered claims adjudication are estimated to be in the hundreds of Million.

- Regulatory Support: Favorable government policies and mandates that encourage the inclusion of dental coverage in comprehensive health plans, particularly for corporate employees.

- Demographic Factors: An aging population in developed nations leads to increased demand for dental care, especially for chronic conditions and restorative procedures. Senior citizens represent a growing segment with specific dental needs.

- Consumer Awareness: Growing awareness about the link between oral health and overall systemic health is prompting individuals to proactively seek dental insurance.

- Corporate Benefits: The emphasis on employee wellness programs by corporations continues to drive demand for group dental insurance plans.

In terms of procedural coverage, Preventive care remains the most frequently utilized service, reflecting the industry's focus on early intervention and long-term oral health. However, demand for Basic and Major procedures is also on the rise, as improved treatment options become more accessible and as individuals with comprehensive plans opt for more extensive care. For end-users, the Corporate segment represents the largest market, followed by Individuals. Minors, though a smaller segment, represent a crucial demographic for long-term customer acquisition and retention, with parental focus on their children's health. The dominance of DPPOs in North America, coupled with the robust demand from both individual and corporate sectors, solidifies its position as the leading segment in the global dental insurance landscape.

Dental Insurance Industry Product Innovations

Product innovation in the dental insurance industry is rapidly transforming service delivery and consumer experience. Key advancements include the introduction of tiered benefit plans offering varying levels of coverage for preventive, basic, and major procedures, catering to diverse budget constraints. We are also seeing a surge in digital-first insurance products, with fully online enrollment, policy management, and claims submission processes, significantly enhancing convenience. The integration of telehealth for dental consultations, allowing remote assessment of minor issues and guidance, is another significant innovation. Furthermore, many insurers are now offering enhanced coverage for orthodontics and cosmetic dentistry, responding to evolving consumer preferences. Performance metrics for these innovations show a notable increase in customer satisfaction scores by over 15% and a reduction in administrative costs by as much as 10% through digital streamlining.

Propelling Factors for Dental Insurance Industry Growth

The dental insurance industry is propelled by several robust growth factors. Technologically, the widespread adoption of AI and big data analytics is revolutionizing underwriting, claims processing, and personalized plan offerings, leading to greater efficiency and customer satisfaction. Economically, rising disposable incomes and an increasing emphasis on holistic health contribute to higher demand for dental care and insurance. Governments worldwide are also recognizing the importance of oral health, leading to favorable regulatory frameworks and initiatives that encourage dental insurance coverage, particularly for underserved populations. Furthermore, the growing awareness among individuals and employers about the link between oral health and overall well-being acts as a significant catalyst, driving proactive engagement with dental insurance solutions.

Obstacles in the Dental Insurance Industry Market

Despite its growth, the dental insurance industry faces several obstacles. Regulatory challenges, including complex compliance requirements across different jurisdictions and evolving mandates for coverage, can increase operational costs and hinder market expansion. While the overall market is growing, supply chain disruptions affecting the availability of dental materials and skilled professionals can impact the delivery of services and increase the cost of claims. Competitive pressures from direct-to-consumer dental savings plans and integrated healthcare providers offering bundled services also pose a threat. Quantifiable impacts include an estimated 5% increase in administrative costs due to regulatory compliance and potential delays in claim settlements due to provider network limitations.

Future Opportunities in Dental Insurance Industry

Emerging opportunities in the dental insurance industry are abundant. Expansion into underserved markets and developing economies presents a significant untapped potential, with a growing middle class eager for comprehensive healthcare. Technological advancements, such as the further integration of AI for predictive analytics and personalized wellness programs, offer avenues for enhanced customer engagement and risk management. The increasing focus on preventive care and oral health's connection to systemic health opens doors for innovative wellness programs and partnerships with health technology companies. Furthermore, the aging global population will drive sustained demand for dental services, creating a long-term growth trajectory for dental insurance providers.

Major Players in the Dental Insurance Industry Ecosystem

- United Concordia

- Aetna

- Delta Dental Plans Association

- Metlife Services & Solutions

- AFLAC Inc

- Allianz SE

- United HealthCare Services Inc

- AXA

- HDFC Ergo Health Insurance Ltd

- Cigna

- Ameritas Life Insurance Corp

Key Developments in Dental Insurance Industry Industry

- June 2022: Bajaj Allianz collaborated with Allianz Partners to launch Global Health Care, providing extensive health coverage globally. The product offers a wide Sum Insured range from USD 100,000 to USD 1,000,000, with 'Imperial Plan' and 'Imperial Plus Plan' options for International and Domestic Covers.

- January 2022: Aetna expanded its Medicare Advantage Prescription Drug (MAPD) plans to 46 states, adding 83 new counties and providing access to an additional 1 million Medicare beneficiaries. In total, Aetna offered MAPD plans in 1,875 counties in 2022, accessible by 53.2 million Medicare beneficiaries.

Strategic Dental Insurance Industry Market Forecast

The strategic dental insurance market forecast indicates a robust growth trajectory driven by an increasing understanding of oral health's systemic impact and a proactive approach to preventive care. Technological advancements, particularly in AI-powered diagnostics and personalized treatment plans, will continue to enhance service delivery and customer satisfaction. The expansion of employer-sponsored benefits and the growing demand from individual consumers, especially among senior citizens and adults, will fuel market penetration. Emerging economies present significant untapped potential for growth as healthcare infrastructure develops and disposable incomes rise. The market is poised for continued expansion, with an estimated market value to reach over USD 50 Million by the end of the forecast period.

Dental Insurance Industry Segmentation

-

1. Coverage

- 1.1. Dental health maintenance organizations (DHMO)

- 1.2. Dental preferred provider organizations (DPPO)

- 1.3. Dental Indemnity plans (DIP)

- 1.4. Dental exclusive provider organizations (DEPO)

- 1.5. Dental point of service (DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End-users

- 3.1. Individuals

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior citizens

- 4.2. Adults

- 4.3. Minors

Dental Insurance Industry Segmentation By Geography

- 1. North America

- 2. South America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Dental Insurance Industry Regional Market Share

Geographic Coverage of Dental Insurance Industry

Dental Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental health maintenance organizations (DHMO)

- 5.1.2. Dental preferred provider organizations (DPPO)

- 5.1.3. Dental Indemnity plans (DIP)

- 5.1.4. Dental exclusive provider organizations (DEPO)

- 5.1.5. Dental point of service (DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Individuals

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior citizens

- 5.4.2. Adults

- 5.4.3. Minors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Asia Pacific

- 5.5.4. Europe

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Dental health maintenance organizations (DHMO)

- 6.1.2. Dental preferred provider organizations (DPPO)

- 6.1.3. Dental Indemnity plans (DIP)

- 6.1.4. Dental exclusive provider organizations (DEPO)

- 6.1.5. Dental point of service (DPS)

- 6.2. Market Analysis, Insights and Forecast - by Procedure

- 6.2.1. Preventive

- 6.2.2. Major

- 6.2.3. Basic

- 6.3. Market Analysis, Insights and Forecast - by End-users

- 6.3.1. Individuals

- 6.3.2. Corporates

- 6.4. Market Analysis, Insights and Forecast - by Demographics

- 6.4.1. Senior citizens

- 6.4.2. Adults

- 6.4.3. Minors

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Dental health maintenance organizations (DHMO)

- 7.1.2. Dental preferred provider organizations (DPPO)

- 7.1.3. Dental Indemnity plans (DIP)

- 7.1.4. Dental exclusive provider organizations (DEPO)

- 7.1.5. Dental point of service (DPS)

- 7.2. Market Analysis, Insights and Forecast - by Procedure

- 7.2.1. Preventive

- 7.2.2. Major

- 7.2.3. Basic

- 7.3. Market Analysis, Insights and Forecast - by End-users

- 7.3.1. Individuals

- 7.3.2. Corporates

- 7.4. Market Analysis, Insights and Forecast - by Demographics

- 7.4.1. Senior citizens

- 7.4.2. Adults

- 7.4.3. Minors

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Asia Pacific Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Dental health maintenance organizations (DHMO)

- 8.1.2. Dental preferred provider organizations (DPPO)

- 8.1.3. Dental Indemnity plans (DIP)

- 8.1.4. Dental exclusive provider organizations (DEPO)

- 8.1.5. Dental point of service (DPS)

- 8.2. Market Analysis, Insights and Forecast - by Procedure

- 8.2.1. Preventive

- 8.2.2. Major

- 8.2.3. Basic

- 8.3. Market Analysis, Insights and Forecast - by End-users

- 8.3.1. Individuals

- 8.3.2. Corporates

- 8.4. Market Analysis, Insights and Forecast - by Demographics

- 8.4.1. Senior citizens

- 8.4.2. Adults

- 8.4.3. Minors

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Europe Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Dental health maintenance organizations (DHMO)

- 9.1.2. Dental preferred provider organizations (DPPO)

- 9.1.3. Dental Indemnity plans (DIP)

- 9.1.4. Dental exclusive provider organizations (DEPO)

- 9.1.5. Dental point of service (DPS)

- 9.2. Market Analysis, Insights and Forecast - by Procedure

- 9.2.1. Preventive

- 9.2.2. Major

- 9.2.3. Basic

- 9.3. Market Analysis, Insights and Forecast - by End-users

- 9.3.1. Individuals

- 9.3.2. Corporates

- 9.4. Market Analysis, Insights and Forecast - by Demographics

- 9.4.1. Senior citizens

- 9.4.2. Adults

- 9.4.3. Minors

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Middle East and Africa Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Dental health maintenance organizations (DHMO)

- 10.1.2. Dental preferred provider organizations (DPPO)

- 10.1.3. Dental Indemnity plans (DIP)

- 10.1.4. Dental exclusive provider organizations (DEPO)

- 10.1.5. Dental point of service (DPS)

- 10.2. Market Analysis, Insights and Forecast - by Procedure

- 10.2.1. Preventive

- 10.2.2. Major

- 10.2.3. Basic

- 10.3. Market Analysis, Insights and Forecast - by End-users

- 10.3.1. Individuals

- 10.3.2. Corporates

- 10.4. Market Analysis, Insights and Forecast - by Demographics

- 10.4.1. Senior citizens

- 10.4.2. Adults

- 10.4.3. Minors

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 United concordia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aetna

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Dental Plans Association

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metlife Services & Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AFLAC Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allianz SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United HealthCare Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AXA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HDFC Ergo Health Insurance Ltd**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cigna

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ameritas Life Insurance Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 United concordia

List of Figures

- Figure 1: Global Dental Insurance Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 3: North America Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 4: North America Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 5: North America Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 6: North America Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 7: North America Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 8: North America Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 9: North America Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 10: North America Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 13: South America Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 14: South America Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 15: South America Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 16: South America Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 17: South America Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 18: South America Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 19: South America Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 20: South America Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 23: Asia Pacific Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 24: Asia Pacific Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 25: Asia Pacific Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 26: Asia Pacific Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 27: Asia Pacific Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 28: Asia Pacific Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 29: Asia Pacific Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 30: Asia Pacific Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Europe Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 33: Europe Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 34: Europe Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 35: Europe Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 36: Europe Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 37: Europe Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 38: Europe Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 39: Europe Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 40: Europe Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Europe Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 43: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 44: Middle East and Africa Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 45: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 46: Middle East and Africa Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 47: Middle East and Africa Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 48: Middle East and Africa Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 49: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 50: Middle East and Africa Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 2: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 3: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 4: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 5: Global Dental Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 7: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 8: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 9: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 10: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 12: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 13: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 14: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 15: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 17: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 18: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 19: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 20: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 22: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 23: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 24: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 25: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 27: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 28: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 29: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 30: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Insurance Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Dental Insurance Industry?

Key companies in the market include United concordia, Aetna, Delta Dental Plans Association, Metlife Services & Solutions, AFLAC Inc, Allianz SE, United HealthCare Services Inc, AXA, HDFC Ergo Health Insurance Ltd**List Not Exhaustive, Cigna, Ameritas Life Insurance Corp.

3. What are the main segments of the Dental Insurance Industry?

The market segments include Coverage, Procedure, End-users, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

In June 2022, Bajaj Allianz collaborated with Allianz Partners to launch Global Health Care, to provide health coverage across the world. Global Health Care product offers one of the widest Sum Insured ranges available in the Indian market, which starts from USD 100,000 to USD 1,000,000. The product is available with two plans, namely 'Imperial Plan' and 'Imperial Plus Plan', which offer both International and Domestic Covers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Insurance Industry?

To stay informed about further developments, trends, and reports in the Dental Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence