Key Insights

The UK Insurtech market is projected for significant expansion, driven by increasing digital adoption, demand for personalized insurance, and supportive regulations. Technological advancements are reshaping business models and enhancing customer experiences. The market encompasses established insurers, agile startups, and technology providers, fostering a competitive yet innovative landscape. Key growth drivers include AI integration, machine learning for risk assessment, and embedded insurance solutions. While cybersecurity and regulatory compliance present challenges, the sector's long-term outlook remains strong.

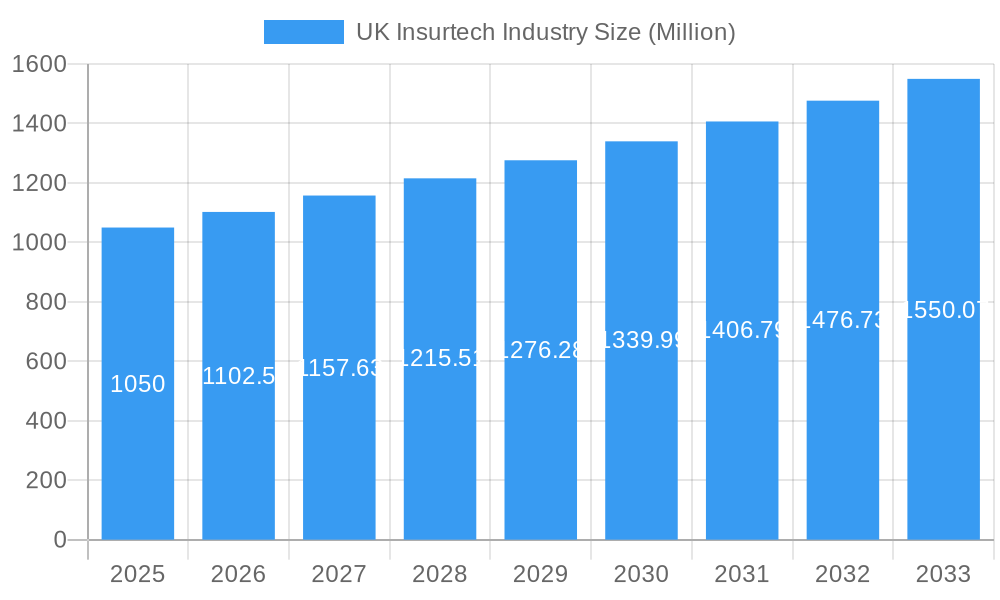

UK Insurtech Industry Market Size (In Billion)

CAGR: 31.6% (2025-2033). The UK Insurtech market is forecast to reach £49.51 billion by 2033, with 2025 as the base year and an estimated market size of £1.05 billion in 2025. This substantial growth trajectory is underpinned by evolving consumer preferences and continuous technological innovation.

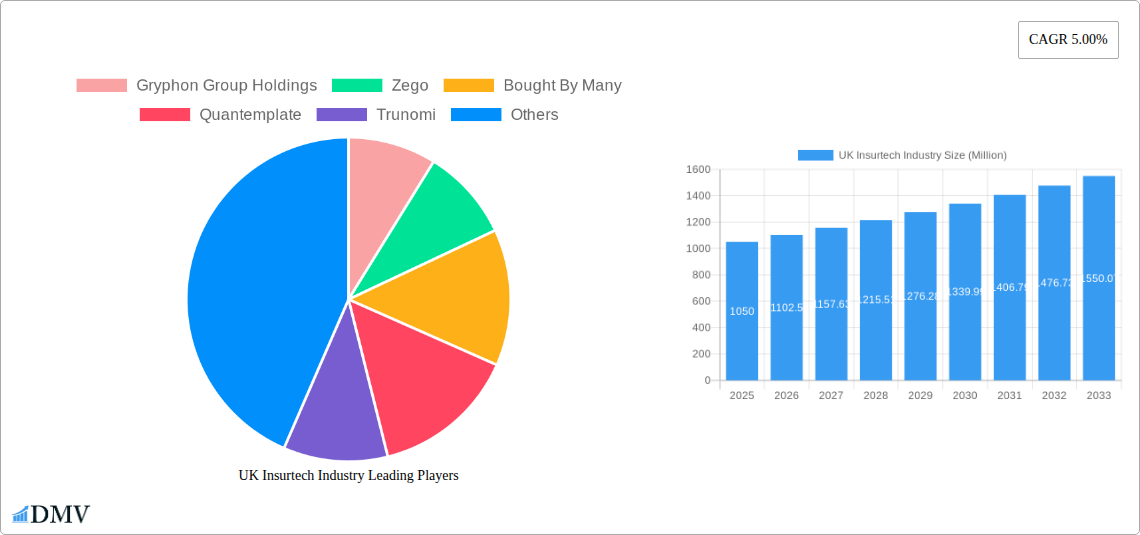

UK Insurtech Industry Company Market Share

UK Insurtech Industry Market Analysis & Forecast: 2025-2033

This report offers a comprehensive analysis of the UK Insurtech market, projecting robust growth from £49.51 billion in 2025 to an anticipated value by 2033. It delves into market dynamics, leading players, technological innovations, and future opportunities, providing critical intelligence for stakeholders. The forecast period extends from 2025 to 2033, with 2025 designated as the base year.

UK Insurtech Industry Market Composition & Trends

This section delves into the competitive landscape of the UK Insurtech market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user demographics, and mergers & acquisitions (M&A) activity. We examine the market share distribution amongst key players, revealing the dominance of certain segments and the impact of strategic partnerships. The analysis incorporates data on M&A deal values, highlighting significant transactions that have shaped the market landscape. The report also explores the influence of regulatory changes on innovation and market entry, analyzing the impact of substitute products and evolving consumer preferences on market dynamics.

- Market Concentration: The UK Insurtech market exhibits a [Describe level of concentration: e.g., moderately concentrated] structure, with [Percentage]% market share held by the top 5 players in 2025.

- Innovation Catalysts: Key innovation drivers include advancements in AI, blockchain, and big data analytics, enabling personalized insurance products and streamlined claims processing.

- Regulatory Landscape: The Financial Conduct Authority (FCA) plays a crucial role in shaping the regulatory environment, impacting innovation and market entry. [Mention specific regulations and their impact]

- Substitute Products: [Describe substitute products and their market impact, e.g., the rise of peer-to-peer insurance platforms].

- End-User Profiles: The report segments end-users based on demographics, risk profiles, and technology adoption rates, providing insights into market segmentation.

- M&A Activity: Significant M&A activity has been observed in the UK Insurtech space, with deal values exceeding £xx Million in 2024. [Provide examples of key M&A deals and their strategic implications].

UK Insurtech Industry Industry Evolution

This section provides a detailed analysis of the UK Insurtech market's evolutionary trajectory, encompassing market growth trends, technological advancements, and evolving consumer demands. We examine historical growth rates, projecting future growth based on current market trends and technological breakthroughs. The analysis also delves into the adoption rates of various Insurtech solutions across different consumer segments, illustrating the impact of technological advancements on market penetration. Factors such as changing consumer expectations regarding speed, convenience, and personalization are also carefully considered.

[Insert 600-word analysis of market growth trajectories, technological advancements, and shifting consumer demands, including specific data points such as growth rates and adoption metrics].

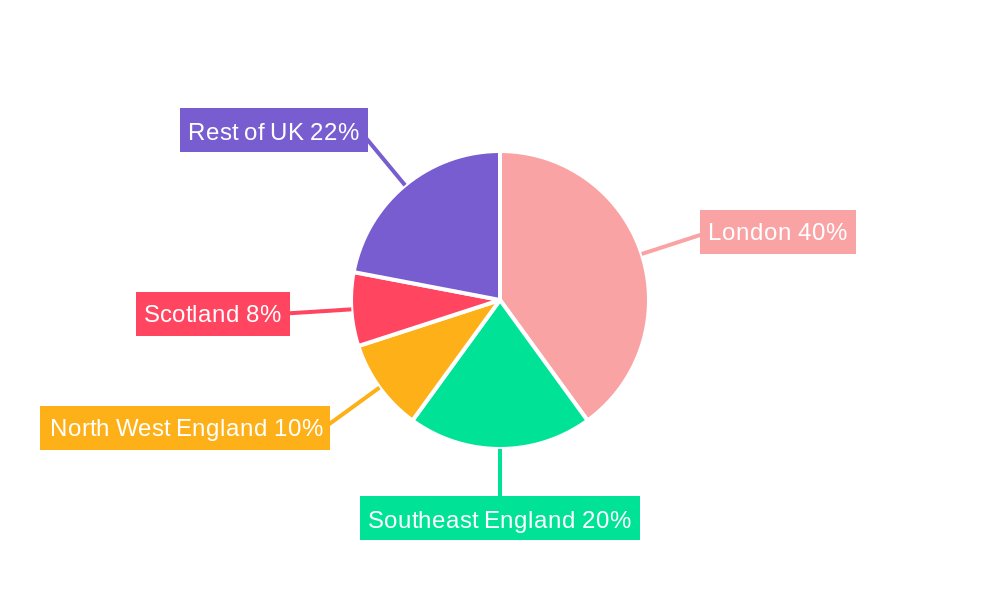

Leading Regions, Countries, or Segments in UK Insurtech Industry

This section pinpoints the leading regions, countries, or segments within the UK Insurtech market. London remains the dominant hub, fueled by a confluence of factors.

- Key Drivers for London's Dominance:

- High concentration of tech talent and startups.

- Robust venture capital investment.

- Supportive regulatory environment fostering innovation.

- Presence of established insurance players driving partnerships.

[Insert 600-word in-depth analysis of dominance factors, including regional variations and contributing elements like investment trends and regulatory support. This should expand on the bullet points above and provide further explanation.]

UK Insurtech Industry Product Innovations

The UK Insurtech market witnesses continuous product innovation. New offerings leverage AI for personalized pricing and risk assessment, blockchain for secure data management and transparent claims processing, and telematics for usage-based insurance. These innovations enhance efficiency, personalize customer experiences, and create unique selling propositions for Insurtech companies, driving market growth and competitive advantage.

Propelling Factors for UK Insurtech Industry Growth

Several key drivers fuel the growth of the UK Insurtech industry. Technological advancements, particularly in AI and data analytics, enable more efficient risk assessment and personalized insurance products. Favorable government policies and regulatory frameworks promote innovation and attract investment. Growing consumer demand for digital solutions and personalized services further accelerates market expansion. Examples include the increasing adoption of usage-based insurance and the rise of embedded insurance within other platforms.

Obstacles in the UK Insurtech Industry Market

Despite significant growth potential, the UK Insurtech market faces certain challenges. Stringent regulatory requirements and data privacy concerns can hinder innovation and market entry. Competition from established insurance players and the need for significant capital investment also pose obstacles. Supply chain disruptions and cybersecurity threats further complicate the market dynamics, impacting operational efficiency and customer trust. [Quantify these impacts where possible, e.g., "Regulatory hurdles resulted in a xx% delay in product launch for X company"].

Future Opportunities in UK Insurtech Industry

The future of the UK Insurtech market presents exciting opportunities. The expansion of embedded insurance within various platforms, such as e-commerce and fintech, promises substantial growth. Advancements in AI and machine learning will further personalize insurance products and streamline claims processing. The increasing adoption of Insurtech solutions by SMEs and underserved populations offers significant market expansion potential.

Major Players in the UK Insurtech Industry Ecosystem

- Gryphon Group Holdings

- Zego

- Bought By Many

- Quantemplate

- Trunomi

- Anorak Technologies

- Wrisk

- Cazana

- Setoo

- By Miles

- Other

Key Developments in UK Insurtech Industry Industry

- [Insert bullet points detailing key developments with year/month, emphasizing their impact on market dynamics, e.g., product launches, mergers, regulatory changes]

Strategic UK Insurtech Industry Market Forecast

The UK Insurtech market is poised for continued strong growth, driven by technological advancements, evolving consumer preferences, and supportive regulatory environments. The increasing adoption of digital solutions and personalized insurance products will fuel market expansion, creating significant opportunities for both established players and new entrants. The forecast anticipates a robust growth trajectory, with the market size exceeding £xx Million by 2033. This positive outlook is underpinned by sustained innovation and the ongoing integration of Insurtech solutions across various sectors.

UK Insurtech Industry Segmentation

-

1. Insurance type

- 1.1. Life

-

1.2. Non-Life

- 1.2.1. Motor

- 1.2.2. House

- 1.2.3. Accident

- 1.2.4. Health

- 1.2.5. Others

UK Insurtech Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Insurtech Industry Regional Market Share

Geographic Coverage of UK Insurtech Industry

UK Insurtech Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Customer Acquisition; Customer Retention; Risk Assessment; Fraud Prevention and Detection; Others

- 3.3. Market Restrains

- 3.3.1. ; Customer Acquisition; Customer Retention; Risk Assessment; Fraud Prevention and Detection; Others

- 3.4. Market Trends

- 3.4.1. INSURTECHS FOCUS ON ANALYTICS / BIG DATA and AI

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life

- 5.1.2. Non-Life

- 5.1.2.1. Motor

- 5.1.2.2. House

- 5.1.2.3. Accident

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Life

- 6.1.2. Non-Life

- 6.1.2.1. Motor

- 6.1.2.2. House

- 6.1.2.3. Accident

- 6.1.2.4. Health

- 6.1.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Life

- 7.1.2. Non-Life

- 7.1.2.1. Motor

- 7.1.2.2. House

- 7.1.2.3. Accident

- 7.1.2.4. Health

- 7.1.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Life

- 8.1.2. Non-Life

- 8.1.2.1. Motor

- 8.1.2.2. House

- 8.1.2.3. Accident

- 8.1.2.4. Health

- 8.1.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Life

- 9.1.2. Non-Life

- 9.1.2.1. Motor

- 9.1.2.2. House

- 9.1.2.3. Accident

- 9.1.2.4. Health

- 9.1.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific UK Insurtech Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Life

- 10.1.2. Non-Life

- 10.1.2.1. Motor

- 10.1.2.2. House

- 10.1.2.3. Accident

- 10.1.2.4. Health

- 10.1.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gryphon Group Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zego

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bought By Many

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quantemplate

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trunomi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Anorak Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wrisk

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cazana

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Setoo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 By Miles

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Other

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Gryphon Group Holdings

List of Figures

- Figure 1: Global UK Insurtech Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Insurtech Industry Revenue (billion), by Insurance type 2025 & 2033

- Figure 3: North America UK Insurtech Industry Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America UK Insurtech Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Insurtech Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Insurtech Industry Revenue (billion), by Insurance type 2025 & 2033

- Figure 7: South America UK Insurtech Industry Revenue Share (%), by Insurance type 2025 & 2033

- Figure 8: South America UK Insurtech Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Insurtech Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Insurtech Industry Revenue (billion), by Insurance type 2025 & 2033

- Figure 11: Europe UK Insurtech Industry Revenue Share (%), by Insurance type 2025 & 2033

- Figure 12: Europe UK Insurtech Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Insurtech Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Insurtech Industry Revenue (billion), by Insurance type 2025 & 2033

- Figure 15: Middle East & Africa UK Insurtech Industry Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Middle East & Africa UK Insurtech Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Insurtech Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Insurtech Industry Revenue (billion), by Insurance type 2025 & 2033

- Figure 19: Asia Pacific UK Insurtech Industry Revenue Share (%), by Insurance type 2025 & 2033

- Figure 20: Asia Pacific UK Insurtech Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Insurtech Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: Global UK Insurtech Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 4: Global UK Insurtech Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 9: Global UK Insurtech Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 14: Global UK Insurtech Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 25: Global UK Insurtech Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Insurtech Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 33: Global UK Insurtech Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Insurtech Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Insurtech Industry?

The projected CAGR is approximately 31.6%.

2. Which companies are prominent players in the UK Insurtech Industry?

Key companies in the market include Gryphon Group Holdings, Zego, Bought By Many, Quantemplate, Trunomi, Anorak Technologies, Wrisk, Cazana, Setoo, By Miles, Other.

3. What are the main segments of the UK Insurtech Industry?

The market segments include Insurance type.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.51 billion as of 2022.

5. What are some drivers contributing to market growth?

; Customer Acquisition; Customer Retention; Risk Assessment; Fraud Prevention and Detection; Others.

6. What are the notable trends driving market growth?

INSURTECHS FOCUS ON ANALYTICS / BIG DATA and AI.

7. Are there any restraints impacting market growth?

; Customer Acquisition; Customer Retention; Risk Assessment; Fraud Prevention and Detection; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Insurtech Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Insurtech Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Insurtech Industry?

To stay informed about further developments, trends, and reports in the UK Insurtech Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence