Key Insights

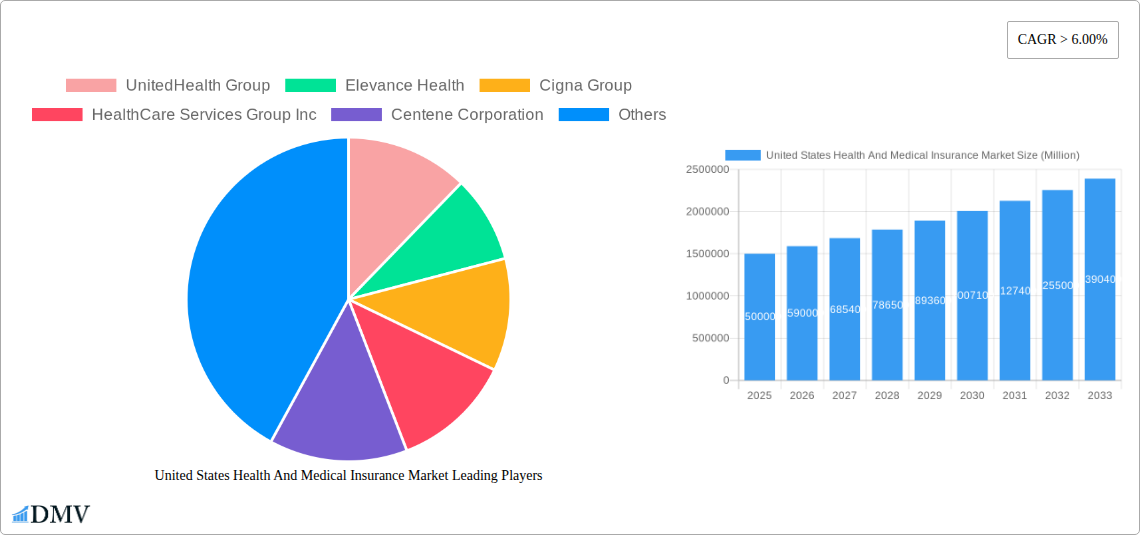

The United States Health and Medical Insurance Market, a $1.5 trillion industry in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key factors. The aging population, increasing prevalence of chronic diseases like diabetes and heart disease, and rising healthcare costs are significant drivers. Furthermore, growing awareness of the importance of preventative care and the increasing adoption of telehealth services contribute to market growth. Government initiatives aimed at expanding healthcare coverage, while facing ongoing debates regarding affordability and access, also play a crucial role. Competitive pressures among major players like UnitedHealth Group, Elevance Health, Cigna, and Humana, along with the emergence of innovative insurance models and technology-driven solutions, further shape the market landscape.

United States Health And Medical Insurance Market Market Size (In Million)

However, the market faces certain restraints. These include the ongoing challenges of controlling healthcare costs, ensuring equitable access to quality care across all demographics, and navigating the complexities of the regulatory environment. Concerns regarding the sustainability of the current healthcare system and the potential impact of rising inflation on insurance premiums also pose considerable challenges. Despite these headwinds, the market is expected to demonstrate sustained growth over the forecast period driven by the underlying demographic and healthcare trends. The segmentation of the market is likely diverse, encompassing various insurance types (e.g., individual, employer-sponsored, Medicare, Medicaid) and service offerings (e.g., preventative care, chronic disease management, mental health services). The market's future will hinge on the interplay of these growth drivers, restraints, and the innovative solutions offered by key market participants.

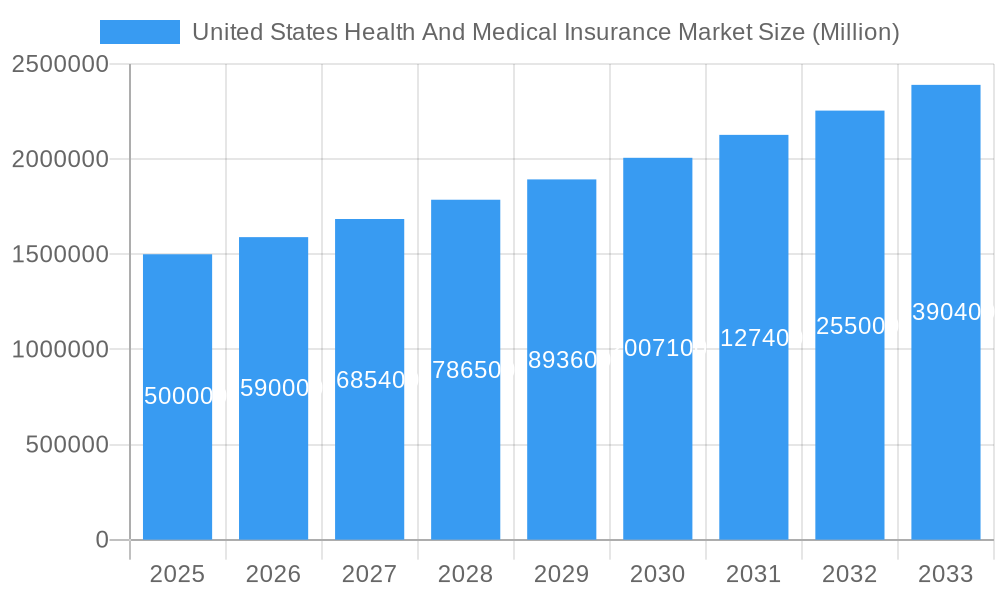

United States Health And Medical Insurance Market Company Market Share

United States Health and Medical Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States Health and Medical Insurance Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market valued at xx Million in 2025.

United States Health And Medical Insurance Market Market Composition & Trends

This section delves into the intricate structure of the US health and medical insurance market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. We analyze market share distribution among key players like UnitedHealth Group, Elevance Health, Cigna Group, HealthCare Services Group Inc, Centene Corporation, Aetna Inc, Kaiser Foundation Group, Independence Health Group, Molina Healthcare, Guidewell Mutual Holding, Humana, and CVS Health (list not exhaustive). The report quantifies the market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and explores the influence of regulatory frameworks, such as the Affordable Care Act (ACA), on market dynamics. Analysis of M&A activities includes deal values and their impact on market consolidation, providing insights into strategic shifts within the industry.

- Market Concentration: Detailed analysis of market share held by top players, illustrating the level of competition. The xx Million market in 2025 is expected to see a concentration ratio of xx% for the top 5 players.

- Innovation Catalysts: Examination of technological advancements driving innovation, including telehealth, AI-powered diagnostics, and personalized medicine.

- Regulatory Landscape: Assessment of the impact of existing and anticipated regulations on market growth and competition.

- Substitute Products: Exploration of alternative healthcare models and their potential impact on the insurance market.

- End-User Profiles: Segmentation of the market based on demographics, health conditions, and insurance coverage.

- M&A Activities: Analysis of recent mergers, acquisitions, and their financial implications, along with projections for future M&A activity. For example, the recent HCSC acquisition of parts of Cigna's Medicare business is examined in detail. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

United States Health And Medical Insurance Market Industry Evolution

This section provides a detailed analysis of the US health and medical insurance market's evolution, encompassing market growth trajectories, technological advancements, and shifting consumer demands. We examine historical growth rates (2019-2024) and project future growth rates (2025-2033) considering macroeconomic factors and industry-specific trends. The impact of technological advancements, such as the increased adoption of telehealth and the rise of data analytics in risk management, is thoroughly examined. Furthermore, we analyze the changing demands of consumers, including their preferences for value-based care and personalized health plans. Specific data points like compound annual growth rates (CAGR) and adoption rates of new technologies are included.

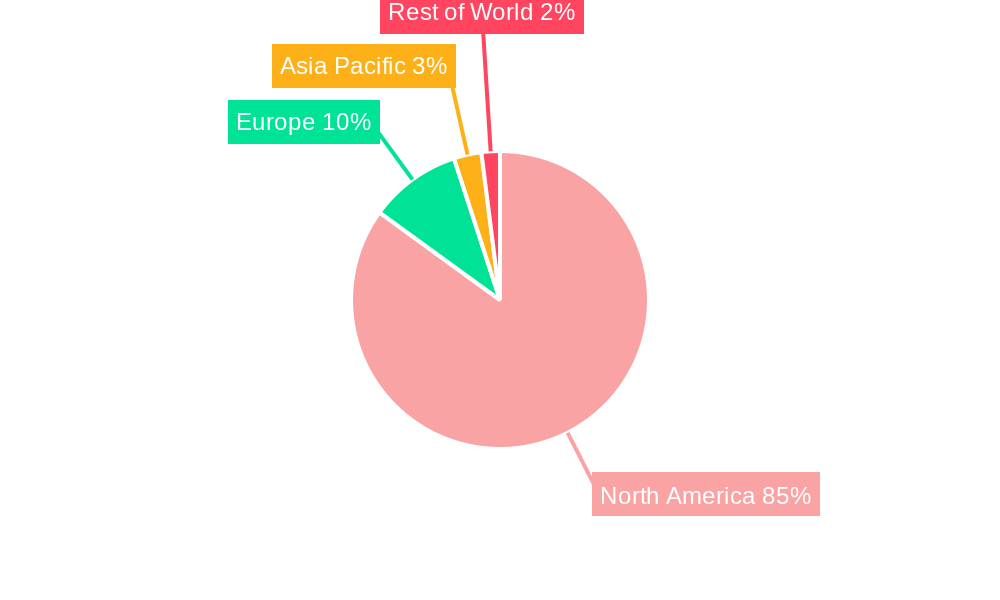

Leading Regions, Countries, or Segments in United States Health And Medical Insurance Market

This section identifies the dominant regions, countries, or segments within the US health and medical insurance market. We pinpoint the leading segments (e.g., Medicare Advantage, Medicaid, commercial insurance) and analyze their growth drivers through detailed examination of investment trends, regulatory support, and demographic shifts. The key factors contributing to the dominance of these regions/segments are explored in depth.

- Key Drivers for Dominant Segments:

- Government initiatives and funding (e.g., Medicare expansion).

- Higher prevalence of chronic diseases.

- Technological advancements and cost-effectiveness initiatives.

- Favorable regulatory environment.

United States Health And Medical Insurance Market Product Innovations

This section highlights recent product innovations, their applications, and performance metrics. We showcase unique selling propositions and the technological advancements driving innovation. Examples include the introduction of new plan designs, the integration of wearable technology for health monitoring, and the development of more sophisticated risk-assessment models. Improved data analytics and predictive modeling also contribute to innovative product offerings.

Propelling Factors for United States Health And Medical Insurance Market Growth

This section identifies key growth drivers, encompassing technological, economic, and regulatory influences. The expanding elderly population fuels demand for Medicare Advantage plans, while technological advancements in telehealth and data analytics improve efficiency and access to care. Government policies and funding also play a vital role in shaping market growth.

Obstacles in the United States Health And Medical Insurance Market Market

This section analyzes the barriers and restraints hindering market growth. These include regulatory complexities, rising healthcare costs, supply chain disruptions, and intense competition. The impact of these obstacles on market growth is quantified whenever possible. For example, the impact of rising prescription drug costs on premiums is analyzed.

Future Opportunities in United States Health And Medical Insurance Market

This section explores emerging opportunities within the market. These include expanding into underserved markets, leveraging new technologies like AI and machine learning for predictive analytics and personalized medicine, and catering to evolving consumer preferences for value-based care and personalized health plans. Growth in the telehealth sector presents significant opportunities.

Major Players in the United States Health And Medical Insurance Market Ecosystem

- UnitedHealth Group

- Elevance Health

- Cigna Group

- HealthCare Services Group Inc

- Centene Corporation

- Aetna Inc

- Kaiser Foundation Group

- Independence Health Group

- Molina Healthcare

- Guidewell Mutual Holding

- Humana

- CVS Health (List Not Exhaustive)

Key Developments in United States Health And Medical Insurance Market Industry

- January 2024: HCSC entered into a binding contract with The Cigna Group to purchase its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. This acquisition significantly expands HCSC's presence in the Medicare market.

- January 2024: Elevance Health announced its plans to acquire Paragon Healthcare Inc., strengthening its position in delivering vital therapies.

Strategic United States Health And Medical Insurance Market Market Forecast

The US health and medical insurance market is poised for significant growth over the forecast period (2025-2033), driven by factors such as an aging population, increasing chronic disease prevalence, and advancements in healthcare technology. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx%. Continued innovation and strategic acquisitions will shape the competitive landscape, presenting substantial opportunities for growth and market leadership.

United States Health And Medical Insurance Market Segmentation

-

1. Procurement Type

- 1.1. Directly/individually Purchased

-

1.2. Employer-Based

- 1.2.1. Small Group Market

- 1.2.2. Large Group Market

-

2. Products and Services Offered

- 2.1. Pharmacy Benefit Management

- 2.2. High Deductible Health Plans

- 2.3. Free-For-Service Plans

- 2.4. Managed Care Plans

-

3. Place of Purchase

- 3.1. On Exchange

- 3.2. Off Exchange

United States Health And Medical Insurance Market Segmentation By Geography

- 1. United States

United States Health And Medical Insurance Market Regional Market Share

Geographic Coverage of United States Health And Medical Insurance Market

United States Health And Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.3. Market Restrains

- 3.3.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.4. Market Trends

- 3.4.1. The Online Channel is Expected to Witness New Growth Avenues in the Coming Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Health And Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 5.1.1. Directly/individually Purchased

- 5.1.2. Employer-Based

- 5.1.2.1. Small Group Market

- 5.1.2.2. Large Group Market

- 5.2. Market Analysis, Insights and Forecast - by Products and Services Offered

- 5.2.1. Pharmacy Benefit Management

- 5.2.2. High Deductible Health Plans

- 5.2.3. Free-For-Service Plans

- 5.2.4. Managed Care Plans

- 5.3. Market Analysis, Insights and Forecast - by Place of Purchase

- 5.3.1. On Exchange

- 5.3.2. Off Exchange

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UnitedHealth Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elevance Health

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cigna Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HealthCare Services Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Centene Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aetna Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kaiser Foundation Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Independence Health Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Molina Healthcare

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guidewell Mutual Holding

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Humana

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CVS Health**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 UnitedHealth Group

List of Figures

- Figure 1: United States Health And Medical Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Health And Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2020 & 2033

- Table 2: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2020 & 2033

- Table 3: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2020 & 2033

- Table 4: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2020 & 2033

- Table 5: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2020 & 2033

- Table 6: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2020 & 2033

- Table 7: United States Health And Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Health And Medical Insurance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2020 & 2033

- Table 10: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2020 & 2033

- Table 11: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2020 & 2033

- Table 12: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2020 & 2033

- Table 13: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2020 & 2033

- Table 14: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2020 & 2033

- Table 15: United States Health And Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Health And Medical Insurance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Health And Medical Insurance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Health And Medical Insurance Market?

Key companies in the market include UnitedHealth Group, Elevance Health, Cigna Group, HealthCare Services Group Inc, Centene Corporation, Aetna Inc, Kaiser Foundation Group, Independence Health Group, Molina Healthcare, Guidewell Mutual Holding, Humana, CVS Health**List Not Exhaustive.

3. What are the main segments of the United States Health And Medical Insurance Market?

The market segments include Procurement Type, Products and Services Offered, Place of Purchase.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

6. What are the notable trends driving market growth?

The Online Channel is Expected to Witness New Growth Avenues in the Coming Future.

7. Are there any restraints impacting market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

8. Can you provide examples of recent developments in the market?

January 2024: HCSC entered into a binding contract with The Cigna Group to purchase its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. This acquisition will bring significant advantages to HCSC's existing and prospective members, as it will strengthen the company's capabilities and expand its presence, especially in the expanding Medicare sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Health And Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Health And Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Health And Medical Insurance Market?

To stay informed about further developments, trends, and reports in the United States Health And Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence