Key Insights

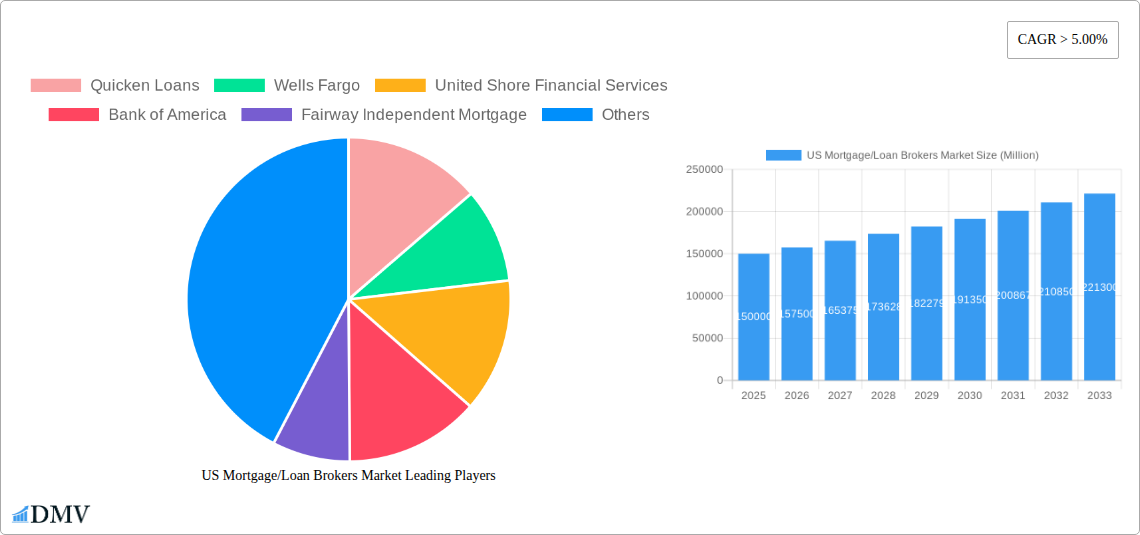

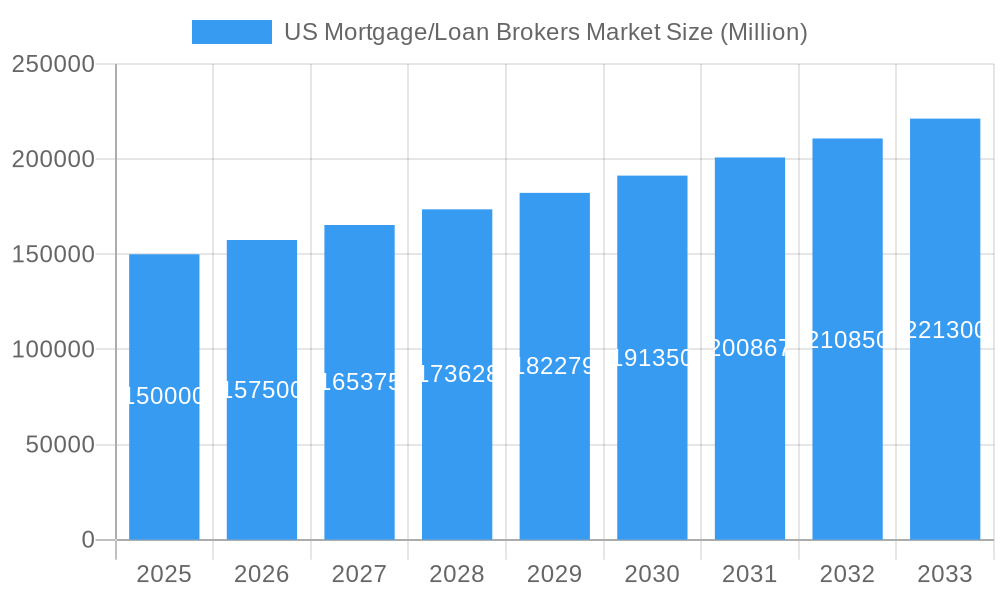

The US mortgage and loan broker market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of 14.2%. This expansion is driven by rising homeownership rates among younger demographics, evolving interest rate environments, and the increasing complexity of mortgage processes, necessitating expert guidance. The market size is estimated at $319.39 billion in the base year of 2025, with further growth anticipated throughout the forecast period. Key market segments likely encompass loan types, loan values, and borrower profiles. Leading entities such as Quicken Loans, Wells Fargo, and United Shore Financial Services command significant market share, supported by strong brand recognition and extensive networks. Independent brokers also maintain a strong presence by delivering personalized service and specialized expertise. While regulatory shifts and economic fluctuations present potential challenges, the demand for mortgage brokerage services ensures a positive market outlook.

US Mortgage/Loan Brokers Market Market Size (In Billion)

The market size was valued at approximately $319.39 billion in 2025, reflecting the significant economic activity within the housing sector and the substantial market share held by key industry participants. Future market dynamics will be shaped by inflation, Federal Reserve interest rate policies, and housing market volatility. Technological innovations, including the proliferation of online mortgage platforms and AI in lending, are revolutionizing the market, presenting both opportunities and strategic imperatives for incumbent firms. This technological evolution is expected to drive market consolidation and foster innovation and operational efficiency amidst ongoing competitive pressures.

US Mortgage/Loan Brokers Market Company Market Share

US Mortgage/Loan Brokers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the US Mortgage/Loan Brokers Market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

US Mortgage/Loan Brokers Market Market Composition & Trends

This section delves into the intricate structure of the US mortgage/loan brokers market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We analyze the competitive landscape, revealing the market share distribution amongst key players like Quicken Loans, Wells Fargo, United Shore Financial Services, Bank of America, Fairway Independent Mortgage, Chase, J P Morgan, Morgan Stanley, Caliber Home Loans, and US Bankcorp (list not exhaustive). The report further explores the impact of regulatory changes, technological disruptions, and shifting consumer preferences on market dynamics. We quantify the impact of M&A activities, providing data on deal values and their influence on market consolidation. The analysis also includes an examination of substitute products and their potential impact on market growth. The report also profiles key end-user segments, including individual homebuyers, real estate investors, and builders, providing insights into their financing preferences and market influence. Detailed information on market share distribution and M&A deal values, in Millions, is provided within the full report.

US Mortgage/Loan Brokers Market Industry Evolution

This section charts the evolution of the US mortgage/loan brokers market, meticulously tracing its growth trajectories, technological advancements, and the ever-shifting consumer demands. We examine the historical period (2019-2024) and forecast period (2025-2033), offering granular data points, including year-over-year growth rates and the adoption metrics of new technologies. We analyze how factors such as the rise of fintech, the increasing adoption of digital platforms, and evolving consumer preferences for personalized services have shaped the industry landscape. The impact of macroeconomic conditions, interest rate fluctuations, and regulatory changes on market growth will also be comprehensively examined. This section will provide in-depth analysis illustrating how these factors interplay to shape the market's future. The influence of technological innovations, such as AI-powered lending platforms and blockchain technology, on streamlining processes and improving customer experience will also be explored.

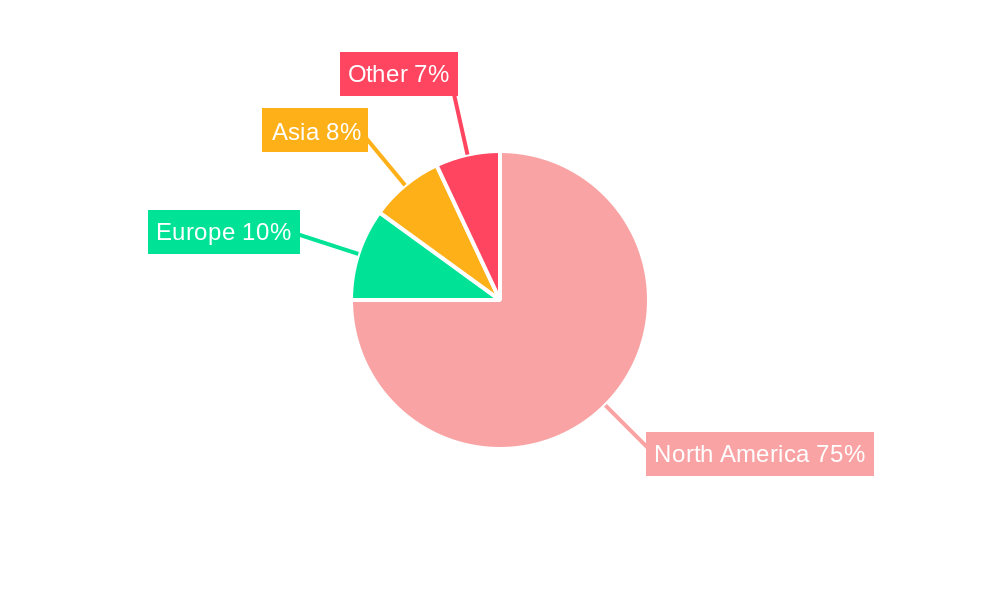

Leading Regions, Countries, or Segments in US Mortgage/Loan Brokers Market

This section pinpoints the dominant regions, countries, or segments within the US mortgage/loan brokers market. We identify the key factors contributing to the dominance of these specific areas.

- Key Drivers:

- Investment Trends: Analysis of investment patterns in different regions and their correlation with market growth.

- Regulatory Support: Examination of regional regulatory environments and their impact on market expansion.

- Economic Conditions: Assessment of regional economic factors and their influence on mortgage demand.

- Demographic Shifts: Analysis of demographic trends and their impact on mortgage needs.

This detailed analysis provides a granular understanding of the market’s geographic and segmental landscape, emphasizing the elements that drive its uneven distribution.

US Mortgage/Loan Brokers Market Product Innovations

Recent innovations in the mortgage/loan broker market include the development of advanced online platforms that simplify the application process, AI-driven underwriting systems that expedite loan approvals, and personalized financial tools that aid borrowers in making informed decisions. These innovations significantly improve the customer experience, enhance efficiency, and reduce operational costs. Key performance metrics such as application processing times, loan approval rates, and customer satisfaction scores are analyzed to quantify the impact of these technological advancements.

Propelling Factors for US Mortgage/Loan Brokers Market Growth

Several key factors drive the growth of the US mortgage/loan brokers market. Low interest rates have historically stimulated borrowing and refinancing activity, fueling market expansion. Technological advancements like AI-powered platforms have streamlined processes, leading to higher efficiency and increased market penetration. Favorable government policies and regulatory frameworks that support homeownership also contribute to sustained market growth. The increasing adoption of digital mortgage solutions by both brokers and consumers further accelerates market expansion.

Obstacles in the US Mortgage/Loan Brokers Market Market

The US mortgage/loan brokers market faces challenges such as stringent regulatory compliance requirements, increasing cybersecurity risks, and the potential for disruptions in the supply chain. Fluctuations in interest rates significantly impact market activity, making it challenging to predict future performance. Competition from established financial institutions and new fintech players increases the pressure on brokers to maintain profitability and market share.

Future Opportunities in US Mortgage/Loan Brokers Market

Future opportunities lie in leveraging emerging technologies such as AI and blockchain to personalize the customer experience and enhance operational efficiency. Expanding into underserved markets and focusing on niche lending products can unlock significant growth potential. The evolving regulatory landscape and growing demand for sustainable mortgage solutions present additional opportunities for market expansion.

Major Players in the US Mortgage/Loan Brokers Market Ecosystem

- Quicken Loans

- Wells Fargo

- United Shore Financial Services

- Bank of America

- Fairway Independent Mortgage

- Chase

- J P Morgan

- Morgan Stanley

- Caliber Home Loans

- US Bankcorp

(List Not Exhaustive)

Key Developments in US Mortgage/Loan Brokers Market Industry

- October 2022: Pennymac Financial Services launched POWER+, its next-generation broker technology platform, enhancing speed and control in the mortgage process.

- November 2022: loanDepot introduced a digital home equity line of credit, addressing rising consumer debt and inflation.

These developments demonstrate the industry's ongoing efforts to enhance technology and adapt to changing economic conditions.

Strategic US Mortgage/Loan Brokers Market Market Forecast

The US mortgage/loan brokers market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and macroeconomic factors. The market's expansion will be shaped by the adoption of innovative digital solutions, the increasing demand for personalized financial services, and ongoing efforts to improve customer experiences. This positive outlook creates attractive opportunities for both established players and new entrants, driving significant market expansion in the coming years.

US Mortgage/Loan Brokers Market Segmentation

-

1. Component

- 1.1. Products

- 1.2. Services

-

2. Enterprise

- 2.1. Large

- 2.2. Small

- 2.3. Medium-sized

-

3. Application

- 3.1. Home Loans

- 3.2. Commercial Loans

- 3.3. Industrial Loans

- 3.4. Vehicle Loans

- 3.5. Loans to Government

- 3.6. Other Applications

-

4. End - User

- 4.1. Business

- 4.2. Individuals

US Mortgage/Loan Brokers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of US Mortgage/Loan Brokers Market

US Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Adoption of the New Technologies Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Products

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large

- 5.2.2. Small

- 5.2.3. Medium-sized

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Home Loans

- 5.3.2. Commercial Loans

- 5.3.3. Industrial Loans

- 5.3.4. Vehicle Loans

- 5.3.5. Loans to Government

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End - User

- 5.4.1. Business

- 5.4.2. Individuals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Products

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Large

- 6.2.2. Small

- 6.2.3. Medium-sized

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Home Loans

- 6.3.2. Commercial Loans

- 6.3.3. Industrial Loans

- 6.3.4. Vehicle Loans

- 6.3.5. Loans to Government

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End - User

- 6.4.1. Business

- 6.4.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Products

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Large

- 7.2.2. Small

- 7.2.3. Medium-sized

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Home Loans

- 7.3.2. Commercial Loans

- 7.3.3. Industrial Loans

- 7.3.4. Vehicle Loans

- 7.3.5. Loans to Government

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End - User

- 7.4.1. Business

- 7.4.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Products

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Large

- 8.2.2. Small

- 8.2.3. Medium-sized

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Home Loans

- 8.3.2. Commercial Loans

- 8.3.3. Industrial Loans

- 8.3.4. Vehicle Loans

- 8.3.5. Loans to Government

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End - User

- 8.4.1. Business

- 8.4.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Products

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Large

- 9.2.2. Small

- 9.2.3. Medium-sized

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Home Loans

- 9.3.2. Commercial Loans

- 9.3.3. Industrial Loans

- 9.3.4. Vehicle Loans

- 9.3.5. Loans to Government

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End - User

- 9.4.1. Business

- 9.4.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific US Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Products

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Large

- 10.2.2. Small

- 10.2.3. Medium-sized

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Home Loans

- 10.3.2. Commercial Loans

- 10.3.3. Industrial Loans

- 10.3.4. Vehicle Loans

- 10.3.5. Loans to Government

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End - User

- 10.4.1. Business

- 10.4.2. Individuals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Quicken Loans

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wells Fargo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 United Shore Financial Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bank of America

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fairway Independent Mortgage

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chase

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 J P Morgan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Morgan Stanley

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Caliber Home Loans

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 US Bankcorp**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Quicken Loans

List of Figures

- Figure 1: Global US Mortgage/Loan Brokers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 5: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 9: North America US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 10: North America US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 13: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: South America US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 15: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 16: South America US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 17: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 19: South America US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 20: South America US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 23: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 25: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 26: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 29: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 30: Europe US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 33: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 35: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 36: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 39: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 40: Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Component 2025 & 2033

- Figure 43: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 45: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 46: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 49: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 50: Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific US Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 3: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 5: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 8: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 10: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 16: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 18: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 24: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 26: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 37: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 38: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 40: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Component 2020 & 2033

- Table 48: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 49: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 50: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 51: Global US Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Mortgage/Loan Brokers Market?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the US Mortgage/Loan Brokers Market?

Key companies in the market include Quicken Loans, Wells Fargo, United Shore Financial Services, Bank of America, Fairway Independent Mortgage, Chase, J P Morgan, Morgan Stanley, Caliber Home Loans, US Bankcorp**List Not Exhaustive.

3. What are the main segments of the US Mortgage/Loan Brokers Market?

The market segments include Component, Enterprise, Application, End - User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Adoption of the New Technologies Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: A digital home equity line of credit was introduced by loanDepot, one of the country's biggest non-bank retail mortgage lenders, against the backdrop of inflation and rising consumer debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the US Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence