Key Insights

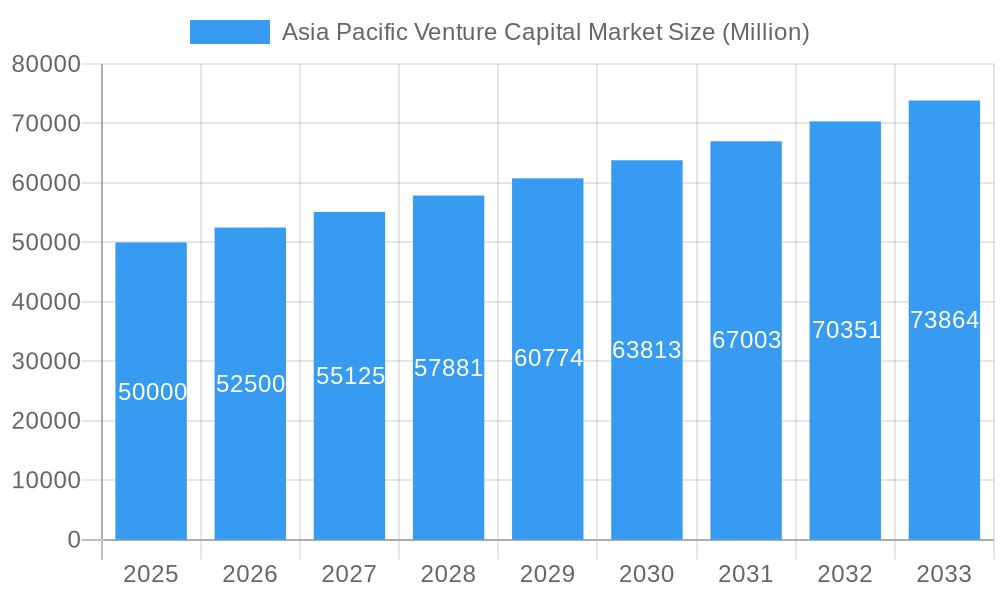

The Asia Pacific Venture Capital market is poised for significant expansion, driven by a dynamic startup landscape and proactive government initiatives promoting innovation. Projections indicate a Compound Annual Growth Rate (CAGR) of 10.8%. This robust growth is attributed to a large, youthful demographic with entrepreneurial drive, an expanding middle class fueling consumer demand, and the widespread adoption of advanced technologies such as AI, Fintech, and e-commerce. The emergence of numerous successful tech unicorns in the region attracts substantial domestic and international venture capital. The current market size stands at an estimated 352.4 billion in the base year of 2024.

Asia Pacific Venture Capital Market Market Size (In Billion)

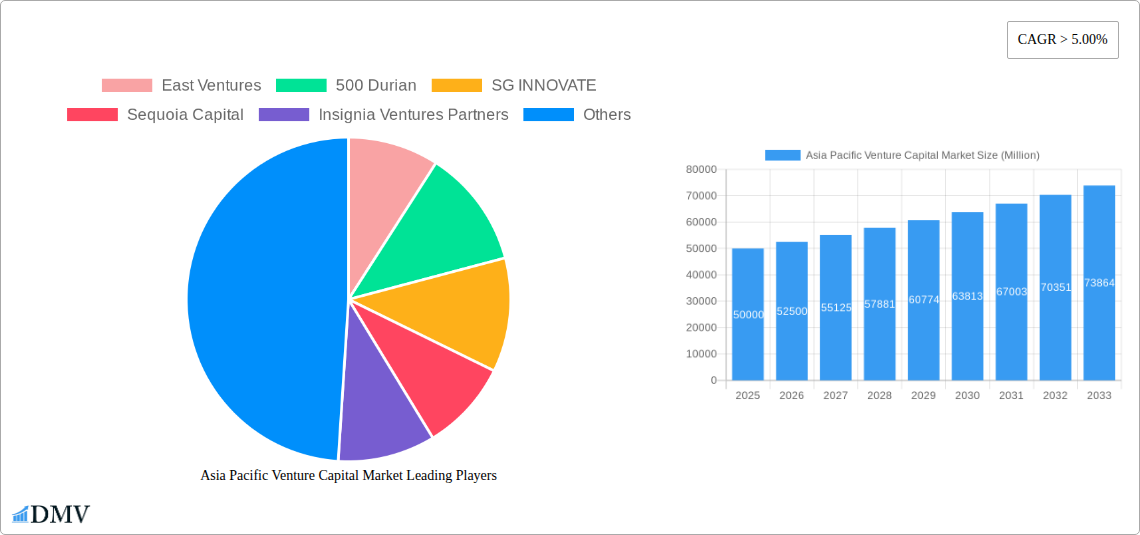

Despite geopolitical uncertainties, evolving regulatory frameworks, and potential economic fluctuations, the long-term prospects for venture capital investment in Asia Pacific remain exceptionally strong. The accelerating digital transformation across the region, especially in emerging economies, presents vast opportunities. Key investors, including East Ventures, 500 Durian, SG Innovate, and Sequoia Capital, underscore the region's high return potential. Market segmentation likely encompasses early-stage, growth-stage, and later-stage funding rounds, addressing the varied requirements of startups. The forecast period of 2025-2033 anticipates sustained growth, propelled by continuous technological advancements and the deepening digitalization of the regional economy.

Asia Pacific Venture Capital Market Company Market Share

Asia Pacific Venture Capital Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific Venture Capital market, covering the period from 2019 to 2033, with a focus on the pivotal year 2025. It delves into market composition, industry evolution, leading players, and future growth prospects, offering valuable insights for investors, entrepreneurs, and industry stakeholders. The report incorporates extensive data analysis, identifying key trends and providing a robust forecast for the coming years. The market is expected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Venture Capital Market Composition & Trends

This section evaluates the market concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and M&A activities within the Asia Pacific Venture Capital market. The analysis covers the historical period (2019-2024) and extends to the forecast period (2025-2033). We examine the market share distribution amongst key players, revealing a moderately concentrated market with several dominant firms commanding significant shares. The report quantifies the total M&A deal value across the study period, highlighting key trends in consolidation and expansion strategies.

- Market Concentration: A detailed breakdown of market share held by top players, including East Ventures, 500 Durian, SG INNOVATE, Sequoia Capital, Insignia Ventures Partners, Wavemaker Partners, Global Founders Capital, and SEEDS Capital (list not exhaustive). Analysis will show the xx% market share held by the top 5 players in 2024.

- Innovation Catalysts: Identification of key technological advancements and emerging business models driving market growth, including detailed discussion of the impact of fintech and e-commerce.

- Regulatory Landscape: Analysis of relevant regulations and their impact on market activity across different countries within the Asia Pacific region. This section includes a comparative analysis of regulatory frameworks across key markets, assessing their influence on investment flows.

- Substitute Products and Services: Evaluation of alternative funding sources and their competitive impact on the Venture Capital market.

- End-User Profiles: Detailed segmentation of end-users based on industry, company size, and investment stage.

- M&A Activities: Analysis of merger and acquisition activities, including deal values and strategic rationale behind such transactions, with a focus on transactions valued above USD 100 Million.

Asia Pacific Venture Capital Market Industry Evolution

This section analyzes the evolution of the Asia Pacific Venture Capital market, tracing its growth trajectory from 2019 to 2024 and projecting its future path until 2033. We explore the interplay of technological advancements, shifting consumer demands, and evolving investment strategies, providing granular data points on growth rates and adoption metrics. The analysis highlights the increasing influence of technology-driven disruptions, the impact of regulatory changes, and the emergence of new investment themes, such as sustainable technologies and impact investing. The detailed analysis encompasses the growth drivers, market challenges, and future opportunities across various segments and geographical areas. The section will feature detailed analysis of the impact of major macroeconomic factors and geopolitical events on investment trends.

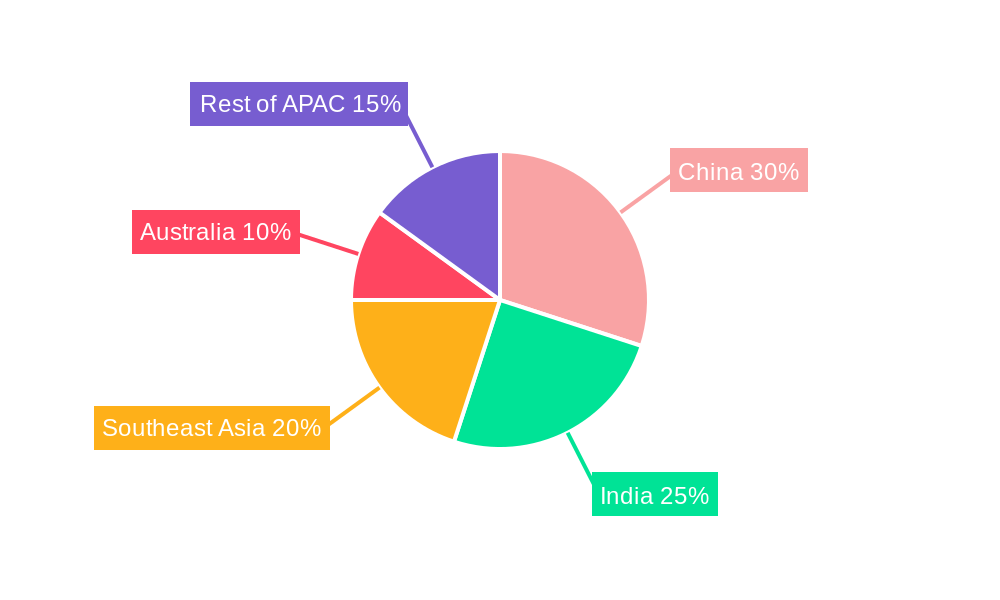

Leading Regions, Countries, or Segments in Asia Pacific Venture Capital Market

This section identifies the dominant regions, countries, and segments within the Asia Pacific Venture Capital market. It examines the factors driving their dominance, including investment trends, regulatory support, and the availability of skilled talent.

Key Drivers:

- Robust economic growth in certain regions.

- Supportive government policies and incentives.

- A thriving entrepreneurial ecosystem.

- High concentration of high-growth startups.

- Availability of skilled talent and technological infrastructure.

In-depth Analysis: This section will provide a detailed analysis of the leading regions (e.g., China, India, Southeast Asia) and their contribution to overall market growth. This analysis includes a comprehensive examination of various factors contributing to their dominance, emphasizing the interplay between economic growth, technological advancements, regulatory environment, and investment sentiment.

Asia Pacific Venture Capital Market Product Innovations

This section highlights the latest product innovations, applications, and performance metrics within the Asia Pacific Venture Capital market. It showcases unique selling propositions and technological advancements that are reshaping the industry. The focus will be on innovations in investment strategies, due diligence processes, and portfolio management tools. This includes the analysis of the adoption of AI and machine learning in investment decision-making, and the impact of blockchain technology on transparency and security.

Propelling Factors for Asia Pacific Venture Capital Market Growth

Several factors are driving the expansion of the Asia Pacific Venture Capital market. Strong economic growth across several countries in the region fuels high demand for venture capital funding. Government initiatives promoting innovation and entrepreneurship also contribute significantly. Furthermore, the increasing number of high-growth startups and the burgeoning technology sector create attractive investment opportunities. The rise of Fintech and e-commerce adds further momentum to the market.

Obstacles in the Asia Pacific Venture Capital Market

The Asia Pacific Venture Capital market faces challenges such as regulatory uncertainty in some regions, increasing competition from other investment options, and difficulties in conducting due diligence in certain emerging markets. These factors can affect investment decisions and limit market growth. Geopolitical risks and macroeconomic instability can also significantly impact investor sentiment and investment flows.

Future Opportunities in Asia Pacific Venture Capital Market

Future opportunities abound within the Asia Pacific Venture Capital market. The growth of the digital economy and the emergence of new technologies (such as AI, blockchain, and renewable energy) present significant investment potential. Moreover, expanding into underserved markets and focusing on sustainable investments offer further avenues for growth.

Major Players in the Asia Pacific Venture Capital Market Ecosystem

Key Developments in Asia Pacific Venture Capital Market Industry

- December 2021: Razorpay Software Private Limited (India) secured USD 375 Million in funding, reaching a USD 7.5 Billion valuation. This signifies a significant milestone for the Indian fintech sector and highlights the growing appetite for investment in high-growth tech companies.

- March 2022: XPeng (China) launched Rockets Capital, a USD 200 Million fund focused on frontier technologies and electric vehicle production. This underscores the increasing interest in disruptive technologies and the expanding role of Chinese investors in the global venture capital landscape.

Strategic Asia Pacific Venture Capital Market Forecast

The Asia Pacific Venture Capital market is poised for substantial growth driven by technological advancements, supportive government policies, and a burgeoning startup ecosystem. The increasing adoption of digital technologies across various sectors, coupled with the growing number of high-growth companies, will continue to attract significant investment. Focus on sustainable investments and expansion into untapped markets will further propel market growth in the coming years.

Asia Pacific Venture Capital Market Segmentation

-

1. Industry/ Sector

- 1.1. Fintech

- 1.2. Logistics and Logitech

- 1.3. Healthcare

- 1.4. IT

- 1.5. Education and Edtech

- 1.6. Others

-

2. stage

- 2.1. Early Stage

- 2.2. Growth and Expansion

- 2.3. Late Stage

Asia Pacific Venture Capital Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Venture Capital Market Regional Market Share

Geographic Coverage of Asia Pacific Venture Capital Market

Asia Pacific Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia’s booming Internet & Fintech economy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 5.1.1. Fintech

- 5.1.2. Logistics and Logitech

- 5.1.3. Healthcare

- 5.1.4. IT

- 5.1.5. Education and Edtech

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by stage

- 5.2.1. Early Stage

- 5.2.2. Growth and Expansion

- 5.2.3. Late Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 East Ventures

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 500 Durian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SG INNOVATE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sequoia Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insignia Ventures Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wavemaker Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Founders Capital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SEEDS Capital**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 East Ventures

List of Figures

- Figure 1: Asia Pacific Venture Capital Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Venture Capital Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 2: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 3: Asia Pacific Venture Capital Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 5: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 6: Asia Pacific Venture Capital Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Venture Capital Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the Asia Pacific Venture Capital Market?

Key companies in the market include East Ventures, 500 Durian, SG INNOVATE, Sequoia Capital, Insignia Ventures Partners, Wavemaker Partners, Global Founders Capital, SEEDS Capital**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Venture Capital Market?

The market segments include Industry/ Sector, stage.

4. Can you provide details about the market size?

The market size is estimated to be USD 352.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia’s booming Internet & Fintech economy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022, the China-based XPeng led an investment into a new fund of around USD 200 million. The fund is focused on backing up frontier technology startups and electric vehicle production. The fund is named as Rockets Capital and includes capital investors such as eGarden, IDG Capital, 5Y Capital, Sequioa China, and GGV Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Venture Capital Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence