Key Insights

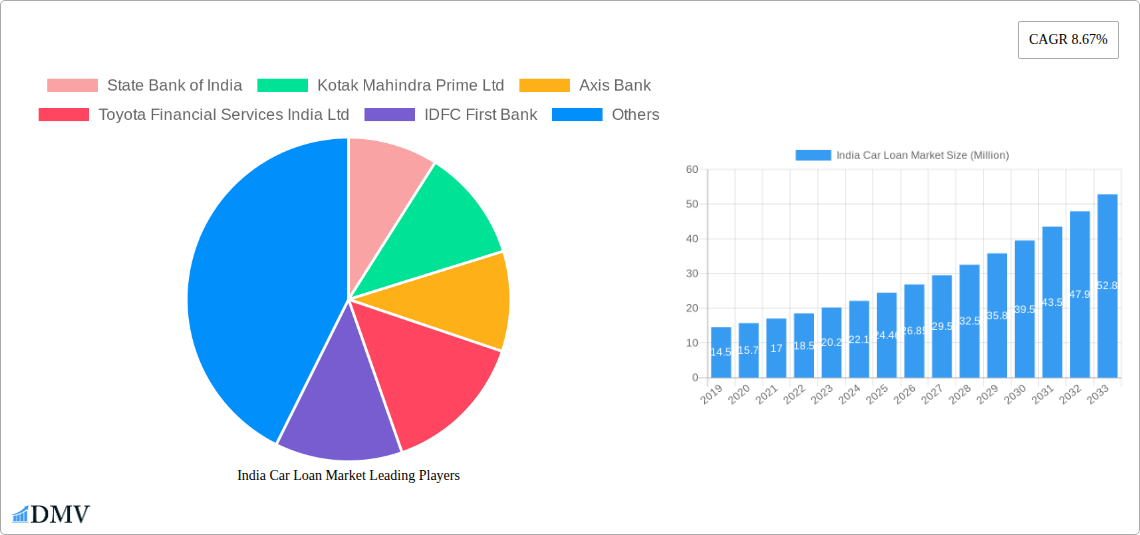

The India Car Loan Market is poised for robust expansion, projected to reach a significant valuation of 24.46 Million by the end of 2025. This growth is fueled by a dynamic Compound Annual Growth Rate (CAGR) of 8.67% over the forecast period of 2025-2033. The market's expansion is driven by several key factors. A rising disposable income among the Indian populace, coupled with increasing aspirations for personal vehicle ownership, forms a primary impetus. The government's focus on infrastructure development, leading to better road networks and connectivity, also makes car ownership a more attractive and practical proposition. Furthermore, the growing availability of diverse and competitive car loan products offered by a wide array of financial institutions, including Original Equipment Manufacturers (OEMs), banks, and Non-Banking Financial Companies (NBFCs), is significantly enhancing accessibility for consumers. The shift towards larger vehicle segments, particularly SUVs, and the increasing demand for pre-owned vehicles are also contributing to market diversification and growth.

India Car Loan Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of trends and restraints. A significant trend is the increasing preference for flexible loan tenures, with a notable segment opting for loans of "Less than 3 Years" and "3-5 Years," indicating a desire for shorter ownership cycles and easier upgrade paths. The proliferation of digital lending platforms and fintech innovations is streamlining the loan application and approval process, making it more convenient and faster for consumers. However, potential restraints such as rising interest rates, fluctuating fuel prices, and evolving regulatory frameworks could pose challenges. Despite these, the inherent demand for mobility and the aspirational value associated with car ownership in India suggest a resilient and upward trajectory for the car loan market. The market's segmentation across new and used cars, various car types like SUVs, Hatchbacks, and Sedans, and different provider types, highlights its multifaceted nature and broad appeal across diverse consumer segments.

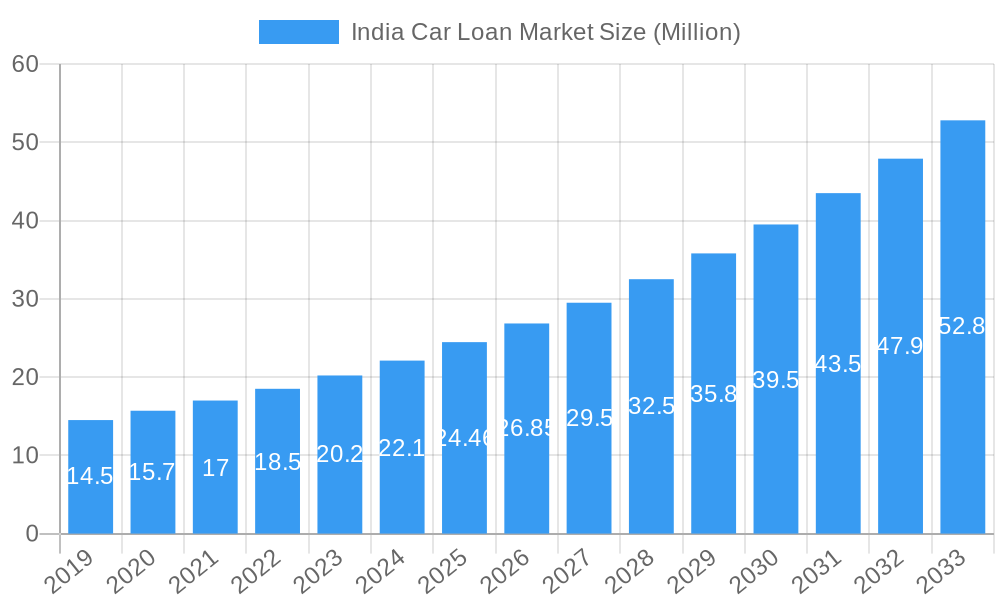

India Car Loan Market Company Market Share

This in-depth report delivers critical insights into the dynamic India Car Loan Market, offering a detailed analysis of market composition, trends, and future trajectories. Covering the study period from 2019 to 2033, with a base year of 2025 and a comprehensive forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving automotive finance landscape in India. Discover key growth drivers, emerging opportunities, and competitive strategies within this rapidly expanding sector.

India Car Loan Market Market Composition & Trends

The India Car Loan Market exhibits a dynamic composition shaped by evolving economic factors, technological advancements, and robust consumer demand for personal mobility. Market concentration is moderately fragmented, with prominent players like State Bank of India, Kotak Mahindra Prime Ltd, Axis Bank, Toyota Financial Services India Ltd, IDFC First Bank, Mahindra & Mahindra Financial Services Limited, Shriram Transport Finance Co Ltd, Tata Motors, Housing Development Finance Corporation Bank, and Industrial Credit and Investment Corporation of India Bank holding significant shares. Innovation is primarily driven by enhanced digital lending platforms, flexible repayment options, and a focus on customer convenience, fueled by the burgeoning new car loan and used car loan segments. Regulatory frameworks, overseen by bodies like the Reserve Bank of India, continuously evolve to ensure market stability and consumer protection, impacting interest rates and lending norms. Substitute products, such as peer-to-peer lending and outright cash purchases for pre-owned vehicles, present a minor competitive challenge. End-user profiles span a wide demographic, from first-time buyers seeking affordable financing for hatchbacks and sedans to families investing in larger SUVs, all influenced by rising disposable incomes and urbanization. Merger and acquisition (M&A) activities are anticipated to increase as larger financial institutions seek to consolidate market share and expand their reach within the OEM, Banks, and NBFCs provider types. The M&A deal values are expected to reflect the strategic importance of acquiring robust customer bases and technological capabilities.

- Market Concentration: Moderately fragmented with significant contributions from leading banks and NBFCs.

- Innovation Catalysts: Digitalization of loan processes, flexible EMI options, and competitive interest rates.

- Regulatory Landscape: Influenced by RBI guidelines on lending, interest rate caps, and financial inclusion initiatives.

- Substitute Products: Limited impact from P2P lending and direct cash purchases for pre-owned vehicles.

- End-User Profiles: Diverse, encompassing young professionals, families, and individuals across income strata.

- M&A Activities: Anticipated to grow as market consolidation intensifies.

India Car Loan Market Industry Evolution

The India Car Loan Market has undergone a remarkable evolution over the historical period of 2019-2024, driven by a confluence of economic growth, technological disruption, and shifting consumer preferences. The study period from 2019 to 2033 highlights a consistent upward trajectory in market expansion. During the initial years, traditional banking channels dominated the landscape, offering standard financing solutions for new vehicle purchases. However, the emergence of digital lending platforms and the increasing penetration of smartphones began to revolutionize access to credit. This shift was further accelerated by the growing acceptance of used car loans, as consumers sought more affordable options to own vehicles.

Technological advancements have been a pivotal force in this evolution. The introduction of AI-powered credit scoring, instant loan approvals, and online application processes by major players like IDFC First Bank and HDFC Bank have significantly reduced turnaround times and enhanced customer experience. This digital transformation has also led to the proliferation of Non-Banking Financial Companies (NBFCs) and Original Equipment Manufacturers (OEMs) offering tailored financing solutions, often with attractive schemes and lower initial down payments. For instance, the September 2023 strategic partnership between CSB Bank and Daimler India Commercial Vehicle (DICV) for vehicle financing exemplifies this trend, aiming to bolster support for dealerships and customers.

Consumer demand has also played a crucial role. An aspirational middle class, coupled with increased urbanization and a growing preference for personal mobility, has fueled the demand for new and pre-owned vehicles. This demand is reflected in the varied preferences across car types, with SUVs continuing their dominance, followed by hatchbacks and sedans. The flexibility in tenure options, ranging from less than 3 years for short-term commitments to more than 5 years for longer-term affordability, caters to diverse financial capabilities. The overall market growth rate, projected to maintain a healthy pace throughout the forecast period of 2025-2033, is a testament to the resilience and adaptive nature of the Indian automotive finance sector. The adoption of digital channels for loan origination and servicing is expected to continue its upward trend, with adoption metrics for online applications and digital loan disbursements steadily increasing.

Leading Regions, Countries, or Segments in India Car Loan Market

The India Car Loan Market is characterized by distinct regional dominance and segment preferences, driven by a complex interplay of economic prosperity, demographic factors, and evolving consumer behavior. While the entire nation presents a significant market, the urban and semi-urban regions of Western India and Southern India historically emerge as leading contributors to car loan disbursements. These regions benefit from higher per capita incomes, greater industrialization, and a more pronounced aspirational lifestyle, translating into a robust demand for personal vehicles.

Within this landscape, the New Car segment consistently leads in terms of loan volume, reflecting a preference for the latest models and the associated benefits of new vehicle warranties and advanced features. However, the Used Car segment is experiencing rapid growth, driven by economic prudence and the availability of a wider range of vehicles at more accessible price points. This surge in the used car market is a significant trend across all provider types.

In terms of Car Type, the SUV segment continues to capture a substantial share of the market, driven by its perceived utility, comfort, and status appeal. Hatchbacks remain popular for their affordability and fuel efficiency, particularly in tier-2 and tier-3 cities, while Sedans cater to a segment of buyers looking for a balance of comfort and style.

The Provider Type landscape is bifurcated, with Banks holding a substantial market share due to their established trust, wide branch networks, and competitive interest rates. However, NBFCs (Non-Banking Financial Companies) are rapidly gaining ground, offering greater flexibility, faster processing times, and catering to a broader spectrum of credit profiles. OEMs (Original Equipment Manufacturers), through their captive finance arms like Toyota Financial Services India Ltd, play a crucial role, often bundling attractive financing schemes with vehicle purchases to drive sales.

The Tenure of car loans also reveals significant segment preferences. While 3-5 Years remains the most popular tenure, offering a balance between manageable EMIs and quicker loan repayment, a notable shift towards More Than 5 Years is observed, especially for higher-value vehicle purchases like premium SUVs, to reduce the monthly financial burden. Conversely, Less Than 3 Years tenure is favored by individuals with higher disposable incomes or those who prefer to upgrade their vehicles frequently.

- Dominant Regions: Western and Southern India, due to economic prosperity and urbanization.

- Leading Segment (Type): New Car, with a rapidly growing Used Car segment.

- Dominant Segment (Car Type): SUV, followed by Hatchback and Sedan.

- Key Provider Types: Banks and NBFCs, with OEMs playing a strategic role.

- Preferred Tenure: 3-5 Years, with an increasing trend towards More Than 5 Years for higher-value vehicles.

- Key Drivers for Dominance: High disposable incomes, aspirational lifestyles, availability of diverse vehicle options, and flexible financing schemes.

India Car Loan Market Product Innovations

Product innovation in the India Car Loan Market is increasingly focused on enhancing customer convenience, reducing processing times, and offering competitive pricing. Digital lending platforms have emerged as a significant innovation, enabling seamless online applications, document submission, and real-time loan status tracking. Unique selling propositions often include pre-approved loan offers based on sophisticated credit algorithms and the introduction of flexible EMI options, allowing borrowers to adjust payments based on their income cycles. Some financial institutions are also exploring co-branded credit cards linked to car loans, such as the collaboration between IDFC First Bank, LIC Cards, and Mastercard, offering reward points on insurance premium payments. Performance metrics for these innovations include reduced loan origination costs, faster disbursement times, and improved customer satisfaction scores.

Propelling Factors for India Car Loan Market Growth

The India Car Loan Market is propelled by a potent combination of technological, economic, and regulatory influences.

- Economic Growth & Rising Disposable Incomes: A burgeoning middle class with increased purchasing power fuels the demand for personal vehicles.

- Technological Advancements: Digital lending platforms, AI-driven credit assessment, and seamless online applications enhance accessibility and convenience.

- Favorable Government Policies: Initiatives promoting financial inclusion and easier access to credit for consumers.

- Attractive Financing Options: Competitive interest rates, flexible tenures, and attractive schemes offered by banks, NBFCs, and OEMs.

- Urbanization & Aspirations: Growing preference for personal mobility and the aspirational desire for vehicle ownership, especially in urban centers.

- Growth of the Used Car Market: Increased affordability and accessibility to pre-owned vehicles, expanding the customer base for car loans.

Obstacles in the India Car Loan Market Market

Despite robust growth, the India Car Loan Market faces several obstacles that can impact its expansion.

- Regulatory Stringency: Evolving norms and compliance requirements can add to operational costs and slow down the loan disbursement process.

- Non-Performing Assets (NPAs): Economic downturns or unexpected personal financial shocks can lead to an increase in defaults, posing a risk to lenders.

- Interest Rate Volatility: Fluctuations in central bank rates can impact the profitability of lenders and the affordability for borrowers.

- Intense Competition: A highly fragmented market with numerous players leads to margin pressures and necessitates continuous innovation.

- Limited Financial Literacy: A segment of the population may lack adequate understanding of loan terms, leading to potential misjudgments.

Future Opportunities in India Car Loan Market

The India Car Loan Market is ripe with future opportunities, driven by emerging consumer trends and technological advancements.

- Expansion into Tier-2 and Tier-3 Cities: Untapped markets with growing aspirations for vehicle ownership.

- Growth of Electric Vehicle (EV) Financing: Increasing demand for EVs presents a new segment for specialized car loan products.

- Data Analytics and AI: Enhanced credit scoring models and personalized loan offerings for improved risk management and customer acquisition.

- Partnerships and Collaborations: Strategic alliances between financial institutions, auto manufacturers, and technology providers to offer bundled solutions.

- Subscription-Based Models: Exploring innovative ownership models beyond traditional loans.

Major Players in the India Car Loan Market Ecosystem

- State Bank of India

- Kotak Mahindra Prime Ltd

- Axis Bank

- Toyota Financial Services India Ltd

- IDFC First Bank

- Mahindra & Mahindra Financial Services Limited

- Shriram Transport Finance Co Ltd

- Tata Motors

- Housing Development Finance Corporation Bank

- Industrial Credit and Investment Corporation of India Bank

Key Developments in India Car Loan Market Industry

- December 2023: IDFC FIRST Bank, LIC Cards, and Mastercard collaborated to launch an exclusive co-branded credit card. Available in two variants, LIC Classic and LIC Select, the credit cards will provide more than 27 crore policyholders across the country an opportunity to save in the form of reward points on every LIC insurance premium payment, the companies said in a joint statement.

- September 2023: CSB Bank and Daimler India Commercial Vehicle (DICV) announced a strategic partnership for vehicle financing. This collaboration offers enhanced support to dealerships and customers while fostering growth and innovation within the sector.

Strategic India Car Loan Market Market Forecast

The India Car Loan Market is poised for sustained growth, driven by a confluence of favorable economic indicators, evolving consumer preferences, and significant technological advancements. The forecast period of 2025-2033 anticipates a robust expansion, fueled by increasing disposable incomes, a growing young population, and the persistent demand for personal mobility. The continuous innovation in digital lending platforms will further democratize access to car finance, particularly in emerging markets and for used vehicle purchases. Strategic collaborations between financial institutions, OEMs, and technology providers will unlock new avenues for customer acquisition and product development, including the burgeoning segment of electric vehicle financing. The market's ability to adapt to regulatory changes and address potential challenges like NPAs will be crucial in realizing its full growth potential.

India Car Loan Market Segmentation

-

1. Type

- 1.1. New Car

- 1.2. Used Car

-

2. Car Type

- 2.1. SUV

- 2.2. Hatchback

- 2.3. Sedan

-

3. Provider Type

- 3.1. OEM (Original Equipment Manufacturers)

- 3.2. Banks

- 3.3. NBFCs (Non Banking Financials Companies)

-

4. Tenure

- 4.1. Less than 3 Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

India Car Loan Market Segmentation By Geography

- 1. India

India Car Loan Market Regional Market Share

Geographic Coverage of India Car Loan Market

India Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Expanding Middle-class population

- 3.3. Market Restrains

- 3.3.1. The Expanding Middle-class population

- 3.4. Market Trends

- 3.4.1. Increase Sales of Passenger Cars in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Car

- 5.1.2. Used Car

- 5.2. Market Analysis, Insights and Forecast - by Car Type

- 5.2.1. SUV

- 5.2.2. Hatchback

- 5.2.3. Sedan

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. OEM (Original Equipment Manufacturers)

- 5.3.2. Banks

- 5.3.3. NBFCs (Non Banking Financials Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than 3 Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 State Bank of India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kotak Mahindra Prime Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axis Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Financial Services India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IDFC First Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Financial Services Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shriram Transport Finance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Housing Development Finance Corporation Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Industrial Credit and Investment Corporation of India Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 State Bank of India

List of Figures

- Figure 1: India Car Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Car Loan Market Share (%) by Company 2025

List of Tables

- Table 1: India Car Loan Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Car Loan Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Car Loan Market Revenue Million Forecast, by Car Type 2020 & 2033

- Table 4: India Car Loan Market Volume Billion Forecast, by Car Type 2020 & 2033

- Table 5: India Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: India Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 7: India Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: India Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: India Car Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Car Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: India Car Loan Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: India Car Loan Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: India Car Loan Market Revenue Million Forecast, by Car Type 2020 & 2033

- Table 14: India Car Loan Market Volume Billion Forecast, by Car Type 2020 & 2033

- Table 15: India Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: India Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 17: India Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: India Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 19: India Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Car Loan Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the India Car Loan Market?

Key companies in the market include State Bank of India, Kotak Mahindra Prime Ltd, Axis Bank, Toyota Financial Services India Ltd, IDFC First Bank, Mahindra & Mahindra Financial Services Limited, Shriram Transport Finance Co Ltd, Tata Motors, Housing Development Finance Corporation Bank, Industrial Credit and Investment Corporation of India Bank**List Not Exhaustive.

3. What are the main segments of the India Car Loan Market?

The market segments include Type, Car Type, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.46 Million as of 2022.

5. What are some drivers contributing to market growth?

The Expanding Middle-class population.

6. What are the notable trends driving market growth?

Increase Sales of Passenger Cars in India.

7. Are there any restraints impacting market growth?

The Expanding Middle-class population.

8. Can you provide examples of recent developments in the market?

December 2023: IDFC FIRST Bank, LIC Cards, and Mastercard collaborated to launch an exclusive co-branded credit card. Available in two variants, LIC Classic and LIC Select, the credit cards will provide more than 27 crore policyholders across the country an opportunity to save in the form of reward points on every LIC insurance premium payment, the companies said in a joint statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Car Loan Market?

To stay informed about further developments, trends, and reports in the India Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence