Key Insights

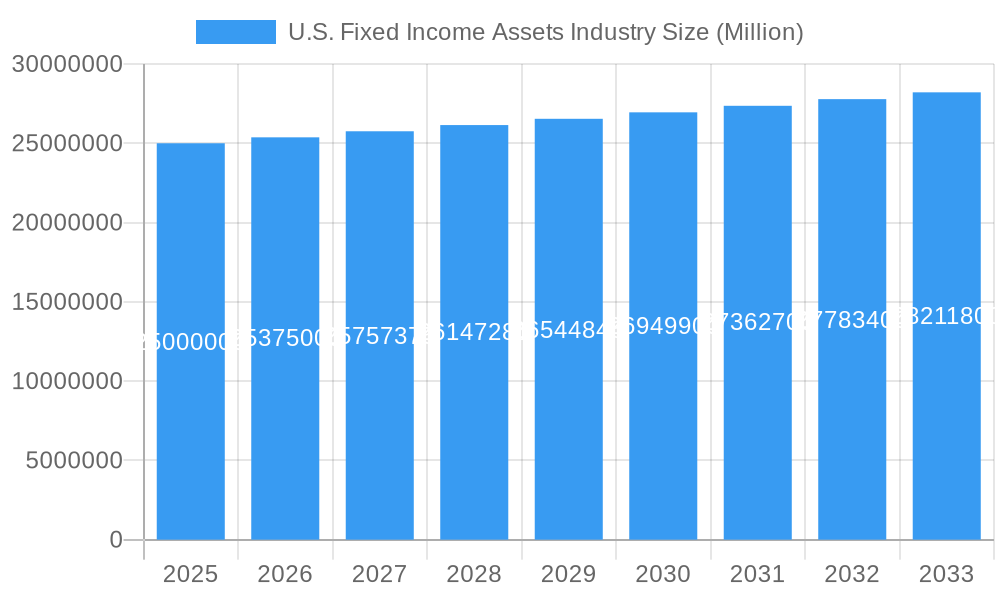

The U.S. fixed income asset industry, a cornerstone of the global financial system, is experiencing steady growth, projected at a 1.50% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This relatively moderate growth reflects a mature market characterized by increasing regulatory scrutiny and evolving investor preferences. While the overall market size in 2025 is not explicitly provided, considering the presence of major players like BlackRock, Vanguard, and Fidelity, a reasonable estimate for the total market value would be in the trillions of dollars. Key drivers for growth include sustained demand for income-generating assets, particularly amongst institutional investors such as pension funds and insurance companies seeking stability amidst market volatility. The increasing complexity of fixed income instruments and the need for sophisticated risk management solutions fuel demand for specialized asset management services, benefiting the large firms dominating this landscape. However, growth is tempered by factors like low interest rate environments, which compress yields, and increasing competition from alternative investment strategies.

U.S. Fixed Income Assets Industry Market Size (In Million)

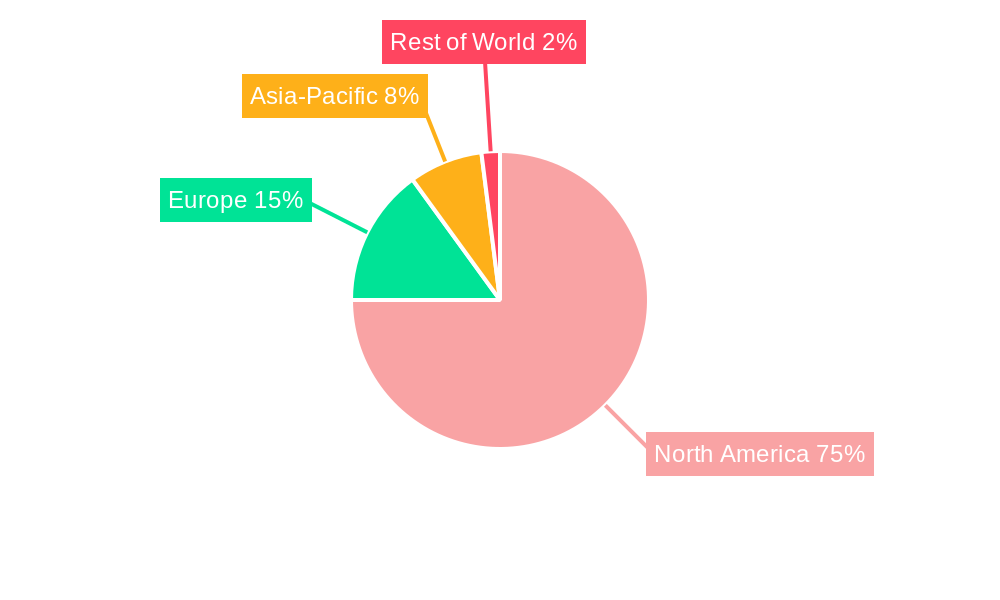

The industry is segmented by asset class (e.g., government bonds, corporate bonds, mortgage-backed securities), investment strategy (active vs. passive management), and investor type (institutional vs. retail). The dominance of large asset management firms highlights the significant capital requirements and economies of scale necessary to compete effectively. Future trends will likely include an increased adoption of technology, particularly in areas like portfolio management and risk analysis, the rise of Environmental, Social, and Governance (ESG) investing within fixed income, and potential regulatory shifts impacting investment strategies. The geographic distribution of assets remains heavily concentrated within the United States, though international diversification strategies by large asset managers are ongoing. The forecast period of 2025-2033 anticipates consistent growth, albeit potentially at a pace influenced by macroeconomic factors and evolving investor sentiment.

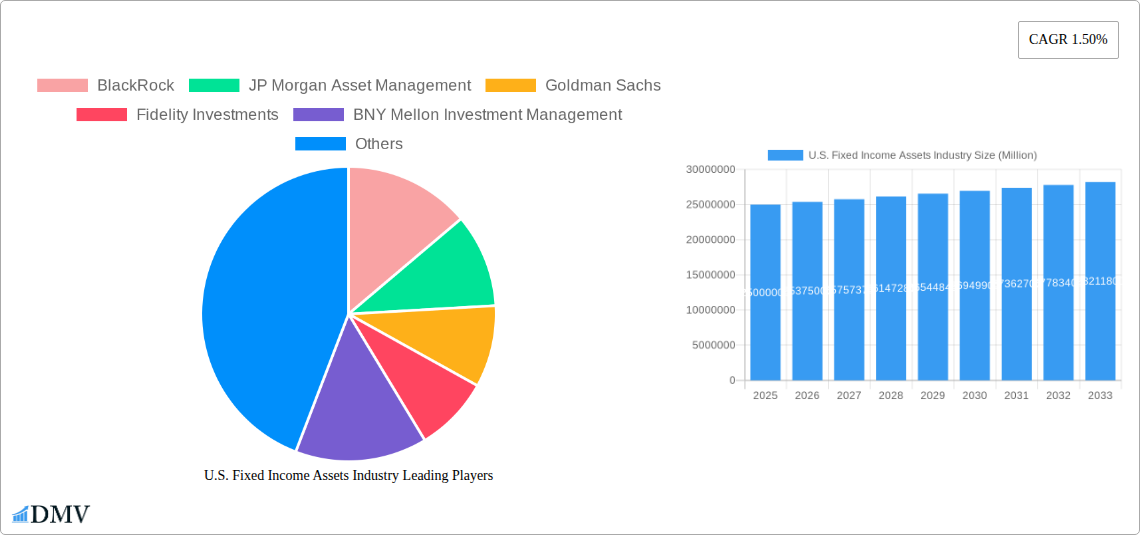

U.S. Fixed Income Assets Industry Company Market Share

U.S. Fixed Income Assets Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the U.S. Fixed Income Assets industry, offering invaluable perspectives for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on the 2025 estimated year, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The study delves into key segments, leading players, and emerging opportunities, offering data-driven forecasts to inform strategic decision-making.

U.S. Fixed Income Assets Industry Market Composition & Trends

This section analyzes the competitive landscape of the U.S. Fixed Income Assets industry, identifying key market trends and influential factors shaping its evolution. We examine market concentration, highlighting the market share distribution amongst leading players like BlackRock, Vanguard, and Fidelity. Furthermore, the report explores the impact of innovation catalysts, regulatory changes (such as new compliance standards and reporting requirements), and the presence of substitute products (e.g., alternative investments) on market dynamics. Analysis of M&A activities, including deal values (estimated at xx Million for the period 2019-2024), and their influence on market consolidation and competitive positioning, is also included. End-user profiles are segmented by institutional investors (pension funds, insurance companies), retail investors, and high-net-worth individuals, quantifying their contribution to the market's overall size and growth.

- Market Concentration: BlackRock, Vanguard, and Fidelity collectively hold an estimated xx% market share in 2025.

- M&A Activity: Total deal value for M&A transactions within the sector from 2019-2024 is estimated at xx Million.

- Regulatory Landscape: Analysis of the impact of evolving regulations on industry practices and investment strategies.

- Innovation Catalysts: Discussion of technological advancements driving efficiency and new product development.

- Substitute Products: Assessment of the competitive threat from alternative investment options.

U.S. Fixed Income Assets Industry Industry Evolution

This section provides a detailed analysis of the U.S. Fixed Income Assets industry's growth trajectory, technological advancements, and evolving consumer demands throughout the historical period (2019-2024) and the forecast period (2025-2033). We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period, driven by factors such as increasing demand for fixed-income investments, the adoption of innovative technologies, and changing investor preferences. The report examines the impact of technological advancements like AI-driven portfolio management and blockchain technology on market efficiency and access. Furthermore, it explores the shifting preferences of retail and institutional investors, including their adoption of ESG (Environmental, Social, and Governance) investing principles.

The analysis incorporates specific data points illustrating growth rates in different segments, penetration rates of new technologies, and shifts in investment strategies among major investor groups. The quantitative data presented will offer concrete evidence of industry evolution and forecast future trajectories with a high degree of confidence.

Leading Regions, Countries, or Segments in U.S. Fixed Income Assets Industry

The U.S. Fixed Income Assets market is characterized by significant regional variations in growth and investment trends. This section identifies the dominant regions or segments and provides a detailed analysis of the factors driving their dominance.

Key Drivers:

- Increasing institutional investor participation (e.g., xx Million increase in pension fund allocations to fixed income between 2020 and 2024).

- Favorable regulatory environment encouraging fixed-income investment.

- Growing demand for low-risk, high-yield investment opportunities.

- Technological advancements improving market access and efficiency.

Dominance Factors: Detailed explanation of the specific factors contributing to the dominance of the identified regions or segments, such as favorable demographics, robust regulatory frameworks, or strong investor confidence. This section will quantify the impact of these factors with specific data points and analysis.

U.S. Fixed Income Assets Industry Product Innovations

The U.S. fixed income asset industry is witnessing significant product innovation, driven by technological advancements and evolving investor needs. New products are emerging, offering enhanced features such as improved risk management tools, customized investment strategies tailored to specific investor profiles, and increased transparency. These innovations are improving efficiency, reducing costs, and enhancing the overall investor experience. The incorporation of AI-driven algorithms and machine learning models into portfolio management strategies represents a significant leap forward, allowing for more precise risk assessments and optimized returns. Unique selling propositions (USPs) for various products are highlighted, and performance metrics are analyzed to demonstrate their effectiveness in meeting diverse investor needs.

Propelling Factors for U.S. Fixed Income Assets Industry Growth

Several factors are driving the growth of the U.S. fixed income assets industry. Technological advancements such as AI-powered portfolio optimization and robo-advisors are enhancing efficiency and accessibility. Favorable economic conditions, including low interest rates in certain periods and consistent demand for stable returns, have also contributed to growth. Furthermore, supportive regulatory frameworks promoting investment and innovation are fostering a conducive environment for industry expansion. The report quantifies the impact of each of these factors on the overall market growth, using specific data points and projected figures.

Obstacles in the U.S. Fixed Income Assets Industry Market

Despite the favorable growth trajectory, the U.S. fixed income assets industry faces several challenges. Regulatory hurdles, including increasingly complex compliance requirements, can increase operational costs and limit investment opportunities. Supply chain disruptions, particularly affecting the availability of essential technologies and services, can negatively impact industry efficiency. Intense competition among established players and the emergence of new entrants are putting downward pressure on margins. The report quantifies the impact of these challenges by estimating potential revenue losses or market share erosion attributed to each of these obstacles.

Future Opportunities in U.S. Fixed Income Assets Industry

The U.S. fixed income assets industry is poised for significant growth in the coming years, fueled by several key opportunities. The expansion of the ESG investing market presents a compelling avenue for growth, as investors increasingly prioritize sustainability and social responsibility in their investment decisions. The growing adoption of fintech solutions and digital platforms is expected to further improve market access and efficiency, leading to higher participation rates among retail investors. New market segments, such as infrastructure investments, are emerging as attractive opportunities. The report forecasts the potential market size and growth for these opportunities and assesses their impact on the overall industry.

Major Players in the U.S. Fixed Income Assets Industry Ecosystem

- BlackRock

- JP Morgan Asset Management

- Goldman Sachs

- Fidelity Investments

- BNY Mellon Investment Management

- The Vanguard Group

- State Street Global Advisors

- Pacific Investment Management Company LLC

- Prudential Financial

- Capital Research & Management Company

- Franklin Templeton Investments

- Northern Trust Global Investments

Key Developments in U.S. Fixed Income Assets Industry Industry

- January 2024: BlackRock's acquisition of Global Infrastructure Partners (GIP) significantly expands its presence in the global infrastructure investment market, potentially increasing its market share and influencing investment strategies in this sector.

- October 2023: BlackRock's partnership with pvest enhances access to investment opportunities for millions of Europeans, potentially driving growth in the European fixed-income market and accelerating the adoption of digital wealth management platforms. pvest's €30 Million fundraising round highlights the significant investment in fintech solutions within the industry.

Strategic U.S. Fixed Income Assets Industry Market Forecast

The U.S. fixed income assets industry is projected to experience robust growth throughout the forecast period (2025-2033), driven by a confluence of factors. Technological innovation, evolving investor preferences (towards ESG and digital solutions), and a supportive regulatory landscape will all contribute to this expansion. Emerging market opportunities, such as infrastructure investments and the growth of the ESG segment, are expected to significantly bolster market size and attractiveness. The overall market potential is substantial, indicating a promising outlook for industry participants and investors alike.

U.S. Fixed Income Assets Industry Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Funds

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Client Types

-

2. Asset Class

- 2.1. Bonds

- 2.2. Money Market Instruments (includes Mutual Funds)

- 2.3. ETF

- 2.4. Other Asset Class

U.S. Fixed Income Assets Industry Segmentation By Geography

- 1. U.S.

U.S. Fixed Income Assets Industry Regional Market Share

Geographic Coverage of U.S. Fixed Income Assets Industry

U.S. Fixed Income Assets Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Distribution of US Fixed Income Assets - By Investment Style

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Fixed Income Assets Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Funds

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Asset Class

- 5.2.1. Bonds

- 5.2.2. Money Market Instruments (includes Mutual Funds)

- 5.2.3. ETF

- 5.2.4. Other Asset Class

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JP Morgan Asset Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Goldman Sachs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Investments

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BNY Mellon Investment Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Vanguard Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 State Street Global Advisors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific Investment Management Company LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prudential Financial

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capital Research & Management Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Franklin Templeton Investments

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Northern Trust Global Investments

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: U.S. Fixed Income Assets Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: U.S. Fixed Income Assets Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 2: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 3: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 5: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 6: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Fixed Income Assets Industry?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the U.S. Fixed Income Assets Industry?

Key companies in the market include BlackRock, JP Morgan Asset Management, Goldman Sachs, Fidelity Investments, BNY Mellon Investment Management, The Vanguard Group, State Street Global Advisors, Pacific Investment Management Company LLC, Prudential Financial, Capital Research & Management Company, Franklin Templeton Investments, Northern Trust Global Investments.

3. What are the main segments of the U.S. Fixed Income Assets Industry?

The market segments include Client Type, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Distribution of US Fixed Income Assets - By Investment Style.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024, BlackRock has finalized an agreement to acquire Global Infrastructure Partners (GIP), a move that positions it as a dominant player in the global infrastructure private markets investment landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Fixed Income Assets Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Fixed Income Assets Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Fixed Income Assets Industry?

To stay informed about further developments, trends, and reports in the U.S. Fixed Income Assets Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence