Key Insights

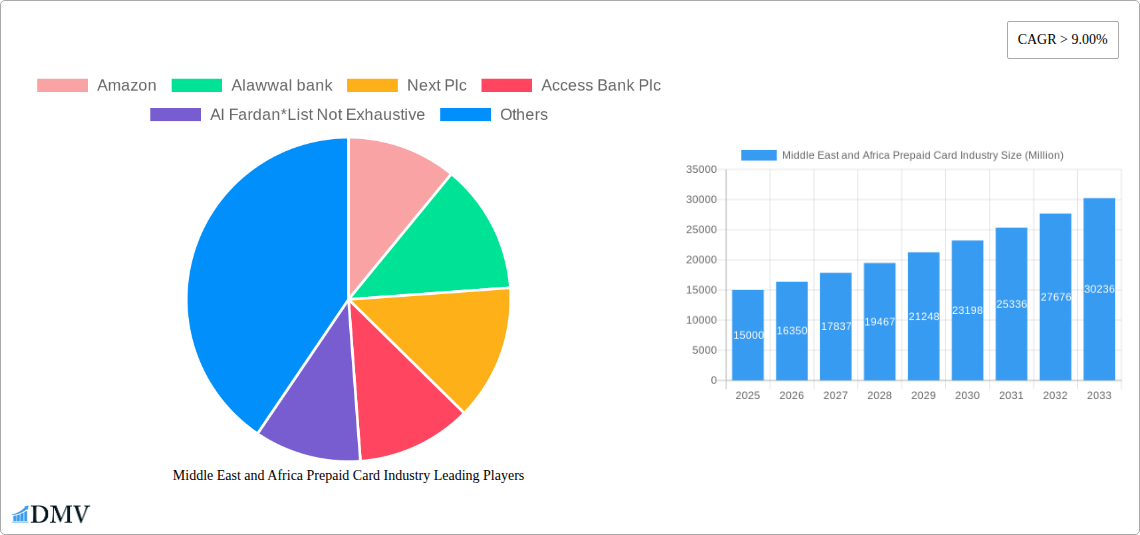

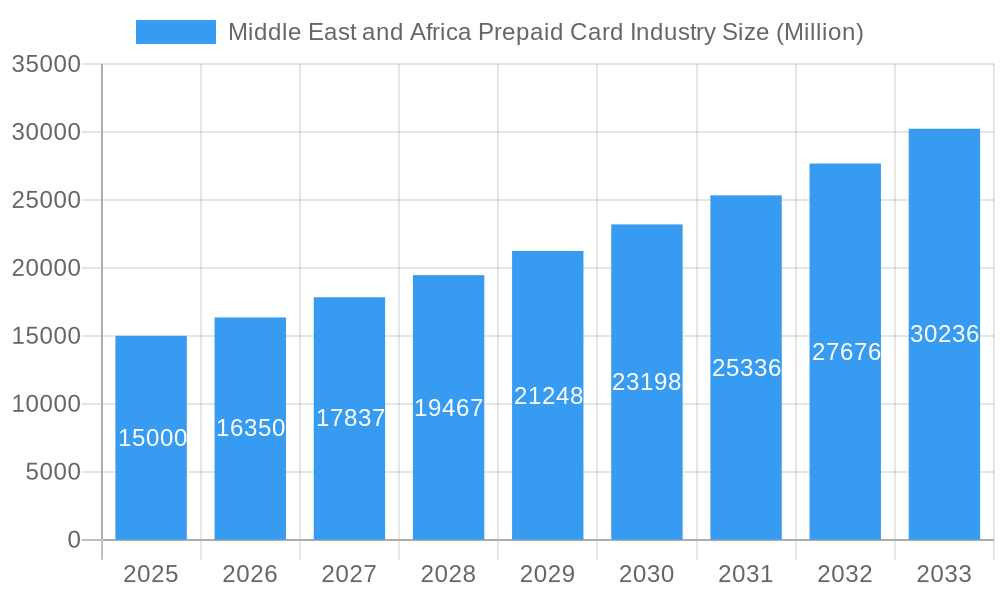

The Middle East and Africa (MEA) prepaid card market is projected for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 11.3% from 2025 to 2033. This growth is underpinned by the escalating adoption of digital payments, fueled by increased smartphone penetration and a digitally-native demographic. Government-led financial inclusion initiatives are also a key driver, providing accessible financial solutions in underbanked areas. The burgeoning e-commerce sector further propels demand. Prepaid cards offer versatile applications, serving retail spending, gift solutions, government disbursements, and payroll. The market is segmented by offering (general purpose, gift cards), card type (open-loop, closed-loop), and end-user (retail, corporate, government). Leading players, including Visa, American Express, and prominent regional banks, are actively innovating to meet evolving market demands.

Middle East and Africa Prepaid Card Industry Market Size (In Billion)

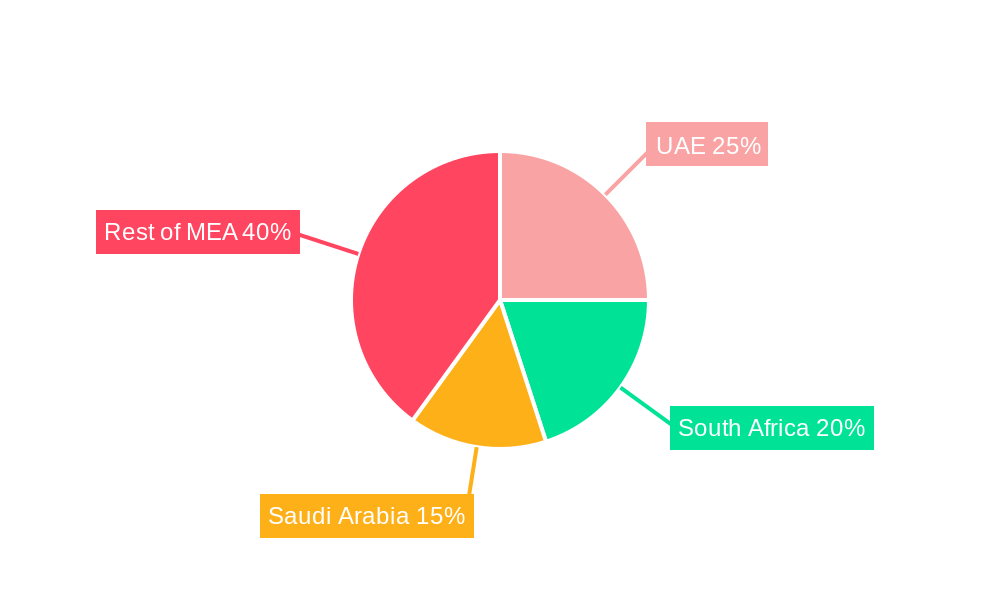

Market leadership within MEA is currently held by countries like the UAE and South Africa, owing to their robust financial infrastructure and advanced digital adoption. Nonetheless, substantial growth potential exists across other MEA nations as financial inclusion efforts advance and digital infrastructure expands. Key challenges include security concerns, the imperative for enhanced financial literacy, and the complexities of diverse regional regulatory frameworks. Despite these hurdles, the MEA prepaid card market outlook is exceptionally positive, driven by technological progress, supportive government policies, and shifts in consumer behavior. The estimated market size is projected to reach $44 billion by 2025.

Middle East and Africa Prepaid Card Industry Company Market Share

Middle East & Africa Prepaid Card Market Analysis and Forecast (2025-2033)

This comprehensive report analyzes the dynamic Middle East and Africa prepaid card market, providing insights into market dynamics, key participants, and future growth trajectories. The analysis covers market sizing, segmentation, technological advancements, and regulatory influences, offering strategic intelligence for stakeholders navigating this rapidly developing sector. The forecast period spans 2025-2033, with a base year of 2025. This report is essential for investors, businesses, and policymakers seeking to leverage opportunities within this high-growth market. The total market value is predicted to reach $44 billion by 2033.

Middle East and Africa Prepaid Card Industry Market Composition & Trends

This section delves into the competitive landscape of the Middle East and Africa prepaid card market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The report analyzes market share distribution among key players, including but not limited to Amazon, Alawwal Bank, Next Plc, Access Bank Plc, Al Fardan, Capitec Bank, Wal-mart Stores Inc, Equity Bank, First Abu Dhabi Bank, Visa, and American Express. M&A deal values are also assessed to understand the strategic shifts within the industry.

- Market Concentration: Analysis of market share held by top players, revealing the level of competition and potential for consolidation.

- Innovation Catalysts: Examination of factors driving innovation, such as technological advancements and evolving consumer preferences.

- Regulatory Landscape: Assessment of the regulatory environment across different countries within the region, its impact on market growth, and compliance challenges.

- Substitute Products: Analysis of alternative payment methods and their impact on the prepaid card market share.

- End-User Profiles: Detailed segmentation of the end-user base, including retail, corporate, and government sectors, with an analysis of their specific needs and preferences.

- M&A Activity: Review of significant M&A transactions, their motivations, and impact on the market structure, including estimated deal values (xx Million).

Middle East and Africa Prepaid Card Industry Industry Evolution

This section provides a detailed analysis of the evolutionary trajectory of the Middle East and Africa prepaid card industry. It examines the market's growth patterns, technological improvements, and changing consumer behavior. Specific data points like compound annual growth rates (CAGR) and adoption rates are provided for various segments. The analysis highlights the shift from traditional prepaid cards to digital solutions and the influence of fintech companies. Growth trends are illustrated with specific data points, covering periods from 2019 to 2033. The impact of mobile money adoption and evolving payment habits are also discussed.

Leading Regions, Countries, or Segments in Middle East and Africa Prepaid Card Industry

This section identifies the leading regions, countries, and segments within the Middle East and Africa prepaid card market, examining the key drivers of their dominance. It analyzes the performance of different segments (General Purpose, Gift Card, Government Card, Incentive/Payroll, Others; Closed-Loop Card, Open-Loop Card; Retail, Corporate, Government) and pinpoints the factors contributing to their success.

Key Drivers (by segment):

- General Purpose Cards: Rapid expansion of mobile banking and financial inclusion initiatives.

- Gift Cards: Growth of e-commerce and increased gifting occasions.

- Government Cards: Government initiatives promoting social welfare programs and digital payments.

- Incentive/Payroll Cards: Growing popularity of employee benefits programs and payroll digitization.

- Closed-Loop Cards: Specific niche applications in retail and loyalty programs.

- Open-Loop Cards: Wider acceptance and utility for everyday transactions.

Dominance Factors: In-depth analysis exploring the underlying reasons for regional and segmental dominance, including factors such as technological infrastructure, regulatory support, consumer behavior, and economic growth.

Middle East and Africa Prepaid Card Industry Product Innovations

This section showcases the latest innovations in prepaid card products and their applications. It highlights unique selling propositions and technological advancements, such as contactless payment capabilities, biometric authentication, and integration with mobile wallets. The section also includes performance metrics and adoption rates for these innovative products.

Propelling Factors for Middle East and Africa Prepaid Card Industry Growth

Several key factors are driving the growth of the Middle East and Africa prepaid card industry. These include the increasing penetration of smartphones and mobile internet access, the expansion of e-commerce, government initiatives promoting financial inclusion, and the rise of fintech companies offering innovative solutions. These factors have significantly boosted the adoption of digital payment methods, including prepaid cards, and created new opportunities for market expansion.

Obstacles in the Middle East and Africa Prepaid Card Industry Market

Despite the significant growth potential, the Middle East and Africa prepaid card market faces several challenges. These include limited financial literacy in certain regions, a lack of robust digital infrastructure in some areas, and concerns about data security and fraud. Regulatory hurdles, inconsistent regulatory environments across different countries, and competition from other payment methods also pose significant obstacles. These barriers are quantified wherever possible, illustrating their impact on market expansion.

Future Opportunities in Middle East and Africa Prepaid Card Industry

The Middle East and Africa prepaid card industry presents numerous opportunities for future growth. The expanding adoption of mobile payments, the growing demand for financial inclusion, and the increasing popularity of e-commerce will continue to propel the market's expansion. The emergence of new technologies, such as blockchain and artificial intelligence, also presents opportunities for innovation and the development of more sophisticated prepaid card solutions. Expansion into under-served markets within the region presents a significant potential.

Major Players in the Middle East and Africa Prepaid Card Industry Ecosystem

- Amazon

- Alawwal bank

- Next Plc

- Access Bank Plc

- Al Fardan

- Capitec Bank

- Wal-mart Stores Inc

- Equity Bank

- First Abu Dhabi Bank

- Visa

- American Express

Key Developments in Middle East and Africa Prepaid Card Industry Industry

- September 2022: Launch of Telda prepaid cards in Egypt, a joint venture between Banque du Caire and a fintech company, powered by Mastercard. This partnership signifies a significant step towards enhancing financial inclusion.

- April 2022: OPay Egypt, a leading fintech startup, receives approval from the Central Bank of Egypt to issue prepaid cards through its app. This development highlights the growing acceptance of fintech solutions within the Egyptian payment ecosystem.

Strategic Middle East and Africa Prepaid Card Industry Market Forecast

The Middle East and Africa prepaid card industry is poised for robust growth in the coming years. Driven by factors such as increasing smartphone penetration, expanding e-commerce adoption, and government initiatives promoting financial inclusion, the market is expected to witness significant expansion. Emerging technologies and innovative business models are expected to shape future market dynamics. The forecast suggests a substantial increase in transaction volume and overall market value by 2033. The report offers specific quantitative projections to assist stakeholders in informed decision-making.

Middle East and Africa Prepaid Card Industry Segmentation

-

1. Offering

- 1.1. General Purpose

- 1.2. Gift Card

- 1.3. Government Card

- 1.4. Incentive/ Payroll

- 1.5. Others

-

2. Card Type

- 2.1. Closed- Loop Card

- 2.2. Open- Loop Card

-

3. End- User

- 3.1. Retail

- 3.2. Corporate

- 3.3. Government

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Regional Market Share

Geographic Coverage of Middle East and Africa Prepaid Card Industry

Middle East and Africa Prepaid Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Digital and Mobile Banking is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. General Purpose

- 5.1.2. Gift Card

- 5.1.3. Government Card

- 5.1.4. Incentive/ Payroll

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Card Type

- 5.2.1. Closed- Loop Card

- 5.2.2. Open- Loop Card

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Retail

- 5.3.2. Corporate

- 5.3.3. Government

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of the Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. South Africa

- 5.5.4. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Saudi Arabia Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. General Purpose

- 6.1.2. Gift Card

- 6.1.3. Government Card

- 6.1.4. Incentive/ Payroll

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Card Type

- 6.2.1. Closed- Loop Card

- 6.2.2. Open- Loop Card

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Retail

- 6.3.2. Corporate

- 6.3.3. Government

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. South Africa

- 6.4.4. Rest of the Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. United Arab Emirates Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. General Purpose

- 7.1.2. Gift Card

- 7.1.3. Government Card

- 7.1.4. Incentive/ Payroll

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Card Type

- 7.2.1. Closed- Loop Card

- 7.2.2. Open- Loop Card

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Retail

- 7.3.2. Corporate

- 7.3.3. Government

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. South Africa

- 7.4.4. Rest of the Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. South Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. General Purpose

- 8.1.2. Gift Card

- 8.1.3. Government Card

- 8.1.4. Incentive/ Payroll

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Card Type

- 8.2.1. Closed- Loop Card

- 8.2.2. Open- Loop Card

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Retail

- 8.3.2. Corporate

- 8.3.3. Government

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. South Africa

- 8.4.4. Rest of the Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the Middle East and Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. General Purpose

- 9.1.2. Gift Card

- 9.1.3. Government Card

- 9.1.4. Incentive/ Payroll

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Card Type

- 9.2.1. Closed- Loop Card

- 9.2.2. Open- Loop Card

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Retail

- 9.3.2. Corporate

- 9.3.3. Government

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. South Africa

- 9.4.4. Rest of the Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Amazon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alawwal bank

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Next Plc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Access Bank Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Fardan*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Capitec Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wal-mart Stores Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Equity Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 First Abu Dhabi Bank

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Visa

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 American Express

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Amazon

List of Figures

- Figure 1: Middle East and Africa Prepaid Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Prepaid Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 3: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 8: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 9: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 12: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 13: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 14: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 17: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 18: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 19: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 22: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 23: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 24: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Prepaid Card Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the Middle East and Africa Prepaid Card Industry?

Key companies in the market include Amazon, Alawwal bank, Next Plc, Access Bank Plc, Al Fardan*List Not Exhaustive, Capitec Bank, Wal-mart Stores Inc, Equity Bank, First Abu Dhabi Bank, Visa, American Express.

3. What are the main segments of the Middle East and Africa Prepaid Card Industry?

The market segments include Offering, Card Type, End- User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Digital and Mobile Banking is Driving the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

In September 2022, One of Egypt's leading banks and a fintech company jointly created Telda prepaid cards, which were powered by Mastercard's debut. The ground-breaking payment solution is the result of a fruitful partnership between Telda, a rapidly expanding Egyptian fintech start-up, and Banque du Caire, one of the nation's top financial institutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Prepaid Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Prepaid Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Prepaid Card Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Prepaid Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence