Key Insights

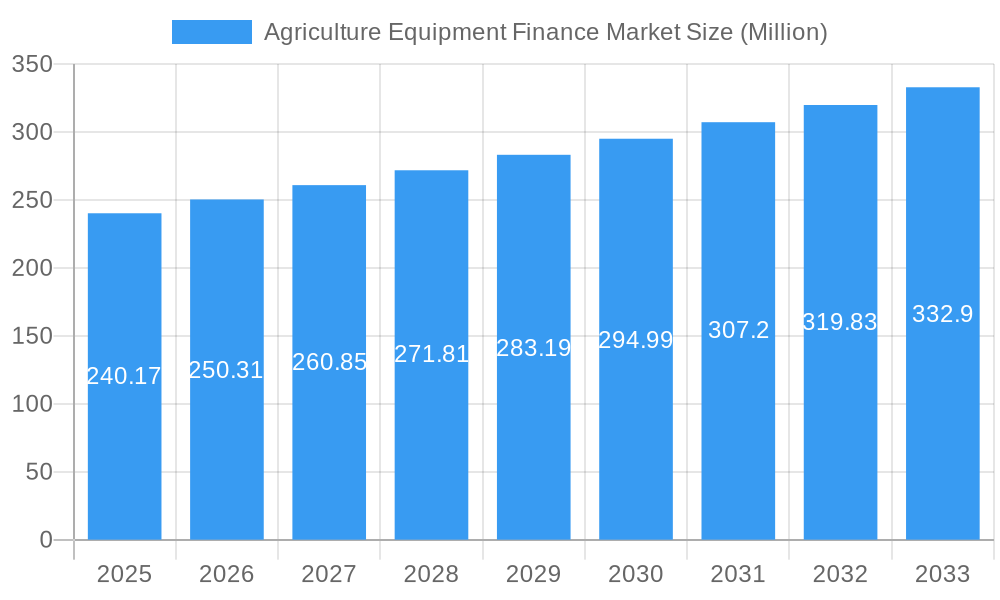

The global Agriculture Equipment Finance Market is poised for robust growth, with a current market size of USD 240.17 million and a projected Compound Annual Growth Rate (CAGR) of 4.23% from 2025 to 2033. This expansion is primarily driven by the increasing demand for advanced agricultural machinery, including tractors, harvesters, and haying equipment, essential for enhancing farm productivity and efficiency. The growing adoption of modern farming techniques, coupled with the need to replace aging fleets with technologically superior models, fuels the demand for financing solutions. Furthermore, favorable government initiatives and subsidies supporting agricultural modernization across various regions are acting as significant catalysts. The market is witnessing a surge in demand for various financing options such as leases, loans, and lines of credit, catering to the diverse financial needs of farmers and agricultural enterprises. Innovations in fintech and the increasing availability of digital lending platforms are also contributing to easier access to capital for equipment acquisition.

Agriculture Equipment Finance Market Market Size (In Million)

The market's trajectory is influenced by key trends such as the increasing focus on precision agriculture and the adoption of smart farming technologies, which necessitate investment in sophisticated equipment. This, in turn, stimulates the need for flexible and accessible financing. While the market presents substantial opportunities, certain restraints, such as fluctuating commodity prices and potential economic downturns impacting farmers' repayment capacities, could pose challenges. However, the increasing mechanization of agriculture, especially in emerging economies, and the continuous need for operational efficiency will likely outweigh these restraints. The market is segmented by the type of finance (Lease, Loan, Line of Credit) and the product financed (Tractors, Harvesters, Haying Equipment, Others), with significant contributions expected from all segments. Leading companies in this space are actively developing innovative financial products to support the agricultural sector's evolving needs.

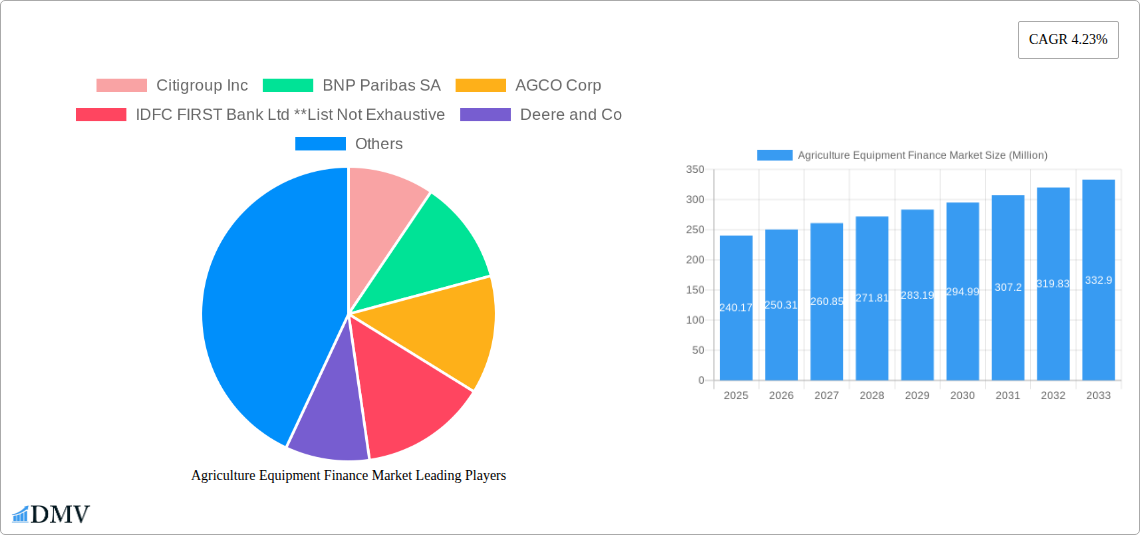

Agriculture Equipment Finance Market Company Market Share

This in-depth agriculture equipment finance market report provides a detailed analysis of the global landscape, encompassing market size, segmentation, key trends, and future projections. Covering the historical period (2019–2024), base year (2025), and extending through a robust forecast period (2025–2033), this study is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within the farm equipment financing sector. We explore critical aspects such as loan for tractors, harvester financing, and lease agreements for agricultural machinery, offering insights into the drivers and challenges shaping this vital industry.

Agriculture Equipment Finance Market Market Composition & Trends

The agriculture equipment finance market is characterized by a dynamic interplay of established financial institutions and specialized agricultural lenders, demonstrating a moderate to high concentration. Innovation catalysts are primarily driven by the increasing adoption of precision agriculture technology, demanding sophisticated financial solutions for advanced machinery. Regulatory landscapes, while varied across regions, generally favor mechanisms that support farm modernization and food security. Substitute products, such as used equipment financing and direct purchase options, exert some competitive pressure, but the long-term benefits of financing new, efficient machinery often outweigh these alternatives for large-scale operations. End-user profiles range from individual farmers and small agricultural cooperatives to large agribusiness conglomerates, each with distinct financing needs and risk appetites. Mergers and acquisitions (M&A) activities, valued in the billions of dollars, are strategic moves to consolidate market share, expand service offerings, and integrate technological capabilities. For instance, recent joint ventures and capital investments, such as AGCO Corporation's strategic moves, underscore the industry's ongoing consolidation and investment in future growth.

- Market Share Distribution: While specific percentages are proprietary, leading players in farm equipment financing hold significant portions, with a gradual increase in the share of integrated financial service providers offering comprehensive solutions.

- M&A Deal Values: Major deals often exceed several billion dollars, reflecting the strategic importance of acquiring technology, expanding geographical reach, and enhancing product portfolios within the agricultural finance sector.

- Innovation Drivers: The push for sustainable farming, automation, and data-driven agriculture directly influences the demand for financing for cutting-edge equipment.

Agriculture Equipment Finance Market Industry Evolution

The agriculture equipment finance market has undergone a significant evolution, propelled by the imperative to modernize farming practices and enhance agricultural productivity globally. Over the study period (2019–2033), this evolution has been shaped by a confluence of technological advancements, shifting consumer demands for food, and supportive governmental policies. The increasing mechanization of agriculture, particularly in developing economies, has been a consistent driver of demand for farm machinery financing. This demand is further amplified by the growing global population, necessitating higher crop yields and, consequently, more efficient and advanced farming equipment.

Technological advancements have played a pivotal role. The advent of precision agriculture – encompassing GPS-guided tractors, drone-based monitoring, automated irrigation systems, and sensor technology – has transformed farming. These sophisticated agricultural implements require substantial capital investment, directly fueling the need for specialized financing solutions like equipment loans and lease-to-own programs. For example, the adoption rate of GPS-enabled tractors has surged, with an estimated year-on-year growth of over 15% in recent years. This trend necessitates finance providers that can understand and underwrite the risks associated with such high-value, technologically advanced assets.

Shifting consumer demands, particularly a greater emphasis on organic produce, sustainable farming methods, and traceability, have also influenced the market. Farmers investing in specialized equipment for these niche markets, such as advanced irrigation systems or specialized harvesting tools for organic crops, often require tailored agricultural credit lines. The increasing awareness of climate change and the need for climate-resilient agriculture have also spurred investments in equipment that can adapt to changing environmental conditions, further driving demand for financing.

Moreover, the financial landscape itself has adapted. Beyond traditional farm equipment loans, financial institutions have diversified their offerings to include flexible leasing options, operating leases, and asset-backed financing. The line of credit for agriculture has become more sophisticated, often structured to align with seasonal cash flows and harvest cycles. The credit for farming equipment market is therefore not static; it is a responsive ecosystem that continuously innovates to meet the evolving needs of the agricultural sector. The increasing accessibility of online financing platforms and fintech solutions has also begun to streamline the application and approval process, making equipment financing more accessible to a broader range of farmers. The overall market trajectory indicates sustained growth, projected to achieve a compound annual growth rate (CAGR) of approximately 6.5% over the forecast period.

Leading Regions, Countries, or Segments in Agriculture Equipment Finance Market

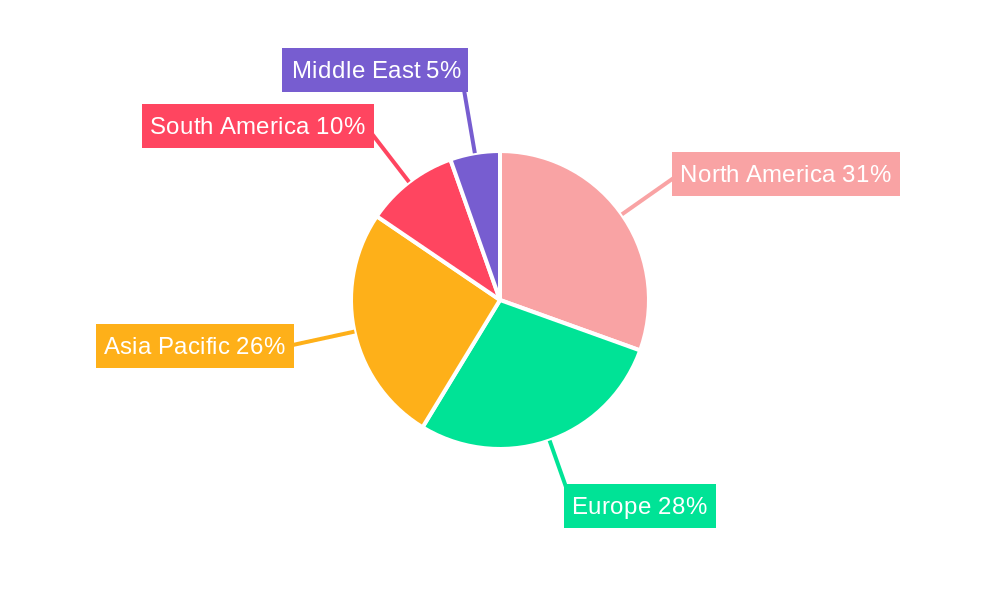

The agriculture equipment finance market exhibits distinct regional dominance and segment preferences, driven by agricultural intensity, economic development, and regulatory frameworks. North America, particularly the United States, and Europe consistently lead in terms of financing volume and adoption of advanced machinery. Asia-Pacific, with its vast agricultural land and rapidly growing economies like India and China, represents a significant and fast-expanding market.

Within the Type of Finance, Loans are the most prevalent instrument, facilitating outright purchase of agricultural machinery. This is closely followed by Lease agreements, which offer flexibility and reduce upfront capital expenditure, making them attractive for farmers seeking to manage cash flow or upgrade equipment frequently. Line of Credit facilities are crucial for operational expenses and short-term working capital needs, often linked to specific crop cycles.

Regarding Product, Tractors represent the largest segment in terms of financing, being the foundational equipment for most farming operations. Harvesters follow, particularly in regions with large-scale grain and crop production. Haying Equipment also commands a substantial share in livestock-dominant agricultural regions. The "Others" category, encompassing a wide range of specialized machinery like planters, sprayers, and processing equipment, is growing in importance as agricultural practices become more diversified and technologically advanced.

Dominance Factors:

North America (USA & Canada):

- Investment Trends: High levels of investment in precision agriculture and large-scale farming operations.

- Regulatory Support: Favorable government programs and subsidies that encourage equipment upgrades.

- Technology Adoption: Rapid integration of advanced technologies like GPS, IoT, and automation in farming.

- Segment Dominance: Strong demand for both Loans and Lease for Tractors and Harvesters.

Europe:

- Investment Trends: Focus on sustainable and organic farming, driving demand for specialized equipment.

- Regulatory Support: EU agricultural policies often encourage modernization and efficiency.

- Technology Adoption: High adoption of smart farming technologies and precision agriculture.

- Segment Dominance: Significant demand for Lease agreements due to cost management and frequent upgrades, with strong financing for Tractors and specialized machinery.

Asia-Pacific (China & India):

- Investment Trends: Rapidly increasing mechanization and government initiatives to boost agricultural output.

- Regulatory Support: Government schemes aimed at providing subsidies and easier access to credit for farmers.

- Technology Adoption: Growing but still nascent adoption of advanced technologies, with a significant leap expected in the forecast period.

- Segment Dominance: Dominated by Loans for essential machinery like Tractors, with an increasing interest in Harvesters and other mechanization tools.

Agriculture Equipment Finance Market Product Innovations

Product innovation in the agriculture equipment finance market is intrinsically linked to advancements in the machinery itself. Manufacturers are increasingly integrating AI-driven diagnostics, autonomous operation capabilities, and advanced sensor technologies into tractors, harvesters, and other agricultural equipment. For example, new models of autonomous tractors are emerging, offering remote operation and optimized fuel efficiency, leading to novel financing structures that account for reduced labor costs and enhanced productivity. The development of modular and adaptable machinery, designed for multi-purpose use, also influences financing models, offering greater flexibility to farmers. Performance metrics such as reduced water and pesticide usage, increased yield per acre, and minimized downtime are key selling propositions for these innovative products, directly impacting their financing appeal and value.

Propelling Factors for Agriculture Equipment Finance Market Growth

The agriculture equipment finance market is experiencing robust growth driven by several key factors. The global imperative for food security, coupled with a rising population, necessitates increased agricultural productivity, directly fueling demand for advanced and efficient farming machinery. Technological advancements, particularly the widespread adoption of precision agriculture technologies, such as GPS guidance, automated steering, and sensor-based monitoring, require significant capital investment, thus boosting the need for financing solutions. Government initiatives and subsidies in many countries aimed at modernizing agriculture and supporting farmers also play a crucial role. Furthermore, the increasing availability of diverse financial products, including flexible lease agreements and specialized equipment loans, makes it easier for farmers to acquire the necessary machinery, driving market expansion.

Obstacles in the Agriculture Equipment Finance Market Market

Despite strong growth prospects, the agriculture equipment finance market faces several obstacles. Fluctuations in commodity prices can significantly impact farmers' revenues and their ability to repay loans, leading to increased risk for financiers. Stringent regulatory requirements and the complex documentation process for agricultural loans can be burdensome for smaller farmers. Supply chain disruptions, as seen in recent years, can lead to extended lead times for new equipment and increased costs, affecting both demand and financing availability. Intense competition among financial institutions and equipment manufacturers, while often beneficial, can also lead to tighter margins and more aggressive lending practices. Weather-related risks and climate change impacts continue to pose inherent challenges to agricultural output and, consequently, to the financial stability of farmers.

Future Opportunities in Agriculture Equipment Finance Market

The future of the agriculture equipment finance market is ripe with opportunities. The expanding adoption of IoT (Internet of Things) devices and data analytics in agriculture presents a significant avenue for innovative financing solutions that leverage predictive maintenance and performance data. The growing demand for sustainable and organic farming practices is creating a niche market for financing specialized equipment. Emerging economies with large, under-mechanized agricultural sectors offer substantial growth potential. Furthermore, the development of crop insurance products integrated with financing packages can mitigate risks for both lenders and borrowers. Fintech solutions and digital platforms are poised to further streamline the financing process, making it more accessible and efficient for a wider range of agricultural stakeholders.

Major Players in the Agriculture Equipment Finance Market Ecosystem

- Citigroup Inc

- BNP Paribas SA

- AGCO Corp

- IDFC FIRST Bank Ltd

- Deere and Co

- Adani Group

- Barclays PLC

- BlackRock Inc

- Agricultural Bank Ltd of China

- Argo Tractors SpA

- ICICI Bank Ltd

Key Developments in Agriculture Equipment Finance Market Industry

- September 2023: AGCO Corporation, a global manufacturer and distributor of precision agriculture equipment and technology, entered a joint venture with Trimble in which AGCO will purchase an 85% share of Trimble's portfolio of agricultural assets and technologies for a cash consideration of USD 2 billion, subject to the participation of JCA Technologies. This strategic move signifies a significant investment in advanced agricultural technologies and consolidation within the precision farming segment, impacting financing needs for related equipment.

- May 2023: AGCO Corporation, the world’s leading designer, manufacturer, and distributor of agricultural equipment and precision agricultural technology, announced a capital improvement project to expand production capacity for Massey Ferguson, Fendt, and Momentum. This expansion indicates an anticipated increase in the supply of these popular equipment lines, likely leading to a corresponding rise in demand for farm equipment financing.

Strategic Agriculture Equipment Finance Market Market Forecast

The strategic agriculture equipment finance market forecast indicates sustained and robust growth, driven by the relentless pursuit of agricultural modernization and efficiency. Projections suggest continued expansion in the adoption of advanced machinery, fueled by government support, technological innovation, and the increasing need to enhance global food production. Flexible financing options, including specialized lease agreements and tailored loan products, will remain critical enablers for farmers to access these capital-intensive assets. The integration of digital platforms and data analytics into financing processes will streamline operations and mitigate risks, opening up new avenues for growth. The market is poised for a significant upswing as emerging economies embrace mechanization and developed nations continue to invest in cutting-edge agricultural technologies, ensuring a positive outlook for the farm equipment finance sector.

Agriculture Equipment Finance Market Segmentation

-

1. Type of Finance

- 1.1. Lease

- 1.2. Loan

- 1.3. Line of Credit

-

2. Product

- 2.1. Tractors

- 2.2. Harvesters

- 2.3. Haying Equipment

- 2.4. Others

Agriculture Equipment Finance Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. South America

- 5. Middle East

Agriculture Equipment Finance Market Regional Market Share

Geographic Coverage of Agriculture Equipment Finance Market

Agriculture Equipment Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate

- 3.3. Market Restrains

- 3.3.1. Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 3.4. Market Trends

- 3.4.1. Rising Demand For Tractors In Agriculture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Finance

- 5.1.1. Lease

- 5.1.2. Loan

- 5.1.3. Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Tractors

- 5.2.2. Harvesters

- 5.2.3. Haying Equipment

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Finance

- 6. Asia Pacific Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Finance

- 6.1.1. Lease

- 6.1.2. Loan

- 6.1.3. Line of Credit

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Tractors

- 6.2.2. Harvesters

- 6.2.3. Haying Equipment

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type of Finance

- 7. North America Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Finance

- 7.1.1. Lease

- 7.1.2. Loan

- 7.1.3. Line of Credit

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Tractors

- 7.2.2. Harvesters

- 7.2.3. Haying Equipment

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type of Finance

- 8. Europe Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Finance

- 8.1.1. Lease

- 8.1.2. Loan

- 8.1.3. Line of Credit

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Tractors

- 8.2.2. Harvesters

- 8.2.3. Haying Equipment

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type of Finance

- 9. South America Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Finance

- 9.1.1. Lease

- 9.1.2. Loan

- 9.1.3. Line of Credit

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Tractors

- 9.2.2. Harvesters

- 9.2.3. Haying Equipment

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type of Finance

- 10. Middle East Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Finance

- 10.1.1. Lease

- 10.1.2. Loan

- 10.1.3. Line of Credit

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Tractors

- 10.2.2. Harvesters

- 10.2.3. Haying Equipment

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type of Finance

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Citigroup Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BNP Paribas SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AGCO Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IDFC FIRST Bank Ltd **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deere and Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adani Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barclays PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BlackRock Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agricultural Bank Ltd of China

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Argo Tractors SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ICICI Bank Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Citigroup Inc

List of Figures

- Figure 1: Global Agriculture Equipment Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 3: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 4: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 5: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 9: North America Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 10: North America Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 11: North America Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: North America Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 15: Europe Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 16: Europe Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 17: Europe Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 21: South America Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 22: South America Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 23: South America Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: South America Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 27: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 28: Middle East Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 29: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 2: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 5: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 8: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 9: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 11: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 14: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 17: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Equipment Finance Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Agriculture Equipment Finance Market?

Key companies in the market include Citigroup Inc, BNP Paribas SA, AGCO Corp, IDFC FIRST Bank Ltd **List Not Exhaustive, Deere and Co, Adani Group, Barclays PLC, BlackRock Inc, Agricultural Bank Ltd of China, Argo Tractors SpA, ICICI Bank Ltd.

3. What are the main segments of the Agriculture Equipment Finance Market?

The market segments include Type of Finance, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 240.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate.

6. What are the notable trends driving market growth?

Rising Demand For Tractors In Agriculture Industry.

7. Are there any restraints impacting market growth?

Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards..

8. Can you provide examples of recent developments in the market?

September 2023: AGCO Corporation, a global manufacturer and distributor of precision agriculture equipment and technology, entered a joint venture with Trimble in which AGCO will purchase an 85% share of Trimble's portfolio of agricultural assets and technologies for a cash consideration of USD 2 billion, subject to the participation of JCA Technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Equipment Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Equipment Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Equipment Finance Market?

To stay informed about further developments, trends, and reports in the Agriculture Equipment Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence