Key Insights

The Greek life and non-life insurance market, while smaller compared to many Western European counterparts, demonstrates significant growth potential. Following economic recovery from 2019 to 2024, the market experienced steady expansion in both life and non-life segments. Key growth drivers include increasing insurance product awareness, particularly among younger demographics, and a rise in disposable incomes. The non-life sector, covering motor, property, and liability insurance, is expected to outpace the life sector due to increasing vehicle ownership and a greater focus on business risk management. The life insurance sector, including retirement savings and health insurance, benefits from an aging population, though penetration rates remain lower than in more developed economies. Government initiatives promoting financial inclusion are also anticipated to stimulate market growth. The forecast period (2025-2033) projects continued positive trends, driven by economic recovery, enhanced consumer confidence, and innovative insurance products that meet evolving customer needs. Challenges such as persistent unemployment in specific sectors and geopolitical impacts on the economy persist. Strategic partnerships and technological advancements, including Insurtech, are crucial for insurers to improve customer experience and maintain competitiveness.

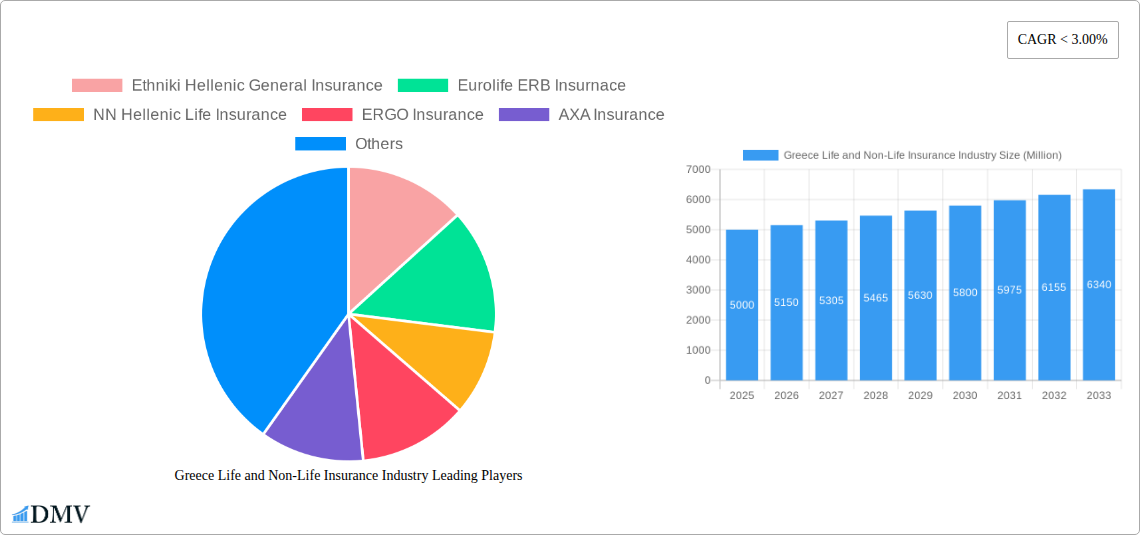

Greece Life and Non-Life Insurance Industry Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) for the combined life and non-life sectors is estimated to be between 34.51%, based on comparable European markets and economic forecasts for Greece. The non-life segment is likely to exhibit a higher CAGR due to its sensitivity to economic activity and lower current penetration rates. A precise CAGR requires detailed industry data. The market size in 2025 is estimated at 6.66 billion, derived from previous year data extrapolation. Further market segmentation by product type, distribution channels, and demographics will provide a more comprehensive market understanding and identify key opportunities.

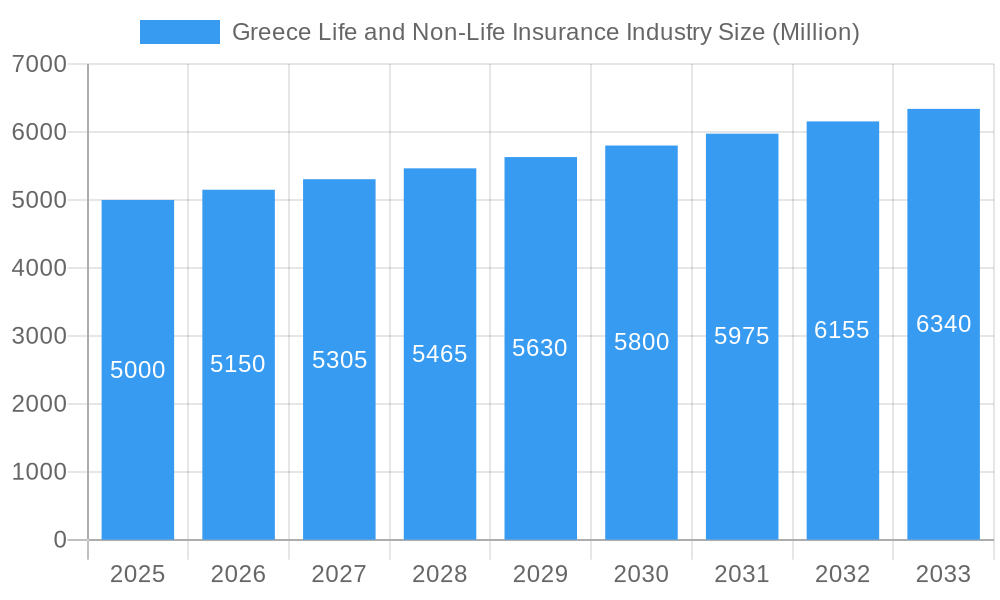

Greece Life and Non-Life Insurance Industry Company Market Share

Greece Life and Non-Life Insurance Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Greek life and non-life insurance industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this evolving market. The report includes forecasts extending to 2033, built upon a robust analysis of historical data (2019-2024) and current market trends. The total market size is estimated at xx Million in 2025.

Greece Life and Non-Life Insurance Industry Market Composition & Trends

This section delves into the competitive landscape of the Greek insurance market, examining market concentration, innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activity.

Market Concentration & M&A Activity:

- The Greek insurance market exhibits a moderate level of concentration, with several major players holding significant market share. The market share distribution is as follows: Ethniki Hellenic General Insurance (xx%), Eurolife ERB Insurance (xx%), NN Hellenic Life Insurance (xx%), and other players accounting for the remaining xx%.

- Significant M&A activity has shaped the industry landscape. The 2021 sale of Ethniki Hellenic General Insurance to a private fund for an undisclosed amount and the 2020 Generali acquisition of AXA's Greek operations for a multiple of 12.2 times the 2019 price-to-earnings ratio demonstrate considerable consolidation. Total M&A deal value in the period 2019-2024 is estimated at xx Million.

Innovation Catalysts & Regulatory Landscape:

- Technological advancements, particularly in digital insurance and data analytics, are driving innovation. The increasing adoption of Insurtech solutions is transforming customer interactions and operational efficiency.

- The regulatory environment plays a crucial role, influencing product development and market access. Recent regulatory reforms aimed at improving transparency and consumer protection have impacted market dynamics.

Substitute Products & End-User Profiles:

- The emergence of alternative risk management solutions and financial products poses a challenge to traditional insurance offerings.

- The end-user profile is diverse, encompassing individuals, businesses, and institutional clients, with varying needs and risk profiles.

Greece Life and Non-Life Insurance Industry Industry Evolution

This section provides a detailed analysis of the Greek insurance industry's evolution, focusing on market growth trajectories, technological advancements, and evolving consumer demands. From 2019 to 2024, the market experienced an average annual growth rate (AAGR) of xx%, driven by factors such as increasing insurance awareness and economic recovery. This upward trend is expected to continue, with a projected AAGR of xx% during the forecast period (2025-2033), reaching a projected market value of xx Million by 2033. Technological advancements, including the increasing use of telematics and AI-driven risk assessment, are streamlining operations and enhancing customer experience. Shifting consumer demands, particularly among younger demographics, are pushing insurers towards digitalization and personalized offerings. The adoption rate of digital insurance platforms is currently at xx% and is projected to reach xx% by 2033.

Leading Regions, Countries, or Segments in Greece Life and Non-Life Insurance Industry

The Attica region consistently dominates the Greek insurance market, driven by its high population density and economic activity.

- Key Drivers of Attica's Dominance:

- High concentration of businesses and high-net-worth individuals.

- Strong regulatory support and infrastructure.

- Significant investments in the insurance sector within the region.

The dominance of Attica is further solidified by the concentration of major insurance players' headquarters and operational centers within this region. The significant economic activity in Attica leads to a higher demand for various insurance products, ranging from property and casualty to life insurance. This concentration of demand creates a self-reinforcing cycle, attracting further investment and solidifying Attica's position as the leading region in the Greek insurance industry.

Greece Life and Non-Life Insurance Industry Product Innovations

Recent innovations include the introduction of customized insurance packages leveraging big data and AI for risk assessment, along with the expansion of digital distribution channels and mobile applications for seamless customer interaction. This has led to improved policy underwriting and claims processing times, enhancing customer satisfaction and operational efficiency. Unique selling propositions emphasize personalized coverage options, bundled services, and transparent pricing models, tailored to specific consumer needs.

Propelling Factors for Greece Life and Non-Life Insurance Industry Growth

Several factors contribute to the growth of the Greek insurance industry. Technological advancements, such as the adoption of AI and blockchain technology, are improving efficiency and security. Economic growth and rising disposable incomes are increasing insurance penetration. Favorable regulatory reforms supporting market liberalization and competition are stimulating growth. The increasing awareness among consumers about the importance of risk management and insurance protection plays a crucial role in driving market expansion.

Obstacles in the Greece Life and Non-Life Insurance Industry Market

The Greek insurance market faces challenges like high levels of uninsured population, economic uncertainty impacting consumer spending, and intense competition from both domestic and international insurers. Stringent regulatory requirements can also pose challenges to market entry and operations. Supply chain disruptions related to global events can further impact the sector's operational efficiency.

Future Opportunities in Greece Life and Non-Life Insurance Industry

Untapped potential lies in expanding into niche markets and underserved segments, including offering specialized insurance solutions for the growing tourism sector and leveraging the potential of Insurtech platforms to reach a wider customer base. Focusing on personalized products and leveraging data analytics for better risk management presents substantial growth opportunities.

Major Players in the Greece Life and Non-Life Insurance Industry Ecosystem

- Ethniki Hellenic General Insurance

- Eurolife ERB Insurance

- NN Hellenic Life Insurance

- ERGO Insurance

- AXA Insurance

- European Reliance General

- MetLife

- General Hellas

- Allianz Hellas

- Gripauma Phoenix Hellenic Insurance

Key Developments in Greece Life and Non-Life Insurance Industry Industry

- 2020: Generali acquires AXA's Greek operations.

- 2021: CVC Capital acquires 90.01% of Ethniki Insurance from NBG.

Strategic Greece Life and Non-Life Insurance Industry Market Forecast

The Greek life and non-life insurance market is poised for sustained growth, driven by technological advancements, economic recovery, and increasing consumer awareness of the importance of insurance. This growth will be fuelled by market consolidation, digital transformation, and the expansion of innovative insurance products. The market's potential for expansion into underserved sectors and the adoption of advanced technologies will shape its future trajectory and unlock significant growth opportunities.

Greece Life and Non-Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-Life Insurances

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Greece Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Greece

Greece Life and Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Greece Life and Non-Life Insurance Industry

Greece Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-Life Insurances

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethniki Hellenic General Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eurolife ERB Insurnace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NN Hellenic Life Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ERGO Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AXA Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 European Relaince General

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MetLife

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Hellas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allianz Hellas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Griupama Phoenix Hellenic Insurance*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ethniki Hellenic General Insurance

List of Figures

- Figure 1: Greece Life and Non-Life Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Greece Life and Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Life and Non-Life Insurance Industry?

The projected CAGR is approximately 34.51%.

2. Which companies are prominent players in the Greece Life and Non-Life Insurance Industry?

Key companies in the market include Ethniki Hellenic General Insurance, Eurolife ERB Insurnace, NN Hellenic Life Insurance, ERGO Insurance, AXA Insurance, European Relaince General, MetLife, General Hellas, Allianz Hellas, Griupama Phoenix Hellenic Insurance*List Not Exhaustive.

3. What are the main segments of the Greece Life and Non-Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.66 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Greek Insurance Conglomerate Ethniki Sold to Private Fund. Through its subsidiaries Garanta and Ethniki Asfalistiki Cyprus, it has a significant and dynamic presence in Romania and Cyprus, respectively. Its growth has attracted the interest of several foreign funds recently. In a statement, CVC Capital announced that it has entered into a definitive agreement to acquire 90.01% of Ethniki Insurance from NBG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Greece Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence