Key Insights

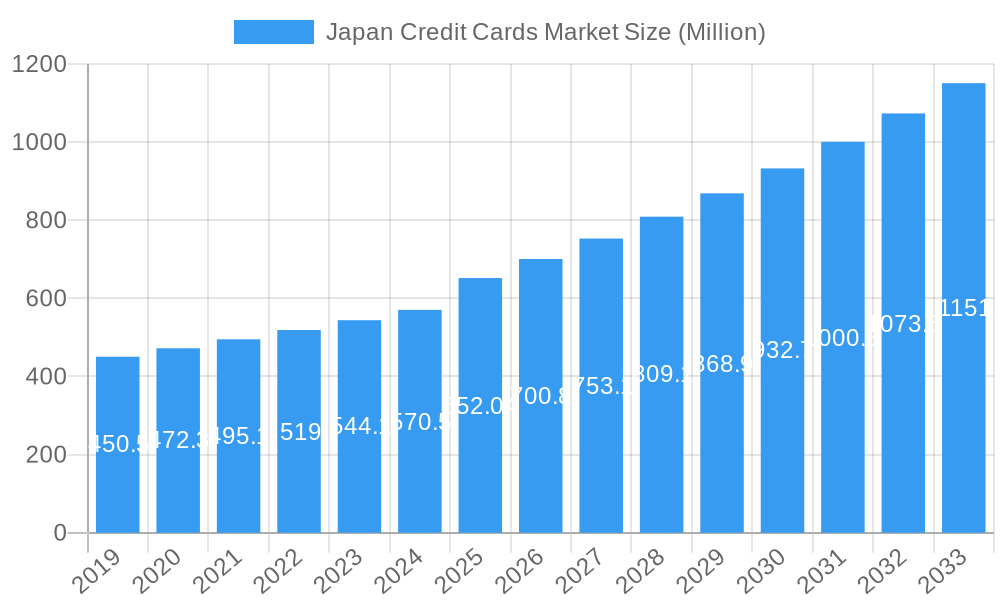

The Japanese credit card market is poised for significant expansion, projecting a substantial market size of $652.04 million with a compelling Compound Annual Growth Rate (CAGR) of 7.36% from 2025 to 2033. This robust growth is primarily fueled by evolving consumer spending habits, a burgeoning digital economy, and increasing adoption of contactless payment solutions. The market's dynamism is further amplified by strategic initiatives from key players like Visa and MasterCard, which are actively collaborating with financial institutions such as Rakuten Card, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group to introduce innovative card products and loyalty programs. These collaborations are instrumental in driving the demand for both general-purpose and specialty credit cards, catering to a diverse range of applications spanning from everyday essentials like food and groceries to discretionary spending in areas such as travel, entertainment, and consumer electronics. The increasing integration of credit cards into daily life, supported by a growing network of merchants and payment terminals, underscores a fundamental shift towards cashless transactions in Japan.

Japan Credit Cards Market Market Size (In Million)

Looking ahead, the market is expected to witness a sustained upward trajectory, driven by several key trends. The increasing prevalence of e-commerce and the growing demand for online services will continue to bolster the use of credit cards for digital transactions. Furthermore, the Japanese government's push towards digital transformation and financial inclusion is expected to create a more conducive environment for credit card adoption, particularly among younger demographics and small businesses. While the market benefits from these strong growth drivers, potential restraints include evolving regulatory landscapes, concerns around data security and privacy, and the ongoing competition from alternative payment methods like digital wallets and QR code payments. However, the strategic focus on enhancing customer experience through personalized offers, rewards, and seamless integration with mobile devices positions the Japanese credit card market for continued success and market penetration throughout the forecast period.

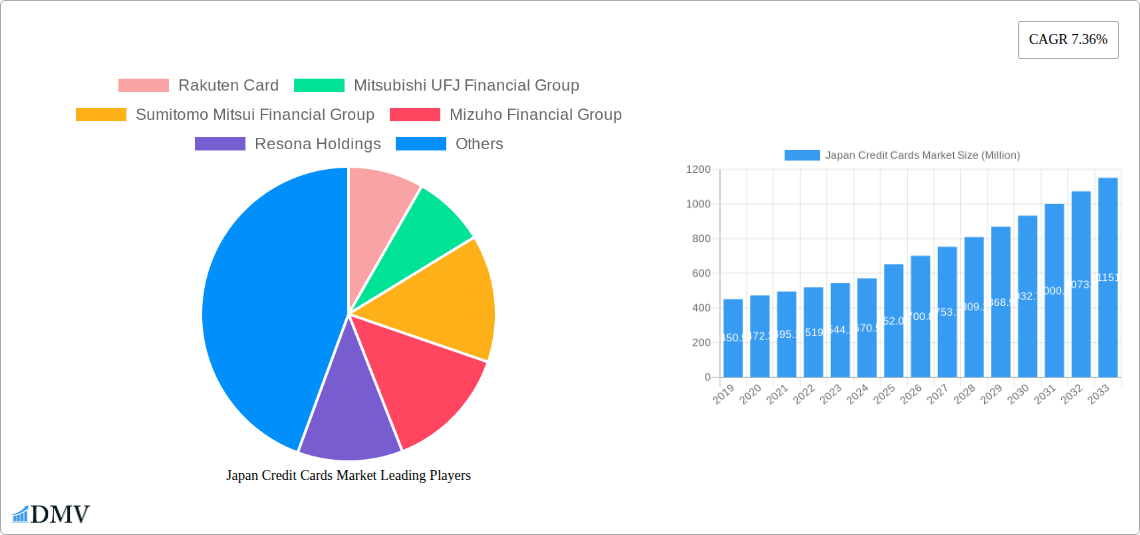

Japan Credit Cards Market Company Market Share

Japan Credit Cards Market: Comprehensive Analysis and Future Outlook (2019-2033)

Dive deep into the dynamic Japan credit cards market with this in-depth report, meticulously analyzing trends, growth drivers, and future projections from 2019 to 2033. Gain unparalleled insights into market composition, industry evolution, regional dominance, product innovations, and key player strategies. This report is essential for stakeholders seeking to understand the Japanese payment solutions, credit card industry in Japan, and the future of financial services in Japan.

Japan Credit Cards Market Market Composition & Trends

The Japan credit cards market exhibits a moderate to high concentration, with major financial institutions and dedicated card issuers vying for market share. Key innovation catalysts include the increasing adoption of digital payments, the rollout of advanced security features, and the integration of credit card functionalities into broader digital ecosystems. Regulatory landscapes, while generally stable, are continually evolving to ensure consumer protection and financial stability, impacting transaction processing and data privacy. Substitute products, such as prepaid cards and mobile payment services, present ongoing competition, forcing credit card providers to enhance their value propositions. End-user profiles are diverse, ranging from young, digitally-savvy consumers to established households and businesses, each with distinct spending habits and service expectations. Mergers and acquisitions (M&A) activity, though not as frequent as in other mature markets, plays a crucial role in market consolidation and expansion. For instance, the acquisition of Greenhill & Co. by Mizuho Financial Group at an enterprise value of approximately USD 550 million signals a strategic push for growth in investment banking, indirectly influencing the broader financial services landscape. The market share distribution is characterized by a few dominant players, alongside a segment of niche providers catering to specific consumer needs.

Japan Credit Cards Market Industry Evolution

The Japan credit card industry has undergone a remarkable transformation over the historical period (2019-2024) and is poised for continued evolution through the forecast period (2025-2033). Driven by an accelerating shift towards cashless transactions, the market has witnessed a consistent upward trajectory in transaction volumes and the number of active credit card accounts. Technological advancements have been pivotal in this evolution, with the widespread adoption of EMV chip technology enhancing security and reducing fraud. Furthermore, the proliferation of contactless payment solutions, including mobile wallets and NFC-enabled cards, has significantly improved transaction speed and convenience for consumers. This shift is also fueled by a growing consumer demand for seamless digital experiences, pushing issuers to invest heavily in user-friendly mobile applications, online account management platforms, and personalized reward programs. The base year (2025) serves as a critical juncture, reflecting the stabilization of post-pandemic economic recovery and the embedding of new payment habits. The study period (2019–2033) encompasses a period of significant disruption and innovation, from the initial stages of digital payment adoption to the mature phase where fintech integration and data analytics become paramount. Early data from the historical period indicates a compound annual growth rate (CAGR) in transaction value of approximately 5-7%, a trend expected to continue, albeit at a more moderate pace of 3-5% during the forecast period. The increasing penetration of credit cards among younger demographics, coupled with government initiatives to promote digital payments, are further solidifying the market's growth trajectory. The industry's ability to adapt to evolving consumer preferences, embrace emerging technologies, and navigate the competitive landscape will be crucial for sustained success.

Leading Regions, Countries, or Segments in Japan Credit Cards Market

The dominance within the Japan credit cards market is multifaceted, with General Purpose Credit Cards holding a significant lead in transaction volume and overall market penetration. This segment caters to a broad spectrum of consumer needs, encompassing everyday purchases across various applications. Within the application segment, Food & Groceries and Travel & Tourism consistently emerge as major spending categories, reflecting fundamental consumer habits and discretionary spending patterns. The Visa and MasterCard networks command a substantial market share, benefiting from their global recognition, extensive merchant acceptance, and robust technological infrastructure.

- Card Type Dominance:

- General Purpose Credit Cards: Account for over 70% of the total credit card market share, driven by their versatility and wide acceptance.

- Specialty & Other Credit Cards: Experiencing steady growth, particularly in co-branded cards offering specific lifestyle benefits.

- Application Drivers:

- Food & Groceries: A consistent high-volume segment, essential for daily living, showing resilience even during economic fluctuations.

- Travel & Tourism: Demonstrates significant growth post-pandemic, driven by pent-up demand for leisure and business travel.

- Consumer Electronics: A key driver of higher-value transactions, especially during promotional periods.

- Provider Landscape:

- Visa & MasterCard: Collectively hold over 80% of the network market share, supported by strong brand loyalty and established infrastructure.

- Other Providers: Including domestic networks like JCB (Japan Credit Bureau), are carving out niches and offering unique value propositions.

- Regional Considerations: While the report focuses on the national market, major metropolitan areas like Tokyo and Osaka exhibit higher credit card penetration rates and a greater propensity for adopting new payment technologies due to their dense populations and higher disposable incomes. Investment trends are increasingly focused on digital infrastructure and loyalty programs to retain customers in this competitive environment. Regulatory support for digital payment adoption further bolsters the growth of these dominant segments.

Japan Credit Cards Market Product Innovations

Product innovations in the Japan credit cards market are increasingly focused on enhancing user experience and security. Card issuers are leveraging advancements in mobile technology to offer seamless digital onboarding processes and intuitive in-app management for cardholders. Features such as real-time transaction alerts, personalized spending insights powered by AI, and dynamic security protocols like tokenization are becoming standard. The integration of loyalty programs with a focus on experiential rewards and sustainable options is also a key differentiator. Performance metrics are shifting towards user engagement, digital channel adoption, and customer lifetime value rather than solely transaction volume. For example, issuers are introducing "buy now, pay later" (BNPL) functionalities within existing credit card frameworks, appealing to a younger demographic seeking flexible payment options.

Propelling Factors for Japan Credit Cards Market Growth

The Japan credit cards market growth is propelled by several key factors. Technological advancements, particularly the rapid adoption of contactless payments and the integration of credit cards into mobile wallets, are enhancing convenience and transaction speeds. Economic recovery and rising disposable incomes contribute to increased consumer spending. Government initiatives promoting cashless societies and digital transformation further incentivize credit card usage. Furthermore, the evolving preferences of younger demographics, who are more inclined towards digital financial services and credit-based spending, are a significant driver. The competitive landscape itself, with issuers constantly innovating with rewards programs, cashback offers, and partnerships, encourages greater adoption.

Obstacles in the Japan Credit Cards Market Market

Despite robust growth, the Japan credit cards market faces certain obstacles. Intense competition among established players and the emergence of fintech disruptors can lead to margin pressures and the need for continuous investment in customer acquisition and retention. Regulatory complexities, although designed to ensure security, can sometimes slow down the implementation of new products and services. Consumer concerns regarding data privacy and security remain a significant factor, requiring ongoing efforts to build trust and transparency. Moreover, the presence of a substantial cash-reliant segment of the population, particularly among older demographics, presents a persistent challenge in achieving complete cashless penetration.

Future Opportunities in Japan Credit Cards Market

Future opportunities in the Japan credit cards market lie in the continued expansion of digital payment ecosystems and the integration of innovative financial technologies. The growing demand for personalized financial management tools and loyalty programs offers significant scope for differentiation. The untapped potential in rural areas and among specific demographic segments presents an opportunity for targeted product development and outreach. Furthermore, the increasing focus on sustainability and ethical consumption can be leveraged through co-branded cards with eco-friendly partners or programs that reward environmentally conscious spending. The rise of e-commerce and cross-border transactions also presents avenues for growth through strategic partnerships and feature enhancements.

Major Players in the Japan Credit Cards Market Ecosystem

- Rakuten Card

- Mitsubishi UFJ Financial Group

- Sumitomo Mitsui Financial Group

- Mizuho Financial Group

- Resona Holdings

- Japan Post Bank

- Aozora Bank

- Norinchukin Bank

- Shizuoka Bank

- JCB (Japan Credit Bureau)

Key Developments in Japan Credit Cards Market Industry

- May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. This strategic investment underscores a growing trend towards ESG (Environmental, Social, and Governance) considerations within the financial sector, potentially influencing product development and partnerships in the credit card industry by aligning with circular economy principles.

- May 2023: Mizuho Financial Group, Inc. and Greenhill & Co., Inc. announced a definitive agreement for Mizuho to acquire Greenhill in an all-cash transaction. This acquisition, valued at approximately USD 550 million enterprise value, signifies Mizuho's strategic ambition to bolster its investment banking capabilities. This could indirectly impact the credit card market through enhanced corporate advisory services and potential for new financial product integration.

Strategic Japan Credit Cards Market Market Forecast

The strategic Japan credit cards market forecast indicates sustained growth driven by the ongoing digital transformation and evolving consumer behavior. The increasing adoption of cashless payment methods, coupled with supportive government policies, will continue to fuel transaction volumes and account growth. Innovation in areas such as personalized rewards, seamless mobile integration, and advanced security features will be critical for maintaining competitiveness and capturing market share. Emerging opportunities in the millennial and Gen Z demographics, along with the potential for further penetration in underserved segments, present substantial avenues for expansion. Strategic partnerships and a focus on customer-centric solutions will be paramount for long-term success in this dynamic market.

Japan Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Japan Credit Cards Market Segmentation By Geography

- 1. Japan

Japan Credit Cards Market Regional Market Share

Geographic Coverage of Japan Credit Cards Market

Japan Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing in Number of Credit Card issued

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Credit Cards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Card

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi UFJ Financial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Financial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mizuho Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resona Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Post Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aozora Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norinchukin Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shizuoka Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JCB (Japan Credit Bureau)**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Card

List of Figures

- Figure 1: Japan Credit Cards Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Credit Cards Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: Japan Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Japan Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Japan Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 6: Japan Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 7: Japan Credit Cards Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Credit Cards Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: Japan Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Japan Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Japan Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Japan Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 15: Japan Credit Cards Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Credit Cards Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Credit Cards Market?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Japan Credit Cards Market?

Key companies in the market include Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, JCB (Japan Credit Bureau)**List Not Exhaustive.

3. What are the main segments of the Japan Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 652.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing in Number of Credit Card issued.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. The Closed Loop Circular Plastics Fund is managed and operated by Closed Loop Partners, an investment firm dedicated to advancing the circular economy. The fund provides catalytic debt and equity financing into solutions and infrastructure that advance the recovery and recycling of plastics, helping keep more materials in circulation while reducing greenhouse gas emissions and leading a shift to the circular economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Credit Cards Market?

To stay informed about further developments, trends, and reports in the Japan Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence