Key Insights

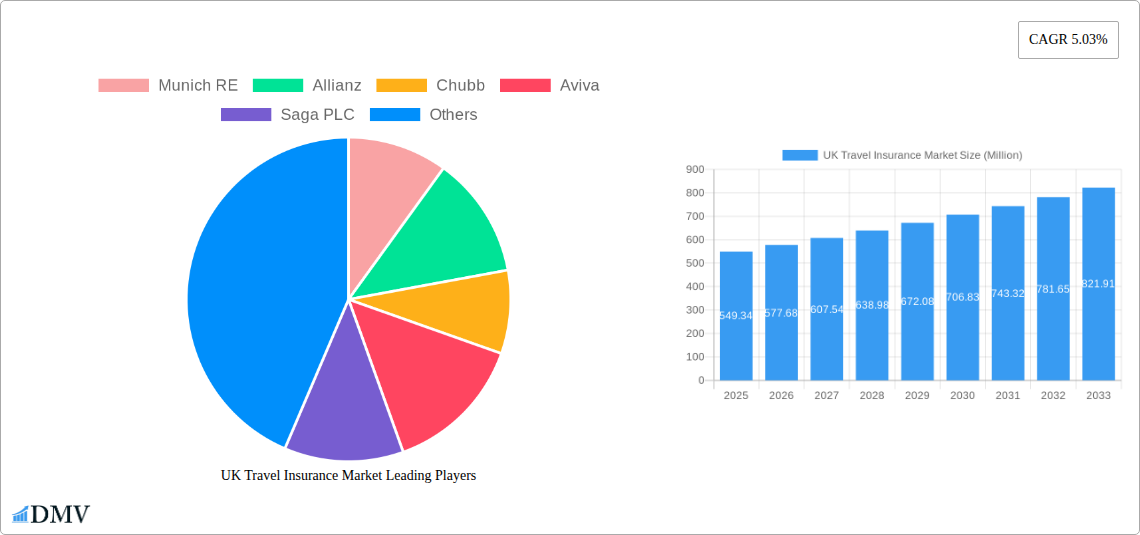

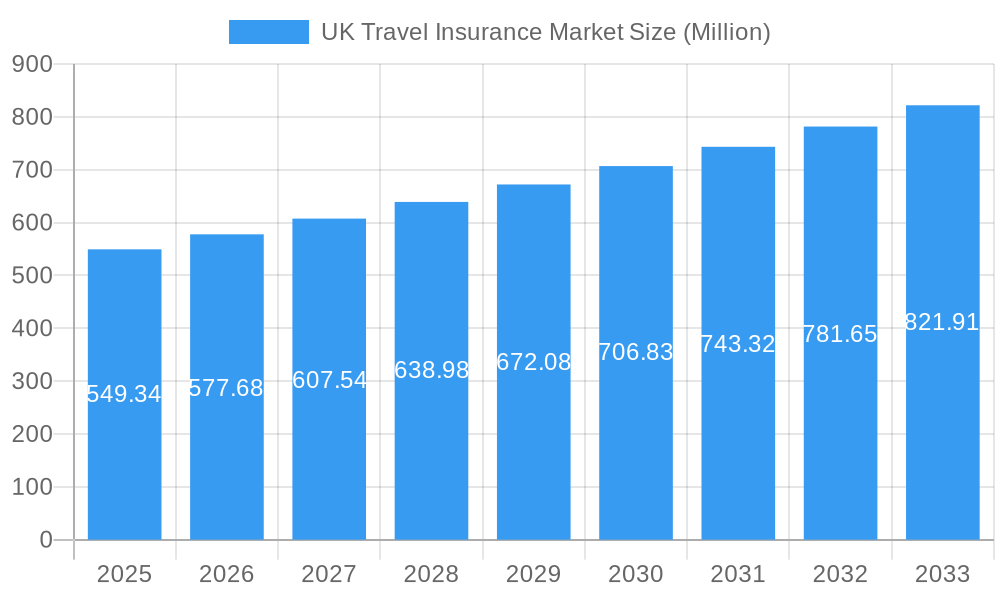

The UK travel insurance market, valued at £549.34 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.03% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing popularity of international travel amongst UK residents fuels demand for comprehensive coverage against unforeseen events like medical emergencies, trip cancellations, and lost luggage. Secondly, heightened consumer awareness regarding potential travel risks, coupled with stricter visa requirements in certain destinations, reinforces the necessity of travel insurance. Furthermore, the evolving insurance landscape, with innovative products and digital distribution channels, contributes to market growth. The market is segmented by various factors including policy type (single trip, annual multi-trip), coverage level (basic, comprehensive), and distribution channels (online, offline). Leading players like Munich Re, Allianz, Chubb, and Aviva dominate the market, leveraging their brand reputation and extensive distribution networks. However, the market also faces challenges, including price sensitivity among consumers and the rise of bundled travel packages that may include basic insurance.

UK Travel Insurance Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, although the CAGR might experience minor fluctuations reflecting broader economic conditions and evolving consumer preferences. The competitive landscape will remain dynamic, with established players investing in technological advancements and smaller insurers seeking niche market segments. The increasing adoption of digital platforms for policy purchases and claims processing presents both opportunities and challenges for companies. Successfully navigating these shifts requires adaptability, strategic partnerships, and a customer-centric approach to product development and service delivery. The market's continued growth demonstrates the enduring need for travel insurance in the UK, underpinned by a growing travel-oriented population and a heightened consciousness of risk management during travel.

UK Travel Insurance Market Company Market Share

UK Travel Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UK Travel Insurance Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market size in 2025 is estimated at £XX Million, projected to reach £XX Million by 2033.

UK Travel Insurance Market Composition & Trends

This section delves into the intricate structure of the UK travel insurance market, examining market concentration, innovation, regulations, substitute products, customer profiles, and merger & acquisition (M&A) activity. We analyze the market share distribution among key players, revealing the competitive landscape and identifying potential areas for disruption. The report also explores the influence of regulatory frameworks, highlighting their impact on market growth and innovation. Furthermore, an in-depth analysis of M&A activities, including deal values (estimated at £XX Million in total for the period 2019-2024), will shed light on strategic market shifts and consolidations.

- Market Concentration: Analysis of market share held by top players like Munich Re, Allianz, Chubb, Aviva, and others. We will quantify the level of market concentration using metrics such as the Herfindahl-Hirschman Index (HHI).

- Innovation Catalysts: Examination of technological advancements (e.g., AI-powered risk assessment, online platforms) driving innovation within the sector.

- Regulatory Landscape: Detailed overview of UK regulations impacting travel insurance providers, including implications for product offerings and customer protection.

- Substitute Products: Assessment of alternative solutions (e.g., credit card travel insurance) and their impact on market demand.

- End-User Profiles: Segmentation of the customer base based on demographics, travel habits, and risk profiles.

- M&A Activities: Review of significant mergers and acquisitions, providing insights into market consolidation and strategic partnerships.

UK Travel Insurance Market Industry Evolution

This section charts the evolution of the UK travel insurance market, analyzing its growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2024, and projecting trends until 2033. We will present data points including year-on-year growth rates and the adoption rate of new technologies. We also delve into the impact of macroeconomic factors, shifting consumer preferences (e.g., increased demand for specific coverage types), and technological disruptions. The analysis will showcase the market's response to significant events, such as the COVID-19 pandemic and its lasting effects on consumer behaviour and industry practices. The section will provide a comprehensive understanding of the market's dynamic nature and its future direction.

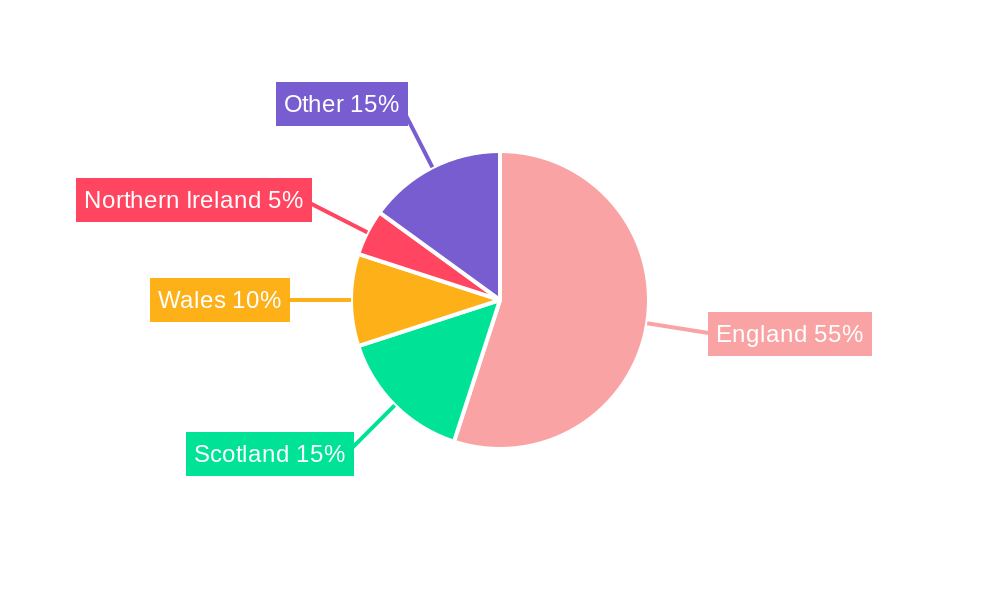

Leading Regions, Countries, or Segments in UK Travel Insurance Market

This section identifies the leading regions, countries, or segments within the UK travel insurance market, providing a granular analysis of the factors driving their dominance. We will analyze regional disparities in demand, pricing, and regulatory environments. Key factors contributing to regional variations are detailed, focusing on investment trends, regulatory support, and infrastructure development that influence market growth within specific geographical areas. The analysis will incorporate data and qualitative observations to illustrate why certain regions outperform others.

- Key Drivers: A comprehensive list of factors contributing to the dominance of the leading region/segment.

- Dominance Factors: Detailed analysis of the competitive landscape, economic drivers, and regulatory environment in the leading region/segment.

UK Travel Insurance Market Product Innovations

This section explores recent product innovations within the UK travel insurance market, highlighting new features, applications, and performance metrics. We will discuss the adoption of advanced technologies such as AI and machine learning, examining their impact on risk assessment, fraud detection, and customer service. We will also analyze the unique selling propositions (USPs) of new products and assess their market traction and potential for future growth.

Propelling Factors for UK Travel Insurance Market Growth

Several factors are driving the growth of the UK travel insurance market. Technological advancements, such as online platforms and mobile applications, have streamlined the purchase process, increasing accessibility. Economic factors, including rising disposable incomes and increased international travel, fuel demand for comprehensive coverage. A supportive regulatory environment, designed to protect consumers and maintain market integrity, fosters confidence and growth.

Obstacles in the UK Travel Insurance Market

Challenges facing the UK travel insurance market include regulatory hurdles, such as compliance with evolving data protection regulations and reporting requirements. Supply chain disruptions, potentially impacting the availability of reinsurance or claims processing services, can hinder operations. Intense competition among established players and new entrants creates pressure on pricing and profitability. These factors, along with unpredictable geopolitical events, impact market stability and growth.

Future Opportunities in UK Travel Insurance Market

The UK travel insurance market presents several exciting future opportunities. Expanding into niche markets (e.g., adventure travel, medical evacuation) offers potential for growth. Leveraging new technologies, such as blockchain for secure claims processing and AI for personalized risk assessment, enhances efficiency and customer experience. Catering to evolving consumer demands, such as sustainable travel insurance options, aligns with broader societal trends.

Key Developments in UK Travel Insurance Market Industry

- October 2023: Munich Re partners with International SOS to offer integrated pandemic management solutions. This collaboration enhances policyholder support and strengthens Munich Re's position in the market.

- December 2023: Chubb partners with NetSPI to enhance cybersecurity capabilities, strengthening risk assessment and potentially reducing claims related to data breaches.

Strategic UK Travel Insurance Market Forecast

The UK travel insurance market is poised for continued growth, driven by factors such as rising travel demand, technological advancements, and evolving consumer preferences. Emerging opportunities in niche segments and the adoption of innovative technologies will further shape market dynamics. The market's resilience and adaptability to changing circumstances suggest a positive outlook for the forecast period.

UK Travel Insurance Market Segmentation

-

1. Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

UK Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Travel Insurance Market Regional Market Share

Geographic Coverage of UK Travel Insurance Market

UK Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.3. Market Restrains

- 3.3.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.4. Market Trends

- 3.4.1. Expansion of Tourism Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-Trip Travel Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Insurance Companies

- 6.2.2. Insurance Intermediaries

- 6.2.3. Banks

- 6.2.4. Insurance Brokers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Senior Citizens

- 6.3.2. Education Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-Trip Travel Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Insurance Companies

- 7.2.2. Insurance Intermediaries

- 7.2.3. Banks

- 7.2.4. Insurance Brokers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Senior Citizens

- 7.3.2. Education Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-Trip Travel Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Insurance Companies

- 8.2.2. Insurance Intermediaries

- 8.2.3. Banks

- 8.2.4. Insurance Brokers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Senior Citizens

- 8.3.2. Education Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-Trip Travel Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Insurance Companies

- 9.2.2. Insurance Intermediaries

- 9.2.3. Banks

- 9.2.4. Insurance Brokers

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Senior Citizens

- 9.3.2. Education Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-Trip Travel Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Insurance Companies

- 10.2.2. Insurance Intermediaries

- 10.2.3. Banks

- 10.2.4. Insurance Brokers

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Senior Citizens

- 10.3.2. Education Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Munich RE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allianz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chubb

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saga PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prudential Guarantee

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KBC Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Europ Assistance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AllClear

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ABTA**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Munich RE

List of Figures

- Figure 1: Global UK Travel Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Travel Insurance Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 5: North America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 13: North America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 17: North America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 21: South America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: South America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 25: South America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: South America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: South America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 29: South America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 33: South America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 37: Europe UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Europe UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 41: Europe UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Europe UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Europe UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Europe UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 45: Europe UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Europe UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 49: Europe UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 53: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East & Africa UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 57: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East & Africa UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East & Africa UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 61: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 69: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Asia Pacific UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 73: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Asia Pacific UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Asia Pacific UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 76: Asia Pacific UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 77: Asia Pacific UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 79: Asia Pacific UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 7: Global UK Travel Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global UK Travel Insurance Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 15: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: United States UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 25: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 29: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Brazil UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 39: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 43: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 45: United Kingdom UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Germany UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: France UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Italy UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Spain UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Russia UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Benelux UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Nordics UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 65: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 69: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 71: Turkey UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Israel UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: GCC UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: North Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: South Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 83: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 85: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 86: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 87: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 88: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 89: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 91: China UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: India UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: Japan UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: South Korea UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: ASEAN UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: Oceania UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Travel Insurance Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the UK Travel Insurance Market?

Key companies in the market include Munich RE, Allianz, Chubb, Aviva, Saga PLC, Prudential Guarantee, KBC Group, Europ Assistance, AllClear, ABTA**List Not Exhaustive.

3. What are the main segments of the UK Travel Insurance Market?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 549.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

6. What are the notable trends driving market growth?

Expansion of Tourism Industry.

7. Are there any restraints impacting market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

8. Can you provide examples of recent developments in the market?

October 2023: Munich Re, a world-renowned reinsurance company, has joined forces with the world-renowned International SOS, an international leader in health and security, to create an integrated policy solution for the management of epidemics and pandemics. As a result of this new collaboration between the two companies, International SOS is now offering health advisory services for Munich Re's policyholders affected by the pandemic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Travel Insurance Market?

To stay informed about further developments, trends, and reports in the UK Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence